Human Body Composition Analyzers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441395 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Human Body Composition Analyzers Market Size

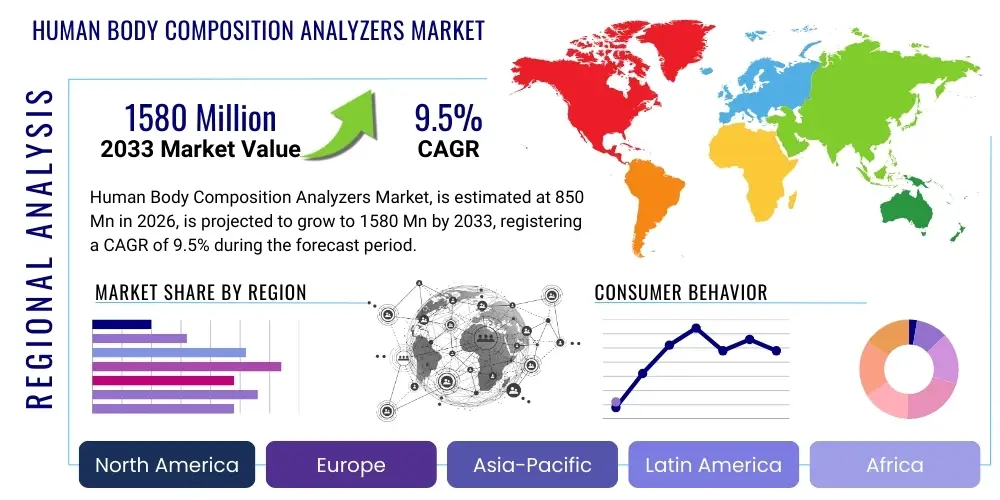

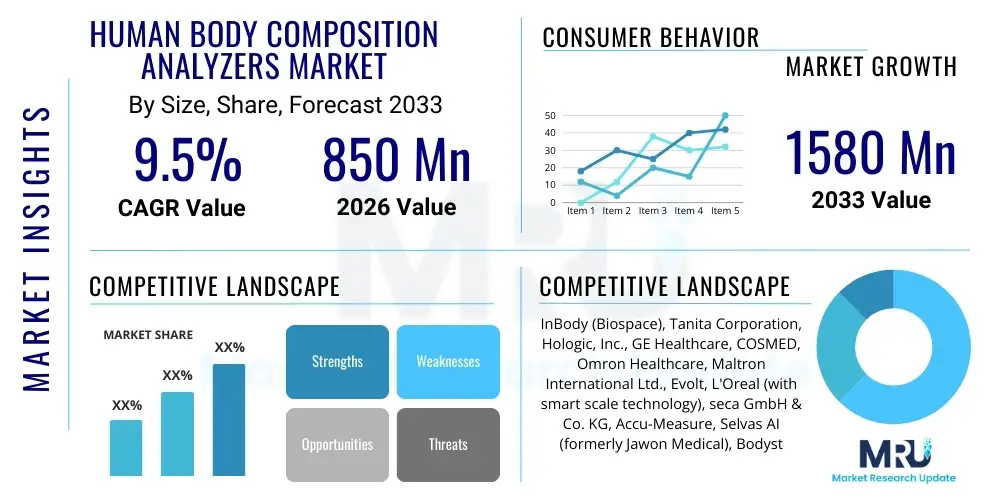

The Human Body Composition Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1580 Million by the end of the forecast period in 2033.

Human Body Composition Analyzers Market introduction

The Human Body Composition Analyzers Market encompasses various advanced devices and techniques designed to quantify the proportions of fat, muscle, water, and bone mass within the human body. These sophisticated instruments move beyond simple weight measurement, offering detailed, actionable insights crucial for clinical diagnostics, preventive healthcare, nutritional planning, and athletic performance optimization. The technologies employed range from Bioelectrical Impedance Analysis (BIA) and Dual-energy X-ray Absorptiometry (DEXA) to whole-body air displacement plethysmography and isotopic dilution methods, catering to diverse end-user needs across professional and consumer settings. The increasing global awareness regarding the direct link between body composition and chronic diseases, such as diabetes, cardiovascular issues, and obesity, is fundamentally reshaping diagnostic protocols and driving market adoption.

The primary applications of these analyzers span clinical settings, including hospitals and diagnostic laboratories, where precise measurements are required for patient management, particularly in cases involving sarcopenia, cachexia, or metabolic syndrome. Beyond healthcare, professional sports organizations, fitness centers, and wellness clinics rely heavily on these tools to monitor training efficacy, guide dietary interventions, and assess the risk of injury. The resulting data provides a holistic view of health, making body composition analysis an indispensable component of modern personalized medicine and wellness programs. The continuous miniaturization and enhanced accuracy of devices, particularly BIA and handheld models, are expanding accessibility beyond institutional walls and into the burgeoning home-use segment.

Market growth is predominantly fueled by several macro-environmental factors, chief among them the escalating global prevalence of obesity and related lifestyle diseases, necessitating objective tools for intervention monitoring. Furthermore, the rising focus on preventive and personalized healthcare models, coupled with significant advancements in sensor technology and data integration capabilities, is accelerating adoption. Regulatory support for non-invasive diagnostic tools and increasing expenditure on fitness and wellness activities, especially across developed economies, further solidify the market's trajectory. These factors collectively highlight the crucial role of body composition analysis in achieving optimal health outcomes and enhancing the quality of medical care provided globally.

Human Body Composition Analyzers Market Executive Summary

The Human Body Composition Analyzers Market is characterized by robust technological innovation and shifting usage patterns, moving from purely clinical environments to widespread consumer and fitness applications. Business trends indicate strong emphasis on developing highly accurate, portable, and user-friendly devices integrated with cloud-based data analytics and smart platforms. Key industry players are focusing on strategic collaborations with fitness tech companies and diagnostic centers to broaden their distribution networks and integrate AI algorithms for enhanced predictive analysis and personalized user feedback. The competitive landscape is intensely focused on patenting advancements in multi-frequency BIA technology and improving the affordability and accessibility of DEXA scanning alternatives, which are traditionally costly and institutionally confined. This drive toward accessible precision is a central theme defining current investment strategies and product roadmaps.

Regionally, North America continues to hold the largest market share, driven by high healthcare expenditure, established fitness culture, and early adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, primarily due to rising health consciousness, rapidly improving healthcare infrastructure in developing economies like China and India, and a burgeoning middle class willing to invest in personal wellness tools. European markets maintain stable growth, underpinned by stringent clinical standards and a proactive approach to managing aging populations, demanding reliable tools for sarcopenia detection. Latin America and the Middle East & Africa (MEA) represent significant opportunities, spurred by increasing urbanization and the resulting rise in lifestyle-related health issues.

Segment trends reveal that the Bioelectrical Impedance Analysis (BIA) technology segment dominates the market in terms of volume due to its portability, cost-effectiveness, and speed, making it ideal for both clinical screening and consumer applications. Conversely, the Dual-energy X-ray Absorptiometry (DEXA) segment, while representing a smaller volume, maintains dominance in terms of revenue contribution in clinical settings due to its superior accuracy in measuring bone mineral density alongside fat and lean mass. The end-user segment is increasingly shifting towards sports and fitness centers, recognizing the lucrative potential of offering detailed performance tracking. Furthermore, the rise of the smart home segment is positioning compact BIA devices and smart scales as essential components of integrated digital health ecosystems, influencing product development towards seamless connectivity and data synchronization.

AI Impact Analysis on Human Body Composition Analyzers Market

Common user questions regarding AI's impact on Human Body Composition Analyzers frequently center on whether artificial intelligence can significantly improve measurement accuracy, how predictive analytics can inform personalized dietary and exercise recommendations, and the potential for integrating analyzer data with existing wearable technology platforms. Users are concerned about data privacy and the reliability of AI-driven diagnostics compared to established clinical methods like DEXA. The overarching themes derived from these queries suggest a strong expectation that AI will transition body composition analysis from a static measurement tool to a dynamic, predictive health management platform, capable of identifying subtle shifts in physiological status before clinical symptoms emerge, thereby optimizing preventive care strategies and offering unprecedented levels of personalization in health and fitness programs.

- Enhanced Diagnostic Precision: AI algorithms process complex raw data (e.g., bioimpedance fluctuations, X-ray spectral patterns) to correct for confounding factors (hydration levels, movement artifacts), significantly boosting the signal-to-noise ratio and improving the clinical reliability of less invasive methods like BIA.

- Predictive Health Modeling: Machine learning models utilize longitudinal body composition data, combined with lifestyle metrics, to forecast the risk of metabolic diseases (e.g., Type 2 Diabetes) years in advance, enabling proactive health interventions tailored to individual physiological responses.

- Personalized Intervention Recommendations: AI analyzes muscle-to-fat ratios, regional fat distribution, and hydration status to generate highly specific, adaptive nutrition and training plans, optimizing outcomes for weight management, athletic performance, and post-injury rehabilitation.

- Data Integration and Ecosystem Building: AI acts as a central hub, seamlessly integrating data captured by body composition analyzers with inputs from smart scales, heart rate monitors, and activity trackers, providing a unified, holistic view of the user's health within a single dashboard.

- Automated Reporting and Interpretation: Natural Language Generation (NLG) techniques, powered by AI, automate the generation of complex clinical reports, translating technical measurements into easily understandable, actionable language for both clinicians and end-users, reducing manual interpretation time.

- Remote Monitoring and Telehealth Facilitation: AI enables continuous, real-time monitoring of body composition parameters in remote settings, alerting healthcare providers to critical changes, thereby supporting advanced telehealth services and chronic disease management programs outside traditional clinical walls.

- Bias Mitigation and Standardization: AI-driven calibration protocols ensure measurement consistency across different device models and user demographics, addressing a long-standing challenge in standardizing body composition results, particularly across varied ethnic and regional populations.

- Pharmaceutical and Clinical Trial Optimization: AI facilitates the rapid analysis of body composition changes in response to novel drug therapies or lifestyle interventions, accelerating clinical trials and providing more granular efficacy metrics beyond simple BMI calculations.

DRO & Impact Forces Of Human Body Composition Analyzers Market

The Human Body Composition Analyzers Market is dynamically shaped by a crucial balance of Drivers promoting growth, Restraints challenging widespread adoption, and significant Opportunities for future expansion, collectively defining the Impact Forces. A primary driver is the accelerating global obesity epidemic and the parallel rise in chronic metabolic disorders, necessitating detailed body metrics beyond traditional BMI. Complementing this is the growing societal emphasis on proactive health and fitness, especially among the aging population who require precise monitoring of lean muscle mass to prevent sarcopenia. Conversely, substantial restraints impede market velocity, including the high capital investment required for gold-standard technologies like DEXA, limiting their accessibility in smaller clinics and developing nations. Furthermore, the lack of universal standardization and the potential variability in results across different BIA devices create hesitation among clinicians seeking reliable, reproducible data. Opportunities lie predominantly in technological convergence, specifically integrating advanced sensors with telehealth platforms and developing cheaper, highly accurate portable alternatives, particularly within the lucrative home-use market, promising significant future market penetration.

- Drivers:

- Escalating Global Prevalence of Obesity and Lifestyle Diseases: Increased demand for accurate diagnostic and monitoring tools.

- Growing Consumer Focus on Fitness and Preventive Healthcare: High user engagement with personalized wellness data.

- Technological Advancements in Portability and Accuracy: Development of multi-frequency BIA and highly accurate handheld devices.

- Increasing Incidence of Sarcopenia in the Geriatric Population: Need for muscle mass measurement for early intervention and management.

- Favorable Government Initiatives Promoting Health and Wellness Programs: Public health campaigns driving testing adoption.

- Restraints:

- High Cost Associated with Gold-Standard Technologies (DEXA): Limits adoption in resource-constrained settings.

- Lack of Universal Standardization and Calibration Protocols: Causes data discrepancies across different vendors and methods.

- Concerns Regarding the Accuracy of Basic Portable Devices (BIA): Dependence on hydration status and environmental factors.

- Limited Reimbursement Policies for Body Composition Analysis in certain regions: Affects clinical adoption rates.

- Opportunities:

- Integration with Wearable Technology and IoT Ecosystems: Enables continuous, passive monitoring and data synthesis.

- Expansion into Emerging Markets (APAC and Latin America): Untapped patient populations and improving healthcare infrastructure.

- Development of Non-Invasive, Radiation-Free Alternatives to DEXA: Addressing safety and accessibility concerns.

- Increased Application in Telehealth and Remote Patient Monitoring: Facilitating home-based management of chronic conditions.

- Impact Forces:

- Bargaining Power of Buyers: Moderate to High. Buyers (Hospitals, large fitness chains) demand cost-effective, clinically validated, and standardized equipment, especially impacting high-volume purchases.

- Bargaining Power of Suppliers: Low to Moderate. Component suppliers (sensors, software) are numerous, but specialized technology suppliers for DEXA or advanced BIA chips maintain some leverage.

- Threat of New Entrants: Moderate. While clinical standards (DEXA) require significant capital and regulatory hurdles, the consumer market is highly susceptible to new entrants offering innovative, cheap, and connected smart scales and sensors.

- Threat of Substitutes: High. Traditional, low-cost methods like BMI and skinfold calipers remain substitutes, although they offer significantly less diagnostic value. Novel technologies like ultrasound also pose an emerging substitution threat.

- Degree of Competition: High. The market is highly fragmented with established clinical leaders competing fiercely with agile, innovation-focused consumer technology companies, leading to rapid price erosion in the BIA segment.

Segmentation Analysis

The Human Body Composition Analyzers Market is strategically segmented based on core technologies utilized, the product type (mobility and application), and the diverse end-user base served. This granular segmentation allows vendors to precisely tailor product development and marketing strategies to specific market needs, ranging from high-precision clinical diagnostics to convenient consumer wellness tracking. Technological differentiation remains the most critical axis, separating the high-accuracy, high-cost methods (DEXA, ADP) used in research settings from the rapid, accessible, and high-volume BIA devices prevalent in commercial fitness centers. The evolving product landscape emphasizes the shift towards portable, multi-functional devices that seamlessly integrate data for longitudinal monitoring. Analyzing these segments provides deep insights into regional market saturation and future investment priorities.

- By Technology:

- Bioelectrical Impedance Analysis (BIA)

- Dual-energy X-ray Absorptiometry (DEXA)

- Air Displacement Plethysmography (ADP)

- Hydrostatic Weighing (Underwater Weighing)

- Skinfold Calipers

- Isotope Dilution

- Other Technologies (MRI, CT, Ultrasound)

- By Product Type:

- Devices

- Portable Analyzers (Handheld, Segmental BIA)

- Stationary/Benchtop Analyzers (Clinical Grade BIA, DEXA Systems)

- Software and Services (Data analysis platforms, Cloud services)

- Devices

- By End User:

- Hospitals and Clinics

- Fitness and Wellness Centers

- Academic and Research Institutions

- Sports and Athletic Centers

- Home Users (Consumer Segment)

- Nutritional and Dietetic Centers

- By Application:

- Obesity and Weight Management

- Cardiology and Metabolic Disorders

- Sports Performance and Nutrition

- Sarcopenia and Osteoporosis Management

- Research and Clinical Trials

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Human Body Composition Analyzers Market

The value chain for the Human Body Composition Analyzers Market begins with the upstream activities centered on the procurement and manufacturing of highly specialized components, which include advanced bioelectrical sensors, high-resolution X-ray tubes for DEXA systems, complex software algorithms, and microprocessors. R&D is a critical, high-value component at this stage, focusing on improving algorithm accuracy, miniaturization, and seamless integration capabilities. Key suppliers provide specialized components, but the core intellectual property often resides with the primary manufacturers who assemble and calibrate the complex diagnostic equipment. Quality control and regulatory compliance, particularly for clinical-grade devices, introduce significant cost and time requirements early in the chain, ensuring devices meet stringent medical device standards across various global jurisdictions.

Midstream activities involve the manufacturing, assembly, and packaging of the final products, followed by distribution. The distribution channel is bifurcated into direct sales channels, typically utilized for high-value clinical systems (like DEXA machines) requiring specialized installation, training, and long-term maintenance contracts, and indirect channels, which dominate the consumer and BIA segment. Indirect channels involve distributors, value-added resellers (VARs), and increasingly, e-commerce platforms and mass retailers for consumer-grade smart scales and portable analyzers. Effective logistics management is crucial for minimizing damage and ensuring prompt delivery, particularly for bulky clinical equipment. Manufacturers leverage global distributors to manage complex import/export requirements and reach regional healthcare providers efficiently.

Downstream activities focus on market penetration, after-sales support, and end-user engagement. For clinical segments (Hospitals/Research), strong relationships, continuous service contracts, and ongoing software updates are essential value additions. For the consumer market, the value is driven by software usability, integration with existing digital health platforms, and the accuracy of interpretation provided through mobile applications. High-quality customer service and educational content that help users understand and act upon their body composition data significantly enhance brand loyalty and drive repeat purchases or subscription renewals for data services. The final stage involves capturing user data to feed back into R&D for continuous product improvement and maintaining a competitive edge through sustained innovation.

Human Body Composition Analyzers Market Potential Customers

The primary cohort of potential customers for Human Body Composition Analyzers includes professional healthcare providers and institutional entities that require diagnostic-grade precision. Hospitals, large clinical chains, and specialty clinics focused on endocrinology, bariatrics, or cardiology represent significant buyers, utilizing analyzers for patient risk stratification, treatment efficacy monitoring, and diagnosing complex metabolic conditions. Academic and scientific research institutions constitute another crucial customer base, relying on gold-standard methods (DEXA, ADP) for high-fidelity data collection in clinical trials and nutritional studies. These institutional buyers prioritize accuracy, throughput, and comprehensive regulatory clearance over low cost, often negotiating large-volume procurement contracts and requiring extensive training and servicing.

A rapidly expanding customer segment comprises the commercial health and fitness industry. This includes large multinational fitness club franchises, independent boutique gyms, and dedicated wellness centers. These buyers predominantly utilize high-speed, segmental BIA devices to offer value-added services to their members, such as personalized training programs, nutritional consultations, and measurable progress tracking, thereby enhancing member retention and differentiating their service offerings in a competitive market. Sports teams and athletic performance centers also fall into this category, using analyzers to monitor muscle mass recovery, optimize peak performance cycles, and manage athlete hydration status, viewing the analyzers as essential training tools rather than purely diagnostic devices.

The consumer market represents the fastest-growing customer segment, driven by the democratization of health data and the proliferation of affordable, connected smart scales and handheld BIA devices. Individual home users, often motivated by personal weight loss goals, general wellness tracking, or managing chronic conditions, seek user-friendly devices that provide instant, actionable feedback integrated into their smartphone environment. This segment demands convenience, affordability, and seamless connectivity, creating a high-volume, yet price-sensitive, purchasing demographic. Nutritionists and dietitians also constitute specialized professional customers, using portable analyzers in their private practices to provide tangible evidence of physiological changes to their clients, bolstering the credibility and effectiveness of their dietary interventions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1580 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | InBody (Biospace), Tanita Corporation, Hologic, Inc., GE Healthcare, COSMED, Omron Healthcare, Maltron International Ltd., Evolt, L'Oreal (with smart scale technology), seca GmbH & Co. KG, Accu-Measure, Selvas AI (formerly Jawon Medical), Bodystat, Beurer GmbH, RJL Systems, Inc., Xitron Technologies, Inc., DMS Imaging, G&G Biotech, North Star Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Body Composition Analyzers Market Key Technology Landscape

The Human Body Composition Analyzers Market is defined by a diverse technological landscape, categorized primarily by cost, invasiveness, and measurement accuracy. The industry gold standard, Dual-energy X-ray Absorptiometry (DEXA), utilizes two distinct X-ray energies to differentiate between bone, fat, and lean soft tissue, providing highly precise segmental analysis and essential bone mineral density (BMD) data. While DEXA offers superior clinical validation, its limitations include high equipment cost, large footprint, radiation exposure (albeit low), and requiring trained specialized operators. Innovation in this area focuses on faster scan times and dose reduction, maintaining its indispensability in clinical research and osteoporosis management.

Bioelectrical Impedance Analysis (BIA) represents the dominant technology in terms of market volume and accessibility. BIA works by applying a small electrical current through the body and measuring the impedance or resistance, correlating this resistance to total body water and subsequently estimating lean and fat mass. The evolution of BIA is marked by the shift from single-frequency to multi-frequency and segmental BIA devices. Multi-frequency BIA provides better differentiation between intracellular and extracellular water, significantly enhancing accuracy, while segmental BIA measures limbs and trunk separately, offering detailed regional analysis crucial for sports science. Ongoing R&D is heavily focused on refining BIA algorithms to reduce dependency on hydration status and external temperature variables.

Other significant technologies include Air Displacement Plethysmography (ADP), commonly known by the brand name Bod Pod, which measures body volume through air displacement and is a highly accurate, non-invasive method often used in research settings and elite sports. Hydrostatic Weighing, while traditionally considered accurate, has declined in commercial popularity due to its cumbersome nature and the requirement for participant immersion. Emerging technologies are heavily focused on integrating advanced ultrasonic measurements and incorporating machine vision systems to map body contours, offering radiation-free alternatives that aim to bridge the accuracy gap between BIA and DEXA, especially for large-scale population screening initiatives and point-of-care diagnostics. Connectivity and the integration of these devices into cloud-based health platforms are becoming standard features across the entire technology spectrum.

Regional Highlights

- North America: This region dominates the global Human Body Composition Analyzers Market, driven by high disposable incomes, extensive healthcare infrastructure, and the early and rapid adoption of advanced medical technologies. The U.S. market benefits significantly from high expenditure on fitness, preventive health programs, and established reimbursement policies for clinical diagnostic procedures. The presence of major market leaders and robust research activities further cements its leading position. Demand is strong across all segments, particularly for high-end DEXA systems in clinical settings and innovative, connected BIA devices in the booming home health and wearable tech market.

- Europe: The European market is characterized by mature healthcare systems and a strong regulatory environment focused on patient safety and data privacy (GDPR). Growth is stable, propelled by governmental initiatives addressing the geriatric population and the associated rise in sarcopenia, driving the need for reliable muscle mass analyzers. Germany, the UK, and France are key contributors, emphasizing the adoption of standardized clinical BIA and DEXA technologies. The focus here is balanced between clinical validation and integrating systems into public health screening programs, alongside a growing demand for premium-quality consumer wellness products.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally. This exponential growth is fueled by rapidly improving healthcare infrastructure, increasing health awareness among the expanding middle-class population, and significant investments in sports and fitness facilities across major economies like China, India, Japan, and South Korea. While the cost sensitivity remains high, leading to a strong preference for affordable BIA technology, rising clinical expenditures are also driving the adoption of high-accuracy DEXA in metropolitan centers. South Korea, in particular, is a hub for BIA manufacturing and technological innovation.

- Latin America (LATAM): The LATAM region presents moderate growth, spurred by urbanization, rising obesity rates, and increased governmental focus on tackling non-communicable diseases. Brazil and Mexico are the primary revenue generators, characterized by increasing private healthcare investment and the development of large fitness chains. Market penetration remains challenging due to varying economic stability and fragmented regulatory landscapes, necessitating vendors to focus on highly cost-effective and ruggedized portable solutions suitable for diverse geographical needs.

- Middle East & Africa (MEA): Growth in the MEA region is accelerating, primarily concentrated in the affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar). These nations are witnessing substantial government-led investment in world-class sports facilities and private hospital complexes, driving the demand for premium clinical and performance analysis equipment. South Africa also contributes significantly, though the broader African continent remains largely untapped, representing a long-term opportunity driven by improving economic conditions and increased awareness of preventative health measures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Body Composition Analyzers Market.- InBody (Biospace)

- Tanita Corporation

- Hologic, Inc.

- GE Healthcare

- COSMED

- Omron Healthcare

- Maltron International Ltd.

- Evolt

- seca GmbH & Co. KG

- Accu-Measure

- Selvas AI (formerly Jawon Medical)

- Bodystat

- Beurer GmbH

- RJL Systems, Inc.

- Xitron Technologies, Inc.

- DMS Imaging

- G&G Biotech

- North Star Medical

- Vascular Health Screening

- Withings (a prominent consumer segment player)

Frequently Asked Questions

Analyze common user questions about the Human Body Composition Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate technology for body composition analysis?

Dual-energy X-ray Absorptiometry (DEXA) is widely regarded as the clinical gold standard due to its high precision in measuring bone mineral density, fat mass, and lean mass segments, offering superior detail compared to BIA and other volumetric methods.

How is the Human Body Composition Analyzers Market affected by the growth of smart wearables?

The integration of body composition analysis (primarily basic BIA) into smart scales and fitness wearables is a major market driver, democratizing access to body metrics, promoting continuous monitoring, and shifting focus toward preventative home-based health management.

What are the primary challenges limiting market growth for these analyzers?

Key challenges include the high capital cost of advanced clinical equipment (DEXA), persistent concerns regarding the accuracy and reliability of low-cost BIA devices, and the lack of universal clinical standardization across different technologies and manufacturers.

Which end-user segment is experiencing the fastest growth rate?

The Home Users (Consumer Segment) is exhibiting the fastest growth, fueled by the development of affordable, highly connected smart scales and the increasing consumer interest in quantifying personal wellness and optimizing fitness outcomes through detailed, accessible data.

How does artificial intelligence enhance the functionality of body composition analyzers?

AI significantly enhances functionality by improving measurement accuracy through algorithm refinement, enabling predictive health modeling based on longitudinal data, and generating personalized, actionable insights for nutrition and training optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager