Hydrogen Sulfide Gas Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442516 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Hydrogen Sulfide Gas Analyzer Market Size

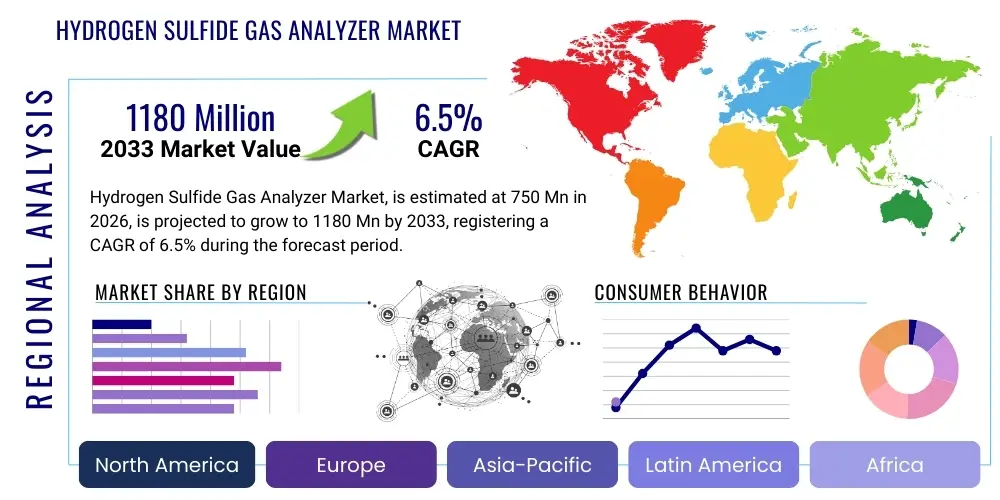

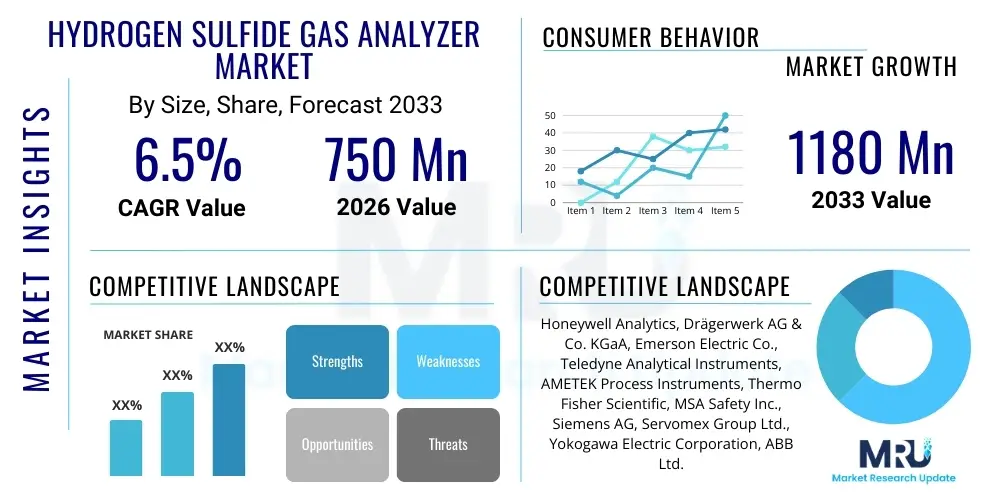

The Hydrogen Sulfide Gas Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1180 Million by the end of the forecast period in 2033.

Hydrogen Sulfide Gas Analyzer Market introduction

The Hydrogen Sulfide (H2S) Gas Analyzer Market encompasses the specialized instrumentation used for the accurate detection, measurement, and monitoring of H2S concentrations in various industrial and environmental settings. Hydrogen sulfide is a highly toxic, corrosive, and flammable gas, making its precise analysis critical for operational safety, regulatory compliance, and process optimization across several heavy industries. Product descriptions range from portable handheld devices used for spot-checking to sophisticated, continuous online monitoring systems utilizing advanced spectroscopic and electrochemical sensor technologies. These analyzers are essential tools for ensuring worker protection and preventing catastrophic failures associated with H2S exposure.

Major applications of H2S gas analyzers are predominantly found in the oil and gas sector, particularly within upstream and midstream operations where sour gas extraction and processing are common. Furthermore, the market benefits significantly from demand arising from wastewater treatment facilities, where H2S is a byproduct of anaerobic decomposition, and from the chemical manufacturing sector, where it is used or produced in various chemical processes. The primary benefit of these devices is life safety monitoring and asset integrity management, as H2S causes rapid corrosion in pipelines and equipment. Driving factors include stringent occupational safety standards mandated by international bodies like OSHA and regional environmental protection agencies, coupled with sustained investment in petrochemical infrastructure globally.

The core function of these analyzers is to provide immediate, reliable data regarding H2S levels, enabling swift mitigation measures. The technological evolution towards non-dispersive infrared (NDIR) and tunable diode laser (TDL) spectroscopy offers enhanced accuracy, reduced cross-sensitivity, and lower maintenance costs compared to traditional electrochemical sensors, thereby accelerating market adoption in challenging environments. The continuous growth of the market is intrinsically linked to industrial activity expansion, especially in regions with high sulfur content hydrocarbon reserves, reinforcing the need for continuous, highly accurate measurement solutions.

Hydrogen Sulfide Gas Analyzer Market Executive Summary

The Hydrogen Sulfide Gas Analyzer Market demonstrates robust growth, driven primarily by evolving global occupational safety regulations and heightened awareness regarding the lethal toxicity and corrosive nature of H2S. Business trends indicate a strong movement towards integrated safety solutions, where H2S analyzers are networked with broader plant safety systems, leveraging IoT capabilities for remote diagnostics and centralized data logging. Manufacturers are focusing on developing intrinsically safe, explosion-proof instrumentation suitable for hazardous area classifications, which is driving innovation in sensor design and housing materials. Mergers and acquisitions are common as key players seek to expand their technological portfolios, specifically targeting companies specializing in advanced spectroscopic techniques like TDLAS, which provides superior performance in complex gas matrices.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market segment, attributable to massive investments in chemical processing, oil refining capacity expansion, and rapidly industrializing economies like China and India, where regulatory oversight is becoming increasingly rigorous. North America, while a mature market, remains dominant in terms of revenue, spurred by hydraulic fracturing activities and the continuous operation of large-scale refineries and petrochemical complexes, necessitating continuous monitoring upgrades. European market stability is maintained by strict EU directives governing industrial emissions and worker protection, favoring high-precision, low-detection limit instruments for both fixed and portable applications.

Segment trends underscore the dominance of fixed H2S gas analyzers in terms of revenue, driven by permanent installation requirements in large-scale industrial facilities for continuous process and perimeter monitoring. However, the portable analyzer segment is exhibiting a higher growth rate, fueled by the necessity for personal safety monitoring and leak detection surveys across various sites, particularly in field services and maintenance operations. Technology-wise, the adoption of laser-based spectroscopic analyzers is accelerating over traditional electrochemical methods due to their stability, selectivity, and requirement for minimal calibration, aligning with the industry's demand for reduced total cost of ownership (TCO).

AI Impact Analysis on Hydrogen Sulfide Gas Analyzer Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Hydrogen Sulfide Gas Analyzer market revolve around how AI can enhance predictive maintenance, improve sensor accuracy by compensating for environmental variables, and enable smarter response systems. Users are keenly interested in leveraging machine learning (ML) algorithms to analyze massive volumes of real-time H2S concentration data, correlating it with operational parameters (temperature, pressure, flow rates) to predict potential sour gas leaks or system failures before they occur. The key themes summarized from user expectations involve moving beyond simple threshold alarming to comprehensive risk modeling, optimizing calibration schedules based on sensor drift analysis, and integrating multi-sensor data fusion to eliminate false alarms, thereby increasing operational reliability and reducing unnecessary downtimes associated with manual checks and unplanned maintenance.

The implementation of AI algorithms dramatically transforms how H2S monitoring systems operate, shifting them from reactive detection tools to proactive diagnostic instruments. By utilizing historical and real-time operational data, ML models can discern subtle patterns indicative of impending failures in scrubbing systems, pipelines, or ventilation controls, which might otherwise be missed by conventional threshold monitoring. This predictive capability is vital in environments where high H2S concentrations pose immediate life-threatening risks, allowing operators to intervene during early stages of deviation. Furthermore, AI facilitates automated reporting and compliance auditing by structuring and interpreting complex monitoring logs, significantly reducing the administrative burden on safety personnel.

AI also plays a crucial role in enhancing the performance and longevity of the sensor hardware itself. Machine learning techniques are applied to compensate for common sensor limitations, such as drift due to temperature fluctuations or aging, and cross-sensitivity interference from other gases present in the environment (e.g., carbon monoxide or volatile organic compounds). This smart compensation ensures that the H2S concentration readings remain highly accurate and reliable over longer operational periods, extending calibration cycles and minimizing the need for physical adjustments. The integration of AI tools is becoming a competitive differentiator, enabling manufacturers to offer 'smart' monitoring solutions that provide superior diagnostic capability and operational efficiency to end-users.

- Predictive Maintenance: AI identifies sensor degradation and system anomalies, scheduling proactive service to prevent H2S detection failure.

- False Alarm Reduction: Machine learning models analyze complex data patterns from multiple sources to validate alarms, significantly improving response credibility.

- Sensor Drift Compensation: AI algorithms automatically correct readings for environmental interference (temperature, humidity) and sensor aging, enhancing measurement accuracy.

- Regulatory Compliance Automation: Automated data logging and AI-driven pattern recognition streamline reporting processes for OSHA and EPA requirements.

- Optimized Response Protocols: Integration with plant safety systems enables AI to trigger customized, location-specific mitigation actions based on predicted risk level.

- Enhanced Data Fusion: Combining H2S sensor data with flow, pressure, and video feeds for comprehensive situational awareness.

DRO & Impact Forces Of Hydrogen Sulfide Gas Analyzer Market

The Hydrogen Sulfide Gas Analyzer market is propelled by stringent regulatory frameworks mandating industrial safety, particularly across high-risk sectors like oil and gas, refining, and chemical processing, acting as the primary driver (D). Restraints (R) primarily include the high initial capital investment required for advanced spectroscopic analyzers and the operational challenges related to frequent sensor calibration and maintenance in harsh operating conditions. Opportunities (O) lie in the burgeoning market for portable and wireless H2S monitoring solutions integrated with cloud connectivity and IoT platforms, along with expanding application scopes in emerging areas such as biogas production and geothermal energy generation. These forces collectively impact the market dynamics, necessitating continuous innovation in sensor longevity and connectivity to maintain growth momentum.

The stringent regulatory landscape globally is the most powerful growth driver. Agencies such as the Occupational Safety and Health Administration (OSHA) in the US, the European Agency for Safety and Health at Work (EU-OSHA), and equivalent national bodies impose rigorous exposure limits (typically parts per million, ppm) for H2S, compelling industries to install continuous monitoring systems. This regulatory pressure ensures a mandatory replacement cycle and continuous upgrade path for existing equipment, sustaining market demand. Furthermore, the rising awareness of the long-term health hazards associated with low-level H2S exposure, beyond immediate fatalities, drives demand for more sensitive and reliable detection limits, particularly for perimeter monitoring and environmental compliance.

However, the market faces constraints related to the technological complexity and cost of ownership. High-precision analyzers, especially those utilizing Tunable Diode Laser Absorption Spectroscopy (TDLAS), require substantial upfront investment, which can deter smaller enterprises or facilities with limited budgets. Additionally, H2S sensors, especially electrochemical types, are susceptible to poisoning and degradation in environments with high humidity or exposure to certain solvents, demanding frequent calibration and replacement, adding significantly to the operational expenditure (OPEX). Overcoming these cost and maintenance hurdles requires manufacturers to focus on developing durable, low-maintenance sensor technologies.

The most significant opportunity stems from technological advancements enabling smart, connected monitoring solutions. The integration of H2S analyzers into the Industrial Internet of Things (IIoT) ecosystem allows for real-time remote monitoring, predictive diagnostics, and centralized data management. This wireless and cloud-enabled capability is particularly attractive for large-scale, geographically dispersed infrastructure, such as pipelines and large wastewater networks, drastically improving response times and operational efficiency. Furthermore, the global shift towards sustainable energy sources, including the increasing production of biogas (which often contains significant levels of H2S impurities), opens up new, specialized application areas for H2S gas analysis equipment designed for process control and feedstock purity monitoring.

Segmentation Analysis

The Hydrogen Sulfide Gas Analyzer Market is broadly segmented based on product type, technology, application, and end-user industry. Analyzing these segments provides a granular view of market dynamics, revealing that fixed analyzers dominate revenue due to mandatory continuous monitoring requirements in large plants, while the portable segment is experiencing faster volume growth driven by field safety applications. Technology-wise, laser-based spectroscopy is gaining traction due to superior performance and reduced operational costs compared to traditional methods, signaling a significant shift in technological preferences, particularly in challenging environments like sour gas processing.

The critical end-user segmentation clearly indicates the Oil and Gas industry as the largest consumer, due to the inherent risks associated with extracting and processing hydrocarbon resources rich in sulfur compounds. However, non-traditional sectors such as food and beverage (for quality control and spoilage detection) and mining (for subsurface atmospheric monitoring) are emerging as significant secondary growth drivers, diversifying the market beyond traditional heavy industries. Understanding the specific detection requirements and regulatory standards pertinent to each end-user vertical is essential for manufacturers developing targeted analyzer solutions, whether focused on high-accuracy process control or simple, robust safety compliance.

Geographically, market segmentation reflects global industrial activity distribution, with North America leading in value due to established infrastructure and rigorous safety culture, while the APAC region spearheads future growth due to rapid industrialization and significant investment in new energy and chemical processing facilities. The continuous evolution in product functionality, specifically the integration of advanced networking features and inherent self-diagnostics, allows manufacturers to tailor products for specific regional regulatory environments and infrastructural maturity levels, optimizing market penetration across diverse global segments.

- By Product Type:

- Fixed Gas Analyzers

- Portable Gas Analyzers

- By Technology:

- Electrochemical Sensors

- Metal Oxide Semiconductor (MOS) Sensors

- Lead Acetate Tape Sensors

- Spectroscopy (TDLAS, NDIR)

- Other Technologies (Colorimetric, Photoionization Detectors (PID))

- By Application:

- Safety Monitoring

- Process Control and Optimization

- Environmental Monitoring

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Wastewater Treatment

- Pulp and Paper

- Mining

- Food and Beverage

- Pharmaceuticals

Value Chain Analysis For Hydrogen Sulfide Gas Analyzer Market

The value chain for the Hydrogen Sulfide Gas Analyzer market begins with the upstream sourcing of highly specialized components, including sensing elements (electrochemical cells, laser diodes, optical filters), microprocessors, and sophisticated enclosure materials suitable for explosion-proof applications. These components are supplied by specialized chemical manufacturers and electronics firms. The core value addition occurs during the manufacturing phase, involving precision assembly, sensor calibration, and quality assurance testing to ensure compliance with intrinsically safe standards (e.g., ATEX, IECEx). Downstream activities involve distribution, system integration, installation, and critical post-sales services such as continuous calibration, maintenance contracts, and technical support, which often represent a significant portion of the total lifetime revenue.

Upstream suppliers face continuous pressure to innovate materials science to improve sensor longevity and stability, particularly reducing cross-sensitivity and drift when exposed to extreme industrial conditions. The reliance on highly specialized components, particularly in spectroscopic technology (like TDLAS), means that the market structure is influenced by a limited number of high-technology providers, giving them considerable bargaining power. Manufacturers must establish robust supply chain management practices to mitigate risks associated with component shortages or rapid obsolescence of electronic parts, ensuring the continuous availability of crucial analyzer spares and replacements throughout the product lifecycle.

The distribution channel is typically bifurcated into direct sales to major integrated industrial end-users (especially large oil and gas companies requiring large capital expenditure projects) and indirect sales through a network of specialized distributors and system integrators. System integrators play a vital role, especially in the fixed analyzer segment, as they customize the monitoring network, install wiring, integrate the analyzers into plant-wide Distributed Control Systems (DCS) or Safety Instrumented Systems (SIS), and provide localized technical expertise. The indirect channel dominates the portable analyzer segment, utilizing regional safety equipment suppliers and resellers who offer localized inventory and swift delivery to operational sites. Service delivery, encompassing ongoing maintenance, calibration checks, and regulatory recertification, forms a critical profit center downstream and requires highly skilled technical personnel.

Hydrogen Sulfide Gas Analyzer Market Potential Customers

Potential customers and primary buyers of Hydrogen Sulfide Gas Analyzers are predominantly end-users operating in environments where H2S is either naturally occurring, intentionally used, or generated as a byproduct of industrial processes. The largest segment of buyers includes multinational energy companies involved in sour crude oil extraction, natural gas processing, and petrochemical refining, where both process control and mandated perimeter safety monitoring necessitate continuous high-accuracy H2S detection. Municipalities and private utility operators running wastewater treatment plants represent another major customer base, requiring monitoring to protect workers from accumulated H2S in confined spaces and manage odor control for public health.

The increasing focus on environmental stewardship and emission control is expanding the customer base to include independent power producers and industrial facilities required to comply with air quality standards. For instance, facilities utilizing flare stacks or thermal oxidizers need H2S analyzers to monitor inlet streams and verify combustion efficiency. Furthermore, specialized customer segments, such as drilling contractors, maintenance crews, and first responders, rely heavily on portable H2S analyzers for immediate personal safety and risk assessment during site entries, leak detection surveys, and confined space operations, highlighting the broad applicability of the instrumentation across operational functions.

Procurement decisions are typically driven by a combination of regulatory necessity, corporate safety policy, instrument reliability, and total cost of ownership (TCO). Engineering, Procurement, and Construction (EPC) firms often act as indirect buyers, specifying and purchasing fixed H2S monitoring systems during the construction phase of new industrial assets, following strict technical specifications and safety standards defined by the asset owner. Ultimately, the end-user requires a solution that minimizes false positives, operates reliably in extreme conditions, and provides seamless data integration into existing plant control systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1180 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell Analytics, Drägerwerk AG & Co. KGaA, Emerson Electric Co., Teledyne Analytical Instruments, AMETEK Process Instruments, Thermo Fisher Scientific, MSA Safety Inc., Siemens AG, Servomex Group Ltd., Yokogawa Electric Corporation, ABB Ltd., Analytical Sensors & Instruments (ASI), Gastec Corporation, Riken Keiki Co., Ltd., Crowcon Detection Instruments Ltd., Sensor Electronics, Gasmet Technologies Oy, Industrial Scientific Corporation, Pem-Tech Inc., Focused Photonics Inc. (FPI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogen Sulfide Gas Analyzer Market Key Technology Landscape

The technological landscape of the H2S Gas Analyzer Market is characterized by a mix of mature sensor technologies and rapidly advancing spectroscopic methods. Traditional methods, primarily electrochemical sensors and lead acetate tape analyzers, remain cost-effective and widely used, particularly for personal and portable detection applications. Electrochemical sensors measure H2S concentration via an oxidation-reduction reaction, generating an electrical current proportional to the gas level. Lead acetate tape technology, historically reliable for trace H2S measurement in process control, involves a chemical reaction causing discoloration quantified photometrically. While reliable, these methods often suffer from cross-sensitivity to other gases, limited lifespan, and require frequent replacement or calibration, driving the market toward more sophisticated solutions.

The emerging technological frontier is dominated by optical techniques, specifically Tunable Diode Laser Absorption Spectroscopy (TDLAS) and Non-Dispersive Infrared (NDIR) technology. TDLAS represents a significant leap forward, offering extremely high selectivity and sensitivity by utilizing a laser tuned to the specific absorption frequency of the H2S molecule. This non-contact measurement method provides rapid, highly accurate, and continuous readings with minimal interference from background gases, making it ideal for high-value applications in refining and natural gas pipeline monitoring. Furthermore, TDLAS systems require significantly less calibration and maintenance than chemical-based sensors, offering a superior total cost of ownership over the long term, thereby accelerating its penetration into the fixed analyzer segment.

Beyond TDLAS, advancements in solid-state sensors, particularly Metal Oxide Semiconductor (MOS) technology, offer low power consumption and robust construction, making them suitable for wireless and battery-operated remote sensing nodes deployed in environmental monitoring networks or large-scale perimeter surveillance. These solid-state devices provide a balance between cost, size, and performance, addressing the growing demand for IoT-enabled devices. The current technology trajectory emphasizes miniaturization, power efficiency, enhanced connectivity (wireless communication protocols like LoRaWAN and cellular 5G), and integration of advanced data processing algorithms (AI/ML) directly into the sensor head for intelligent diagnostics and improved accuracy.

Regional Highlights

Market activity for H2S gas analyzers shows distinct regional characteristics driven by varying industrial maturity, regulatory enforcement, and energy sector focus.

- North America (NA): Dominant market share due to mature refining and petrochemical industries, extensive natural gas infrastructure, and the rigorous enforcement of OSHA safety standards. Key growth is driven by replacement cycles, ongoing upstream activities (shale gas extraction), and the need for advanced TDLAS analyzers for pipeline integrity monitoring and fugitive emission detection.

- Europe: Characterized by stringent environmental protection policies (EU directives) and high adoption rates of advanced, high-precision analyzer technologies. The market is stable, focusing on reducing occupational exposure limits and increasing efficiency in wastewater treatment and biogas processing sectors. Germany, the UK, and the Netherlands are key contributors due to robust chemical manufacturing and sophisticated industrial automation.

- Asia Pacific (APAC): Highest projected CAGR, propelled by massive industrial expansion, capacity addition in the chemical and refining sectors (especially China, India, and Southeast Asia), and gradually strengthening regional safety regulations. The demand is strong for both cost-effective electrochemical sensors for basic safety needs and high-end spectroscopic solutions for large-scale new projects.

- Middle East and Africa (MEA): Significant demand originating from massive investment in the oil and gas sector, particularly associated with processing sour crude and gas reserves. Saudi Arabia, UAE, and Qatar are major consumers, prioritizing reliable, fixed monitoring systems engineered to withstand extremely high temperatures and harsh desert environments common in large production facilities.

- Latin America (LATAM): Growth is tied to fluctuations in commodity prices impacting the exploration and production activities in countries like Brazil and Mexico. Demand focuses on affordable, robust monitoring solutions, often balancing capital expenditure constraints with fundamental regulatory compliance requirements for worker safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogen Sulfide Gas Analyzer Market.- Honeywell Analytics

- Drägerwerk AG & Co. KGaA

- Emerson Electric Co.

- Teledyne Analytical Instruments

- AMETEK Process Instruments

- Thermo Fisher Scientific

- MSA Safety Inc.

- Siemens AG

- Servomex Group Ltd.

- Yokogawa Electric Corporation

- ABB Ltd.

- Analytical Sensors & Instruments (ASI)

- Gastec Corporation

- Riken Keiki Co., Ltd.

- Crowcon Detection Instruments Ltd.

- Sensor Electronics

- Gasmet Technologies Oy

- Industrial Scientific Corporation

- Pem-Tech Inc.

- Focused Photonics Inc. (FPI)

Frequently Asked Questions

What is the primary factor driving the demand for Hydrogen Sulfide Gas Analyzers?

The foremost driver is the implementation and stringent enforcement of international and national occupational safety regulations (e.g., OSHA, EU directives) that mandate continuous monitoring of H2S concentrations to protect human life and prevent catastrophic equipment corrosion in industrial settings.

Which technology segment is expected to show the highest growth rate?

The Spectroscopy technology segment, particularly Tunable Diode Laser Absorption Spectroscopy (TDLAS), is projected to exhibit the highest growth rate due to its superior accuracy, high selectivity, rapid response time, and significantly lower long-term maintenance requirements compared to traditional electrochemical methods.

How is the oil and gas industry utilizing H2S Gas Analyzers?

The oil and gas industry uses H2S analyzers extensively for three main purposes: mandatory worker safety monitoring (fixed and portable units), process control (monitoring sour gas treatment efficiency), and environmental compliance (monitoring emissions from flares and vents).

What role does AI play in modern H2S Gas Analyzer systems?

AI integrates machine learning algorithms to enable predictive maintenance by detecting sensor drift, reduce false alarms by fusing data from multiple sensors, and optimize calibration schedules, thereby enhancing overall system reliability and operational efficiency for safety-critical applications.

Which geographical region represents the most significant growth opportunity?

Asia Pacific (APAC) represents the most significant growth opportunity, driven by massive investments in new infrastructure, rapid expansion of refining and petrochemical capacity, and the increasing adoption of Western industrial safety standards across major economies like China and India.

Deep Dive: Regulatory Environment and Safety Standards

The operational environment for the Hydrogen Sulfide Gas Analyzer Market is fundamentally shaped by a dense network of global, national, and regional regulatory mandates focused on industrial health and safety, along with environmental protection. These regulations establish the mandatory need for detection equipment and dictate performance parameters such as detection limits, response times, and certification requirements (e.g., explosion proofing). Key international standards set by organizations like the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) provide technical specifications for instrument design, particularly for fixed monitoring systems intended for use in potentially explosive atmospheres (ATEX, IECEx certification zones).

In the United States, the Occupational Safety and Health Administration (OSHA) sets Permissible Exposure Limits (PELs) for H2S, typically 10 ppm as a ceiling limit, driving demand for continuous monitoring and alarming capabilities. The American Petroleum Institute (API) provides industry-specific standards for monitoring in drilling and production operations, reinforcing the technical requirements for durability and reliability in harsh conditions. These mandatory limits ensure that end-users, especially in the Oil and Gas sector, must invest consistently in highly reliable, certified detection equipment and maintain rigorous maintenance protocols, thereby sustaining the recurring revenue stream for analyzer manufacturers through service contracts and parts replacement.

Environmental regulations, such as those governed by the Environmental Protection Agency (EPA) or European Environment Agency (EEA), further amplify demand by focusing on H2S as a major component of industrial air emissions and odor nuisance, particularly originating from wastewater treatment facilities, pulp mills, and chemical plants. This necessitates specialized analyzers capable of trace analysis (ppb levels) for perimeter and stack monitoring, pushing technological advancements towards high-sensitivity optical techniques like TDLAS. The convergence of occupational safety and environmental monitoring requirements ensures dual market growth avenues, making regulatory compliance not just a burden but a central operational requirement for all major industrial facilities globally.

Competitive Landscape and Strategic Imperatives

The Hydrogen Sulfide Gas Analyzer Market exhibits moderate fragmentation, characterized by a few global dominant players offering a comprehensive portfolio across fixed and portable segments, alongside several specialized niche firms focusing exclusively on advanced technologies such as TDLAS or electrochemical sensor manufacturing. Competition revolves primarily around instrument reliability, total cost of ownership (TCO), speed of response, and the capability of the analyzer to withstand harsh operating conditions, which are critical procurement criteria for major industrial end-users. Key competitive strategies employed by market leaders include backward integration into sensor component manufacturing to control quality and cost, and aggressive investment in R&D for next-generation optical and solid-state sensing elements.

A crucial strategic imperative for market players is the integration of advanced digital features and IoT connectivity. Companies are differentiating their offerings by providing comprehensive software platforms that manage fleet data, automate compliance reporting, enable remote diagnostics, and facilitate predictive maintenance scheduling based on AI analysis. This move towards 'Gas Detection as a Service' (GDaaS) models allows manufacturers to capture high-margin recurring revenue from services, moving beyond one-time hardware sales. Furthermore, partnerships with major system integrators and EPC firms are essential for securing large-scale, fixed analyzer installation contracts during new refinery or pipeline construction projects, securing market share early in the project lifecycle.

For specialized technology providers, the imperative is focused on enhancing technological leadership and reducing the entry barrier (i.e., high capital cost) for advanced solutions. For instance, manufacturers focused on TDLAS are striving to miniaturize laser components and simplify the optical path to reduce unit cost and size, making the technology viable for a wider range of applications, including portable units or lower-budget fixed installations. Geographic expansion, particularly into the high-growth APAC and MEA regions, is also a critical strategic priority, requiring localized sales and service networks that can quickly address regional regulatory requirements and logistical challenges inherent in these markets.

Key Market Challenges and Mitigation Strategies

Despite robust growth drivers, the Hydrogen Sulfide Gas Analyzer Market faces several intrinsic challenges that manufacturers and end-users must address. One of the foremost technical hurdles is the issue of sensor poisoning and drift, especially prevalent in electrochemical cells, where exposure to high concentrations of H2S or other interfering gases can rapidly degrade sensor performance and lead to inaccuracies or complete failure. This necessitates frequent and costly calibration routines and sensor replacements, significantly increasing the long-term operational costs for end-users, acting as a restraint on technology adoption.

To mitigate the challenge of sensor longevity, manufacturers are increasingly pivoting towards technologies with inherent long-term stability, such as spectroscopic analyzers (TDLAS), which offer non-contact measurement and are virtually immune to chemical poisoning. Furthermore, the integration of advanced diagnostics and AI-driven predictive maintenance allows the system to anticipate sensor failure or drift before it compromises safety, enabling timely replacement or calibration and maximizing uptime. Another significant challenge is the high upfront capital expenditure required for installing advanced, fixed monitoring infrastructure, particularly in brownfield sites where integration with existing legacy control systems can be complex and expensive.

Addressing the high capital expenditure constraint involves offering flexible financing models, leasing options, and developing modular, wireless, and easily scalable monitoring solutions that minimize installation complexity and civil work requirements. For portable units, ensuring the device is intrinsically safe and robust enough to handle the inevitable physical abuse and extreme weather conditions encountered in field operations remains a continuous design challenge. Ultimately, market players that successfully reduce the total cost of ownership—through lower maintenance requirements, extended sensor life, and simplified integration—will gain a decisive competitive advantage and accelerate market penetration across small and mid-sized industrial facilities.

Future Market Outlook and Emerging Trends

The future outlook for the Hydrogen Sulfide Gas Analyzer Market is exceptionally positive, fueled by the irreversible trend towards enhanced industrial safety digitalization and increasingly strict global environmental standards. A major emerging trend is the widespread adoption of wireless H2S monitoring networks, leveraging low-power, wide-area network (LPWAN) technologies like LoRaWAN, which dramatically reduces the cost and time associated with deploying fixed monitoring points across vast industrial campuses or extensive pipeline networks. This shift facilitates real-time data collection from previously inaccessible or prohibitively expensive locations, offering a comprehensive view of H2S risks.

Another powerful trend is the migration towards multi-gas detection platforms that integrate H2S analysis with the simultaneous detection of other critical toxic or combustible gases (e.g., CO, LELs, O2), utilizing advanced sensor fusion techniques. These integrated platforms simplify instrument management, reduce inventory requirements, and provide a holistic safety assessment for personnel operating in complex hazardous environments. Furthermore, there is a growing specialization within the market, with increasing demand for H2S analyzers optimized specifically for new application areas such as carbon capture and storage (CCS) facilities, where H2S may be present as an impurity in the captured CO2 stream, requiring high-pressure, robust analyzers.

The long-term market growth will also be significantly influenced by advancements in micro-electromechanical systems (MEMS) sensor technology, promising highly miniaturized, low-cost, and low-power H2S sensors suitable for mass integration into wearable technology and personal protection equipment (PPE). The combination of stricter governmental regulations, continued infrastructure investment in developing economies, and technological convergence with IIoT, AI, and miniaturization techniques ensures sustained growth and continuous innovation in the H2S gas analysis domain through the forecast period and beyond.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager