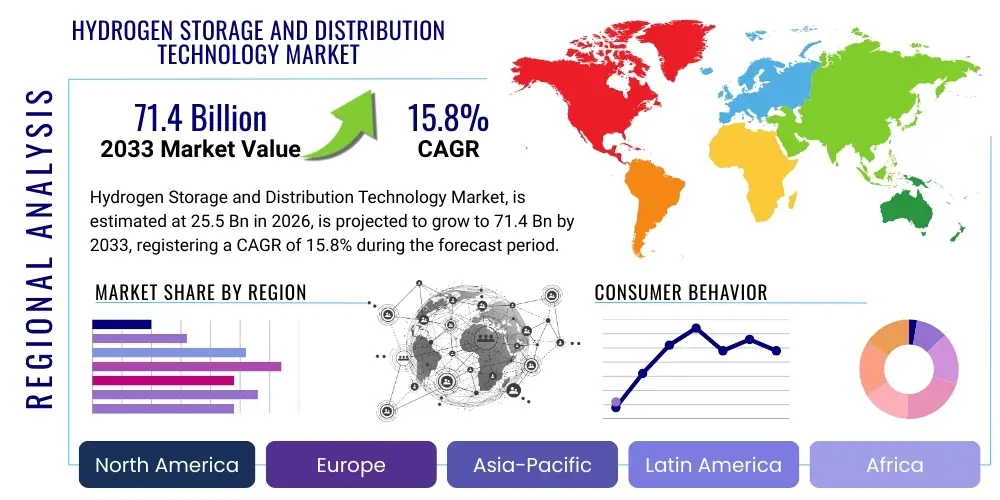

Hydrogen Storage and Distribution Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443042 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Hydrogen Storage and Distribution Technology Market Size

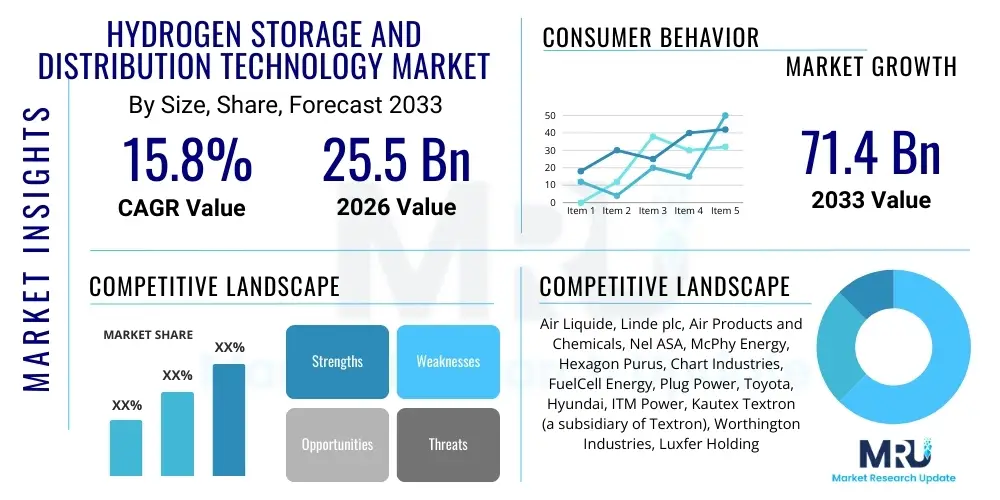

The Hydrogen Storage and Distribution Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 71.4 Billion by the end of the forecast period in 2033.

Hydrogen Storage and Distribution Technology Market introduction

The Hydrogen Storage and Distribution Technology Market encompasses the infrastructure and technological solutions essential for safely and efficiently managing hydrogen energy, a critical component of the global transition toward decarbonization. This market includes advanced solutions for storing hydrogen (such as high-pressure tanks, cryogenic liquid hydrogen storage, and material-based storage like metal hydrides) and robust distribution infrastructure (pipelines, tube trailers, and tanker ships). As governments worldwide implement ambitious net-zero targets and invest heavily in green hydrogen production via electrolysis powered by renewable energy, the efficacy and scalability of storage and distribution systems become paramount. The primary goal is to lower the levelized cost of hydrogen (LCOH) by optimizing logistics from the point of production to the final point of consumption, which spans mobility, industrial feedstock, and power generation sectors.

Product descriptions within this domain range from Type IV composite storage cylinders, crucial for Fuel Cell Electric Vehicles (FCEVs) due to their lightweight properties, to large-scale underground salt cavern storage utilized for bulk, grid-level energy balancing. Major applications are predominantly found in the transportation sector, where hydrogen offers zero-emission propulsion; heavy industry, particularly steel and cement production requiring high-temperature heat; and the energy sector, using hydrogen for long-duration energy storage (LDES) and blending with natural gas. The market’s dynamism is fueled by continuous innovation aimed at increasing volumetric and gravimetric hydrogen density, enhancing safety protocols, and reducing the energy intensity required for compression and liquefaction processes, thereby addressing fundamental technical hurdles that currently hinder widespread commercial adoption.

The core benefits derived from advancements in this market include enabling the proliferation of clean energy solutions, enhancing energy security through diversified energy carriers, and providing a reliable method for integrating intermittent renewable energy sources into the grid. Key driving factors include escalating global regulatory mandates favoring low-carbon energy, significant financial incentives and subsidies for hydrogen projects (such as those outlined in the U.S. Inflation Reduction Act and European Green Deal), and the undeniable technical necessity of hydrogen storage for stabilizing fluctuating renewable energy supplies. Without efficient and cost-effective distribution channels, hydrogen production capacity, regardless of its scale, cannot effectively meet the end-user demand, positioning storage and distribution as the vital bottleneck that market innovation seeks to alleviate.

Hydrogen Storage and Distribution Technology Market Executive Summary

The Hydrogen Storage and Distribution Technology market is undergoing rapid evolution, driven by aggressive decarbonization mandates and substantial governmental investment globally, shifting market focus from pilot projects to large-scale commercial deployment. Business trends indicate a strong move toward integrated solutions, where key players are expanding their portfolios to cover the entire hydrogen value chain, from production and liquefaction to last-mile delivery infrastructure. There is a pronounced trend toward collaborative ventures and partnerships between established energy giants, specialized technology developers, and automotive OEMs, aiming to standardize safety protocols and accelerate the deployment of large-capacity infrastructure, especially in pipeline construction and maritime transport of liquid hydrogen. Capital expenditure is increasingly directed toward optimizing existing infrastructure for hydrogen compatibility (e.g., repurposing natural gas pipelines) and developing advanced composite materials for high-pressure storage tanks to improve safety and reduce vehicle weight.

Regional trends reveal Asia Pacific, particularly Japan, South Korea, and China, as frontrunners in technology adoption, largely due to explicit national hydrogen roadmaps and investments in mobility and industrial applications. Europe demonstrates robust growth, propelled by the Green Deal, focusing heavily on establishing the ‘Hydrogen Backbone’—a transnational pipeline network—and utilizing renewable hydrogen for industrial clusters in Germany and the Netherlands. North America, leveraging the Inflation Reduction Act, is seeing a surge in development of hydrogen hubs, prioritizing large-scale storage facilities like salt caverns in regions with high renewable energy potential, cementing its role in long-duration energy storage applications.

Segment trends highlight the dominance of gaseous hydrogen storage via high-pressure vessels, primarily due to its maturity and immediate applicability in FCEVs and fueling stations, though material-based and liquid hydrogen storage technologies are gaining momentum for their superior energy density in large-volume applications. The distribution segment is witnessing significant innovation in dedicated hydrogen pipelines, which, while highly capital intensive, offer the lowest operational cost for bulk transport over long distances. Application-wise, the mobility segment remains the primary revenue driver, but the industrial power and stationary power generation segments are projected to exhibit the highest Compound Annual Growth Rate (CAGR) as commercial-scale power-to-gas projects materialize.

AI Impact Analysis on Hydrogen Storage and Distribution Technology Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) in the Hydrogen Storage and Distribution Technology Market reveals a strong focus on enhancing safety, optimizing logistics, and improving the operational lifespan of critical infrastructure. Key concerns revolve around whether AI can reliably predict failure points in high-pressure systems, how machine learning (ML) algorithms can streamline complex distribution networks involving multiple sources and intermittent demand, and the role of predictive maintenance in reducing the high capital costs associated with hydrogen infrastructure. Users expect AI to significantly contribute to the efficiency of electrolyzer integration, dynamic routing of tube trailers, and the precise monitoring of storage conditions (temperature, pressure, material stress) to prevent leaks and maximize uptime. The prevailing theme is leveraging AI and digital twins to transition the entire hydrogen supply chain from reactive maintenance to proactive, intelligent management, ensuring both economic viability and public safety.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failures in compressors, pipelines, and storage vessels, significantly reducing unexpected downtime and maintenance costs.

- Optimized Supply Chain Logistics: Implementing AI algorithms for real-time routing and scheduling of hydrogen transportation (tube trailers, liquid hydrogen tankers) based on dynamic energy prices, demand fluctuations, and traffic conditions.

- Digital Twin Modeling: Creation of virtual representations of entire distribution networks or large-scale storage facilities (e.g., salt caverns) to simulate operational scenarios, test safety protocols, and optimize efficiency before physical deployment.

- Safety and Leak Detection Enhancement: Applying AI-powered vision and sensor fusion technologies to rapidly detect minute hydrogen leaks, improving response times and overall infrastructure safety standards far beyond traditional monitoring systems.

- Process Control and Efficiency in Storage: Using AI to manage the energy-intensive processes of hydrogen compression and liquefaction, minimizing energy input required while maintaining optimal storage conditions.

DRO & Impact Forces Of Hydrogen Storage and Distribution Technology Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that shape investment and technological priorities. The primary driver is the accelerating global shift towards net-zero emissions, strongly supported by massive governmental stimuli and regulatory backing across major economies, which necessitates hydrogen as a fundamental clean energy vector for hard-to-abate sectors. Coupled with this is the increasing technical maturity and cost reduction of electrolysis technology, making green hydrogen production economically competitive in certain regions, which naturally pulls demand for enhanced storage and distribution solutions. The ability of hydrogen to serve as a critical component for long-duration energy storage (LDES) to manage grid stability in systems with high penetration of variable renewables further solidifies its essential role, compelling infrastructure investment.

However, significant restraints impede the rapid scaling of this market. Foremost among these is the high capital expenditure (CapEx) required for developing dedicated hydrogen infrastructure, particularly high-pressure pipelines and large-scale liquefaction plants, which currently lack the economies of scale seen in natural gas infrastructure. Technical challenges, such as the inherent difficulty of storing hydrogen due to its low volumetric energy density (requiring extremely high pressure or low cryogenic temperatures) and the phenomenon of hydrogen embrittlement in conventional steel piping, necessitate expensive materials and complex engineering solutions. Furthermore, public perception and safety concerns surrounding the transport and storage of a flammable gas, coupled with the lack of universally standardized international safety codes and regulations, create friction points for cross-border infrastructure projects.

Opportunities abound in leveraging existing infrastructure and pioneering novel technologies. Repurposing or blending hydrogen into existing natural gas pipeline networks represents a near-term opportunity to scale distribution capacity rapidly, pending technical feasibility and material compatibility studies. Long-term opportunities lie in developing novel material-based storage solutions, such as metal-organic frameworks (MOFs) or advanced chemical hydrides, which promise higher density storage under milder conditions, drastically simplifying distribution logistics. The expansion into niche markets, such as utilizing hydrogen for port operations (maritime bunkering) and aviation, alongside the development of international hydrogen trade corridors, offers substantial growth potential, transforming regional supply chains into globally interconnected energy networks and maximizing the utilization of geographically concentrated renewable energy resources.

Segmentation Analysis

The Hydrogen Storage and Distribution Technology Market is meticulously segmented based on the physical state of storage, the type of distribution channel used, the specific storage technology employed, and the diverse applications it serves. This segmentation provides a granular view of market dynamics, revealing where capital investment is concentrated and which technological pathways are gaining traction. The market is primarily bifurcated into Storage and Distribution segments, each with intricate sub-segments reflecting the technical complexities and end-user requirements of managing hydrogen energy. Understanding these segments is crucial for stakeholders to align their investment strategies with the most promising and scalable technologies required to meet varied energy demands globally.

- By Storage Technology:

- Physical Storage (Compressed Gas Storage, Liquid Hydrogen Storage, Cryo-Compressed Hydrogen Storage)

- Material-Based Storage (Metal Hydrides, Chemical Hydrides, Adsorption Technologies)

- Underground Storage (Salt Caverns, Depleted Oil/Gas Fields, Aquifers)

- By Distribution Channel:

- Pipelines (Dedicated Hydrogen Pipelines, Blended Natural Gas Pipelines)

- Road Transportation (Tube Trailers, Liquid Hydrogen Tankers)

- Maritime Transportation (Liquid Hydrogen Tanker Ships, Ammonia Carriers)

- Rail Transportation

- By Application:

- Mobility (Fuel Cell Electric Vehicles - FCEVs, Buses, Trucks, Forklifts, Rail, Maritime)

- Industrial Feedstock (Refining, Ammonia Production, Methanol Production, Steel Manufacturing)

- Stationary Power Generation and Grid Services (Fuel Cells, Turbines, Long-Duration Energy Storage - LDES)

Value Chain Analysis For Hydrogen Storage and Distribution Technology Market

The value chain for the Hydrogen Storage and Distribution Technology Market begins upstream with hydrogen production, primarily via Steam Methane Reforming (SMR) or water electrolysis (green hydrogen). Upstream activities focus on sourcing necessary raw materials and components: specialized steel alloys for compressors and pipeline components, carbon fiber and polymers for Type IV storage tanks, and advanced catalysts for metal hydride storage. Key upstream players include specialized material manufacturers and energy engineering firms providing high-pressure compression equipment and liquefaction units. The efficiency and cost of these upstream processes, especially the energy consumption of compression and liquefaction, directly dictate the final price of delivered hydrogen, emphasizing the strategic importance of technological breakthroughs in this stage.

The midstream segment constitutes the core of the market under review, focusing specifically on storage and distribution. Storage technologies involve the manufacturing of specialized vessels (Type I, II, III, IV, V), the engineering of cryogenic facilities, and the development of underground storage sites. Distribution channels involve pipeline construction and operation, logistics management for road-based distribution (tube trailers), and maritime shipping infrastructure. Direct distribution involves supplying hydrogen directly from a nearby production facility via dedicated pipelines to a large industrial consumer (e.g., a steel mill), bypassing intermediate storage. Indirect distribution involves transporting hydrogen via trailers or ships to decentralized refueling stations or smaller industrial clusters, requiring complex logistics management and often multiple trans-loading points, increasing both complexity and cost.

Downstream activities center on the final consumption and delivery interface, including the installation and operation of hydrogen fueling stations (HRS) for the mobility sector and the integration of storage solutions at industrial sites or power plants. The distribution channel plays a vital role here; specialized engineering firms ensure safe coupling and dispensing systems that meet stringent safety standards. The overall efficiency of the distribution system—the percentage of hydrogen produced that is successfully delivered to the end-user—is a critical metric. Optimization requires integrated planning across the entire chain, linking production output dynamically with fluctuating downstream consumption patterns, ultimately determining the economic viability of hydrogen as an energy source compared to fossil fuels.

Hydrogen Storage and Distribution Technology Market Potential Customers

The potential customers for Hydrogen Storage and Distribution Technology span a diverse range of high-energy-demand sectors and those prioritizing decarbonization, making end-user industries the primary beneficiaries of advanced storage and logistics solutions. Major customers include transportation fleet operators—both passenger vehicle OEMs investing in Fuel Cell Electric Vehicles (FCEVs) and commercial logistics companies adopting hydrogen trucks, buses, and forklifts—who require reliable, high-capacity refueling infrastructure. Given the critical need for safe, dense storage in vehicles, these customers drive demand for lightweight, high-pressure composite tanks (Type IV) and rapid dispensing technologies. The successful commercialization of hydrogen mobility hinges entirely on the efficiency and coverage of the distribution network connecting production sites to fueling stations.

Another dominant segment comprises heavy industrial users, specifically those in chemical manufacturing (ammonia, methanol), refining, and primary materials production (steel, cement). These sectors require vast, continuous volumes of hydrogen feedstock, driving demand for dedicated, large-scale distribution solutions like pipelines or bulk storage solutions such as underground caverns near industrial clusters. These clients prioritize cost stability and supply reliability, making efficient bulk distribution technologies the key selling point. As industries shift towards green hydrogen, the reliance on secure, large-scale storage becomes non-negotiable for maintaining operational continuity.

Furthermore, utility companies and Independent Power Producers (IPPs) represent a rapidly growing customer base, utilizing hydrogen for long-duration energy storage (LDES) and blending it into natural gas grids to decarbonize power generation. These customers seek massive, geo-specific storage solutions (salt caverns or depleted fields) and robust distribution methods to move hydrogen between centralized production hubs and power plants. Governments and municipal agencies, particularly those managing large public transit fleets or seeking to establish local hydrogen hubs, also act as significant potential customers, often through Public-Private Partnerships (PPPs) that mandate the initial build-out of foundational storage and distribution networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 71.4 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Liquide, Linde plc, Air Products and Chemicals, Nel ASA, McPhy Energy, Hexagon Purus, Chart Industries, FuelCell Energy, Plug Power, Toyota, Hyundai, ITM Power, Kautex Textron (a subsidiary of Textron), Worthington Industries, Luxfer Holdings, Wuxi Snaga, Doosan Fuel Cell, Sinopec, Shell, Baker Hughes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Storage and Distribution Technology Market Key Technology Landscape

The technology landscape of the Hydrogen Storage and Distribution market is characterized by a push towards higher efficiency, greater safety, and lower cost solutions across three primary fronts: compressed gas, liquid hydrogen, and material-based storage. In compressed gas storage, the transition from traditional steel tanks (Type I and II) to lightweight, high-strength carbon fiber composite tanks (Type IV) is critical, particularly for the mobility sector (700 bar pressure is the standard for FCEVs). Continuous advancements focus on reducing the cost of carbon fiber and improving liner materials to enhance gas impermeability and durability. For distribution, the primary technological hurdle lies in developing hydrogen-dedicated pipelines that can withstand potential hydrogen embrittlement effects, necessitating advanced steel alloys or specialized internal coatings to maintain infrastructure integrity over decades of operation.

Liquid Hydrogen (LH2) technology dominates the long-haul, high-volume distribution segment due to its superior volumetric energy density (approximately 845 times denser than gaseous hydrogen at ambient temperature). The technological challenge here is twofold: reducing the energy penalty associated with the cryogenic liquefaction process (which consumes about 30% of the hydrogen's energy content) and developing insulation and boil-off mitigation systems for LH2 storage tanks and maritime transport vessels. Super-insulation techniques and zero-boil-off liquefaction technologies are areas of intense research and development. Furthermore, the development of large-scale liquid hydrogen transfer pumps and loading arms compatible with high flow rates and extreme temperatures is crucial for scaling global maritime trade corridors.

Material-based storage represents the frontier of innovation, aiming to solve the density and pressure challenges simultaneously. This includes utilizing metal hydrides, which store hydrogen chemically within a solid matrix at relatively low pressures and ambient temperatures, and adsorption technologies like Metal-Organic Frameworks (MOFs) or carbon nanostructures. While these technologies offer theoretically superior gravimetric density, the primary constraints are the weight of the material itself, slow kinetics (charge/discharge rates), and thermal management issues during operation. Significant governmental and academic funding is targeting breakthroughs in these areas, as successful commercialization could revolutionize mobile and decentralized storage, making hydrogen significantly more competitive with conventional fuels.

Regional Highlights

- North America: Driven by the U.S. Inflation Reduction Act (IRA), which provides unprecedented tax credits (45V) for clean hydrogen production, the region is rapidly accelerating infrastructure development, particularly focused on establishing regional 'Hydrogen Hubs' in Texas, California, and the Midwest. The emphasis is on utilizing underground storage solutions, like salt caverns, for grid-scale energy balancing, alongside the expansion of high-pressure storage for heavy-duty trucking corridors. Canada is also making strides, utilizing its abundant hydropower for green hydrogen production and focusing on export pathways, driving demand for liquefaction and maritime distribution technologies.

- Europe: Europe is the global leader in establishing policy frameworks, notably the European Hydrogen Strategy and the REPowerEU plan, aiming for 20 million tonnes of renewable hydrogen consumption by 2030. Regional development is dominated by the 'European Hydrogen Backbone' initiative, focused on repurposing over 60% of existing natural gas pipelines for hydrogen transport. Countries like Germany, the Netherlands (Rotterdam Port), and Spain are investing heavily in coastal infrastructure for hydrogen imports and establishing industrial clusters that utilize dedicated pipelines for feedstock, creating a high demand for pipeline integrity and blending technologies.

- Asia Pacific (APAC): APAC leads in commercializing hydrogen mobility, driven by national strategies in Japan and South Korea, which emphasize FCEV deployment and establishing nationwide refueling networks. China is rapidly expanding its hydrogen infrastructure, focusing on fleet applications (buses, logistics vehicles) and developing localized supply chains leveraging both green and gray hydrogen. The region exhibits high demand for Type IV high-pressure composite tanks and the establishment of localized production and distribution centers to serve dense urban environments, driving intense competition in mobile storage unit manufacturing.

- Latin America: Characterized by abundant renewable energy resources (wind in Chile, hydro in Brazil), Latin America is rapidly emerging as a major potential exporter of green hydrogen and its derivatives (ammonia). The market focus is on developing large-scale coastal production facilities, necessitating significant investment in maritime logistics, specifically liquid hydrogen carriers and large-scale liquefaction plants. Storage demand centers around export terminal infrastructure and chemical storage for ammonia/methanol conversion.

- Middle East and Africa (MEA): Gulf nations, particularly Saudi Arabia (NEOM project) and the UAE, are investing billions in world-scale green and blue hydrogen projects, aiming to diversify their energy exports. The primary demand for storage and distribution technology is centered on bulk, export-oriented infrastructure, including massive ammonia production facilities, large storage tanks, and robust distribution logistics capable of linking production sites to international shipping lanes. Africa, specifically South Africa and Namibia, focuses on leveraging exceptional solar and wind resources for producing green hydrogen destined for European markets, spurring early-stage investment in dedicated distribution infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Storage and Distribution Technology Market.- Air Liquide

- Linde plc

- Air Products and Chemicals

- Nel ASA

- McPhy Energy

- Hexagon Purus

- Chart Industries

- FuelCell Energy

- Plug Power

- Toyota

- Hyundai

- ITM Power

- Kautex Textron (a subsidiary of Textron)

- Worthington Industries

- Luxfer Holdings

- Wuxi Snaga

- Doosan Fuel Cell

- Sinopec

- Shell

- Baker Hughes

Frequently Asked Questions

Analyze common user questions about the Hydrogen Storage and Distribution Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most cost-effective method for long-distance bulk hydrogen distribution?

The most cost-effective method for distributing bulk hydrogen over long distances is via dedicated hydrogen pipelines, which offer the lowest operational costs once capital investment is recovered. Alternatively, maritime transport of Liquid Hydrogen (LH2) or hydrogen carriers like ammonia (NH3) is cost-efficient for global, intercontinental trade.

What are the primary safety challenges associated with high-pressure hydrogen storage tanks?

The primary safety challenges include ensuring structural integrity against rapid depressurization, mitigating potential leakage due to hydrogen's small molecular size, and preventing hydrogen embrittlement in metallic components. Modern Type IV composite tanks address these issues through lightweight, durable composite construction and rigorous safety testing protocols.

How is green hydrogen stored on a utility or grid-scale for long-duration energy storage (LDES)?

On a utility or grid-scale, green hydrogen is primarily stored in large underground geological formations, such as salt caverns, depleted oil/gas reservoirs, or deep aquifers. Salt caverns are currently the most technically mature and favored option due to their high capacity, sealing capabilities, and rapid cycling potential essential for LDES applications.

Which storage technology offers the highest energy density for vehicular applications?

Liquid Hydrogen (LH2) offers the highest volumetric energy density, making it suitable for heavy-duty, long-haul mobility. However, for most passenger FCEVs, 700 bar compressed gaseous hydrogen stored in Type IV composite tanks is the standard due to its faster refueling time and avoidance of complex cryogenic requirements.

What role does the repurposing of natural gas pipelines play in hydrogen distribution?

Repurposing natural gas pipelines allows for the rapid, capital-efficient scaling of hydrogen distribution capacity, often through blending hydrogen up to certain limits (typically 5-20%). Dedicated repurposing requires extensive material analysis and modification to mitigate hydrogen embrittlement, providing a vital bridge solution before dedicated hydrogen backbone networks are fully constructed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager