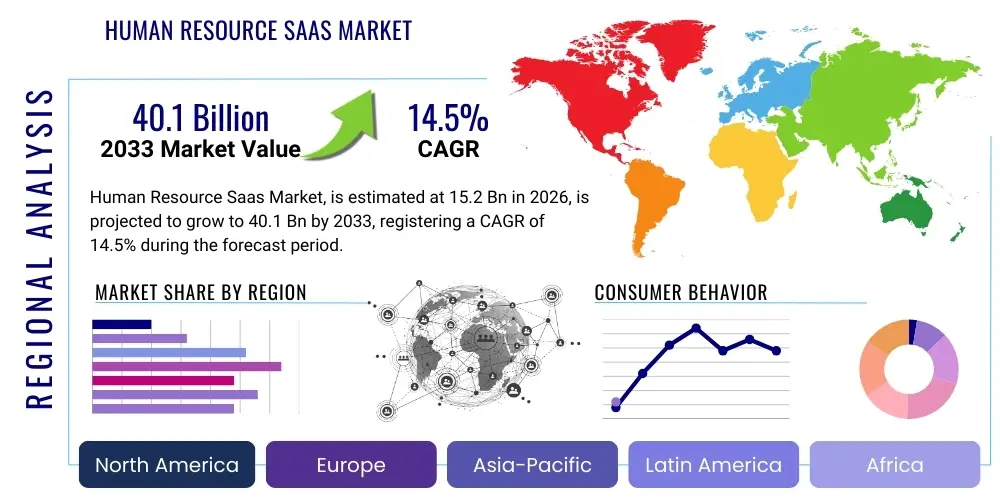

Human Resource Saas Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441834 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Human Resource Saas Market Size

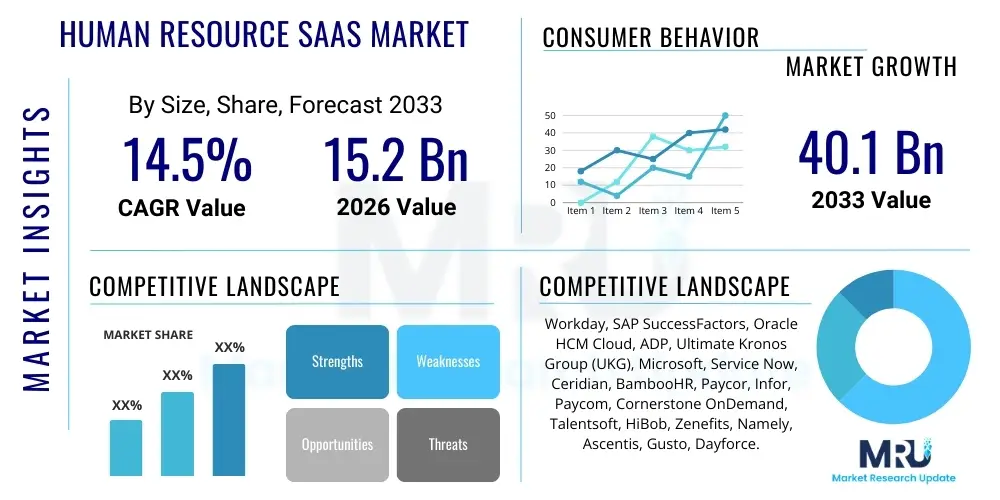

The Human Resource Saas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 40.1 Billion by the end of the forecast period in 2033.

Human Resource Saas Market introduction

The Human Resource Software as a Service (HR SaaS) market encompasses cloud-based applications designed to manage core HR functions efficiently. This model eliminates the need for organizations to install, maintain, and upgrade proprietary hardware or software, significantly reducing capital expenditure and operational complexities. HR SaaS solutions span the entire employee lifecycle, from initial recruitment and onboarding to compensation management, performance appraisal, learning and development, and eventual offboarding. The fundamental shift towards subscription-based cloud services provides scalability, automatic updates, enhanced security protocols, and ubiquitous access, positioning HR SaaS as the foundational technology driving modern workforce management strategies globally. The inherent flexibility and integration capabilities of these platforms are critical drivers for their pervasive adoption across various enterprise scales and industry verticals, ensuring compliance and improving employee experience.

The core product offerings within the HR SaaS ecosystem are broad and highly specialized. These include specialized modules such as Core Human Capital Management (HCM), Talent Acquisition (Recruiting and Applicant Tracking Systems - ATS), Talent Management (Performance, Succession Planning, Learning Management Systems - LMS), Workforce Management (Time and Attendance, Scheduling), and Payroll administration. Major applications of HR SaaS are seen in improving operational efficiencies, standardizing global HR processes, and providing advanced analytical capabilities for strategic workforce planning. The immediate benefits derived by organizations include faster deployment cycles, lower total cost of ownership (TCO), improved data accuracy, and enhanced employee self-service capabilities, which collectively boost productivity and engagement. Furthermore, the continuous compliance updates inherent in the SaaS model help multinational corporations navigate complex and frequently changing labor regulations worldwide, minimizing legal risks.

Driving factors for sustained market growth are multifaceted, centered around the acceleration of digital transformation initiatives post-2020 and the increasing complexity of managing a hybrid or remote workforce. The imperative for real-time data visibility into workforce productivity, coupled with the necessity to deliver personalized and intuitive employee experiences, mandates the adoption of sophisticated SaaS platforms. Furthermore, the rising demand for Artificial Intelligence (AI) and Machine Learning (ML) integration into HR functions—such as predictive attrition modeling, automated screening, and dynamic compensation benchmarking—is forcing traditional HR departments to migrate to agile, cloud-native platforms. These driving forces, combined with the continuous innovation cycles delivered by key vendors, sustain the market's high projected Compound Annual Growth Rate (CAGR) throughout the forecast period.

Human Resource Saas Market Executive Summary

The Human Resource SaaS market exhibits robust business trends characterized by intense competition among established enterprise resource planning (ERP) giants and specialized pure-play SaaS providers. Key business strategies currently revolve around expanding micro-service capabilities, focusing on seamless integration with third-party tools (e.g., collaboration software like Slack or Teams), and developing vertically integrated solutions tailored for specific industries (e.g., healthcare, finance). A primary trend involves the shift from transactional HR processing to strategic HCM platforms that emphasize employee well-being, engagement scoring, and prescriptive analytics. Mergers and acquisitions remain frequent, driven by the desire to acquire niche technological expertise, particularly in areas like next-generation payroll or advanced predictive analytics, consolidating market share and broadening the functional scope of vendor portfolios. Investment in robust data security and privacy protocols (GDPR, CCPA compliance) is mandatory, distinguishing leading platforms in highly regulated environments.

Regionally, North America maintains market leadership due to high technological maturity, the early adoption of cloud solutions, and the presence of major industry players and sophisticated enterprise IT budgets. However, the Asia Pacific (APAC) region is projected to register the highest growth rate (CAGR) driven by rapid digitization across emerging economies, particularly China, India, and Southeast Asia. This growth is fueled by increasing foreign direct investment, the professionalization of HR departments in SMEs, and government initiatives promoting cloud infrastructure. European markets prioritize stringent data localization and privacy features, demanding specialized regional SaaS offerings that adhere strictly to local regulations, creating specific niche opportunities for vendors focusing on compliance as a competitive differentiator. Latin America and the Middle East and Africa (MEA) are emerging markets, showing accelerated adoption, primarily focusing on core HR and basic payroll functions as the initial entry point into cloud migration.

Segment trends highlight the dominance of Talent Management and Core HCM modules. Within Talent Management, Learning Management Systems (LMS) and Continuous Performance Management tools are experiencing surging demand, driven by the necessity for rapid reskilling and upskilling in fast-evolving economic landscapes. The market is also seeing a pronounced segmentation by enterprise size, with SMEs increasingly adopting tailored, user-friendly, and cost-effective modular SaaS solutions, reducing the historical market dominance held by large-scale, all-encompassing suite solutions traditionally favored by large enterprises. Deployment-wise, pure cloud solutions (public and private cloud) overwhelmingly dominate over hybrid models, reflecting the growing enterprise confidence in cloud security and performance scalability. This widespread adoption across all enterprise sizes confirms the essential role of SaaS in contemporary organizational structure.

AI Impact Analysis on Human Resource Saas Market

User inquiries regarding AI's influence on the HR SaaS market predominantly center on the themes of automation potential, ethical implications, and the shift in required HR skill sets. Common questions explore how AI-driven tools will specifically automate recruitment tasks (screening, sourcing), improve personalization in learning and development, and enhance predictive capabilities regarding employee attrition or performance deficiencies. Significant user concern revolves around algorithmic bias in hiring and performance reviews, ensuring fairness, transparency, and data privacy when utilizing large language models (LLMs) and deep learning for sensitive personnel decisions. Users also frequently seek clarity on the necessary data infrastructure and integration complexity required to effectively deploy sophisticated AI/ML features within existing HR stacks, confirming a high expectation for AI to transform HR from an administrative function into a strategic data science discipline.

- AI automates routine HR tasks, such as initial candidate screening, scheduling interviews, and answering basic employee queries via chatbots, freeing up HR professionals for strategic initiatives.

- Predictive analytics powered by Machine Learning (ML) forecasts key workforce metrics, including turnover rates, identifying flight risks, and optimizing staffing levels based on business demand signals.

- Enhanced personalized employee experiences through AI-driven learning pathways, customized benefits recommendations, and targeted career development suggestions.

- Natural Language Processing (NLP) improves candidate search and matching capabilities, analyzing resumes and job descriptions more effectively than traditional keyword systems.

- Concerns about algorithmic fairness necessitate transparent AI models and explainability features (XAI) within HR SaaS platforms to mitigate bias in hiring and promotion decisions.

- Generative AI capabilities are being integrated to assist with drafting job descriptions, performance review summaries, and policy documentation, improving content creation efficiency.

- AI facilitates continuous listening strategies by analyzing sentiment from employee feedback (surveys, communication channels), providing real-time insights into organizational morale and culture.

- The development of specialized AI chips and dedicated cloud services (MaaS - Model as a Service) will further accelerate the deployment and scalability of complex HR intelligence tools.

DRO & Impact Forces Of Human Resource Saas Market

The market dynamics are defined by a strong set of drivers primarily linked to the necessity for digital agility and cost efficiency, tempered by significant restraints concerning data governance and integration complexity. Opportunities are vast, driven by underserved niche markets and the integration of emerging technologies. The overall impact forces demonstrate a significant favorable pull towards cloud adoption, yet require continuous vendor investment in security and compliance to maintain momentum. The core driver remains the need to replace legacy, on-premise Human Resource Information Systems (HRIS) that lack the scalability and real-time connectivity demanded by modern, decentralized work environments. However, initial implementation costs and the substantial organizational change management required for adopting new SaaS platforms act as immediate frictional restraints on rapid deployment, particularly within highly risk-averse large organizations.

Key drivers include the global adoption of remote and hybrid work models, which necessitates centralized, cloud-accessible workforce management tools for time tracking, collaboration monitoring, and equitable performance assessment across geographies. This is coupled with the growing regulatory complexity, where HR SaaS providers offer automated solutions to manage global compliance (e.g., tax reporting, GDPR adherence), reducing organizational burden. Furthermore, the strategic shift of HR from administrative processing to becoming a key business partner demands sophisticated analytics and reporting capabilities, features inherently embedded in modern SaaS architectures. Restraints predominantly involve data security and privacy concerns, particularly the sensitivity surrounding employee data and external storage compliance. The market also faces restraint from integration challenges, where seamless connectivity between diverse HR modules (e.g., linking ATS with LMS and Payroll) is often technically intricate, delaying full platform utilization and value realization for end-users.

Opportunities are emerging through vertical specialization, offering HR SaaS tailored specifically for sectors like manufacturing (shift scheduling, safety compliance) or highly regulated financial services (certification tracking, stringent auditing capabilities). The untapped Small and Medium Enterprise (SME) segment in emerging economies represents a massive opportunity for modular, pay-as-you-go HR solutions. Impact forces reflect high technological advancement, compelling organizations towards immediate investment in cloud infrastructure to remain competitive in talent management. The competitive landscape force is high, pushing vendors towards continuous innovation, lower price points, and enhanced user experience (UX) to differentiate themselves. The cumulative effect of these forces strongly favors the maturation and expansion of the SaaS model across all major functional areas of human resources management, establishing it as the default delivery mechanism.

Segmentation Analysis

The Human Resource SaaS market is broadly segmented based on functional module, deployment type, and enterprise size, reflecting the diverse needs and maturity levels of organizational adopters globally. Functional segmentation categorizes the market based on the specific HR processes managed, such as talent acquisition, Core HCM, or workforce management, with integrated suites offering the highest potential value proposition. Deployment segmentation, predominantly cloud versus hybrid, showcases the overwhelming preference for public and private cloud models due to scalability and reduced infrastructure overhead. Enterprise size segmentation distinguishes the requirements of large enterprises, which often demand highly customized, comprehensive suites, from SMEs, which prioritize affordability, speed of deployment, and simplicity of modular solutions. Understanding these segments is crucial for vendors to tailor their marketing and product development strategies effectively.

- By Functional Module:

- Core HR (HRIS)

- Talent Management (Recruitment, Onboarding, Performance, Learning & Development, Succession Planning)

- Workforce Management (Time & Attendance, Scheduling)

- Payroll Management

- Benefits Management

- By Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Healthcare

- Manufacturing

- Retail

- Government & Education

Value Chain Analysis For Human Resource Saas Market

The value chain for HR SaaS is structured around the continuous delivery of cloud-based services, commencing with infrastructure and platform development and culminating in customer support and long-term retention. Upstream activities are dominated by technology providers (e.g., AWS, Azure, Google Cloud) offering scalable Infrastructure as a Service (IaaS) and Platform as a Service (PaaS), which enable HR SaaS vendors to build and host their applications. This includes data center management, network optimization, and foundational security provisioning. The core value creation step involves the SaaS developers themselves, focusing on application development, user experience design, compliance module engineering, and proprietary algorithm creation (especially for AI/ML features in talent management). The quality and speed of upstream technology provision directly influence the scalability and resilience of the final HR solution.

Downstream activities center heavily on distribution, deployment, and customer lifecycle management. Distribution channels are bifurcated into direct sales (major vendors targeting large enterprises) and indirect channels utilizing system integrators, HR consulting firms, and value-added resellers (VARs) who customize and integrate the SaaS platform into the client's existing enterprise environment. Post-sale, value is generated through rigorous implementation services, employee training, and ongoing technical support, including 24/7 helpdesks and continuous platform updates. Strong downstream engagement, particularly successful platform adoption and high user satisfaction, are critical for minimizing churn and maximizing the lifetime value of the customer. The transition to a cloud model means that product updates and feature enhancements are continuous, requiring sustained technical communication with end-users.

The distinction between direct and indirect channels is critical for market penetration strategy. Direct sales ensure tight control over the customer relationship and high-margin deals, typically reserved for complex, large-scale HCM suite implementations. Conversely, indirect channels allow rapid scalability into the SME segment and specialized regional markets where local integrators possess necessary cultural and regulatory expertise. For HR SaaS, the quality of system integration—ensuring seamless data flow between HR modules and core financial or operational systems—is perhaps the most decisive factor in customer satisfaction. Thus, vendors invest heavily in open APIs and partner programs to certify integrators, acknowledging the distributed nature of the modern enterprise IT environment.

Human Resource Saas Market Potential Customers

Potential customers for Human Resource SaaS solutions span nearly all organizational entities globally that employ staff, ranging from small startups requiring basic payroll and time management to multinational conglomerates demanding complex global HCM suites. The end-users, or buyers, are primarily categorized by organizational size and industry vertical, each exhibiting distinct needs. Large enterprises (over 1,000 employees) are focused on comprehensive, unified solutions that handle international payroll, complex compliance, and advanced strategic workforce planning, making them prime customers for major suite providers like Workday or SAP. These buyers are typically Chief Human Resources Officers (CHROs) and Chief Information Officers (CIOs) who prioritize long-term scalability, data integrity, and deep integration with existing ERP systems.

Small and Medium Enterprises (SMEs) represent a rapidly expanding customer base, driven by the need to professionalize HR operations without the capital expenditure associated with traditional software. These customers seek modular, easy-to-use platforms focusing on core functionalities like applicant tracking, payroll, and basic performance review. Their buying decisions are often influenced by Total Cost of Ownership (TCO) and rapid deployment timelines, leading them towards vendors specializing in user-friendly, vertical-specific SaaS solutions (e.g., BambooHR, Paylocity). The BFSI and IT & Telecom sectors are consistent heavy adopters due to high labor turnover, large employee bases, and stringent regulatory reporting requirements, prioritizing solutions with robust security certifications and audit trails.

Furthermore, the public sector, including government and educational institutions, is increasingly recognized as a key potential customer segment. While traditionally slow to adopt cloud technologies due to security mandates and procurement complexity, these organizations are migrating to HR SaaS to manage large, fragmented workforces, complex union contracts, and detailed pension administration. Healthcare providers are also critical buyers, requiring specialized workforce management tools for complex shift scheduling, compliance tracking (certifications, mandatory training), and managing highly mobile staff. Essentially, any organization prioritizing talent acquisition, employee retention, operational efficiency, and regulatory compliance is a direct target for HR SaaS market participants, ensuring a continually expanding addressable market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 40.1 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Workday, SAP SuccessFactors, Oracle HCM Cloud, ADP, Ultimate Kronos Group (UKG), Microsoft, Service Now, Ceridian, BambooHR, Paycor, Infor, Paycom, Cornerstone OnDemand, Talentsoft, HiBob, Zenefits, Namely, Ascentis, Gusto, Dayforce. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Human Resource Saas Market Key Technology Landscape

The technological landscape of the HR SaaS market is rapidly evolving, driven by the transition from monolithic HRIS architectures to agile, microservices-based platforms. Core technologies employed include multi-tenant cloud infrastructure, which allows vendors to efficiently serve numerous clients while maintaining data segregation and scalability. The underlying technology stack often leverages advanced frameworks for continuous integration and continuous delivery (CI/CD), ensuring rapid, seamless deployment of updates and bug fixes without disruptive downtime. Key infrastructure providers, such as AWS, Azure, and Google Cloud Platform, offer the necessary computing power, security layers, and global network latency optimization required to host these sophisticated enterprise applications, directly influencing platform performance and global reach.

Beyond the core infrastructure, innovation is concentrated heavily on incorporating intelligence and enhancing user interaction. Artificial Intelligence (AI) and Machine Learning (ML) are foundational technologies now integrated into almost every functional module, utilizing large datasets to provide predictive staffing models, personalized employee recommendations, and sophisticated fraud detection within payroll systems. Furthermore, the adoption of Application Programming Interfaces (APIs) and low-code/no-code platforms is crucial, allowing customers and third-party developers to easily integrate HR SaaS solutions with other enterprise systems (e.g., finance, CRM) and build custom extensions, fostering a thriving HR technology ecosystem. This interoperability is paramount for platforms positioning themselves as central hubs in the wider Human Capital Management landscape.

Other critical technological trends include the widespread use of mobile-first design principles and Progressive Web Applications (PWAs) to ensure full accessibility and functionality for remote employees, particularly for time tracking and self-service portals. Blockchain technology is beginning to gain traction, particularly in verifying academic credentials, certifications, and secure payroll processes, offering tamper-proof records and improved data trust. Furthermore, advancements in data visualization and business intelligence (BI) tools are transforming raw HR data into actionable insights through dynamic dashboards and natural language querying (NLQ), shifting the focus of HR professionals from data entry to strategic data interpretation and decision support.

Regional Highlights

Regional dynamics play a significant role in shaping the HR SaaS market, influenced by varying regulatory frameworks, technological adoption rates, and economic maturity. North America, encompassing the United States and Canada, leads the market primarily due to high IT spending, the early and widespread adoption of cloud computing across large enterprises, and the presence of the majority of the world's leading HR SaaS innovators and vendors. This region demands highly specialized solutions focused on complex compliance (e.g., ACA reporting in the US), advanced analytics, and cutting-edge talent management tools to attract and retain highly competitive workforces. The robust venture capital ecosystem also fuels continuous innovation and market disruption in this area.

Europe represents the second-largest market, characterized by stringent data protection laws, most notably the General Data Protection Regulation (GDPR). European customers prioritize platforms offering strong data localization and privacy features, creating demand for geographically compliant, regionalized solutions. Western European countries exhibit high market maturity, focusing on optimizing existing SaaS implementations and integrating advanced AI/ML features. Eastern Europe, conversely, shows accelerated growth as organizations rapidly transition from legacy systems directly to cloud-native platforms, bypassing intermediate stages of digitization.

The Asia Pacific (APAC) region is poised for the fastest growth (highest CAGR) during the forecast period. This rapid expansion is fueled by massive urbanization, the expansion of multinational corporations into emerging economies (India, China, Southeast Asia), and government initiatives promoting digital economies. While large enterprises demand globally scalable solutions, the vast SME segment drives demand for low-cost, mobile-first HR solutions. Regulatory complexity varies significantly across the region, making localization of payroll and compliance modules a crucial competitive differentiator for vendors operating here. Latin America and the Middle East & Africa (MEA) are emerging, offering substantial potential, primarily driven by investments in national digital transformation projects and the necessity to manage large, diversified, and often multi-lingual workforces efficiently.

- North America: Market leader; driven by high technological maturity, large enterprise adoption, and intense focus on advanced HCM and predictive analytics. High concentration of innovation centers and early adopters of AI-driven HR solutions.

- Europe: Second largest market; growth is compliance-driven (GDPR mandates), emphasizing data security, localization, and multilingual platform support. Steady, mature growth in Western economies.

- Asia Pacific (APAC): Highest projected CAGR; rapid digital transformation, increasing professionalization of HR in SMEs, and foreign investment fuel massive cloud adoption, particularly in emerging markets like India and China.

- Latin America (LATAM): Emerging market; focus on core HR functions, payroll accuracy, and transitioning away from manual processes. Demand is rising due to economic stabilization and increased foreign business presence.

- Middle East and Africa (MEA): Growth driven by government initiatives (e.g., Saudi Vision 2030, UAE's digital strategy) requiring modern workforce management tools for public and private sector transformation. Emphasis on mobile capabilities due to demographic structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Human Resource Saas Market.- Workday

- SAP SuccessFactors

- Oracle HCM Cloud

- ADP

- Ultimate Kronos Group (UKG)

- Microsoft

- ServiceNow

- Ceridian

- BambooHR

- Paycor

- Infor

- Paycom

- Cornerstone OnDemand

- Talentsoft

- HiBob

- Zenefits

- Namely

- Ascentis

- Gusto

- Dayforce

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Human Resource SaaS Market?

The Human Resource SaaS Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033, driven by global digital transformation and increasing demand for strategic Human Capital Management (HCM) tools.

Which functional module dominates the HR SaaS market segmentation?

Talent Management, encompassing modules like recruitment, performance management, and learning and development (L&D), holds a significant market share, fueled by organizational emphasis on employee experience and retention strategies.

How is Artificial Intelligence (AI) primarily impacting HR SaaS platforms?

AI is transforming HR SaaS by enabling advanced automation of routine tasks, predictive analytics for workforce planning (e.g., attrition forecasting), and personalized employee engagement through sophisticated machine learning algorithms.

Which region is expected to demonstrate the highest growth in the HR SaaS market?

The Asia Pacific (APAC) region is anticipated to record the highest growth rate, largely due to rapid digitization across developing economies, increased foreign investment, and the growing professionalization of HR processes in Small and Medium Enterprises (SMEs).

What are the primary restraints affecting the adoption of HR SaaS solutions?

The main restraints include persistent concerns regarding data security, the complexity and high cost of integrating new SaaS platforms with existing legacy ERP systems, and internal resistance to the organizational changes required for successful platform adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager