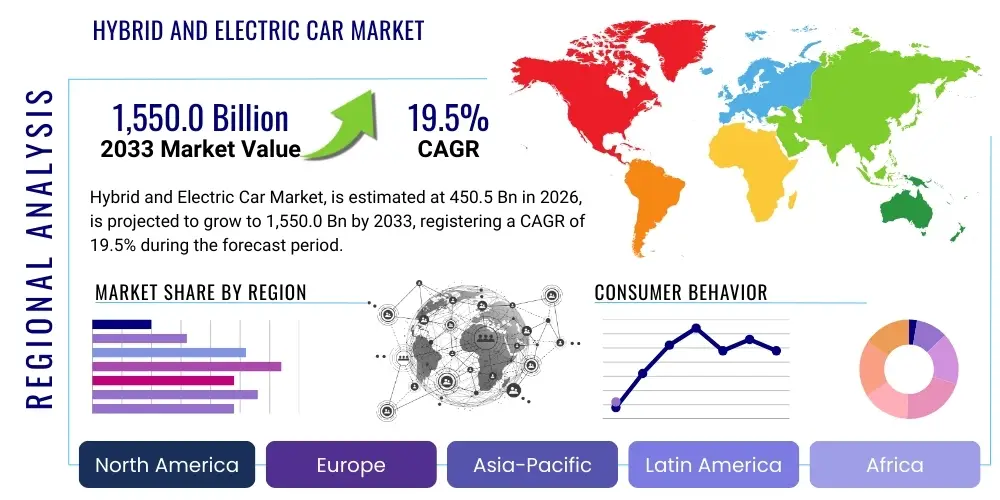

Hybrid and Electric Car Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442919 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Hybrid and Electric Car Market Size

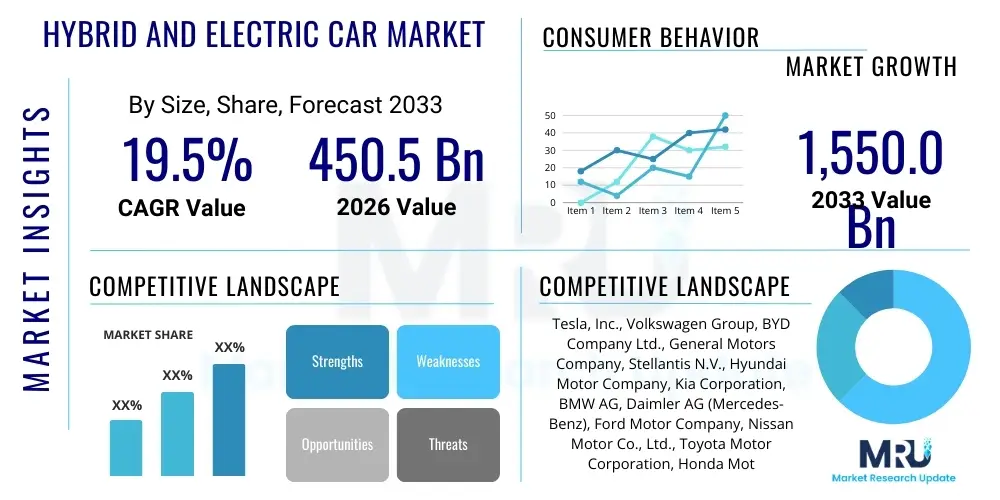

The Hybrid and Electric Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 1,550.0 Billion by the end of the forecast period in 2033.

Hybrid and Electric Car Market introduction

The Hybrid and Electric Car Market encompasses the global sale and production of vehicles utilizing alternative powertrain technologies, primarily Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and standard Hybrid Electric Vehicles (HEVs). This rapid transition away from conventional Internal Combustion Engine (ICE) vehicles is fundamentally driven by global sustainability mandates, stringent governmental emission regulations, and significant technological advancements in battery energy density and charging infrastructure. These vehicles represent a pivotal shift in automotive engineering, prioritizing energy efficiency and reduced environmental impact, positioning them as central to future transportation strategies worldwide.

The primary application of hybrid and electric cars is personal mobility, though their use is expanding rapidly into commercial fleets, taxis, and logistics operations, especially within urban centers characterized by zero-emission zone mandates. Key product descriptions include high-torque instantaneous power delivery, regenerative braking systems that enhance energy recovery, and sophisticated thermal management systems crucial for maintaining battery longevity and performance across diverse climates. The benefits associated with adopting these vehicles include substantial reductions in tailpipe emissions, lower operating costs due to reduced reliance on volatile fossil fuels, and significant governmental incentives such as tax credits and preferential parking or access privileges.

Driving factors stimulating market expansion are multifaceted, anchored by the falling cost of lithium-ion batteries—a critical component—and the increasing consumer acceptance driven by improving vehicle range and performance capabilities. Furthermore, robust commitments from major global automakers to electrify their entire portfolios within the next decade are accelerating production scale and variety. Supportive governmental policies, including aggressive targets for phasing out ICE vehicle sales in key markets like Europe, North America, and China, provide the regulatory certainty necessary for sustained private and public sector investment in the electric vehicle (EV) ecosystem, cementing the market’s trajectory toward exponential growth.

Hybrid and Electric Car Market Executive Summary

The Hybrid and Electric Car Market is undergoing a foundational transformation characterized by rapid scaling, intense competition, and deep vertical integration across the supply chain. Business trends highlight a strong focus on enhancing charging infrastructure interoperability and developing solid-state battery technology to mitigate range anxiety and improve charging speed. Leading automakers are increasingly forming strategic partnerships with technology firms and raw material suppliers to secure long-term battery material access, which remains a critical bottleneck. Furthermore, subscription models and Vehicle-to-Grid (V2G) capabilities are emerging as crucial value-added services, optimizing battery utilization beyond simple transportation and potentially stabilizing electricity grids, thereby reshaping traditional automotive business models.

Regional trends indicate that the Asia Pacific, particularly China, remains the dominant global market both in terms of production volume and consumer adoption, largely fueled by strong government subsidies and extensive domestic manufacturing capacity. Europe is experiencing rapid adoption driven by stringent emission standards (Euro 7) and consumer preference for compact, high-performance EVs, with Scandinavian countries and Germany leading the penetration rates. North America is accelerating its market entry, significantly supported by large-scale federal investment (e.g., Inflation Reduction Act in the US) aimed at domesticizing the EV supply chain, promoting localized battery manufacturing, and expanding the public charging network, thereby setting the stage for substantial long-term growth.

Segmentation trends reveal that Battery Electric Vehicles (BEVs) are projected to capture the largest share of market growth, driven by technological maturity and sustained infrastructure investment, though Plug-in Hybrid Electric Vehicles (PHEVs) maintain relevance in markets where long-distance travel and charging access remain intermittent. The passenger car segment dominates, but there is an increasing shift toward the electrification of commercial fleets, including light commercial vehicles and buses, seeking to capitalize on operational cost savings and meet urban environmental compliance. Moreover, battery chemistry segmentation shows a trend toward higher nickel cathode materials for enhanced energy density, while sodium-ion batteries are gaining attention for cost-sensitive, short-range urban vehicles.

AI Impact Analysis on Hybrid and Electric Car Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Hybrid and Electric Car Market predominantly center on three major themes: improving battery management system (BMS) efficiency, enhancing autonomous driving capabilities, and optimizing manufacturing processes. Consumers and industry stakeholders are particularly keen on understanding how AI can predict battery degradation, thereby extending vehicle lifespan and maintaining resale value. There is also significant focus on how machine learning algorithms will drive the development of Level 4 and Level 5 autonomy, ensuring safety and navigating complex urban environments. Key expectations revolve around AI enabling more personalized driving experiences, optimizing energy consumption based on real-time traffic and topography, and streamlining complex EV supply chain logistics from raw material sourcing to final assembly, ultimately aiming for superior operational efficiency and lower production costs.

- AI optimizes Battery Management Systems (BMS) through predictive analytics for thermal regulation and state-of-charge estimation, maximizing battery life and efficiency.

- Machine learning algorithms are fundamental to developing robust Advanced Driver Assistance Systems (ADAS) and fully autonomous driving features, enhancing vehicle safety and user experience.

- Generative AI and computer vision streamline manufacturing operations by enabling predictive maintenance, improving quality control, and optimizing robotic assembly lines.

- AI models analyze driver behavior and real-time topographical data to dynamically adjust powertrain settings, leading to optimized energy consumption and extended real-world range.

- Supply chain resilience is bolstered by AI systems that forecast component demand, identify potential sourcing bottlenecks (especially for critical minerals), and manage complex global logistics networks.

- AI-driven charging network optimization leverages usage patterns and grid capacity forecasts to recommend optimal charging times and locations, alleviating infrastructure strain.

DRO & Impact Forces Of Hybrid and Electric Car Market

The market trajectory for Hybrid and Electric Cars is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Significant Drivers include supportive governmental policies such as emission mandates and subsidies, coupled with diminishing battery costs achieving near cost parity with ICE vehicles. These forces compel both manufacturers and consumers toward electrification. However, persistent Restraints involve the initial purchase price parity challenge, underdeveloped charging infrastructure in many rural areas, and ongoing concerns about raw material scarcity (lithium, cobalt, nickel) and ethical sourcing practices. The key Opportunities lie in the massive untapped potential of commercial fleet electrification, the monetization of V2G capabilities, and the rapid deployment of next-generation battery technologies (e.g., solid-state) that promise revolutionary improvements in energy density and charging time, effectively mitigating primary restraints.

Impact Forces are predominantly regulatory and technological. Regulatory pressures, especially the European Union's ambitious climate targets and China's NEV credit system, exert immediate and measurable influence on production strategies. Technologically, the rapid evolution of power electronics, motors, and integrated thermal management systems dictates product competitiveness and market acceptance. Socio-economic forces, such as rising consumer environmental awareness and changing urban mobility patterns, also play a significant role. The critical impact force, however, remains geopolitical stability, particularly concerning the supply chain of critical battery minerals, where concentration risks pose a substantial long-term threat to sustained, scalable growth. Successfully navigating these impact forces requires multinational cooperation and investment in diversified sourcing and recycling infrastructure.

Segmentation Analysis

The Hybrid and Electric Car Market is comprehensively segmented based on Vehicle Type, Propulsion Technology, Component, and geographical region, reflecting the diverse product landscape and varying stages of adoption globally. Analysis of these segments is crucial for understanding market dynamics, investment priorities, and target audience needs. The Passenger Vehicle segment currently holds the dominant market share due to established consumer demand and extensive product variety, while the commercial vehicle segment, driven by lower total cost of ownership (TCO) benefits, is projected to exhibit the highest CAGR. Furthermore, the Component segmentation highlights the growing importance of the battery pack and associated electronics, representing the most significant value concentration within the vehicle structure.

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks, Buses)

- By Propulsion Technology:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

- Fuel Cell Electric Vehicles (FCEV)

- By Component:

- Battery Pack (Lithium-ion, Solid State, etc.)

- Motor

- Power Electronics (Inverters, Converters)

- Transmission

- Charging Equipment (On-board chargers, Off-board chargers)

- By Range:

- Short Range (<200 Miles)

- Mid Range (200-300 Miles)

- Long Range (>300 Miles)

- By End-Use Application:

- Shared Mobility

- Personal Use

- Fleet Operations

Value Chain Analysis For Hybrid and Electric Car Market

The value chain of the Hybrid and Electric Car Market is highly complex, extending from upstream raw material extraction to downstream consumer sales and recycling initiatives. Upstream activities involve the mining and processing of critical minerals such as lithium, cobalt, nickel, and manganese, primarily conducted by specialized mining firms and chemical processors. This stage is highly vulnerable to geopolitical risk and supply volatility, necessitating massive investments in sustainable sourcing and refining capacity. Midstream processes are dominated by battery cell manufacturing (gigafactories), powertrain assembly (motor and inverter production), and vehicle platform development, which is increasingly localized and integrated across regions like China, Europe, and the U.S.

Downstream activities center on vehicle assembly, distribution, sales, and aftermarket services, including charging infrastructure maintenance and battery recycling. Distribution channels are evolving rapidly, moving beyond traditional dealership models to include direct-to-consumer sales (e.g., Tesla model) and digital purchasing platforms, aiming for enhanced consumer transparency and reduced transactional friction. Direct sales models allow manufacturers greater control over branding and pricing, while traditional indirect channels leverage established service networks for maintenance and repair, a crucial element for addressing consumer concerns about EV servicing complexity. The emergence of specialized charging network operators (CPOs) represents a critical new layer in the downstream market.

The entire value chain is characterized by a high degree of integration between automotive OEMs and battery suppliers, often through joint ventures or long-term procurement agreements. This integration is vital for securing supply and standardizing battery architecture across different vehicle models. The loop closes with the end-of-life management, where companies focusing on battery repurposing (for stationary storage) and recycling (recovering valuable minerals) are becoming essential, driven by both economic necessity and regulatory mandates aiming for a circular economy in the EV sector. This circular model is expected to significantly mitigate future dependency on primary mineral extraction.

Hybrid and Electric Car Market Potential Customers

The potential customer base for the Hybrid and Electric Car Market is increasingly diversifying beyond early adopters and environmentally conscious consumers. Primary target segments now include urban commuters seeking low operating costs and access benefits within clean air zones, and technology enthusiasts drawn to the high-performance and advanced digital features embedded in modern EVs. Fleet operators, including logistics companies, ride-sharing services, and municipal agencies, constitute a rapidly growing B2B segment, motivated by the long-term TCO savings derived from reduced fuel consumption and lower maintenance requirements, alongside meeting corporate sustainability targets.

Geographically, customers in markets with high governmental support, such as Norway, Germany, and California, exhibit high adoption rates, indicating that regulatory incentives remain a powerful tool for driving consumer uptake. Furthermore, families requiring multi-purpose vehicles (SUVs and crossovers) are migrating towards electric platforms as vehicle range improves and charging becomes more accessible in suburban environments. This segment prioritizes safety, spaciousness, and reliable charging infrastructure near residential areas or workplaces. Understanding the nuanced needs—from long-haul towing capacity for light trucks to fast, reliable urban charging for commuters—is crucial for effective market penetration.

The rise of the affordable EV segment is poised to unlock massive potential among first-time car buyers and customers in emerging economies, provided the local manufacturing ecosystems can deliver cost-effective models without compromising on essential features or safety standards. Manufacturers are focusing on developing models priced competitively with mid-range ICE counterparts, addressing one of the most significant historical barriers to mass adoption. Ultimately, the market is shifting from one catering to niche enthusiasm to one serving the mainstream consumer seeking reliable, cost-effective, and environmentally responsible transportation solutions across various income brackets and use cases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 1,550.0 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla, Inc., Volkswagen Group, BYD Company Ltd., General Motors Company, Stellantis N.V., Hyundai Motor Company, Kia Corporation, BMW AG, Daimler AG (Mercedes-Benz), Ford Motor Company, Nissan Motor Co., Ltd., Toyota Motor Corporation, Honda Motor Co., Ltd., Rivian Automotive, Inc., Lucid Group, Inc., NIO Inc., XPeng Inc., SAIC Motor Corporation Limited, Contemporary Amperex Technology Co. Ltd. (CATL), Panasonic Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hybrid and Electric Car Market Key Technology Landscape

The technological landscape of the Hybrid and Electric Car Market is characterized by intense innovation focused primarily on energy storage, power train efficiency, and charging speed. Battery technology remains the central competitive arena, with significant research directed toward increasing energy density while simultaneously enhancing safety and reducing charging time. Current dominant lithium-ion chemistries (NMC and LFP) are rapidly evolving, but the emerging focus is on solid-state batteries (SSBs). SSBs promise higher energy density, lower risk of thermal runaway, and faster charging capabilities by replacing the liquid electrolyte with a solid counterpart, potentially revolutionizing the market by addressing range and safety anxieties comprehensively.

Beyond energy storage, significant technological advancements are occurring in power electronics and motor design. The shift from silicon-based to Silicon Carbide (SiC) semiconductors in inverters is crucial. SiC power electronics drastically improve efficiency by reducing energy losses during voltage conversion, allowing vehicles to achieve better range and faster acceleration with the same battery pack size. Similarly, advancements in permanent magnet synchronous motors (PMSMs) and the development of reluctance motors (used to minimize reliance on rare-earth minerals) are enhancing the power-to-weight ratio and overall system efficiency. Integration of these components into an 'e-axle' concept simplifies vehicle architecture and manufacturing complexity.

Furthermore, the development of ultra-fast charging technology, including 800V architectures, is critical for mass market acceptance. This technology significantly reduces the time required to recharge, making the refueling experience comparable to conventional vehicles. Additionally, the integration of advanced software platforms, including sophisticated Battery Management Systems (BMS) utilizing AI for predictive performance modeling and over-the-air (OTA) update capabilities, ensures that vehicles remain technologically current post-purchase. This digital evolution is transforming the vehicle from a simple hardware product into a continuously evolving software platform.

Regional Highlights

- Asia Pacific (APAC): APAC, led by China, is the epicenter of global EV adoption and manufacturing, accounting for the majority of global sales volume and battery production capacity. Government policies, such as the New Energy Vehicle (NEV) credit system in China and subsidies in South Korea and Japan, drive consumer adoption. The region benefits from localized supply chains and intense competition among domestic automakers, leading to rapid product diversification and price competitiveness.

- Europe: Europe exhibits the highest penetration rate of electrified vehicles relative to total new car sales, underpinned by ambitious decarbonization mandates and strong consumer demand, particularly in Northern and Western Europe. Strict emission targets (e.g., EU CO2 standards and ZEV zones) are forcing automakers to prioritize electrification. Germany, France, and the UK are massive markets, heavily investing in cross-border charging infrastructure (e.g., IONITY) and domestic battery manufacturing (gigafactories).

- North America: North America, primarily the United States, is undergoing an accelerated transition, supported by massive governmental stimuli such as the Infrastructure Investment and Jobs Act and the Inflation Reduction Act (IRA). These policies focus on building a resilient domestic supply chain, encouraging local battery cell production, and expanding the public charging network significantly. The region shows strong demand for electric trucks and SUVs, reflecting local consumer preferences.

- Latin America (LATAM): The market in LATAM is nascent but growing, driven initially by hybrid vehicle adoption due to infrastructure limitations. Countries like Brazil and Mexico are emerging as potential manufacturing hubs, capitalizing on raw material resources. Adoption is concentrated in major urban centers, with governments beginning to implement specific clean air zones and pilot electric public transportation projects.

- Middle East and Africa (MEA): Adoption in MEA is highly localized. The Middle East, particularly the UAE and Saudi Arabia, is investing heavily in large-scale smart city projects (e.g., NEOM) and diversifying its energy mix, creating high-potential niche markets for premium EVs and related infrastructure. Africa’s EV market remains largely focused on electric mobility scooters and buses, though South Africa is showing early signs of passenger EV market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hybrid and Electric Car Market.- Tesla, Inc.

- Volkswagen Group

- BYD Company Ltd.

- General Motors Company

- Stellantis N.V.

- Hyundai Motor Company

- Kia Corporation

- BMW AG

- Daimler AG (Mercedes-Benz)

- Ford Motor Company

- Nissan Motor Co., Ltd.

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- NIO Inc.

- XPeng Inc.

- Li Auto Inc.

- SAIC Motor Corporation Limited

- Contemporary Amperex Technology Co. Ltd. (CATL)

Frequently Asked Questions

Analyze common user questions about the Hybrid and Electric Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Hybrid and Electric Car Market?

The Hybrid and Electric Car Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033, driven by regulatory support and technological advancements, positioning it as one of the fastest-growing segments in the global automotive industry.

Which segment of the electric vehicle market holds the largest growth potential?

Battery Electric Vehicles (BEVs) are anticipated to hold the largest growth potential due to improving battery energy density, increasing consumer preference for fully electric drive trains, and massive global investments in public charging infrastructure supporting long-range travel.

What are the primary restraints affecting the mass adoption of electric cars?

The primary restraints include the relatively high initial purchase cost compared to conventional vehicles, the persistent challenge of establishing universally accessible and reliable charging infrastructure, and supply chain volatility concerning critical battery raw materials like lithium and cobalt.

How is AI impacting the development and performance of electric vehicles?

AI is fundamentally impacting EVs by optimizing Battery Management Systems (BMS) for enhanced longevity and efficiency, enabling advanced autonomous driving functionalities (ADAS), and streamlining complex manufacturing processes to reduce production costs and improve vehicle quality.

Which region is currently leading the global Hybrid and Electric Car Market in terms of sales volume?

The Asia Pacific region, particularly China, currently leads the global Hybrid and Electric Car Market in terms of both sales volume and production capacity, supported by strong governmental policy mandates and significant market penetration by leading domestic and international manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager