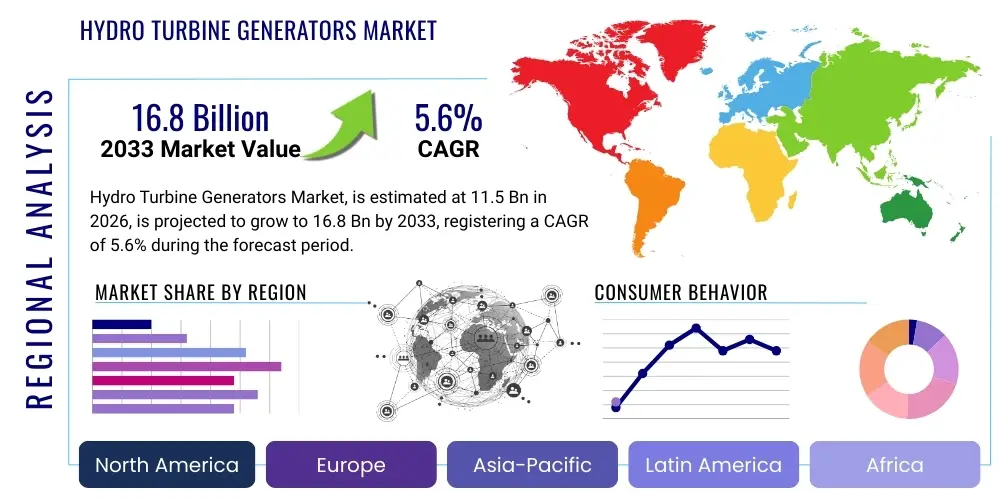

Hydro Turbine Generators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442947 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Hydro Turbine Generators Market Size

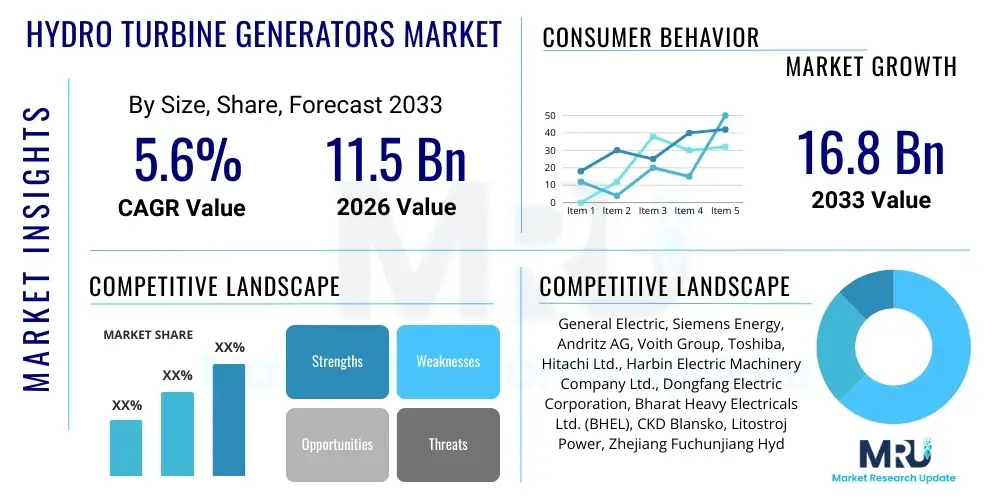

The Hydro Turbine Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $16.8 Billion USD by the end of the forecast period in 2033.

Hydro Turbine Generators Market introduction

The Hydro Turbine Generators Market is central to the global renewable energy infrastructure, providing the critical mechanical and electrical conversion necessary for hydroelectric power plants. These systems utilize the kinetic energy of flowing water, harnessed by hydro turbines (such as Francis, Kaplan, or Pelton types), and convert it into rotational mechanical energy. The generator component then transforms this mechanical rotation into electrical energy, making hydropower one of the most reliable and long-standing sources of green electricity. Product descriptions vary significantly based on the generator’s capacity, head height capability, and specific turbine coupling, ranging from large synchronous generators for massive dam projects to smaller induction generators for run-of-river installations.

Major applications for hydro turbine generators span large-scale utility power generation, particularly in conventional storage projects and increasingly in pumped storage facilities crucial for grid stability and energy storage. They also find applications in smaller decentralized projects for industrial or remote community power supply. Key benefits driving market growth include the long operational life of hydropower assets, low operational costs once infrastructure is built, and the ability of hydropower to provide flexible, dispatchable power, which is essential for balancing intermittent renewable sources like solar and wind.

Driving factors propelling market expansion include aggressive global targets for decarbonization, substantial government investment in renewable energy infrastructure, and the necessity for grid modernization to incorporate high penetration levels of variable renewables. Furthermore, the massive potential in emerging economies, particularly in Asia Pacific and Latin America, where untapped water resources can be developed for electrification, continues to fuel demand for new installations, alongside significant refurbishment and upgrading projects in mature markets like North America and Europe.

Hydro Turbine Generators Market Executive Summary

The Hydro Turbine Generators Market is currently experiencing robust growth, underpinned by increasing global focus on energy transition and grid resilience. Business trends indicate a strong shift towards modernization and digitalization, with major manufacturers integrating smart monitoring systems and predictive maintenance capabilities to enhance efficiency and reliability of existing aging infrastructure. Mergers, acquisitions, and strategic partnerships are prevalent as key players seek to expand their geographical footprint and technological portfolios, particularly in highly specialized areas such as high-head Francis turbines and variable-speed pumped storage solutions. The competitive landscape is characterized by established multinational corporations and a growing presence of specialized regional manufacturers, particularly from China and India, focusing on cost-effective solutions for developing markets.

Regionally, the Asia Pacific (APAC) continues to dominate the market in terms of new installed capacity due to ongoing major dam projects in countries like China, India, and Vietnam, driven by rapid industrialization and escalating electricity demand. North America and Europe, while having limited scope for new large-scale conventional hydro development, exhibit significant market activity focused on refurbishment, capacity expansion, and the development of crucial pumped storage projects necessary for integrating renewable energy intermittency. Latin America, rich in hydro resources, is also poised for strong growth, with Brazil, Chile, and Peru leading investments in new infrastructure, making regional trends distinctly bifurcated between new development in emerging markets and modernization efforts in developed economies.

Segment trends reveal that the Reaction turbine segment (Francis and Kaplan) holds the largest market share due to its versatility across medium to high head applications, which constitute the majority of global hydro resources. However, the Pumped Storage segment is anticipated to witness the highest Compound Annual Growth Rate (CAGR), driven by the global imperative for long-duration energy storage and grid stabilization services. In terms of capacity, the Large Capacity segment (above 100 MW) maintains substantial value, yet the Small and Micro Hydro segment is gaining traction, supported by decentralized power policies and the need for reliable off-grid solutions, reflecting diverse requirements across the global energy infrastructure spectrum.

AI Impact Analysis on Hydro Turbine Generators Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Hydro Turbine Generators Market predominantly revolve around optimizing operational efficiency, predicting equipment failure, and enhancing the overall flexibility of hydropower assets in a rapidly changing energy mix. Common questions include: "How can AI reduce downtime in aging hydro plants?", "What is the role of machine learning in optimizing pumped storage operations?", and "Are AI-driven diagnostic tools reliable for turbine health monitoring?" The key themes highlight a strong expectation for AI to transform operational expenditure (OPEX) by shifting maintenance practices from reactive or time-based to highly accurate predictive models, thereby maximizing energy output and extending asset life. Users are keenly focused on AI's capability to manage complex variables associated with water flow, weather patterns, and fluctuating grid demands to achieve optimal generation profiles, particularly for highly dynamic assets like pumped storage plants.

AI’s influence is moving beyond simple data logging into sophisticated system control and optimization. By analyzing vast datasets generated by sensors monitoring vibration, temperature, pressure, and electrical output, AI algorithms can detect subtle anomalies that precursors equipment failure, enabling precise, just-in-time maintenance interventions. This predictive capability significantly minimizes catastrophic failures and unplanned outages, crucial for maintaining the reliable base-load and peak-shaving capacity provided by hydropower. Furthermore, the application of machine learning in water resource management is becoming vital, allowing plant operators to forecast inflows and optimize reservoir levels for maximum power generation efficiency, adhering simultaneously to environmental regulations.

The implementation of AI also impacts the design and manufacturing phase. Generative design tools, powered by AI, are being utilized to simulate and optimize turbine runner geometries, improving hydraulic efficiency and reducing cavitation risks before physical prototyping. This digital transformation reduces R&D cycles and leads to the production of more efficient and durable components. As the market transitions towards greater grid flexibility, AI-driven control systems allow hydro plants to respond instantaneously to Automatic Generation Control (AGC) signals, making them indispensable allies to intermittent renewable sources and cementing the role of hydropower as a flexible, reliable backbone of future smart grids.

- Predictive Maintenance: AI algorithms analyze vibration and temperature data to forecast component degradation, reducing unplanned downtime by up to 30%.

- Operational Optimization: Machine Learning models optimize water usage and generation schedules based on real-time electricity prices and grid demand.

- Enhanced Design: AI-powered generative design tools improve turbine runner efficiency and structural integrity during the manufacturing process.

- Remote Monitoring: Integration of IoT and AI enables comprehensive, centralized monitoring and remote diagnostic capabilities for distributed hydro assets.

- Grid Stability Services: AI-driven control systems allow pumped storage plants to provide faster, more accurate frequency and voltage regulation services.

DRO & Impact Forces Of Hydro Turbine Generators Market

The Hydro Turbine Generators Market is primarily driven by the global energy transition mandate, which necessitates the development of dispatchable renewable sources and significant capacity for energy storage, inherently boosting demand for new conventional and pumped storage hydro projects. Simultaneously, the market is restrained by substantial initial capital expenditure (CAPEX) required for large hydro projects, complex regulatory hurdles related to environmental impact assessments, and lengthy project gestation periods, which often discourage private investment. Opportunities abound in the refurbishment and modernization segment, as thousands of aging hydro facilities in developed regions require significant upgrades to improve efficiency, extend operational life, and adapt to modern grid requirements. The impact forces acting on the market are highly influenced by geopolitical stability concerning resource access and government policies regarding renewable energy subsidies and permitting processes.

A critical driver is the increasing global need for grid stability and energy storage. Hydroelectricity, particularly through pumped storage, offers scalable, long-duration energy storage that is currently unmatched by most battery technologies in utility-scale applications, making it essential for balancing volatile solar and wind generation. This structural requirement ensures sustained long-term demand for hydro generators. However, the market faces strong resistance from environmental advocacy groups regarding the ecological impact of large dams on river ecosystems and local communities, often resulting in prolonged legal battles and increased scrutiny, thereby acting as a powerful restraint that limits new conventional installations in certain key regions.

The major opportunity lies in leveraging technological advancements, such as high-efficiency components, variable speed generators for pumped storage, and advanced digital controls, which enhance the economic viability and operational flexibility of hydro assets. Furthermore, decentralized energy policies globally are opening niche opportunities for small and mini-hydro solutions suitable for rural electrification and localized grid systems. The overall impact forces are shifting towards favorable conditions, driven by global climate commitments (the 'push' factor) and the proven longevity and reliability of hydro technology (the 'pull' factor), overcoming some of the high initial cost barriers through public financing mechanisms and carbon credit schemes.

Segmentation Analysis

The Hydro Turbine Generators Market is broadly segmented based on Type, Capacity, Application, and End-User. Analyzing these segments provides a nuanced understanding of market dynamics, revealing where investment is flowing and which technological solutions are gaining prominence. The segmentation by type is crucial as it dictates the generator specifications based on the hydraulic characteristics (head and flow) of the site, differentiating between high-head impulse systems and lower-head reaction systems. Capacity segmentation, ranging from micro to large-scale, reflects the contrasting demands of centralized utility grids versus decentralized power needs. Application segmentation clearly highlights the growing strategic importance of pumped storage in the modern energy storage landscape relative to traditional base-load generation.

The dominance of reaction turbines, particularly the Francis type, is structural, as these are suitable for the majority of the world's accessible hydro resources characterized by medium head and medium flow rates. However, the anticipated growth rate of the impulse turbine segment (e.g., Pelton) is notable, driven by the increasing development of high-head, mountainous regions where these turbines are most efficient. Furthermore, the End-User segmentation reinforces the market's primary focus on large-scale utility power generation, which accounts for the vast majority of revenue and installed capacity, yet the nascent industrial and remote microgrid segments represent significant, albeit smaller, pockets of growth driven by energy independence goals.

- By Type:

- Impulse Turbine Generators (Pelton, Turgo, Cross-flow)

- Reaction Turbine Generators (Francis, Kaplan, Propeller)

- By Capacity:

- Small Hydro (Up to 10 MW)

- Medium Hydro (10 MW to 100 MW)

- Large Hydro (Above 100 MW)

- By Application:

- Conventional Hydro (Run-of-River, Reservoir Storage)

- Pumped Storage Hydropower (PSH)

- By End-User:

- Utility/Power Generation Companies

- Industrial Users

- Residential/Commercial (Micro Hydro)

Value Chain Analysis For Hydro Turbine Generators Market

The value chain for the Hydro Turbine Generators Market is highly complex, involving multiple stages from raw material sourcing to final installation and long-term maintenance. The upstream segment primarily involves sourcing specialized high-grade materials, including stainless steel alloys for turbine runners (critical for resisting cavitation and corrosion), high-specification copper for generator windings, and complex electrical insulation materials. Key upstream activities are characterized by strict quality control and long-term relationships with material suppliers due to the bespoke nature and demanding operating environment of hydro equipment. Price fluctuations in base metals like steel and copper significantly impact the manufacturing costs of the generators.

The core manufacturing and assembly stage involves detailed engineering design, fabrication of massive components (casings, rotors, stators), precise machining of turbine components, and rigorous testing before shipment. Major original equipment manufacturers (OEMs) operate highly specialized manufacturing facilities often located near major ports or large industrial areas due to the immense size of the components. The distribution channel is crucial; due to the project-based nature of the industry, distribution is predominantly direct, involving bidding processes, long-term contracts, and customized logistics managed directly by the OEMs to the construction site. Indirect channels are rare and generally limited to the supply of standardized small hydro components or spare parts through specialized local distributors or agents.

Downstream activities are dominated by installation, commissioning, and, most importantly, post-sale services, including extensive maintenance, repair, and refurbishment (MRO). The lifecycle of a hydro generator can exceed 40–50 years, making MRO and long-term service contracts a vital source of recurring revenue for manufacturers. The success in the downstream segment is highly dependent on the manufacturer's ability to provide rapid, highly skilled technical support and spare parts availability globally. Furthermore, the integration phase—connecting the generator output to the grid infrastructure—involves third-party electrical contractors and utility regulatory bodies, emphasizing the collaborative, multi-stakeholder nature of project completion.

Hydro Turbine Generators Market Potential Customers

The primary customer base for hydro turbine generators consists of entities involved in large-scale electricity generation and transmission infrastructure development. The most significant end-users are national and regional Utility and Power Generation Companies (both public and private), which undertake the construction of major conventional reservoir dams and pumped storage facilities. These utilities demand highly reliable, custom-engineered, large-capacity generators capable of decades of continuous service, often seeking partnerships or turnkey solutions from major global OEMs who can manage the entire project lifecycle, from design to commissioning and long-term maintenance.

A rapidly growing segment of potential customers includes Independent Power Producers (IPPs) and developers focusing on renewable energy portfolios. These entities are increasingly investing in medium-scale hydro projects and especially in pumped storage facilities to fulfill grid contracts requiring firm, dispatchable power to complement solar and wind farms. Their purchasing decisions are often driven by economic returns, efficiency guarantees, and the speed of project execution, leading them to favor standardized components where possible, or high-efficiency, variable-speed generators for flexible operation.

Furthermore, government agencies and regional development banks in emerging economies constitute crucial customers, particularly for financing and overseeing new infrastructure development aimed at rural electrification or industrial growth. Finally, a niche market exists within large industrial users (e.g., mining operations, large manufacturing plants) seeking localized, captive power solutions through run-of-river or small hydro installations to ensure energy security and reduce operational costs. These customers prioritize robustness, ease of operation, and low maintenance requirements for their localized power systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $16.8 Billion USD |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric, Siemens Energy, Andritz AG, Voith Group, Toshiba, Hitachi Ltd., Harbin Electric Machinery Company Ltd., Dongfang Electric Corporation, Bharat Heavy Electricals Ltd. (BHEL), CKD Blansko, Litostroj Power, Zhejiang Fuchunjiang Hydropower Equipment Co., Ltd., Wartsila, Mitsubishi Heavy Industries, SNC-Lavalin, Power Machines JSC, IMPSA, Gilbert Gilkes & Gordon Ltd., Global Hydro Energy, Canyon Hydro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydro Turbine Generators Market Key Technology Landscape

The core technology landscape in the Hydro Turbine Generators Market is defined by continuous evolution towards higher efficiency, increased reliability, and enhanced flexibility, crucial for operating within dynamic modern grids. A foundational technological advancement involves the integration of Variable Speed Drive (VSD) systems, particularly for pumped storage hydropower (PSH) applications. Traditional PSH systems operate at fixed speeds, but VSD generators allow for variable input and output power control, significantly enhancing the flexibility and efficiency of the plant when operating in both pumping and generating modes. This allows PSH assets to provide faster and more precise ancillary services, essential for grid frequency stabilization when accommodating high volumes of intermittent solar and wind power.

Another critical area of innovation is in materials science and computational fluid dynamics (CFD). Manufacturers are utilizing advanced materials, such as specialized stainless steels and composite coatings, to improve the longevity and corrosion resistance of turbine runners, particularly minimizing the effects of cavitation erosion—a major cause of maintenance issues. Furthermore, the application of sophisticated CFD modeling and Finite Element Analysis (FEA) allows engineers to refine hydraulic profiles, leading to optimized turbine runner designs that maximize energy capture across a wider range of operating conditions, thereby boosting overall efficiency by several percentage points and significantly reducing lifecycle costs.

Finally, the entire operational and maintenance framework is being revolutionized by digitalization, integrating Industrial Internet of Things (IIoT) sensors, advanced Supervisory Control and Data Acquisition (SCADA) systems, and machine learning (ML) platforms. These digital technologies facilitate predictive maintenance strategies, continuous health monitoring, and automated operational adjustments in real-time. Smart generators are now capable of self-diagnosing anomalies, communicating performance metrics remotely, and integrating seamlessly with utility-wide asset performance management systems, ensuring maximum availability and dispatchability, thus future-proofing existing and new hydro installations against increasing grid complexity.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of new capacity installation, primarily driven by massive infrastructure projects in China, India, and Southeast Asian nations aiming to meet surging electricity demand from industrialization and population growth. China remains the world’s largest producer and consumer of hydropower, continuously investing in new large-scale dams and robust pumped storage capacity. The market in this region is characterized by high competition and the presence of dominant local manufacturers who often leverage cost advantages, making technological transfer and localized manufacturing key strategic factors for international players seeking market entry.

- North America: The market in North America is mature, characterized by minimal new conventional hydro construction but significant investment in refurbishment, modernization, and capacity uprating of existing facilities (many 50+ years old). A major focus is placed on developing new pumped storage projects in areas like California and the U.S. Northeast to support high intermittent renewable penetration. The emphasis here is on high-efficiency, advanced digital control systems, and regulatory compliance related to environmental impact mitigation and fish passage.

- Europe: Similar to North America, the European market is dominated by modernization and efficiency improvement projects, particularly in countries with high hydro potential like Norway, Sweden, and the Alpine nations (Switzerland, Austria). Europe is also a global leader in researching and deploying innovative PSH technologies, including variable-speed reversible units. Strict European Union regulations regarding environmental protection and grid stability necessitate high technological standards and robust automation in generator design and operation.

- Latin America: This region possesses vast untapped hydro resources, particularly in Brazil, Colombia, and Peru. The market is driven by national electrification strategies and the abundance of suitable high-flow river systems. While large-scale project financing can be complex, the long-term fundamentals support strong demand for large and medium capacity hydro turbine generators. Political stability and economic conditions remain critical determinants of the pace of development.

- Middle East and Africa (MEA): The MEA market is highly focused on specific large projects, such as the Grand Ethiopian Renaissance Dam (GERD) in Africa, and regional water management initiatives. While water scarcity is a restraint in some ME territories, specific countries in Sub-Saharan Africa and those with large river systems present significant opportunity for new hydro development aimed at expanding grid access and industrial power supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydro Turbine Generators Market.- General Electric

- Siemens Energy

- Andritz AG

- Voith Group

- Toshiba

- Hitachi Ltd.

- Harbin Electric Machinery Company Ltd.

- Dongfang Electric Corporation

- Bharat Heavy Electricals Ltd. (BHEL)

- CKD Blansko

- Litostroj Power

- Zhejiang Fuchunjiang Hydropower Equipment Co., Ltd.

- Wartsila

- Mitsubishi Heavy Industries

- SNC-Lavalin

- Power Machines JSC

- IMPSA

- Gilbert Gilkes & Gordon Ltd.

- Global Hydro Energy

- Canyon Hydro

Frequently Asked Questions

Analyze common user questions about the Hydro Turbine Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hydro Turbine Generators Market?

The primary driver is the accelerating global transition to renewable energy combined with the critical need for long-duration energy storage and grid flexibility, primarily fulfilled by pumped storage hydropower (PSH) facilities requiring advanced hydro turbine generators.

How is digital technology impacting the lifespan and efficiency of hydro generators?

Digitalization, through IIoT sensors and AI-driven predictive maintenance systems, allows for real-time health monitoring, optimized operational scheduling, and early fault detection, significantly extending the operational lifespan and increasing the efficiency (availability) of the generator assets.

Which geographic region dominates the market in terms of new installed capacity?

The Asia Pacific (APAC) region currently dominates the market for new installed capacity, driven by large-scale projects and ongoing massive hydroelectric infrastructure development in countries such as China and India.

What are the main types of hydro turbine generators based on water flow characteristics?

The main types are Reaction turbines (like Francis and Kaplan, suitable for medium to low head/high flow applications) and Impulse turbines (like Pelton, designed for high head/low flow applications).

What role do Variable Speed Drives (VSDs) play in modern hydro turbine generators?

VSDs enable reversible hydro turbine generators, primarily used in pumped storage, to operate efficiently at variable speeds. This flexibility is essential for rapid response to grid fluctuations, allowing PSH plants to optimize power input and output based on real-time grid demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager