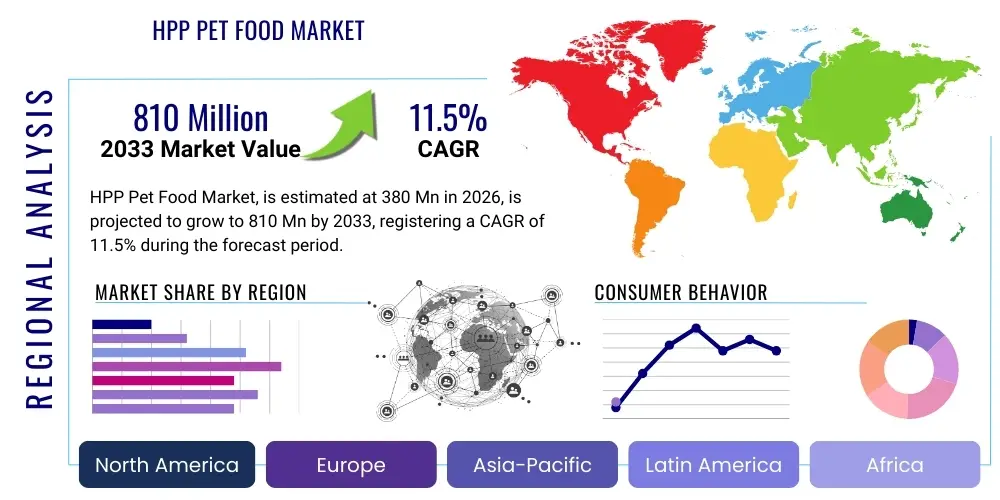

HPP Pet Food Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442417 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

HPP Pet Food Market Size

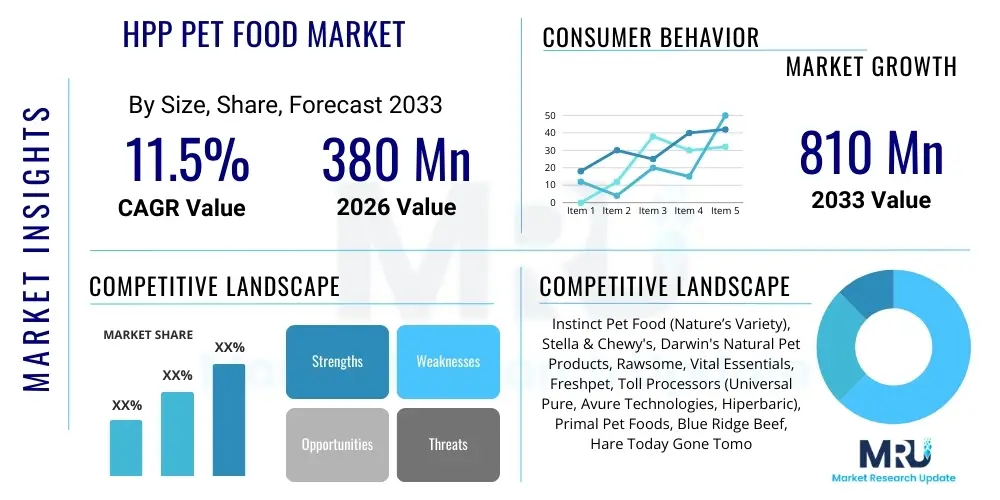

The HPP Pet Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $380 Million USD in 2026 and is projected to reach $810 Million USD by the end of the forecast period in 2033.

HPP Pet Food Market introduction

The High-Pressure Processing (HPP) Pet Food Market encompasses the manufacturing and distribution of pet food products treated with non-thermal pasteurization methods, primarily using high hydrostatic pressure. This innovative technique significantly enhances food safety and extends the shelf life of perishable pet food, particularly raw and fresh recipes, without compromising the nutritional integrity, flavor, or texture of the ingredients. HPP involves subjecting packaged food to extremely high levels of water pressure (typically 400–600 MPa) for a short duration, effectively inactivating pathogenic bacteria, molds, yeasts, and parasites, ensuring certified food safety. The market’s rapid ascent is intrinsically linked to the premiumization trend within pet care, where consumers demand transparency, minimal processing, and verifiable safety documentation for the diets consumed by their companion animals. This technology provides a commercially scalable solution that addresses the inherent microbial risks associated with raw meat, positioning HPP as a pivotal advancement in modern pet nutrition science and overcoming traditional barriers to raw food adoption. The structural expansion of this market involves heavy investment in specialized processing facilities and sophisticated cold chain management systems necessary to maintain product quality post-HPP treatment. The adoption curve is steepest in geographies with high regulatory scrutiny and strong consumer purchasing power, such as North America and Western Europe, where the willingness to pay a significant premium for guaranteed product safety is established.

Major applications of HPP technology within the pet food sector are concentrated in raw frozen, fresh refrigerated, and high-moisture semi-moist diets, with recent expansion into functional treats and specialty supplements where thermal stability is paramount. The demand for these premium formats is intrinsically driven by the pervasive pet humanization movement, wherein pet owners increasingly apply human-grade food standards and expectations to their pets’ diets. HPP ensures these products retain vital heat-sensitive nutrients—such as Vitamin B complexes, natural enzymes, and essential fatty acids like Omega-3s—that might be degraded by traditional retort or extrusion processing. The primary benefits realized through HPP technology include superior microbial safety (reducing risks associated with pathogens like Salmonella, Listeria, and E. coli), maintaining superior sensory attributes (texture, color, and palatability), and providing an essential clean-label alternative to chemical preservatives. Furthermore, the extended refrigerated or frozen shelf life provided by HPP facilitates broader, more efficient distribution channels, allowing specialized, niche brands to scale their operations and reach national and international markets while assuring peak product freshness and minimizing waste, thereby improving sustainability metrics across the supply chain.

The market expansion is fundamentally driven by escalating consumer concerns regarding pet health and the documented risks of foodborne illnesses associated with improperly handled raw diets, coupled with a pervasive preference for fresh, biologically appropriate raw food (BARF) or raw-mimicking culinary preparations. Increasing discretionary income levels across developed and rapidly developing economies further enable greater expenditure on sophisticated, premium pet nutrition solutions. The stringent regulatory landscapes in regions like the US and EU, particularly those focusing on rigorous pathogen reduction targets for meat-containing pet foods, unintentionally but powerfully accelerate the necessity and adoption of HPP as a robust, non-chemical safety verification step. Additionally, continuous engineering advancements in HPP equipment—resulting in higher throughput capacity, reduced footprint, and improved energy efficiency—coupled with decreasing unit operational costs as the technology matures and scales, make HPP increasingly accessible and economically viable for a wider range of medium-to-large scale pet food manufacturers, fueling expansion across diverse product categories, including functional toppers and high-protein bone broths requiring cold pasteurization. The ability to guarantee a consistent level of safety without altering nutritional profiles remains the cornerstone driver of market acceptance and growth.

HPP Pet Food Market Executive Summary

The HPP Pet Food Market is experiencing a period of accelerated growth, fundamentally characterized by robust investment, aggressive market consolidation, and profound product innovation, all underpinned by the sustained global trends in pet humanization and the resultant demand for ultra-safe, clean-label raw and fresh diets. Key business trends show that strategic mergers, acquisitions, and minority investments are common among established pet food conglomerates aiming to acquire specialized HPP capacity and brand portfolios quickly, rather than developing the infrastructure organically. This consolidation is particularly evident in the HPP tolling sector, where service providers are expanding their geographic reach and processing capacity to meet surging manufacturer demand, creating integrated supply chain ecosystems focused exclusively on non-thermal processing. Furthermore, product developers are shifting focus towards incorporating novel, sustainable, and functional ingredients—such as insect proteins, ancient grains, and targeted probiotic strains—all preserved via HPP, addressing the sophisticated consumer desire for holistic pet health solutions, including specific formulas targeting gut health, cognitive function, and mobility support across different life stages. E-commerce remains the primary growth engine, necessitating continuous innovation in temperature-controlled shipping solutions and subscription model optimization, maximizing consumer convenience while mitigating logistical risks associated with perishable goods.

Regionally, the market exhibits clear developmental tiers. North America sustains its market dominance not only through sheer volume but also through consumer sophistication regarding raw food safety, supported by the largest installed base of HPP processing equipment globally, both in proprietary manufacturing sites and third-party tolling facilities. Europe follows, distinguishing itself through strict quality controls and a particularly high affinity for organic and sustainably sourced raw materials, making the HPP preservation method highly aligned with core consumer values. The most transformative regional trend, however, is the burgeoning investment in the Asia Pacific market. While current penetration is low, the massive market potential driven by exploding pet populations in urban China and South East Asia, coupled with high average revenue per pet in sophisticated markets like Japan, promises exponential growth. Manufacturers are actively overcoming regional hurdles related to cold chain logistics through strategic joint ventures with local logistics specialists, aiming to establish regional processing hubs to serve the massive upcoming demand for premium safety-certified foods.

Segmentation analysis confirms that the Fresh Refrigerated segment is the primary growth accelerator, offering a balance of nutritional integrity and user convenience superior to traditional raw frozen formats, thereby expanding the potential customer base beyond hardcore raw feeders. Ingredient trends favor high-quality, single-source animal proteins, although there is increasing interest in HPP applications for raw, high-moisture vegetable components used in complete and balanced raw diets, where safety concerns are equally paramount. Distribution channel trends underscore the critical role of specialized channels: while online platforms master the logistical fulfillment, specialty pet retail channels remain essential for high-touch customer education regarding the handling and benefits of HPP-treated perishable products. The technological segment is evolving rapidly, too, with manufacturers focusing on integrating advanced quality assurance protocols, often utilizing AI and IoT sensors, into every stage of the HPP value chain to provide verifiable proof of product safety and consistency, reinforcing consumer confidence in the premium price justification. This continuous enhancement of the operational framework ensures HPP pet food maintains its competitive edge in the rapidly evolving premium pet nutrition landscape, driving sustained, double-digit market expansion and attracting substantial investment from venture capital and corporate entities seeking exposure to the high-growth raw food sector.

AI Impact Analysis on HPP Pet Food Market

User inquiries concerning AI's role in the HPP Pet Food Market are increasingly sophisticated, moving from general feasibility questions to focused queries on optimization, efficiency, and customized formulation. The core analytical concern is how Artificial Intelligence and Machine Learning (ML) can move HPP from a standardized batch process to a highly adaptive, prescriptive technology. Stakeholders frequently question how algorithms can precisely adjust HPP parameters (pressure intensity, dwell time, temperature moderation) in real-time based on fluctuating input variables such as the exact microbial load, water activity, fat content, and protein type of the specific raw meat matrix entering the vessel. This level of dynamic parameter adjustment is crucial for ensuring the absolute highest level of pathogen kill efficacy while simultaneously ensuring the minimal possible degradation of heat-sensitive vitamins and bioactive compounds, thereby maximizing the nutritional retention claims which justify the product's premium cost. Furthermore, a substantial portion of user concern centers on AI's ability to provide end-to-end supply chain visibility and predictive spoilage modeling, especially given the strict refrigerated shelf life of HPP products, requiring flawlessly executed cold chain management across wide geographic areas, a challenge AI is uniquely positioned to solve through advanced sensor integration and real-time data processing.

The integration of advanced AI and sophisticated Machine Learning models is currently transforming the operational core of the HPP sector, pushing efficiency boundaries previously limited by empirical testing and fixed-parameter processing. In manufacturing environments, AI platforms analyze massive, multi-dimensional datasets gathered from raw material testing, processing logs, and real-time sensory inputs. These algorithms establish optimal, customized HPP protocols for every unique batch formulation, dramatically improving consistency and energy utilization. For example, ML models can predict the specific pressure required to achieve a 5-log reduction of common pathogens in a formulation containing 30% fat and 60% moisture versus one with 10% fat, thus preventing over-processing which wastes energy and under-processing which risks safety failure. Moreover, AI drives the next generation of predictive maintenance, utilizing sensor data (vibration analysis, hydraulic pressure anomalies, thermal signatures) from high-capital HPP intensifiers and vessels to anticipate mechanical failure up to weeks in advance, allowing scheduled, rather than reactive, maintenance, thereby guaranteeing continuous production throughput critical for perishable goods and significantly reducing the total cost of ownership for expensive equipment.

In the realm of market strategy and logistics, AI algorithms provide advanced predictive modeling capabilities that are indispensable for managing the complex distribution of HPP products. Due to their limited chilled shelf life, accurate demand forecasting is paramount to minimize expensive product spoilage. AI analyzes granular historical sales data, promotional campaign effectiveness, micro-seasonal consumption shifts, regional climate impacts, and even macro-economic indicators to produce highly accurate forecasts, optimizing inventory holding across refrigerated warehouses and guiding precise production schedules. Furthermore, in cold chain management, IoT sensors coupled with ML algorithms continuously monitor temperature and humidity across shipping routes. If an excursion is detected, the AI system instantly recalculates the remaining safe shelf life (dynamic dating) and suggests immediate logistical redirection or disposition, providing manufacturers with unprecedented granular control over product safety and quality assurance, thereby solidifying the high-trust consumer relationship essential for the premium HPP market segment. This technology elevates quality control from a point-in-time check to a continuous, end-to-end assurance process, fundamentally optimizing the economic structure of the market, enabling scaling while maintaining safety assurances.

- AI optimizes HPP parameters (pressure/time) based on specific ingredients, maximizing microbial safety and nutritional retention, enabling custom-batch processing.

- Machine Learning models predict complex cold chain disruptions and optimize logistics routing for perishable HPP products, significantly reducing expensive spoilage waste and ensuring freshness delivery.

- AI-driven computer vision and image recognition systems enhance upstream quality control, swiftly inspecting raw materials for consistency, texture, and physical contaminants prior to costly HPP treatment.

- Predictive maintenance using AI monitors the operational health of high-capital HPP equipment (intensifier pumps, pressure vessels), preventing catastrophic unplanned downtime and maximizing asset utilization rates.

- Data analytics and ML are applied to sophisticated consumer preference mapping, analyzing pet health data to facilitate the rapid, targeted development of personalized HPP-preserved dietary formulations tailored for specific health needs and breeds.

- AI is utilized for dynamic shelf-life determination (dynamic dating) based on accumulated temperature exposure during transit, providing transparent safety metrics to distributors and consumers, enhancing supply chain reliability.

DRO & Impact Forces Of HPP Pet Food Market

The HPP Pet Food Market is driven forward by several mutually reinforcing forces, primarily centered on health and quality assurances. The principal driver remains the deeply entrenched trend of pet humanization, which elevates consumer expectations, leading to a substantial willingness to pay a premium for food products that mimic or exceed human consumption standards. This cultural shift translates directly into heightened demand for raw, fresh, and minimally processed diets, attributes intrinsically enabled by HPP technology which acts as the crucial safety guarantor. The market benefits significantly from the increasing volume of nutritional research supporting the superior digestibility and improved health outcomes (e.g., improved skin and coat condition, better weight management) associated with raw feeding regimes. Furthermore, regulatory scrutiny, particularly from authorities concerned with the safety profile of uncooked meat products, mandates demonstrable pathogen reduction. HPP provides a scientifically validated, non-chemical means of meeting these stringent safety standards, effectively transforming a niche, high-risk product category (raw) into a commercially viable, trust-certified premium offering, thereby accelerating adoption among risk-averse large manufacturers and minimizing the potential for expensive product recalls.

Despite the strong drivers, market expansion encounters substantial restraints that limit its accessibility and overall velocity. The most significant impediment is the massive capital expenditure required for acquiring, installing, and maintaining HPP machinery, which demands specialized infrastructure (high-pressure vessels, dedicated utilities, robust cold storage). This high barrier to entry confines competitive participation largely to well-funded enterprises and specialized tolling centers, limiting market democratization. Consequently, the elevated production cost is passed directly to the consumer, resulting in a high retail price point—often three to four times that of premium kibble—which restricts consumption primarily to high-income demographics, inhibiting mass market appeal. An equally critical restraint is the complex logistical challenge of maintaining the essential cold chain continuity (refrigerated or frozen) throughout the entire supply cycle, from processing plant to the consumer's doorstep. Any failure in temperature control compromises the HPP-extended shelf life and risks product integrity, necessitating expensive, specialized logistics partners and bespoke packaging solutions, adding further cost and complexity, particularly in hot climates or geographically dispersed regions lacking adequate refrigerated infrastructure.

Opportunities for substantial future growth in the HPP Pet Food market are largely technological and geographic. Technologically, there is vast untapped potential in applying HPP to specialized functional foods and nutritional supplements, such as highly sensitive probiotics, omega oil supplements, and botanicals, where the preservation of efficacy is crucial and impossible via heat treatment. Furthermore, ongoing innovation in packaging materials promises to enhance HPP's viability; the development of cheaper, more sustainable (e.g., compostable) packaging that effectively withstands ultra-high pressure and offers superior oxygen barrier properties will significantly lower input costs and further extend ambient shelf life potential, potentially facilitating limited penetration into mass market channels. Geographically, strategic market penetration into untapped, high-growth urban centers in Asia Pacific and Latin America, achieved through localized HPP tolling arrangements and robust e-commerce cold chain build-outs, offers exponential growth potential as these regions rapidly adopt Western pet care standards and premium feeding practices, mitigating the current geographical limitations imposed by existing infrastructure gaps and unlocking new consumer bases with rising disposable incomes.

The collective impact forces suggest a structurally positive, high-value trajectory for the HPP Pet Food market. The confluence of consumer willingness to prioritize safety over cost in the premium segment, coupled with continuous advancements aimed at driving down operational expenditure and increasing throughput efficiency of HPP equipment, strongly mitigates the existing financial and logistical restraints. The market is increasingly recognizing HPP not as an optional preservation method but as an indispensable component of product quality and trust validation, particularly for raw food brands mandated to demonstrate certified pathogen reduction. This regulatory and consumer pressure fuels continuous R&D investment, cementing HPP’s role as the gold standard for minimal processing safety in the fresh pet food industry. Ultimately, the verifiable reduction of food safety risk provided by HPP is creating a substantial, durable competitive advantage that is reshaping product formulation and marketing strategies across the entire premium segment, ensuring high brand loyalty and sustained revenue growth despite the elevated price structure.

Segmentation Analysis

The granular segmentation analysis of the HPP Pet Food Market reveals precise dynamics regarding product acceptance and consumer channel preferences, essential for strategic market positioning. Segmentation based on food type distinctly highlights the dominance of perishable formats—Raw Frozen and Fresh Refrigerated meals—which inherently necessitate HPP treatment for safety assurance. The Raw Frozen segment, comprising primarily complete and balanced BARF diets, accounts for the foundational market share, as HPP effectively addresses the primary microbial risk associated with uncooked meat while maintaining the essential structural integrity of the raw materials. However, the Fresh Refrigerated segment, offering ready-to-serve convenience and often formulated in a gently cooked or lightly processed manner before HPP, is demonstrating the fastest CAGR. This accelerated growth is attributed to its appeal to a broader consumer base that seeks the benefits of human-grade ingredients and high safety standards but prefers the ease of serving a refrigerated meal over thawing a frozen product. Emerging segments, such as HPP-treated broth toppers and functional chews, indicate a growing acceptance of the technology across supplementary pet nutrition categories, driving further market diversification and value creation.

Analyzing the market by Animal Type confirms that Dog Food remains the substantial volume leader, mirroring the larger canine population globally and the historical focus of raw food feeding advocacy on dogs. The sheer diversity of dog breeds and life stages necessitates a wide array of HPP-treated formulations, from large-breed puppy formulas to senior diets focusing on enhanced digestibility and nutrient absorption. Simultaneously, the Cat Food segment is exhibiting disproportionately high growth in terms of HPP adoption rate. Feline-specific diets, which require higher protein and moisture content, align perfectly with HPP’s ability to preserve the inherent palatability and nutritional value of meat-rich recipes without the addition of unnecessary carbohydrates or binders often found in heat-treated kibbles. This segment’s growth is further fueled by increased veterinary emphasis on moisture intake for feline kidney and urinary tract health, where HPP-preserved fresh and wet meals offer a highly palatable solution, leading to increased manufacturer focus on high-moisture HPP feline products.

Distribution channel segmentation illustrates the vital link between specialized product logistics and consumer engagement. The Online/E-commerce channel now holds a dominant and rapidly expanding share, capitalizing on subscription models that guarantee consistent delivery of perishable goods and manage the sophisticated cold chain fulfillment process efficiently. The direct-to-consumer (DTC) model minimizes handling points and maximizes profit margins while providing crucial control over the cold supply chain integrity, essential for maintaining product safety claims. Specialty Pet Stores remain essential as they offer a high-touch environment for consumer education, allowing staff to explain the technical benefits and proper handling of HPP products, justifying the higher price point and building brand loyalty. Mass Retail penetration remains stubbornly low, largely constrained by the requirement for significant investment in dedicated, highly reliable refrigerated shelving and back-of-house cold storage capacity, a complexity that most standard grocery retailers are hesitant to undertake for a niche, high-cost item, thereby limiting the market’s exposure to casual buyers and reinforcing the premium, specialized positioning of HPP pet food within highly targeted retail environments.

- By Food Type:

- Raw Frozen Pet Food (Dominant, foundational segment utilizing HPP for essential microbial inactivation.)

- Fresh Refrigerated Pet Food (Fastest-growing segment, valuing convenience alongside nutrient preservation.)

- Wet/Semi-Moist Pet Food (Application in highly palatable treats, chews, and meal mixers.)

- Supplements and Toppers (Niche, focused on preserving sensitive bioactive ingredients like probiotics and omega oils.)

- By Animal Type:

- Dog Food (Largest volume segment, driven by broad formulation demand and large breed sizes.)

- Cat Food (High growth segment, leveraging HPP for moisture-rich, high-protein feline-specific diets.)

- Other Pets (Including specialized raw diets for ferrets and certain exotic animal feeders.)

- By Distribution Channel:

- Specialty Pet Stores (Key for brand education, high-trust recommendations, and premium placement.)

- Online/E-commerce (Highest growth and market share, essential for cold chain fulfillment and subscription services, enabling broad geographic reach.)

- Veterinary Clinics (Niche channel for prescription and therapeutic HPP diets focusing on digestibility.)

- Mass Retailers (Limited penetration, constrained by specialized refrigerated infrastructure requirements and price elasticity limitations.)

- By Ingredient Source:

- Meat-based (Poultry, Beef, Fish, Exotic Meats – primary HPP application target.)

- Plant-based/Vegan Formulations (Niche, utilizing HPP for certified safety of raw vegetables, legumes, and seeds in complete diets.)

Value Chain Analysis For HPP Pet Food Market

The value chain for the HPP Pet Food Market is characterized by high requirements for quality control at every stage, demanding significant capital allocation from raw material sourcing through final cold distribution. Upstream activities commence with highly selective and quality-assured sourcing of human-grade raw inputs, principally meat, bone, and organs, alongside fresh produce. Unlike conventional pet food where lower-grade inputs can be thermally sterilized, HPP mandates stringent microbial control from the farm or processing facility, requiring suppliers to adhere to human food safety standards (e.g., USDA or CFIA equivalent). Manufacturers must invest heavily in rigorous incoming material testing, advanced mixing, and cryogenic freezing technologies for temporary storage. The cost of these high-specification raw ingredients, combined with the complexity of maintaining HACCP (Hazard Analysis Critical Control Point) plans designed for raw food handling, constitutes a significant proportion of the total product cost, creating a high barrier to entry and distinguishing HPP pet food supply chains from traditional extruded feed models which rely on high-heat sterilization to neutralize initial bioburden.

The midstream segment involves the core manufacturing processes: formulation, specialized packaging, and the HPP treatment itself. After precise grinding and mixing, the product must be loaded into flexible, proprietary packaging designed to withstand the immense hydrostatic pressure without leakage or tearing, adding a specialized material cost not faced by conventional manufacturers. The HPP processing stage—often outsourced to regional tolling centers or conducted internally using multi-million dollar machinery—is capital-intensive and requires high energy consumption, contributing significantly to the unit cost. Key to this stage is the meticulous validation process, often involving microbiological challenge testing, ensuring the HPP cycle achieves the necessary log reduction target for pathogens while maintaining consistent pressure and temperature profiles. The efficiency of the HPP equipment (throughput capacity and cycle time) is the single most important determinant of margin profitability in the midstream, driving continuous investment in the latest generation of horizontal HPP systems to maximize economies of scale and minimize per-unit processing time, thereby improving the long-term cost structure.

Downstream activities focus entirely on achieving flawless cold chain execution and optimizing market reach. The distribution channel structure relies heavily on refrigerated logistics partners capable of maintaining specific temperature ranges (typically below 4°C for refrigerated or -18°C for frozen) during transportation, storage, and final delivery. This specialized, high-cost logistics model, requiring real-time temperature telemetry (IoT monitoring) throughout transit, significantly elevates distribution costs compared to ambient goods. Direct-to-consumer (DTC) channels, facilitated by e-commerce, have flourished because they allow manufacturers to tightly manage this cold chain risk and capture higher margins, using specialized insulated shipping containers and dry ice or gel packs. Indirect channels, involving specialty pet retailers, require significant ongoing investment in retailer education and audits to ensure compliance with product handling standards. Effective consumer education, provided both online and in-store, on the proper storage and expiration protocols for HPP-preserved foods is a vital downstream activity, translating the safety investment into sustained consumer trust and loyalty, thus protecting brand equity and ensuring the efficacy of the entire value proposition.

HPP Pet Food Market Potential Customers

The core demographic for HPP Pet Food consists of highly involved pet parents, typically characterized by above-average household income, urban or suburban residency, and a sophisticated understanding of nutritional science. These consumers operate within the framework of intense pet humanization, treating their dogs and cats as integral members of the family unit, resulting in non-negotiable standards for food quality and safety that align with their own consumption habits. They actively reject traditional, highly processed kibble based on concerns over ingredient quality, synthetic additives, and the degradation caused by high-heat extrusion. Their purchasing decisions are primarily motivated by a desire for preventative health and longevity for their pets, viewing premium HPP-treated meals as a foundational investment in long-term wellness. They seek transparency and verifiable claims regarding ingredient origin and pathogen reduction, making the certified safety provided by HPP a decisive factor that validates the substantial price premium they are willing to pay monthly and encourages strong brand loyalty.

A rapidly expanding segment of the potential customer base includes owners whose pets have documented health challenges, such as chronic gastrointestinal issues, severe allergies, skin conditions, or inflammatory bowel disease (IBD). For these customers, traditional processed foods often exacerbate symptoms, and they are actively seeking therapeutic dietary interventions. HPP-treated raw and fresh foods, due to their higher digestibility, minimized exposure to synthetic preservatives, and clean ingredient panels, frequently serve as the optimal dietary solution, often recommended or required by functional and holistic veterinarians. This segment is highly loyal to successful product lines and exhibits minimal price sensitivity, prioritizing the functional efficacy and safety assurance of the HPP process. The utilization of HPP allows manufacturers to formulate highly targeted, limited-ingredient diets (LID) that maintain safety without compromising the nutritional complexity required for therapeutic applications, positioning the product as a necessity rather than a luxury.

Furthermore, the institutional and professional market forms a high-volume, albeit niche, customer group. This includes highly reputable show dog breeders, specialized performance canine training facilities (e.g., service, police, military dogs), and veterinary rehabilitation centers. These institutional buyers require consistent, bulk access to high-energy, nutrient-dense, and highly digestible food to maintain peak animal condition and performance. They are acutely aware of the risks associated with raw food contamination and demand the highest possible safety standards. The assurance provided by HPP processing significantly reduces their operational risk related to potential illness outbreaks within their kennels or facilities. These customers

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $380 Million USD |

| Market Forecast in 2033 | $810 Million USD |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instinct Pet Food (Nature’s Variety), Stella & Chewy's, Darwin's Natural Pet Products, Rawsome, Vital Essentials, Freshpet, Toll Processors (Universal Pure, Avure Technologies, Hiperbaric), Primal Pet Foods, Blue Ridge Beef, Hare Today Gone Tomorrow, Arrowhead Pet, Small Batch Pets, Lotus Pet Food, Champion Petfoods, JustFoodForDogs, Steve's Real Food, K-9 Kraving. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HPP Pet Food Market Key Technology Landscape

The technological landscape of the HPP Pet Food Market is centered on refining the High-Pressure Processing mechanism itself, improving ancillary equipment, and developing packaging suitable for ultra-high-pressure conditions. The core technology involves the use of robust, high-pressure vessels and intensifier pumps, typically manufactured by specialized firms like Hiperbaric, Avure, and ThyssenKrupp, which can generate and withstand pressures up to 6,000 bar (87,000 psi). Recent technological advancements focus intensely on developing next-generation, larger-capacity horizontal HPP units, which significantly increase throughput capacity and reduce batch cycle times, directly addressing the high capital cost barrier associated with processing high volumes of pet food. Furthermore, energy recovery systems, closed-loop water recirculation systems, and optimized intensifier pump designs are key areas of innovation aimed at lowering the operational energy costs per cycle, thereby enhancing the economic viability and sustainability profile of HPP for manufacturers, making it a more attractive long-term investment.

Crucially, the commercial success of HPP pet food depends fundamentally on the specialized packaging technology employed. Pet food products must be packaged in flexible, high-barrier materials (typically specific, multi-layer plastic polymers such as Nylon/PE or PET/PE laminates) engineered specifically to transmit pressure uniformly across the product and survive the extreme compression/decompression cycle without rupturing, leakage, or loss of seal integrity. Simultaneously, the packaging must maintain excellent oxygen and moisture barrier properties to prevent post-process contamination and slow down oxidative degradation, critical for extended shelf life. Innovations in sustainable, HPP-compatible packaging are rapidly emerging, including recyclable mono-materials and bio-based polymers designed to endure ultra-high pressure. Manufacturers are also widely implementing advanced sensor technology, data logging systems, and integrated control software within the processing lines to ensure rigorous validation and verification of pressure magnitude, dwell time, and temperature stability, all essential for stringent regulatory compliance and substantiating product safety claims.

Beyond the core HPP machinery, the supporting technological landscape includes the sophisticated integration of automation and ubiquitous cold chain monitoring solutions. Highly automated loading and unloading systems are being adopted to streamline the production process, minimizing human contact and maximizing overall plant hygiene—a non-negotiable factor for raw food safety. Advanced refrigeration management systems and Internet of Things (IoT) sensors are deployed extensively across the distribution network to meticulously track and record temperature and humidity excursions in real-time, providing comprehensive telemetry data. This sophisticated cold chain management technology provides verifiable, auditable data proof that the HPP-achieved product integrity has been maintained precisely from the processing facility through to the final point of sale or consumer delivery. This end-to-end transparency and verifiable assurance significantly strengthens consumer confidence in the quality and safety of these premium, chilled or frozen pet diets, supporting the brand's premium market positioning.

Regional Highlights

The HPP Pet Food Market demonstrates significant regional variation in maturity, growth drivers, and market penetration, influenced heavily by disposable income levels, pet ownership culture, and regulatory stringency regarding raw food safety.

North America (United States & Canada): North America is the undisputed leader in the HPP Pet Food Market, accounting for the largest market share globally. This dominance is attributable to several factors: high disposable incomes enabling significant expenditure on premium pet nutrition, a deeply ingrained culture of pet humanization, and early widespread consumer adoption of raw and fresh pet diets. The United States, in particular, has seen rapid proliferation of specialized HPP-treated brands and co-packing facilities (tolling services), driven by strict FDA and state-level safety regulations regarding raw meat products, making HPP a necessary step for market entry and competitive differentiation. The market here is highly competitive, characterized by continuous product innovation, aggressive marketing emphasizing health, safety, and human-grade quality, and a preference for raw frozen formats. E-commerce platforms are exceptionally strong in managing the complex cold chain logistics required for widespread distribution across large geographic areas.

Europe: Europe represents the second-largest market, exhibiting strong, stable growth, particularly in Western countries such as the UK, Germany, France, and the Scandinavian nations. The region is characterized by a strong consumer preference for natural, organic, and locally sourced high-quality ingredients and a cautious approach towards synthetic food preservation methods. European regulatory bodies maintain strict oversight on microbial safety in pet food, naturally favoring the non-thermal, clean-label attributes of HPP. Growth is particularly robust in the fresh refrigerated meal segment, appealing to urban consumers seeking convenient, ready-to-serve meals that align with high ethical and sustainability standards. However, regulatory fragmentation across the European Union occasionally presents logistical challenges for cross-border distribution compared to the North American market, requiring localized adaptation of cold chain strategies, specialized packaging, and rigorous product labeling compliance for different national markets.

Asia Pacific (APAC): The APAC region is forecast to be the fastest-growing market over the forecast period, albeit from a smaller current base. Growth is concentrated in rapidly urbanizing economies like China, Japan, and South Korea, where increasing disposable incomes and the adoption of Western pet ownership models are fueling demand for premium, high-safety pet foods. Pet food safety scandals in the past have heightened consumer trust issues, making the certified safety of HPP highly attractive for premium positioning. The main challenge in APAC is the historically less developed cold chain infrastructure outside major metropolitan areas, coupled with higher costs of HPP technology import and operation. Strategic partnerships with local cold storage and logistics providers are essential for market penetration, with an emerging focus on smaller, single-serve portions tailored to smaller breeds prevalent in the region and addressing the logistical constraints of smaller household freezer capacity.

Latin America and Middle East & Africa (LAMEA): These regions currently hold smaller market shares but present strategic long-term opportunities. Growth is nascent and primarily restricted to major economic hubs (e.g., Brazil, Mexico, UAE, South Africa) where an affluent consumer base demands imported or domestically produced premium pet foods. The market is highly price-sensitive, and the high cost of HPP equipment, coupled with the underdeveloped cold chain infrastructure, remains a substantial barrier to widespread adoption. Future growth depends heavily on foreign direct investment, the establishment of regional HPP tolling centers to reduce import costs, and targeted marketing towards niche, high-income consumers seeking premium, highly digestible foods for purebred and companion animals, requiring localized distribution solutions that guarantee temperature control in challenging climatic conditions.

- North America (Dominant Market): Driven by high disposable income, strong pet humanization trends, and necessary safety compliance for raw diets, supported by extensive HPP tolling network.

- Europe (Second Largest): Characterized by stringent food safety standards, preference for natural ingredients, and high penetration in the fresh refrigerated segment, focused heavily on clean-label production.

- Asia Pacific (Fastest Growing): Fueled by urbanization, increasing disposable income, and demand for certified safe products following past health scares, concentrated in highly developed urban centers.

- Latin America: Growth concentrated in affluent metropolitan areas; constrained by high price sensitivity and underdeveloped refrigerated logistics networks outside major cities.

- Middle East & Africa (MEA): Highly niche market focused on premium, imported goods for high-net-worth consumers, dependent on advanced localized cold storage facilities and specialty distribution channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HPP Pet Food Market.- Instinct Pet Food (Nature’s Variety)

- Stella & Chewy's

- Darwin's Natural Pet Products

- Rawsome

- Vital Essentials

- Freshpet

- Primal Pet Foods

- Blue Ridge Beef

- Hare Today Gone Tomorrow

- Arrowhead Pet

- Small Batch Pets

- Lotus Pet Food

- Champion Petfoods (Acana/Orijen - increasing HPP applications)

- JustFoodForDogs

- Avure Technologies (Equipment Provider)

- Hiperbaric (Equipment Provider)

- Universal Pure (Tolling Services)

- Tyson Foods (Through subsidiary investments in fresh pet food)

- Nestlé Purina PetCare (Strategic interest and R&D into non-thermal methods)

- Mars Petcare (Exploration of fresh and raw segments using advanced processing)

Frequently Asked Questions

Analyze common user questions about the HPP Pet Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High-Pressure Processing (HPP) and how does it ensure pet food safety?

HPP is a non-thermal pasteurization technique that uses intense hydrostatic pressure (up to 6,000 bar) transmitted through water to inactivate pathogenic bacteria like Salmonella and E. coli in packaged pet food. This cold processing method maintains the raw nutritional integrity while ensuring microbial safety, a critical factor for fresh and raw diets, achieving certified pathogen reduction without heat.

Is HPP Pet Food nutritionally superior to traditionally processed kibble?

Yes, HPP pet food is generally considered nutritionally superior to extruded kibble because the absence of high heat preserves heat-sensitive vitamins, essential fatty acids (Omegas), and natural enzymes found in raw ingredients, offering maximum biological availability and nutritional density, supporting better pet health outcomes.

What are the primary factors driving the high cost of HPP pet food?

The premium price point of HPP pet food is primarily driven by three factors: the high initial capital investment required for HPP machinery, the operational costs associated with maintaining a dedicated cold chain distribution network, and the consistent requirement for sourcing high-quality, human-grade raw ingredients, resulting in elevated unit costs.

Which pet food segments benefit most from High-Pressure Processing technology?

The Raw Frozen Pet Food and Fresh Refrigerated Pet Food segments benefit most significantly from HPP. HPP provides the necessary safety assurance for raw meat products without altering the texture or flavor profile, supporting the clean-label and minimally processed attributes valued by consumers in these premium, high-growth segments.

How is the adoption of Artificial Intelligence influencing HPP Pet Food manufacturing?

AI influences HPP manufacturing by optimizing processing parameters (pressure, time) based on ingredient variability, maximizing pathogen kill while preserving nutrients. AI also enhances predictive maintenance for equipment and improves complex cold chain logistics and inventory forecasting, thereby reducing production costs and minimizing expensive spoilage waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager