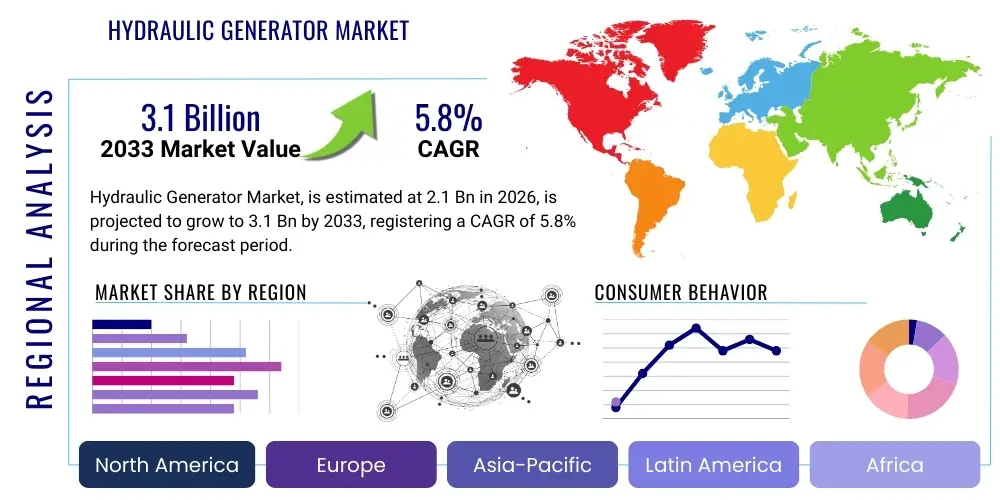

Hydraulic Generator Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440837 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Hydraulic Generator Market Size

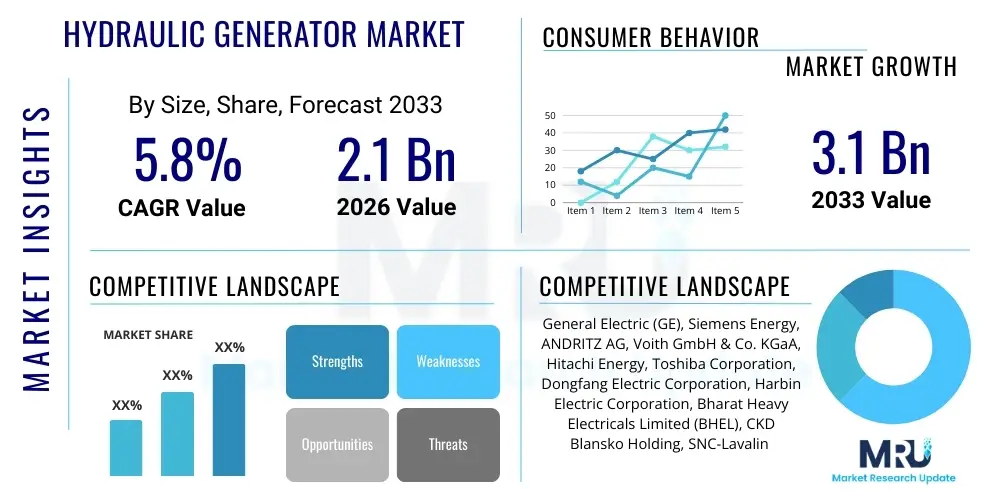

The Hydraulic Generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Hydraulic Generator Market introduction

The Hydraulic Generator Market encompasses the global industry involved in the design, manufacturing, and deployment of power generation systems that convert mechanical energy from hydraulic sources, primarily water flow, into electrical energy. These generators are integral components of hydroelectric power plants, ranging from large-scale utility projects to small and micro-hydro installations, playing a crucial role in providing renewable and sustainable energy. The core technology leverages the principles of fluid dynamics to drive turbines connected to generators, ensuring efficient energy conversion. This sector is vital for countries aiming to diversify their energy mix, reduce carbon footprints, and enhance energy independence through clean power sources.

The primary products within this market include various types of hydraulic turbines—such as Pelton, Francis, Kaplan, and Turgo turbines—each optimized for different head and flow conditions, coupled with synchronous or asynchronous generators. Major applications span utility-scale power generation, industrial power supply, rural electrification in remote areas, and grid stabilization services. The versatility of hydraulic generators allows for their integration into diverse geographical and hydrological settings, from high-head mountain rivers to low-head run-of-river schemes. Additionally, pumped-hydro storage solutions, which utilize hydraulic generators in both generation and pumping modes, represent a significant and growing application area, enhancing grid flexibility and renewable energy integration.

Key benefits of hydraulic generators include their high efficiency, long operational lifespan, minimal environmental impact compared to fossil fuel alternatives, and ability to provide dispatchable and reliable power. Hydroelectric power plants offer significant operational flexibility, capable of rapid start-up and shutdown, which is crucial for balancing intermittent renewable sources like solar and wind. Driving factors for market growth include the escalating global demand for electricity, increasing focus on renewable energy development and climate change mitigation, favorable government policies and incentives for green energy, and advancements in turbine and generator technologies that improve efficiency and reduce costs. The inherent stability and predictable nature of hydropower further solidify its position as a cornerstone of future energy infrastructure.

Hydraulic Generator Market Executive Summary

The Hydraulic Generator Market is poised for sustained growth, driven by an expanding global energy demand and an intensified focus on sustainable power solutions. Business trends indicate a shift towards modular and standardized designs to reduce project complexities and costs, alongside a growing emphasis on hybrid power systems that integrate hydropower with other renewables. Companies are increasingly investing in research and development to enhance turbine efficiency, extend operational lifespans, and incorporate smart technologies for predictive maintenance and optimized performance. Strategic collaborations and acquisitions are also prevalent, as market players seek to expand their geographical reach, diversify their product portfolios, and leverage specialized expertise in different segments of the hydropower value chain. Furthermore, the market is witnessing an uptick in retrofit and modernization projects for aging hydro infrastructure, aiming to boost capacity and efficiency of existing assets.

Regionally, Asia Pacific continues to be a dominant market, fueled by robust economic growth, rapid industrialization, and significant investments in large-scale hydroelectric projects, particularly in countries like China, India, and Southeast Asian nations. North America and Europe are characterized by modernization efforts for existing facilities and a strong drive towards small and micro-hydro installations, often supported by stringent environmental regulations and attractive feed-in tariffs. Latin America, with its abundant water resources, presents substantial opportunities for new large-scale and run-of-river projects, especially in Brazil, Chile, and Colombia. The Middle East and Africa regions, while smaller in scale, are gradually exploring hydropower potential to address energy poverty and achieve sustainable development goals, often with international funding and technological support. Each region exhibits unique hydrological characteristics and regulatory landscapes that shape the specific types and scales of hydraulic generator deployments.

Segmentation trends highlight a strong demand for Francis turbines due to their versatility across a wide range of head and flow conditions, making them suitable for most medium to large hydropower projects. Kaplan turbines are gaining traction in low-head applications, while Pelton turbines remain critical for high-head installations. The small and micro-hydro segment is experiencing significant growth, driven by decentralized energy solutions, off-grid applications, and rural electrification initiatives. In terms of capacity, generators with capacities ranging from 1 MW to 10 MW are seeing increased adoption, bridging the gap between micro-hydro and large-scale projects. The shift towards sustainable infrastructure development and the integration of smart grid technologies are further refining product development and deployment strategies across all segments, ensuring that hydraulic generators remain a cornerstone of global renewable energy efforts. The increasing adoption of variable-speed generators is also a notable trend, offering enhanced flexibility and efficiency in grid operations.

AI Impact Analysis on Hydraulic Generator Market

Common user questions regarding AI's impact on the Hydraulic Generator Market frequently revolve around how artificial intelligence can enhance operational efficiency, predictive maintenance, and overall plant performance. Users are particularly interested in AI's role in optimizing energy production, ensuring grid stability, and extending the lifespan of critical equipment. Concerns often include the initial investment costs, data privacy and security implications, and the need for skilled personnel to manage AI-driven systems. There is also significant curiosity about how AI can contribute to real-time decision-making, fault detection, and intelligent control systems within complex hydroelectric power plant environments. Users seek to understand the tangible benefits AI can deliver in terms of reduced downtime, improved safety, and more sustainable energy management practices across diverse scales of hydraulic generator installations. The integration challenges and the return on investment for AI technologies are also key areas of inquiry, reflecting a pragmatic approach to adopting advanced analytical capabilities.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data from generators and turbines to predict potential equipment failures before they occur, reducing unplanned downtime and maintenance costs. This allows for proactive scheduling of repairs and parts replacement, significantly improving asset utilization and reliability.

- Optimized Energy Production: AI systems can forecast water availability, electricity demand, and market prices with high accuracy, enabling real-time adjustments to turbine operations for maximum power generation efficiency and revenue optimization. This dynamic optimization is crucial for integrating hydropower with intermittent renewables.

- Intelligent Control Systems: AI-driven control systems can automate complex operational decisions, such as regulating water flow, turbine speed, and generator output, based on multiple variables and operational objectives, leading to more stable and responsive grid integration. These systems adapt to changing environmental and demand conditions.

- Improved Resource Management: AI helps in modeling and managing water resources more effectively across river basins, considering factors like precipitation, snowmelt, and downstream requirements, thereby optimizing water usage for power generation and other purposes like irrigation and flood control.

- Real-time Fault Detection and Diagnostics: AI monitors operational parameters continuously, identifying anomalies and potential issues instantly, which aids in rapid fault diagnosis and mitigation, preventing minor issues from escalating into major problems. This capability minimizes operational risks and enhances safety.

- Cybersecurity Enhancements: AI can detect unusual patterns in network traffic and system behavior within hydroelectric plant IT/OT infrastructure, identifying and neutralizing cyber threats more effectively, thereby protecting critical energy assets from malicious attacks.

- Design and Simulation Optimization: AI tools can accelerate the design process for new hydraulic generator components and entire plant layouts by simulating various scenarios and optimizing parameters for efficiency, cost-effectiveness, and environmental impact, leading to superior engineering solutions.

DRO & Impact Forces Of Hydraulic Generator Market

The Hydraulic Generator Market is significantly influenced by a confluence of driving forces, prominent among which is the escalating global demand for renewable energy. Nations worldwide are committed to decarbonizing their energy sectors and achieving ambitious climate targets, making hydropower a cornerstone of their sustainable energy strategies due to its reliability and low carbon footprint. Coupled with this is the increasing need for grid stability and flexibility; as intermittent renewable sources like solar and wind proliferate, hydraulic generators, particularly those in pumped-hydro storage configurations, become indispensable for balancing the grid and ensuring a consistent power supply. Furthermore, government policies and incentives, including feed-in tariffs, tax credits, and regulatory mandates for renewable portfolio standards, actively promote the development and expansion of hydropower projects, providing a stable investment environment. Technological advancements, leading to more efficient turbines and generators, lower maintenance requirements, and the integration of smart monitoring systems, also act as significant drivers, improving the economic viability and operational performance of hydraulic projects. The long operational life and low operating costs of hydropower assets, once constructed, further solidify their appeal.

However, the market also faces considerable restraints that temper its growth. High upfront capital costs associated with the construction of hydroelectric power plants are a major barrier, often requiring substantial long-term financing and posing significant financial risks. Environmental concerns, particularly regarding the impact of large dams on aquatic ecosystems, river flows, and local biodiversity, lead to stringent regulatory hurdles and prolonged approval processes. Social opposition, stemming from land displacement, cultural heritage issues, and changes to local livelihoods, can also impede project development and cause significant delays. Additionally, geographical limitations, as not all regions possess suitable hydrological conditions for hydropower development, restrict market expansion in certain areas. Climate change, paradoxically, can also be a restraint, as altered precipitation patterns and increased frequency of droughts can affect water availability and the consistent operation of hydroelectric facilities. The complexity of engineering and construction for these large-scale projects, coupled with lengthy development timelines, also adds to the challenges faced by developers.

Amidst these dynamics, significant opportunities emerge for market players. The immense potential of untapped hydropower resources in developing economies, particularly in Africa, Latin America, and parts of Asia, offers avenues for substantial new project development aimed at rural electrification and industrial growth. The modernization and upgrading of aging hydro infrastructure in developed regions present a lucrative market for retrofit solutions, capacity expansion, and efficiency improvements. The growing demand for pumped-hydro storage solutions to support grid modernization and the integration of variable renewables provides a specialized and high-growth niche. Innovation in small and micro-hydro technologies allows for decentralized power generation, catering to remote communities and off-grid applications. Furthermore, the development of hybrid power solutions, combining hydropower with solar, wind, or battery storage, offers enhanced reliability and optimized energy management. The pursuit of sustainable development goals and international climate finance mechanisms also creates a favorable environment for investment and technological transfer in the hydropower sector, fostering long-term market expansion.

Segmentation Analysis

The Hydraulic Generator Market is comprehensively segmented across several crucial dimensions to provide a granular understanding of its diverse landscape and growth dynamics. These segments primarily include Generator Type, Capacity, Turbine Type, Application, and End-User. Each segmentation offers distinct insights into the market's structure, catering to varied industrial requirements and geographical specificities. The Generator Type category differentiates between synchronous and asynchronous generators, which are selected based on grid connection requirements and operational flexibility. Capacity segmentation, ranging from micro to large-scale, reflects the diverse range of power output needs, from localized off-grid solutions to massive utility-scale power plants. Turbine Type is critical, as different turbine designs are optimized for specific hydrological conditions, directly impacting efficiency and suitability for a given site.

Understanding the market through its Application segment reveals the primary uses of hydraulic generators, encompassing base load power generation, peak load management, and grid stabilization services, often highlighting the role of pumped-hydro storage. The End-User segmentation categorizes the primary consumers of hydraulic generators, including utility companies, industrial enterprises, and rural communities, each driven by unique energy demands and infrastructure requirements. This multi-faceted approach to segmentation allows for precise market analysis, enabling stakeholders to identify niche opportunities, tailor product offerings, and devise targeted strategies for market penetration. The continuous evolution of hydropower technology and increasing emphasis on distributed energy resources further refines these segmentation categories, making them dynamic indicators of market progression and innovation.

- By Generator Type

- Synchronous Generators: Predominantly used in large and medium-scale hydropower plants for stable grid connection and voltage regulation, offering high efficiency and power factor control.

- Asynchronous Generators: Often preferred for small and micro-hydro applications due to their simpler design, lower maintenance, and ease of grid integration without complex synchronization.

- By Capacity

- Up to 1 MW: Primarily for micro and mini-hydro projects, serving decentralized energy needs, remote communities, and off-grid applications.

- 1 MW to 10 MW: Medium-scale projects, suitable for small grid-connected plants, industrial power supply, and distributed generation schemes.

- 10 MW to 100 MW: Medium to large-scale utility projects, contributing significantly to national grids and regional power supply.

- Above 100 MW: Large-scale hydropower plants, forming the backbone of national energy infrastructure, providing base load power and grid stability.

- By Turbine Type

- Francis Turbines: Versatile and widely used for medium to high head and medium flow applications, prevalent in most major hydroelectric plants.

- Kaplan Turbines: Ideal for low head and high flow conditions, commonly found in run-of-river projects and tidal power applications.

- Pelton Turbines: Best suited for high head and low flow conditions, typically deployed in mountainous regions with significant vertical drop.

- Turgo Turbines: Similar to Pelton but designed for medium head and flow conditions, offering a balance of efficiency and cost-effectiveness.

- Propeller Turbines: A broad category including Kaplan, generally used for low head applications with varying blade designs.

- By Application

- Base Load Power Generation: Providing a consistent and continuous supply of electricity to meet fundamental demand.

- Peak Load Power Generation: Offering rapid response to fluctuations in electricity demand, especially during peak consumption hours.

- Pumped-Hydro Storage: Utilizing hydraulic generators for both power generation and pumping water to higher reservoirs for energy storage, crucial for grid balancing.

- Grid Stabilization and Ancillary Services: Contributing to frequency regulation, voltage support, and black start capabilities to maintain grid reliability.

- By End-User

- Utility Companies: Major consumers for large-scale power generation and grid management.

- Industrial: Industries requiring reliable and often self-generated power for their operations.

- Commercial: Smaller scale power generation for commercial establishments or multi-use facilities.

- Residential: Very small-scale or micro-hydro for individual homes or small communities, often off-grid.

Value Chain Analysis For Hydraulic Generator Market

The value chain for the Hydraulic Generator Market is a complex interplay of various stages, starting from raw material sourcing and extending to the end-use and maintenance of the power generation systems. The upstream segment of this chain primarily involves the extraction and processing of essential raw materials such as steel, copper, aluminum, and various specialized alloys crucial for manufacturing turbine components, generators, and associated electrical equipment. Key suppliers in this phase include metal fabricators, casting companies, and manufacturers of insulation materials and electronic components. The quality and availability of these raw materials, along with their fluctuating prices, significantly impact the manufacturing costs and lead times for hydraulic generators. Efficiency in sourcing, coupled with robust supplier relationships, is paramount for maintaining competitive pricing and ensuring the consistent quality of finished products.

Further along the value chain, the manufacturing phase constitutes the core process, where these raw materials and components are assembled into complete hydraulic generators. This stage involves sophisticated engineering, precision machining, and rigorous testing of turbines, generators, control systems, and ancillary equipment. Manufacturers often specialize in particular types of turbines or generator capacities, leveraging their expertise to optimize performance and durability. After manufacturing, the products are distributed through a combination of direct and indirect channels. Direct sales often involve large-scale projects where manufacturers directly engage with utility companies, government bodies, or independent power producers for custom solutions and direct installation support. Indirect channels typically involve distributors, system integrators, and engineering, procurement, and construction (EPC) firms that handle sales, installation, and project management for smaller or more standardized projects, particularly in diverse geographical markets.

The downstream activities encompass the installation, commissioning, operation, and maintenance of hydraulic generator systems. Installation requires specialized civil engineering and construction expertise, often involving significant infrastructure development like dams, penstocks, and powerhouses. Post-commissioning, the generators enter their operational phase, which can span several decades. Maintenance services, including routine inspections, repairs, and modernization projects, form a crucial part of the downstream value chain, ensuring the long-term reliability and efficiency of the assets. Direct maintenance is often provided by the original equipment manufacturers (OEMs) or specialized service providers, while indirect maintenance can be handled by local contractors or the plant operators themselves, leveraging parts and technical support from manufacturers. The entire value chain is characterized by a strong emphasis on engineering excellence, project management capabilities, and a commitment to long-term operational support, ensuring the sustainable and efficient generation of hydropower.

Hydraulic Generator Market Potential Customers

The potential customers for hydraulic generators are diverse, reflecting the broad applicability of hydropower across various scales and economic development stages. Foremost among these are large utility companies and national power grids, which invest in significant hydropower projects to provide stable base load power, manage peak demands, and enhance grid resilience. These entities are primarily concerned with reliability, efficiency, and the long-term operational costs of massive generating units. Their purchasing decisions are often influenced by national energy policies, regulatory frameworks, and the need to integrate renewable sources into their energy portfolios. Utility-scale projects, including new installations and the modernization of existing plants, represent a substantial segment of demand, driven by the imperative to deliver consistent and affordable electricity to large populations and industrial centers.

Another significant customer segment comprises industrial enterprises, particularly those with high energy consumption or operations in remote locations. Industries such as mining, manufacturing, and large agricultural operations may develop captive hydropower plants to ensure a reliable and cost-effective power supply, reducing their dependence on grid electricity or fossil fuels. These customers prioritize operational stability, specific power output requirements, and the environmental benefits of self-generated green energy. The trend towards industrial decarbonization and energy independence further motivates these investments. For them, the return on investment through reduced energy bills and increased operational autonomy is a primary driver, often favoring tailor-made solutions that integrate seamlessly with their existing infrastructure and operational demands, focusing on robust and low-maintenance systems.

Furthermore, government agencies and rural electrification programs, especially in developing countries, represent a crucial customer base for small and micro-hydro hydraulic generators. These initiatives aim to bring electricity to remote and underserved communities, fostering economic development and improving living standards where grid expansion is economically unfeasible. Non-governmental organizations (NGOs) and international development agencies often fund and facilitate such projects, seeking sustainable and community-managed energy solutions. These customers prioritize ease of installation, low operational complexity, and long-term sustainability for distributed power generation. The focus here is often on modular, standardized designs that can be deployed quickly and maintained with local expertise. Additionally, independent power producers (IPPs) and private investors seeking to capitalize on renewable energy incentives also constitute a growing customer segment, focusing on the financial viability and profitability of projects across all capacity ranges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE), Siemens Energy, ANDRITZ AG, Voith GmbH & Co. KGaA, Hitachi Energy, Toshiba Corporation, Dongfang Electric Corporation, Harbin Electric Corporation, Bharat Heavy Electricals Limited (BHEL), CKD Blansko Holding, SNC-Lavalin Group, WWS Wasserkraft GmbH, Hydro-Québec, Litostroj Power, Mavel, a.s., Flovel Energy Private Limited, Zhejiang Fuchunjiang Hydropower Equipment Co., Ltd., Canyon Hydro, GILKES, Cornell Pump Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Generator Market Key Technology Landscape

The Hydraulic Generator Market is characterized by a dynamic technology landscape continuously evolving to enhance efficiency, reliability, and environmental compatibility. A cornerstone of this landscape is the advanced design and materials used in turbine manufacturing, including computational fluid dynamics (CFD) modeling for optimizing blade profiles and flow passages. This leads to higher energy conversion rates and reduced cavitation, extending the lifespan of turbine components. Material science advancements are also critical, with the development of corrosion-resistant alloys and composite materials that improve durability and performance in challenging hydrological environments, reducing the need for frequent maintenance and minimizing operational costs. Furthermore, the integration of smart sensors and IoT devices is transforming traditional hydraulic generators into intelligent assets, enabling real-time monitoring of various operational parameters.

Generator technology itself has seen significant progress, with improvements in synchronous and asynchronous generator designs that enhance efficiency, reduce energy losses, and offer better grid integration capabilities. Variable-speed generators, which allow turbines to operate optimally across a wider range of water flows, are becoming increasingly prevalent, particularly in pumped-hydro storage applications. These generators utilize advanced power electronics to control speed and output, providing greater flexibility and responsiveness to grid demands. The development of permanent magnet generators (PMGs) for small and micro-hydro applications offers higher efficiency and compact designs, reducing the overall footprint and making them suitable for remote and decentralized power generation projects. Furthermore, advancements in insulation materials and cooling systems contribute to the robustness and longevity of generator units, capable of withstanding extreme operational conditions.

Beyond the core generator and turbine technologies, the market is heavily influenced by sophisticated control and automation systems. Modern hydraulic power plants employ advanced SCADA (Supervisory Control and Data Acquisition) systems, PLCs (Programmable Logic Controllers), and distributed control systems (DCS) that enable remote monitoring, automated operation, and predictive maintenance. These systems utilize artificial intelligence and machine learning algorithms to optimize power output, predict equipment failures, and manage water resources effectively. The integration of digital twins for virtual modeling and simulation of plant operations is also gaining traction, allowing operators to test scenarios, train personnel, and optimize performance without impacting live operations. Cybersecurity solutions are also a critical component, protecting these increasingly interconnected and automated systems from cyber threats, ensuring the secure and reliable operation of hydraulic power generation facilities.

Regional Highlights

- North America: The North American market for hydraulic generators is primarily characterized by modernization and upgrades of aging infrastructure. The region boasts a significant installed base of large hydropower plants, particularly in the US and Canada, which are now undergoing rehabilitation to enhance efficiency and extend operational life. There is also a growing interest in small and micro-hydro projects, driven by decentralized energy initiatives and stricter environmental regulations promoting renewable energy adoption. Investments are focused on technological advancements to optimize existing assets and integrate hydropower with other renewables, especially in regions with abundant water resources and supportive regulatory frameworks. The emphasis on grid reliability and resilience further drives the demand for flexible hydropower solutions, including pumped-hydro storage.

- Europe: Europe is a mature market for hydraulic generators, with a strong focus on sustainability, environmental protection, and energy security. Countries like Norway, France, and Switzerland have extensive hydropower capacities, and the market here is largely driven by retrofit projects, capacity upgrades, and the deployment of pumped-hydro storage to balance intermittent wind and solar power. Strict environmental policies encourage the development of run-of-river and small-scale hydro projects, minimizing ecological impact. The European Union's renewable energy targets and carbon neutrality goals provide robust policy support and financial incentives for continued investment in efficient and environmentally friendly hydropower solutions. Innovation in smart grid integration and digital solutions for plant management is also a key regional trend.

- Asia Pacific (APAC): The Asia Pacific region stands as the largest and most dynamic market for hydraulic generators, propelled by rapid industrialization, burgeoning energy demand, and extensive untapped hydropower potential, particularly in emerging economies. Countries like China and India are leading in large-scale hydropower development, constructing new mega-projects to meet their growing energy needs and reduce reliance on fossil fuels. Southeast Asian nations, including Vietnam, Laos, and Myanmar, are also investing heavily in hydropower for economic development and rural electrification. The region's diverse geography, from high mountains to vast river systems, supports a wide range of project types. Government initiatives, infrastructure development, and international funding are significant drivers, though environmental and social considerations increasingly influence project planning and execution.

- Latin America: Latin America possesses vast and largely untapped hydropower resources, making it a region with significant growth potential. Brazil, with its extensive river systems, already has a substantial hydropower fleet and continues to invest in new projects. Countries like Colombia, Chile, and Peru are actively exploring their hydro potential to diversify their energy mix and provide reliable power to expanding economies. The market is driven by increasing electricity demand, economic development objectives, and the desire for energy independence. Challenges include complex regulatory environments, financing hurdles, and, in some instances, social and environmental opposition to large-scale projects. However, the abundance of water resources and growing focus on renewable energy make it a promising region for future hydraulic generator deployments.

- Middle East and Africa (MEA): The Middle East and Africa region currently holds a smaller share of the global hydraulic generator market but is poised for growth, particularly in areas with significant river systems like the Nile and Congo basins. Many countries in sub-Saharan Africa are actively seeking to address energy poverty and expand access to electricity, with hydropower being a viable solution due to its renewable nature and potential for large-scale generation. Investments are often supported by international development banks and foreign aid. The Middle East, while less endowed with conventional hydropower potential, shows emerging interest in pumped-hydro storage for grid stability, especially as renewable energy penetration (solar) increases. Challenges include political instability, infrastructure deficits, and financing constraints, yet the fundamental need for sustainable energy drives ongoing exploration and project development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Generator Market.- General Electric (GE)

- Siemens Energy

- ANDRITZ AG

- Voith GmbH & Co. KGaA

- Hitachi Energy

- Toshiba Corporation

- Dongfang Electric Corporation

- Harbin Electric Corporation

- Bharat Heavy Electricals Limited (BHEL)

- CKD Blansko Holding

- SNC-Lavalin Group

- WWS Wasserkraft GmbH

- Hydro-Québec

- Litostroj Power

- Mavel, a.s.

- Flovel Energy Private Limited

- Zhejiang Fuchunjiang Hydropower Equipment Co., Ltd.

- Canyon Hydro

- GILKES

- Nidec Corporation

Frequently Asked Questions

Analyze common user questions about the Hydraulic Generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of hydraulic generators used in hydropower plants?

The primary types of hydraulic generators include synchronous and asynchronous generators. Synchronous generators are typically used in larger hydropower plants due to their ability to provide stable voltage and frequency for grid connection. Asynchronous generators, conversely, are often favored for smaller or micro-hydro applications due to their simpler design, lower maintenance requirements, and ease of integration into both grid-connected and off-grid systems. The choice depends heavily on the project's scale, grid requirements, and operational flexibility needs.

How do hydraulic generators contribute to renewable energy and grid stability?

Hydraulic generators are fundamental to renewable energy portfolios because they harness the kinetic energy of water, a naturally replenishing resource, to produce electricity with minimal carbon emissions. They contribute significantly to grid stability by offering dispatchable power that can be rapidly adjusted to meet demand fluctuations, unlike intermittent renewables such as solar and wind. Pumped-hydro storage systems, in particular, act as large-scale batteries, absorbing excess power from the grid to pump water uphill and then releasing it to generate electricity when needed, thus balancing supply and demand efficiently.

What factors are driving the growth of the Hydraulic Generator Market?

Several key factors are driving market growth, including the increasing global demand for clean and renewable energy sources, stringent climate change mitigation targets, and the need for enhanced grid flexibility and stability to accommodate other intermittent renewables. Favorable government policies, subsidies, and incentives for hydropower development, coupled with continuous technological advancements in turbine and generator design that improve efficiency and reduce costs, are also significant drivers. The long operational lifespan and low operating costs of hydropower assets further contribute to their attractiveness and market expansion.

What are the main challenges faced by the Hydraulic Generator Market?

The Hydraulic Generator Market faces several challenges, primarily high upfront capital costs and long project development timelines associated with hydroelectric power plant construction. Environmental concerns regarding the impact on aquatic ecosystems, biodiversity, and local communities can lead to significant regulatory hurdles and social opposition. Geographical limitations mean not all regions possess suitable hydrological conditions for development. Additionally, climate change-induced alterations in precipitation patterns and increased drought frequency can affect water availability and the consistent operation of hydropower facilities, adding a layer of operational uncertainty.

How is AI impacting the operation and maintenance of hydraulic generators?

AI is profoundly impacting the operation and maintenance of hydraulic generators by enabling predictive maintenance through the analysis of sensor data, which anticipates equipment failures before they occur and reduces unplanned downtime. AI-driven control systems optimize energy production by forecasting water availability and demand, making real-time adjustments to turbine operations for maximum efficiency. Furthermore, AI enhances real-time fault detection, aids in water resource management, and can bolster cybersecurity for critical plant infrastructure. These advancements lead to improved reliability, operational efficiency, and extended asset life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager