Hydraulic Radial Piston Pumps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442554 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hydraulic Radial Piston Pumps Market Size

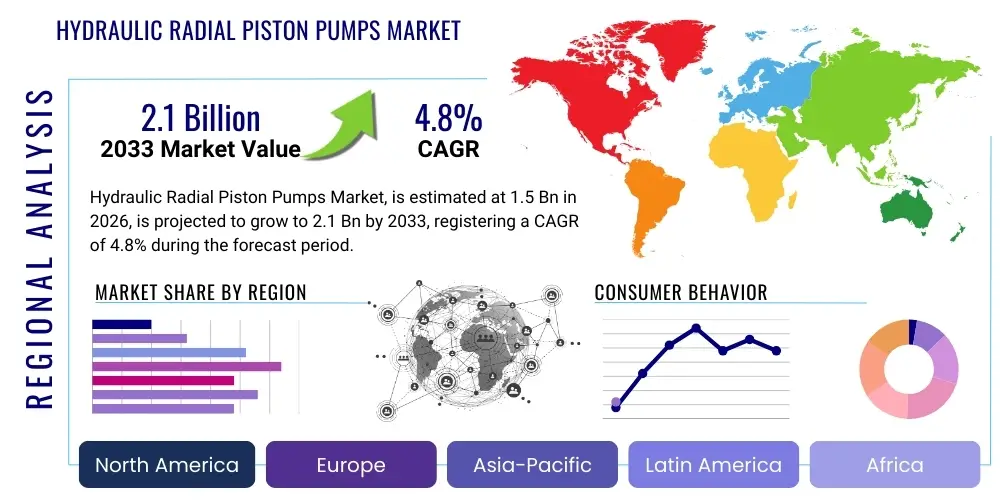

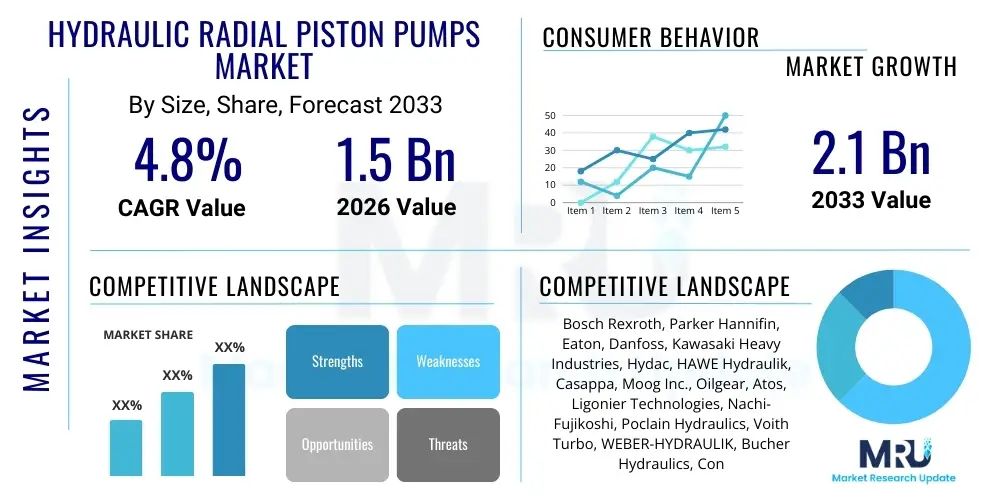

The Hydraulic Radial Piston Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Hydraulic Radial Piston Pumps Market introduction

The Hydraulic Radial Piston Pumps Market encompasses highly specialized positive displacement pumps designed for applications requiring high pressure, exceptional efficiency, and robust reliability, particularly in continuous duty cycles within demanding industrial and mobile settings. These pumps operate on the principle of radial piston movement against an eccentric shaft or cam ring, generating extremely high volumetric efficiency—often exceeding 95%—which is critical for complex hydraulic systems used in heavy machinery and precision manufacturing. Unlike axial piston pumps, the radial design typically offers better noise reduction, reduced pulsation, and superior performance stability when handling low-viscosity fluids under maximum stress, positioning them as essential components in modern, energy-efficient hydraulic drives.

The core product description revolves around their compact, modular design and the capacity to operate reliably at pressures exceeding 700 bar (10,000 psi), making them indispensable for sophisticated hydraulic power units. Major applications span critical sectors, including heavy-duty construction machinery such as excavators and cranes, specialized material handling equipment in logistics centers, and high-precision industrial applications like metal forming presses, injection molding machines, and large machine tools where consistent force and speed control are paramount. Their design allows for multi-circuit systems powered by a single unit, enhancing system integration and reducing overall footprint, directly addressing the modern industry's need for space-saving and highly concentrated power sources.

Key benefits driving market adoption include their unparalleled longevity due to minimal internal leakage and robust construction, exceptional efficiency which translates directly into lower operational energy costs, and the ability to maintain steady flow rates irrespective of system pressure fluctuations. These attributes are crucial for industries focusing on minimizing environmental impact and maximizing production throughput. The primary driving factors stimulating market growth are the global resurgence in infrastructure development, increasing automation across the manufacturing sector (Industry 4.0 initiatives), and the continuous demand for powerful, reliable hydraulic systems that comply with stringent noise and energy efficiency regulations, particularly in Europe and North America where energy costs and sustainability goals are significant operational considerations.

Hydraulic Radial Piston Pumps Market Executive Summary

The global Hydraulic Radial Piston Pumps Market is characterized by a strong emphasis on technological convergence, driven by the increasing need for system efficiency, connectivity, and miniaturization across industrial and mobile segments. Current business trends indicate a shift toward intelligent hydraulic systems, where pumps are equipped with integrated sensors and controls, enabling real-time diagnostics, predictive maintenance, and optimized energy consumption. Major manufacturers are heavily investing in modular pump designs that facilitate easy integration into existing industrial setups and offer variable displacement capabilities to match power output precisely to load requirements, thereby reducing wasted energy and heat generation. Furthermore, strategic mergers and acquisitions among key players are reshaping the competitive landscape, focused on consolidating technology portfolios and extending global distribution networks, especially targeting high-growth manufacturing hubs in Asia Pacific.

Regionally, the market trajectory is segmented, with Asia Pacific (APAC) emerging as the fastest-growing area, fueled primarily by massive investments in infrastructure development, particularly in China and India, alongside the rapid expansion of the automotive and heavy machinery manufacturing base across Southeast Asia. North America and Europe maintain their status as mature markets, characterized by high adoption rates of advanced, highly-efficient radial piston pumps, driven by strict regulatory standards concerning energy efficiency (e.g., EU Ecodesign directives) and industrial safety. The demand in these established regions centers on replacing older, less efficient hydraulic components with modern, smart pumps that offer enhanced connectivity and reduced operational noise, aligning with urban industrial environment mandates.

In terms of segment trends, the High-Pressure segment (above 400 bar) is witnessing accelerated growth, largely attributed to its application in specialized machinery requiring extreme force density, such as metal forging and aerospace testing equipment. Simultaneously, the Variable Displacement Pumps segment is gaining traction over fixed displacement models, driven by the overall industry push towards energy saving and load-sensing capabilities, providing optimal flow control under dynamic operational conditions. The industrial equipment end-use sector remains the largest consumer, but the construction and mining industries are showing robust compounded growth, reflecting the global commitment to large-scale infrastructure projects. The convergence of hydraulic power with electronic controls (electro-hydraulics) is the defining trend across all segments, ensuring precise and repeatable performance essential for automated manufacturing processes.

AI Impact Analysis on Hydraulic Radial Piston Pumps Market

User queries regarding AI's influence on the Hydraulic Radial Piston Pumps Market frequently center on themes such as predictive maintenance capability, optimization of pump performance parameters in real-time, and the integration of machine learning algorithms to enhance energy efficiency. Users are keenly interested in how AI can move hydraulic systems beyond traditional reactive maintenance schedules, focusing instead on detecting minute pressure, temperature, and vibration anomalies indicative of imminent failure. Furthermore, significant discussion revolves around using AI to manage complex multi-pump systems, ensuring optimal load sharing and minimizing overall system energy draw by dynamically adjusting pump displacement based on precise operational needs and predictive load forecasting. Concerns often relate to data security, the necessity for robust sensor technology (edge computing capabilities), and the required investment in retrofitting existing hydraulic infrastructure with smart, AI-compatible components.

The integration of Artificial Intelligence transforms radial piston pumps from simple mechanical components into intelligent, interconnected nodes within a broader industrial ecosystem. AI algorithms, particularly those utilizing deep learning, can process vast streams of operational data—flow rates, pressure curves, internal temperatures, and rotational speeds—to establish dynamic operational baselines. When deviations occur, the AI system alerts operators or, increasingly, triggers automated adjustments to the pump's control valves or displacement mechanisms, preempting mechanical wear and extending component life significantly. This capability is paramount in high-stakes environments like aerospace ground testing equipment or continuous-operation press lines where downtime is prohibitively expensive, ensuring continuous high-reliability performance and vastly improving overall equipment effectiveness (OEE).

Ultimately, AI drives the next generation of hydraulic pump innovation, pushing the boundaries of what is achievable in terms of energy minimization and operational lifespan. AI-driven condition monitoring systems not only predict component failures but also allow maintenance personnel to optimize the scheduling of interventions, minimizing unnecessary shutdowns and ensuring parts are ordered precisely when needed. This transition toward 'smart hydraulics' is crucial for supporting the tenets of Industry 4.0, where decentralized control, intelligent assets, and seamless data exchange are foundational requirements. Manufacturers are leveraging AI to design more efficient pump geometries during the R&D phase by simulating millions of operating scenarios, leading to pumps that are smaller, quieter, and inherently more resilient to fluctuating operating conditions than their predecessors.

- AI enables real-time volumetric efficiency optimization through dynamic control of swash plates and control valves, resulting in significant energy savings.

- Predictive Maintenance (PdM) powered by machine learning analyzes vibration and pressure signatures to anticipate component failure up to weeks in advance.

- AI facilitates automated fault detection and diagnostics, minimizing human intervention and reaction time to operational anomalies.

- Implementation of Edge AI capabilities allows for localized data processing, ensuring fast control loop responses crucial for high-speed hydraulic systems.

- Machine learning assists in optimizing the design phase, simulating material stress and fluid dynamics for enhanced pump longevity and compact structure.

DRO & Impact Forces Of Hydraulic Radial Piston Pumps Market

The dynamics of the Hydraulic Radial Piston Pumps Market are shaped by a complex interplay of internal market forces and external macroeconomic factors, summarized effectively through the Drivers, Restraints, and Opportunities (DRO) framework. Key drivers include the global mandate for higher energy efficiency in industrial machinery, making the inherently high volumetric efficiency of radial piston pumps highly attractive, especially in regions with escalating energy costs. The robust growth in heavy construction and mining sectors, particularly in emerging economies, mandates the use of reliable, high-pressure hydraulic components capable of enduring harsh operating environments. Furthermore, technological advancements leading to compact, quieter pump designs support the increased automation trend across precision manufacturing segments. These positive influences combine to create significant momentum, pushing market penetration and application diversity.

However, the market faces significant restraints. The high initial capital cost associated with radial piston pumps, stemming from precision machining and specialized material requirements, often deters smaller enterprises from adoption, favoring cheaper, albeit less efficient, gear or vane pump alternatives. Additionally, the complexity of maintaining and repairing these high-precision units necessitates specialized technical expertise, creating a skills gap challenge in certain geographical areas. The cyclical nature of the end-use industries, such as construction and automotive manufacturing, introduces volatility into demand forecasting, impacting manufacturer investment strategies. Lastly, the increasing prevalence of electric and servo-hydraulic systems poses a long-term competitive threat, as these alternatives offer comparable precision with potentially lower noise levels and reduced fluid reliance, especially in medium-duty applications.

Opportunities for market expansion are predominantly centered on technological innovation and geographical diversification. The rising demand for integrated electro-hydraulic systems, where radial piston pumps are paired with variable speed drives (VSDs) and sophisticated electronic controls, offers a pathway to unprecedented efficiency gains and connectivity, crucial for Industry 4.0 adoption. Furthermore, the development of pumps optimized for alternative or biodegradable hydraulic fluids addresses environmental regulations and opens new avenues in environmentally sensitive sectors like marine and renewable energy. Impact forces acting upon this market, particularly the bargaining power of major component suppliers (due to specialized materials) and the high technological barrier to entry for new competitors, ensure that established key players maintain a dominant, albeit highly competitive, position, focusing relentlessly on proprietary design patents and performance metrics to sustain market share.

Segmentation Analysis

The Hydraulic Radial Piston Pumps Market segmentation provides a granular view of diverse applications and product specifications, crucial for targeted marketing and strategic resource allocation. The market is primarily categorized based on displacement mechanism (Fixed vs. Variable), operating pressure range (Low, Medium, High), and the critical application sectors (Industrial, Mobile). This structure highlights that while industrial applications, specifically machine tools and presses, currently dominate revenue share due to their need for consistent high-pressure performance, the fastest growth is anticipated in the mobile sector, driven by heavy construction and agricultural machinery demanding compact, robust, and highly efficient pump solutions for dynamic operational scenarios. Analyzing these segments helps manufacturers tailor their R&D efforts—for example, focusing on robust materials for high-pressure industrial pumps and lightweight designs for mobile machinery—to maximize appeal across diverse user groups and regulatory environments.

Detailed analysis of the displacement type reveals a growing preference for Variable Displacement Radial Piston Pumps, despite their higher initial cost. This preference is strongly correlated with the universal drive toward energy efficiency and precise load sensing, particularly within automated manufacturing environments where power consumption must be meticulously managed. Fixed displacement pumps maintain a stable presence in applications requiring simple, constant flow rates under consistent load, yet the market momentum favors variable systems due to their superior ability to reduce heat generation and prolong system lifespan by only supplying the exact required flow. Geographically, segmentation trends align with industrial maturity; mature markets prioritize high-pressure and variable displacement units, whereas developing regions often first adopt reliable, cost-effective fixed displacement systems before transitioning to advanced models as infrastructure and regulatory requirements evolve.

- By Displacement Type:

- Fixed Displacement Pumps

- Variable Displacement Pumps

- By Operating Pressure:

- Low Pressure (Up to 200 Bar)

- Medium Pressure (201 - 400 Bar)

- High Pressure (Above 400 Bar)

- By Application:

- Construction Machinery

- Material Handling Equipment

- Industrial Equipment (Presses, Machine Tools, Injection Molding)

- Aerospace and Defense

- Mining and Quarrying

- Marine and Offshore

- By End-Use Industry:

- Manufacturing and Automation

- Construction and Infrastructure

- Agriculture

- Oil & Gas

- Transportation

Value Chain Analysis For Hydraulic Radial Piston Pumps Market

The value chain for the Hydraulic Radial Piston Pumps Market begins with upstream activities focused on raw material sourcing and the highly specialized manufacturing of precision components. The primary upstream suppliers provide critical materials such as high-grade steel alloys, specialty aluminum, and engineered elastomers, which are essential for manufacturing components like piston blocks, cam rings, and control valves that must withstand extreme pressures and frictional forces. Given the high tolerance requirements and the complexity of these components, the bargaining power of specialized component manufacturers who possess proprietary surface treatment and precision machining technologies is substantial. Quality assurance at this initial stage is non-negotiable, as component reliability directly dictates the operational lifespan and safety rating of the final pump unit, influencing the reputation of the final pump manufacturer significantly.

The midstream segment involves the core activities of pump assembly, testing, and system integration conducted by the major market players. This stage emphasizes advanced manufacturing techniques, strict quality control protocols, and the integration of electronic controls for smart pump functionality. Direct sales often characterize the distribution channel for Original Equipment Manufacturers (OEMs), where pump manufacturers forge long-term, direct relationships with large machinery builders (e.g., manufacturers of large excavators or industrial presses). These direct channels ensure specialized technical support, customization capabilities, and optimized delivery schedules tailored to the OEM's production lines, representing the most lucrative sales avenue for high-volume, standard models.

Downstream activities center around maintenance, repair, and replacement (MRO) services, delivered primarily through indirect distribution channels, including certified regional distributors, authorized service centers, and specialized hydraulic repair shops. These indirect channels are crucial for reaching smaller end-users, managing spare parts inventory, and providing localized technical support and diagnostic services required for the complex maintenance of high-pressure radial piston pumps. The efficiency of the downstream network significantly impacts customer satisfaction and the market lifespan of the product. The trend toward digitalization and remote monitoring also influences the downstream, with service providers increasingly utilizing data from integrated pump sensors to offer predictive maintenance contracts, thereby shifting the emphasis from reactive repairs to proactive asset management, securing long-term service revenues.

Hydraulic Radial Piston Pumps Market Potential Customers

Potential customers for the Hydraulic Radial Piston Pumps Market are characterized by their stringent demand for high power density, exceptional control precision, and prolonged operational reliability, typically operating in environments where failure is costly or hazardous. The primary buyers fall into two main categories: Original Equipment Manufacturers (OEMs) who integrate the pumps into heavy machinery, and large industrial end-users who purchase pumps for replacement or system upgrades within their manufacturing or processing plants. OEMs in the heavy equipment sector, such as manufacturers of large hydraulic excavators, concrete pumps, mining trucks, and offshore drilling equipment, constitute a major customer base due to the indispensable role these pumps play in transmitting massive forces necessary for high-load applications. Their purchasing decisions are driven by factors like pump efficiency ratings, noise reduction compliance, and the global service network provided by the pump manufacturer.

The second major cohort comprises end-users in the industrial manufacturing sector, particularly in metal forming, plastic injection molding, and large-scale press operations. These customers require radial piston pumps for their precision, consistency, and ability to withstand continuous, high-pressure duty cycles—often in excess of 500 bar—which is critical for maintaining product quality and production throughput. Furthermore, the aerospace and defense sectors are significant niche buyers, utilizing these pumps in testing rigs, simulation platforms, and specialized ground support equipment where safety margins and operational precision must meet the highest possible standards. For these high-stakes buyers, compliance with specific industry standards (e.g., MIL-specs, ISO standards) and verifiable longevity data are often more critical purchasing criteria than initial unit cost.

Emerging potential customers are increasingly found in the renewable energy sector, specifically manufacturers of wind turbine pitch control systems and tidal energy equipment, which require reliable, highly durable pumps capable of operating under extreme weather conditions and complex, intermittent duty cycles. Additionally, the proliferation of large logistics and material handling centers, which utilize highly automated systems for heavy lifting and transportation, represents a growing customer base. These sectors are actively seeking pumps that can seamlessly integrate into electro-hydraulic architectures, leveraging the pump's mechanical robustness with the controllability and energy savings afforded by electronic variable speed drives, highlighting a market shift toward smarter, more versatile hydraulic solutions tailored to dynamic modern industrial requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Danfoss, Kawasaki Heavy Industries, Hydac, HAWE Hydraulik, Casappa, Moog Inc., Oilgear, Atos, Ligonier Technologies, Nachi-Fujikoshi, Poclain Hydraulics, Voith Turbo, WEBER-HYDRAULIK, Bucher Hydraulics, Concentric AB, Bondioli & Pavesi, Vickers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Radial Piston Pumps Market Key Technology Landscape

The Hydraulic Radial Piston Pumps market is witnessing significant technological evolution, largely driven by the imperative for enhanced power density, reduced noise emission, and seamless digital integration. A primary advancement is the proliferation of Electro-Hydraulic Technology (EHT), wherein the traditional mechanical control of pump displacement is replaced or augmented by sophisticated electronic controls and variable speed drives (VSDs). This integration allows the pump motor speed and displacement to be dynamically adjusted in real-time, matching the hydraulic power output precisely to the load demand. This shift dramatically improves system efficiency by eliminating throttling losses and significantly reducing operational noise compared to constantly running fixed-speed systems, positioning EHT as the benchmark for new industrial and mobile pump designs complying with stringent environmental regulations and energy consumption targets.

Another crucial technological development involves the refinement of materials science and internal pump geometry, specifically focusing on hydrostatic balancing and bearing design. Modern radial piston pumps utilize specialized ceramic coatings and high-performance steel alloys for piston/cylinder pairings, minimizing friction and maximizing resistance to wear under extreme high-pressure cycles (often 700 bar and above). This focus on enhanced durability and reduced internal leakage directly translates to longer pump lifetimes and consistent performance over prolonged operation, thereby reducing total cost of ownership (TCO). Furthermore, the trend toward modular design allows manufacturers to create integrated pump assemblies that combine multiple radial piston sections or integrate other hydraulic components like valves and reservoirs, achieving superior compactness and reducing installation complexity for OEMs, which is a major advantage in space-constrained applications like mobile machinery.

The integration of digital sensors and connectivity features represents the third pivotal technological area, aligning the hydraulic pump market with broader Industry 4.0 principles. Advanced pumps are now equipped with integrated IoT sensors that monitor critical parameters such as pressure pulsations, oil temperature, and vibration spectra. These sensors feed data to onboard controllers or cloud-based analytics platforms, enabling sophisticated condition monitoring and predictive maintenance algorithms. This connectivity transforms the radial piston pump into a smart asset, providing valuable operational insights that allow users to optimize system performance proactively. Future developments are expected to concentrate on miniaturization techniques and the use of additive manufacturing (3D printing) for creating optimized internal flow passages, potentially leading to even lighter and more energy-efficient pump designs with improved transient response characteristics.

Regional Highlights

The **Asia Pacific (APAC)** region dominates the market growth trajectory for hydraulic radial piston pumps, driven by unprecedented levels of urbanization, massive government investment in infrastructure (e.g., China’s Belt and Road Initiative, India’s "Make in India"), and the rapid expansion of the regional manufacturing base. China, in particular, is the world’s largest producer and consumer of construction machinery and industrial automation equipment, creating colossal demand for reliable, high-pressure hydraulic components. Local manufacturers in South Korea, Japan, and India are increasing their adoption of high-efficiency radial piston pumps to enhance the quality and competitiveness of their export-oriented machinery. This region is characterized by high volume demand, often prioritizing pumps that offer a favorable balance between performance, durability, and cost-effectiveness, although a growing segment is moving toward premium, digitally-enabled products.

**North America**, particularly the United States, represents a highly mature and technologically advanced market. Demand here is characterized by stringent requirements for energy efficiency, precision control, and long-term reliability, especially within the aerospace, heavy mining, and specialized industrial sectors (e.g., oil and gas exploration equipment). Market growth is steady, driven primarily by the replacement cycle of aging hydraulic systems with modern, electro-hydraulic radial piston pumps that comply with state-level energy consumption mandates. The region’s focus on R&D for automation and robotics necessitates the use of pumps capable of extremely precise flow and pressure control, ensuring high margins for suppliers of highly specialized and digitally integrated pump solutions.

**Europe** is a vital market segment, defined by stringent regulatory environments related to noise pollution (e.g., in urban industrial zones) and energy consumption (Ecodesign Directive). This legislative landscape heavily favors high-efficiency radial piston pumps, particularly variable displacement and servo-driven electro-hydraulic models, which offer superior performance with minimized energy waste and noise emission. Germany, as the industrial heartland of Europe, demonstrates persistent high demand for these pumps in machine tool manufacturing, automotive production, and specialized equipment. The region's growth is predominantly driven by technological upgrades, compliance requirements, and the strong adoption of Industry 4.0 principles, making it a critical market for premium, innovation-led manufacturers.

The **Latin America** market exhibits moderate growth, closely tied to cyclical investments in mining, infrastructure, and agricultural development, particularly in Brazil and Mexico. Adoption is often driven by international OEMs operating within the region who integrate global standards into local production. While sensitivity to initial cost remains a factor, the increasing mechanization of agriculture and mining mandates more robust hydraulic power solutions, gradually pushing the demand toward durable radial piston pumps capable of handling harsh, remote operating conditions. Stability in commodity prices significantly influences capital expenditure in this region.

The **Middle East and Africa (MEA)** market is expanding, primarily fueled by extensive capital projects in the construction, oil, and gas sectors in countries like Saudi Arabia and the UAE. Demand centers on large-scale infrastructure projects requiring heavy mobile machinery and high-pressure industrial equipment for oil refining and processing. The region is largely dependent on imported machinery, positioning global manufacturers with robust regional support infrastructure advantageously. The long-term trajectory is optimistic, contingent upon sustained investment in diversification projects beyond hydrocarbon reliance and the subsequent growth of local manufacturing capabilities.

- Asia Pacific (APAC): Highest volume growth; driven by construction, infrastructure, and manufacturing automation (China, India). Focus on cost-performance ratio and high-volume production scale.

- Europe: High-value market; driven by strict energy efficiency and noise regulations; strong demand for servo-hydraulic and variable displacement units (Germany, Italy).

- North America: Mature market; emphasis on high precision (aerospace, specialized industrial); steady replacement cycles and focus on digitalization (USA).

- Latin America (LATAM): Growth linked to mining, agriculture, and construction investments (Brazil, Mexico); balancing cost sensitivity with demand for robust, reliable components.

- Middle East & Africa (MEA): Growth centered on oil & gas infrastructure and mega construction projects; reliance on imported, heavy-duty equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Radial Piston Pumps Market.- Bosch Rexroth

- Parker Hannifin

- Eaton

- Danfoss

- Kawasaki Heavy Industries

- Hydac

- HAWE Hydraulik

- Casappa

- Moog Inc.

- Oilgear

- Atos

- Ligonier Technologies

- Nachi-Fujikoshi

- Poclain Hydraulics

- Voith Turbo

- WEBER-HYDRAULIK

- Bucher Hydraulics

- Concentric AB

- Bondioli & Pavesi

- Vickers (Eaton legacy)

Frequently Asked Questions

Analyze common user questions about the Hydraulic Radial Piston Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of radial piston pumps over axial piston pumps?

The primary advantage of radial piston pumps lies in their superior volumetric efficiency, particularly under extreme high-pressure conditions (often exceeding 400 bar), and their reduced operational noise and pressure pulsation. The radial design is inherently more robust and allows for higher pressure capabilities and better longevity, making them preferred for continuous, heavy-duty industrial applications like hydraulic presses and testing equipment where consistent force output is critical.

How is the integration of Industry 4.0 affecting the design of hydraulic radial piston pumps?

Industry 4.0 integration drives the development of 'smart pumps' equipped with embedded sensors for monitoring pressure, temperature, and vibration. This connectivity facilitates predictive maintenance (PdM) and real-time remote diagnostics, allowing for optimized operational performance and reduced unexpected downtime. Furthermore, integration with Variable Speed Drives (VSDs) enables pumps to become integral components of electro-hydraulic control loops, significantly improving energy efficiency and overall system intelligence.

Which end-use industries are driving the highest demand for high-pressure radial piston pumps?

The highest demand is driven by sectors requiring extreme force and precision. This includes the industrial equipment segment (metal forming presses, injection molding machines), heavy construction machinery (large excavators, cranes), and niche high-stakes applications such as aerospace ground support equipment and specialized mining machinery. These industries prioritize the radial pump's reliability and high-pressure capability (often medium to high pressure segments, above 200 bar) for critical operations.

What are the key technical specifications to consider when selecting a radial piston pump for a new application?

Key technical specifications include the maximum required operating pressure (Bar/PSI), the necessary flow rate (LPM/GPM), the displacement type (Fixed or Variable, where Variable is preferred for energy efficiency), the required fluid compatibility (especially for synthetic or biodegradable fluids), and the operational noise level requirements. Matching the pump's displacement control mechanism to the system's dynamic load requirements is crucial for maximizing efficiency and minimizing heat generation.

How do variable displacement radial piston pumps contribute to energy savings in industrial systems?

Variable displacement radial piston pumps contribute significantly to energy savings by precisely adjusting the flow output to match the immediate load demand, eliminating the need to continuously run the pump at maximum capacity and dump excess flow via relief valves. This load-sensing capability prevents unnecessary power consumption and heat build-up, reducing cooling requirements and extending the lifespan of both the pump and the hydraulic fluid, resulting in measurable operational cost reductions and better compliance with energy efficiency standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager