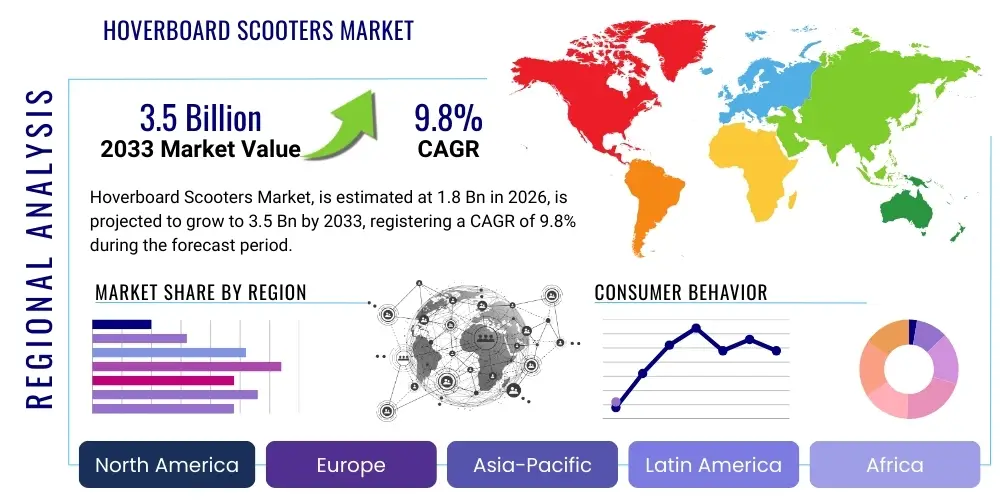

Hoverboard Scooters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442252 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hoverboard Scooters Market Size

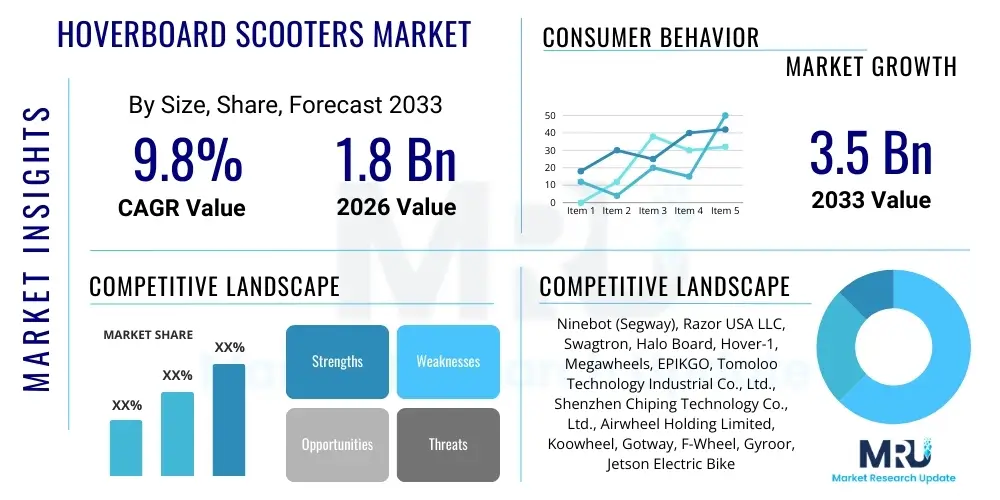

The Hoverboard Scooters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

The hoverboard scooters market has demonstrated robust expansion, primarily driven by increasing consumer preference for micro-mobility solutions, particularly in urban environments facing severe traffic congestion and parking limitations. This growth trajectory is further supported by technological advancements focusing on enhanced safety features, such as improved battery management systems (BMS) and dynamic self-balancing technology. Early market penetration was challenged by safety concerns, but rigorous regulatory standards, especially in North America and Europe, have significantly restored consumer confidence, propelling the market towards sustained double-digit growth rates in the medium term. The versatility of hoverboards, ranging from basic models for recreational use to high-performance versions for personal commuting, ensures a broad and expanding consumer base.

Geographically, key growth is anticipated in the Asia Pacific region, driven by large population densities in metropolitan areas and supportive governmental initiatives promoting electric vehicle adoption. Manufacturers are capitalizing on economies of scale to reduce production costs, making these devices increasingly accessible to middle-income demographics globally. Furthermore, strategic collaborations between hoverboard producers and major retail chains, coupled with effective digital marketing campaigns emphasizing convenience and environmental benefits, are crucial factors underpinning the projected market valuation increase by 2033. The continuous refinement of motor efficiency and chassis durability remains a focal point for R&D, promising superior performance specifications that attract discerning consumers.

Hoverboard Scooters Market introduction

The Hoverboard Scooters Market encompasses self-balancing personal transporters, commonly known as hoverboards or two-wheeled smart scooters, which utilize gyroscopic sensors and electric motors for movement and stabilization. These devices, defined primarily by their portability and zero-emission operation, serve as effective solutions for last-mile connectivity and recreational activities across diverse user segments, including students, young professionals, and tourists. Major applications involve personal transportation, indoor mobility within large facilities, and increasingly, integration into rental micro-mobility schemes operating in densely populated urban cores. Key benefits include reduced travel time in congested areas, low operational costs, and environmental friendliness. The market is being vigorously driven by rapid urbanization, favorable regulatory frameworks standardizing safety certifications (like UL certifications), and the escalating consumer desire for innovative and sustainable personal electric vehicles (PEVs).

Hoverboard Scooters Market Executive Summary

The Hoverboard Scooters Market Executive Summary reveals strong underlying business trends characterized by heightened competition and a distinct shift toward premium models incorporating advanced sensor fusion technology and enhanced battery life. Regionally, North America and Europe dominate in terms of early adoption and stringent safety standards, driving innovation, while the Asia Pacific region is poised for the fastest expansion due fueled by sheer volume of potential consumers and burgeoning infrastructure development supporting micro-mobility. Segment trends indicate that the recreational segment maintains the largest market share, but the commuter segment is exhibiting the highest CAGR, particularly for off-road and larger-wheeled variants that offer superior stability and performance over varied terrains. Strategic mergers and acquisitions focused on securing advanced battery technology patents and expanding distribution networks define the competitive landscape, emphasizing efficiency and regulatory compliance as paramount success factors for sustained market leadership across all geographical boundaries.

AI Impact Analysis on Hoverboard Scooters Market

User queries regarding the intersection of Artificial Intelligence (AI) and hoverboard scooters often center on themes of enhanced safety, autonomous navigation capabilities, and predictive maintenance protocols. Consumers are keen to understand how AI can prevent falls by improving real-time stability adjustments and how machine learning algorithms can optimize battery usage based on riding patterns and terrain characteristics. There is significant interest in future hoverboards potentially integrating sophisticated AI for obstacle avoidance and dynamic speed governance within crowded zones, addressing current safety limitations. Furthermore, questions frequently arise regarding the use of AI in manufacturing quality control and personalized user experience calibration, suggesting a consumer expectation for smarter, safer, and highly customized personal mobility devices driven by intelligent systems integration.

- AI-driven real-time stability control (Adaptive Gyroscopic Balancing).

- Predictive maintenance analytics optimizing component lifespan and scheduling service needs.

- Enhanced battery management systems (BMS) utilizing machine learning for optimal charging cycles and range prediction.

- Integration of visual AI and sensor fusion for improved obstacle detection and dynamic speed limitation in high-density areas.

- Personalized performance profiling and calibration based on rider weight, skill level, and typical riding environment.

- AI-enabled voice command integration and user interface simplification for intuitive control.

DRO & Impact Forces Of Hoverboard Scooters Market

The dynamics of the Hoverboard Scooters Market are shaped by powerful drivers such as rising urban congestion and the push for sustainable transportation alternatives, which strongly incentivize the adoption of micro-mobility solutions. Restraints include ongoing public safety concerns, despite improved standards, and regulatory inconsistencies across different jurisdictions regarding sidewalk usage and permissible speeds, potentially limiting market accessibility in certain key cities. Opportunities are abundant in the development of modular and multifunctional hoverboards, along with the expansion of rental and sharing services specifically targeting tourist hubs and corporate campuses, fostering new revenue streams. The primary impact forces affecting this market are consumer perception regarding safety (positive impact from UL certification), competition from adjacent micro-mobility segments like e-scooters and e-bikes, and the fluctuating prices of critical components, particularly lithium-ion batteries.

Segmentation Analysis

The Hoverboard Scooters Market is meticulously segmented based on pivotal differentiating factors, including the type of product, wheel size, application area, sales channel, and geographic region, enabling a detailed assessment of market dynamics and targeted strategic development. Analyzing these segments is critical for understanding consumer purchasing behavior and identifying high-growth niches within the broader micro-mobility ecosystem. The segmentation by product type, such as traditional models versus high-performance off-road variants, provides insight into the technological sophistication demanded by different consumer groups, influencing manufacturing investments and pricing strategies. Furthermore, the segmentation by application helps delineate between recreational, commuter, and commercial rental uses, indicating where capital expenditures are most effectively deployed for maximum market penetration and return on investment.

Segmentation based on wheel size is particularly relevant as it directly correlates with the device’s performance capabilities and safety profile, with larger wheels generally preferred for rougher terrains and greater stability, appealing to the commuter demographic. Conversely, smaller wheels maintain relevance in dense urban or indoor settings where agility is prioritized. Analyzing the market through sales channels—online versus offline retail—illuminates distribution efficiencies and consumer preferences for immediate purchase versus experiential buying. The confluence of these granular segmentations allows market participants to tailor their marketing efforts, optimize inventory management, and develop highly specific products that address unmet needs within distinct consumer cohorts, ensuring competitive advantage in a rapidly evolving market landscape.

- By Product Type:

- Standard Hoverboards

- Self-Balancing Scooters (advanced gyroscope)

- Off-Road Hoverboards

- Handle-based Hoverboards

- By Wheel Size:

- 6.5 Inches and Below

- 7 to 9 Inches

- 10 Inches and Above

- By Application:

- Personal Mobility/Recreational Use

- Commercial (Rental Services, Corporate Campuses)

- By Sales Channel:

- Online Retail

- Offline Retail (Specialty Stores, Departmental Stores)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Hoverboard Scooters Market

The value chain for hoverboard scooters begins with upstream activities involving the sourcing of specialized raw materials, predominantly lithium for batteries, advanced plastics and alloys for chassis construction, and complex electronic components such as microcontrollers and gyroscopic sensors. Effective upstream supply chain management focuses heavily on negotiating stable, ethical sourcing contracts and establishing rigorous quality assurance protocols for critical components, especially the battery packs, which represent the highest cost component and regulatory risk factor. Successful manufacturers implement strategies to diversify their supplier base geographically to mitigate geopolitical risks and ensure continuity of production, aiming for vertical integration in high-value component manufacturing where possible, such as motor assembly and software development.

Moving downstream, the value chain encompasses assembly, testing, branding, and comprehensive quality certification processes, notably acquiring UL certification in Western markets, which significantly influences market access and consumer trust. The distribution channel analysis highlights a dual approach: direct-to-consumer online sales, offering higher margins and immediate customer feedback, and indirect channels leveraging large-scale electronic retailers and specialized sporting goods stores, which provide wider geographical reach and physical product demonstration opportunities. The efficiency of the distribution network, particularly optimizing last-mile logistics for large, heavy items, is paramount to maintaining competitive pricing and ensuring rapid market responsiveness, especially during peak holiday seasons when demand surges significantly across all major consumer segments.

Post-sale activities, including warranty provision, maintenance services, and consumer support, conclude the value chain, playing a crucial role in brand reputation and customer retention. Robust after-sales support networks, including authorized service centers and readily available spare parts, are essential, particularly given the product's high usage frequency and potential for wear and tear. Companies that excel in streamlining their reverse logistics—managing returns, repairs, and recycling—gain a substantial advantage by minimizing waste and enhancing their sustainability profile, further optimizing the value delivered throughout the product lifecycle, from initial concept to end-of-life management and circular economy initiatives.

Hoverboard Scooters Market Potential Customers

The primary potential customers for hoverboard scooters span several distinct demographic and application segments, reflecting the device's versatility as both a utilitarian commuter tool and a recreational item. Key buyers include urban dwellers seeking efficient and affordable last-mile transportation alternatives to augment public transit or replace short car trips, driven by the desire to avoid traffic congestion and reduce carbon footprint. Another significant segment comprises teenagers and young adults who utilize hoverboards primarily for recreational purposes, often valuing aesthetics, speed, and advanced features such as integrated Bluetooth speakers and customizable LED lighting. Furthermore, commercial enterprises represent a growing potential customer base, including large warehouse operators, airport personnel, and security staff who require quick, personal, internal mobility solutions within expansive private complexes, prioritizing durability and operational efficiency.

In addition to these core segments, the tourism sector offers compelling opportunities, with rental service providers targeting tourists for sightseeing and guided city tours, leveraging the novelty and convenience of these devices in pedestrian-heavy zones. Geographically, potential customers are concentrated in densely populated metropolitan areas with supportive infrastructure, such as dedicated bicycle lanes or favorable regulations regarding PEV usage. Successful market penetration strategies involve tailoring product offerings to meet the specific safety and performance criteria of each customer group, such as focusing on enhanced battery life and rugged build quality for commuters, while emphasizing lightweight design and vibrant color options for the recreational youth market.

Moreover, institutions involved in education, particularly university campuses, increasingly represent a substantial customer segment. Students frequently require quick and efficient modes of transport to traverse large campus areas between classes, making hoverboards an ideal, compact, and cost-effective solution compared to traditional bicycles or cars. Marketing efforts directed towards this institutional sector emphasize convenience, environmental benefits, and low maintenance requirements. Ultimately, the market relies heavily on early adopters of technology and consumers who prioritize innovation and sustainability in their lifestyle choices, positioning the hoverboard as a lifestyle accessory rather than solely a functional transportation method, broadening the overall appeal across socioeconomic strata.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ninebot (Segway), Razor USA LLC, Swagtron, Halo Board, Hover-1, Megawheels, EPIKGO, Tomoloo Technology Industrial Co., Ltd., Shenzhen Chiping Technology Co., Ltd., Airwheel Holding Limited, Koowheel, Gotway, F-Wheel, Gyroor, Jetson Electric Bikes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hoverboard Scooters Market Key Technology Landscape

The technological evolution of the hoverboard scooters market is centered on enhancing three core pillars: safety, performance, and user experience. Crucially, the mandatory adoption of UL 2272 certification, which specifically addresses the electrical and fire safety of personal e-mobility devices, has standardized the market and forced manufacturers to invest significantly in advanced Battery Management Systems (BMS). These systems meticulously monitor individual cell voltages, temperature, and current flow, preventing thermal runaway and short-circuiting, thereby substantially mitigating the primary historical safety risk associated with earlier generations of hoverboards. Furthermore, motor technology has progressed from simple brushed DC motors to more efficient, quieter, and high-torque hub motors, facilitating smoother acceleration and better hill-climbing capabilities, crucial features for commuter-focused models.

Performance advancements are driven by sophisticated sensor fusion technology, integrating high-precision gyroscopes, accelerometers, and microprocessors to achieve superior dynamic stabilization, allowing the devices to respond instantaneously to shifts in the rider's center of gravity. This has led to the development of "self-balancing" features that maintain the board upright even when unoccupied, greatly improving user accessibility and perceived safety. Concurrently, the integration of advanced connectivity solutions, primarily Bluetooth Low Energy (BLE), allows riders to connect their devices to smartphone applications. These apps offer functionalities such as GPS tracking, ride statistics analysis, remote locking, customizable speed limits for novice riders, and firmware updates, seamlessly merging the physical riding experience with digital management and enhancing the overall value proposition.

Looking ahead, the market is increasingly incorporating technologies that move beyond basic mobility. The emerging landscape includes kinetic energy recovery systems (KERS) to moderately extend range by recapturing braking energy, and improved robust, all-terrain tire designs coupled with shock absorption systems to handle varied urban infrastructure. Material science also plays a vital role, with lighter yet stronger chassis materials, such as aerospace-grade aluminum and carbon fiber composites, being utilized to maintain portability while enhancing durability and load capacity. This relentless pursuit of incremental technological improvements, supported by intellectual property development in balancing algorithms and power delivery optimization, underscores the competitive necessity for manufacturers to continually innovate and differentiate their offerings in a saturated consumer electronics landscape.

Regional Highlights

Regional dynamics play a crucial role in shaping the Hoverboard Scooters Market, influenced by regulatory environments, consumer purchasing power, and urbanization rates. Each major region presents unique growth opportunities and challenges that manufacturers must navigate strategically to maximize global market share and operational efficiency.

- North America: Characterized by high consumer spending and stringent safety regulations, particularly the widespread adoption of the UL 2272 standard. The market here is mature but driven by demand for premium, technologically advanced models with high speed and long-range capabilities, predominantly catering to the recreational and affluent commuter segments. Key adoption centers include major metropolitan areas on the coasts and in the Sun Belt.

- Europe: Growth is moderately high, propelled by governmental emphasis on reducing urban vehicular emissions and strong public acceptance of micro-mobility solutions. Regulatory fragmentation across EU nations regarding usage on public sidewalks and roads presents complexity, but strong market performance is seen in countries like Germany, the UK, and France. Emphasis is placed on durable, compliant models suitable for multimodal transport integration.

- Asia Pacific (APAC): Expected to register the highest growth rate due to rapid urbanization, increasing disposable income in emerging economies (China, India), and severe traffic congestion. The APAC region is the primary manufacturing hub, driving competitive pricing and rapid product iteration. Demand is high across both budget-friendly recreational models and utility-focused commuter boards, leveraging population density for scalable rental services.

- Latin America (LAMEA): This region is an emerging market with potential, though growth is constrained by infrastructure limitations and economic volatility. Urban centers like São Paulo and Mexico City show promising adoption rates for personal use, largely driven by the cost-effectiveness of hoverboards compared to traditional vehicle ownership. Market expansion requires localized distribution strategies and robust customer support infrastructure.

- Middle East and Africa (MEA): Growth is steady, focused mainly on the UAE and Saudi Arabia, driven by smart city initiatives and high disposable income, particularly for luxury recreational goods. The extreme heat in certain areas necessitates specialized thermal management components for battery systems. South Africa acts as a regional hub for entry-level recreational devices, while the Gulf Cooperation Council (GCC) states focus on high-end models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hoverboard Scooters Market.- Ninebot (Segway)

- Razor USA LLC

- Swagtron

- Halo Board

- Hover-1

- Megawheels

- EPIKGO

- Tomoloo Technology Industrial Co., Ltd.

- Shenzhen Chiping Technology Co., Ltd.

- Airwheel Holding Limited

- Koowheel

- Gotway

- F-Wheel

- Gyroor

- Jetson Electric Bikes

- IO HAWK

- X-Treme Scooters

- WHEELSTER

- Saga Technology Co., Ltd.

- Coolreall

Frequently Asked Questions

Analyze common user questions about the Hoverboard Scooters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Hoverboard Scooters Market?

The Hoverboard Scooters Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period spanning from 2026 to 2033, driven by increasing adoption of micro-mobility solutions globally and technological enhancements in product safety.

Which regions are driving the highest demand and market growth for hoverboards?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to rapid urbanization, dense metropolitan areas, and improving economic conditions, while North America and Europe currently hold significant market share driven by high consumer awareness and strict regulatory standards like UL 2272 certification.

What are the primary safety standards relevant to hoverboard scooters?

The most crucial safety standard is the UL 2272 certification, which assesses the electrical and fire safety of the device’s battery, motor, and charging system. Adherence to UL 2272 is increasingly mandatory for retail and import in major Western markets, significantly enhancing consumer confidence.

How is AI impacting the development and functionality of modern hoverboards?

AI is primarily being integrated into advanced Battery Management Systems (BMS) for optimized efficiency and range prediction, and into sensor fusion technology to provide real-time adaptive gyroscopic stabilization, leading to significantly safer and more intuitive riding experiences for consumers.

What is the most significant restraint affecting the Hoverboard Scooters Market?

The most significant restraint is the inconsistency and ambiguity of regulatory frameworks across different cities and countries regarding the legal usage of hoverboards on public infrastructure, such as sidewalks and bike lanes, which creates market uncertainty and limits broader adoption for commuter purposes.

To further elaborate on the competitive landscape and strategic maneuvers within the Hoverboard Scooters Market, it is essential to analyze the recent trends in product innovation and intellectual property acquisition. Major industry players are increasingly focusing their research and development efforts on battery technology optimization, moving towards solid-state battery architecture to enhance energy density, reduce charging times, and further minimize the risk of thermal incidents, thereby future-proofing their product lines against increasingly strict safety mandates. This technological arms race extends into advanced materials science, with manufacturers exploring composite materials that offer a superior strength-to-weight ratio, allowing for lighter, more portable designs without compromising structural integrity or rider weight limits. Such innovations are crucial for maintaining differentiation in a market where basic functionality has become highly commoditized across numerous entry-level brands.

Furthermore, strategic partnerships and ecosystem development are becoming pivotal determinants of market success. Companies are actively collaborating with telecommunications providers to integrate advanced IoT capabilities into commercial fleet hoverboards, enabling real-time diagnostics, geo-fencing for compliance with city regulations, and remote management for micro-mobility rental operations. This integration transforms the hoverboard from a simple consumer electronic gadget into a connected device within the smart city infrastructure. The ability to seamlessly integrate with urban planning initiatives and public transport networks offers lucrative B2B opportunities beyond standard retail sales, representing a crucial shift in business model focus toward service provision rather than just hardware sales. This focus on B2B fleet management solutions provides a more stable, recurring revenue stream compared to the inherently seasonal and trend-driven consumer market.

The role of marketing and branding cannot be overstated in this highly visible consumer segment. Effective campaigns are now concentrating on repositioning hoverboards not as toys, but as essential tools for sustainable, efficient urban mobility, particularly targeting environmentally conscious millennials and Generation Z consumers. Social media influence, coupled with endorsements from prominent figures in sports and technology, serves to drive immediate sales and shape positive public perception. Companies are also investing heavily in experiential marketing, setting up demo zones in high-traffic areas to allow potential customers to experience the improved stability and safety features firsthand, directly addressing lingering skepticism from early product failures. This comprehensive approach, combining cutting-edge technology, strategic B2B partnerships, and targeted consumer engagement, dictates the long-term success of stakeholders in this dynamic market.

A detailed examination of the segmentation by Wheel Size reveals distinct market preferences linked directly to intended use. The 6.5 Inches and Below category dominates the recreational and indoor use markets, favored for its light weight, compact size, and high maneuverability, often appealing to younger riders due to lower speeds and easier handling. Conversely, the 10 Inches and Above segment is specifically engineered for rugged terrains and commuting over longer distances, where greater ground clearance and pneumatic tires offer superior shock absorption and stability. This segment’s growth is robust in regions with less pristine urban infrastructure, demanding higher-performance motors and extended battery life, justifying a premium price point. Manufacturers must align their product offerings precisely with these segment needs, ensuring that material choices and motor specifications meet the durability expectations of the commuter segment while maintaining the affordability required by the recreational demographic.

The segmentation by Application, differentiating between Personal Mobility/Recreational Use and Commercial Use, highlights divergent growth vectors. While the personal use segment remains the largest volume driver, fueled by impulse buying and holiday sales, the Commercial segment, encompassing rental services and internal corporate mobility, is demonstrating exponential growth in terms of revenue stability. Rental schemes require fleet-specific models characterized by robust, tamper-proof designs, longer duty cycles, and integration with specialized fleet management software. This commercial demand shifts the focus away from aesthetic customization towards operational longevity and low maintenance cost, presenting a lucrative, although more technically demanding, revenue stream for manufacturers capable of producing commercial-grade hardware and software solutions that seamlessly interface with third-party application platforms for billing and tracking services.

Furthermore, the analysis of the Sales Channel segmentation underscores the critical balance between online and offline strategies. Online retail channels provide advantages in terms of reduced overhead, direct consumer data collection, and faster global market reach, making them preferred for launching new, specialized models or handling large-volume, low-margin sales. However, Offline Retail, particularly through specialty electronics stores and established department stores, remains essential for high-value purchases, as consumers often prefer to physically inspect and test the device before committing. Successful companies utilize an omnichannel strategy, leveraging the online platform for visibility and initial engagement while maintaining a physical presence to address crucial concerns regarding product scale, weight, and safety perception, ensuring comprehensive coverage across diverse customer purchasing journeys.

The critical success factors in the Hoverboard Scooters Market revolve around continuous adaptation to evolving global safety regulations and effective cost management in the supply chain, particularly concerning battery procurement. Given the intense price competition, especially from Asian manufacturers, minimizing production costs without compromising the rigorous safety standards (UL 2272) is a constant challenge. Companies achieving vertical integration or securing long-term contracts for raw materials like lithium-ion cells gain a substantial competitive edge. Moreover, the ability to rapidly iterate product design based on consumer feedback regarding performance and known points of failure (e.g., foot sensor durability or chassis cracking) determines brand loyalty and minimizes costly warranty claims in the long run, essential for sustaining profitability in a high-volume, low-to-medium margin industry.

Another significant factor is intellectual property (IP) protection, especially surrounding gyroscopic balancing algorithms and proprietary battery management software. Early market entrants faced substantial IP infringement issues, but leading players are now aggressively defending their patented technology, creating higher barriers to entry for new competitors. The market is slowly consolidating around brands that offer verified, safe, and reliable technology, moving away from the highly fragmented landscape characterized by numerous low-quality offerings that plagued the market during its initial boom phase. This consolidation favors companies with strong R&D pipelines and robust legal resources capable of navigating international patent law complexities, signaling a maturation of the industry towards quality and compliance.

Finally, governmental infrastructure investment plays a subtle yet powerful role as an impact force. Cities investing in expanded networks of dedicated bicycle lanes or multi-use paths inadvertently create favorable conditions for hoverboard usage, transforming them from occasional recreational devices into viable commuting options. Conversely, cities that impose outright bans or severe restrictions on PEV usage significantly stifle market growth. Therefore, effective lobbying and collaboration with municipal authorities to establish clear, safe, and reasonable operational guidelines (e.g., designated low-speed zones or specific usage hours) are becoming critical strategic activities for market stakeholders aiming for long-term growth and stable operational environments within key metropolitan centers globally.

The dynamics of component supply are central to understanding market stability. Microcontrollers and processors, essential for the high-speed processing required by the gyroscopic sensors, are subject to global semiconductor shortages, which can impact production timelines and increase input costs, adding volatility to the final pricing structure. Manufacturers are exploring modular design architectures that allow for easier component upgrades and replacements, enhancing repairability and extending the product lifecycle, appealing to increasingly environmentally conscious consumers who prioritize durability over rapid obsolescence. This move towards sustainable design aligns with broader global corporate social responsibility (CSR) goals and can serve as a powerful marketing tool in ecologically sensitive markets like Northern Europe.

In terms of user experience, the next wave of technological innovation focuses heavily on advanced ergonomics and intuitive interaction. Designers are exploring dynamic footpad designs that provide better grip and sensory feedback, optimizing the connection between the rider and the device. Furthermore, connectivity standards are evolving beyond basic Bluetooth to potentially incorporate UWB (Ultra-Wideband) technology for more precise location tracking and interaction, particularly useful in commercial rental applications for inventory management and theft prevention. These detailed, user-centric improvements, though incremental, collectively enhance safety and perceived quality, distinguishing premium products and justifying higher average selling prices (ASPs) within the competitive landscape.

Regulatory scrutiny remains a consistent threat and opportunity. While the initial focus was solely on fire safety, regulatory bodies are now turning their attention to speed limits, collision avoidance, and noise pollution, particularly in dense urban areas. Manufacturers that proactively integrate features such as adjustable speed modes that comply with regional limits and silent operating motors will be better positioned for seamless global market entry and sustained operation. The proactive engagement with policy makers to help shape rational and fair regulations is becoming a non-market strategy essential for securing favorable operating environments and mitigating sudden legislative risks that could severely restrict market potential in lucrative geographic areas.

The competitive rivalry in the Hoverboard Scooters Market is intensified by continuous product substitution threats. While traditional competitors include other personal electric vehicles such as electric bikes and electric scooters, the emerging threat comes from advanced walking assistants and personal mobility aids that offer similar last-mile functionality with potentially greater stability for certain demographics, like the elderly or those with mild mobility constraints. Successful strategies involve highlighting the unique attributes of hoverboards—namely their compact footprint, high portability, and engaging riding experience—to maintain their distinct market appeal against these substitute products, reinforcing their niche in the recreational and short-distance urban commuting ecosystem.

Analyzing the potential customer base through a psychographic lens reveals a strong affinity for tech-savvy early adopters who prioritize novelty, convenience, and status symbols. These customers are less price-sensitive and more willing to invest in premium models offering the latest connectivity and safety features. Conversely, the mass market consumer (comprising the majority of sales volume) is highly sensitive to price and requires a compelling balance of cost and verified safety credentials, often settling for standard, UL-certified models. Strategic marketing must clearly segment these groups, using high-tech demonstrations for the early adopters and emphasizing value, safety, and reliability in mass-market campaigns, ensuring that promotional messages resonate authentically with the specific needs and concerns of each distinct psychographic profile across different regional and economic backgrounds.

The increasing trend toward customization also influences customer acquisition. Manufacturers are finding success offering customizable shells, LED lighting patterns, and even personalized performance settings via app control. This level of personalization taps into the psychological desire for self-expression, particularly among younger consumers, turning the hoverboard into a personalized statement rather than a mere means of transport. This strategy enhances customer engagement and can drive repeat business or accessories sales, indirectly boosting the overall lifetime value of the customer and reinforcing brand loyalty within a competitive and highly interchangeable product category.

Finally, the growing influence of the sharing economy cannot be overlooked. Commercial rental customers—the operators of hoverboard sharing services—demand ruggedness, extended battery life, and centralized management capabilities. Their purchasing decisions are based on total cost of ownership (TCO) rather than upfront price, making reliability and ease of maintenance paramount. This commercial sector requires specialized business relationships and product lines distinct from the consumer market, focusing on robust fleet management software licenses and long-term maintenance contracts, representing a sophisticated B2B sales cycle that contrasts sharply with direct-to-consumer retail dynamics and demands specialized organizational competency from manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager