Household Indoor Dehumidifier Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441507 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Household Indoor Dehumidifier Market Size

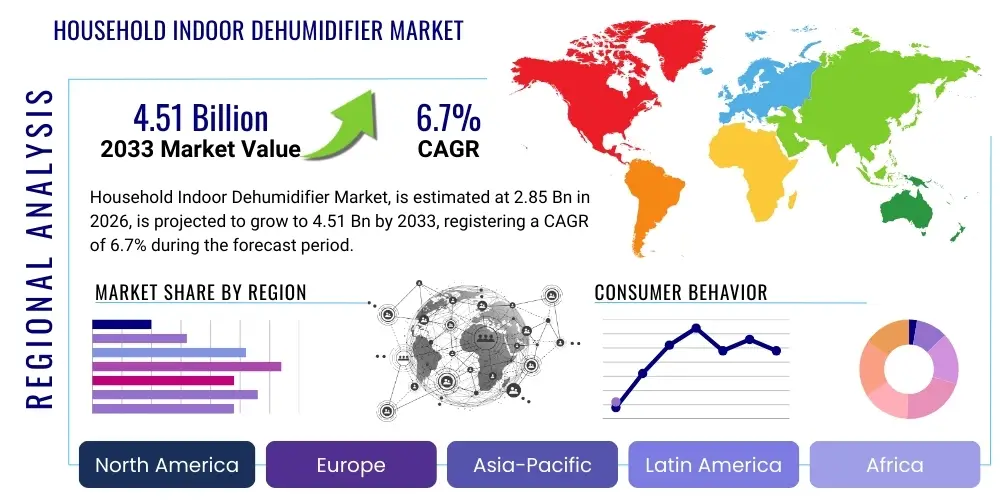

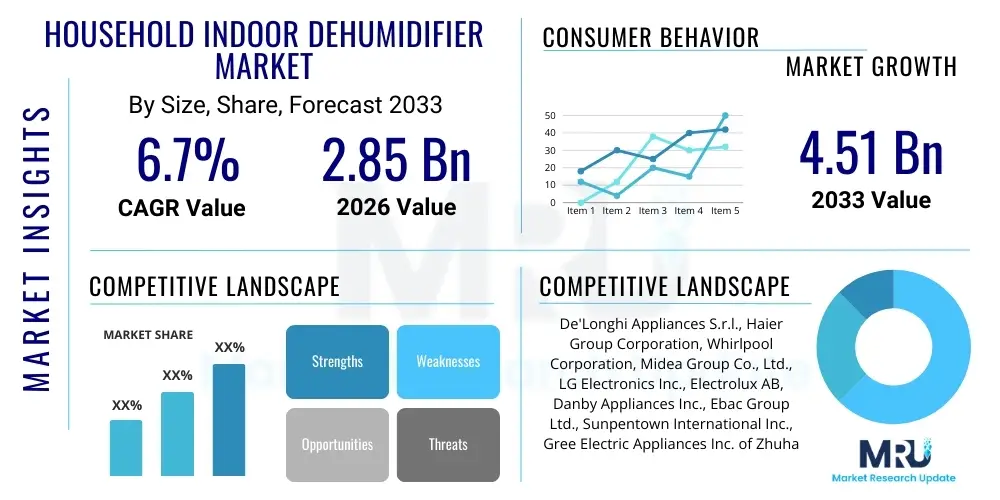

The Household Indoor Dehumidifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 2.85 billion in 2026 and is projected to reach USD 4.51 billion by the end of the forecast period in 2033.

Household Indoor Dehumidifier Market introduction

The Household Indoor Dehumidifier Market encompasses a range of electrical appliances designed primarily to reduce the level of humidity (moisture) in the air within residential spaces. These devices operate either using refrigeration principles (compressor models) or absorbent materials (desiccant models) to condense or adsorb moisture, thereby preventing the growth of biological contaminants such as mold, mildew, and dust mites. The core product description focuses on portable and fixed units ranging widely in capacity, typically measured in pints of moisture removed per day. Major applications include basements, crawl spaces, laundry rooms, and standard living areas, particularly in geographic regions experiencing high relative humidity levels, which are detrimental to both human health and building materials. The market's steady expansion is intrinsically linked to rising consumer education regarding the critical role of balanced indoor air quality (IAQ) in overall well-being.

The primary benefits derived from the use of household dehumidifiers extend beyond simple comfort. They include the mitigation of structural damage to homes (warping wood, peeling paint), preservation of sensitive materials (electronics, documents), and, most importantly, the creation of a healthier living environment by suppressing allergens and pathogens thriving in damp conditions. Modern dehumidifiers are characterized by significant energy efficiency improvements, digital humidistats for precise control, and smart connectivity features, transforming them from rudimentary appliances into sophisticated climate management tools. This technological evolution enhances convenience and optimizes performance, ensuring that the device operates only when necessary, which addresses historical consumer concerns regarding high operational costs.

Major driving factors fueling market growth include global climate change patterns leading to increased frequency and severity of humidity spikes, coupled with evolving construction practices that emphasize airtight building envelopes, which inadvertently trap moisture indoors. Furthermore, the post-pandemic focus on home health and optimization has accelerated the adoption of all indoor air quality solutions, positioning dehumidifiers as essential appliances rather than discretionary purchases. Government regulations encouraging energy-efficient appliances, alongside aggressive marketing campaigns highlighting the long-term cost savings associated with preventing moisture-related damage, continue to stimulate robust demand across key residential markets globally.

Household Indoor Dehumidifier Market Executive Summary

The Household Indoor Dehumidifier Market is poised for sustained expansion, defined by key business trends centered on technological integration and premiumization, particularly concerning energy efficiency and smart home compatibility. Business trends show a distinct shift toward IoT-enabled devices that offer remote monitoring, predictive maintenance alerts, and seamless integration with broader home automation systems. Manufacturers are increasingly focusing on sustainability, utilizing eco-friendly refrigerants and optimizing component designs to meet stringent international energy consumption standards, which serves both regulatory compliance and strong consumer preference for green technologies. The competitive landscape is characterized by innovation in noise reduction technology and the introduction of hybrid units that combine dehumidification with air purification capabilities, creating multifaceted value propositions for the end-user.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to high population density, rapid urbanization, and intrinsically humid climates, particularly in Southeast Asia and coastal China. These factors create an urgent necessity for effective moisture control in residential settings. North America and Europe, while representing mature markets, maintain high adoption rates driven by replacement cycles and the strong demand for smart, high-capacity units suitable for large basements and attics. European markets are particularly sensitive to design aesthetics and low operational noise levels, pushing innovation towards sleek, quiet, and compact units. Latin America and the Middle East and Africa (MEA) are emerging regions showing gradual, steady growth spurred by climate-specific requirements and rising discretionary income facilitating appliance purchases.

Segment trends confirm that compressor-based dehumidifiers retain market dominance owing to their cost-effectiveness and efficiency across warm-to-moderate temperature ranges, representing the largest revenue segment. However, the desiccant segment is experiencing accelerating growth in niche applications, such as cold basements and highly specialized storage areas, due to their superior performance in low-temperature environments. In terms of capacity, medium and large-capacity units (40-60+ Pints) dominate sales value, reflecting the necessity for powerful whole-house solutions. The distribution landscape is witnessing rapid migration toward online sales channels, capitalizing on the convenience of direct-to-consumer models and the ability of consumers to thoroughly research and compare highly technical product specifications before purchase.

AI Impact Analysis on Household Indoor Dehumidifier Market

User queries regarding AI in dehumidification systems overwhelmingly center on achieving proactive, rather than reactive, humidity management, energy cost optimization, and predictive maintenance capabilities. Consumers are highly interested in knowing how AI can learn specific home usage patterns, integrate local weather forecasting data, and automatically adjust fan speeds and compressor cycling to maintain optimal comfort zones while minimizing electricity consumption. The primary themes emerging from user concerns revolve around the accuracy of environmental prediction, data privacy associated with continuous home monitoring, and the cost-benefit analysis of premium AI-enabled hardware compared to traditional models. These insights indicate a strong market expectation for AI to deliver tangible, measurable improvements in energy efficiency and maintenance simplicity, moving beyond simple remote control functions.

AI's primary role in the household dehumidifier sector is the transformation of static appliances into dynamic, self-learning environmental control systems. By processing vast datasets encompassing historical humidity levels, occupancy patterns, and external atmospheric data, AI algorithms can predict future moisture accumulation, activating the dehumidifier optimally before humidity thresholds are exceeded. This predictive capability is vital for mold and allergen prevention, providing a superior level of health protection that conventional humidistat-controlled units cannot match. Furthermore, AI enables sophisticated fault diagnostics, continuously monitoring mechanical performance metrics such as fan vibration, coil temperature, and refrigerant pressure, allowing the system to alert the user or service provider to potential component failure long before total breakdown, thereby reducing unexpected maintenance costs and appliance downtime.

The implementation of machine learning is also pivotal in enhancing energy efficiency, a critical purchasing criterion for environmentally conscious consumers. AI models are optimized to find the 'sweet spot' in operation, balancing moisture removal speed with power draw. For example, in off-peak energy hours or when external conditions are favorable, the AI might choose to run the unit at higher capacity, utilizing dynamic pricing data where available, or conversely, prioritize quiet, low-power operation during occupied hours. This intelligent cycling extends the lifespan of the compressor and further validates the premium price point for smart dehumidifiers. The continuous improvement of sensing technology, coupled with AI processing, is driving the market towards truly autonomous indoor air quality management hubs, addressing the core user expectation of effortless, effective humidity control.

- AI-driven Predictive Humidity Regulation: Anticipates moisture spikes based on weather forecasts and historical home data.

- Energy Consumption Optimization: Machine learning algorithms adjust operational cycles to minimize power usage during peak tariffs.

- Automated Diagnostics and Maintenance Alerts: Monitors component health (compressor, filters) to predict failures proactively.

- Seamless Smart Home Integration: Ensures compatibility and optimized interaction with existing IoT ecosystems (e.g., Alexa, Google Home).

- Enhanced User Experience: Provides simplified, set-and-forget operation, adapting to user-defined comfort parameters over time.

DRO & Impact Forces Of Household Indoor Dehumidifier Market

The dynamics of the Household Indoor Dehumidifier Market are shaped by powerful Drivers (D) related to health and climate, Restraints (R) concerning operational characteristics and initial investment, and strategic Opportunities (O) in technology and service models. The primary Drivers include increasing consumer education regarding the link between high indoor humidity and respiratory illnesses, coupled with intensified global climate variability, leading to more erratic and often higher moisture levels in residential structures. Conversely, significant Restraints persist, notably the relatively high purchase price of high-capacity and smart models, the perceived operating noise, which limits placement options in living spaces, and general consumer skepticism regarding the long-term energy costs associated with running these appliances continuously. Manufacturers must continuously innovate to mitigate these drawbacks through quieter and more efficient designs.

Opportunities are largely concentrated in the realm of smart technology and market penetration into previously underserved segments. The development of compact, visually appealing, and silent dehumidifiers for visible living areas opens up significant new revenue streams beyond traditional basement applications. Furthermore, the integration of subscription-based maintenance services, remote diagnostics, and guaranteed filter replacement programs provides recurring revenue streams and enhances customer loyalty, transforming a one-time purchase into a long-term service relationship. The untapped potential of the desiccant dehumidifier segment in cooler northern climates, where compressor models struggle, also presents a focused opportunity for specialized product development and targeted marketing strategies emphasizing low-temperature effectiveness.

The key Impact Forces dictating market trajectory are technological advancement and regulatory pressure. The rapid evolution of sensor technology, combined with the power of IoT connectivity, fundamentally impacts product functionality and perceived value. Consumers now demand high precision and convenience, effectively forcing the obsolescence of older, non-connected models. Simultaneously, government bodies worldwide are implementing stricter energy efficiency standards, such as the frequent updates to the U.S. Energy Star rating requirements. These regulatory mandates compel continuous investment in R&D to optimize compressor technology, utilize better refrigerants, and improve overall Coefficient of Performance (COP), ensuring that only the most energy-responsible products remain competitive in the saturated market landscape. Failure to adapt to these stringent standards acts as a significant barrier to entry for smaller or less innovative manufacturers.

Segmentation Analysis

The Household Indoor Dehumidifier Market is meticulously segmented based on key criteria including Product Type, Capacity (Pints/Day), and Distribution Channel, reflecting the diverse applications and end-user requirements within the residential sector. Segmentation is essential for manufacturers and retailers to accurately target product offerings, aligning specific features (e.g., low-temperature operation, portable design) with corresponding consumer needs (e.g., basement moisture control vs. bedroom air quality improvement). The foundational segmentation by technology—compressor versus desiccant—is crucial because it dictates the primary operating environment, cost structure, and energy consumption profile of the unit, directly impacting purchasing decisions in different climate zones across the globe.

The Compressor Dehumidifier segment dominates the market value globally, particularly in regions where average room temperatures are consistently above 65°F (18°C). These units are favored for their high efficiency (low energy input relative to moisture removed) and robust performance in typical residential settings. Conversely, Desiccant Dehumidifiers, while typically having a higher energy consumption per pint removed, excel in cold environments (below 50°F or 10°C), such as unheated basements and garages, where compressor coils tend to freeze. Manufacturers are working on hybrid models and improved desiccant materials to bridge this performance gap, offering consumers specialized solutions for challenging environments and driving market sophistication beyond simple compressor dominance.

In terms of sales pathways, the distribution channel analysis highlights the increasing significance of E-commerce platforms, driven by detailed product comparison features, competitive pricing, and logistical efficiency for bulky appliances. While traditional retail outlets (hypermarkets, home improvement stores) remain vital for immediate purchases and customer service requiring face-to-face interaction, the online channel is strategically leveraged for premium, smart, and niche products due to its capacity for extensive technical specification presentation and direct customer feedback utilization. Capacity segmentation—ranging from small personal units (under 30 Pints) to large industrial-grade household units (over 70 Pints)—is essential for pricing strategy, with higher capacity units naturally commanding a significant premium due to the larger motors and coil surfaces required for extensive moisture removal tasks in whole-house or large basement applications.

- By Product Type:

- Compressor/Refrigerant Dehumidifiers

- Desiccant Dehumidifiers

- Thermoelectric/Peltier Dehumidifiers (Niche)

- By Capacity (Pints/Day):

- Small Capacity (Under 30 Pints)

- Medium Capacity (30–50 Pints)

- Large Capacity (Over 50 Pints)

- By Application:

- Basements and Crawl Spaces

- Living Areas and Bedrooms

- Laundry and Storage Rooms

- By Distribution Channel:

- Online Retail/E-commerce

- Offline Retail (Hypermarkets, Specialty Stores, Home Improvement Centers)

Value Chain Analysis For Household Indoor Dehumidifier Market

The Value Chain for the Household Indoor Dehumidifier Market starts with upstream suppliers specializing in key raw materials and core components. Upstream analysis focuses heavily on the procurement of specialized refrigeration components, including highly efficient compressors, refrigerants (increasingly R290 or R32 to comply with environmental mandates), copper tubing, and specialized plastics/polymers for casing. The cost and stability of sourcing these components, particularly microprocessors for smart units and high-quality sensors (hygrometers), directly influence final product pricing and manufacturing margins. Maintaining strong, diversified relationships with compressor manufacturers and semiconductor suppliers is critical to mitigate supply chain volatility and ensure adherence to quality standards and environmental regulations, especially those governing refrigerant use and electrical safety compliance.

The downstream activities involve the highly competitive processes of assembly, branding, marketing, and distribution. Manufacturers invest heavily in automated assembly lines to ensure high-volume production and consistent quality control, particularly in integrating complex electronics for IoT connectivity. Effective branding emphasizes not just efficiency and capacity, but also aesthetic design, noise reduction, and smart features, differentiating premium models in a crowded market. The final sale involves a dual distribution channel strategy—direct and indirect. Direct channels include manufacturers' dedicated websites and large-scale e-commerce operations, allowing for greater control over pricing and customer relationship management. Indirect channels involve partnerships with large brick-and-mortar retailers, wholesalers, and specialized HVAC distributors, which provide necessary regional reach and localized customer service support.

The critical success factors in the distribution channel strategy revolve around logistical efficiency and channel specific optimization. For bulky appliances like dehumidifiers, minimizing shipping costs and transit damage is paramount. Indirect distribution through major home improvement centers (e.g., Home Depot, Lowe's, B&Q) offers consumers immediate access, the ability to physically inspect the unit, and often provides professional installation or consultation services. However, the E-commerce channel is rapidly gaining traction due to superior inventory visibility, personalized marketing, and the ability to handle returns efficiently. Optimizing the flow of information and goods across both channels, ensuring consistent pricing parity and inventory availability, determines market penetration and responsiveness to seasonal demand spikes, particularly during peak humidity seasons.

Household Indoor Dehumidifier Market Potential Customers

The potential customer base for the Household Indoor Dehumidifier Market is segmented into several distinct residential demographics and buyer profiles, all sharing the common goal of managing indoor moisture levels for health, comfort, or structural preservation. The primary end-users are homeowners residing in high-humidity climates, coastal regions, and geographical areas prone to excessive rainfall or localized water seepage issues (e.g., basements and subterranean living spaces). This segment values high capacity, energy efficiency, and features designed for continuous, long-term operation without frequent manual intervention. These buyers often purchase high-end, connected units as a long-term investment to protect their property value and maintain a mold-free environment, emphasizing performance specifications over initial purchase price.

A second significant customer segment comprises renters and apartment dwellers who seek portable, medium-capacity units designed for localized moisture control in bedrooms, bathrooms, or shared living spaces. This segment prioritizes low noise output, compact size, and user-friendliness, as they typically require units that can be moved easily and stored discreetly. For this demographic, the initial cost is a more sensitive factor, and they are often drawn to mid-range models or reliable brands offering a balance between efficiency and affordability. The increasing focus on indoor air quality, particularly among urban populations concerned about environmental triggers for allergies and asthma, further fuels demand from this profile, leading to greater adoption of units with built-in filtration systems.

Finally, a growing niche market includes buyers interested in environmental control for specialized purposes, such as wine cellars, valuable art storage rooms, or home gyms where precise humidity levels must be maintained. These customers represent a premium segment requiring extremely accurate digital controls, seamless integration with existing home automation systems, and superior long-term reliability. Potential institutional buyers, such as landlords managing multi-family units or property management companies, also represent volume purchasing opportunities, focusing on robust, durable, and low-maintenance models that minimize operational intervention across multiple properties. Understanding these varied buyer motivations—from health and comfort to asset protection—is key to tailored product development and targeted marketing initiatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.85 Billion |

| Market Forecast in 2033 | USD 4.51 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | De'Longhi Appliances S.r.l., Haier Group Corporation, Whirlpool Corporation, Midea Group Co., Ltd., LG Electronics Inc., Electrolux AB, Danby Appliances Inc., Ebac Group Ltd., Sunpentown International Inc., Gree Electric Appliances Inc. of Zhuhai, Honeywell International Inc., Therma-Stor LLC, Kenmore, Trotec GmbH, General Filters Inc., Keystone, Vornado Air LLC, Frigidaire, Seaira Global, Aprilaire. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Household Indoor Dehumidifier Market Key Technology Landscape

The technological landscape of the Household Indoor Dehumidifier Market is rapidly evolving, moving beyond simple refrigeration cycles towards complex integrated systems focused on efficiency, intelligence, and user convenience. The core technology remains the compressor-based refrigerant system, but significant R&D effort is concentrated on improving the Coefficient of Performance (COP) by optimizing heat exchanger design and utilizing variable-speed compressor technology. Variable-speed compressors allow the unit to run continuously at lower speeds when only minor moisture removal is needed, dramatically reducing noise levels and saving energy compared to traditional on/off fixed-speed models. Furthermore, the mandatory shift towards environmentally safer refrigerants, such as R290 (Propane) which has a very low Global Warming Potential (GWP), is reshaping component manufacturing and safety protocols across the industry, ensuring compliance with global environmental mandates like the Kigali Amendment.

Beyond the core mechanical improvements, the most transformative technological shift is the widespread adoption of IoT connectivity and sophisticated sensor arrays. Modern dehumidifiers now feature advanced digital humidistats capable of maintaining humidity within a ±1% tolerance, combined with Wi-Fi modules enabling remote control and integration with smart home protocols (e.g., Matter, Thread). This connectivity allows for over-the-air firmware updates, continuously improving the unit's operating intelligence and features post-purchase. Advanced sensors are being integrated not only for humidity and temperature but also potentially for monitoring volatile organic compounds (VOCs) and particulate matter, positioning the dehumidifier as a central hub for comprehensive indoor environmental monitoring and linking its function intrinsically with air purification systems, often in a single appliance footprint.

Niche technology development focuses on improving desiccant systems and miniaturization. Desiccant wheel technology, which uses a moisture-absorbing material (like silica gel) that is later regenerated using a heating element, is being optimized for higher efficiency in colder climates through improved air flow and heating element designs that minimize energy waste during the regeneration cycle. For small-scale applications, Thermoelectric (Peltier effect) dehumidifiers are gaining traction due to their silent operation and extremely compact size, making them ideal for small closets or RVs, although their low capacity and low energy efficiency limit their use in standard residential rooms. Overall, the industry is leveraging computational fluid dynamics (CFD) modeling to refine internal air pathways, reduce acoustic emissions, and maximize water removal rates, driving the overall market expectation toward quiet, powerful, and intelligent moisture control solutions.

Regional Highlights

Regional dynamics heavily influence the Household Indoor Dehumidifier Market, primarily driven by climatic conditions, economic development, and stringent regional energy efficiency regulations. North America, especially the U.S. and Canada, represents a substantial market share, dominated by the necessity for high-capacity units to manage moisture in large basements and subterranean spaces, a standard feature in many residential designs. Demand here is mature but consistently refreshed by consumers upgrading to smart, high-efficiency Energy Star certified models. The emphasis in this region is on unit durability, high pint-per-day capacity (often exceeding 70 pints), and robust warranties, reflecting the consumer expectation of long-term investment in property preservation and proactive mold mitigation strategies, particularly in regions prone to seasonal flooding or severe humidity spikes.

Asia Pacific (APAC) is projected to exhibit the fastest growth rate globally, fueled by dense populations concentrated in coastal and tropical regions such as India, China, and Southeast Asia, which naturally experience extreme humidity levels year-round. Rapid urbanization, coupled with rising disposable incomes, has accelerated the adoption of dehumidifiers as essential appliances for maintaining comfortable and healthy living conditions in compact urban housing. Unlike North America, APAC demand often focuses on medium-capacity, aesthetically pleasing, and highly portable units suitable for visible living spaces and bedrooms. Furthermore, government initiatives in countries like South Korea and Japan promoting superior indoor air quality standards also significantly contribute to the market’s vigorous expansion, often preferring high-tech solutions integrated with air purification.

Europe presents a fragmented but technologically demanding market. Demand varies significantly between Southern Europe (Mediterranean climates) and Northern Europe (cooler, damp environments). The market here is strongly regulated by strict noise emission standards and energy directives, pushing manufacturers to innovate primarily in acoustic engineering and compact design. Germany, the UK, and Scandinavia show high penetration rates, particularly for desiccant models suited for lower temperature conditions prevalent during winter. Latin America and the Middle East and Africa (MEA) remain emerging markets. While MEA faces localized high humidity (e.g., Gulf coastal areas), market penetration is generally lower, constrained by purchasing power and lower consumer awareness regarding proactive moisture control, presenting a long-term opportunity through consumer education and accessible pricing strategies for reliable, basic dehumidifier models.

- North America: Dominant market share driven by large residential basements and strict IAQ standards. Focus on high capacity (50–70+ Pints) and Energy Star certified smart units.

- Asia Pacific (APAC): Fastest-growing region due to intense tropical humidity, urbanization, and rising disposable income. Strong demand for portable, medium-capacity units with advanced filtration.

- Europe: Mature market characterized by stringent noise and energy efficiency regulations. High preference for sleek designs and specialized desiccant models in cooler northern climates.

- Latin America & MEA: Emerging markets with potential growth driven by rising awareness of mold-related health issues and targeted product introductions suitable for moderate budgets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Household Indoor Dehumidifier Market.- De'Longhi Appliances S.r.l.

- Haier Group Corporation

- Whirlpool Corporation

- Midea Group Co., Ltd.

- LG Electronics Inc.

- Electrolux AB

- Danby Appliances Inc.

- Ebac Group Ltd.

- Sunpentown International Inc.

- Gree Electric Appliances Inc. of Zhuhai

- Honeywell International Inc.

- Therma-Stor LLC

- Kenmore

- Trotec GmbH

- General Filters Inc.

- Keystone

- Vornado Air LLC

- Frigidaire

- Seaira Global

- Aprilaire

Frequently Asked Questions

Analyze common user questions about the Household Indoor Dehumidifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most energy-efficient type of household dehumidifier?

The most energy-efficient dehumidifiers are typically compressor-based models that have earned the highest level of Energy Star certification. Modern units utilize variable-speed compressors and R290 refrigerant to minimize power consumption while maximizing the amount of water removed per kilowatt-hour, providing significant long-term savings.

How do smart dehumidifiers improve residential air quality beyond moisture removal?

Smart dehumidifiers enhance air quality by integrating IoT connectivity and advanced sensor technology, enabling them to proactively adjust performance based on learned home occupancy patterns and local weather forecasts. Many high-end models also include HEPA or activated carbon filters to remove airborne particulates and odors, offering comprehensive indoor air quality management.

Should I choose a compressor or desiccant dehumidifier for my basement?

The choice depends on the temperature. If your basement temperature consistently remains above 65°F (18°C), a compressor dehumidifier is the most efficient choice. However, if the area is frequently cold (below 50°F or 10°C), a desiccant dehumidifier is recommended as it operates effectively without freezing, ensuring consistent moisture removal year-round.

What capacity (Pints/Day) dehumidifier do I need for a large living space?

For large living spaces, open-plan homes, or moisture-heavy basements exceeding 2,000 square feet, a large capacity unit (50 Pints/Day or greater) is typically necessary. The exact requirement depends on the starting humidity level; highly damp areas require the largest available capacity to effectively reduce moisture quickly and maintain optimal conditions.

What are the primary factors driving the premium pricing of high-end dehumidifiers?

Premium pricing is driven by three core factors: the inclusion of advanced technology (AI/IoT, sophisticated sensors), superior component quality (variable-speed, quiet compressors and R290 refrigerants), and sophisticated acoustic engineering for ultra-quiet operation. These features significantly enhance convenience, energy efficiency, and overall lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager