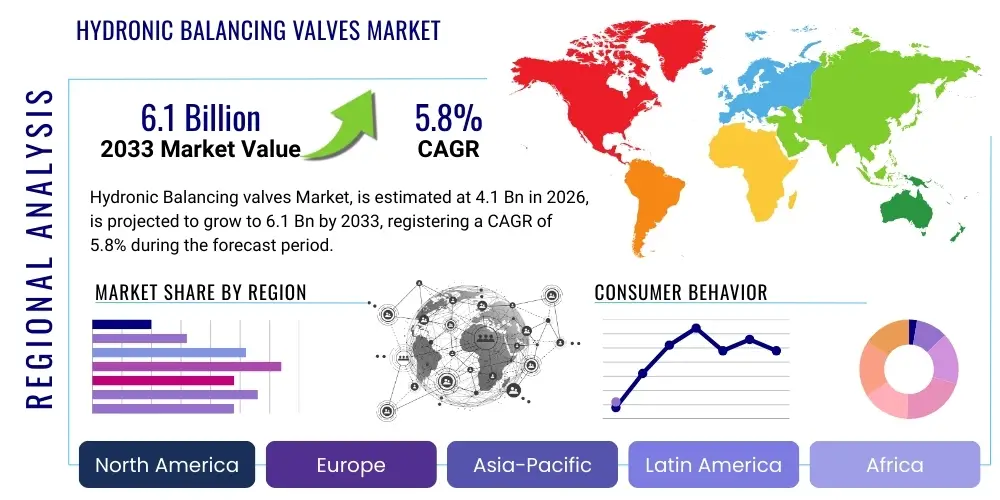

Hydronic Balancing valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441914 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hydronic Balancing valves Market Size

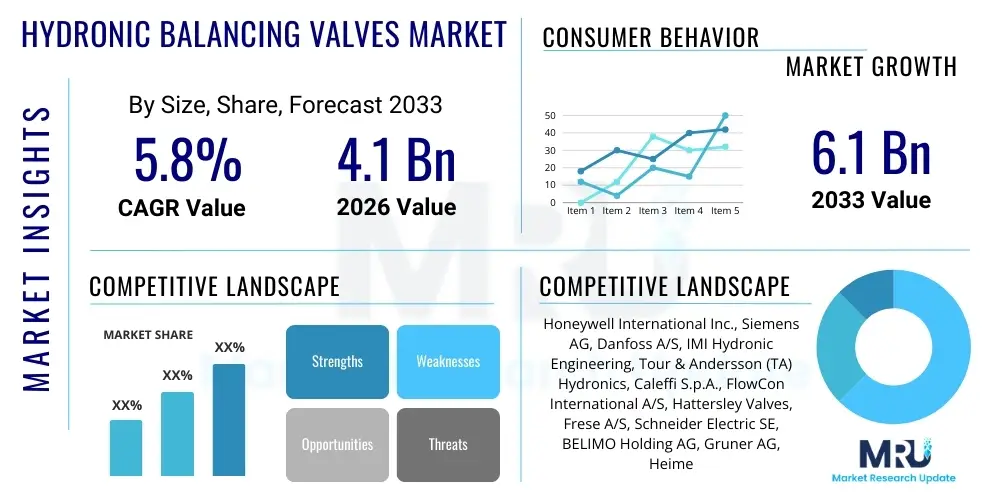

The Hydronic Balancing valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Hydronic Balancing valves Market introduction

The Hydronic Balancing valves Market encompasses specialized fluid control devices crucial for optimizing the performance and energy efficiency of heating, ventilation, and air conditioning (HVAC) systems, as well as district heating and cooling networks. These valves ensure that the flow rate of the heating or cooling medium (typically water or glycol solution) delivered to each terminal unit—such as radiators, fan coils, or heat exchangers—matches the design specification. This precise flow regulation prevents system inefficiencies, discomfort caused by temperature variances, and excessive energy consumption due to over-pumping.

Hydronic balancing valves are primarily categorized into manual and automatic (or pressure-independent) types. Manual balancing valves require periodic adjustment based on differential pressure readings, demanding skilled labor and time. Conversely, automatic balancing valves, particularly Pressure Independent Control Valves (PICVs), automatically maintain a constant flow rate regardless of pressure fluctuations in the system, offering superior dynamic performance, simplified commissioning, and significant long-term operational cost savings. Major applications span commercial buildings (offices, hospitals, hotels), large residential complexes, industrial process temperature control, and modern municipal district energy infrastructures.

The fundamental benefits driving the adoption of these valves include enhanced system stability, extended equipment lifespan for pumps and chillers, reduced commissioning time, and a dramatic improvement in building energy performance. Regulatory mandates promoting green building standards and stringent energy efficiency targets in regions like Europe and North America act as strong catalysts. Furthermore, the increasing complexity of modern HVAC systems necessitates precise hydronic control to ensure comfort and operational integrity, positioning balancing valves as indispensable components in efficient fluid handling.

Hydronic Balancing valves Market Executive Summary

The global Hydronic Balancing valves Market is characterized by robust growth, primarily fueled by the accelerating global focus on building energy efficiency and sustainability mandates. Business trends indicate a definitive shift toward smart, automatic balancing solutions, particularly Pressure Independent Control Valves (PICVs) integrated with IoT capabilities for remote monitoring and real-time adjustment. Key players are investing heavily in connectivity features, enabling seamless integration with advanced Building Management Systems (BMS) to facilitate predictive maintenance and dynamic flow optimization based on occupancy and external conditions, transforming traditional mechanical products into sophisticated digital assets.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by massive infrastructure development, rapid urbanization, and the adoption of modern, energy-efficient HVAC systems in China, India, and Southeast Asia. While North America and Europe remain mature markets, growth here is dominated by stringent retrofit initiatives aimed at updating aging building stock to meet modern energy standards. These regions prioritize technology adoption, pushing demand for highly accurate, diagnostic-capable smart valves that contribute demonstrably to achieving Net-Zero targets.

Segment trends underscore the dominance of the automatic balancing valve segment due to its operational advantages—simpler installation, reduced maintenance, and superior efficiency compared to manual alternatives. The commercial sector, encompassing institutional and large infrastructural projects, remains the largest application segment, although the residential sector is showing burgeoning growth, particularly with the rise of decentralized heating systems and smart home integration. Material segmentation shows increasing preference for DZR (dezincification-resistant) brass and stainless steel alloys to handle diverse water qualities and ensure longevity, especially in large-scale district energy applications.

AI Impact Analysis on Hydronic Balancing valves Market

Common user questions regarding AI’s impact on the Hydronic Balancing valves Market generally revolve around how AI can enhance system accuracy, minimize human intervention, and achieve predictive energy savings. Users are keen to understand the shift from static balancing to dynamic, adaptive control, asking if AI algorithms can use real-time data from smart valves (flow, pressure, temperature) to predict imbalance scenarios before they manifest as comfort complaints or energy spikes. Key concerns focus on the security of IoT-enabled valves and the required skill level for commissioning and maintaining AI-driven hydronic networks. The overarching expectation is that AI will move flow optimization beyond scheduled maintenance, enabling truly autonomous, self-correcting HVAC operation.

AI's primary influence is in transitioning hydronic systems from reactive control to predictive and prescriptive optimization. By analyzing the massive datasets generated by smart balancing valves—including data on differential pressure, valve position, ambient temperature, and system demand—machine learning models can identify subtle inefficiencies or drift in flow rates that conventional BMS controllers often miss. This capability allows the system to proactively adjust valve settings, modulate pump speeds, and anticipate necessary flow changes based on learned patterns of building usage and weather forecasts. The integration of AI therefore elevates hydronic balancing from a setup task to a continuous, intelligent optimization process, drastically reducing operational costs and improving tenant comfort.

The immediate practical application of AI involves enhanced fault detection and diagnostics (FDD). AI algorithms can rapidly correlate anomalies reported by specific balancing valves with overall system performance metrics, pinpointing potential issues such as fouling, actuator failure, or system leaks. This diagnostic accuracy minimizes downtime and simplifies maintenance workflows. Furthermore, AI facilitates automated commissioning, where the system "learns" the optimal flow profile during the initial operational phase, significantly cutting the time and expertise traditionally required for manual balancing procedures in large, complex systems.

- Predictive Flow Optimization: AI algorithms use real-time sensor data to anticipate load changes and adjust valve flow rates dynamically.

- Automated Commissioning: Machine learning models simplify setup by autonomously determining and setting initial optimal valve positions.

- Fault Detection and Diagnostics (FDD): AI identifies subtle performance anomalies in valves, preventing critical system failures and reducing repair time.

- Energy Demand Response: Integration with grid signals allows AI to optimize hydronic flow during peak demand periods, minimizing energy use without compromising comfort.

- Cybersecurity and Data Integrity: AI is increasingly used to monitor data streams from smart valves for unusual patterns indicative of security breaches.

DRO & Impact Forces Of Hydronic Balancing valves Market

The Hydronic Balancing valves Market is shaped by a confluence of strong regulatory drivers, technological advancements, and persistent structural challenges. The primary driver is the global mandate for enhanced energy efficiency in commercial and residential buildings, primarily targeting reductions in HVAC-related energy consumption, which often accounts for 40-60% of a building's total energy load. This is reinforced by rising electricity prices and corporate sustainability goals. Simultaneously, rapid urbanization and large-scale infrastructure projects, especially the expansion of district heating and cooling networks in Asia and Eastern Europe, generate immense demand for reliable flow control components.

Restraints primarily revolve around the initial capital investment required for automatic and smart balancing valves, which are substantially higher than their manual counterparts. In cost-sensitive markets, this initial barrier can delay adoption, especially in retrofit projects where budgets are constrained. Furthermore, a persistent challenge is the lack of specialized, skilled labor capable of accurately installing, commissioning, and maintaining complex hydronic systems, including advanced PICVs and interconnected smart networks. System designers and installers require continuous education to keep pace with the digitalization of these components.

Opportunities for market growth are vast, centered on the retrofitting of millions of older commercial buildings globally that still rely on outdated, manually balanced systems. Transitioning these systems to smart, pressure-independent valves offers immediate and measurable energy savings. Another key opportunity lies in the development of modular, pre-assembled hydronic kits that simplify installation for contractors, addressing the labor skill gap. The future trajectory is heavily focused on integrated solutions, where the valve is a data point in a larger IoT ecosystem, maximizing its potential for intelligent, network-wide optimization and predictive maintenance services.

Segmentation Analysis

The Hydronic Balancing valves Market is segmented based on critical technical and application parameters, including Product Type, Application, and Material. Analyzing these segments provides crucial insights into technological preferences and market saturation across different end-user verticals. The technological evolution within the market heavily favors automatic and pressure-independent valves, reflecting the industry's continuous pursuit of reduced commissioning time and optimal, dynamic energy performance. Segmentation by application clearly defines the primary demand drivers, with the commercial sector leading due to the complexity and scale of HVAC systems in modern skyscrapers and institutional facilities, necessitating sophisticated hydronic control mechanisms.

Segmentation by product type reveals a significant shift away from traditional manual balancing valves toward highly sophisticated automatic variants. Automatic valves, which include Pressure Independent Control Valves (PICVs) and Differential Pressure Control Valves (DPCVs), are preferred because they eliminate the need for laborious manual measurement and adjustment, maintaining system balance automatically despite changes in load or system pressure. This ensures that only the required flow is delivered, thereby maximizing energy savings by reducing unnecessary pump work. The PICV segment, in particular, is witnessing rapid innovation and market penetration due to its dual functionality of flow control and differential pressure regulation in a single unit.

The material segment highlights industry requirements for durability and chemical resistance. Standard brass is being increasingly supplemented or replaced by DZR brass, which offers superior resistance to dezincification—a form of corrosion common in high-temperature or aggressive water environments. For critical applications such as district heating or industrial processes involving aggressive media, stainless steel valves are mandatory due to their exceptional corrosion resistance and high-pressure tolerance, although they command a significant price premium. Understanding these segment dynamics is essential for manufacturers to tailor product development and marketing strategies to specific end-user needs and regional water quality standards.

- Product Type:

- Manual Balancing Valves

- Automatic Balancing Valves (e.g., PICV, DPCV)

- Application:

- Commercial (Offices, Hospitals, Hotels, Institutional Buildings)

- Residential (Apartment Complexes, Large Housing Units)

- Industrial (Process Cooling, Manufacturing Facilities)

- District Heating/Cooling Networks

- Material:

- Brass and DZR Brass

- Stainless Steel

- Others (e.g., Composite Materials)

Value Chain Analysis For Hydronic Balancing valves Market

The value chain for the Hydronic Balancing valves Market begins with raw material sourcing, predominantly involving high-grade metals like copper, zinc (for brass), and specialized steel alloys (DZR brass and stainless steel). Upstream analysis is critical, as the quality and stability of raw material supply directly influence the durability and precision of the final product. Key activities at this stage include sourcing high-quality, certified materials and subjecting them to stringent metallurgical testing to ensure compliance with international standards for pressure resistance and corrosion prevention, which is vital for product longevity in hydronic systems.

The midstream focuses on precision manufacturing, which involves complex casting, machining, and assembly of components like valve bodies, seats, actuators, and measuring points. Specialized processes are required for pressure-independent valves, involving highly precise internal cartridges and control elements that dictate flow accuracy. Leading manufacturers leverage advanced CNC machining and automated assembly lines to ensure tight tolerances and repeatable performance. Furthermore, the integration of electronic actuators, sensors, and communication chips marks the transition of traditional manufacturing toward smart component production, requiring expertise in both mechanical engineering and embedded systems.

Downstream analysis covers the distribution channels, which are typically robust networks comprising large wholesalers, specialized HVAC distributors, and system integrators. Direct sales channels are often used for large, custom projects like district energy schemes or high-profile commercial developments, providing engineering consultation alongside product supply. Indirect channels leverage the established relationships of wholesalers with plumbing and HVAC contractors, who are the final installers. The role of consulting engineers and mechanical contractors is pivotal, as they specify the valves and often influence the procurement decisions based on performance guarantees, ease of installation, and lifecycle cost analysis.

Hydronic Balancing valves Market Potential Customers

The primary customers for Hydronic Balancing valves are professional entities involved in the design, installation, maintenance, and operation of large-scale fluid transfer systems. These end-users are characterized by their need for optimized energy consumption, reliable temperature control, and compliance with stringent environmental regulations. The largest segment of buyers comprises Mechanical, Electrical, and Plumbing (MEP) contractors and HVAC system installers who purchase valves in bulk for new construction projects and major system retrofits. Their purchasing decisions are highly influenced by product quality, ease of installation, and technical support provided by manufacturers.

Another major customer group consists of Building Owners and Facility Managers, particularly those operating large commercial or institutional complexes such as airports, universities, hospitals, and corporate headquarters. For these buyers, the total cost of ownership (TCO) is paramount, making automatic and smart balancing valves highly attractive due to the substantial operational cost savings derived from reduced energy bills and minimized maintenance needs. These customers are increasingly seeking valves with IoT capabilities that integrate seamlessly into their existing Building Management Systems (BMS) for centralized control and performance monitoring.

Furthermore, utility companies and municipal entities involved in operating and expanding district heating and cooling (DHC) networks represent a high-value customer base. DHC systems require extremely robust and accurate high-pressure balancing valves (often stainless steel) to manage flow across miles of piping and numerous interconnected buildings. Consulting engineers specializing in energy system design also act as crucial influencers, specifying particular valve technologies to meet complex hydronic design requirements and energy performance contracts for their clients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Siemens AG, Danfoss A/S, IMI Hydronic Engineering, Tour & Andersson (TA) Hydronics, Caleffi S.p.A., FlowCon International A/S, Hattersley Valves, Frese A/S, Schneider Electric SE, BELIMO Holding AG, Gruner AG, Heimeier (part of IMI), Johnson Controls International plc, Mueller Water Products Inc., Vexve Oy, Oventrop GmbH & Co. KG, Walraven Group, Nexus Valve, Inc., Armstrong Fluid Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydronic Balancing valves Market Key Technology Landscape

The technology landscape for Hydronic Balancing valves is rapidly evolving, driven primarily by the shift toward automated and intelligent flow management. The most influential technology is the Pressure Independent Control Valve (PICV), which combines dynamic balancing, flow limitation, and temperature control functionalities into a single unit. PICVs use an internal diaphragm or cartridge to sense and neutralize upstream and downstream pressure fluctuations, ensuring the flow rate remains constant regardless of changes in the system load or pump differential pressure. This precision is fundamental to maximizing the efficiency of variable flow systems and is often a prerequisite for high-performance building certification.

A major technological trend reshaping the market is the integration of Internet of Things (IoT) capabilities and advanced actuator technologies. Modern smart balancing valves incorporate wireless communication protocols (such as Zigbee, Wi-Fi, or BACnet) and built-in sensors to monitor flow, pressure, and temperature in real-time. These actuators are highly accurate, capable of minute adjustments, and can be remotely accessed and controlled via a Building Management System (BMS). This connectivity enables facilities managers to diagnose issues, perform flow adjustments, and optimize the system dynamically without manual intervention, leading to predictive maintenance cycles and significant labor savings.

Furthermore, material science continues to be a crucial technological area. Manufacturers are increasingly utilizing corrosion-resistant alloys, specifically DZR (dezincification-resistant) brass and high-grade stainless steel, to extend the lifespan and reliability of valves, especially in applications exposed to high temperatures, high pressures, or chemically treated water (like glycol solutions). The utilization of magnetic or ultrasonic flow metering technology integrated within the valve body is also gaining traction, offering higher accuracy and non-intrusive flow measurement compared to traditional differential pressure taps, thereby enhancing the overall performance verification capability of the hydronic network.

Regional Highlights

- North America: This region is a mature market characterized by stringent building codes aimed at energy conservation, particularly in states like California and provinces in Canada. Demand is driven by retrofitting aging commercial HVAC infrastructure with smart, automatic balancing valves and the adoption of digital twin technologies for hydronic system modeling. The prevalence of large, institutional buyers (universities, military bases) ensures sustained high-value demand for robust, certified valves.

- Europe: Europe is the global leader in adopting advanced hydronic solutions, largely mandated by directives such as the Energy Performance of Buildings Directive (EPBD) and the push toward nearly Zero-Energy Buildings (nZEBs). The market is heavily influenced by district heating and cooling expansion in Nordic countries and Central Europe. High regulatory pressure and environmental awareness accelerate the penetration of PICVs and smart valves with integrated M-Bus or BACnet communication capabilities.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, massive commercial construction booms (China, India, Southeast Asia), and government investments in modern infrastructure. While price sensitivity remains, the need for international standard compliance in luxury residential and large commercial projects drives the adoption of automatic balancing technologies. The shift towards large-scale centralized cooling systems in dense urban centers fuels demand for high-capacity balancing solutions.

- Latin America: Characterized by emerging economies and volatile construction markets, the demand for balancing valves is steadily growing, primarily concentrated in commercial and high-end residential construction in major metropolitan areas (e.g., Brazil, Mexico). The market tends to favor cost-effective solutions, though increasing foreign investment in infrastructure is introducing high-specification automatic valves.

- Middle East and Africa (MEA): Growth in MEA is dominated by major infrastructure projects, large-scale hospitality developments, and the expansion of data centers, particularly in the GCC countries (Saudi Arabia, UAE). Extreme climatic conditions necessitate highly efficient cooling systems, driving demand for premium, durable balancing valves capable of operating under high stress and pressure differentials, with energy efficiency being a critical procurement factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydronic Balancing valves Market.- Honeywell International Inc.

- Siemens AG

- Danfoss A/S

- IMI Hydronic Engineering

- Tour & Andersson (TA) Hydronics

- Caleffi S.p.A.

- FlowCon International A/S

- Hattersley Valves

- Frese A/S

- Schneider Electric SE

- BELIMO Holding AG

- Gruner AG

- Heimeier (part of IMI)

- Johnson Controls International plc

- Mueller Water Products Inc.

- Vexve Oy

- Oventrop GmbH & Co. KG

- Walraven Group

- Nexus Valve, Inc.

- Armstrong Fluid Technology

Frequently Asked Questions

What are the primary advantages of Automatic Balancing Valves (ABVs) over Manual Balancing Valves?

Automatic Balancing Valves (ABVs), especially Pressure Independent Control Valves (PICVs), offer superior system performance by automatically maintaining a constant, set flow rate regardless of system pressure fluctuations, unlike manual valves which require time-consuming, periodic adjustments. ABVs significantly reduce commissioning time, simplify system design, and deliver optimal energy savings by ensuring system stability and preventing flow changes caused by varying loads.

How does the integration of IoT technology enhance the functionality of Hydronic Balancing Valves?

IoT integration transforms balancing valves into smart components, allowing for remote flow adjustment, real-time performance monitoring, and integration with Building Management Systems (BMS). This enables facilities managers to leverage data analytics for predictive maintenance, diagnose flow issues remotely, and dynamically optimize the hydronic system based on real-time building demand and environmental conditions, leading to continuous efficiency improvements.

Which application segment is driving the highest demand in the Hydronic Balancing valves Market?

The Commercial application segment, which includes large office buildings, hospitals, hotels, and educational facilities, currently drives the highest demand. These large-scale facilities feature complex, multi-zone HVAC systems where precise hydronic balancing is essential to ensure uniform temperature distribution, meet occupant comfort standards, and comply with stringent commercial energy efficiency regulations.

What role do DZR Brass and Stainless Steel play in valve material segmentation?

DZR (dezincification-resistant) Brass and Stainless Steel are critical materials offering enhanced durability and corrosion resistance, particularly important in systems using chemically treated water or operating at high temperatures. DZR Brass is the industry standard for reliable, high-quality residential and commercial applications, while Stainless Steel is preferred for high-pressure industrial environments and aggressive district heating networks due to its superior strength and corrosion immunity.

What is the projected growth rate (CAGR) for the Hydronic Balancing valves Market through 2033?

The Hydronic Balancing valves Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This growth trajectory is sustained by mandatory energy efficiency regulations globally, robust expansion in district heating infrastructure, and the widespread adoption of advanced, smart pressure-independent valve technology in both new construction and retrofit projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager