Hydraulic Riveting Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442173 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Hydraulic Riveting Machine Market Size

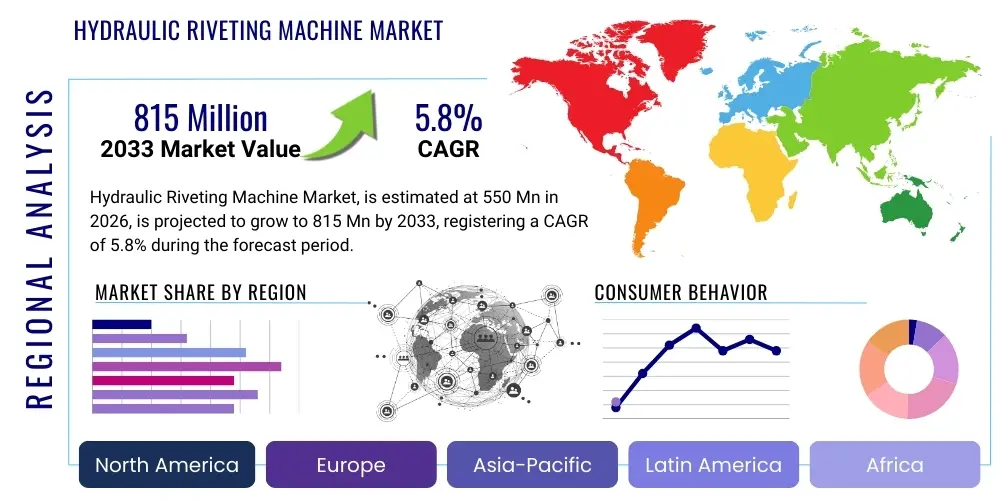

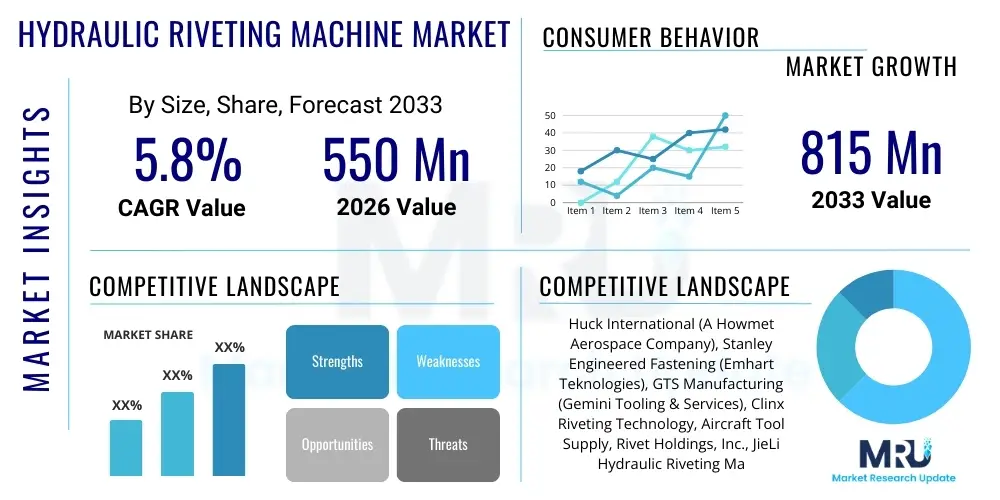

The Hydraulic Riveting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 815 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the escalating demand for reliable, high-strength fastening solutions across critical manufacturing sectors, particularly aerospace, automotive, and heavy machinery fabrication, where structural integrity and consistency are non-negotiable prerequisites. The hydraulic mechanism offers superior force delivery and precise stroke control compared to pneumatic or mechanical alternatives, leading to enhanced quality control in high-volume production environments.

The market trajectory is significantly influenced by global trends toward lightweighting in transportation industries. As manufacturers seek to replace traditional welding with advanced fastening techniques to join dissimilar materials (such as aluminum and composites), hydraulic riveting machines provide an optimal solution. Furthermore, the push for automated and semi-automated production lines requires riveting equipment that can be seamlessly integrated with robotics and sophisticated control systems, a capability inherent in modern hydraulic riveting platforms. Investments in smart factory infrastructure across developed and emerging economies further catalyze market growth, fostering the adoption of advanced, reliable, and energy-efficient fastening equipment.

Geographical market dynamics show strong growth potential in Asia Pacific, propelled by massive infrastructure development and booming automotive manufacturing hubs in countries like China, India, and South Korea. Conversely, mature markets in North America and Europe focus primarily on replacing aging equipment with newer, precision-driven hydraulic systems that adhere to stringent safety and quality standards, especially within the defense and aerospace supply chains. The durability and lower maintenance requirements of hydraulic systems, coupled with their ability to handle large diameter rivets for heavy-duty applications, solidify their critical role in the contemporary manufacturing landscape, underpinning the forecasted market expansion over the analysis period.

Hydraulic Riveting Machine Market introduction

The Hydraulic Riveting Machine Market encompasses the global trade and utilization of equipment designed to install rivets using hydraulic pressure, ensuring a secure, permanent joint between two or more components. Hydraulic riveting machines are highly valued for their capability to deliver consistent, immense force required for setting large or hard rivets in high-strength materials, critical for structural integrity in demanding applications. The product typically includes a hydraulic power unit, a cylinder assembly, and specialized tooling (jaws, dies, and anvils) customized for various rivet types (solid, semi-tubular, blind). These machines range from portable, hand-held units used in maintenance operations to large, automated, gantry-style systems integrated into production lines, offering superior repeatability and reduced operator fatigue compared to manual or purely pneumatic tools. The fundamental advantage of hydraulic systems lies in their precise control over the exerted force and speed, which minimizes material distortion and guarantees optimal rivet setting, particularly in aerospace skin fabrication and heavy vehicle chassis assembly. Key applications span across railway rolling stock manufacturing, shipbuilding, general heavy fabrication, construction equipment assembly, and the increasingly crucial field of electric vehicle battery housing assembly where structural rigidity is paramount. Driving factors for market adoption include the burgeoning demand for high-integrity joints in safety-critical applications, the expansion of global manufacturing capacity, and continuous technological advancements improving machine efficiency and integration capabilities. The inherent durability and power-to-weight ratio of hydraulic systems further enhance their competitive edge over competing fastening technologies in heavy-duty environments, positioning them as essential assets for modern industrial production. The shift towards automation and the need for standardized fastening processes across international supply chains also significantly contribute to the rising deployment rates of these specialized machines.

Hydraulic Riveting Machine Market Executive Summary

The Hydraulic Riveting Machine Market is experiencing robust growth driven by accelerating industrial automation and surging demand from the aerospace and automotive sectors, particularly for high-strength, fatigue-resistant joints. Business trends indicate a strong focus on developing integrated, computerized numerical control (CNC) hydraulic riveting solutions that offer enhanced precision, real-time monitoring, and diagnostics capabilities, addressing the complex material joining requirements of modern manufacturing, such such as riveting carbon fiber or joining dissimilar metal alloys. Key manufacturers are prioritizing strategic partnerships with system integrators to embed their machines within larger robotic assembly cells, optimizing throughput and reducing reliance on manual labor. The competitive landscape is characterized by innovation in energy efficiency, aiming to reduce the operational footprint of hydraulic power units, alongside significant investment in modular designs that allow for easy customization and adaptation to diverse manufacturing layouts and specific application needs, enhancing product versatility and total cost of ownership (TCO) attractiveness.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented infrastructure investment, rapid expansion of the electric vehicle (EV) manufacturing base, and substantial defense modernization programs, especially in China, India, and Southeast Asian nations. These countries require high-capacity, reliable riveting solutions for everything from bridge construction to high-speed rail production. North America and Europe, while being mature markets, exhibit consistent demand primarily driven by the aerospace sector’s stringent quality requirements and the continuous requirement for replacing legacy hydraulic and pneumatic equipment with modern, connected, industry 4.0 compatible machinery. Regulatory compliance concerning structural integrity in aircraft and heavy machinery mandates the use of proven, precision fastening methods, solidifying the market presence of hydraulic riveting technology across these regions, sustaining high average selling prices (ASPs) for premium, advanced equipment models and specialized tooling.

Segmentation trends highlight the increasing dominance of automated and robotic riveting systems over manual and semi-automatic benches, reflecting the global industrial shift towards zero-defect manufacturing strategies and maximized production speeds. By application, the aerospace segment remains the most lucrative and technology-intensive, driving innovation in portable and specialized riveting solutions for structural airframe assembly and repair operations. Furthermore, the segment focused on large-diameter rivets for heavy industries, such as construction and shipbuilding, continues to grow steadily, capitalizing on global urbanization and maritime expansion projects. The preference for stationary, floor-mounted machines in high-volume assembly lines contrasts with the growing demand for portable, compact units crucial for maintenance, repair, and overhaul (MRO) activities and localized structural modifications in remote operational environments.

AI Impact Analysis on Hydraulic Riveting Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hydraulic Riveting Machine Market primarily center on three core themes: 'Can AI improve rivet quality inspection and minimize errors?', 'How can predictive maintenance using AI reduce machine downtime?', and 'Will AI-driven robotics replace human operators entirely in complex riveting tasks?'. Users are highly interested in how AI, particularly machine learning and computer vision systems, can transition the riveting process from a deterministic, programmed operation to a self-optimizing, adaptive manufacturing step. Expectations revolve around using AI for real-time adjustments to hydraulic pressure and feed rate based on instantaneous material variations (material thickness, surface finish, hardness), ensuring flawless joint formation under varying conditions, a significant departure from traditional fixed-parameter riveting processes.

The implementation of advanced sensor fusion and sophisticated algorithms allows hydraulic riveting systems to move beyond simple automation. AI enables the system to monitor acoustical signatures, hydraulic pressure waveforms, and motor current draw during the riveting cycle, comparing these real-time metrics against validated ideal signatures stored in extensive databases. This comparative analysis facilitates immediate detection of anomalies such as bent rivets, improper seating, or material cracks, which conventional quality checks might miss. Furthermore, AI-driven process optimization allows machines to ‘learn’ the optimal settings for new materials or complex geometries faster than manual trial-and-error, dramatically reducing setup time and material wastage in high-mix, low-volume production scenarios typical of aerospace assembly.

Predictive maintenance powered by machine learning algorithms is another major AI application transforming the market. By continuously analyzing operational data—including hydraulic fluid temperature, pump vibration levels, valve switching frequency, and cycle time drift—AI models can predict impending component failures (e.g., seal deterioration, pump wear) with high accuracy. This capability allows maintenance teams to schedule interventions precisely when needed, rather than relying on fixed time intervals or reacting to catastrophic failures. This predictive capability translates directly into higher equipment utilization rates, minimized unplanned downtime, and reduced overall maintenance costs, thereby significantly improving the total lifecycle efficiency and economic viability of high-capital hydraulic riveting machinery.

- AI-enabled computer vision systems for real-time, non-contact quality assurance (Q/A) and defect detection.

- Predictive maintenance analytics optimizing equipment uptime and scheduling proactive component replacement based on operational stress data.

- Machine learning algorithms optimizing hydraulic pressure, stroke length, and speed parameters dynamically based on material properties and rivet geometry.

- Integration with robotic systems using AI for path planning and collision avoidance during complex, multi-axis riveting operations on large structures.

- Automated process parameter generation, reducing the engineering time required for setting up new jobs or handling material variability.

- Enhanced operator safety through AI monitoring of interaction zones and immediate system shutdown protocols upon detecting unauthorized entry or unsafe actions.

DRO & Impact Forces Of Hydraulic Riveting Machine Market

The Hydraulic Riveting Machine Market is primarily driven by the escalating demand for high-integrity, fatigue-resistant joints in structural components, especially in the burgeoning aerospace and high-speed rail sectors where safety and reliability are paramount. Restraints include the high initial capital expenditure associated with advanced, automated hydraulic riveting systems and the inherent complexity and bulkiness of hydraulic power units compared to increasingly efficient electric or servo-driven fastening alternatives. Opportunities are vast, focused on developing miniaturized and portable hydraulic systems for the rapidly expanding maintenance, repair, and overhaul (MRO) segment, along with integrating Industry 4.0 technologies like IoT sensors and AI for enhanced process control and predictive diagnostics. These factors, alongside external impact forces such as stringent governmental regulations on structural integrity in transportation and construction, create a dynamic market environment where technological differentiation and cost efficiency determine competitive success and market penetration rates.

Driving forces specifically include the continuous increase in aircraft production and maintenance cycles globally, necessitating reliable, robust riveting solutions capable of handling exotic materials and complex geometries with extreme precision. Furthermore, the global trend towards automation, particularly in the automotive industry for chassis and structural component assembly, mandates the use of highly repeatable and controlled fastening equipment. Hydraulic systems provide the necessary brute force and fine control required for setting large-diameter structural rivets that welding processes cannot reliably replace in critical applications. The durability, long service life, and relatively simple maintenance procedure of hydraulic components, compared to complex mechanical linkages, also contribute significantly to their favorable market positioning, encouraging adoption across heavy fabrication sectors like shipbuilding and mining equipment manufacturing, where operational stress levels are exceptionally high and continuous.

Key restraining elements involve the operational concerns related to hydraulic fluid maintenance, including potential leaks, required periodic fluid changes, and sensitivity to temperature variations which can affect force output consistency, especially in non-climate-controlled environments. Competition from alternative fastening technologies, such as advanced mechanical fasteners (e.g., Huck bolts, structural blind rivets) and sophisticated spot welding techniques utilizing laser or resistance technology, poses a constant competitive threat, particularly where lightweighting and speed are prioritized over sheer force. However, the largest market opportunity lies in customizing hydraulic riveting systems to meet the unique requirements of emerging applications, such as the assembly of large-scale battery enclosures for electric vehicles, which require sealing and structural fastening processes optimized for aluminum alloys and composite materials, demanding specialized tooling and precision control that hydraulic systems are uniquely positioned to offer. Furthermore, developing environmentally friendly, biodegradable hydraulic fluids represents a niche opportunity to address sustainability concerns and enhance market appeal in environmentally conscious regions like Europe.

Segmentation Analysis

The Hydraulic Riveting Machine Market is comprehensively segmented based on machine type, operation mode, application industry, and riveting technology utilized, reflecting the diverse requirements of end-user sectors ranging from high-precision aerospace manufacturing to heavy-duty construction. The segmentation by machine type distinguishes between portable handheld units, essential for MRO and field repairs, and large stationary or bench-top machines, which are the backbone of high-volume production lines in automotive and general fabrication facilities. Operation mode segmentation, which includes manual, semi-automatic, and fully automatic (robotic) systems, highlights the ongoing industry transition towards increased automation to boost throughput and minimize human error. This transition is especially pronounced in safety-critical applications where process repeatability is highly valued. Understanding these segments is crucial for market participants to tailor their product development strategies and focus their efforts on high-growth areas such as automated riveting for specialized materials and applications.

From an end-user perspective, the market is primarily driven by the aerospace and defense sectors, which demand specialized, high-tolerance equipment for structural assembly, followed closely by the automotive industry, which utilizes hydraulic riveting for vehicle chassis and frame assembly to enhance crash safety and structural rigidity. The construction and railway segments form another significant part of the market, requiring robust, high-force machines capable of setting large structural rivets in heavy steel components. Technological segmentation often differentiates between squeeze riveting (which utilizes constant pressure for high-quality joints) and impact riveting (used for faster, high-volume, but potentially less precise applications). The growth forecast indicates that the automated/robotic segment coupled with the aerospace application segment will exhibit the highest CAGR due to increasing production volumes of commercial aircraft and the imperative for zero-defect fastening processes mandated by global regulatory bodies and customer safety standards. This detailed segmentation allows stakeholders to analyze specific competitive niches and capitalize on regional manufacturing specialization.

- By Machine Type:

- Portable/Handheld Hydraulic Riveters

- Bench-Top/Stationary Hydraulic Riveters

- Gantry/Robotic Hydraulic Riveting Systems

- By Operation Mode:

- Manual/Semi-Automatic

- Fully Automatic/Robotic Systems

- By Riveting Technology:

- Squeeze Riveting Machines

- Impact Riveting Machines

- Spin Riveting Machines (Hydraulic Assisted)

- By Application/End-Use Industry:

- Aerospace and Defense

- Automotive (Passenger and Commercial Vehicles)

- Railway and Transportation

- Construction and Heavy Fabrication

- General Machinery and Manufacturing

Value Chain Analysis For Hydraulic Riveting Machine Market

The value chain for the Hydraulic Riveting Machine Market begins with upstream activities involving the sourcing and processing of raw materials, primarily high-grade steel, specialized aluminum alloys for lightweight machine bodies, and high-performance components such as hydraulic pumps, motors, seals, and precision electronic controls. Key upstream suppliers include manufacturers specializing in high-tolerance hydraulic components (e.g., Vickers, Bosch Rexroth) and advanced material providers. R&D and design constitute a critical early stage, focusing on developing new tooling geometries, optimizing hydraulic circuit efficiency, and integrating digital control interfaces. The cost structure at this stage is heavily influenced by global metal prices and the cost of sophisticated electronic control modules. Efficiency in sourcing and the establishment of reliable, long-term supplier relationships for critical hydraulic power unit components are vital for manufacturers to maintain competitive pricing and ensure product quality consistency across the entire production portfolio.

Midstream activities involve the core manufacturing and assembly processes, where the hydraulic power units are built, frames are fabricated, and precision machining of tooling and dies occurs. This stage is characterized by high operational complexity and the need for rigorous quality control to ensure the machine’s performance, reliability, and compliance with industrial safety standards. Manufacturers often specialize in specific machine types, such as large gantry systems for aerospace or portable units for automotive repair. Distribution channels, both direct and indirect, form the downstream link. Direct sales are common for large, customized, and automated systems sold directly to Tier 1 aerospace or large automotive OEMs, involving extensive post-sale support, training, and maintenance contracts. Indirect channels rely on a global network of specialized industrial equipment distributors and local representatives, who handle sales, regional service support, and spare parts management for standard, lower-cost bench-top and portable units, often catering to small- and medium-sized enterprises (SMEs) within the general fabrication sector.

The aftermarket segment, consisting of maintenance, repair, and overhaul (MRO) services, spare parts supply (especially hydraulic seals and specialized riveting dies), and software updates, represents a crucial and highly profitable part of the downstream value chain. Success in the downstream market is increasingly tied to the manufacturer’s ability to provide comprehensive technical support and rapid access to proprietary tooling and certified replacement parts, minimizing customer downtime. Digital platforms for ordering spare parts and remotely diagnosing machine performance failures are becoming standard practices, enhancing the customer experience and solidifying manufacturer-client relationships. The overall efficiency and responsiveness of the distribution and service network are paramount, as machine reliability directly impacts the end-users’ production schedules and operational continuity, making localized service capabilities a significant competitive differentiator in this highly specialized industrial equipment market.

Hydraulic Riveting Machine Market Potential Customers

The primary end-users and potential customers of hydraulic riveting machines span multiple high-value, capital-intensive industries that prioritize structural integrity, joint strength, and high-volume, repeatable fastening processes. These include leading Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers within the global aerospace sector, such as Boeing, Airbus, Lockheed Martin, and their extensive global supply chains, requiring systems capable of setting high-strength titanium or aluminum rivets in airframe assemblies with micron-level precision and adherence to strict fatigue life specifications. Similarly, large automotive manufacturers (e.g., Daimler, Ford, Tesla) and heavy truck and bus builders constitute a significant customer base, deploying these machines for critical structural assemblies, chassis construction, and increasingly, the assembly of heavy-duty battery packs for electric vehicles, where a secure, leak-proof, and durable enclosure structure is mandatory.

Another major category of potential customers encompasses the railway rolling stock manufacturers (e.g., Alstom, CRRC) and shipbuilding yards, which require exceptionally powerful, reliable hydraulic riveting systems to join large, thick steel sections used in high-speed trains, locomotives, and maritime vessel hulls and superstructures. In these heavy fabrication environments, the sheer force capacity and consistent application pressure provided by hydraulic systems are often indispensable for achieving required joint strength standards. Furthermore, the specialized nature of these applications often necessitates custom-engineered tooling and integrated automation solutions, making these customers highly valuable due to the higher average transaction value per machine sold. The defense industry, including military vehicle and equipment manufacturers, also represents a constant, high-specification customer segment driven by ongoing governmental modernization and procurement contracts, requiring equipment capable of handling armored materials and specialized military-grade fasteners.

The construction machinery sector, including manufacturers of excavators, cranes, and large earth-moving equipment (e.g., Caterpillar, Komatsu), relies on heavy-duty hydraulic riveters for assembling critical structural frames and booms that must withstand extreme operational loads and harsh environmental conditions over extended operational lifecycles. Beyond large OEMs, the market includes numerous smaller entities involved in subcontracting, specialized repair workshops, and Maintenance, Repair, and Overhaul (MRO) facilities, particularly those servicing commercial aircraft fleets or maintaining specialized industrial machinery. These smaller customers primarily target portable and versatile bench-top hydraulic riveters, often seeking equipment known for ease of mobility, rapid setup, and consistent performance in diverse field conditions. The diversification of the end-user base across these critical infrastructure and manufacturing sectors underpins the market's resilience and sustained demand for robust hydraulic fastening solutions globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 815 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Riveting Machine Market Key Technology Landscape

The technological landscape of the Hydraulic Riveting Machine Market is rapidly evolving, driven by the increasing need for enhanced precision, system integration, and data communication capabilities mandated by Industry 4.0 principles. Modern hydraulic riveting machines increasingly incorporate closed-loop control systems, which utilize sophisticated sensors to monitor and instantly adjust parameters such as pressure, speed, and stroke depth throughout the riveting cycle. This feedback mechanism ensures that the force applied is precisely matched to the material properties and rivet specifications, guaranteeing consistent joint quality and minimizing material stress or distortion. Furthermore, there is a strong shift towards developing systems that feature modular tooling and quick-change die systems, dramatically reducing machine setup time and enhancing flexibility for production lines dealing with high-mix, low-volume manufacturing environments, particularly in customized aerospace component fabrication and specialized vehicle assembly processes.

A significant trend involves the integration of advanced diagnostic and monitoring technologies, leveraging the Internet of Things (IoT) connectivity. New generation hydraulic power units are equipped with embedded sensors and network capabilities that transmit operational data—including fluid temperature, vibration, energy consumption, and cycle counts—to centralized manufacturing execution systems (MES) or cloud platforms. This data stream facilitates real-time performance monitoring, enables proactive anomaly detection, and supports predictive maintenance strategies utilizing machine learning algorithms. The adoption of electro-hydraulic systems, which replace traditional separate pump units with highly integrated servo-motor-driven pumps, is also gaining traction. These systems offer superior energy efficiency, quieter operation, and significantly faster response times, providing the precise control necessary for advanced spin and orbital riveting techniques used for cosmetic and high-load bearing joints, such as those found in medical devices or high-end consumer electronics structural components.

The tooling and end-effector technology segment is witnessing innovation focused on improving accessibility and longevity. Customized, application-specific tooling, often manufactured using advanced techniques like additive manufacturing (3D printing) for complex geometries, allows access to tight spaces within complex airframe structures or vehicle bodies that were previously unreachable by standard riveters. Simultaneously, advancements in hydraulic seals and high-pressure fluid management systems are extending the operational life of the hydraulic components, reducing leakage risks, and enhancing the overall reliability of the riveting equipment in continuous operational cycles. The increasing compatibility of hydraulic riveting systems with collaborative robot (cobot) platforms for semi-automatic tasks ensures safer human-machine interaction and allows for the precise, repetitive, high-force tasks to be handled reliably by automation, further solidifying the technological evolution within this critical industrial machinery segment.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, driven primarily by massive investments in infrastructure development, burgeoning domestic automotive production (especially in the EV segment), and expanding aerospace manufacturing capabilities in China, India, and Japan. The region benefits from lower manufacturing costs, leading to increased installation of new, automated assembly lines that require high-throughput hydraulic riveting systems for heavy fabrication and mass transit projects. Government initiatives supporting ‘Make in India’ and ‘Made in China 2025’ strongly favor the domestic installation of sophisticated industrial machinery, creating a robust demand environment for imported and domestically manufactured hydraulic riveters.

- North America: This region holds a significant market share, largely dominated by the highly demanding aerospace and defense sectors. North American companies prioritize precision, quality certifications (e.g., AS9100), and integration with sophisticated automation platforms. Demand here is often centered on high-end gantry-style robotic riveting systems and specialized portable units for MRO activities on legacy aircraft. The renewal cycle for aging manufacturing equipment in the automotive sector also provides steady demand for modern, high-efficiency hydraulic riveting technology, especially for joining advanced materials used in performance and electric vehicles.

- Europe: Characterized by stringent quality standards and a strong focus on sustainability, the European market shows robust demand from the railway and automotive sectors, particularly Germany, France, and the UK. European manufacturers emphasize precision-engineered tooling, superior energy efficiency in hydraulic power units, and seamless integration of Industry 4.0 technologies. The shift towards lightweight component assembly and the stringent regulation of structural fastening processes in the construction and transportation industries sustain the market for high-quality, closed-loop controlled hydraulic riveting machines, often leading to higher average selling prices (ASPs) for premium European and imported machinery.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily driven by investments in the mining sector, infrastructure projects, and the expansion of the regional automotive assembly industry, particularly in Brazil and Mexico. Demand focuses mainly on reliable, durable, and cost-effective standard bench-top and portable hydraulic riveters suitable for heavy-duty, high-stress environments. Economic volatility in certain countries remains a constraint, but long-term industrialization efforts support the steady adoption of essential manufacturing equipment.

- Middle East and Africa (MEA): This region exhibits niche growth driven by large-scale oil and gas infrastructure projects (requiring heavy fabrication), defense spending, and nascent aerospace investments (e.g., UAE, Saudi Arabia). The requirement for robust, reliable machinery that can operate effectively under extreme temperature conditions drives demand for specialized hydraulic systems with enhanced cooling and durable sealing components. Investments in transportation infrastructure, including metro systems and railway networks, further contribute to the demand for heavy-duty riveting equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Riveting Machine Market.- Huck International (A Howmet Aerospace Company)

- Stanley Engineered Fastening (Emhart Teknologies)

- GTS Manufacturing (Gemini Tooling & Services)

- Clinx Riveting Technology

- Aircraft Tool Supply

- Rivet Holdings, Inc.

- JieLi Hydraulic Riveting Machine

- KUK Automation (KUKA Group)

- Robots Done Fast

- Böllhoff Group

- Arcus-EDS

- Riveting Machine Tools (RMT)

- AVDEL (Stanley Black & Decker)

- Chicago Pneumatic

- Atlas Copco

- Fuji Industrial Co., Ltd.

- Zipp Tool

- Fastening Systems International, Inc. (FSII)

- Trelleborg AB

- Hydra-Tec

Frequently Asked Questions

Analyze common user questions about the Hydraulic Riveting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of hydraulic riveting machines over pneumatic or mechanical systems?

The primary advantage is the superior combination of massive force output and precise, consistent control over the riveting stroke and pressure profile. This ensures a higher-quality, repeatable, and structurally sound joint, especially crucial for large-diameter or high-strength solid rivets used in safety-critical applications like aerospace and heavy vehicle chassis construction.

Which end-use industry contributes most significantly to the demand for high-end hydraulic riveting technology?

The Aerospace and Defense industry contributes most significantly. This sector demands specialized gantry and robotic hydraulic riveting systems with micron-level precision and closed-loop control for assembling airframe structures using exotic materials, necessitating adherence to rigorous certification and fatigue life standards.

How is Industry 4.0 influencing the design and functionality of modern hydraulic riveters?

Industry 4.0 is integrating IoT sensors, predictive maintenance algorithms, and network connectivity into hydraulic riveters. This allows for real-time performance monitoring, remote diagnostics, optimized process control via data analysis, and seamless integration into fully automated manufacturing execution systems (MES).

What are the main regional growth drivers for the Hydraulic Riveting Machine Market?

The main growth driver is the Asia Pacific (APAC) region, fueled by massive infrastructure development, expansion of domestic automotive and EV manufacturing, and significant government investment in high-speed rail and defense modernization programs, requiring extensive installation of new riveting capacity.

What is the key technological trend emerging in hydraulic riveting machine tooling?

The key trend is the development of modular, quick-change, and application-specific tooling, often manufactured using advanced additive techniques. This allows manufacturers to quickly adapt the machines for different rivet types and sizes and reach complex, confined geometries found in modern lightweight structures, minimizing changeover time.

The extensive growth in the Hydraulic Riveting Machine market is inherently linked to global industrial stability and increasing complexity of engineered structures. Manufacturers are continually focusing on improving the force-to-weight ratio of portable hydraulic units to enhance field serviceability and MRO efficiency. Advanced hydraulic fluids with improved thermal stability and reduced environmental impact are also becoming standard requirements, particularly in European markets governed by strict environmental directives. The integration of advanced human-machine interfaces (HMI) with touch-screen controls simplifies machine operation, programming, and fault diagnosis, making these complex machines more accessible to a wider range of technical personnel. The competitive landscape pushes companies to innovate not only in hydraulic power units but also in sophisticated end-effector designs and automated feeding systems that ensure consistent rivet presentation and placement, crucial for maintaining high quality in rapid assembly lines. The continuous push toward electric vehicles necessitates specialized hydraulic riveting machines capable of handling battery casing materials, such as specific aluminum alloys and composite substrates, often requiring sealing processes in conjunction with structural fastening, which adds another layer of technological complexity and market specialization. This robust demand across critical, high-value sectors assures sustained investment and innovation in the hydraulic riveting machine industry, supporting the forecasted CAGR through 2033. The long lifecycle and high reliability of these capital goods make them indispensable assets for global heavy manufacturing.

Specific technological advancements in sensor technology are enabling hydraulic riveting systems to achieve higher levels of process verification than ever before. For example, piezoelectric sensors are now being utilized to measure micro-deformations in the rivet material and surrounding substrate during the forming process, providing immediate feedback on joint quality. This real-time quality monitoring capability minimizes the reliance on post-process non-destructive testing (NDT), thereby streamlining production flow and reducing overall manufacturing lead times. Furthermore, the market is seeing increased differentiation based on the level of noise and vibration reduction. Modern hydraulic units are being designed with enhanced dampening technologies to meet increasingly stringent occupational safety standards, particularly within enclosed factory environments in developed economies. This focus on ergonomics and workplace safety, alongside technical performance, shapes product development strategies for leading market players. The global shortage of highly skilled manual labor capable of performing traditional fastening tasks reliably is accelerating the adoption of fully automated hydraulic riveting cells, reinforcing the trend toward large, gantry-style robotic systems that can operate 24/7 with minimal supervision. These systems often feature automatic tool changers, multiple rivet size handling capabilities, and integrated material handling, representing the pinnacle of riveting technology deployment in sectors like commercial aircraft wing assembly and fuselage fabrication. Investment in localized service centers and global parts distribution networks is paramount for maintaining market trust and ensuring the long-term operational viability of these expensive, specialized machines, especially in geographically dispersed industrial operations.

The segmentation of the market by riveting technology further indicates diverse customer requirements. Squeeze riveting, characterized by its slow, controlled application of force, remains the preferred method for stress-sensitive materials and high-specification joints where material deformation must be minimal. Conversely, impact riveting, while faster, is typically reserved for general fabrication and non-critical components where speed and simplicity are prioritized. Spin riveting, which is often hydraulically assisted, offers a visually appealing, smooth joint finish and is gaining traction in applications where both aesthetics and structural integrity are important, such as in consumer appliances and certain automotive interior components. The trend is moving towards multi-functional machines capable of performing various riveting techniques or handling different fastener types, offering greater flexibility and efficiency to smaller fabrication shops and versatile job shops. Moreover, there is a clear geographic distinction in technology adoption; while APAC rapidly adopts new, fully automated systems for greenfield projects, North America and Europe primarily focus on upgrading existing machinery with advanced digital controls and enhanced tooling capabilities to improve efficiency without necessitating full factory overhauls. This continuous cycle of innovation and replacement ensures steady, long-term growth for the Hydraulic Riveting Machine Market, reinforcing its critical role in modern complex manufacturing processes globally.

The competitive intensity in the Hydraulic Riveting Machine Market is high, driven by a few large global players who possess deep expertise in both hydraulic power systems and precision tooling. These established companies, often operating under parent organizations specializing in fasteners or industrial automation, maintain their market leadership through continuous R&D investment and global service capabilities. Smaller, regional players often compete by specializing in custom tooling, niche applications (like railway maintenance or heavy construction), or by offering highly cost-effective, standard bench-top models, often sourced from efficient manufacturing hubs in East Asia. Intellectual property, specifically patents protecting proprietary hydraulic circuit designs and unique rivet setting mechanisms, plays a significant role in maintaining competitive differentiation and creating barriers to entry for new market entrants. Furthermore, long-term supply agreements and strategic vendor status with major aerospace and automotive OEMs provide crucial revenue stability for market leaders. The industry also sees consolidation, with large fastener companies acquiring specialized riveting machine manufacturers to offer integrated, comprehensive fastening solutions—encompassing both the machine and the proprietary fastener—to end-users, thus strengthening their overall value proposition and simplifying the procurement process for complex manufacturing clients. This dynamic landscape necessitates continuous strategic positioning and innovation to secure market share and capitalize on emerging application opportunities, such as those arising from new composite material usage and large-scale industrial digitization initiatives globally, all of which heavily rely on precise and powerful fastening solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager