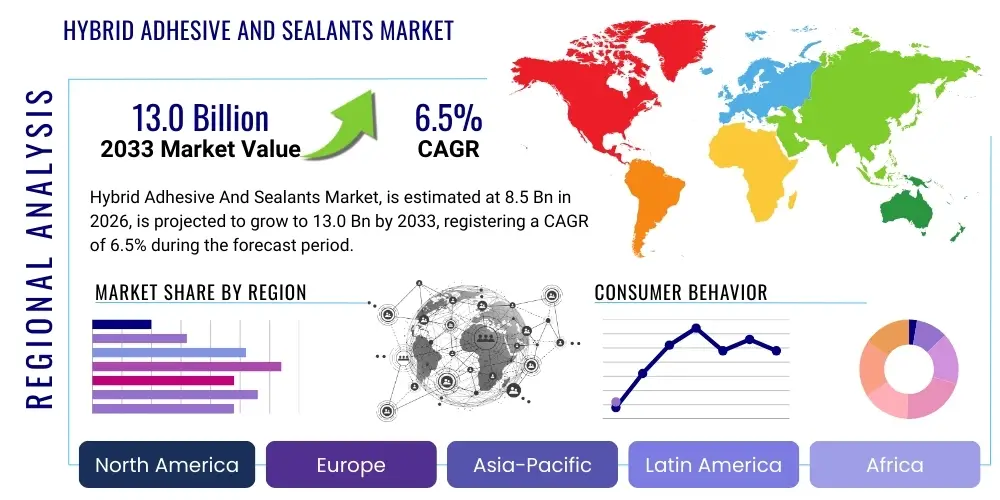

Hybrid Adhesive And Sealants Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442779 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hybrid Adhesive And Sealants Market Size

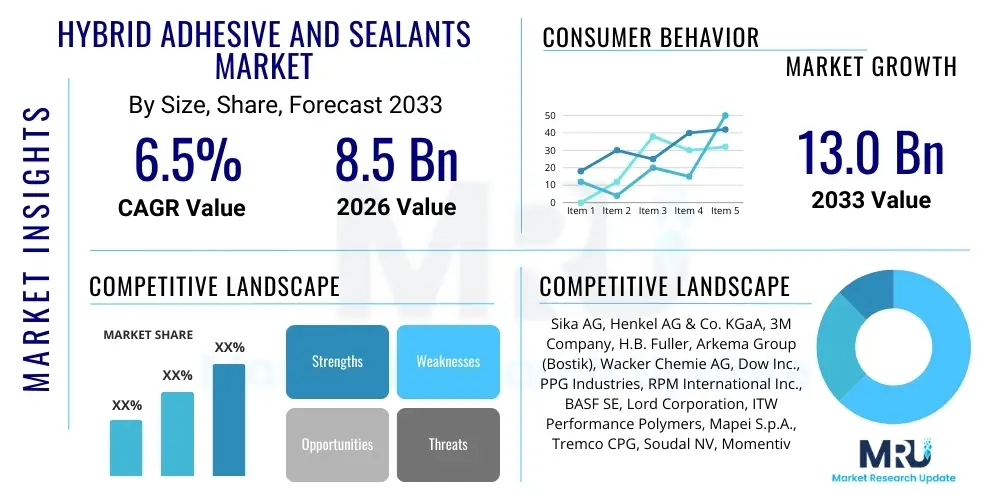

The Hybrid Adhesive And Sealants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.0 Billion by the end of the forecast period in 2033.

Hybrid Adhesive And Sealants Market introduction

The Hybrid Adhesive and Sealants Market encompasses high-performance chemical formulations that strategically combine the beneficial properties of different polymer chemistries, predominantly merging polyurethane (PU) or epoxy with silicone (Si) or silyl-modified polymers (SMPs). These hybrid solutions are engineered to overcome the inherent limitations of traditional single-chemistry products, offering a unique balance of high mechanical strength, rapid curing times, exceptional elasticity, and long-term durability against environmental stressors such as UV radiation, temperature fluctuations, and moisture. This technological synergy delivers products that are often solvent-free, possess low volatile organic compound (VOC) content, and are isocyanate-free, aligning perfectly with evolving global sustainability and worker safety mandates, positioning them as essential materials across numerous industrial and construction applications.

Key applications for hybrid adhesives and sealants are extensive and growing, driven by the materials’ versatility in bonding dissimilar substrates. In the building and construction sector, they are crucial for structural glazing, joint sealing, facade weatherproofing, and flooring installation, where their robust flexibility and adhesion to materials like concrete, glass, metal, and PVC are highly valued for long-term structural integrity and aesthetic performance. The automotive and transportation industries utilize these materials for direct glazing, body panel bonding, and interior assembly, primarily to facilitate lightweighting strategies, improve vehicle aerodynamics, and enhance crash safety through superior impact resistance.

The primary driving factors propelling market expansion include the global infrastructure development boom, particularly in emerging economies, which necessitates high-specification sealing solutions for modern architecture and civil engineering projects. Furthermore, the stringent regulatory environment in developed regions (like North America and Europe) is accelerating the displacement of solvent-borne systems by healthier, safer, and environmentally benign hybrid alternatives. The continuous innovation in polymer modification, leading to next-generation MS polymers (Silyl Modified Polyethers), further enhances performance attributes, enabling penetration into specialized, high-demand segments such as electronics encapsulation and renewable energy component manufacturing.

Hybrid Adhesive And Sealants Market Executive Summary

The global Hybrid Adhesive and Sealants Market is currently experiencing robust growth, fueled by a fundamental shift in end-user preference toward high-performance, sustainable, and compliant bonding solutions across major industries. Business trends indicate a strong focus on merger and acquisition activities among key industry players aimed at consolidating market share, expanding technological capabilities, and securing proprietary raw material supply chains, especially concerning advanced silane technologies and specialized polyether backbones. Manufacturers are heavily investing in R&D to develop bio-based and recyclable hybrid systems, catering to the circular economy demands and enhancing product differentiation in a competitive landscape characterized by demanding performance specifications.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily due to massive investments in residential and commercial construction, coupled with the rapid expansion of the automotive manufacturing base in countries like China, India, and South Korea. North America and Europe maintain significant market shares, characterized by early adoption of sophisticated hybrid technologies, particularly MS polymer systems, driven by strict regulatory requirements concerning low VOC emissions and superior fire ratings. In these mature markets, innovation is centered around functionality, such as products offering anti-microbial properties or enhanced acoustic damping capabilities.

Segmentation trends reveal that Silyl Modified Polymers (SMPs), specifically MS polymers, dominate the market based on type, due to their excellent all-around performance profile, including paintability and freedom from isocyanates and solvents. By application, the Building and Construction segment remains the largest end-user, accounting for the highest volume consumption, particularly in exterior facade sealing and interior wet area applications. However, the Automotive & Transportation segment is exhibiting the highest projected growth rate, driven by the increasing application of structural hybrid adhesives in electric vehicle (EV) battery assembly and body-in-white structures designed for weight reduction and increased rigidity.

AI Impact Analysis on Hybrid Adhesive And Sealants Market

Analysis of user inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) within the hybrid adhesives and sealants domain reveals three critical areas of interest: predictive formulation optimization, enhanced quality control, and optimized supply chain resilience. Users frequently question how AI can expedite the discovery of novel polymer combinations, specifically addressing the complex interactions between different chemistries (e.g., polyurethanes and silicones) to achieve targeted properties such as specific shore hardness, elongation characteristics, or accelerated curing profiles without extensive physical prototyping. The expectation is that AI-driven simulation can drastically reduce the time-to-market for new high-performance hybrid products, especially those targeting niche or highly regulated applications.

A second major theme concerns the application of AI in manufacturing and end-use environments. Users are seeking AI tools for real-time monitoring of production batches to ensure consistent rheology, viscosity, and curing homogeneity, thereby minimizing waste and operational variability. Furthermore, there is growing interest in smart, IoT-enabled adhesives and sealants—products that might incorporate sensors or require AI analysis of their long-term performance data in infrastructure or automotive components. This enables predictive maintenance schedules, where AI algorithms interpret environmental stress data captured by embedded systems, moving maintenance from reactive to proactive models based on real-time performance degradation assessments.

Finally, the complex and often volatile supply chain for specialized raw materials, such as specific silane coupling agents or modified polyethers, is a key concern where AI is expected to provide solutions. Users anticipate that ML models will be deployed to forecast raw material price fluctuations, predict potential logistical bottlenecks (e.g., supply chain shocks due to geopolitical events), and optimize global inventory management. Successful integration of AI across these functions is viewed as essential for maintaining competitive pricing and ensuring manufacturing continuity, ultimately enhancing the reliability and scalability of hybrid adhesive and sealant production globally.

- AI optimizes complex hybrid formulations, predicting material properties (rheology, curing speed, adhesion strength) with fewer physical tests.

- Machine Learning enhances quality control in manufacturing by identifying and adjusting process parameters in real-time to ensure batch consistency and minimize defects.

- Predictive maintenance models utilizing smart hybrid sealants embedded with IoT sensors assess long-term structural integrity and forecast failure points in critical infrastructure.

- AI-driven supply chain analytics improve raw material procurement and inventory management, mitigating risks associated with volatile polymer and additive costs.

- Generative design algorithms assist in creating novel, high-performance silyl-modified polymer structures tailored for extreme environmental conditions (e.g., high humidity, high temperature).

DRO & Impact Forces Of Hybrid Adhesive And Sealants Market

The Hybrid Adhesive and Sealants Market trajectory is significantly influenced by a powerful interplay of drivers, restraints, and opportunities (DRO), which collectively constitute the principal impact forces shaping industry dynamics. A critical driver is the intensified demand for sustainable building materials, where hybrid solutions offer non-hazardous, low-VOC alternatives to traditional solvent-based counterparts, aligning with international green building standards such as LEED and BREEAM. Coupled with this, the rapid adoption of lightweighting strategies in the automotive sector, driven by the proliferation of electric vehicles (EVs), necessitates high-strength, flexible bonding solutions for battery pack assembly and multi-material joining (e.g., aluminum to carbon fiber), areas where hybrids excel in providing structural integrity and vibration damping.

However, the market faces notable restraints that temper growth potential. The primary challenge remains the relatively high initial cost of hybrid formulations compared to established, lower-specification polyurethane or silicone sealants, particularly in price-sensitive developing markets. Furthermore, the reliance on specialized raw materials, specifically silyl-modified polyether backbones and proprietary catalysts, exposes manufacturers to raw material price volatility and supply chain complexities, which can impact profitability and production stability. Educating end-users and applicators about the specific requirements for surface preparation and application techniques inherent to hybrid systems also presents a logistical hurdle that slows widespread adoption in certain construction segments.

Opportunities for exponential growth are concentrated in several key areas. The development of advanced bio-based or partially bio-sourced hybrid polymers presents a significant pathway for market leaders to differentiate their portfolios and capture the rising consumer demand for environmentally responsible products. Expansion into high-growth, technically demanding segments such as electronics encapsulation, aerospace assembly, and large-scale renewable energy projects (e.g., sealing and bonding wind turbine blades) offers lucrative avenues. The increasing trend towards prefabrication and modular construction globally also favors hybrid adhesives, which facilitate faster, more reliable off-site assembly processes, thereby optimizing construction timelines and improving overall quality control, making them indispensable components in future construction methodologies.

Segmentation Analysis

The Hybrid Adhesive and Sealants market is primarily segmented based on the underlying chemical technology (Type), the specific industrial sector utilizing the product (Application), and the end-use market where the product is ultimately deployed. Analyzing these segments is crucial for understanding market dynamics, investment patterns, and identifying high-potential niches. The segmentation by Type is critical as it reflects the performance characteristics and regulatory compliance of the product, with MS Polymers leading the innovation curve due to their versatility and compliance with strict environmental standards regarding isocyanate and solvent content.

The Application segmentation reveals the diverse utility of hybrid products across macro-economic sectors. Building and Construction remains the bedrock of demand, driven by large-scale infrastructure projects, but the fastest acceleration is observed in high-value, specialized segments such as Automotive & Transportation, which leverages these materials for lightweighting and critical assembly, ensuring long-term performance and safety. Furthermore, the Industrial Assembly segment, covering everything from appliance manufacturing to machinery fabrication, demonstrates steady growth, relying on hybrid solutions for durable, elastic, and strong bonds that resist operational stresses and environmental degradation.

- By Type:

- Silyl Modified Polymers (SMP) / MS Polymers

- Polyurethane Hybrids (e.g., STPUs)

- Epoxy Hybrids

- Silicone Hybrids

- Others (e.g., Acrylic Hybrids)

- By Application:

- Building & Construction (Residential, Commercial, Infrastructure)

- Automotive & Transportation (OEM, Aftermarket, Marine, Aerospace)

- Industrial Assembly (Appliance, HVAC, Machinery)

- Others (e.g., DIY/Consumer, Electronics)

- By End-Use Market:

- Adhesives

- Sealants

Value Chain Analysis For Hybrid Adhesive And Sealants Market

The value chain for the Hybrid Adhesive and Sealants Market is intricate, commencing with the highly specialized upstream analysis involving the sourcing and production of complex chemical intermediaries. Key raw materials include base polymers (polyether polyols, epoxy resins, polyurethane prepolymers), functional additives (fillers, pigments, catalysts), and crucially, silane coupling agents and silyl-terminated chemistries. The specialized nature of silane modification dictates that a limited number of global chemical giants control the production of high-quality base hybrid polymers, granting them significant leverage in terms of pricing and supply stability. Innovation at this stage, focusing on novel polyether backbones for improved elasticity and adhesion, is essential for competitive advantage downstream.

Midstream activities involve the formulation and compounding of these raw materials into the final adhesive or sealant products by market participants such as Sika, Henkel, and 3M. This stage is knowledge-intensive, requiring deep expertise in rheology control, curing mechanism optimization, and tailoring the formulation to meet stringent regulatory standards (e.g., low VOC, specific fire ratings) and application requirements (e.g., sag resistance, open time). The success of a formulator depends heavily on proprietary know-how regarding additive packages that ensure long-term UV and moisture resistance, making intellectual property protection a significant barrier to entry.

Downstream analysis focuses on distribution channel strategies, which vary widely based on the target application. For large-scale industrial consumers, such as automotive OEMs and major construction companies, a direct distribution model is typically utilized, ensuring technical support, customized product delivery, and volume pricing. Conversely, smaller construction projects, Maintenance, Repair, and Operations (MRO), and DIY markets rely heavily on indirect channels, involving global and regional distributors, specialized industrial supply houses, and retail hardware chains. Effective channel management, including optimized logistics and product training for distributors, is paramount for maximizing market reach and penetrating diverse end-user segments efficiently.

Hybrid Adhesive And Sealants Market Potential Customers

The potential customer base for hybrid adhesives and sealants is highly diverse, spanning multiple high-value industries that prioritize durability, performance, and environmental compliance. Primary end-users in the Building and Construction segment include large construction contractors specializing in commercial high-rise buildings, civil engineering firms responsible for bridges and tunnels, and residential developers focused on high-quality, energy-efficient housing. These buyers seek long-term weatherproofing solutions, structural bonding agents for facade systems (including unitized curtain walls), and flexible sealants for expansion joints that must withstand continuous movement and harsh climate cycles, demanding products with guaranteed warranties exceeding 10–20 years.

A second major category of customers includes original equipment manufacturers (OEMs) across the Automotive, Transportation, and Industrial Assembly sectors. Automotive OEMs are increasingly significant buyers, utilizing hybrid structural adhesives in the production line for direct glazing, reinforcing chassis components, and securing complex battery modules in electric vehicles. The demand here is driven by the need for lightweighting, improved noise, vibration, and harshness (NVH) performance, and accelerated robotic application compatibility. Industrial OEMs, particularly those manufacturing appliances, HVAC systems, and electronic components, rely on hybrids for durable assembly and potting applications that require resistance to heat, moisture, and chemical exposure.

Furthermore, specialized industrial sectors such as Marine and Renewable Energy represent high-growth potential customer groups. Shipbuilders and marine maintenance providers use hybrids for decking, hull sealing, and interior assembly due to their excellent resistance to salt spray and continuous moisture exposure. Renewable energy companies, particularly manufacturers of solar panels and wind turbine blades, require robust sealing and bonding solutions that can endure extreme offshore or desert conditions, demanding materials that offer superior mechanical strength and extended UV stability. These customers often require custom formulations and technical partnership support from hybrid adhesive manufacturers to meet highly specialized regulatory and performance specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, Henkel AG & Co. KGaA, 3M Company, H.B. Fuller, Arkema Group (Bostik), Wacker Chemie AG, Dow Inc., PPG Industries, RPM International Inc., BASF SE, Lord Corporation, ITW Performance Polymers, Mapei S.p.A., Tremco CPG, Soudal NV, Momentive Performance Materials, Kömmerling Chemische Fabrik, Huntsman Corporation, Evonik Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid Adhesive And Sealants Market Key Technology Landscape

The technological landscape of the Hybrid Adhesive and Sealants Market is predominantly defined by advancements in Silyl Modified Polymer (SMP) chemistry, specifically revolving around MS Polymer and Silyl-Terminated Polyurethane (STPU) systems. MS Polymers, which are polyether backbones terminated with hydrolyzable silyl groups, represent the foundational technology. This framework allows for a moisture-curing mechanism that releases methanol or ethanol rather than acidic byproducts (unlike traditional silicones), offering superior adhesion to a wide range of substrates without the need for priming, and ensuring compatibility with sensitive materials and paint systems. Continuous innovation focuses on enhancing the backbone structure to improve elasticity, tensile strength, and reduce cure time, thereby meeting the high-speed demands of automated industrial assembly lines.

A parallel and equally critical technological trend is the development of non-isocyanate polyurethane (NIPU) hybrid systems. Traditional polyurethane-based adhesives rely on isocyanates, which pose significant health risks and regulatory challenges. NIPU hybrids seek to mitigate these issues by employing alternative chemistries, often through cyclic carbonate reactions, to achieve the robust mechanical properties associated with polyurethanes while maintaining the favorable environmental profile of hybrid sealants. This technological shift is paramount for market acceptance in Europe and North America, where worker safety and stringent VOC regulations heavily penalize traditional isocyanate-containing formulations, driving R&D toward safer, greener alternatives for structural bonding applications.

Furthermore, innovation extends into the realm of specialized functional additives, which are crucial for tailoring the performance of hybrid systems for specific environments. These additives include rheology modifiers for improved thixotropy (sag resistance), advanced UV stabilizers for exterior applications, and adhesion promoters (often specific silane coupling agents) to ensure robust bonding across dissimilar, low-surface-energy plastics and difficult metals. The effective combination of these advanced additives with core polymer chemistry allows manufacturers to create bespoke hybrid products that offer high service temperatures, resistance to aggressive chemicals, and enhanced fire retardancy, significantly expanding the market reach into niche, high-specification industries like aerospace interiors and electronics manufacturing.

Regional Highlights

- Asia Pacific (APAC): The APAC region is poised for the highest growth rate, primarily driven by massive government expenditure on infrastructure development, including smart cities, railways, and industrial parks, particularly in China, India, and Southeast Asian nations. The region's dominant role in global automotive and electronics manufacturing also creates immense demand for high-performance structural adhesives and sealants required for localized production. Furthermore, the progressive adoption of international building codes promoting energy efficiency and low-VOC materials is rapidly accelerating the transition from conventional solvent-based products to advanced hybrid solutions.

- North America: North America constitutes a significant mature market, characterized by stringent environmental regulations enforced by bodies like the EPA and OSHA, which favor the use of isocyanate-free and low-VOC hybrid systems. Growth here is primarily driven by refurbishment projects, the increasing use of hybrid solutions in the production of electric vehicles (EVs) and light commercial vehicles, and the highly specialized use in construction for complex building facades, demanding superior adhesion and elasticity for longevity in diverse climate zones.

- Europe: Europe holds a strong position in the hybrid market, marked by pioneering regulatory frameworks such as REACH, which mandates the use of safer chemical alternatives, thereby strongly encouraging the shift to SMPs and NIPU-based hybrids. The focus on energy-efficient building standards and passive house design necessitates high-performance sealants for airtightness and thermal bridging reduction. Germany, France, and the UK are key contributors, specializing in advanced automotive assembly and precision industrial applications, maintaining a high average selling price for sophisticated hybrid formulations.

- Latin America (LATAM): The LATAM market exhibits moderate, yet steady, growth, largely concentrated in construction and infrastructure projects, particularly in Brazil and Mexico. The adoption rate of advanced hybrids is increasing as global manufacturers expand their local presence and introduce specialized products that address tropical climate challenges, such as high humidity and heat, which require materials with enhanced fungus resistance and UV stability.

- Middle East and Africa (MEA): The MEA region is characterized by substantial investment in mega-construction projects and diversification away from oil economies, notably in the UAE, Saudi Arabia, and Qatar. This environment creates high demand for specialized hybrid sealants capable of withstanding extreme heat, sand erosion, and high salinity environments, particularly in large-scale commercial real estate and utility infrastructure developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid Adhesive And Sealants Market.- Sika AG

- Henkel AG & Co. KGaA

- 3M Company

- H.B. Fuller

- Arkema Group (Bostik)

- Wacker Chemie AG

- Dow Inc.

- PPG Industries

- RPM International Inc.

- BASF SE

- Lord Corporation (now part of Parker Hannifin)

- ITW Performance Polymers

- Mapei S.p.A.

- Tremco CPG (part of RPM International)

- Soudal NV

- Momentive Performance Materials

- Kömmerling Chemische Fabrik GmbH

- Huntsman Corporation

- Evonik Industries AG

- Pecora Corporation

Frequently Asked Questions

Analyze common user questions about the Hybrid Adhesive And Sealants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary chemical advantage of hybrid adhesives over traditional polyurethanes and silicones?

Hybrid adhesives, particularly Silyl Modified Polymers (SMPs), combine the strength and paintability of polyurethanes with the excellent weather resistance and UV stability of silicones. Critically, they cure without releasing hazardous isocyanates or acetic acid, making them safer, low-odor, and compliant with strict environmental standards (low VOC).

Which end-use application is driving the highest growth rate for hybrid sealants?

The Automotive and Transportation segment, specifically within electric vehicle (EV) manufacturing, is exhibiting the highest growth rate. Hybrid structural adhesives are essential for bonding large battery packs, reinforcing multi-material body structures, and facilitating vehicle lightweighting due to their combination of high mechanical strength, flexibility, and vibration damping properties.

What are the main regulatory factors influencing the market adoption of hybrid technology?

Strict global regulations, notably REACH in Europe and tightening EPA standards in North America, mandate the reduction or elimination of hazardous substances like isocyanates and high volatile organic compound (VOC) solvents. Hybrid formulations inherently meet these mandates, positioning them as the preferred compliant alternative across construction and manufacturing industries.

How do raw material costs impact the profitability of the hybrid adhesive market?

Profitability in the hybrid market is sensitive to the fluctuating costs of specialized feedstocks, primarily silyl-terminated polyether polyols and advanced silane coupling agents. As these materials are often proprietary and produced by a few key chemical suppliers, price volatility can significantly influence the final product cost and manufacturing margins, demanding sophisticated supply chain management.

What is the role of MS Polymer (SMP) technology in the overall hybrid market?

MS Polymer (Silyl Modified Polyether) technology is the most prominent segment within the hybrid market. It serves as the backbone for versatile, high-performance adhesives and sealants used extensively in construction and industrial assembly, valued for being solvent-free, non-yellowing, and highly paintable without compromising structural integrity or long-term flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager