HVAC Contained Servers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441016 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

HVAC Contained Servers Market Size

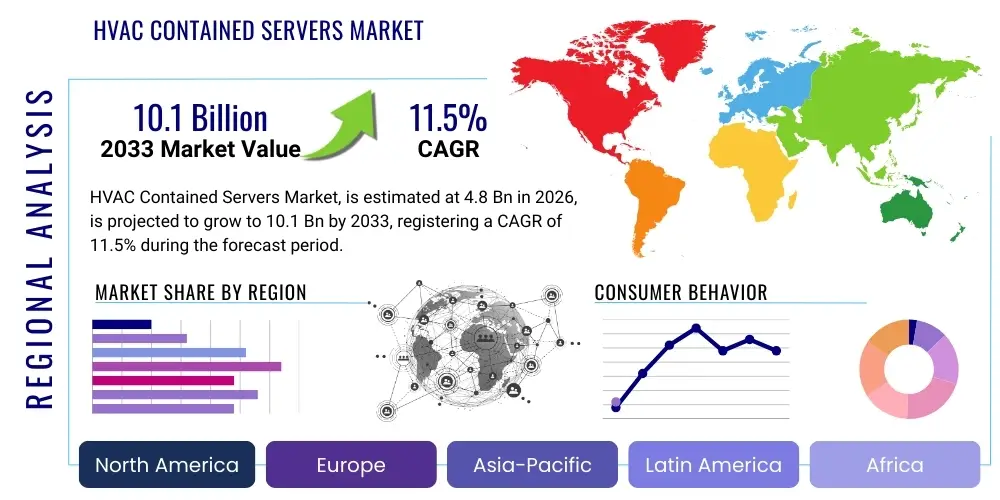

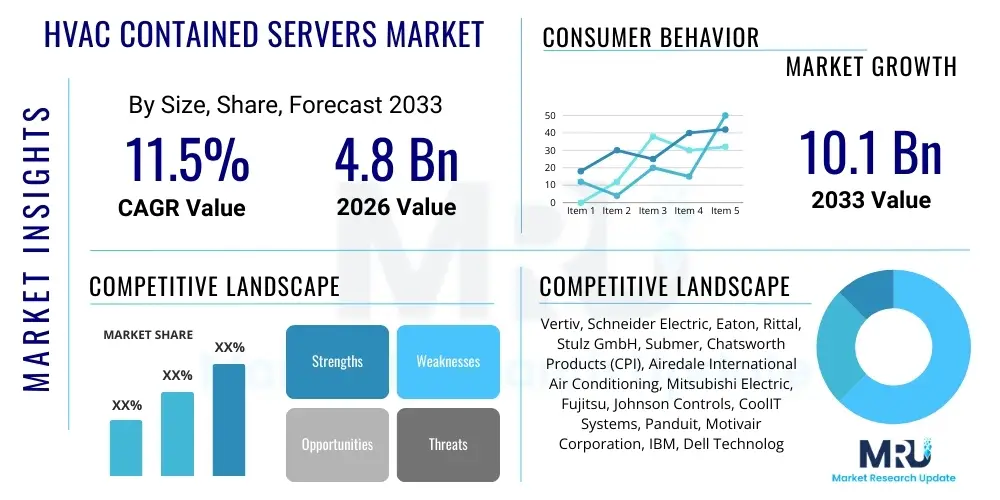

The HVAC Contained Servers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.1 Billion by the end of the forecast period in 2033. The substantial growth trajectory is underpinned by the escalating need for energy-efficient cooling solutions within hyperscale data centers and the proliferation of high-density computing architectures. Organizations are increasingly adopting contained server solutions to manage thermal loads effectively, particularly in environments requiring precise temperature and humidity control, driving significant investment across various industry verticals globally. This growth is compounded by the global mandate for corporate environmental sustainability and the increasing pressure on data center operators to reduce Power Usage Effectiveness (PUE) ratios below industry averages, making localized, contained HVAC solutions a strategic necessity rather than a mere operational preference. The transition from legacy room-level cooling to integrated rack-level or aisle-level containment fundamentally redefines infrastructure deployment methodologies, justifying the projected double-digit CAGR.

Market expansion is also heavily influenced by technological advancements in server hardware, notably the launch of high-thermal design power (TDP) processors and accelerators optimized for artificial intelligence and machine learning tasks. These components generate unprecedented heat flux, rendering conventional data center cooling strategies ineffective or prohibitively expensive to operate. HVAC Contained Servers address this challenge directly by isolating the heat source and providing dedicated, precise cooling, often through sophisticated liquid cooling mechanisms fully enclosed within the containment boundary. Furthermore, the modularity inherent in contained server architectures supports the rapid deployment and scaling required by cloud service providers, ensuring that infrastructure capacity can match the volatile and high-growth demands of modern digital services worldwide.

HVAC Contained Servers Market introduction

The HVAC Contained Servers Market encompasses specialized thermal management solutions designed to isolate and efficiently cool high-density server racks, optimizing environmental conditions directly at the heat source. These systems integrate Heating, Ventilation, and Air Conditioning (HVAC) technology directly into server enclosures, such as aisle containment systems or individual rack-level cooling units, drastically improving Power Usage Effectiveness (PUE) and reducing overall operational expenditure. The fundamental product is a closed-loop or localized cooling apparatus that precisely manages airflow, humidity, and temperature within the containment structure, moving beyond traditional room-level cooling approaches. This localization ensures that cold air is delivered only where needed and hot air is extracted efficiently, preventing harmful thermal mixing that plagues open-air data center floors. The primary objective is not just to cool, but to provide a stable, optimized microclimate for IT equipment, thereby extending hardware lifespan and enhancing system reliability.

Major applications of HVAC contained servers span hyperscale data centers, enterprise server rooms, edge computing facilities, and industrial automation environments where reliable, continuous operation under varying thermal loads is critical. These systems are highly beneficial for managing extreme heat generated by advanced hardware, including AI accelerators and high-performance computing (HPC) clusters. The application in edge computing is particularly transformative, allowing mission-critical processing nodes to be deployed in harsh, remote environments outside of purpose-built data center facilities, leveraging the contained nature of the unit for physical protection and consistent environmental control. The primary benefits include energy efficiency gains, enhanced hardware longevity through stable operating environments, increased power density capacity, and improved flexibility in deploying IT infrastructure modularly, which significantly shortens deployment cycles and minimizes installation disruption.

Driving factors for this market include the global expansion of digital infrastructure, particularly cloud computing and 5G network deployment, which necessitate denser server installations. Furthermore, stringent environmental regulations and corporate sustainability mandates are pushing data center operators to adopt advanced, energy-saving cooling technologies. The rapid adoption of artificial intelligence and machine learning technologies, which demand high-density graphics processing unit (GPU) clusters, exacerbates thermal challenges, making contained HVAC solutions indispensable for modern computing environments seeking optimized performance and operational efficiency. Moreover, the increasing cost of energy globally is forcing a critical evaluation of cooling methodologies, establishing contained server systems as the preferred mechanism for immediate and measurable efficiency improvements and operational cost reduction, thereby accelerating market adoption across all geographic regions.

HVAC Contained Servers Market Executive Summary

The HVAC Contained Servers Market is experiencing robust acceleration driven by pivotal technological shifts in data center architecture and increasing demands for sustainability. Business trends indicate a strong movement toward modular and scalable containment solutions, favoring manufacturers capable of offering integrated monitoring and predictive maintenance capabilities. Key strategic mergers and acquisitions focusing on integrating advanced cooling technologies, such as adiabatic and liquid cooling components, are shaping the competitive landscape. Furthermore, heightened scrutiny on PUE metrics is pushing vendors to innovate rapidly, creating market opportunities for specialized cooling service providers and integrated infrastructure management (IIM) platforms. The market is moving away from generic containment solutions towards highly customized, intelligent enclosures that dynamically respond to workload fluctuations, reflecting a critical shift in how enterprises view cooling infrastructure—from a static utility to a critical, dynamic IT resource.

Regional trends highlight North America and Europe as early adopters due to the presence of hyperscale cloud providers and strict energy efficiency standards, driving demand for complex, high-efficiency liquid containment systems. The Asia Pacific region, particularly countries like China and India, is projected to exhibit the highest growth rates, fueled by massive digital transformation initiatives, rapid data center construction, and the burgeoning edge computing market. Developing regions show a preference for modular, quickly deployable HVAC containment solutions suitable for varied climate conditions, often integrating renewable energy sources to power ancillary cooling components. Specific regulatory variances, such as the German standard for maximizing free cooling hours or Singapore's limitations on energy usage, further define regional product demand, pushing manufacturers to regionalize specific design elements, such as heat rejection mechanisms and humidification controls within the contained environment.

Segment trends underscore the dominance of liquid-cooled contained servers due to their superior ability to handle extreme heat flux densities associated with modern processors and accelerators. However, air-cooled solutions remain prevalent in retrofit projects and small to medium-sized enterprise (SME) data centers where capital expenditure constraints are stricter. Application-wise, hyperscale data centers account for the largest market share, while edge computing represents the fastest-growing segment, requiring rugged, compact contained HVAC units designed for non-traditional, often remote IT environments where consistent ambient temperature control is challenging. This segmentation confirms a bifurcated market strategy: high-end, customized liquid containment for hyperscale and HPC, and robust, standardized air or hybrid containment for the rapidly deploying edge infrastructure market segment.

AI Impact Analysis on HVAC Contained Servers Market

The convergence of Artificial Intelligence (AI) and Machine Learning (ML) deployment fundamentally reshapes the thermal management requirements within the data center ecosystem, directly influencing the HVAC Contained Servers Market. Common user questions frequently revolve around whether existing containment infrastructure can support the extreme thermal loads generated by AI hardware (specifically high-TDP GPUs), how AI optimization can enhance cooling efficiency and predictive maintenance, and what new design standards are emerging specifically for AI-intensive racks. Users express concerns regarding the energy consumption associated with cooling AI clusters and seek validation on the return on investment for migrating to advanced liquid-cooled contained solutions versus traditional air containment. This analytical insight confirms that AI is not only generating unprecedented thermal challenges but also simultaneously providing the digital tools necessary to manage these challenges efficiently.

Key themes emerging from this analysis summarize that AI deployment acts as a primary market accelerator, forcing higher power densities that traditional HVAC systems cannot handle efficiently, thus necessitating specialized containment. Users expect AI to not only create the heat problem but also provide the solution, specifically through sophisticated machine learning algorithms that optimize chiller operation, air handler speeds, and overall thermal distribution dynamically within the contained environment. The expectation is a paradigm shift towards intelligent cooling infrastructures where containment systems are intrinsically linked to real-time workload management to maximize efficiency and resilience in high-density AI processing environments. This feedback loop allows the contained HVAC system to anticipate thermal spikes based on scheduled AI model training jobs, adjusting cooling output proactively before temperature limits are approached.

The practical impact of AI deployment forces data centers to transition from partial aisle containment to full cabinet or liquid immersion containment, pushing the boundaries of power density per rack far beyond previous norms. AI-driven optimization tools are becoming standard requirements for monitoring airflow leakage, predicting equipment failure based on thermal anomalies, and dynamically adjusting the cooling set points within the contained server environment, maximizing PUE in real-time. This technological convergence is driving demand for containment solutions that are inherently compatible with liquid cooling distribution units (CDUs) and advanced monitoring sensors. Moreover, the dynamic and often intermittent nature of AI workloads necessitates containment solutions that can handle extreme thermal variance rapidly and efficiently without compromising PUE, a complexity that is driving innovation in phase-change materials and advanced fluid dynamics within contained spaces.

- AI workload spikes necessitate immediate cooling response, favoring dynamically managed containment systems utilizing machine learning controls.

- Increased usage of high-TDP GPUs (e.g., exceeding 700W per unit) drives mandatory adoption of liquid-based contained cooling solutions (direct-to-chip or immersion).

- AI-powered predictive maintenance reduces downtime in contained server environments by anticipating thermal faults and optimizing component replacement cycles.

- Machine learning algorithms optimize airflow patterns and set points within containment systems, maximizing energy savings by correlating cooling output directly to instantaneous compute demand.

- Requirement for containment infrastructure capable of housing densely packed server racks optimized for deep learning training and inference at densities exceeding 50 kW per rack.

- Facilitation of high-power density infrastructure necessary for developing and deploying large language models (LLMs) and generative AI applications globally.

- AI integration streamlines the process of balancing cooling loads across geographically dispersed contained server deployments, standardizing thermal management protocols.

DRO & Impact Forces Of HVAC Contained Servers Market

The dynamics of the HVAC Contained Servers Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), collectively dictating the impact forces shaping its trajectory. The primary driver is the pervasive trend toward high-density computing and AI adoption, which creates immediate thermal management challenges that only contained solutions can address efficiently. Simultaneously, the imperative for energy efficiency and compliance with global sustainability mandates acts as a significant market impetus, rewarding vendors who supply high PUE solutions. This regulatory push, particularly in Europe and parts of North America, enforces the use of contained architectures to leverage ambient environmental conditions for free cooling, significantly reducing reliance on compressor-based cooling cycles. The economic viability of scaling infrastructure rapidly and modularly, especially for cloud services, further reinforces these drivers by offering a clear path to lower total cost of ownership (TCO) compared to traditional data center builds.

Restraints include the high initial capital expenditure (CapEx) associated with implementing complex containment and integrated HVAC systems, especially for retrofitting existing facilities where ceiling heights or structural layouts may impede efficient aisle separation. Furthermore, the persistent challenge of managing the physical installation complexity and ensuring interoperability between diverse cooling components (e.g., specialized server racks, CDUs, containment barriers) from multiple vendors acts as a significant barrier to entry for smaller operators. Another key restraint is the current lack of universal standardization, particularly in the emerging liquid cooling containment space, which introduces risk regarding long-term maintenance and potential vendor lock-in for critical infrastructure components, complicating procurement and integration processes for multi-national organizations.

Opportunities for growth are abundant, particularly in the rapidly evolving edge computing segment, which requires miniature, resilient contained cooling systems deployed outside traditional data center environments. Furthermore, the increasing interest in advanced liquid cooling technologies, such as direct-to-chip and immersion cooling, presents lucrative avenues for manufacturers specializing in hybrid containment enclosures that seamlessly integrate these methods, promising densities far exceeding 100 kW per rack. The concept of modular and prefabricated data centers, often relying exclusively on contained HVAC solutions for rapid deployment, also serves as a key area for market expansion, appealing to telecommunication carriers and government agencies seeking quick, scalable, and secure deployments. Finally, the integration of DCIM platforms with contained HVAC controls offers opportunities for value-added services focused on advanced thermal analytics and optimization.

Segmentation Analysis

The HVAC Contained Servers Market is meticulously segmented based on key criteria including the type of cooling employed, the containment architecture utilized, the specific application environment, and the final end-user industry. This granular analysis provides a clear perspective on which technologies are gaining traction and which market verticals are driving demand. Understanding these segments is crucial for stakeholders to tailor product development and market strategies. The market segments reflect a continuous shift toward specialized, high-efficiency systems capable of handling the stringent thermal requirements of next-generation IT infrastructure, moving beyond simple air containment solutions to encompass sophisticated liquid and hybrid cooling methodologies within contained structures. The depth of segmentation reveals the industry’s response to varying thermal loads and operational environments.

The segmentation by Cooling Type is critical, differentiating between established air-based methods and emerging liquid-based solutions, which correlates directly with achievable power density per rack. Air-Cooled Contained Servers, relying on precise isolation of hot and cold aisles (HAC/CAC) and dedicated computer room air conditioners (CRACs) or handlers (CRAHs), still dominate in volume but are limited in high-density applications. Conversely, Liquid-Cooled Contained Servers, including direct-to-chip and single-phase/two-phase immersion systems, represent the premium segment, essential for managing heat from high-TDP components (e.g., AI/HPC clusters), often exceeding 50 kW per rack. Hybrid solutions, which use containment for ambient air cooling but integrate liquid manifolds for specific high-heat components, bridge the gap, offering flexibility and phased upgrade paths for large enterprises.

Containment architecture further defines the product landscape, ranging from affordable Aisle Containment to high-security, Rack-Level Containment units. Aisle containment provides a cost-effective solution for large floor plans by simply placing physical barriers (e.g., panels, doors) around the hot or cold aisle, dramatically improving air delivery efficiency. Rack-Level Containment, or micro data centers, are self-contained, sealed environments that integrate all necessary components (cooling, power, fire suppression) within a single or small group of racks. This architecture is increasingly vital for Edge Computing, where the IT environment must be completely separated from the external ambient environment, requiring a sealed, resilient enclosure capable of managing complex thermal and physical security demands outside the controlled facility perimeter.

- By Cooling Type:

- Air-Cooled Contained Servers (Hot/Cold Aisle Containment, Rack-Level Air Cooling, In-Row Coolers) - Dominant in volume, optimized for up to 20 kW/rack.

- Liquid-Cooled Contained Servers (Direct-to-Chip Liquid Cooling Contained Manifolds, Single-Phase Immersion Cooling Enclosures, Two-Phase Immersion Cooling Systems) - Essential for AI/HPC, exceeding 50 kW/rack.

- Hybrid Cooling Solutions (Combined Air Containment with Supplemental Liquid Cooling Loops for specific components) - Offers flexibility and phased upgrade paths.

- By Containment Architecture:

- Aisle Containment (Cold Aisle Containment - CAC, Hot Aisle Containment - HAC, Modular and scalable designs, integration with ceiling/floor plenums) - Standard for large, traditional data halls.

- Rack-Level Containment (Micro Data Centers, Single Cabinet Integrated Cooling Units, Ruggedized Outdoor Enclosures) - Critical for Edge and Industrial IT applications.

- By Application:

- Hyperscale Data Centers (Massive deployments requiring high scalability and custom liquid containment solutions) - Largest market consumers globally.

- Enterprise Data Centers (Focus on reliability, tiered deployment, and CapEx management, often utilizing hybrid air containment) - Mid-level volume market.

- Edge Computing Facilities (Requires resilience, compact design, and robust rack-level containment for remote sites) - Fastest-growing application segment.

- Industrial IT and Manufacturing (Specialized contained units for harsh environmental conditions, protection from dust and vibration).

- By End-User Industry:

- IT & Telecommunication (Driving 5G and cloud infrastructure expansion, major users of both liquid and air containment).

- Banking, Financial Services, and Insurance (BFSI) (Prioritizes resilience, compliance, and contained solutions for mission-critical core systems).

- Government and Public Sector (Demands high security, often standardized rack-level units, focus on long-term maintainability).

- Healthcare and Life Sciences (Utilizes contained HPC clusters for genomics and R&D, requires high uptime and precise environmental control).

- Energy and Utilities (Deployment of contained edge systems for smart grid management and remote site monitoring).

- Manufacturing and Automotive (Requires contained industrial IT solutions for IoT and automation control loops).

Value Chain Analysis For HVAC Contained Servers Market

The Value Chain for the HVAC Contained Servers Market begins with the Upstream Analysis, which focuses on the sourcing and manufacturing of specialized components critical for thermal management and containment structure integrity. This includes high-efficiency compressors, precision heat exchangers (both air-to-air and liquid-to-air/liquid-to-liquid), containment materials (fire-rated plastics, specialized sealing gaskets, composite panels), advanced control sensors (pressure differential, temperature, humidity), and high-quality Liquid Cooling Distribution Units (CDUs). Key upstream activities involve intensive R&D into novel cooling fluids, miniaturization of components for compact edge deployment, and the secure supply of critical materials used in advanced cooling ceramics and heat pipes. Manufacturers rely heavily on strategic partnerships with specialized sensor and control system providers to ensure integrated operational efficiency and reliability, which are paramount in contained server environments where fault tolerance is minimal. Quality control at this stage is crucial, as the performance of the entire contained system depends on the integrity of individual components like variable frequency drives (VFDs) and EC fan units.

The Midstream component involves the design, manufacturing, assembly, and testing of the final contained server system. This stage includes sophisticated computational fluid dynamics (CFD) modeling used by manufacturers to optimize airflow patterns within the containment boundary, ensuring uniform thermal distribution and eliminating hot spots. Assembly processes must adhere to strict tolerances to guarantee effective sealing against air leakage, which is the single largest factor affecting PUE in aisle containment systems. For rack-level containment, this stage includes the integration of complex subsystems—such as integrated fire suppression, power management, and proprietary monitoring interfaces—into a single, deployable unit. Final testing must rigorously simulate the intended operational environment, validating thermal resilience and cooling performance under maximum design load conditions, ensuring the contained solution meets specific customer PUE targets.

The Downstream Analysis involves the crucial processes of distribution, installation, integration, and post-sales support. Distribution channels are typically a mix of direct sales to large hyperscale clients and reliance on value-added resellers (VARs), global system integrators (GSIs), and specialized cooling technology distributors for enterprise and SME clients. Installation is highly specialized, requiring certified technicians to ensure proper sealing, differential pressure management across the containment boundary, and seamless integration with the data center’s existing Building Management Systems (BMS) and power infrastructure. Post-sales support, including remote monitoring, proactive predictive maintenance contracts leveraging AI, and rapid spare parts management for proprietary cooling components, represents a significant source of recurring revenue and a key competitive differentiator in this highly technical market. High-quality support is vital given the mission-critical nature of the contained IT loads.

HVAC Contained Servers Market Potential Customers

The primary potential customers for HVAC Contained Servers are organizations operating environments characterized by high power density, stringent uptime requirements, and significant operational scale. Hyperscale cloud providers, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, represent the largest customer segment due to their continuous expansion and necessity to manage massive, concentrated heat loads from millions of servers efficiently. These entities prioritize PUE optimization, rapid deployment capabilities, and modularity, often driving bespoke contained cooling design specifications, including custom liquid containment manifolds, to achieve peak efficiency and leverage renewable energy sources by facilitating warmer coolant temperatures.

Enterprise data centers, particularly those supporting mission-critical operations in sectors like BFSI and Healthcare, constitute another vital customer group. These users seek contained solutions primarily for risk mitigation, ensuring reliable operation of critical applications, and achieving better segregation of IT loads within a single facility, often using HAC or CAC retrofit solutions. For these customers, reliability, redundancy (e.g., N+1 cooling), and the compliance of the contained cooling mechanism with regulatory standards (e.g., HIPAA, GDPR) often outweigh initial cost considerations. Furthermore, they are increasingly adopting contained solutions as part of their digital transformation roadmap to support hybrid cloud strategies and high-density virtualization initiatives within their existing data center footprint, extending the life of current facilities.

The fastest-growing segment of potential customers includes organizations deploying Edge Computing Infrastructure. This encompasses telecommunication companies rolling out 5G networks, industrial manufacturers implementing IoT and AI at factory floors, and retail chains needing localized processing power. These customers demand rugged, compact, and often unmanned HVAC contained servers (micro data centers) that can operate reliably in harsh, non-traditional IT environments, requiring specialized thermal management designed to protect equipment from dust, humidity, vibration, and wide temperature swings. This necessity for complete environmental resilience at the network perimeter makes rack-level, self-contained cooling a non-negotiable requirement for critical infrastructure deployed in remote or non-standard locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vertiv, Schneider Electric, Eaton, Rittal, Stulz GmbH, Submer, Chatsworth Products (CPI), Airedale International Air Conditioning, Mitsubishi Electric, Fujitsu, Johnson Controls, CoolIT Systems, Panduit, Motivair Corporation, IBM, Dell Technologies, Hewlett Packard Enterprise (HPE), Trane Technologies, Liebert (Vertiv), Nortek Air Solutions, Munters Group AB, Green Revolution Cooling, LiquidStack, Envicool, Daikin Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HVAC Contained Servers Market Key Technology Landscape

The technological landscape of the HVAC Contained Servers Market is characterized by a rapid evolution toward precision, integration, and intelligence to meet escalating density demands. A critical technology is the advancement in dedicated In-Row Cooling Units (IRCU) and Rack-Level Cooling (RLC), which are specifically designed to be integrated within the containment perimeter. These units employ variable speed drive (VSD) compressors and electronically commutated (EC) fans to modulate cooling capacity precisely based on localized thermal load, maximizing efficiency by eliminating the need to overcool the entire data center floor. This localization minimizes air leakage and thermal mixing, which are major sources of inefficiency in traditional HVAC setups, making contained systems highly effective. Modern IRCUs often utilize chilled water or refrigerant loops managed by sophisticated microprocessor controls that interface directly with the DCIM platform, allowing for minute-by-minute adjustments to maintain the optimal operating environment within the aisle or rack.

Furthermore, the increased adoption of Liquid Cooling Distribution Units (CDUs) is transforming the contained server environment. CDUs manage the interface between facility water (or coolant) and the high-temperature fluid required for direct-to-chip or immersion cooling systems within the contained rack. This integration requires contained architectures to accommodate robust fluid delivery infrastructure, leak detection sensors (e.g., rope sensors, spot sensors), and thermal monitoring systems directly at the server level. The development of modular, quick-connect couplings for liquid lines, minimizing the risk of leaks during maintenance, is a key focus area. The most sophisticated containment solutions now feature integrated environmental sensors, including temperature, humidity, pressure differential, and fluid flow meters, feeding real-time operational data back into advanced Building Management Systems (BMS) or Data Center Infrastructure Management (DCIM) platforms, crucial for GEO and AEO requirements by providing actionable, structured thermal data points.

Generative Engine Optimization (GEO) principles emphasize providing structured data relevant to advanced technological inquiries. Key technologies include advanced sealing mechanisms (e.g., automated curtain systems, high-integrity brush strips, magnetic gasketed panels) crucial for maintaining differential pressure in hot/cold aisle containment, which ensures complete thermal separation and maximizes cooling unit return air temperatures for optimal efficiency. The integration of advanced economizer modes, such as indirect adiabatic or evaporative cooling, directly into the contained HVAC unit allows operators to significantly extend the duration of free cooling utilization, reducing reliance on mechanical cooling. Additionally, the move towards passive containment (relying on natural convection and dedicated exhaust paths for low-density areas) and hybrid cooling methodologies, which switch intelligently between air and liquid cooling based on the instantaneous server load, represents the cutting edge. These technologies are foundational to achieving PUE values below 1.2, which is the benchmark for modern, sustainable contained server environments globally. Innovation in fire suppression systems specifically designed for contained environments, such as localized inert gas or clean agent delivery, is also paramount to ensure operational safety without compromising server integrity.

Regional Highlights

The global deployment of HVAC Contained Servers exhibits significant regional variations influenced by energy costs, regulatory frameworks, climate conditions, and the concentration of hyperscale facilities. North America currently dominates the market share due to the early and massive adoption by major cloud providers and the continuous investment in next-generation high-performance computing (HPC) centers. These deployments heavily favor advanced, high-density containment solutions, including extensive liquid-cooled contained racks, driven by stringent energy efficiency standards and the operational scale required by large tech firms. The U.S. market, specifically, sees high demand for customizable, large-scale containment projects, often involving sophisticated integration of DCIM platforms to meet complex reporting requirements related to sustainability and efficiency metrics. Furthermore, the presence of major manufacturers and continuous R&D investment solidifies North America's leadership position in adopting cutting-edge containment technologies.

Europe represents a highly mature market, characterized by strict regulations like the EU Green Deal and increasing pressure to reduce carbon footprints, such as the German government’s initiative to mandate low PUE scores for new data centers. This has accelerated the shift towards contained server environments, especially those utilizing free cooling techniques (adiabatic or evaporative) integrated seamlessly within the containment architecture. Countries like Germany, the UK, and the Nordics are leaders in adopting sophisticated Hot Aisle Containment (HAC) and rack-level micro data center solutions for localized IT requirements, focusing heavily on PUE improvements and resilience. The emphasis in Europe is often on minimizing water usage and maximizing the number of free cooling hours, leading to demand for contained systems optimized for higher supply temperatures (e.g., utilizing ASHRAE A3 and A4 temperature standards) and leveraging external cold air efficiently.

Asia Pacific (APAC) is forecast to be the fastest-growing region, propelled by massive investments in digital infrastructure expansion across China, India, and Southeast Asia. The rapid growth in mobile data consumption, cloud adoption, and the subsequent need for localized processing drive significant demand for modular, quickly deployable, and resilient contained server units, particularly in edge computing applications driven by 5G rollout. Due to varied and often challenging climates (high ambient heat and high humidity), containment solutions in APAC frequently require specialized dehumidification components and robust sealing mechanisms integrated into the HVAC system to protect sensitive server hardware effectively. Government-led digitization projects and foreign direct investment into regional hyperscale facilities further fuel this explosive market growth, often favoring local manufacturing capabilities for customized containment structures to meet regional scalability demands efficiently.

- North America: Market leader; High investment in hyperscale and liquid cooling containment; Driven by stringent energy targets and AI/HPC demand, leading innovation in integrated DCIM.

- Europe: Mature market; Focus on sustainability and low PUE through free cooling integration; Strong regulatory compliance driving HAC adoption and high-efficiency designs.

- Asia Pacific (APAC): Highest growth rate; Massive data center build-out; Strong demand for modular edge computing containment; Needs specialized humidity and extreme ambient heat control solutions.

- Latin America (LATAM): Emerging market; Increasing adoption in BFSI and telecom sectors; Preference for cost-effective, standardized aisle containment solutions driven by energy cost mitigation.

- Middle East and Africa (MEA): Rapid growth driven by digital transformation initiatives; Specialized requirement for contained cooling resilient to extreme ambient heat and sand ingress, often favoring sealed closed-loop systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HVAC Contained Servers Market. These companies are crucial in driving innovation across air, hybrid, and liquid cooling contained solutions, influencing global standards and adoption rates.- Vertiv Holdings Co.

- Schneider Electric SE

- Eaton Corporation plc

- Rittal GmbH & Co. KG

- Stulz GmbH

- Submer Technologies SL

- Chatsworth Products (CPI)

- Airedale International Air Conditioning Ltd.

- Mitsubishi Electric Corporation

- Fujitsu Limited

- Johnson Controls International plc

- CoolIT Systems Inc.

- Panduit Corporation

- Motivair Corporation

- IBM Corporation

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- Trane Technologies plc

- Nortek Air Solutions, LLC

- Munters Group AB

- Green Revolution Cooling (GRC)

- LiquidStack

Frequently Asked Questions

Analyze common user questions about the HVAC Contained Servers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary financial advantage of deploying HVAC contained servers over traditional room cooling?

The primary financial advantage is the significant reduction in operational expenditure (OpEx) driven by superior Power Usage Effectiveness (PUE). Contained systems cool the heat source directly, requiring less energy to move conditioned air, often reducing cooling energy consumption by 20% to 40% compared to traditional data center cooling methods, leading to substantial long-term cost savings and a faster return on investment (ROI).

How do containment systems facilitate the shift to high-density liquid cooling?

Containment systems provide the necessary physical structure and isolation to safely and effectively integrate Liquid Cooling Distribution Units (CDUs) and associated plumbing directly into the rack environment. This localization ensures that the extreme heat generated by high-density server clusters, particularly those using direct-to-chip cooling, is managed efficiently and independently of the ambient room temperature, preventing environmental contamination and maximizing thermal capture efficiency.

Are Hot Aisle Containment (HAC) or Cold Aisle Containment (CAC) systems more effective for energy savings?

Both HAC and CAC are effective, but HAC is often considered slightly superior for maximizing PUE. HAC ensures that all hot exhaust air is returned directly to the cooling units without mixing with the cold supply air, allowing the entire room outside the containment to be operated at a higher, warmer temperature. This enables superior use of free cooling techniques (economizers) and enhances overall system efficiency by maximizing the delta T (temperature differential).

What role does edge computing play in the future growth of the contained servers market?

Edge computing is a major growth driver, demanding compact, rugged, and secure rack-level contained server solutions, often referred to as micro data centers. These contained units include integrated HVAC, UPS, and security systems, making them essential for deploying critical IT infrastructure reliably in non-traditional, often environmentally challenging remote locations close to the end-user, crucial for low-latency 5G and IoT applications.

What are the typical thermal limitations for air-cooled contained server environments?

Air-cooled containment systems typically perform optimally for rack densities up to 15 kW to 20 kW per rack. Beyond this threshold, the volume of air required becomes prohibitively difficult to move efficiently through the IT equipment or results in undesirable pressure differentials. Higher densities necessitate a transition to specialized liquid-assisted containment architectures, such as hybrid or full immersion cooling, to manage heat flux effectively and maintain low PUE.

How important is airflow management software integration in modern containment solutions?

Airflow management software and DCIM integration are essential for maximizing the ROI of contained server solutions. These tools monitor pressure differentials, temperature gradients, and fan speed requirements in real-time. They use this data to dynamically adjust cooling set points and fan velocities within the containment, ensuring that cooling energy consumption is precisely matched to the actual server load, which is critical for maintaining optimal PUE.

What distinguishes rack-level containment from traditional aisle containment?

Rack-level containment (micro data centers) provides a fully sealed, localized environment for one or a few racks, integrating all cooling, power, and monitoring systems into a single unit, independent of the room environment. Aisle containment, conversely, relies on surrounding facility cooling and is used to separate hot and cold air paths across many rows of racks within a larger data hall. Rack-level is preferred for edge, remote, or high-security deployments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager