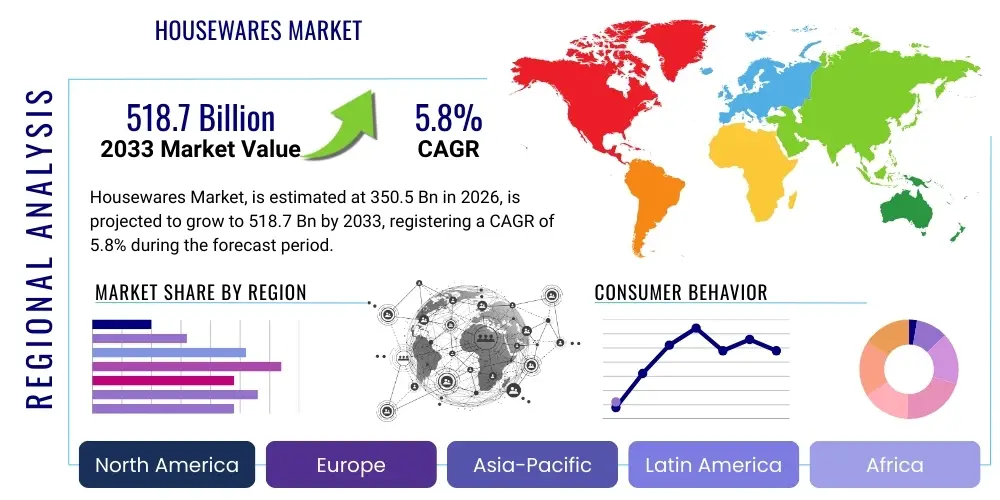

Housewares Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441998 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Housewares Market Size

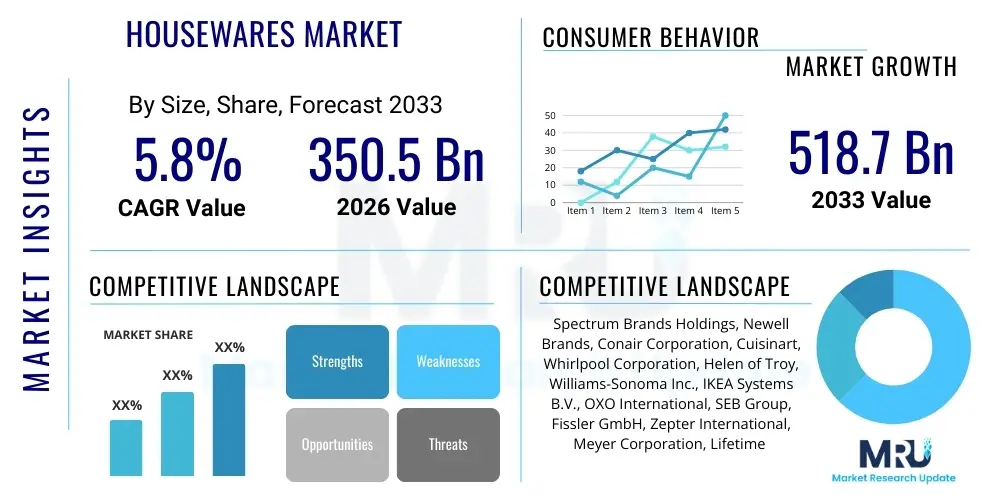

The Housewares Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 518.7 Billion by the end of the forecast period in 2033.

Housewares Market introduction

The global housewares market encompasses a vast array of functional and decorative products designed for use within residential settings, covering categories such as kitchenware, tableware, cleaning tools, small appliances, and home organization solutions. This sector is fundamentally driven by consumer lifestyle changes, urbanization trends, and the continuous desire for home enhancement and convenience. Products within this market segment are often characterized by cyclical innovation, focusing on smart features, sustainable materials, and ergonomic design, reflecting evolving consumer values toward health, efficiency, and environmental responsibility. The industry is highly fragmented, featuring large multinational corporations alongside niche, design-focused brands, all competing for shelf space and digital visibility.

The major applications of housewares extend across essential domestic activities, including food preparation and storage, serving meals, interior decoration, and maintaining cleanliness and organization. The ongoing integration of technology, particularly in kitchen appliances and cleaning robots, significantly broadens the scope of product utility and performance, driving premiumization within specific sub-segments. Furthermore, the aesthetic dimension of housewares is gaining prominence, positioning products not just as functional tools but as integral elements of personal expression and interior design, thereby increasing demand for designer goods and personalized items.

Key benefits derived from modern housewares include enhanced efficiency in daily tasks, improved health outcomes through specialized cooking and air purification devices, and increased comfort and organization in the living space. Driving factors influencing market expansion include rising disposable incomes in emerging economies, a strong global trend toward home cooking and entertaining, the persistent rise of e-commerce platforms facilitating easier access to a diverse product portfolio, and continuous innovation in material science leading to more durable and safer products. These macro and micro trends converge to create a resilient and dynamic market landscape characterized by steady demand and high competition.

Housewares Market Executive Summary

The global housewares market is undergoing a significant transformation marked by accelerating shifts toward digital commerce and sustainability-focused product development. Business trends highlight a consolidation among traditional retailers and manufacturers, coupled with intense investment in Direct-to-Consumer (DTC) models to capture higher margins and better control customer experience. Innovation remains centered on integrating Internet of Things (IoT) capabilities into appliances, such as smart refrigerators and connected kitchen gadgets, enhancing user convenience and data collection capabilities. Furthermore, supply chain resilience has become a critical strategic priority following recent global disruptions, leading companies to diversify sourcing and invest in automation to ensure product availability and mitigate cost volatility.

Regional trends indicate that the Asia Pacific (APAC) region is poised to be the fastest-growing market, primarily fueled by rapid urbanization, expanding middle-class populations, and increasing adoption of Western-style kitchen fittings and appliances, particularly in China and India. North America and Europe, while being mature markets, continue to demonstrate strong demand for premium, high-efficiency, and environmentally friendly housewares, driving growth through replacement cycles and shifts toward smart home integration. Regulatory pressure concerning material safety and energy efficiency is also shaping product offerings significantly across these developed economies, influencing consumer choice and manufacturing processes.

Segment trends demonstrate robust performance in the small electrical appliances category, driven by lifestyle changes such as increased coffee consumption at home and the popularity of specialized cooking methods (e.g., air fryers). Within the non-electric segment, materials such as borosilicate glass, bamboo, and recycled plastics are gaining traction, reflecting consumer preference for durable and sustainable alternatives over conventional materials. Distribution channels show a decisive shift, with online sales consistently outpacing brick-and-mortar growth, necessitating substantial investments in digital marketing, logistics optimization, and augmented reality (AR) features for virtual product viewing to maintain competitive parity.

AI Impact Analysis on Housewares Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the housewares market primarily revolve around three core themes: the feasibility and functionality of smart kitchen appliances, the personalization of shopping and customer service experiences, and the role of AI in optimizing supply chain and design processes. Consumers are highly interested in how AI can move beyond simple connectivity to truly automate domestic tasks, asking questions about predictive maintenance, recipe generation based on available ingredients (computer vision integration), and adaptive cleaning schedules. Concerns often focus on data privacy, the complexity of setting up and operating AI-enabled devices, and the long-term maintenance costs associated with this advanced technology. Expectations are high for seamless integration, energy efficiency improvements, and a genuinely intuitive user experience that justifies the premium price point of AI-enabled housewares.

The integration of AI is fundamentally restructuring both the manufacturing and consumer-facing aspects of the housewares industry. Manufacturers are leveraging machine learning algorithms to forecast demand with greater accuracy, significantly reducing overstocking and optimizing inventory levels across complex distribution networks. Furthermore, generative AI is beginning to be deployed in product design, allowing companies to rapidly iterate on ergonomic and aesthetic designs based on large datasets of user feedback and behavioral patterns. This speeds up the time-to-market for innovative products and allows for better alignment with highly specific consumer preferences.

On the consumer side, AI drives substantial improvements in the functionality of smart housewares. For example, AI-powered thermostats and air purifiers learn resident habits to optimize environmental controls autonomously, maximizing energy savings and comfort. In the retail sector, AI algorithms analyze browsing history, purchase patterns, and demographic data to offer hyper-personalized product recommendations, enhancing the customer journey and improving conversion rates. Chatbots and AI-driven customer service platforms are also being utilized to provide immediate, context-aware support for product setup and troubleshooting, improving overall customer satisfaction and brand loyalty in a highly competitive digital environment.

- Enhanced predictive maintenance and diagnostics for small appliances, reducing downtime.

- Optimization of cooking processes through AI-driven recipe and time adjustments in smart ovens.

- Personalized inventory management within smart refrigerators using object recognition technology.

- AI-enabled demand forecasting and supply chain efficiency improvement for manufacturers.

- Hyper-personalized retail experiences and customized product suggestions via machine learning.

- Automation of routine cleaning tasks using advanced navigational and adaptive algorithms in robotic vacuums.

DRO & Impact Forces Of Housewares Market

The Housewares Market is shaped by a confluence of critical Drivers, Restraints, and Opportunities, which collectively dictate the industry's growth trajectory and competitive intensity. A primary Driver is the increasing global emphasis on home improvement and interior aesthetics, catalyzed by trends like remote work and increased time spent indoors, pushing consumers to invest more in comfortable and functional living spaces. Secondly, the rapid technological advancements in small appliances, particularly concerning smart connectivity and energy efficiency, consistently provide replacement cycles and premiumization opportunities. Conversely, major Restraints include the market's sensitivity to macroeconomic volatility, such as inflation impacting raw material costs and consumer disposable income, leading to delayed non-essential purchases. Furthermore, the proliferation of low-cost, unbranded alternatives, particularly through vast e-commerce marketplaces, creates intense price pressure for established manufacturers, limiting margin potential across standard product lines.

Significant Opportunities in the sector lie in the burgeoning demand for sustainable and eco-friendly housewares. Consumers are increasingly seeking products made from recycled, bio-degradable, or ethically sourced materials, creating a fertile ground for green innovation and brand differentiation. The expansion of professional cleaning and organizational services also indirectly drives the sales of specialized, high-performance tools designed for specific tasks. Market players capitalizing on this segment by ensuring transparency in sourcing and manufacturing processes are likely to capture substantial market share. Moreover, the untapped potential in emerging markets, characterized by rapid modernization of retail infrastructure and rising household wealth, presents lucrative geographical expansion prospects.

The collective Impact Forces operate as a complex equilibrium of consumer desire for innovation and economic constraints. The force of buyer bargaining power is high, driven by market transparency and extensive product comparisons facilitated by online platforms. Supplier power is generally moderate, though specialized material suppliers (e.g., high-grade stainless steel, advanced polymers) can exert leverage. Threat of new entrants is moderate, lowered by the capital intensity required for branding and distribution but raised by the ease of entry for digitally native, niche brands. Finally, the threat of substitutes is significant, especially in decorative or low-tech segments where consumers can opt for alternatives from adjacent industries (e.g., furniture, specialized electronics). Successful strategies must focus on enhancing product differentiation through design, embedded technology, and brand storytelling to mitigate these competitive pressures and maintain margin integrity.

Segmentation Analysis

The housewares market is highly diverse and is segmented based on product type, distribution channel, material, and application. This granularity allows for targeted marketing and strategic product development, addressing the specific needs of various consumer groups, from basic functionality to premium aesthetic appeal. Understanding these segment dynamics is crucial for identifying areas of high growth, managing supply chain complexity, and optimizing pricing strategies across different geographies and retail formats. The market’s segmentation reflects the broad utility and variability in consumer willingness to pay for features, durability, and brand reputation across domestic items.

The primary segments reveal structural preferences in consumer buying habits and technological adoption rates. For instance, the small electric appliance segment, driven by rapid technology iteration, requires different strategic investment compared to the traditional, low-tech segments like cookware or storage containers, which rely more on material science and ergonomic design. The shift towards online distribution is perhaps the most defining recent segmentation trend, forcing manufacturers to adapt packaging and logistics capabilities to accommodate direct shipping to consumers, fundamentally altering the traditional retail landscape and supply chain architecture globally.

- By Product Type:

- Cookware and Bakeware (Pots, Pans, Baking Sheets)

- Tableware and Drinkware (Dinner sets, Glassware, Mugs)

- Small Electrical Appliances (Toasters, Blenders, Coffee Makers, Air Fryers)

- Home Organization and Storage (Containers, Racks, Closet Systems)

- Cleaning and Maintenance (Brooms, Mops, Vacuums, Cleaning tools)

- Other Housewares (Textiles, Decorative Items)

- By Material:

- Metal (Stainless Steel, Aluminum)

- Ceramics and Glass

- Plastics and Polymers

- Wood and Bamboo

- Others (Silicone, Composite Materials)

- By Distribution Channel:

- Offline (Supermarkets/Hypermarkets, Specialty Stores, Department Stores)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

- By Application:

- Kitchen and Dining

- Bathroom

- Living Room and Bedroom

- Cleaning and Utility Areas

Value Chain Analysis For Housewares Market

The value chain for the housewares market is generally complex and geographically extended, beginning with upstream raw material sourcing and culminating in final consumer sales. Upstream analysis involves the procurement of diverse materials such as various grades of plastic resins, metals (steel, aluminum), ceramic components, glass, and wood. Material costs are highly volatile and significantly influence manufacturing margins; therefore, strategic sourcing relationships and long-term contracts are essential for cost stability. Efficient management of material input is crucial, often involving rigorous quality control and adherence to international safety and sustainability standards, particularly concerning food contact materials. Suppliers who can offer sustainable or recycled inputs are gaining a competitive edge in this stage of the value chain.

The core midstream activity involves design, manufacturing, and assembly, which are increasingly shifting towards automation and specialized production centers, predominantly located in Asian countries due to optimized labor and production costs. Effective production necessitates continuous investment in tooling, machinery, and quality assurance processes to handle diverse product specifications, ranging from basic storage solutions to complex electrical appliances. Downstream analysis focuses primarily on distribution and sales. The distribution channels are bifurcated into traditional brick-and-mortar retail and rapidly growing e-commerce platforms. The choice between direct and indirect distribution significantly affects profitability, with direct channels offering greater control over branding and customer data, but indirect channels providing wider market reach through large retailers and marketplaces.

The logistics involved in the downstream segment are intricate, requiring sophisticated warehousing and fulfillment capabilities, especially for fragile items like glassware or bulky storage units. Direct distribution via company-owned e-commerce platforms requires robust logistics partnerships and efficient last-mile delivery services, often leveraging advanced software for route optimization and inventory tracking. Indirect distribution relies heavily on relationships with large national retailers and global wholesalers, where negotiation leverage and promotional support dictate market visibility. Overall, optimizing the flow of goods from high-volume manufacturing hubs to diverse international consumer points, while minimizing breakage and transit time, remains the principal challenge in maintaining a competitive downstream advantage.

Housewares Market Potential Customers

Potential customers for the housewares market are broadly segmented across various demographics and psycho-graphics, including young professionals establishing their first homes, growing families requiring durable and high-capacity solutions, and mature households undertaking home renovation or seeking premium, replacement products. The primary end-users or buyers are individual consumers who purchase products for personal or household use, driven by factors such as necessity, convenience, aesthetic preferences, and social trends. A key emerging segment includes the highly digital, millennial demographic, who prioritize design, sustainability, and smart functionality, often conducting extensive online research before making a purchase and favoring DTC brands.

A second significant group comprises commercial buyers, including hotels, restaurants, corporate offices, and institutional users, who procure housewares in large volumes. These buyers prioritize durability, standardization, compliance with commercial safety regulations, and long-term cost of ownership, often requiring specialized, industrial-grade products that differ substantially from consumer-grade items. Serving this segment requires tailored B2B sales strategies, complex procurement negotiation, and specialized distribution networks capable of handling bulk orders and providing ongoing maintenance support.

Furthermore, gift buyers constitute a robust, cyclical segment, purchasing high-quality or novelty housewares for occasions like weddings, holidays, and housewarmings. This segment often drives demand for premium, branded, or aesthetically superior items that serve a dual purpose of utility and decorative appeal. Manufacturers focusing on attractive packaging, strong brand perception, and effective seasonal merchandising are best positioned to capture this highly profitable, though less predictable, portion of the market, necessitating dynamic inventory management to cope with demand spikes associated with major global holidays.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 518.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectrum Brands Holdings, Newell Brands, Conair Corporation, Cuisinart, Whirlpool Corporation, Helen of Troy, Williams-Sonoma Inc., IKEA Systems B.V., OXO International, SEB Group, Fissler GmbH, Zepter International, Meyer Corporation, Lifetime Brands, Groupe SEB, Breville Group, Tupperware Brands Corporation, WMF Group, Thermos LLC, Instant Brands (Corelle). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Housewares Market Key Technology Landscape

The housewares market is increasingly defined by the integration of advanced technologies aimed at enhancing efficiency, user experience, and sustainability. A critical technological trend involves the proliferation of Internet of Things (IoT) connectivity, particularly in small electrical appliances such as kitchen devices, environmental control systems, and cleaning robots. This connectivity enables remote operation, diagnostic capabilities, and seamless integration into broader smart home ecosystems, allowing devices to communicate and operate harmoniously. Manufacturers are investing heavily in secure cloud infrastructure and user-friendly mobile applications to support these connected features, moving housewares beyond simple mechanical function toward sophisticated digital interaction and service provision.

Material science innovation represents another foundational technological pillar. This includes the development of non-stick coatings with superior durability and safety profiles (e.g., PFOA/PFOS-free ceramic-based options), self-cleaning and antimicrobial surfaces for hygiene products, and the use of advanced polymers and recycled materials for storage and organization solutions. These developments address key consumer demands for health safety, environmental responsibility, and product longevity, creating distinct market segments for premium, technologically differentiated materials. The push toward high-performance materials also supports energy efficiency goals, particularly in cooking and heating appliances, by improving heat transfer and retention capabilities.

Furthermore, manufacturing technologies such as advanced robotics, precision molding, and 3D printing are optimizing the production process across the value chain. Robotics enhance manufacturing consistency and speed, reducing defects, while advanced computer-aided design (CAD) and simulation tools accelerate the product development lifecycle. 3D printing is specifically being utilized for rapid prototyping and the creation of highly customized, complex component designs, offering flexibility that traditional mass manufacturing techniques cannot match. These technological adoptions are essential for maintaining cost competitiveness and responding rapidly to fast-evolving consumer aesthetic and functional demands.

Regional Highlights

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, driven by a burgeoning middle class, increasing urbanization, rising disposable incomes, and the modernization of residential infrastructure, leading to strong demand for Western-style and smart kitchen appliances.

- North America: A mature yet highly innovative market characterized by high consumer spending on premium, smart, and energy-efficient housewares. Growth is driven primarily by replacement cycles, smart home integration, and a strong preference for branded, design-centric products.

- Europe: Defined by stringent regulatory standards regarding material safety and energy consumption. The market shows strong demand for high-quality, durable, and sustainable products, with significant penetration of branded specialty retailers and a focus on minimalist and functional Scandinavian design aesthetics.

- Latin America: Characterized by increasing foreign direct investment in retail infrastructure and rising consumer awareness regarding international brands. Growth is steady, albeit constrained by economic volatility in certain countries, leading to a balanced demand for both value-driven and mid-range products.

- Middle East and Africa (MEA): Emerging market opportunities linked to rapid real estate development, high net-worth households, and a significant appetite for luxury and decorative housewares, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Housewares Market.- Spectrum Brands Holdings

- Newell Brands

- Conair Corporation

- Cuisinart

- Whirlpool Corporation

- Helen of Troy

- Williams-Sonoma Inc.

- IKEA Systems B.V.

- OXO International

- SEB Group

- Fissler GmbH

- Zepter International

- Meyer Corporation

- Lifetime Brands

- Groupe SEB

- Breville Group

- Tupperware Brands Corporation

- WMF Group

- Thermos LLC

- Instant Brands (Corelle)

- Unilever PLC

- Kimberly-Clark Corporation

- Procter & Gamble (P&G)

- LG Electronics

- Samsung Electronics

Frequently Asked Questions

Analyze common user questions about the Housewares market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Housewares Market?

The Housewares Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning 2026 to 2033, driven by innovation in smart appliances and increasing e-commerce penetration.

How is the rise of smart home technology influencing housewares sales?

Smart home technology is significantly driving sales in the small electrical appliances segment by offering features like IoT connectivity, AI-driven automation, and energy efficiency, prompting consumers to upgrade traditional devices for enhanced convenience.

Which geographic region is expected to lead market growth in the near future?

The Asia Pacific (APAC) region is anticipated to lead market growth, supported by rapid urbanization, rising disposable incomes among the expanding middle class, and increasing consumer interest in modern and specialized home products.

What key material trends are shaping the future of cookware and storage solutions?

Key material trends include a substantial shift towards sustainable options such as recycled plastics, bamboo, and advanced ceramic coatings, emphasizing durability, non-toxicity, and environmental responsibility in product development.

What are the primary distribution channels driving revenue for the Housewares Market?

The primary distribution channels are undergoing a structural shift, with online sales (e-commerce platforms and DTC websites) increasingly outpacing traditional offline retail channels like specialty stores and supermarkets due to convenience and broader product accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager