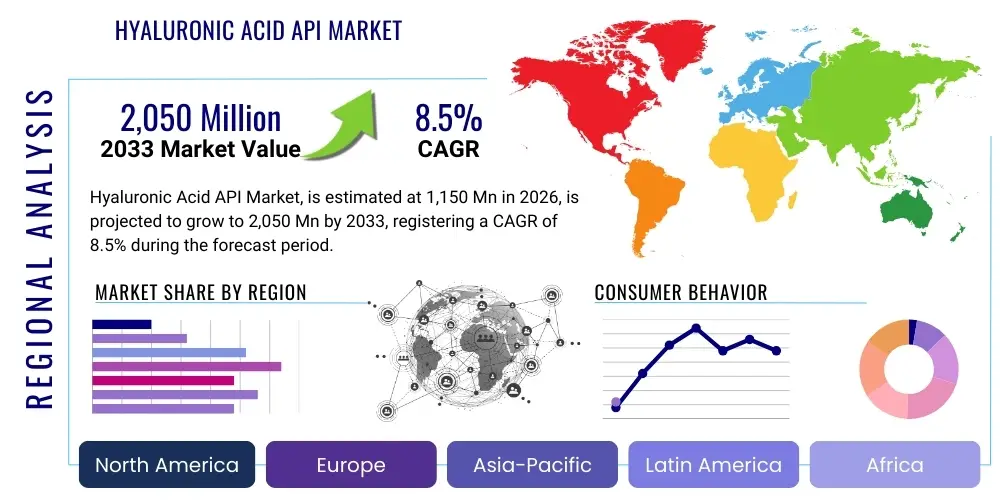

Hyaluronic Acid API Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442757 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hyaluronic Acid API Market Size

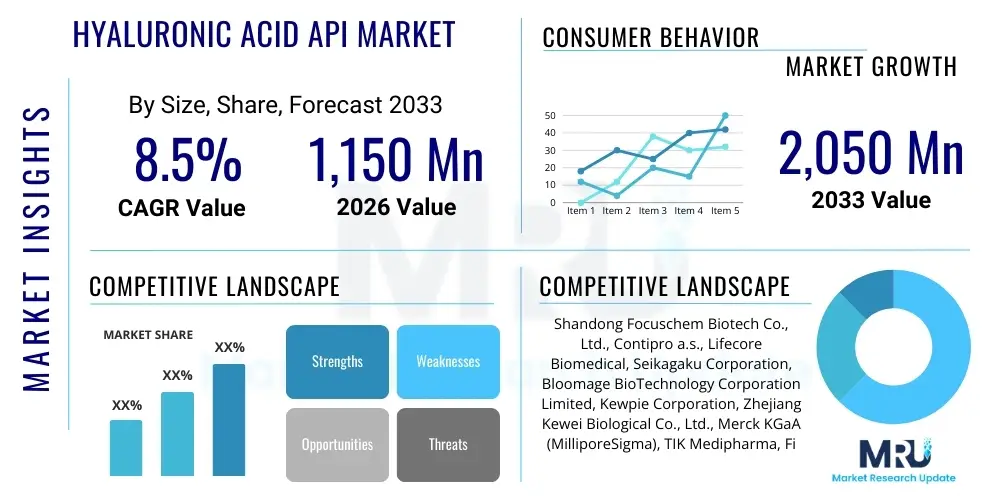

The Hyaluronic Acid API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1,150 Million in 2026 and is projected to reach $2,050 Million by the end of the forecast period in 2033.

Hyaluronic Acid API Market introduction

The Hyaluronic Acid (HA) Active Pharmaceutical Ingredient (API) Market encompasses the highly purified grade of sodium hyaluronate used primarily in injectable medical devices, ophthalmic surgery, orthopedic treatments, and advanced pharmaceutical formulations. HA API is a naturally occurring polysaccharide found in connective tissues, epithelia, and neural tissues, renowned for its viscoelastic and moisturizing properties, making it invaluable across medical and cosmetic sectors. Its high water retention capacity and biocompatibility establish it as a cornerstone material in regenerative medicine and anti-aging applications. The API grade requires stringent quality controls regarding molecular weight distribution, purity, and endotoxin levels, significantly differentiating it from lower-grade HA used in topical cosmetics.

Major applications driving the demand for HA API include the formulation of viscosupplements for treating osteoarthritis, where it acts as a joint lubricant and shock absorber, and its extensive use in ophthalmic viscoelastic devices (OVDs) during cataract and refractive surgeries. Furthermore, HA API is a crucial component in dermal fillers, which address aesthetic concerns by restoring volume and reducing wrinkles, contributing substantially to the market growth, particularly in technologically advanced economies. The versatility of HA API, depending on its molecular weight (ranging from LMW to HMW), allows manufacturers to tailor products for specific biological functions, such as cell proliferation, tissue scaffolding, and drug delivery optimization.

The market expansion is robustly driven by the global increase in the aging population, which consequently raises the prevalence of age-related disorders like osteoarthritis and cataracts. Additionally, the growing consumer preference for minimally invasive cosmetic procedures, coupled with technological advancements in HA fermentation and purification processes that yield high-quality, reproducible API, accelerate market adoption. Regulatory support for new medical devices utilizing HA, along with increasing healthcare expenditure across emerging economies, further solidify the market’s positive trajectory. Key benefits of HA API include its natural origin, low immunogenicity, and exceptional healing properties, which reinforce its status as an indispensable biological material in modern medicine.

Hyaluronic Acid API Market Executive Summary

The Hyaluronic Acid API market is characterized by intense focus on purity standards and innovation in molecular weight control, reflecting key business trends centered around vertical integration and strategic collaborations between fermentation specialists and end-product manufacturers. Business trends highlight a shift towards microbial fermentation methods over traditional animal extraction to ensure scalability, ethical sourcing, and enhanced regulatory compliance, especially in developed markets like North America and Europe. Manufacturers are increasingly investing in proprietary purification technologies to produce ultra-high purity HA API suitable for sensitive applications like intra-articular injections and ophthalmic use, resulting in premium pricing and improved competitive differentiation across the value chain. Sustainable sourcing and production efficiency are paramount, driving the adoption of advanced bioprocessing techniques aimed at reducing manufacturing costs while maintaining superior product quality.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to rapidly expanding pharmaceutical and medical device manufacturing industries in countries like China and India, coupled with rising disposable incomes fueling demand for aesthetic procedures. North America and Europe, however, currently hold the largest market shares, driven by established regulatory frameworks, high prevalence of osteoarthritis, and advanced reimbursement policies for HA-based treatments. Regional trends indicate growing regulatory harmonization efforts, particularly within the European Union (EU) under the Medical Device Regulation (MDR), influencing how HA APIs are classified and utilized in medical products. The strong presence of leading aesthetic and ophthalmic companies in North America maintains its dominance in high-value segment consumption.

Segment trends underscore the dominance of the high molecular weight (HMW) HA API segment in terms of volume and value, primarily due to its widespread application in viscosupplementation and as the preferred rheological modifier in dermal fillers, offering longer residence time and superior biological function. The application segment sees ophthalmic and orthopedic uses capturing the majority share, though the dermal filler segment is projecting the highest compound annual growth rate, reflecting the booming aesthetic medicine industry worldwide. Within end-user segments, pharmaceutical companies and Contract Manufacturing Organizations (CMOs) specializing in sterile injectables represent the largest buyers, driven by the complexity of formulating and manufacturing finished HA products under Good Manufacturing Practice (GMP) standards.

AI Impact Analysis on Hyaluronic Acid API Market

Common user questions regarding AI's impact on the Hyaluronic Acid API market frequently revolve around its potential to optimize fermentation yields, enhance molecular weight predictability, and accelerate novel formulation development. Users are keen to understand if AI can address variability issues inherent in biological production, ensuring consistently high purity levels demanded by regulatory bodies. Specific concerns include the ethical implications of using AI in quality control and whether initial high implementation costs will restrict adoption to only major players. The analysis indicates a strong user expectation that AI, particularly machine learning and deep learning algorithms, will revolutionize the upstream process (bioreactor optimization) and the downstream process (purification and quality assurance), offering unprecedented control over the complex polymer structure of HA. Key themes summarize AI as a tool for precision manufacturing, predictive quality control, and accelerated drug delivery system innovation utilizing HA.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning from theoretical potential to practical application within the Hyaluronic Acid API manufacturing landscape, promising substantial improvements in efficiency and product consistency. AI models are being deployed to manage complex bioreactor parameters—including pH, temperature, nutrient levels, and dissolved oxygen—in real-time during microbial fermentation. By analyzing vast datasets generated during production runs, AI can predict optimal operating conditions that maximize HA yield and, crucially, accurately control the final molecular weight distribution, which is a critical quality attribute for regulatory approval and clinical efficacy across different applications, such as high viscosity HMW HA for orthopedics versus lower viscosity LMW HA for tissue engineering.

Furthermore, AI significantly impacts research and development, particularly in the creation of novel modified and cross-linked HA derivatives. Generative AI is increasingly used to model the physicochemical interactions between HA molecules and other compounds, accelerating the screening process for enhanced dermal fillers or specialized drug delivery vehicles. In quality assurance, machine vision systems powered by AI are enhancing automated inspection processes for particulate matter and container closure integrity in sterile HA API packaging, minimizing human error and ensuring compliance with stringent injectable standards. This technological shift is driving down manufacturing variability, leading to higher batch success rates and ultimately lowering the cost of high-quality API production.

- AI optimizes microbial fermentation processes by predicting optimal bioreactor conditions, maximizing yield and controlling specific molecular weights.

- Machine Learning (ML) models enhance Quality Control (QC) by analyzing spectroscopic data to ensure high purity and low endotoxin levels in real-time.

- Generative AI accelerates the design of advanced HA cross-linking technologies and hydrogel formulations for regenerative medicine and sustained drug release.

- Predictive maintenance algorithms minimize downtime in high-cost API production facilities, improving overall manufacturing throughput and efficiency.

- AI-driven data analytics support regulatory compliance by providing comprehensive traceability and real-time documentation of manufacturing parameters.

DRO & Impact Forces Of Hyaluronic Acid API Market

The Hyaluronic Acid API market growth is primarily driven by the increasing incidence of orthopedic and ophthalmic diseases linked to global demographic aging, alongside the soaring demand for non-surgical aesthetic enhancements which utilize HA as the primary component in dermal fillers. However, the market faces significant restraints, chiefly concerning the high capital expenditure required for setting up and maintaining GMP-compliant fermentation and purification facilities, which limits entry to major established players and often results in supply bottlenecks for premium grades. Opportunities abound in the development of innovative, modified HA APIs tailored for emerging fields like tissue engineering, 3D bioprinting, and targeted drug delivery systems, leveraging its biocompatible scaffolding properties. The market dynamics are subject to intense impact forces, specifically the stringent regulatory mandates imposed by bodies such as the FDA and EMA concerning API purity, sterility, and origin, which dictate market entry and product commercialization timelines.

Key drivers sustaining the market momentum include the escalating patient acceptance of viscosupplementation therapy as a viable alternative to knee replacement surgery for osteoarthritis, especially given the positive long-term outcomes associated with high molecular weight HA injections. Furthermore, the robust expansion of the cosmetic industry, fueled by social media influence and improved access to aesthetic procedures in developing regions, ensures consistent demand for HA API suitable for dermal and lip fillers. Technological innovation in bioprocessing, particularly the ability to genetically engineer specific microbial strains (e.g., Streptococcus equi or recombinant Bacillus subtilis) to produce HA with tailored molecular weights, provides manufacturers with a competitive edge and supports diversified application development across medical fields.

Restraints impeding unrestrained growth include the inherent volatility in raw material costs, the risk of batch-to-batch variability in biological fermentation processes if not tightly controlled, and the pervasive issue of counterfeit and low-quality HA API entering the market, which jeopardizes patient safety and damages legitimate supplier credibility. Regulatory hurdles, particularly in obtaining approvals for novel injectable devices, demand extensive clinical data and compliance with evolving global standards (like the EU MDR implementation), imposing high costs and lengthy timelines on market access. Despite these challenges, the foremost opportunities lie in expanding the API's therapeutic applications beyond traditional orthopedics and aesthetics, focusing on areas such as wound healing matrices, sophisticated ocular drug delivery, and advanced pediatric formulations, ensuring long-term market sustainability and diversification.

Segmentation Analysis

The Hyaluronic Acid API market is comprehensively segmented based on its defining characteristics, which include molecular weight, the source of extraction, the specific application area, and the ultimate end-user industries. This structured segmentation is critical for analyzing market dynamics, as the utility and regulatory pathway of HA API are fundamentally linked to its physical and chemical properties. For instance, high molecular weight HA is generally preferred for viscosupplementation due to its superior viscoelasticity, while lower molecular weight HA is often utilized in topical formulations and certain targeted drug delivery systems due to better penetration and signaling capabilities. The segmentation by source highlights the transition from traditional animal-based extraction (e.g., rooster combs) towards modern, scalable microbial fermentation, which addresses ethical concerns and ensures higher purity standards, aligning with current regulatory expectations for injectable pharmaceutical ingredients.

The primary application segments delineate the major consumption areas, where orthopedics and ophthalmology remain cornerstone sectors due to the high efficacy and established clinical use of HA in these fields. However, the rapidly expanding aesthetics segment, driven by global demand for dermal fillers and mesotherapy, represents the most dynamic growth area. End-user categorization distinguishes between pharmaceutical manufacturers, which use HA API in prescription drugs and complex injectable formulations, and the rapidly growing medical device companies that utilize the API for specialized products such as surgical adjuncts, anti-adhesion barriers, and advanced wound dressings. Analyzing these segmentations allows stakeholders to identify specific market niches and focus investment on technologies that deliver tailored HA API properties suitable for high-growth applications, ensuring maximum market relevance and penetration.

- By Molecular Weight:

- High Molecular Weight (HMW) HA API (> 1,800 kDa)

- Medium Molecular Weight (MMW) HA API (1,000 kDa – 1,800 kDa)

- Low Molecular Weight (LMW) HA API (< 1,000 kDa)

- By Source:

- Microbial Fermentation

- Animal Extraction (e.g., Rooster Combs)

- By Application:

- Orthopedics (Viscosupplementation)

- Ophthalmology (OVDs, Dry Eye Treatment)

- Aesthetics (Dermal Fillers, Mesotherapy)

- Drug Delivery and Tissue Engineering

- Wound Healing

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Medical Device Manufacturers

- Cosmeceutical and Skincare Product Manufacturers

Value Chain Analysis For Hyaluronic Acid API Market

The value chain of the Hyaluronic Acid API market begins with the upstream segment focused on raw material sourcing and primary production, primarily relying on highly specialized fermentation media and purified microbial strains. Upstream activities involve significant investment in proprietary biotechnology to optimize microbial fermentation yields and ensure tight control over the molecular weight of the synthesized HA polymer. The transition away from animal-based sources emphasizes sterile, contained fermentation processes, making the quality and consistency of raw material inputs, such as glucose and peptones, crucial. Key challenges in this stage include preventing microbial contamination and achieving high conversion efficiency to keep the cost of goods manageable while adhering to stringent GMP guidelines required for API manufacturing.

The intermediate stage encompasses the rigorous downstream processing, including multiple steps of purification, precipitation, filtration, and drying to extract the high-purity sodium hyaluronate. This phase is capital-intensive, requiring advanced chromatography and ultrafiltration systems to remove impurities, proteins, and crucially, minimize endotoxin levels to meet injectable grade standards (typically < 0.05 EU/mg). Quality assurance and control are paramount here, involving extensive analytical testing for molecular weight distribution, purity (using methods like HPLC and GPC), and microbial load. Successful API manufacturers differentiate themselves by their ability to consistently produce customized molecular weight profiles with exceptional purity levels, often protected by proprietary technical know-how.

The distribution channel involves moving the finalized HA API to end-user manufacturers. Direct distribution, where large API producers supply directly to pharmaceutical majors and large medical device companies, is common due to the need for strict quality agreements and technical support. Indirect channels utilize specialized chemical distributors and agents, particularly in fragmented or emerging regional markets. Downstream analysis focuses on the final formulation and packaging of finished products, such such as pre-filled syringes of dermal fillers or vials of viscosupplementation agents, which requires sterile filling operations. The success of the final product is directly tied to the consistent quality of the HA API, making robust supply chain integrity and reliable logistics essential components of the market's value proposition.

Hyaluronic Acid API Market Potential Customers

The primary customers in the Hyaluronic Acid API market are categorized based on their scale of operations, regulatory requirements, and the final application of the HA. Pharmaceutical companies represent a crucial customer segment, particularly those focused on developing prescription drugs and complex biologic formulations where HA serves as a key excipient or active ingredient for targeted drug delivery systems. These customers demand the highest purity, GMP-certified, and frequently customized molecular weight HA API, often procured in large volumes under long-term supply agreements. Their stringent regulatory environments mean suppliers must provide comprehensive documentation, including Drug Master Files (DMFs), to facilitate the customer's product registration process with global health authorities.

Medical device manufacturers constitute another significant customer base, encompassing companies specializing in orthopedic devices (viscosupplements, bone scaffolds), ophthalmic surgical aids (OVDs), and wound management products (dressings, anti-adhesion barriers). These buyers prioritize HA API that is validated for sterilization methods (e.g., autoclaving, irradiation) and ensures appropriate rheological properties compatible with their device design. Demand from this segment is increasingly focused on cross-linked or chemically modified HA API variants that offer enhanced mechanical strength, longer biodegradation times, or specific biological signaling functions necessary for sophisticated implantable devices.

A third, high-growth customer category includes leading cosmeceutical companies and Contract Development and Manufacturing Organizations (CDMOs) specializing in aesthetic products. These customers purchase HA API primarily for the production of dermal fillers and highly concentrated serum formulations. While the regulatory demands for aesthetic applications can sometimes be less stringent than for internal injectables, the need for exceptional product consistency, low immunogenicity, and specific particle size distributions for filler applications remains critical. The growth in this segment is strongly tied to consumer trends and the rapid innovation cycle within the non-surgical beauty industry, requiring suppliers to be agile and capable of quick scale-up.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,150 Million |

| Market Forecast in 2033 | $2,050 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shandong Focuschem Biotech Co., Ltd., Contipro a.s., Lifecore Biomedical, Seikagaku Corporation, Bloomage BioTechnology Corporation Limited, Kewpie Corporation, Zhejiang Kewei Biological Co., Ltd., Merck KGaA (MilliporeSigma), TIK Medipharma, Fidia Farmaceutici S.p.A., Genzyme (Sanofi), B. Braun Melsungen AG, Meiji Seika Pharma Co., Ltd., Novozymes A/S, Sino-Biochem Co., Ltd., HA-Derma Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hyaluronic Acid API Market Key Technology Landscape

The Hyaluronic Acid API market is fundamentally shaped by advancements in biomanufacturing technology, with microbial fermentation standing as the dominant and most critical technique. This process involves utilizing carefully selected bacterial strains, typically non-pathogenic Streptococcus species or recombinant strains like Bacillus subtilis, within large bioreactors under strictly controlled sterile conditions. Technological focus is currently centered on optimizing fermentation parameters—such as nutrient feed rates, strain genetics, and oxygen transfer efficiency—to maximize the yield of HA while precisely controlling its polydispersity (molecular weight distribution). High-yield, genetically modified strains that produce high-purity HA API are essential for reducing overall manufacturing costs and ensuring regulatory compliance, particularly for injectable applications requiring ultra-low endotoxin levels.

Following fermentation, the purification technology landscape is crucial for achieving API grade quality. Advanced purification techniques, including tangential flow filtration (TFF), precipitation methods utilizing organic solvents, and proprietary chromatography steps, are employed to separate the HA polymer from bacterial components, proteins, and fermentation media residues. The implementation of closed-loop, automated purification systems minimizes the risk of contamination and ensures reproducibility, which is critical for continuous production consistency. Furthermore, technologies designed for enhanced removal of residual solvents and nucleic acids are paramount, guaranteeing the HA API meets the stringent pharmacopoeial standards established by EP, USP, and JP for implantable materials and injectables.

Beyond basic extraction, innovation in chemical modification technologies is expanding the functional scope of HA API. Cross-linking technologies, such as those employing Divinyl Sulfone (DVS), Butanediol Diglycidyl Ether (BDDE), or PEGylation, are utilized to alter the viscoelastic properties, thermal stability, and biodegradation rate of HA. This technical capability allows manufacturers to create tailor-made HA derivatives for specific medical devices, such as long-lasting dermal fillers or bioinks for 3D bioprinting. Additionally, the development of specialized depolymerization techniques enables the precise creation of Low Molecular Weight (LMW) HA fragments, which are increasingly sought after for specific cellular signaling and targeted drug delivery applications, requiring precise control over fragment size and composition.

Regional Highlights

- North America: North America, particularly the United States, holds a commanding position in the HA API market, driven by its sophisticated healthcare infrastructure, high consumer adoption rates of aesthetic procedures, and significant investments in regenerative medicine research. The stringent regulatory environment mandates the use of high-purity, GMP-compliant HA API, favoring established global suppliers. The region benefits from strong reimbursement policies for viscosupplementation, supporting the orthopedic segment, while the presence of major biopharma and medical device companies ensures continuous innovation and high consumption of premium-grade HA APIs.

- Europe: Europe represents a mature market characterized by rigorous quality standards, transitioning under the comprehensive requirements of the Medical Device Regulation (MDR). This regulation places greater scrutiny on raw material quality, driving up the demand for microbial-sourced HA API with extensive documentation and clinical data. Germany, France, and Italy are key consumption hubs, fueled by an aging population requiring orthopedic and ophthalmic treatments. The aesthetic medicine segment is also robust, maintaining high demand for high molecular weight HA dermal fillers and mesotherapy products.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, primarily led by massive demand from China, Japan, and South Korea. This growth is accelerated by rapidly improving healthcare access, increasing healthcare expenditure, and the localization of manufacturing capabilities. China is both a major consumer and a leading producer of HA API, often dominating the LMW and MMW segments. Japan and South Korea, however, lead in the consumption of high-end, aesthetic-grade HA, driven by strong cosmetic surgery industries and high consumer awareness regarding premium cosmetic injectables. Favorable government initiatives supporting domestic biotechnology manufacturing further enhance the region’s market potential.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets showing considerable growth potential, although they currently hold smaller shares. Growth in LATAM is concentrated in Brazil and Mexico, driven by increasing adoption of aesthetic procedures and improving access to private orthopedic care. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in healthcare infrastructure and medical tourism, leading to increased consumption of high-quality HA APIs for both medical and cosmetic applications. Market growth is often dependent on favorable import policies and the establishment of local distribution networks to manage supply chain complexity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hyaluronic Acid API Market.- Shandong Focuschem Biotech Co., Ltd.

- Contipro a.s.

- Lifecore Biomedical

- Seikagaku Corporation

- Bloomage BioTechnology Corporation Limited

- Kewpie Corporation

- Zhejiang Kewei Biological Co., Ltd.

- Merck KGaA (MilliporeSigma)

- TIK Medipharma

- Fidia Farmaceutici S.p.A.

- Genzyme (Sanofi)

- B. Braun Melsungen AG

- Meiji Seika Pharma Co., Ltd.

- Novozymes A/S

- Sino-Biochem Co., Ltd.

- A-BioTech Co., Ltd.

- Chisso Corporation

- Alchem International

- R&D Systems (Bio-Techne)

- Sunwin Medical Science and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hyaluronic Acid API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between HA API and standard cosmetic-grade Hyaluronic Acid?

HA API (Active Pharmaceutical Ingredient) is ultra-high purity sodium hyaluronate manufactured under strict GMP conditions, specifically controlled for low endotoxin levels and precise molecular weight distribution, making it suitable for injectable medical devices and sterile pharmaceutical formulations.

Which molecular weight segment of Hyaluronic Acid API is dominant in the current market?

High Molecular Weight (HMW) Hyaluronic Acid API is the dominant segment by value, primarily due to its widespread use in viscosupplementation for treating osteoarthritis and its superior rheological performance in long-lasting dermal fillers.

How is the microbial fermentation source impacting the HA API market?

Microbial fermentation is the preferred source, replacing animal extraction, because it guarantees scalable production, higher purity levels, minimizes the risk of infectious agents, and allows for precise control over the polymer's molecular characteristics, essential for regulatory compliance.

What are the major growth drivers for the Hyaluronic Acid API used in the aesthetic segment?

The aesthetic segment is driven by increasing global demand for non-surgical cosmetic procedures, rising consumer acceptance of dermal fillers, and technological advancements creating safer, longer-lasting cross-linked HA formulations.

Which geographical region is showing the fastest growth potential for HA API manufacturers?

The Asia Pacific (APAC) region, led by China and South Korea, exhibits the fastest growth due to expanding pharmaceutical and medical device manufacturing, rising disposable incomes, and the rapid expansion of the cosmetic surgery and aesthetic medicine industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager