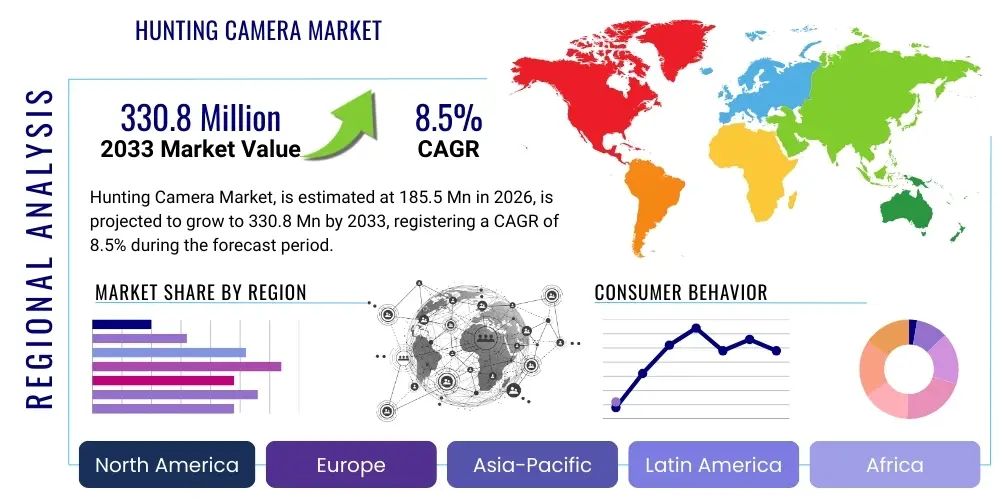

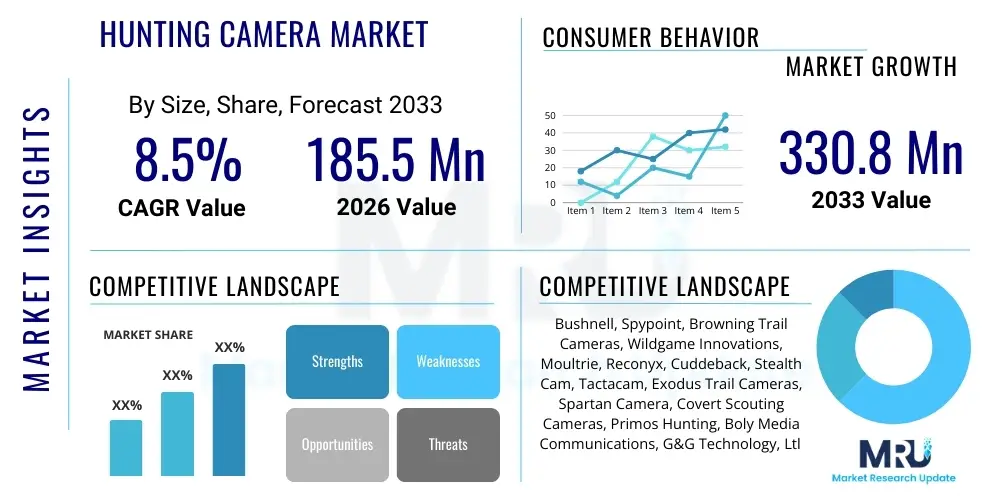

Hunting Camera Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442422 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Hunting Camera Market Size

The Hunting Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $185.5 Million in 2026 and is projected to reach $330.8 Million by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing adoption of advanced digital surveillance technologies for wildlife management, recreational hunting, and remote property security, especially in North America and key European regions. Market expansion is further supported by innovations in sensor technology, battery longevity, and the proliferation of affordable cellular connectivity options, enhancing the utility and reliability of these devices in remote environments.

Hunting Camera Market introduction

The Hunting Camera Market encompasses specialized remote-sensing devices, commonly known as trail cameras, designed to capture still images or video footage of wildlife activity with minimal human interference. These rugged, weather-resistant cameras are typically equipped with Passive Infrared (PIR) sensors to detect movement and temperature changes, triggering the capture process. Initially utilized primarily by hunters for scouting game animals, the product scope has rapidly expanded to include applications in ecological research, agricultural monitoring to mitigate crop damage, and remote security surveillance for land owners and outdoor enthusiasts seeking proactive property protection.

Major applications of hunting cameras center around monitoring game movement patterns, assessing deer density, and tracking specific animal behavior crucial for successful hunting seasons and conservation efforts. Beyond recreational use, the market benefits significantly from professional applications, where researchers use these non-invasive tools for long-term biodiversity studies and population health assessment without disturbing natural habitats. The integration of high-definition resolution capabilities, superior night vision through advanced infrared flash technologies (both low-glow and no-glow), and rapid trigger speeds have solidified the camera's position as an indispensable tool for remote observation and data collection.

Driving factors for market growth include the increasing disposable income allocated to outdoor recreational activities, coupled with significant technological advancements such as built-in cellular connectivity (4G LTE/5G compatibility). These connectivity options allow users to receive real-time updates, images, and videos directly to their mobile devices, significantly reducing the need for physical retrieval of memory cards. This real-time intelligence capability not only enhances convenience but also maximizes the effectiveness of scouting and surveillance operations, making sophisticated hunting cameras a value-added investment for serious users.

Hunting Camera Market Executive Summary

The global Hunting Camera Market is poised for substantial expansion, characterized by a fundamental shift toward wireless and technologically integrated devices. Business trends indicate a strong move away from basic SD-card retrieval models toward cellular-enabled cameras offering cloud storage and seamless integration with smartphone applications. Key players are heavily investing in proprietary Artificial Intelligence (AI) and Machine Learning (ML) algorithms to improve detection accuracy, minimize false triggers caused by environmental factors (e.g., wind, moving branches), and provide automated species recognition, streamlining the data analysis process for end-users.

Regionally, North America maintains its dominance, driven by deeply entrenched hunting traditions, vast private land ownership, and high consumer readiness to adopt premium, feature-rich electronic devices. Europe follows as a mature market, exhibiting steady growth propelled by stringent wildlife management regulations and increasing application in ecological research. The Asia Pacific region, while emerging, shows potential, particularly in countries utilizing these cameras for remote environmental monitoring, anti-poaching efforts, and rural property security applications, benefiting from rapid expansion of telecommunications infrastructure necessary for cellular camera deployment.

Segment trends highlight the overwhelming preference for cellular-enabled hunting cameras, driven by the desire for instantaneous data access and improved efficiency. Within flash technology, the No-Glow Infrared segment is experiencing the fastest uptake, as it offers completely covert operation, essential for both security monitoring and avoiding startling game animals. Furthermore, consumers are increasingly prioritizing ultra-high-resolution models (e.g., 20MP and above) and 4K video capabilities, demanding superior image clarity for detailed analysis and documentation, despite the resultant increase in data storage and transmission requirements.

AI Impact Analysis on Hunting Camera Market

Common user questions regarding AI in hunting cameras frequently revolve around the ability of these devices to accurately differentiate between target species and irrelevant movement, how AI affects battery longevity, and whether AI can facilitate instant species identification. Users are concerned about the reliability of alerts and the necessity of sifting through thousands of irrelevant images. The core expectation is that AI should transform trail cameras from mere recording devices into intelligent, decision-making tools that conserve battery life by only triggering for valuable events and providing categorized, searchable data.

The influence of Artificial Intelligence (AI) is fundamentally transforming the operational efficiency and data utility of hunting cameras. By integrating specialized on-device machine learning chipsets, modern trail cameras can execute complex computer vision tasks locally. This edge computing capability allows the camera to instantly classify detected objects (e.g., deer, turkey, human, vehicle) before deciding whether to capture the image or video and transmit the alert. This sophisticated filtering process drastically reduces the number of false triggers caused by vegetation or weather, thereby conserving precious battery life and minimizing unnecessary cellular data usage, addressing key pain points for remote users.

Furthermore, AI-driven analytics platforms—often hosted in the cloud—are revolutionizing post-capture data management. These platforms automatically tag and organize captured media, allowing users to search their extensive photo libraries based on species, time of day, and specific activities. This capability saves researchers and serious hunters hundreds of hours of manual review. Future developments are focused on predictive AI models that analyze movement data over time to forecast optimal wildlife movement periods and migration paths, moving the industry toward truly proactive wildlife management and scouting methodologies.

- Enhanced Detection Accuracy: AI algorithms significantly minimize false triggers from environmental factors (wind, rain, shadows).

- Automated Species Identification: Real-time classification of wildlife, allowing users to filter images by specific animal type.

- Optimized Power Management: Intelligent triggering and processing decisions extend field life and battery conservation.

- Cloud-Based Data Tagging: Automatic indexing and sorting of thousands of images, improving data searchability and retrieval.

- Behavioral Pattern Analysis: Predictive analytics based on historical data to forecast game movement and feeding times.

DRO & Impact Forces Of Hunting Camera Market

The hunting camera market dynamics are shaped by a powerful synergy of technological advancements and evolving consumer demands, countered by significant operational constraints inherent to remote electronic deployment. Key drivers include the miniaturization of high-resolution sensor components and the widespread availability of economical cellular network access, making real-time monitoring financially viable for a broader demographic. Restraints primarily revolve around the perpetual challenge of power management, as prolonged field deployment in harsh weather necessitates robust battery solutions, which often conflict with the consumer desire for smaller, lighter form factors. Opportunities arise from expanding IoT integration, allowing cameras to communicate with other smart devices, and the untapped potential in specialized government and research applications requiring ultra-rugged equipment.

Drivers: The single most significant driver is the shift toward instantaneous communication. The demand for cellular-enabled cameras (4G/5G) has created a premium segment where users prioritize the ability to monitor remote locations without physical visitation. Secondly, continuous improvements in image quality, including 4K video recording and high-megapixel stills, satisfy the professional user's need for granular data and detailed identification. Furthermore, the decreasing cost of high-performance microprocessors and memory components makes these advanced features accessible across more price tiers, accelerating mass market penetration. These technological forces are compelling conventional users to upgrade their older, non-connected equipment.

Restraints: The market faces substantial resistance from limitations in power sourcing and battery life, especially during intensive use or in cold climates where battery efficacy drops dramatically. While solar panels offer a partial solution, integrating them effectively without compromising portability remains a design challenge. Additionally, the regulatory landscape regarding cellular data transmission and the necessity for users to maintain separate cellular subscriptions for each camera can be complex and costly. Finally, the need for extreme durability against moisture, temperature fluctuations, and animal tampering demands specialized, often expensive, housing and sealing technologies, increasing unit cost.

Opportunities: Significant growth pathways exist in developing integrated IoT solutions where hunting cameras form part of a larger smart property security or ecological monitoring network, communicating with remote gates, flood sensors, or automated feeders. The untapped opportunity within specialized government contracts, including environmental law enforcement and military perimeter security, requires highly customized, robust cellular models offering encrypted transmission. Developing alternative, long-life power sources, such as advanced solid-state batteries or more efficient solar harvesting technologies, represents a major competitive advantage for companies that can overcome current power constraints.

Segmentation Analysis

The Hunting Camera Market is systematically segmented based on key technological attributes, distribution channels, and primary end-use applications, allowing manufacturers to tailor their product lines to distinct consumer needs. The market is primarily divided by connectivity type, separating traditional non-cellular models from the rapidly growing cellular-enabled segment, which dominates revenue generation due to its convenience and real-time data capabilities. Secondary segmentation criteria focus on the core components determining performance, such as image resolution (MP count), video capabilities (HD, 4K), and the type of infrared flash utilized, critically impacting covertness and night vision range.

Understanding these segments is crucial for strategic market positioning. For instance, the professional wildlife research segment emphasizes durability and extremely high resolution, often preferring No-Glow IR for minimal disturbance, while the mass-market recreational hunter might prioritize ease of setup and battery life in a low-glow cellular model. The rise of e-commerce as a dominant distribution channel further segments the market, favoring brands capable of robust online marketing and direct-to-consumer fulfillment, bypassing traditional retail intermediaries.

Overall segmentation analysis underscores a clear market trend toward premiumization, where users are willing to pay higher prices for advanced features like 4G LTE connectivity, built-in GPS tracking, and AI-powered image analysis, moving the average selling price (ASP) upward across most geographies. Conversely, the basic segment (Non-Cellular, Low Resolution) continues to serve entry-level users and markets with underdeveloped cellular infrastructure, maintaining a foundational volume component for the overall industry.

- By Product Type:

- Cellular Hunting Cameras (4G LTE, 5G compatible)

- Non-Cellular Hunting Cameras (SD Card Retrieval)

- By Flash Type:

- No-Glow Infrared (Invisible Flash)

- Low-Glow Infrared (Red Light Visible)

- White Flash (Color Night Vision)

- By Resolution:

- Below 12 Megapixels

- 12 Megapixels to 20 Megapixels

- Above 20 Megapixels

- By Application:

- Hunting and Scouting

- Wildlife Monitoring and Research

- Security and Surveillance (Property Monitoring)

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Stores, Sporting Goods Retailers, Mass Merchants)

Value Chain Analysis For Hunting Camera Market

The value chain for the hunting camera market starts with sophisticated upstream activities focused on securing high-quality electronic components. This includes sourcing advanced CMOS image sensors from specialized global manufacturers (critical for high resolution and low light performance), procuring high-speed microprocessors and dedicated AI chips, and securing robust, low-power connectivity modules (LTE-M, NB-IoT). Manufacturers often operate in global supply chains, requiring strict quality control over weatherproofing materials, specialized lenses, and power management integrated circuits (PMICs). Efficiency in the upstream segment directly determines the final product's performance specifications and cost competitiveness.

Manufacturing and assembly constitute the central stage, involving the integration of these sensitive components into rugged, weatherproof casings, followed by complex firmware development and quality assurance testing for trigger speed, detection range, and environmental resilience (IP ratings). Post-manufacturing, the downstream phase focuses on distribution channels. While indirect channels such as wholesale distributors, specialized sporting goods stores, and large mass merchants historically dominated, the proliferation of e-commerce has fundamentally reshaped the landscape. Direct-to-consumer (DTC) models via official websites and major online marketplaces now represent a critical growth vector, offering higher margins and direct consumer feedback.

The distribution channel analysis reveals that success hinges on optimizing both direct and indirect routes. Direct sales allow companies to control branding and customer experience, facilitating faster product iteration based on user data. Indirect channels, particularly specialized sporting goods retail giants, provide crucial physical visibility and trust for customers who prefer to examine the ruggedness and size of the unit before purchase. Effective value chain management requires rigorous inventory control, minimizing lead times for cutting-edge components, and strategically aligning distribution to target both tech-savvy online buyers and traditional brick-and-mortar shoppers.

Hunting Camera Market Potential Customers

The primary customer base for the Hunting Camera Market is diverse, extending far beyond the traditional demographic of recreational hunters. Hunters and serious outdoor scouts constitute the largest end-user segment, relying on these cameras to gather detailed, non-intrusive data on game trails, feeding habits, and trophy quality throughout the year, significantly increasing their chances of a successful hunt. These users typically demand high reliability, superior trigger speed, and excellent battery life, often preferring cellular models for efficiency and instantaneous updates on remote plots of land.

A rapidly expanding segment consists of professional wildlife researchers, ecologists, and conservation agencies. For these groups, hunting cameras serve as essential, non-invasive tools for long-term population monitoring, species inventory, and studying ecosystem dynamics. Their requirements are highly specialized, often prioritizing ultra-high resolution (for fine details like distinct markings), GPS tagging capabilities, and extremely durable casings suitable for prolonged exposure in harsh, inaccessible environments. Adoption in this segment is strongly correlated with available government funding and ecological research budgets.

The third major segment involves private landowners and security-conscious individuals utilizing trail cameras for property surveillance and general security. These users leverage the cameras' covert nature and remote monitoring capabilities to detect trespassers, monitor gates, deter illegal dumping, and observe rural property perimeters. In this application, features like No-Glow IR flash, discreet sizing, and instant cellular alerts become paramount. As consumer awareness of accessible, remote security solutions grows, this segment is expected to contribute substantially to the overall market revenue, driving demand for affordable, yet feature-rich, cellular models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $330.8 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bushnell, Spypoint, Browning Trail Cameras, Wildgame Innovations, Moultrie, Reconyx, Cuddeback, Stealth Cam, Tactacam, Exodus Trail Cameras, Spartan Camera, Covert Scouting Cameras, Primos Hunting, Boly Media Communications, G&G Technology, Ltl Acorn, Hawke Optics, ScoutGuard, HCO Outdoor Products, Trail Cam Pro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hunting Camera Market Key Technology Landscape

The technological landscape of the hunting camera market is characterized by rapid innovation centered on connectivity, image quality, and power efficiency. The transition from basic analog circuitry to highly integrated digital systems incorporating specialized microcontrollers and image signal processors (ISPs) has been foundational. Crucially, the deployment of 4G LTE-M and NB-IoT communication modules ensures reliable data transmission even in areas with weak cellular coverage, overcoming previous geographical limitations. Additionally, advanced sensor technology, particularly high-sensitivity CMOS sensors paired with large aperture lenses, enables superior performance in extremely low-light conditions, maintaining color fidelity when utilizing white flash and delivering crisp monochrome images with IR lighting.

Night vision capability is a fiercely competitive technological area, dominated by two primary infrared flash types: Low-Glow (940nm wavelength) and No-Glow (850nm wavelength). No-Glow technology is becoming the standard for premium, covert applications, minimizing the visibility of the camera flash to both humans and animals. This requires specialized LED arrays and careful thermal management to ensure consistent performance. Furthermore, the increasing adoption of specialized AI chipsets (often based on Neural Processing Units or NPUs) dedicated to edge processing allows for immediate object classification, reducing the data burden on the main processor and optimizing power consumption, which is critical for long-term deployments.

In terms of user experience and integration, cloud-based infrastructure and sophisticated companion mobile applications are essential components. These applications not only facilitate remote configuration and management of the camera settings but also act as the portal for AI analytics, allowing users to efficiently manage thousands of captured images and videos, often including two-way communication capabilities with the camera. Manufacturers are also focusing on robust, integrated energy solutions, including solar panels and efficient power management ICs, to significantly extend the time between battery changes, addressing one of the industry's most persistent technical challenges.

Regional Highlights

The regional analysis reveals distinct market maturity and growth drivers across major geographic zones, strongly correlating with regulatory environments, outdoor recreational traditions, and telecommunications infrastructure density. North America (NA) represents the largest and most mature market, characterized by high adoption rates of premium cellular cameras, substantial spending on outdoor gear, and extensive application in both recreational hunting and private property management. Europe follows, with growth driven particularly by the utilization of these devices for professional wildlife management, conservation projects, and academic research, where detailed data collection is mandated by environmental regulations.

Asia Pacific (APAC) is projected to be the fastest-growing region, albeit starting from a lower base. Market penetration is accelerating due to rising consumer interest in outdoor activities, increased governmental focus on combating poaching and illegal logging, and the continuous improvement in regional cellular network coverage. Countries like Australia and specific regions in Southeast Asia are adopting trail cameras for environmental monitoring and high-stakes surveillance. Latin America and the Middle East & Africa (MEA) remain niche markets, where adoption is primarily concentrated among large agricultural operations for security and specific eco-tourism ventures requiring biodiversity documentation.

- North America (NA): Dominant market share fueled by extensive hunting culture, large private land ownership, and early adoption of 4G/5G cellular technology. Key countries include the United States and Canada, where competitive premium brands thrive.

- Europe: Mature market with stable growth, characterized by strong governmental and academic use for wildlife population studies and environmental compliance monitoring. Germany, the UK, and Scandinavian countries are key revenue contributors, emphasizing covert and durable systems.

- Asia Pacific (APAC): Highest growth potential driven by increasing surveillance needs, anti-poaching initiatives, and expanding recreational markets in developed economies such as Australia and Japan. Infrastructure improvements in telecommunications are enabling cellular camera penetration.

- Latin America (LATAM): Emerging market focused primarily on commercial security applications, agricultural estate monitoring, and localized conservation efforts, often prioritizing battery longevity over advanced connectivity due to spotty remote network coverage.

- Middle East & Africa (MEA): Limited but growing adoption concentrated in high-value conservation zones, private game reserves for anti-poaching operations, and perimeter security for large infrastructure projects. Demand often focuses on extreme temperature resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hunting Camera Market.- Bushnell

- Spypoint

- Browning Trail Cameras

- Wildgame Innovations

- Moultrie

- Reconyx

- Cuddeback

- Stealth Cam

- Tactacam

- Exodus Trail Cameras

- Spartan Camera

- Covert Scouting Cameras

- Primos Hunting

- Boly Media Communications

- G&G Technology

- Ltl Acorn

- Hawke Optics

- ScoutGuard

- HCO Outdoor Products

- Trail Cam Pro

Frequently Asked Questions

Analyze common user questions about the Hunting Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of cellular hunting cameras?

The primary driver is the demand for real-time remote monitoring and data access. Cellular connectivity eliminates the need for physical visits to retrieve memory cards, offering immediate image transmission, substantial time savings, and enhanced efficiency for scouting and security applications, directly addressing the inconvenience of traditional trail cameras.

How does No-Glow IR technology improve hunting camera performance?

No-Glow Infrared technology uses 940nm wavelengths, which are invisible to the naked eye, ensuring the camera remains covert during night operation. This is critical for both security surveillance, where detection is undesirable, and wildlife monitoring, as it prevents startling game animals, resulting in more natural behavior captured and improved image evidence.

What role does AI play in extending the battery life of modern trail cameras?

AI significantly extends battery life by utilizing advanced machine learning models to differentiate between irrelevant movement (like wind-blown branches or shadows) and relevant objects (like animals or people). By minimizing false triggers, the camera only powers up the sensor and transmission components when genuinely needed, conserving energy and maximizing deployment duration.

Which geographic region holds the largest market share for hunting cameras?

North America currently holds the largest market share. This dominance is attributable to the region's strong cultural foundation in recreational hunting, significant investment in premium outdoor equipment, and well-established cellular network coverage supporting the demand for high-end, connected trail camera systems.

What is the expected long-term impact of 5G connectivity on the hunting camera market?

The adoption of 5G connectivity is expected to facilitate ultra-high-definition video streaming and transmission from remote locations. 5G offers significantly lower latency and higher bandwidth compared to 4G, enabling more frequent, real-time data uploads of large 4K video files and supporting more complex cloud-based AI processing and instantaneous remote camera control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager