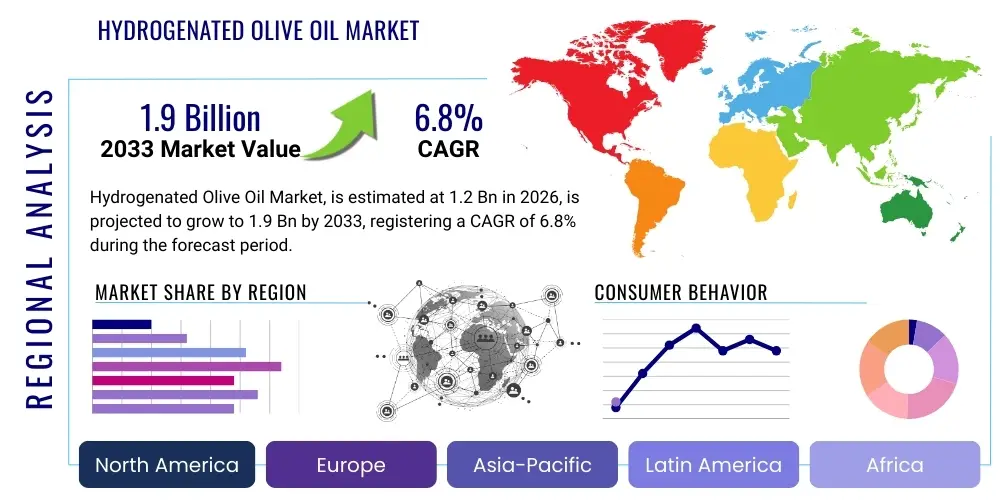

Hydrogenated Olive Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441116 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hydrogenated Olive Oil Market Size

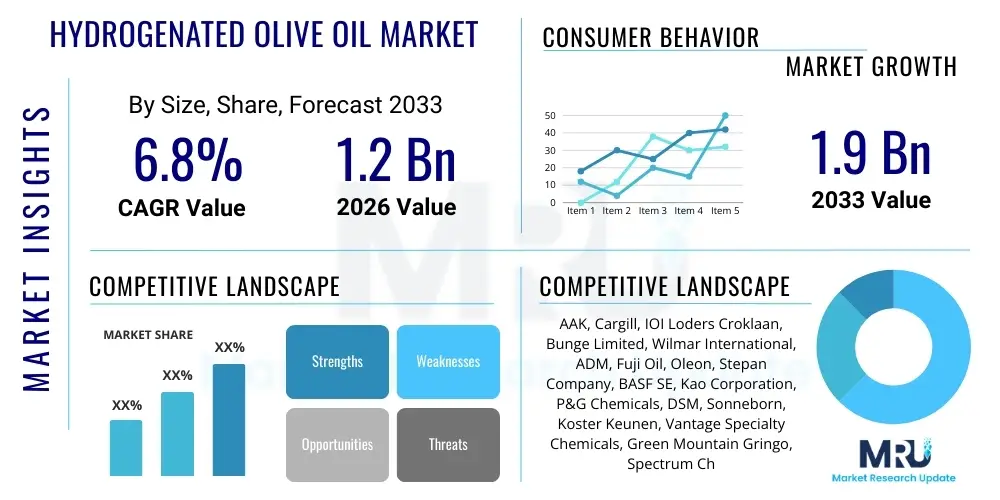

The Hydrogenated Olive Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033.

Hydrogenated Olive Oil Market introduction

Hydrogenated olive oil is a refined, semi-solid fat derived from olive oil through the catalytic hydrogenation process. This chemical modification stabilizes the oil, raises its melting point, and enhances its shelf life, making it highly valuable across numerous industrial sectors, particularly in specialized cosmetic and food manufacturing applications. The primary function of hydrogenation is to convert the polyunsaturated and monounsaturated fatty acids into saturated forms, resulting in a product with superior textural properties compared to liquid olive oil, without introducing trans fats if the process is controlled and optimized, which is a major technological focus within the industry.

The product, often utilized as a thickener, emollient, and texture enhancer, finds extensive application in premium personal care products like lip balms, skin creams, and hair conditioners due to its excellent moisturizing capabilities and non-greasy feel. In the food industry, hydrogenated olive oil serves as a specialized fat base in confectioneries, baked goods, and certain margarines, providing desirable structural integrity and improving the mouthfeel of the final product. The market growth is fundamentally driven by the increasing consumer demand for natural oil derivatives in cosmetics and the functional versatility it offers to formulators looking for stable, plant-derived alternatives to traditional synthetic waxes or animal fats, coupled with rigorous research and development efforts aimed at minimizing saturated fat content while maintaining structural benefits.

Hydrogenated Olive Oil Market Executive Summary

The Hydrogenated Olive Oil Market is characterized by robust growth, primarily fueled by strong demand signals emanating from the global cosmetics and personal care industry seeking natural, stable emollients and thickeners. Business trends indicate a significant push toward sustainable sourcing and advanced processing techniques, particularly selective hydrogenation, designed to reduce potential trans fat formation and improve the overall functional profile of the product. Manufacturers are investing heavily in research to optimize crystallization properties, allowing for tailored grades of hydrogenated olive oil suitable for very specific industrial requirements, such as high-temperature stability in pharmaceutical applications or desired skin penetration rates in cosmeceuticals, thereby enhancing market penetration across specialized segments.

Regional trends reveal that North America and Europe currently dominate the market share, driven by high consumer awareness regarding ingredient quality in premium personal care products and stringent regulatory frameworks favoring natural lipid bases over synthetic alternatives. However, the Asia Pacific (APAC) region is poised for the fastest expansion, driven by rapid urbanization, increasing disposable incomes, and the burgeoning local manufacturing base for cosmetics and processed foods, particularly in countries like China and India. This regional growth is further supported by the shifting supply chain dynamics, where key producers are establishing local manufacturing facilities closer to end-use markets to mitigate complex logistics and reduce environmental footprint associated with long-distance shipping of high-volume specialty ingredients.

Segmentation analysis highlights the Cosmetic Grade segment as the dominant revenue generator, emphasizing the ingredient's essential role in formulation stability and skin conditioning. Nevertheless, the Food Grade segment is witnessing accelerated adoption, especially in niche bakery products and specialized vegan confectioneries where alternatives to palm oil or traditional shortening are highly sought after. Functionally, the Texturizers and Emulsifying Agents segments are expected to show impressive growth rates, reflecting the industry's focus on improving sensory experiences and ensuring emulsion stability in complex, multi-phase formulations, which directly impacts consumer acceptance and product appeal across all major end-use sectors.

AI Impact Analysis on Hydrogenated Olive Oil Market

User queries regarding AI's influence in the Hydrogenated Olive Oil Market primarily revolve around optimizing the complex hydrogenation process itself, ensuring product consistency, and predicting raw material price volatility. Users frequently ask how AI can be utilized to model reaction kinetics during selective hydrogenation to maximize desired fatty acid profiles while minimizing unwanted byproducts, specifically focusing on achieving zero trans fat formulations efficiently. Furthermore, there is significant interest in how machine learning algorithms can enhance supply chain resilience by forecasting global olive oil harvests, analyzing geopolitical factors affecting logistics, and optimizing inventory management for varied grades of hydrogenated products (e.g., cosmetic versus pharmaceutical grade), ensuring just-in-time delivery and reducing operational waste, which are crucial concerns for large-scale manufacturers operating on thin margins.

- AI models optimize selective hydrogenation parameters (temperature, pressure, catalyst load) to ensure specific melting points and desired saturation levels, thereby guaranteeing superior product consistency and functional performance.

- Machine learning algorithms predict fluctuations in virgin olive oil feedstock prices, enabling procurement teams to execute hedging strategies and negotiate contracts more effectively, significantly mitigating raw material cost risks.

- AI enhances quality control by analyzing spectroscopic data in real-time during production, automatically flagging batches that deviate from strict quality specifications (e.g., iodine value, solid fat content), reducing manual testing time and improving regulatory compliance.

- Predictive maintenance schedules for high-pressure reactors and purification equipment are established using sensor data and AI, minimizing unplanned downtime and extending the operational lifespan of critical manufacturing assets.

- Generative AI tools assist R&D chemists in simulating new formulation combinations utilizing hydrogenated olive oil, accelerating the discovery of novel stabilizers, emollients, and texture systems for next-generation cosmetic and food products.

- AI-driven supply chain platforms optimize routing and warehousing for temperature-sensitive ingredients, ensuring product integrity from the production site to the final customer across diverse global distribution networks.

DRO & Impact Forces Of Hydrogenated Olive Oil Market

The Hydrogenated Olive Oil Market expansion is predominantly driven by escalating demand in the high-growth personal care sector, where consumers are increasingly seeking ingredients that offer both natural origin claims and proven functional stability. This driver is counterbalanced by significant restraints, chiefly the inherent price volatility of virgin olive oil, which serves as the primary feedstock, making stable long-term pricing and procurement challenging for manufacturers. Opportunities exist in expanding specialized pharmaceutical applications, particularly as carriers or excipients in topical drug delivery systems, leveraging the ingredient’s excellent biocompatibility and stability profile. These market dynamics are significantly influenced by impact forces such as stringent global regulations concerning trans fats, which necessitate advanced processing techniques, and evolving consumer preferences favoring highly sustainable, transparently sourced, and minimally processed ingredients, pushing the industry toward cleaner label solutions and sustainable manufacturing practices.

Segmentation Analysis

The Hydrogenated Olive Oil Market is broadly segmented based on Type, Application, and Function, reflecting the diverse industrial needs that this specialized ingredient fulfills. Segmentation by Type distinguishes between Food Grade, Cosmetic Grade, and Industrial Grade, primarily based on purity levels and regulatory adherence specific to the intended end-use environment. Application segmentation focuses on major consuming sectors such as Cosmetics & Personal Care (which includes specialized segments like lip care and hair conditioning), Food & Beverages (especially premium bakery and confectionery), Pharmaceuticals, and specialized Industrial Lubricants. Furthermore, Function segmentation identifies the primary role the product plays in the final formulation, differentiating its use as an Emulsifying Agent, Thickening Agent, Texturizer, or Stabilizer, highlighting its versatile physico-chemical properties essential for modern product formulation success across multiple high-value markets.

- By Type:

- Food Grade

- Cosmetic Grade

- Industrial Grade

- By Application:

- Cosmetics & Personal Care

- Skin Care

- Hair Care

- Lip Care Products

- Color Cosmetics

- Food & Beverages

- Confectionery

- Bakery Products

- Dressings and Sauces

- Processed Snacks

- Pharmaceuticals (Excipients and Carriers)

- Industrial Lubricants and Waxes

- Cosmetics & Personal Care

- By Function:

- Emulsifying Agents

- Thickening Agents/Viscosity Modifiers

- Texturizers (Aesthetic Enhancers)

- Stabilizers and Structuring Agents

Value Chain Analysis For Hydrogenated Olive Oil Market

The value chain for hydrogenated olive oil commences with the Upstream Analysis, which is dominated by the sourcing and refining of high-quality virgin olive oil feedstock. This stage involves complex global agricultural logistics, harvesting, crushing, and primary refining processes. Key suppliers in this phase are large agricultural cooperatives and commodity traders specializing in high-grade olive oil, predominantly concentrated in Mediterranean regions. The primary challenge upstream is managing the inherent seasonality and geopolitical instability affecting olive harvests, which directly impacts the raw material cost and quality consistency essential for the subsequent high-specification hydrogenation process. Strategic partnerships between ingredient manufacturers and large-scale olive oil producers are critical for ensuring a stable and traceable supply of feedstock, which is becoming increasingly scrutinized by end-use regulatory bodies and consumer watchdogs.

The core manufacturing process, involving catalytic hydrogenation and subsequent purification (Midstream), transforms the liquid olive oil into a semi-solid, functional fat. This phase requires significant capital investment in high-pressure reactors, specialized catalysts, and sophisticated quality control systems to ensure the desired solid fat content and minimal trans fat levels. This segment is characterized by high barriers to entry due to the technical expertise required for selective hydrogenation and the necessity of adhering to extremely strict purity and regulatory standards (e.g., cGMP for cosmetic/pharmaceutical grades). Companies with advanced proprietary processing technologies gain a substantial competitive advantage by producing tailored grades that meet highly specific technical requirements, such as unique melting profiles or enhanced oxidative stability necessary for sensitive formulations.

Downstream analysis focuses on Distribution Channel mechanisms, encompassing both Direct and Indirect sales models leading to the end-users. Direct distribution is common for large-volume industrial buyers, such as major multinational cosmetic companies or large food conglomerates, often involving specialized ingredient distributors and bulk logistics networks. Indirect channels rely on regional specialty chemical distributors and formulators who manage smaller volumes, provide technical support, and cater to regional small-to-mid-sized enterprises (SMEs) in the personal care and niche food sectors. The effectiveness of the distribution network hinges on timely delivery and the ability to maintain the product’s quality specifications throughout transit, ensuring the ingredient retains its functional properties when it reaches the final formulation site, requiring meticulous temperature and storage management throughout the complex global supply chain.

Hydrogenated Olive Oil Market Potential Customers

The primary consumers and buyers of hydrogenated olive oil span multiple high-value, highly regulated industries, with Cosmetics and Personal Care manufacturers forming the largest segment. These customers utilize the ingredient extensively as a natural wax alternative, an exceptional emollient, and a stabilizing agent in formulations such as high-end moisturizing creams, luxury lipsticks, and highly stable anhydrous systems like solid body butters. Their purchasing decisions are heavily influenced by technical specifications (melting point, purity), natural origin claims, and regulatory certifications (e.g., COSMOS or ECOCERT compliance) that validate the ingredient’s suitability for clean label products, making rigorous supplier auditing a critical part of the procurement process.

Another significant customer base resides in the Food & Beverage industry, specifically within specialized bakery and confectionery sectors that require high-performance, plant-derived structuring fats. These customers leverage hydrogenated olive oil to replace traditional shortenings, achieving superior texture, extended shelf life, and enhanced heat stability in products like premium biscuits, chocolate coatings, and gourmet vegan spreads. Procurement in this sector emphasizes consistency in solid fat content (SFC) curves and strict adherence to food safety standards, particularly the minimization or elimination of trans fats, which drives demand for partially or fully hydrogenated, non-trans-fat yielding alternatives that can mimic the functionality of traditional structured fats.

Furthermore, Pharmaceutical companies represent a growing, albeit specialized, customer segment. They use hydrogenated olive oil as an excipient, binder, or vehicle in topical applications, suppositories, and certain oral solid dosage forms. These buyers demand the highest level of purity (often USP or EP compliance), impeccable traceability, and stringent documentation regarding safety and stability. The procurement cycle in the pharmaceutical sector is extensive, involving lengthy qualification processes and stability testing, rewarding suppliers who can consistently demonstrate extremely high batch-to-batch consistency and a robust regulatory support package for their specialized lipid offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAK, Cargill, IOI Loders Croklaan, Bunge Limited, Wilmar International, ADM, Fuji Oil, Oleon, Stepan Company, BASF SE, Kao Corporation, P&G Chemicals, DSM, Sonneborn, Koster Keunen, Vantage Specialty Chemicals, Green Mountain Gringo, Spectrum Chemical, Alfa Aesar, Lipo Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrogenated Olive Oil Market Key Technology Landscape

The manufacturing process for hydrogenated olive oil relies heavily on the advancement of catalytic hydrogenation technologies. The core technological objective is shifting from traditional, full hydrogenation toward selective hydrogenation processes, which allow manufacturers precise control over the degree of saturation and the final isomer profile of the fatty acid chains. This technological sophistication is critical for creating tailor-made products that possess specific melting points, crystal structures, and solid fat content curves, essential parameters for high-performance applications in luxury cosmetics and specific food manufacturing processes. Modern hydrogenation plants utilize specialized nickel or palladium catalysts in highly controlled pressure and temperature environments, ensuring maximum efficiency and purity while critically minimizing the formation of undesirable trans fatty acids, which is a major regulatory and consumer concern across key global markets, driving continuous process innovation in reactor design and catalyst composition for enhanced selectivity.

Beyond the hydrogenation reactor itself, the technology landscape is heavily influenced by advanced purification and fractionation techniques. After hydrogenation, the resulting lipid mixture often undergoes dewaxing, deodorization, and molecular distillation to remove impurities, residual catalysts, and volatile odor compounds, ensuring the final product meets the stringent purity requirements, especially for pharmaceutical and cosmetic grades. Fractionation technology, utilizing temperature-controlled crystallization, is employed to separate the hydrogenated mixture into distinct fractions with varying melting ranges, providing manufacturers with highly specific waxy or solid components that can be used to engineer complex texture systems in end-user formulations. Furthermore, the integration of real-time analytical technologies, such as advanced gas chromatography and nuclear magnetic resonance (NMR) spectroscopy, into the production line is becoming standard practice, allowing instantaneous quality assurance checks and proactive process adjustments to maintain batch consistency and regulatory compliance efficiently.

Innovation is also evident in the upstream sourcing and sustainability technologies. Companies are increasingly adopting blockchain and advanced digital tracking systems to enhance the traceability of the virgin olive oil feedstock, verifying its geographic origin, agricultural practices, and ethical sourcing standards, which addresses the growing demand for supply chain transparency from corporate buyers and regulatory bodies. Energy efficiency in the hydrogenation process, often involving optimization of heat recovery systems and utilization of sustainable hydrogen production methods, represents a critical area of technological investment. This focus on green chemistry and sustainable manufacturing not only lowers operational costs but also aligns with global sustainability mandates and corporate social responsibility goals, providing a significant competitive edge in the procurement landscape driven by environmentally conscious multinationals.

Regional Highlights

- North America: This region holds a significant market share, driven by a large and rapidly expanding personal care industry, characterized by high consumer spending on premium, natural-labeled cosmetic products. Regulatory standards in the US and Canada favor plant-derived ingredients, propelling the use of hydrogenated olive oil as a functional, stable natural alternative to synthetic waxes. The region also boasts high penetration of specialized food manufacturers focusing on health-conscious and clean-label bakery goods, further stimulating demand for high-quality food-grade structured fats.

- Europe: Europe is the leading region in terms of both consumption and production, supported by the proximity to major olive oil producing nations in the Mediterranean basin. The stringent EU cosmetic regulations, specifically concerning ingredient safety and traceability, favor hydrogenated olive oil. Demand is particularly robust in countries like Germany, France, and Italy, where the pharmaceutical sector uses it extensively as a high-purity excipient, demanding rigorous quality control and certification from suppliers.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is attributed to the burgeoning middle class, rapid industrialization, and the massive scale-up of local manufacturing capabilities in China, India, and Southeast Asian nations for both food processing and cosmetics. The shift away from traditional, less stable oils in local food preparations and the increasing Westernization of beauty standards are key underlying demand drivers in this dynamic market, leading to increased localized production and import substitution strategies.

- Latin America (LATAM): The LATAM market is experiencing steady growth, primarily focused on regional cosmetic manufacturing centers in Brazil and Mexico. The market is highly price-sensitive but shows increasing preference for ingredients derived from regional agricultural products, positioning olive oil derivatives favorably. Investment in local processing capabilities is critical to overcome logistical challenges and capitalize on localized formulation trends that demand stable, locally sourced emollients.

- Middle East and Africa (MEA): Growth in MEA is driven by expanding industrialization, especially in the Gulf Cooperation Council (GCC) countries, focusing on establishing self-sufficiency in food processing and luxury personal care production. The use of specialty fats in institutional catering and the high demand for high-stability ingredients in high-temperature environments contribute significantly to the adoption of hydrogenated olive oil, particularly in cosmetic grades that require enhanced thermal resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrogenated Olive Oil Market.- AAK

- Cargill

- IOI Loders Croklaan

- Bunge Limited

- Wilmar International

- ADM

- Fuji Oil

- Oleon

- Stepan Company

- BASF SE

- Kao Corporation

- P&G Chemicals

- DSM

- Sonneborn

- Koster Keunen

- Vantage Specialty Chemicals

- Green Mountain Gringo

- Spectrum Chemical

- Alfa Aesar

- Lipo Chemicals

Frequently Asked Questions

Analyze common user questions about the Hydrogenated Olive Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of hydrogenated olive oil in cosmetic formulations?

Hydrogenated olive oil primarily functions as a natural thickening agent, texturizer, and emollient in cosmetics, enhancing the stability of formulations (like creams and lip balms) and delivering superior moisturizing properties without a greasy residue, serving as a plant-derived substitute for traditional waxes.

How does the process of hydrogenation impact the nutritional profile of olive oil?

The hydrogenation process significantly increases the oil's saturation levels, converting liquid components into solids, which raises the melting point and stability. Modern selective hydrogenation aims to eliminate the formation of undesirable trans fats while retaining necessary functional properties for industrial applications.

Which end-use application segment dominates the current demand for hydrogenated olive oil?

The Cosmetics and Personal Care segment currently holds the dominant market share, driven by high global demand for stable, natural, and traceable structuring agents suitable for premium skin care, hair care, and lip care products marketed under clean label standards.

What are the main regional growth drivers for the Hydrogenated Olive Oil Market?

The main regional growth drivers include the mature premium cosmetic markets of North America and Europe, alongside the exponential growth of the cosmetics and packaged food manufacturing industries in the Asia Pacific (APAC) region, driven by urbanization and rising disposable income.

What are the key technological challenges facing manufacturers in this market?

The primary technological challenge is perfecting selective hydrogenation techniques to consistently achieve highly specific functional properties (e.g., melting point, crystal structure) while simultaneously ensuring zero trans fat formation and maintaining compliance with increasingly stringent global purity and traceability regulations for both food and cosmetic grades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager