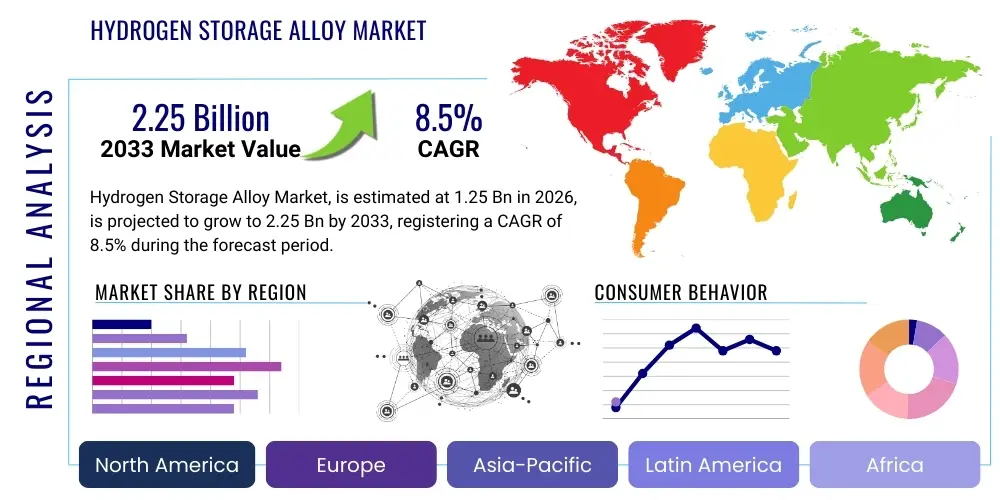

Hydrogen Storage Alloy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443647 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hydrogen Storage Alloy Market Size

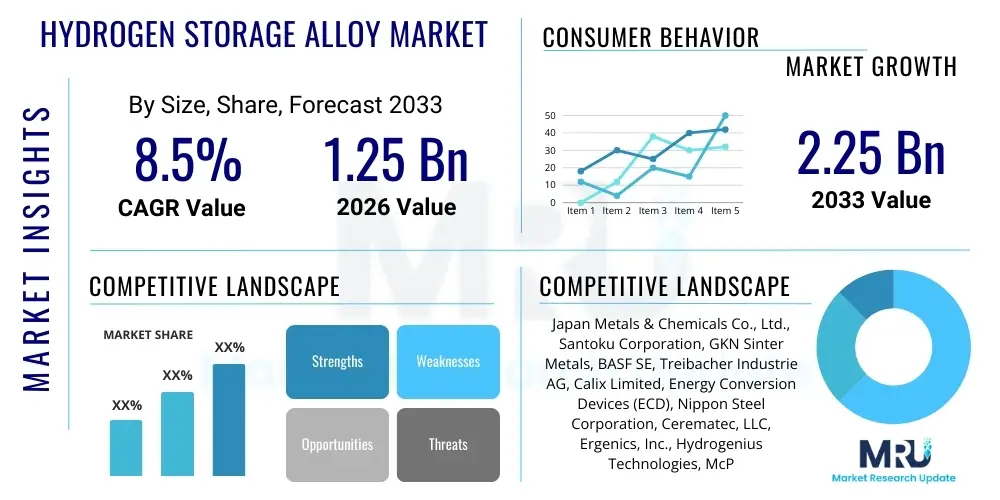

The Hydrogen Storage Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.25 Billion by the end of the forecast period in 2033.

Hydrogen Storage Alloy Market introduction

The Hydrogen Storage Alloy Market encompasses materials specifically designed to reversibly absorb and release hydrogen gas, offering a solid-state alternative to high-pressure gas tanks and cryogenic liquid storage. These alloys, primarily based on intermetallic compounds such as AB5 (e.g., LaNi5), AB2, A2B, and BCC structures, are critical enablers for the burgeoning hydrogen economy, providing enhanced safety, volumetric efficiency, and controllable desorption kinetics vital for mobile and stationary applications. The inherent stability and customizable thermodynamics of these materials position them as indispensable components in fuel cell systems, specialized battery technology, and hydrogen purification processes, directly addressing the complexities associated with conventional hydrogen handling.

Hydrogen storage alloys function by forming metal hydrides through an exothermic chemical reaction with gaseous hydrogen under moderate pressure and temperature conditions. This process allows for dense packing of hydrogen atoms within the metal lattice, achieving higher volumetric density than even liquid hydrogen, though generally lower gravimetric density. Key product descriptions include low-temperature alloys (e.g., LaNi5 variants used in nickel-metal hydride batteries) and high-temperature alloys (often titanium or vanadium-based) used for thermal energy storage and high-purity hydrogen separation. The materials are often engineered to possess fast kinetics, reversibility over many cycles, resistance to degradation, and high stability, balancing performance requirements with cost-effectiveness for mass adoption.

Major applications for hydrogen storage alloys span across stationary power generation, automotive fuel cell vehicles, portable electronics, and critical industrial gas handling. In stationary settings, they are utilized for buffer storage in renewable energy systems, managing intermittent power supply by storing excess electricity as hydrogen. For transportation, these alloys offer a safer, albeit weightier, solution for on-board hydrogen storage in prototypes and specialized vehicles. Furthermore, specialized alloys are employed in advanced hydrogen purification systems (getters) and isotope separation, highlighting their versatility beyond pure energy storage into crucial high-tech industrial processes. The overarching benefit of these alloys is the facilitation of safe, compact, and efficient hydrogen utilization, which is a significant driving factor propelling market growth.

Hydrogen Storage Alloy Market Executive Summary

The Hydrogen Storage Alloy Market is experiencing robust expansion, fundamentally driven by the global imperative for decarbonization and the increasing commitment of major economies towards hydrogen infrastructure development. Business trends highlight significant investment in R&D focusing on magnesium-based and complex hydride systems, aiming to improve gravimetric density, a critical bottleneck, particularly for vehicular applications. Strategic partnerships between alloy manufacturers, automotive OEMs, and national laboratories are defining the commercial landscape, focusing on scalable production techniques and cost reduction through optimized material processing. The shift towards solid-state storage solutions is creating new opportunities in sectors demanding high safety standards, such as urban public transport and residential energy systems, reinforcing the market’s technological maturity.

Regional trends indicate that Asia Pacific, spearheaded by strong government backing in Japan, South Korea, and China, remains the dominant market force, particularly due to established utilization in Ni-MH batteries and ambitious national hydrogen roadmaps. Europe is witnessing accelerated growth, propelled by the European Green Deal and significant funding allocated to hydrogen valleys and cross-border infrastructure, emphasizing industrial applications and maritime transport. North America, driven by the US Department of Energy’s Hydrogen Shot initiative and associated tax credits, is ramping up domestic manufacturing capabilities, focusing heavily on reducing the cost of electrolyzers and associated storage mediums, thereby boosting demand for high-performance alloys.

Segment trends reveal that the intermetallic alloy category, particularly AB5 type, holds the largest market share due to its proven performance and wide adoption in commercial products, although novel materials like complex hydrides are exhibiting the fastest growth trajectory driven by their theoretical potential for high gravimetric capacity. Application-wise, stationary power storage and industrial buffer systems are the most lucrative segments currently, benefiting from large-scale utility projects. However, the automotive segment is projected to show accelerated growth toward the latter half of the forecast period as technological advancements address weight constraints. Furthermore, the rising demand for high-purity hydrogen across semiconductor and specialty chemical industries is bolstering the market for getter alloys.

AI Impact Analysis on Hydrogen Storage Alloy Market

Common user questions regarding AI's influence center on how computational methods can accelerate the discovery and optimization of novel alloy compositions, specifically focusing on overcoming the persistent challenge of improving gravimetric density without compromising kinetics or cyclability. Users often inquire about AI's role in predicting material degradation mechanisms, optimizing synthesis processes (e.g., milling parameters, sintering temperatures), and designing functional materials with targeted thermodynamic properties. Key themes summarize to expectations that AI will drastically shorten the material development cycle, reduce expensive experimental iterations, and potentially unlock commercial viability for previously theoretical alloy systems that require highly precise atomic manipulation and predictive modeling.

AI and Machine Learning (ML) are transforming the materials science pipeline, enabling researchers to sift through vast chemical compositional spaces far more efficiently than traditional high-throughput screening. Predictive models, often employing deep learning techniques, can correlate synthesis parameters with resulting hydride stability and hydrogen absorption/desorption kinetics, offering precise guidelines for experimental synthesis. This data-driven approach allows manufacturers to rapidly optimize existing alloys for specific end-use requirements, such as enhanced tolerance to impurities or improved performance under extreme temperatures, thereby decreasing time-to-market for next-generation solid-state hydrogen storage solutions.

Furthermore, AI facilitates predictive maintenance and quality control within the manufacturing environment for hydrogen storage components. By analyzing operational data from prototypes and installed systems, ML algorithms can identify subtle indicators of material fatigue, predict cycling lifespan, and optimize charging/discharging protocols to maximize the longevity and safety of the storage units. This integration of smart monitoring enhances the overall reliability and cost-effectiveness of hydrogen storage infrastructure, addressing one of the major commercial hurdles facing widespread adoption of hydrogen technologies. The ability of AI to model complex, multi-component phase diagrams significantly lowers the barrier to entry for developing novel, high-capacity lightweight alloys, moving the industry closer to meeting the stringent targets set by energy initiatives globally.

- Accelerated discovery of high-capacity lightweight alloys through predictive modeling.

- Optimization of synthesis and manufacturing parameters (e.g., milling time, annealing temperature) using ML algorithms.

- Enhanced quality control and failure prediction systems for long-term operational safety and reliability.

- Modeling of complex thermodynamic behaviors and phase transitions under varying operational conditions.

- Reduction in R&D costs and experimental cycles required to commercialize new storage materials.

DRO & Impact Forces Of Hydrogen Storage Alloy Market

The market is primarily Driven by unprecedented global governmental investment in hydrogen infrastructure and the escalating demand for reliable, safe, and compact energy storage solutions to facilitate the transition to renewable energy systems. The proven safety record of solid-state storage compared to high-pressure gaseous storage provides a significant competitive advantage. However, the market faces significant Restraints, chiefly the low gravimetric density of currently commercialized alloys, making them less competitive for long-range mobile applications where weight is critical. High initial capital costs associated with rare-earth metal precursors (for AB5 alloys) and complex manufacturing processes also limit rapid market penetration. Substantial Opportunities lie in the development of lightweight, affordable magnesium-based hydrides and complex hydrides (e.g., alanates, borohydrides) that offer improved gravimetric densities, alongside expansion into niche markets like drones, specialty vehicles, and highly localized stationary power buffering. These factors interact to create compelling Impact Forces that dictate the pace of technological innovation and subsequent commercialization.

Segmentation Analysis

The Hydrogen Storage Alloy Market is comprehensively segmented based on the type of alloy, the specific material utilized, and the end-use application, providing a granular view of market dynamics and specialized technological requirements. The alloy type segmentation categorizes materials based on their crystallographic structure and stoichiometric ratio, influencing their storage capacity and operational temperature range. Material segmentation focuses on the key metallic components driving the hydride formation, such as rare earths or transition metals, which determines cost and performance metrics. Application segmentation highlights the diverse utilization landscape, ranging from portable electronics to large-scale industrial buffering, each requiring tailored alloy characteristics.

Intermetallic alloys currently dominate the revenue landscape due to their maturity and reliability, particularly in Ni-MH battery applications, which serve as a critical foundation for market revenue. However, the future growth trajectory is heavily skewed toward novel materials like complex hydrides, driven by aggressive R&D goals aimed at achieving high gravimetric capacity for fuel cell electric vehicles (FCEVs). The strategic importance of optimizing performance across diverse segments necessitates targeted innovation, for example, developing high-pressure, high-temperature tolerant alloys for industrial hydrogen purification, versus low-pressure, ambient-temperature alloys for portable electronic energy supply, ensuring market resilience and diversification.

- By Alloy Type:

- Intermetallic Alloys (AB5, AB2, BCC, etc.)

- Complex Hydrides (Alanates, Borohydrides)

- Chemical Hydrides

- Others (e.g., Amides, Imides)

- By Material:

- Rare Earth-Nickel (LaNi5 variants)

- Titanium-based Alloys (TiFe, TiV)

- Magnesium-based Alloys (MgH2)

- Vanadium-based Alloys

- By Application:

- Stationary Power Storage (Grid stabilization, residential backup)

- Automotive (Fuel Cell Electric Vehicles)

- Portable Electronics and Small Power Devices

- Industrial Hydrogen Purification and Compression

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hydrogen Storage Alloy Market

The value chain for the Hydrogen Storage Alloy Market begins with the highly specialized Upstream Analysis involving the sourcing and refinement of critical raw materials, primarily rare earth elements (like Lanthanum and Cerium), transition metals (Nickel, Titanium, Vanadium), and specialty precursors for complex hydrides (Magnesium, Boron). The upstream phase is characterized by geopolitical factors influencing rare earth supply stability and the high energy intensity required for initial metal production. Subsequent stages involve the intricate alloying and powder metallurgy processes, where precise stoichiometry and microstructure control are paramount to achieving desired storage properties, often requiring specialized vacuum induction melting and mechanical alloying techniques. Efficiency and purity at this stage directly impact the final product performance and cost.

The core manufacturing stage transitions into product fabrication, where the refined alloy powders are shaped into usable components, such as cartridges, tanks, or heat exchangers, designed to maximize heat transfer—a crucial factor given the exothermic nature of hydrogen absorption. Distribution channels involve both Direct and Indirect methods. Direct distribution is common for large-volume industrial clients (e.g., utility companies or specialized FCEV manufacturers) requiring tailored specifications and engineering support. Indirect channels utilize specialized distributors and system integrators who incorporate the alloy components into broader energy storage or fuel cell systems before delivery to end-users.

The Downstream Analysis focuses on system integration, installation, and end-of-life management. System integrators combine the alloy storage units with balance-of-plant components, including pressure regulators, cooling systems, and sensors. Effective integration is essential for ensuring operational safety and maximizing system efficiency across diverse applications, from high-cycle Ni-MH batteries to large-scale stationary hydrogen buffer storage. Due to the high value of precursor metals, recycling and material recovery are increasingly important downstream activities, closing the loop and mitigating supply chain risks associated with critical minerals, thus contributing to the sustainability of the overall hydrogen economy.

Hydrogen Storage Alloy Market Potential Customers

The primary End-Users/Buyers of hydrogen storage alloys are diverse, spanning multiple industrial, energy, and transportation sectors, unified by the requirement for safe, reliable, and energy-dense hydrogen handling. The largest current segment includes battery manufacturers, specifically those producing advanced Nickel-Metal Hydride (Ni-MH) batteries utilized in hybrid electric vehicles (HEVs) and specific consumer electronics, where the alloy serves as the negative electrode material. Furthermore, utility companies and industrial gas providers constitute significant potential customers, seeking large-scale stationary storage solutions for grid stabilization, peak shaving, and managing hydrogen pipeline networks. These customers prioritize long lifespan, high cycle stability, and integration ease.

Another rapidly emerging customer base comprises automotive OEMs and specialized vehicle manufacturers (e.g., forklifts, heavy-duty trucks, maritime vessels) focused on developing zero-emission fuel cell technologies. While current FCEVs predominantly use high-pressure gaseous storage, ongoing efforts to improve gravimetric density in solid-state alloys position them as future key components for niche FCEV markets or improved safety in passenger vehicles. These clients demand materials that meet stringent safety standards and offer high operational performance under dynamic load conditions. Additionally, research institutions and governmental defense/aerospace entities are key buyers, procuring specialized alloys for high-purity hydrogen generation, isotope separation, and specialized lightweight power systems for remote or critical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Japan Metals & Chemicals Co., Ltd., Santoku Corporation, GKN Sinter Metals, BASF SE, Treibacher Industrie AG, Calix Limited, Energy Conversion Devices (ECD), Nippon Steel Corporation, Cerematec, LLC, Ergenics, Inc., Hydrogenius Technologies, McPhy Energy, Mitsubishi Heavy Industries, Metal Hydride Development (MHD), SAFC Hitech, Höganäs AB, Hunan Corun New Energy Co., Ltd., FDK Corporation, Tianjin Kingyee New Material Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Storage Alloy Market Key Technology Landscape

The technological landscape of the Hydrogen Storage Alloy Market is defined by the continual pursuit of materials exhibiting high gravimetric and volumetric storage density, rapid kinetics, and thermodynamic stability near ambient conditions. Current commercial technology heavily relies on intermetallic compounds, specifically the AB5 (e.g., LaNi5) and AB2 (Laves phase) alloys, which offer excellent cycling stability and manageable operating pressures, making them ideal for applications such as Ni-MH batteries and certain small-scale storage devices. Advancements in this domain focus on doping the base alloys with transition metals (e.g., Cobalt, Aluminum) to fine-tune the plateau pressure and hysteresis, thereby improving efficiency and reducing the heat management burden during operation. Mechanical alloying and high-energy ball milling are standard processing techniques used to create nanocrystalline structures, enhancing surface area and accelerating absorption kinetics.

The primary area of intense research and technological innovation centers on lightweight materials, predominantly magnesium-based alloys and complex hydrides like sodium alanates (NaAlH4) and lithium borohydrides (LiBH4). Magnesium hydride (MgH2) offers a high theoretical gravimetric capacity (around 7.6 wt%), significantly exceeding intermetallic capabilities, but its commercial viability has historically been hindered by extremely high desorption temperatures and sluggish kinetics. Recent breakthroughs involve nanostructuring the MgH2 using advanced catalysts (e.g., transition metal oxides or carbon scaffolds) to dramatically lower the activation energy required for hydrogen release, pushing its operational window closer to practical temperatures (around 150-250°C). This catalytic enhancement represents a major technological pivot point.

Furthermore, research into chemical hydrides and novel materials, such as metal-organic frameworks (MOFs) and porous carbon materials, continues, although these are typically geared towards niche, extremely low-temperature, or specialized applications. The integration of advanced thermal management systems (TMS) is equally critical technology, as the highly exothermic nature of hydrogen absorption requires efficient heat dissipation to maintain fast charging rates and prevent material damage. The development of integrated heat exchanger technology, often utilizing microchannel designs or phase change materials (PCMs), is becoming standard practice to ensure the optimal performance and longevity of solid-state storage tanks, supporting the safe and effective utilization of hydrogen storage alloys in large-scale systems.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Hydrogen Storage Alloy Market, primarily driven by substantial investment in FCEV development and the robust established market for Ni-MH batteries, especially in Japan, South Korea, and China. Government initiatives, such as Japan's Basic Hydrogen Strategy, mandate the expansion of hydrogen infrastructure and promote research into high-density storage solutions. China’s vast manufacturing capacity and focus on scaling up fuel cell technologies for heavy transport and stationary applications ensure continuous high demand for both established intermetallic alloys and advanced lightweight materials.

- Europe: Europe represents a high-growth market fueled by ambitious decarbonization goals under the European Green Deal and extensive funding through programs like the Clean Hydrogen Partnership. The focus here is on integrating hydrogen storage into renewable energy systems for grid balancing and leveraging solid-state storage for industrial clusters and maritime applications. Countries like Germany and the Netherlands are leading in developing localized hydrogen ecosystems (Hydrogen Valleys), driving demand for large-scale, stationary alloy-based storage systems that prioritize safety and volumetric efficiency.

- North America: The market in North America, centered in the United States and Canada, is accelerating due to targeted federal support, including tax credits and research grants aimed at achieving cost parity for clean hydrogen technologies. Research is heavily concentrated on developing highly efficient, low-cost hydrides to meet the Department of Energy's targets for vehicular storage. The region exhibits high demand for high-purity hydrogen, particularly in the semiconductor and chemical industries, bolstering the market for specialty getter alloys used in purification processes.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are nascent but hold significant long-term potential. In the MEA, rich natural gas resources are positioning countries like Saudi Arabia and the UAE as future global hydrogen export hubs ("blue hydrogen" initiatives), creating a need for robust, large-scale stationary storage and transport solutions. LATAM's growth is tied to utilizing renewable energy sources (e.g., Chile's green hydrogen plans) to power local industry, necessitating secure and efficient buffer storage systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Storage Alloy Market.- Japan Metals & Chemicals Co., Ltd.

- Santoku Corporation

- GKN Sinter Metals

- BASF SE

- Treibacher Industrie AG

- Calix Limited

- Energy Conversion Devices (ECD)

- Nippon Steel Corporation

- Cerematec, LLC

- Ergenics, Inc.

- Hydrogenius Technologies

- McPhy Energy

- Mitsubishi Heavy Industries

- Metal Hydride Development (MHD)

- SAFC Hitech

- Höganäs AB

- Hunan Corun New Energy Co., Ltd.

- FDK Corporation

- Tianjin Kingyee New Material Technology Co., Ltd.

- UBE Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Hydrogen Storage Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety benefits of using hydrogen storage alloys?

Hydrogen storage alloys offer inherent safety advantages over compressed gas or cryogenic liquid storage because hydrogen is chemically bound within the solid metal lattice at lower pressures. In the event of damage, hydrogen release is typically slower and more controllable, significantly reducing explosion risk compared to catastrophic rupture of high-pressure tanks.

What is the main challenge limiting the widespread adoption of solid-state hydrogen storage in vehicles?

The primary constraint is the low gravimetric density (storage capacity relative to weight) of currently commercialized alloys. While they offer high volumetric density, the heavy weight of the metal host material reduces overall vehicle efficiency and range, making them less competitive than compressed gas for long-haul FCEVs, though ongoing R&D in lightweight hydrides aims to resolve this.

How does the Hydrogen Storage Alloy Market relate to the Nickel-Metal Hydride (Ni-MH) battery industry?

The Ni-MH battery industry is a foundational segment of this market, utilizing AB5 type hydrogen storage alloys as the negative electrode material. The alloys reversibly absorb and release hydrogen ions during charge and discharge cycles, providing stable and proven performance for applications like hybrid electric vehicles.

Which types of hydrogen storage alloys show the most promising future growth potential?

Complex hydrides, such as alanates and borohydrides, along with highly catalyzed magnesium-based alloys, exhibit the highest growth potential. These materials possess high theoretical gravimetric densities crucial for future mobile applications, driven by extensive global research efforts to overcome current kinetic and thermodynamic limitations.

What role does effective thermal management play in the performance of alloy storage systems?

Effective thermal management is critical because hydrogen absorption is highly exothermic, releasing significant heat. If this heat is not rapidly dissipated, the absorption kinetics slow down dramatically. Similarly, desorption requires heat input. Advanced thermal systems ensure rapid charging/discharging rates and prevent thermal runaway, maximizing system efficiency and longevity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager