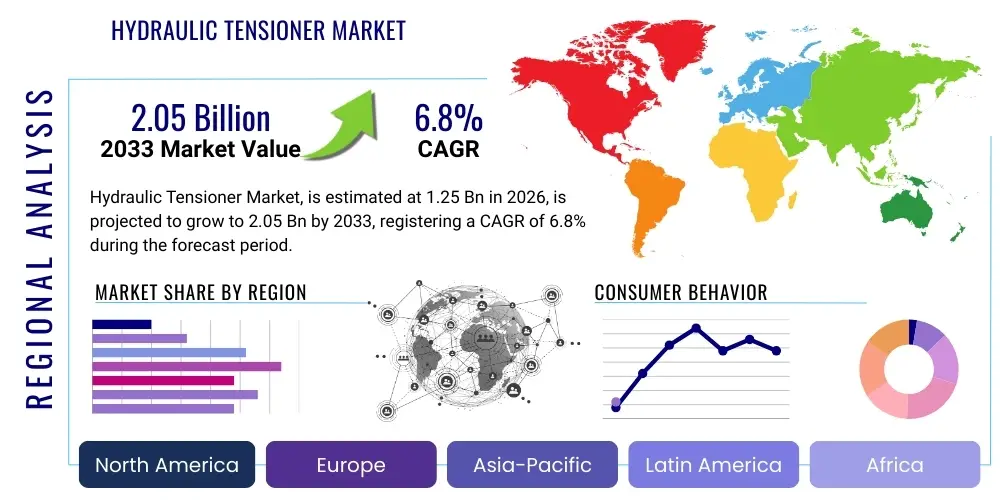

Hydraulic Tensioner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441270 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hydraulic Tensioner Market Size

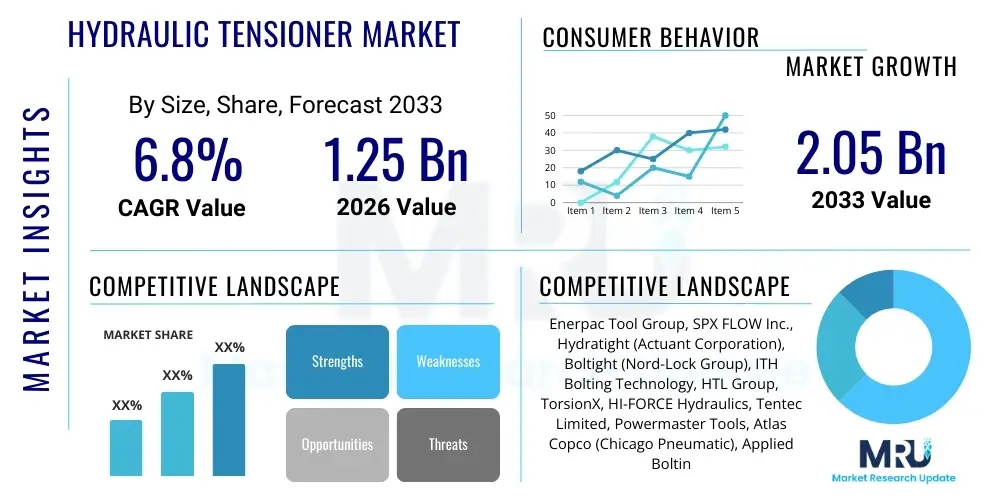

The Hydraulic Tensioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

Hydraulic Tensioner Market introduction

The Hydraulic Tensioner Market encompasses specialized tools designed for the precise and uniform tightening of large bolted joints, primarily utilizing hydraulic pressure to stretch the bolt, allowing the nut to be tightened without friction. This non-torsional method ensures superior accuracy and consistency compared to traditional torque methods, minimizing risks associated with bolt fatigue and structural failure in critical applications. These devices are essential for maintaining the integrity of machinery and infrastructure where powerful, reliable clamping force is mandatory. Key benefits include enhanced joint reliability, faster operation times, improved worker safety by eliminating manual effort, and significantly extended bolt life due to the prevention of premature thread wear.

Major applications driving the demand for hydraulic tensioners span across heavy industries such as oil and gas (pipelines, offshore platforms), power generation (nuclear, thermal, and wind turbines), heavy machinery manufacturing, mining, and large-scale civil construction projects (bridges, structural steel). The product range typically includes top-side tensioners, subsea tensioners, and custom-designed specialty tools tailored for unique industrial requirements. The critical nature of these applications—where failure can result in massive financial loss or catastrophic safety incidents—reinforces the reliance on high-precision hydraulic solutions.

Driving factors for market growth include the global infrastructure development surge, particularly in developing economies, the relentless expansion of renewable energy capacity (especially offshore and onshore wind farms which require robust bolt fastening solutions), and stringent regulatory requirements in the oil and gas sector demanding high levels of joint security and traceability. Furthermore, the increasing complexity and size of industrial machinery necessitate sophisticated tensioning solutions that only hydraulic systems can reliably provide, pushing manufacturers towards advanced, digitally integrated models.

Hydraulic Tensioner Market Executive Summary

The Hydraulic Tensioner Market is experiencing robust growth fueled primarily by global investments in energy infrastructure and heavy industrial maintenance. Business trends indicate a shift towards automated and smart tensioning systems, integrating sensors and monitoring capabilities to ensure compliance and traceability, which is particularly critical in the wind energy and subsea oil and gas sectors. Manufacturers are focusing on developing lighter, more durable materials and modular designs to enhance portability and operational efficiency, thereby expanding the potential application range. Price competition remains moderate, but differentiation through technical sophistication and comprehensive service packages, including rental and calibration services, is becoming a key market strategy, enabling premium pricing for specialized, high-pressure models.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive infrastructure projects in China, India, and Southeast Asia, coupled with substantial investments in new power generation facilities. North America and Europe maintain a mature market status, characterized by high demand for maintenance, repair, and overhaul (MRO) activities in aging power plants and advanced manufacturing sectors, prioritizing high-end, certified hydraulic tools. The Middle East and Africa (MEA) region shows significant potential due to ongoing upstream oil and gas developments requiring highly resilient, explosion-proof tensioning equipment for rigorous operational environments.

Segment trends highlight the dominance of top-side tensioners due to their wide usage across various applications, but the subsea tensioners segment is witnessing the highest growth rate, correlated directly with the expansion of deep-water drilling and offshore renewable energy projects. By operation type, the high-pressure segment (above 1500 bar) is gaining traction, necessary for modern, high-strength bolted connections in specialized machinery. The application landscape is increasingly dominated by power generation, which includes both turbine installation and continuous maintenance, positioning it as the largest consumer of hydraulic tensioning solutions globally.

AI Impact Analysis on Hydraulic Tensioner Market

User inquiries regarding AI's influence on the Hydraulic Tensioner Market frequently center on themes of predictive maintenance, operational efficiency, and the potential for fully autonomous bolt tensioning systems. Common concerns involve how AI integration will affect the required skillset of maintenance technicians, the security of interconnected hydraulic systems, and the return on investment for incorporating smart sensors and machine learning algorithms into traditionally mechanical tools. Users are keen to understand if AI can reliably predict tool failure, optimize bolt loading sequences based on real-time material stress analysis, and streamline inventory management for consumable parts like seals and pumps across large industrial fleets.

The core expectation is that Artificial Intelligence will transition hydraulic tensioning from a manual, reactive process to a data-driven, proactive activity. AI algorithms can process operational data gathered from smart tensioners—including pressure curves, cycle times, and temperature fluctuations—to identify anomalies and patterns indicative of future component failure or inconsistent bolt load application. This capability not only maximizes tool uptime and minimizes emergency repairs but also significantly enhances the overall safety and reliability of critical fastened joints in complex structures, such as nuclear reactors or offshore wind platforms. Furthermore, AI-driven process optimization allows for precise resource allocation, matching the right tensioner specifications and maintenance schedules to specific job requirements.

Consequently, the integration of AI models fundamentally changes the service landscape. Instead of simply selling hardware, manufacturers are evolving into providers of integrated tensioning solutions, offering subscription-based data analytics and predictive insights. This transformation moves the focus from hardware sales to value-added digital services, creating new revenue streams and fostering closer, long-term relationships with large industrial end-users focused on maximizing asset longevity and minimizing downtime. This shift necessitates investment in robust cybersecurity measures to protect sensitive operational data transmitted by the tensioning equipment in industrial IoT environments.

- Enhanced Predictive Maintenance: AI analyzes tensioning cycle data to forecast potential tool failure, optimizing maintenance schedules and reducing unexpected downtime.

- Automated Load Sequence Optimization: Machine learning algorithms determine the most efficient and reliable bolt tightening patterns based on material characteristics and environmental factors.

- Improved Quality Control and Traceability: AI systems log precise tensioning forces and environmental conditions for every joint, creating an immutable digital record for compliance and auditing.

- Supply Chain and Inventory Management: Predictive algorithms forecast demand for tensioner parts (seals, hoses) based on usage patterns, optimizing stock levels for industrial rental fleets.

- Autonomous Robotic Tensioning: Development of collaborative robots utilizing AI for precise, automated application of hydraulic tensioners in hazardous or remote environments (e.g., subsea).

- Real-time Operator Assistance: AI-driven interfaces provide instant feedback and error correction suggestions to operators, ensuring procedural adherence and consistent output quality.

DRO & Impact Forces Of Hydraulic Tensioner Market

The Hydraulic Tensioner Market is propelled by several strong drivers, notably the accelerating deployment of renewable energy infrastructure, particularly large-scale offshore wind energy projects, which require extremely reliable and powerful tensioning tools for turbine assembly and foundational anchoring. Further major drivers include the global rejuvenation of aging infrastructure and increased capital expenditure in heavy manufacturing and mining sectors, demanding durable and precise bolting solutions to ensure operational safety and regulatory compliance. However, the market faces constraints, primarily high initial investment costs for advanced hydraulic systems, which can deter smaller enterprises, coupled with the mandatory, frequent calibration and specialized maintenance required for precision hydraulic equipment, adding to the total cost of ownership. The market’s resilience is also influenced by volatile raw material prices, particularly specialized steels and hydraulic fluid components.

Opportunities for growth are significant in the realm of smart tensioning technology, focusing on IoT integration, which allows for remote monitoring, data logging, and automatic force adjustment, offering a premium solution that caters to the industry’s demand for high traceability and error reduction. The expansion of rental and leasing models presents a substantial opportunity, mitigating the high upfront cost barrier for project-based users and providing manufacturers with a stable, recurring revenue stream through comprehensive service contracts. Geographically, emerging economies in APAC and Latin America offer untapped potential as their infrastructure and industrial bases mature and adopt higher safety standards.

The competitive landscape is governed by specific impact forces. The bargaining power of buyers is moderate to high, driven by the availability of several established, high-quality international brands and alternative bolting methods (e.g., torque wrenches). However, for highly specialized applications (e.g., subsea), buyer power diminishes due to the limited number of qualified suppliers. The threat of new entrants is low, primarily because of the high capital requirement, stringent industry certifications (API, ISO), and the necessity of established distribution and service networks. The intensity of rivalry among existing competitors is medium, focused primarily on technological innovation, quality certifications, and the expansion of global service footprint rather than aggressive price undercutting, ensuring a market environment prioritizing technical excellence and reliability over mere cost reduction.

Segmentation Analysis

The Hydraulic Tensioner Market is meticulously segmented based on product type, operational specifications, pressure rating, and the primary industrial application, providing a granular view of market dynamics and demand centers. This segmentation helps identify key revenue streams, enabling manufacturers to tailor their research and development efforts toward high-growth niches such as specialized subsea equipment and high-pressure modular systems. The analysis confirms that the market structure is heavily influenced by the end-user industry’s safety standards and specific operational environments, driving demand for customization and robust certification standards across all product lines. The application segment, particularly Power Generation and Oil & Gas, remains the most significant determinant of market scale and technological innovation, dictating the need for highly precise and reliable tensioning capabilities.

- Product Type:

- Top-Side Tensioners

- Subsea Tensioners

- Customized Specialty Tensioners (e.g., Turbine Stud Tensioners)

- Operation:

- Manual Operation

- Automated/Remote Operation

- Pressure Rating:

- Low Pressure (Up to 1000 Bar)

- Medium Pressure (1000 Bar to 1500 Bar)

- High Pressure (Above 1500 Bar)

- Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Power Generation (Wind, Nuclear, Thermal)

- Construction and Infrastructure

- Heavy Machinery and Mining

- Aerospace and Defense

- Marine and Shipbuilding

Value Chain Analysis For Hydraulic Tensioner Market

The value chain for the Hydraulic Tensioner Market begins with the upstream segment, which involves the sourcing and processing of specialized raw materials. This includes high-strength alloy steels, precision hydraulic seals (often PTFE or specialized elastomers), high-pressure fittings, and durable hydraulic fluids. Key upstream activities focus on material quality control and ensuring compliance with international standards for tensile strength and corrosion resistance, particularly crucial for subsea applications. Supplier relationships in this phase are critical, as the precision and reliability of the final product depend heavily on the consistency and quality of sourced components. Volatility in the price of specialty metals presents a recurring challenge in managing upstream costs.

The midstream segment involves the core manufacturing process: design, precision machining, assembly, testing, and certification. Manufacturers invest heavily in computer numerical control (CNC) machining capabilities to achieve the tight tolerances required for high-pressure operation. Rigorous quality assurance (QA) protocols, including hydrostatic testing and calibration, are mandatory before the product is released. Differentiation often occurs here through proprietary seal technologies, ergonomic designs for operator safety, and the integration of electronic monitoring sensors. Specialized certification bodies play a crucial role, validating the tensioners' capacity, durability, and compliance with industry-specific standards like API for Oil & Gas or DNV for marine applications.

The downstream segment focuses on distribution and after-sales service. Distribution channels are typically a mix of direct sales to major industrial end-users (especially large energy companies or government infrastructure projects) and indirect channels through specialized industrial equipment distributors, rental companies, and regional agents. Direct channels are preferred for highly customized or large-volume orders, allowing manufacturers to maintain close control over pricing and technical support. Indirect channels, particularly industrial rental fleets, dominate the supply of standard tensioners for short-term project needs, offering flexibility to end-users. After-sales service, including mandatory calibration, maintenance, and technical training, is a vital value-add component and a significant revenue generator, essential for maintaining long-term customer satisfaction and ensuring the safe operation of the high-pressure equipment.

Hydraulic Tensioner Market Potential Customers

Potential customers, or end-users, of the Hydraulic Tensioner Market are concentrated in sectors that rely on the structural integrity of large, high-stress bolted joints where manual torquing is insufficient or unreliable. The primary buyers are large energy producers, including power generation companies (especially those operating wind farms and nuclear facilities), and major oil and gas operators involved in deep-water exploration and pipeline infrastructure development. Furthermore, heavy industrial manufacturers involved in shipbuilding, mining equipment production, and large-scale civil engineering firms constructing bridges, tunnels, and structural foundations constitute significant segments. These buyers prioritize safety, reliability, traceability of applied load, and rapid deployment capabilities, often demanding full certification and specialized training services alongside the purchase or rental of the tensioning equipment. They are characterized by procurement processes that prioritize long-term asset reliability over initial purchase price, focusing on Total Cost of Ownership (TCO).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Enerpac Tool Group, SPX FLOW Inc., Hydratight (Actuant Corporation), Boltight (Nord-Lock Group), ITH Bolting Technology, HTL Group, TorsionX, HI-FORCE Hydraulics, Tentec Limited, Powermaster Tools, Atlas Copco (Chicago Pneumatic), Applied Bolting Technology, FPT Fluid Power Technology, WREN Hydraulic Tools, Valley Fastener Group, SMC Hydraulic Tools, Torc LLC, Titan Technologies, Norbar Torque Tools, Sealweld Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydraulic Tensioner Market Key Technology Landscape

The contemporary technological landscape in the Hydraulic Tensioner Market is defined by a strong emphasis on smart integration, material science advancements, and enhanced ergonomic design. A primary development involves the widespread adoption of smart tensioners equipped with embedded sensors (strain gauges and pressure transducers) capable of measuring and transmitting real-time operational data. This data includes the exact load applied, environmental temperature, and cycle duration. This integration facilitates immediate quality verification on-site and feeds into digital twin systems, enhancing the asset management capabilities of end-users. The implementation of Bluetooth or Wi-Fi connectivity allows for wireless data transfer to tablets or centralized monitoring systems, simplifying traceability and compliance documentation, which is paramount in regulated industries like nuclear power and aerospace.

Furthermore, significant technological effort is directed toward improving the durability and power-to-weight ratio of the equipment. Manufacturers are leveraging advanced composite materials and higher-grade stainless steels to reduce the overall weight of tensioner bodies, enhancing portability and reducing physical strain on operators, thereby directly improving workplace safety. Parallel innovation in hydraulic pump technology focuses on creating lighter, more efficient, and often battery-powered hydraulic power units (HPUs) that can sustain extremely high pressures (up to 2500 bar) with greater reliability and less maintenance overhead. These advanced HPUs often feature integrated data logging capabilities, removing the reliance on external recording devices.

Another crucial technological frontier is the development of modular and application-specific tensioning systems. Customization using computer-aided design (CAD) and simulation tools allows manufacturers to rapidly produce specialized tensioners for unique bolt sizes and flange geometries, minimizing the necessity for complex, multi-tool setups. Innovations in sealing technology, specifically focusing on advanced elastomer and metallic seals, enable tensioners to operate effectively in harsh environments, including extreme cold (arctic operations) or high temperatures (thermal power plants), while minimizing fluid leakage and maximizing operational lifespan between service intervals. The push for automated tensioning systems, utilizing robotic arms in conjunction with hydraulic tensioners, is also gaining traction, particularly in mass production environments like turbine assembly.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market due to massive governmental spending on infrastructure development (e.g., high-speed rail, ports, bridges) and rapid industrialization across China, India, and ASEAN nations. The region is home to the world's largest expansion of wind energy capacity, both onshore and offshore, driving exceptional demand for robust hydraulic tensioning tools for turbine installation and maintenance. The burgeoning manufacturing sector, especially in heavy machinery and shipbuilding, further cements APAC's market leadership potential.

- North America: North America represents a mature, high-value market characterized by stringent safety standards and a high focus on MRO activities in the energy sector. Demand is driven by the maintenance and life extension of aging oil and gas infrastructure, power grid modernization, and significant investment in domestic aerospace and defense manufacturing. The region shows high adoption rates for technologically advanced, IoT-enabled smart tensioners, prioritizing data traceability and operational efficiency.

- Europe: Europe is a key market, propelled by pioneering investments in offshore wind energy and nuclear power infrastructure. Countries like Germany, the UK, and Scandinavian nations have robust regulatory frameworks demanding the highest quality and precision in bolted joint management, favoring European and certified international suppliers. The market is also heavily supported by a strong rental culture, offering flexibility to contractors working on complex civil engineering and power projects.

- Middle East and Africa (MEA): Growth in MEA is fundamentally tied to large-scale upstream oil and gas exploration and production projects, requiring specialized tensioners capable of withstanding extreme desert and marine conditions. Massive investment in petrochemical refining capacity and diversification projects in countries like Saudi Arabia and the UAE drive sustained demand for high-performance hydraulic tools.

- Latin America (LATAM): LATAM presents emerging opportunities, linked primarily to mining operations, infrastructure upgrades, and the development of regional oil and gas reserves (e.g., Brazil’s pre-salt fields). Market adoption is gradual, with a growing trend towards professional, certified bolting solutions replacing traditional methods as industrial standards mature.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydraulic Tensioner Market.- Enerpac Tool Group

- SPX FLOW Inc.

- Hydratight (Actuant Corporation)

- Boltight (Nord-Lock Group)

- ITH Bolting Technology

- HTL Group

- TorsionX

- HI-FORCE Hydraulics

- Tentec Limited

- Powermaster Tools

- Atlas Copco (Chicago Pneumatic)

- Applied Bolting Technology

- FPT Fluid Power Technology

- WREN Hydraulic Tools

- Valley Fastener Group

- SMC Hydraulic Tools

- Torc LLC

- Titan Technologies

- Norbar Torque Tools

- Sealweld Corporation

Frequently Asked Questions

Analyze common user questions about the Hydraulic Tensioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of hydraulic tensioning over traditional torque methods?

The primary advantage is precision and consistency. Hydraulic tensioning directly stretches the bolt, ensuring the axial load is applied uniformly without introducing frictional losses or torsional stress, resulting in significantly higher accuracy and improved joint integrity compared to imprecise torque methods.

Which industrial sectors are the largest consumers of hydraulic tensioners globally?

The largest consuming sectors are Power Generation, particularly wind and nuclear power plants, and the Oil & Gas industry (subsea and onshore pipelines), due to their critical reliance on secure, high-integrity bolted joints in high-stress, dangerous, or inaccessible environments.

How is IoT technology impacting the future design of hydraulic tensioners?

IoT integration is driving the development of 'smart' tensioners that include embedded sensors for real-time data logging and transmission. This facilitates automatic load verification, ensures procedural compliance, and supports centralized predictive maintenance programs, moving the market toward data-driven joint management.

What is the key growth restraint currently affecting the Hydraulic Tensioner Market?

The main restraint is the high initial capital investment required for high-quality, certified hydraulic tensioning systems and their associated power packs. Furthermore, the mandatory requirement for frequent, specialized calibration and maintenance adds to the equipment's long-term operating cost.

Why is the Asia Pacific (APAC) region experiencing the fastest growth in this market?

APAC growth is driven by massive government-backed infrastructure projects, rapid industrial expansion, and extensive investment in renewable energy capacity, especially offshore wind farms, which necessitate large volumes of reliable, high-specification hydraulic tensioning tools.

The global Hydraulic Tensioner Market analysis demonstrates a shift from basic mechanical tools to sophisticated, digitally integrated fastening solutions essential for safety and reliability across heavy industries. The market's consistent growth rate of 6.8% CAGR reflects sustained investment in critical global infrastructure, particularly in the energy transition sectors. The reliance on precision equipment mandates rigorous quality control and specialized manufacturing processes, positioning established players with robust service networks advantageously. The ongoing trend towards automation and AI-driven predictive maintenance will continue to redefine product offerings, transforming tensioners from simple tools into integral components of industrial asset management systems. Key regional dynamics show APAC dominating growth due to rapid industrialization, while North America and Europe lead in technological adoption, emphasizing quality, certification, and integrated data solutions to manage complex, aging critical assets. The core value proposition remains the enhanced safety and operational lifespan achieved through precise, non-torsional bolt loading.

Further examination of the technology trajectory confirms that modular design and high-pressure capabilities are critical for future market penetration. As engineers design machinery with higher operational stresses, the demand for tensioners exceeding 2000 bar pressure rating will escalate. The competitive strategy for market leaders increasingly involves expanding global service centers, offering comprehensive training programs, and developing customized tooling solutions that adhere to hyper-specific client requirements, moving beyond standardized product catalogs. Environmental considerations, such as the use of biodegradable hydraulic fluids and pressure to reduce waste through equipment longevity, are beginning to influence purchasing decisions, particularly in environmentally sensitive sectors like marine and offshore operations. This dedication to precision technology ensures the Hydraulic Tensioner Market maintains its vital role in global industrial security and structural integrity.

In terms of specific application segments, the maintenance and repair segment (MRO) presents a constant, stable revenue stream, contrasting with the more volatile demand from new construction projects. MRO activities require a vast array of tensioner sizes and customization options to service diverse existing equipment efficiently. This necessity drives the success of rental markets, which provide immediate access to calibrated tools without forcing end-users into significant capital expenditure, smoothing demand fluctuations. Therefore, companies investing heavily in global rental fleet management and rapid logistics are securing a disproportionately large share of the short-term project market. The integration of augmented reality (AR) in field service operations is also an emerging technology, enabling remote diagnostics and instruction for technicians performing maintenance or calibration procedures on tensioners in isolated or hazardous locations, further enhancing operational efficiency and lowering specialized labor costs.

The continuous evolution of materials used in fastener technology itself also directly impacts tensioner design. As manufacturers develop stronger bolt materials, the hydraulic tensioners must be designed to handle exponentially higher loads while maintaining compact size and safety ratings. This pressure for increased power density often leads to intensive research in advanced metallurgy for the tensioner bodies and innovative sealing mechanisms to prevent high-pressure leakage. Successfully navigating these technological challenges requires substantial R&D investment, reinforcing the barriers to entry for new competitors. The market's structural reliance on specialized knowledge, certification bodies, and established supply chains confirms its maturity and specialization, ensuring that growth is driven primarily by quality and technological differentiation rather than volume.

A final point of consideration is the regulatory landscape, which serves as a powerful market driver, especially in North America and Europe. Stricter mandates concerning structural integrity in wind energy and oil platforms necessitate certified bolting procedures, often making hydraulic tensioning the only viable, auditable method. Regulatory bodies increasingly require verifiable proof of applied load, giving substantial impetus to the adoption of smart, data-logging tensioners. These regulatory demands not only accelerate the phase-out of older, unverified torquing methods but also continuously push the industry toward higher standards of precision and documentation, directly benefiting manufacturers who invest in compliance features and digital reporting capabilities.

The strategic implications for market participants involve emphasizing integrated service models where the sale of hardware is bundled with comprehensive support, including calibration contracts, specialized operator training, and data analytics dashboards for managing joint integrity across the client’s asset portfolio. This approach creates sticky customer relationships and elevates the value proposition beyond mere tool provision. Companies capable of offering globally consistent service quality will capture major contracts from multinational energy and construction firms. Furthermore, future mergers and acquisitions will likely focus on acquiring specialized subsea technology expertise or expanding regional service footprints, rather than simple volume consolidation, reflecting the market's emphasis on high-tech specialization. The market is increasingly a technology and service market, not just a hardware market.

The market faces external pressures related to the transition away from fossil fuels. While the oil and gas sector remains a crucial application segment, the explosive growth in offshore renewables provides a long-term hedge against potential decline in hydrocarbon-related activity. Manufacturers are actively retooling their product lines to meet the massive requirements of wind turbine fabrication and deep-sea foundation assembly, which demand highly specialized, corrosion-resistant tensioners built for extreme marine environments. This sector shift is driving innovation in materials and operational resilience, ensuring the market's trajectory remains positive despite energy market volatility. Successfully navigating this energy transition requires strategic alignment with global decarbonization goals and tailoring marketing efforts toward sustainable energy solution providers.

Finally, competition is increasingly focusing on ergonomics and worker safety. The heavy and precise nature of hydraulic tensioners means that weight reduction and ease-of-use are significant selling points, especially in repetitive assembly line environments or confined spaces. Quick-release couplings, lighter hoses, and more compact pump designs are innovations directly aimed at improving operator handling and reducing the risk of injury. Companies that successfully combine high performance with superior ergonomics gain a distinct competitive advantage, particularly when bidding for contracts with global organizations that prioritize comprehensive worker health and safety standards. This focus on the human factor complements the technological push toward digital integration, creating a holistic strategy for market leadership in the coming decade.

The Hydraulic Tensioner Market's future is secure, anchored by non-negotiable industrial requirements for safety and structural integrity. Technological advancements, particularly the fusion of hydraulic power with IoT and AI, ensure that tensioning solutions remain central to critical infrastructure development and maintenance worldwide. The market dynamics reflect a continuous cycle of innovation driven by regulatory mandates and end-user demands for faster, safer, and more reliable bolting operations. The projected growth reaffirms the essential role of precision hydraulics in managing the world’s heavy bolted joints, making the sector highly resilient against economic downturns and fluctuations in specific industrial segments due to its diversified application base spanning energy, construction, and manufacturing.

Manufacturers must prioritize strategic investments in digital infrastructure to support the growing demand for data logging and traceability features. This includes developing user-friendly software interfaces and cloud-based data storage solutions that integrate seamlessly with existing industrial asset management platforms. The ability to provide comprehensive, tamper-proof documentation for every bolting cycle is quickly moving from a value-add feature to a mandatory requirement, particularly in highly regulated industries like nuclear and aerospace. The successful execution of a digital strategy will determine market leadership over the forecast period, emphasizing the transformation of hardware providers into integrated solution architects capable of managing full joint life cycles.

The increasing complexity of modern industrial equipment, characterized by higher operational pressures and lighter material structures, demands corresponding enhancements in tensioner precision. This has led to the adoption of advanced sensor technology that can compensate for slight variations in bolt material stretch and thread friction, ensuring the final achieved load remains within extremely tight tolerances. This level of precision is unattainable by traditional means and necessitates sophisticated calibration procedures, often performed by robotic or automated systems to eliminate human error. Consequently, the specialized service sector for hydraulic tensioner calibration and repair is growing rapidly, becoming a lucrative adjacent market opportunity for key players.

In summary, the Hydraulic Tensioner Market is robust, characterized by steady growth, high technological specialization, and strong links to global capital expenditure in energy and infrastructure. While challenges remain concerning cost and technical expertise, opportunities in smart tensioning, subsea applications, and the expansion of rental models provide a clear pathway for sustained market value accretion. The dominance of a few highly certified international players ensures quality control and technological leadership, setting a high standard for entry and competition across all global regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager