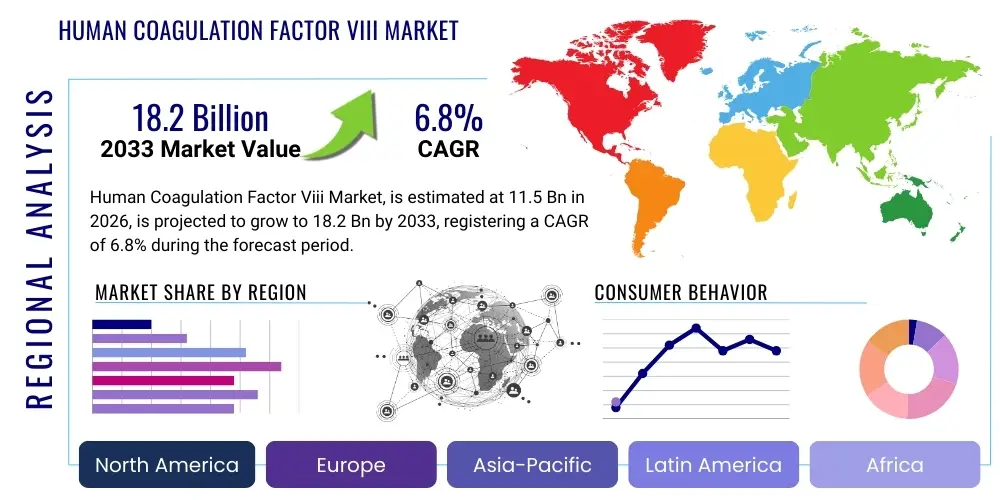

Human Coagulation Factor Viii Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442805 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Human Coagulation Factor Viii Market Size

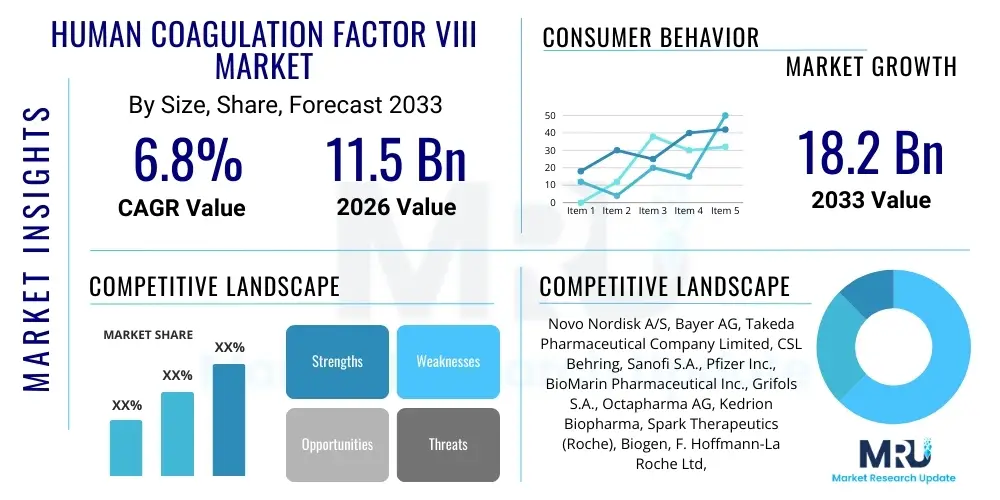

The Human Coagulation Factor Viii Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033. This steady expansion is primarily attributed to the increasing global prevalence of Hemophilia A, coupled with significant advancements in prophylactic treatment methodologies and the introduction of novel, extended half-life (EHL) and non-factor therapies that are competing with traditional FVIII replacements. The demand remains robust, particularly in developed economies with established healthcare infrastructure and comprehensive screening programs.

Human Coagulation Factor Viii Market introduction

The Human Coagulation Factor VIII Market centers on the provision of therapeutic proteins essential for blood clotting, primarily utilized in the management and prevention of bleeding episodes in individuals diagnosed with Hemophilia A, an X-linked genetic disorder characterized by a deficiency or defect in functional Factor VIII. Factor VIII is a critical component of the intrinsic pathway of the coagulation cascade, and its absence leads to chronic, spontaneous bleeding, particularly into joints and muscles. The market encompasses a range of products, including plasma-derived FVIII (pdFVIII) and, predominantly, recombinant FVIII (rFVIII) products, which have become the standard of care due to enhanced safety profiles regarding pathogen transmission and improved manufacturing scalability. The primary application of these products is prophylactic treatment, significantly reducing the frequency of bleeding events and subsequent long-term joint damage.

The market landscape is dynamically shaped by continuous innovation, moving beyond standard rFVIII products towards extended half-life (EHL) variants. These EHL FVIII products reduce the necessary frequency of intravenous infusions, thereby enhancing patient compliance and quality of life, which is a major benefit driving their adoption. Furthermore, the development pipeline includes breakthrough technologies such as gene therapy aimed at providing curative or long-lasting therapeutic effects, alongside non-factor replacement therapies that bypass the FVIII deficiency entirely. Major benefits of current FVIII therapies include effective bleeding control, reduced morbidity, and improved physical functioning for patients worldwide, particularly those in high-income countries where access to regular prophylactic treatment is standard.

Key driving factors fueling market expansion include the rising awareness and improved diagnostic rates of Hemophilia A globally, increased governmental and non-governmental support for patient access programs, and substantial investment in research and development leading to safer and more convenient administration routes. The demographic shift towards an aging population of hemophilia patients who require long-term treatment also contributes significantly to sustained market growth. Conversely, challenges such as high treatment costs in low- and middle-income countries and the ongoing risk of inhibitor development remain crucial considerations influencing market strategy and accessibility.

Human Coagulation Factor Viii Market Executive Summary

The Human Coagulation Factor VIII market is characterized by robust business trends centered on therapeutic differentiation and geographical expansion. A dominant trend is the rapid adoption of Extended Half-Life (EHL) FVIII products, which offer superior pharmacokinetics compared to conventional recombinant therapies, leading to premium pricing and strong revenue generation in established markets like North America and Europe. Furthermore, the industry is witnessing intense competitive activity surrounding emerging non-factor therapies, which, while not FVIII replacements, directly impact the treatment paradigm for Hemophilia A, especially in patients with inhibitors. Strategic partnerships focused on improving cold chain logistics and distribution networks are becoming vital for accessing emerging markets, ensuring product stability and availability where resources are constrained. Companies are heavily investing in clinical trials for next-generation products, notably gene therapies, positioning the market for potentially disruptive shifts within the next decade.

Regional trends indicate that North America and Europe continue to hold the largest market share due to high diagnosis rates, sophisticated healthcare spending, and favorable reimbursement policies supporting expensive prophylactic treatments. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, rising disposable incomes in key economies such as China and India, and increasing awareness campaigns led by patient organizations. Governments in APAC are slowly expanding coverage for FVIII products, moving away from on-demand treatment towards proactive prophylaxis. Meanwhile, Latin America and the Middle East & Africa (MEA) present significant untapped potential, though market penetration remains challenging due to economic constraints and logistical hurdles, necessitating tailored low-cost treatment strategies and strong government procurement programs.

Segment trends highlight the continued dominance of recombinant Factor VIII products over plasma-derived counterparts, driven by safety concerns related to plasma sourcing. Within the recombinant segment, EHL FVIII products are rapidly cannibalizing the market share of standard half-life products, particularly in patient cohorts prioritizing treatment convenience and adherence. Furthermore, the market segmentation based on treatment type shows a pronounced shift towards prophylaxis, which accounts for the majority of the revenue generated, reflecting global clinical guideline recommendations. The rise of sophisticated laboratory diagnostics and personalized dosing regimens based on pharmacokinetics is also shaping the service component of the market, requiring providers to offer integrated care solutions rather than just product supply.

AI Impact Analysis on Human Coagulation Factor Viii Market

User inquiries concerning the integration of Artificial Intelligence (AI) in the Human Coagulation Factor VIII market primarily revolve around optimizing treatment personalization, predicting bleeding risks, streamlining drug development timelines, and enhancing manufacturing efficiency. Common questions focus on how AI algorithms can leverage real-world data (RWD) to calculate individualized prophylactic dosing schedules, potentially moving beyond fixed regimens to dynamic, patient-specific treatments that minimize resource use while maximizing therapeutic efficacy. There is also significant user interest in AI's role in accelerating the discovery and optimization of novel therapeutic candidates, particularly extended half-life modifications or gene therapy vectors. Key themes emerging from these analyses include the expectation that AI will lead to more precise dosing, reduced incidence of joint bleeds, faster development cycles for highly specialized biopharmaceuticals, and improved remote patient monitoring capabilities, ultimately leading to better resource allocation in hemophilia care.

- AI-driven pharmacokinetic (PK) modeling enabling personalized, on-demand FVIII dosing regimens.

- Predictive analytics for early identification of patients at high risk of developing FVIII inhibitors.

- Optimization of large-scale recombinant protein manufacturing processes, enhancing yield and purity.

- Accelerated discovery and screening of novel non-factor coagulation pathway targets.

- Deployment of machine learning tools for analyzing real-world efficacy and safety data (RWE/RWD) from registries.

- AI chatbots and virtual assistants for enhanced patient adherence support and symptom tracking.

- Automated image analysis (e.g., MRI) for early detection and quantification of hemophilic arthropathy.

DRO & Impact Forces Of Human Coagulation Factor Viii Market

The dynamics of the Human Coagulation Factor VIII market are governed by a complex interplay of internal and external forces. Key drivers include the mandatory shift towards prophylactic treatment globally, increasing prevalence and awareness of Hemophilia A, and rapid technological advancements resulting in extended half-life (EHL) products that improve patient quality of life. These drivers collectively push market growth by increasing the per-patient consumption of FVIII products and broadening the pool of diagnosed and treated individuals. However, the market faces significant restraints, primarily the exceptionally high cost of FVIII therapy, which limits access in developing nations and imposes substantial economic burden even on established healthcare systems. Furthermore, the persistent threat of inhibitor development (immune response neutralizing the FVIII product) necessitates complex and costly treatment alternatives like bypassing agents, adding friction to the standard FVIII market.

Opportunities for expansion are abundant, particularly in leveraging innovative delivery mechanisms and exploring emerging markets in Asia and Latin America, where current penetration is low relative to the patient population. The successful commercialization of breakthrough technologies, such as gene therapy for Hemophilia A, represents a monumental opportunity that could redefine the market structure by offering a potential one-time functional cure, although this also presents a long-term threat to traditional FVIII replacement therapy sales. Strategic opportunities also lie in developing tailored, low-cost prophylactic solutions suitable for resource-constrained settings, expanding the total addressable market beyond high-income economies. Addressing the inhibitor challenge through prophylactic immune tolerance induction (ITI) regimens using advanced FVIII formulations also represents a high-value clinical and commercial opportunity.

Impact forces currently shaping the market include stringent regulatory approval pathways for biologics, which impose high development costs, and intense pricing pressure from payers, forcing manufacturers to demonstrate superior pharmacoeconomic value, particularly for newer EHL products. The impending launch and uptake of competing non-factor therapies, which offer subcutaneous administration and are effective in inhibitor patients, pose a significant disruptive force to the FVIII replacement segment. Furthermore, geopolitical instability and supply chain vulnerabilities, particularly concerning plasma sourcing (for plasma-derived products) and specialized biologics manufacturing, represent ongoing operational risks. Collectively, the market is being pulled between high clinical needs driven by improving standards of care and downward pressure on pricing due to competition and payer scrutiny.

Segmentation Analysis

The Human Coagulation Factor VIII market is primarily segmented based on product type, application, and distribution channel, reflecting diverse therapeutic needs and market access strategies. The product type segmentation distinguishes between Recombinant Factor VIII (rFVIII) and Plasma-Derived Factor VIII (pdFVIII), with the recombinant segment holding clear market dominance due to superior safety profiles and higher production scalability. Further segmentation within rFVIII includes standard half-life (SHL) and extended half-life (EHL) products, with EHL growing fastest as it offers enhanced convenience and improved patient adherence. The application segments are crucial, dividing the market into prophylaxis, on-demand treatment, and surgical hemostasis, where prophylaxis represents the foundational revenue stream and is the universally recommended standard of care.

- By Product Type:

- Recombinant Factor VIII (rFVIII)

- Standard Half-Life (SHL) FVIII

- Extended Half-Life (EHL) FVIII

- Plasma-Derived Factor VIII (pdFVIII)

- By Application:

- Prophylaxis (Routine Prevention)

- On-Demand Treatment (Bleeding Episodes)

- Surgical Hemostasis

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Human Coagulation Factor Viii Market

The value chain for Human Coagulation Factor VIII is inherently complex, starting with sophisticated upstream activities related to raw material acquisition and biopharmaceutical manufacturing. For recombinant products, this involves cell culture engineering, fermentation, purification, and viral inactivation processes which demand high levels of expertise and specialized facilities. The upstream phase is heavily regulated and capital-intensive, focusing on achieving high yield and purity of the complex FVIII protein. For plasma-derived products, the upstream segment involves the critical steps of plasma collection, stringent screening, and fractionation, where managing supply chain security and ensuring pathogen safety are paramount. Controlling these upstream costs and maintaining regulatory compliance are key competitive differentiators for manufacturers in this market.

The midstream activities center on formulation, aseptic filling, and packaging, culminating in the production of the final drug product, often requiring cold chain maintenance due to the thermal instability of FVIII. Following manufacturing, the distribution channel takes over, classifying into direct and indirect routes. Direct distribution involves manufacturers supplying large hospital systems or government procurement agencies under contractual agreements, allowing for greater control over inventory and pricing. Indirect distribution relies on specialized wholesalers, distributors, and pharmacy networks, including hospital and retail pharmacies, which manage last-mile delivery to patients and treatment centers. This stage is crucial for ensuring timely access, particularly for patients requiring scheduled prophylactic infusions, and requires robust, validated cold storage logistics globally.

Downstream analysis focuses on the end-users and payer dynamics. The primary end-users are specialized Hemophilia Treatment Centers (HTCs) and individual patients administering prophylaxis at home. Payer influence is extremely high due to the significant cost of FVIII therapy. Reimbursement policies, national health service budgets, and private insurance coverage heavily dictate which products are prescribed (SHL vs. EHL) and the extent of prophylactic treatment adopted. Effective market penetration requires manufacturers not only to demonstrate clinical superiority but also compelling pharmacoeconomic value to secure favorable formulary placement and ensure consistent patient access across diverse geographic and economic settings.

Human Coagulation Factor Viii Market Potential Customers

The primary customer base for Human Coagulation Factor VIII products consists of patients diagnosed with Hemophilia A, ranging from infants requiring early prophylactic intervention to adults managing chronic joint disease. Specifically, the high-value customer segment comprises individuals with severe Hemophilia A (FVIII activity < 1 IU/dL) who require mandatory routine prophylactic infusions, often multiple times per week. These patients drive the bulk of the market revenue due to their lifelong reliance on consistent, high-dose factor replacement therapy. As clinical guidelines increasingly advocate for starting prophylaxis early in life, the pediatric population requiring FVIII becomes a key focus area for specialized formulations and delivery systems, including those offering improved infusion speed and reduced volume.

Beyond individual patients, the institutional customers are critical purchasers and decision-makers. Hemophilia Treatment Centers (HTCs), specialized units within hospitals or clinics, serve as major procurement hubs, influencing product selection, providing patient education, and overseeing treatment regimens. National and regional public health services and governmental procurement bodies, particularly in nations with universal healthcare, act as central buyers, negotiating bulk purchases and often defining national formularies that dictate patient access. These institutional customers prioritize cost-effectiveness, supply reliability, and clinical efficacy data when making large-scale purchasing decisions for national hemophilia programs.

Finally, insurance providers and pharmacy benefit managers (PBMs) in countries with segmented healthcare systems represent crucial indirect customers who control reimbursement pathways. Their decisions regarding coverage limits and preferred products (e.g., preference for biosimilars or specific EHL brands) directly impact the commercial success of FVIII manufacturers. Targeting these financial stakeholders requires comprehensive pharmacoeconomic evidence demonstrating the long-term benefits of FVIII therapy, such as reduced hospitalization costs and prevention of debilitating arthropathy, justifying the high upfront investment in these biologic treatments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Novo Nordisk A/S, Bayer AG, Takeda Pharmaceutical Company Limited, CSL Behring, Sanofi S.A., Pfizer Inc., BioMarin Pharmaceutical Inc., Grifols S.A., Octapharma AG, Kedrion Biopharma, Spark Therapeutics (Roche), Biogen, F. Hoffmann-La Roche Ltd, Shire (now Takeda), Catalyst Biosciences, Hemobiotics LLC, GeneOne Life Science Inc., Aptevo Therapeutics Inc., Amgen Inc., Bristol Myers Squibb Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Coagulation Factor Viii Market Key Technology Landscape

The technological evolution within the Human Coagulation Factor VIII market has shifted dramatically from traditional plasma fractionation to sophisticated genetic engineering and protein modification. The predominant technological platform is recombinant DNA technology, which enables the large-scale, consistent production of Factor VIII without reliance on human plasma sources, significantly mitigating pathogen transmission risks. This technology has been foundational for standard half-life FVIII products (SHL). The subsequent major technological leap involved modifying the FVIII molecule to extend its half-life in vivo, resulting in Extended Half-Life (EHL) products. EHL technologies utilize conjugation techniques such as PEGylation, Fc fusion, or Xynex technology (fusion with the albumin-binding domain) to reduce renal clearance and degradation, thereby allowing for less frequent dosing and greatly improving patient compliance and quality of life.

A critical emerging technological frontier is the application of Gene Therapy, specifically leveraging Adeno-Associated Virus (AAV) vectors to deliver a functional copy of the FVIII gene into the patient's liver cells. This aims to achieve sustained, endogenous expression of FVIII, potentially offering a curative or long-lasting therapeutic effect, fundamentally challenging the need for weekly or bi-weekly infusions of replacement factor. While still in early commercial stages and facing challenges regarding durability and vector immunity, AAV-based gene therapy represents the highest level of technological disruption in the market. Its success hinges on achieving reliable, therapeutic levels of FVIII expression over many years and ensuring patient safety profiles remain favorable compared to lifelong replacement therapy.

Furthermore, diagnostic and monitoring technologies are increasingly vital. Pharmacokinetic (PK) assessment tools, often facilitated by microfluidic chips or personalized dosing software, utilize sparse sampling data to determine individual patient half-lives, allowing clinicians to tailor prophylaxis regimens precisely. This precision medicine approach optimizes FVIII consumption and clinical outcomes. Additionally, the development of sophisticated non-factor replacement therapies, such as bispecific antibodies (e.g., emicizumab) which mimic FVIII function but are subcutaneously administered, relies on advanced antibody engineering and represents a competing technological pathway that bypasses the challenges associated with delivering a large, unstable protein like FVIII.

Regional Highlights

The global Human Coagulation Factor VIII market exhibits significant regional disparity in terms of market maturity, treatment protocols, and reimbursement structures. North America, particularly the United States, commands the largest market share globally. This dominance is attributable to high patient awareness, advanced diagnostic infrastructure, aggressive adoption of expensive EHL FVIII products, and robust health insurance and reimbursement coverage that supports high-cost, routine prophylactic treatment from an early age. The region is also the primary hub for clinical trials and the early commercialization of next-generation therapies, including gene therapy, establishing it as a key indicator of future global market trends. The high concentration of specialized Hemophilia Treatment Centers further cements North America’s leading position.

Europe represents the second-largest market, characterized by comprehensive national healthcare systems that prioritize prophylaxis. Key countries such as Germany, the UK, France, and Italy have established patient registries and stringent guidelines, ensuring broad patient access to factor replacement therapy. While cost-control measures and centralized procurement processes are stricter than in the US, Europe has been proactive in adopting EHL products to improve patient compliance and reduce long-term healthcare burdens related to hemophilic arthropathy. The regulatory environment under the European Medicines Agency (EMA) facilitates timely introduction of advanced biologic treatments, maintaining a strong market growth trajectory.

The Asia Pacific (APAC) region is poised for the most rapid market expansion. Although treatment rates historically lagged, increasing economic prosperity, rising governmental investment in public health, and intensified efforts by organizations like the World Federation of Hemophilia (WFH) are significantly improving diagnosis and treatment access. Countries like Japan and Australia already possess mature markets similar to Western nations, but the explosive growth is anticipated in populous markets such as China and India. In these nations, the focus is shifting from on-demand treatment to subsidized prophylaxis, necessitating strategic partnerships to manage complex distribution networks and often requiring flexible, tiered pricing strategies to meet local economic constraints. Latin America and MEA remain markets with vast unmet needs, where limited financial resources often necessitate reliance on plasma-derived products or subsidized foreign aid, though local manufacturing initiatives are emerging as a potential solution.

- North America (USA, Canada): Market leader, high penetration of EHL products, early adoption of gene therapy, favorable reimbursement landscape.

- Europe (Germany, UK, France): Strong commitment to prophylaxis, robust public health systems, strategic procurement, increasing use of EHL and non-factor treatments.

- Asia Pacific (China, India, Japan): Fastest-growing region, rapidly improving diagnosis rates, increasing healthcare spending, high potential for new patient uptake.

- Latin America (Brazil, Mexico): Challenged by access and cost barriers, reliance on government tendering, gradual shift towards increased FVIII availability.

- Middle East & Africa (MEA): Significant unmet medical need, limited market access, high dependence on international humanitarian aid and specific regional centers of excellence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Coagulation Factor Viii Market.- Novo Nordisk A/S

- Bayer AG

- Takeda Pharmaceutical Company Limited

- CSL Behring

- Sanofi S.A.

- Pfizer Inc.

- BioMarin Pharmaceutical Inc.

- Grifols S.A.

- Octapharma AG

- Kedrion Biopharma

- Spark Therapeutics (Roche)

- Biogen

- F. Hoffmann-La Roche Ltd

- Swedish Orphan Biovitrum AB (Sobi)

- Emergent BioSolutions Inc.

- Precision BioSciences, Inc.

- Aptevo Therapeutics Inc.

- Hemobiotics LLC

- Genentech (A member of the Roche Group)

- Bristol Myers Squibb Company

Frequently Asked Questions

Analyze common user questions about the Human Coagulation Factor Viii market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard half-life (SHL) and extended half-life (EHL) Factor VIII products?

EHL Factor VIII products have been engineered using technologies like PEGylation or Fc fusion to remain active in the body significantly longer than SHL products, typically requiring infusions every 3 to 5 days instead of every 2 days, greatly improving patient convenience and adherence to prophylactic treatment regimens.

How is gene therapy expected to impact the future of the Factor VIII replacement market?

Gene therapy, currently in clinical application for Hemophilia A, aims to provide a long-lasting or potentially curative effect by enabling the patient's own body to produce Factor VIII, thereby eliminating the need for regular replacement infusions and posing a significant long-term competitive threat to the traditional FVIII product market.

What are Factor VIII inhibitors and why are they a major concern in Hemophilia A treatment?

Inhibitors are antibodies produced by the patient's immune system that neutralize the therapeutic Factor VIII protein, rendering replacement therapy ineffective. Their development necessitates shifting to expensive and complex bypassing agents or non-factor therapies, representing a critical challenge in clinical management and market strategy.

Which geographical region dominates the consumption of Human Coagulation Factor VIII products?

North America, led by the United States, holds the largest market share due to high diagnosis rates, comprehensive insurance coverage supporting universal prophylaxis, and the rapid adoption of premium-priced Extended Half-Life (EHL) and novel factor therapies.

What role do non-factor replacement therapies play in the Factor VIII market landscape?

Non-factor therapies, such as bispecific antibodies that mimic the function of Factor VIII, are competitive disruptors. They offer advantages like subcutaneous administration and effectiveness in patients with inhibitors, compelling FVIII manufacturers to innovate further or face market share loss, particularly in high-risk patient cohorts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager