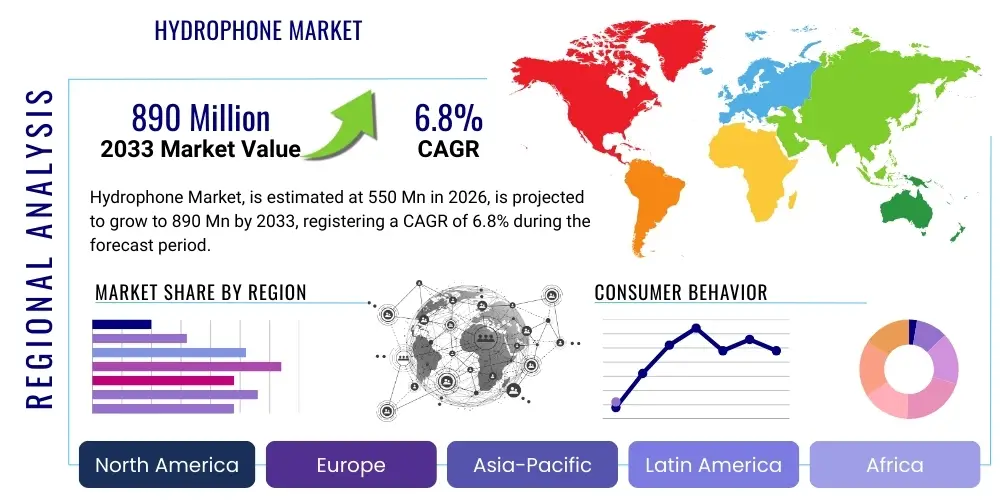

Hydrophone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442052 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Hydrophone Market Size

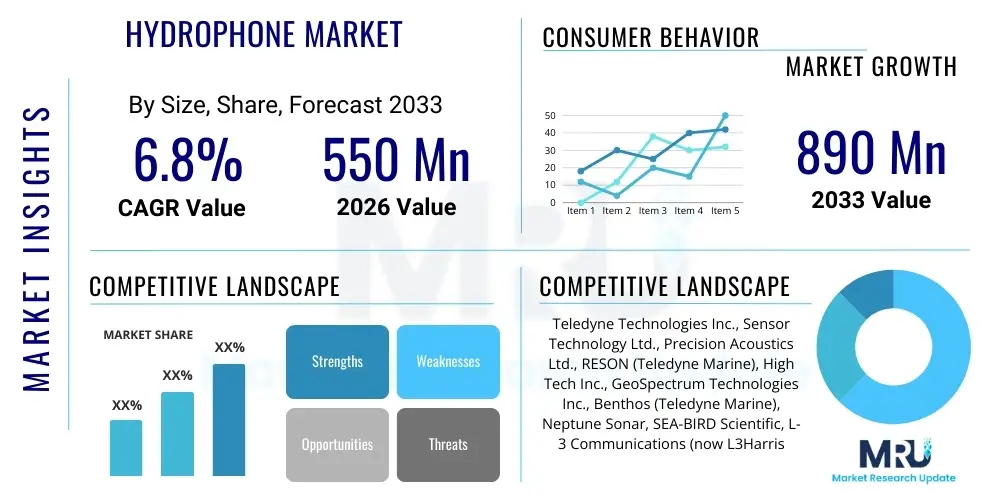

The Hydrophone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 890 Million by the end of the forecast period in 2033.

The steady expansion of the hydrophone market is primarily driven by escalating global investments in marine research, defense sector modernization, and the increasing necessity for offshore oil and gas exploration monitoring. The unique capabilities of hydrophones, particularly their role in passive acoustic monitoring (PAM) and high-resolution underwater mapping, solidify their foundational importance across various maritime industries. Growth acceleration is further supported by the technological advancements transforming piezoelectric materials and digital signal processing, leading to devices with improved sensitivity, reduced noise floor, and expanded operational depth capabilities.

Moreover, the heightened geopolitical tensions and the associated demand for advanced submarine warfare systems and naval surveillance capabilities contribute significantly to market dynamics, especially in regions bordering strategic waterways. Environmental monitoring initiatives, particularly those focusing on marine mammal protection and deep-sea ecosystem assessment, are creating substantial demand for highly specialized, low-frequency hydrophones. These factors collectively underscore the market's trajectory towards sustainable and robust expansion over the forecasted period, positioning hydrophones as indispensable tools for understanding and controlling the subsea environment.

Hydrophone Market introduction

The Hydrophone Market encompasses the design, manufacturing, and distribution of sophisticated underwater acoustic sensors used to detect and record sound waves beneath the water surface. Hydrophones, essentially underwater microphones, convert pressure fluctuations from sound waves into electrical signals, allowing for detailed acoustic analysis in liquid environments. The core product offering spans various designs, including piezoelectric, fiber-optic, and MEMS hydrophones, each tailored for specific frequency ranges, sensitivities, and operational depths. These instruments are fundamental in numerous critical applications, ranging from seismic exploration and environmental noise monitoring to military surveillance and commercial fisheries tracking. The intrinsic benefits of hydrophones lie in their high reliability, precision acoustic measurement capabilities, and ability to operate effectively in challenging marine conditions, providing essential data for both scientific endeavors and defense strategies.

A major driving factor for market growth is the intensified focus on securing maritime borders and enhancing naval dominance, which necessitates state-of-the-art acoustic tracking and communication systems. Furthermore, the global push towards sustainable energy sources is bolstering offshore wind farm development, requiring extensive subsea noise monitoring to ensure compliance with environmental regulations and minimize impact on marine life. The technological shift towards autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) acts as a powerful catalyst, integrating miniature, high-performance hydrophones for navigation, obstacle avoidance, and data collection. These interconnected trends highlight the hydrophone's role as a vital technological component in the burgeoning blue economy, demanding continuous innovation in material science and sensor integration techniques.

The specialized nature of hydrophone applications requires rigorous engineering and calibration, contributing to a high-value market segment. Hydrophones serve as the primary sensory input for passive sonar systems, aiding in the identification and classification of submerged vessels and marine organisms. In the scientific domain, they facilitate critical research on ocean acoustics, climate change impact assessments, and geophysical surveys mapping the ocean floor structure. The growing complexity of underwater operations, coupled with the need for real-time acoustic intelligence, ensures sustained investment in this market segment, emphasizing sensors that can withstand extreme pressures and maintain integrity over extended deployment periods. This convergence of military necessity, commercial requirements, and environmental stewardship fuels the consistent demand for advanced hydrophone solutions globally.

Hydrophone Market Executive Summary

The Hydrophone Market is experiencing robust expansion, driven predominantly by strategic defense spending in naval capabilities and significant technological integration across the energy and environmental sectors. Business trends indicate a strong move toward digitalization and miniaturization, enabling the deployment of large-scale, networked sensor arrays crucial for persistent surveillance and comprehensive environmental data collection. Key market players are heavily investing in developing fiber optic hydrophones (FOHs) due to their immunity to electromagnetic interference and ability to transmit data over long distances with minimal loss, positioning them as the future standard for deep-sea installations. Furthermore, partnerships between defense contractors and specialized sensor manufacturers are becoming common to meet stringent military specifications, accelerating the commercialization of cutting-edge acoustic technologies.

Regionally, North America and Europe maintain dominance, primarily due to established naval procurement programs and pioneering offshore energy projects. However, the Asia Pacific region, particularly China, Japan, and South Korea, is emerging as the fastest-growing market segment. This growth is fueled by rapidly expanding naval modernization programs, escalating maritime territorial disputes, and intense investment in marine infrastructure, including complex subsea cable networks and deep-water ports. Latin America and the Middle East also show promising growth potential, contingent on the scaling of their respective offshore oil and gas industries and corresponding regulatory requirements for environmental noise monitoring.

Segment-wise, the market is profoundly influenced by the application sector, with Defense & Homeland Security accounting for the largest revenue share, demanding high-sensitivity, broadband sensors for sonar systems. Conversely, the Environmental Monitoring segment is projected to exhibit the highest CAGR, propelled by global regulations aimed at protecting marine ecosystems from anthropogenic noise pollution, especially from shipping and construction activities. Technology segmentation favors piezoelectric ceramic hydrophones currently, owing to their cost-effectiveness and versatility, although fiber optic variants are rapidly gaining traction due particularly to their suitability for deep-sea, high-pressure, and long-baseline applications, redefining precision measurement standards within the market.

AI Impact Analysis on Hydrophone Market

Common user questions regarding AI's impact on the Hydrophone Market center heavily on how artificial intelligence can enhance data processing efficiency, improve target detection accuracy, and reduce the burden of manual acoustic interpretation. Users frequently inquire about AI's role in real-time classification of underwater sounds, differentiation between natural marine noise and artificial anthropogenic signatures (e.g., vessel noise, seismic surveys), and the integration of machine learning algorithms directly into smart hydrophone nodes. Key concerns often revolve around the computational demands of AI deployment in remote subsea environments, the reliability of autonomous decision-making in critical defense applications, and the development of standardized training datasets for acoustic classification. These themes highlight a strong market expectation for AI to transform hydrophones from mere data collection tools into sophisticated, intelligent acoustic intelligence platforms capable of providing actionable insights instantly.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally changing the functional landscape of hydrophones, shifting their utility beyond passive data collection toward sophisticated, autonomous acoustic analysis. AI algorithms are now deployed to perform real-time pattern recognition, enabling rapid identification and classification of complex underwater signals, such as distinguishing specific marine mammal calls, identifying the signatures of various vessel types, or locating distress signals with unprecedented speed and accuracy. This advancement significantly reduces the latency inherent in transferring raw acoustic data to shore-based analysis centers, thereby enhancing the operational tempo of both military surveillance and large-scale environmental monitoring projects. Furthermore, AI helps in filtering out irrelevant background noise, dramatically improving the signal-to-noise ratio and extracting valuable information from acoustically cluttered environments, leading to higher quality and more reliable data output essential for critical decision-making processes.

Moreover, AI contributes substantially to optimizing the performance and deployment of hydrophone arrays. Predictive maintenance models, fueled by ML, can analyze operational data to anticipate potential sensor failures or calibration drift, allowing operators to schedule proactive interventions, which is crucial for deep-sea installations where servicing is costly and complex. Generative Engine Optimization (GEO) concepts are relevant here, as AI helps generate synthetic acoustic training data, overcoming the limitations of acquiring comprehensive real-world datasets for rare events or specific threat signatures. This iterative improvement cycle, driven by intelligent data processing and autonomous calibration, ensures that hydrophone systems maintain peak performance throughout their lifecycle, making them increasingly reliable and cost-effective instruments for long-duration subsea acoustic sensing.

- AI enables real-time acoustic classification (e.g., vessel types, marine species).

- Machine Learning algorithms improve signal-to-noise ratio for cleaner data extraction.

- Predictive maintenance models enhance the longevity and reliability of hydrophone arrays.

- AI integration reduces the dependency on high bandwidth communication by processing data at the source (edge computing).

- Generative AI assists in creating synthetic acoustic datasets for advanced sonar training and threat simulation.

DRO & Impact Forces Of Hydrophone Market

The Hydrophone Market’s dynamic is shaped by strong drivers such as escalating global naval modernization programs and the critical need for effective defense against underwater threats, coupled with the expansion of deep-sea resource exploration, which mandates comprehensive acoustic monitoring. Restraints primarily involve the severe operational challenges associated with deep-sea deployments, including extreme pressure, corrosion, and biofouling, alongside the high initial cost of advanced hydrophone arrays and the complexity of signal processing in highly noisy environments. Opportunities abound in the realm of fiber-optic sensor technology integration, the burgeoning market for environmental noise mitigation systems, and the development of standardized, interoperable sensor networks for the blue economy. These interacting factors—Drivers, Restraints, and Opportunities—collectively constitute the Impact Forces, dictating the strategic priorities for manufacturers and influencing procurement cycles across military, scientific, and commercial sectors.

Key drivers include the indispensable role of hydrophones in seismic surveys for oil and gas exploration, where precise acoustic data is necessary for subsurface imaging and reservoir characterization. Furthermore, international conventions and national legislation focused on mitigating marine noise pollution are forcing industries like shipping and construction to adopt hydrophones for compliance monitoring, creating a sustained commercial demand. The technological evolution toward smaller, lighter, and more energy-efficient piezoelectric materials and digital sensors is reducing system costs and expanding applicability to smaller platforms like autonomous underwater vehicles (AUVs), democratizing access to high-fidelity acoustic sensing capabilities. This technological momentum is critical for sustaining growth, particularly in scientific research and specialized niche applications.

However, the market faces significant restraints. The development and deployment of ultra-deep-sea hydrophones necessitate materials and packaging solutions that can withstand immense hydrostatic pressures, often requiring specialized and expensive manufacturing processes. Moreover, the inherent variability and complexity of the underwater acoustic environment, subject to temperature and salinity gradients, complicate signal calibration and interpretation, presenting a persistent technological challenge. Despite these hurdles, strategic opportunities exist, particularly in leveraging machine learning for automated anomaly detection and signal classification, transforming massive raw data streams into valuable operational intelligence. The convergence of hydrophone technology with emerging IoT standards for underwater networking (IoUT) represents a substantial future growth pathway, offering real-time, persistent acoustic monitoring capabilities over vast oceanic areas.

Segmentation Analysis

The Hydrophone Market is comprehensively segmented based on technology, operational depth, application, and end-user, reflecting the diverse and specialized requirements of the subsea acoustic sensing domain. Technology segmentation primarily differentiates between piezoelectric, fiber optic, and micro-electromechanical systems (MEMS) hydrophones, each offering unique performance characteristics related to sensitivity, frequency response, and robustness. Operational depth, spanning shallow water (up to 300m), intermediate depths (300m to 1500m), and deep water (below 1500m), dictates the mechanical design and material selection for pressure tolerance. Application analysis categorizes demand into critical areas such as defense and security, seismic surveys, environmental monitoring, and marine research, while end-users range from military organizations and government agencies to offshore energy companies and academic institutions. Understanding these segments is crucial for manufacturers tailoring product development and for end-users seeking optimal acoustic measurement solutions for specific maritime missions.

The segmentation by operational depth is particularly vital as it relates directly to technological feasibility and cost. Deep-water applications, driven primarily by ultra-deep offshore oil exploration and military submarine detection, require custom-engineered hydrophones capable of maintaining high performance under extreme pressures and low temperatures, often favoring robust piezoelectric or advanced fiber-optic designs. In contrast, shallow-water monitoring for port security or marine biological surveys may utilize more cost-effective, versatile sensors, including MEMS devices that offer smaller form factors suitable for integrating into littoral platforms or surface drones. This delineation ensures that specialized performance metrics are met while managing complexity and cost across different environmental regimes.

Furthermore, the End-User segmentation highlights the primary revenue drivers. The Defense sector typically requires hydrophones characterized by ultra-low noise, high sensitivity across a broad frequency spectrum, and ruggedized housing for deployment on towed arrays or hull-mounted sonar systems. Commercial end-users, such as seismic survey companies, prioritize array scalability and reliable, high-bandwidth data acquisition capabilities. The growing Environmental Monitoring segment demands highly calibrated, long-term deployable sensors with low power consumption for passive acoustic monitoring (PAM) of marine fauna, indicating a growing convergence between commercial and scientific requirements driven by global sustainability goals and regulatory compliance needs.

- By Technology:

- Piezoelectric Hydrophones (PZT Ceramic)

- Fiber Optic Hydrophones (FOH)

- MEMS Hydrophones

- Electromagnetic Hydrophones

- By Operational Depth:

- Shallow Water (Up to 300 meters)

- Intermediate Depth (300 meters to 1500 meters)

- Deep Water (1500 meters and above)

- By Application:

- Defense & Homeland Security (Sonar, Surveillance, Anti-Submarine Warfare)

- Seismic Survey & Mapping (Oil & Gas Exploration, Geophysical Research)

- Environmental & Marine Monitoring (Passive Acoustic Monitoring - PAM)

- Research & Academic

- Commercial (Fisheries, Shipping Noise Monitoring)

- By End-User:

- Military & Government Agencies

- Offshore Energy (Oil & Gas, Wind Farms)

- Marine Research Institutions

- Commercial Survey Companies

Value Chain Analysis For Hydrophone Market

The value chain for the Hydrophone Market begins with highly specialized Upstream Analysis, centered on the sourcing and processing of critical materials, particularly piezoelectric ceramics (like PZT) and advanced fiber optic components, alongside the precision manufacturing of electronic circuitry and robust housing materials capable of withstanding extreme marine conditions. This stage is characterized by high barriers to entry due to the proprietary nature of material science and specialized cleanroom manufacturing requirements. Key activities at this stage include sensor element fabrication, pre-amplification circuit design, and quality assurance testing of component sensitivity and frequency response. Strategic partnerships with suppliers of high-grade ceramics and specialty optical fibers are essential to secure a competitive edge and ensure product reliability and acoustic fidelity, which are non-negotiable prerequisites for operational deployment.

The middle segment of the chain involves assembly, integration, and distribution. Hydrophone elements are integrated into ruggedized packages, often as single units or complex towed/fixed arrays, followed by comprehensive calibration against industry standards (e.g., ISO 17025) in certified acoustic test tanks. Distribution channels vary significantly based on the end-user. Direct channels are predominant for large-scale, high-value defense contracts, where detailed customization, secure delivery, and specialized training are mandatory. Indirect channels, involving system integrators, specialized resellers, and distributors, typically handle commercial, research, and smaller volume sales, leveraging local expertise for installation and post-sales support across diverse geographical regions. This stage also includes the development of proprietary software for data acquisition and preliminary signal processing, adding significant value to the hardware component.

Downstream analysis focuses on deployment, operational support, and maintenance. Hydrophones are deployed across diverse platforms, ranging from naval vessels and autonomous underwater vehicles (AUVs) to permanent seabed observatories. The operational phase generates substantial demand for complementary services, including acoustic data processing and analysis (often incorporating AI/ML tools), system maintenance, and re-calibration services. This end of the value chain is increasingly reliant on software capabilities and field service expertise, ensuring sustained performance and longevity in hostile environments. The circular aspect of the value chain is completed through feedback from end-users, driving continuous improvement in sensor design and the development of more robust, sensitive, and intelligent hydrophone systems for future iterations.

Hydrophone Market Potential Customers

Potential customers for hydrophones span a wide spectrum of specialized entities that require high-fidelity acoustic data from subsea environments for operational, strategic, or regulatory purposes. The largest and most demanding customer segment consists of Military and Government Agencies, specifically naval forces responsible for submarine detection (ASW), mine countermeasures, and persistent maritime surveillance. These end-users typically procure large, high-specification towed or hull-mounted arrays, prioritizing absolute reliability, stealth technology compatibility, and integration with complex sonar processing systems. Defense budgets worldwide serve as a primary indicator of demand within this segment, driving innovation toward low-frequency and highly sensitive broadband hydrophones.

The second major group comprises the Offshore Energy Sector, including international Oil & Gas companies and rapidly expanding Offshore Wind Farm developers. Oil and gas exploration relies heavily on seismic surveys utilizing multi-channel hydrophone streamers to map subsurface geological structures for resource identification. Meanwhile, offshore wind farm developers utilize hydrophones for baseline noise assessments and regulatory compliance monitoring, ensuring construction and operational activities do not exceed permitted noise levels that could harm marine mammals. These commercial buyers prioritize durability, system scalability, and cost-effectiveness for large-scale, long-duration deployments in demanding operational areas.

Finally, a significant and rapidly growing customer base includes Marine Research Institutions, universities, and Environmental Consulting Firms. These entities utilize hydrophones for Passive Acoustic Monitoring (PAM) to study marine mammal populations, track ocean noise levels (ocean ambient noise studies), and conduct geophysical and climate research. This segment often demands highly sensitive, low-power hydrophones capable of autonomous deployment over months or years, requiring robust data logging and retrieval mechanisms. Regulatory bodies enforcing environmental protection laws also act as indirect customers, driving demand through compliance mandates placed upon the industrial and shipping sectors, thereby ensuring a sustained, diversified revenue stream for the hydrophone market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 890 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne Technologies Inc., Sensor Technology Ltd., Precision Acoustics Ltd., RESON (Teledyne Marine), High Tech Inc., GeoSpectrum Technologies Inc., Benthos (Teledyne Marine), Neptune Sonar, SEA-BIRD Scientific, L-3 Communications (now L3Harris), JASCO Applied Sciences, HTI-Hydroacoustics Inc., RTS Systems, Sonardyne International Ltd., Ultra Electronics, Orca Offshore, Bruel & Kjaer, Colmar Systems, Piezotech S.A., Aquarian Audio Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydrophone Market Key Technology Landscape

The current technology landscape of the Hydrophone Market is dominated by two primary, competing technologies: traditional Piezoelectric (PZT) ceramics and emerging Fiber Optic Hydrophones (FOH). Piezoelectric technology remains the industry workhorse due to its robust nature, relative cost-effectiveness, and established performance history, particularly in towed arrays and hull-mounted applications. Recent advancements in PZT focus on synthesizing new ceramic materials that offer enhanced sensitivity across broader frequency ranges and improved thermal stability, allowing for more reliable operation in varied oceanographic conditions. The integration of advanced microelectronics directly into the sensor head is also prevalent, facilitating analog-to-digital conversion at the source to minimize noise interference during signal transmission, a critical feature for high-fidelity acoustic data capture.

Fiber Optic Hydrophones (FOH), leveraging interferometry and optical sensing principles, represent the cutting edge of technological innovation. FOHs offer distinct advantages, most notably complete immunity to electromagnetic interference (EMI), which is crucial for applications near high-power underwater cables or within complex electronic environments. They also excel in deep-sea applications due to their small size, light weight, and the ability to transmit acoustic data over extremely long distances without the need for bulky electronic repeaters or active components in the water. The shift towards FOH is particularly pronounced in large, distributed sensor networks and permanent seabed monitoring systems where system longevity and resistance to corrosion are paramount. However, FOH deployment currently entails higher initial complexity and cost compared to PZT solutions, limiting their adoption primarily to strategic defense and high-end scientific projects.

A smaller, but rapidly evolving, segment involves Micro-Electro-Mechanical Systems (MEMS) hydrophones. MEMS technology allows for the creation of miniature, highly integrated sensors utilizing silicon-based fabrication techniques. While currently limited in deep-water pressure tolerance compared to PZT or FOH, MEMS hydrophones are transformative for integration into small, autonomous platforms like AUVs, gliders, and disposable sensor buoys due to their low power consumption and potential for mass production at lower costs. Future technological convergence is expected to see hybrid systems, combining the robustness of PZT with the data transmission capabilities of fiber optics, or utilizing AI algorithms directly embedded within the digital processing units of MEMS sensors to achieve unparalleled underwater acoustic intelligence capabilities.

Regional Highlights

Regional dynamics in the Hydrophone Market are deeply intertwined with geopolitical strategy, natural resource exploration efforts, and the concentration of marine technology expertise. North America, anchored by the United States, commands a leading market share primarily driven by substantial and continuous investments in naval superiority, particularly through sophisticated Anti-Submarine Warfare (ASW) programs and extensive subsea surveillance initiatives. The region also benefits from a mature offshore energy sector and numerous leading academic and military research institutions that drive demand for cutting-edge acoustic sensing technology. This dominance is sustained by the presence of key industry players and advanced manufacturing capabilities for both traditional and fiber-optic hydrophones.

Europe represents another mature and high-value market, characterized by significant governmental spending on maritime border security, offshore renewable energy projects (especially wind farms), and stringent environmental regulations demanding noise monitoring. Countries like the UK, Norway, and France are pivotal, contributing heavily to the market through defense procurement and pioneering research into low-noise, sustainable deployment technologies. The European market is also at the forefront of adopting hydrophones for compliance with environmental directives, driving steady commercial demand for Passive Acoustic Monitoring (PAM) systems.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rising geopolitical tensions in the South China Sea and the Indian Ocean, fueling massive naval expansion and modernization efforts across major economies, including China, India, Japan, and South Korea. Simultaneously, APAC is witnessing rapid growth in offshore oil and gas exploration, coupled with significant infrastructural development like subsea cable installation and deep-sea port expansion, all requiring comprehensive acoustic monitoring solutions. Investments from nations aiming to establish or enhance their blue-water naval capabilities are rapidly transforming the region into the most critical growth vector for the hydrophone industry globally.

- North America: Dominates due to strong military expenditure, mature offshore energy market, and concentration of key R&D centers. High demand for advanced ASW systems and sophisticated fiber optic hydrophone arrays.

- Europe: Characterized by strict environmental noise regulations, significant investments in offshore wind energy, and robust naval security requirements in the North Sea and Mediterranean. Strong adoption of PAM systems for regulatory compliance.

- Asia Pacific (APAC): Fastest-growing market segment, fueled by escalating naval modernization programs, maritime territorial disputes, and expanding regional offshore exploration activities. High demand for seismic survey equipment and surveillance hydrophones.

- Latin America: Growth driven by ongoing, albeit fluctuating, deep-water oil and gas exploration off the coasts of Brazil and Mexico, creating a steady need for seismic survey hydrophones and environmental impact assessment tools.

- Middle East and Africa (MEA): Market growth linked to strategic coastal defense requirements, port security enhancements, and new offshore energy exploration ventures, particularly in the Gulf region, focusing on robust, high-temperature tolerant sensors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydrophone Market.- Teledyne Technologies Inc.

- Sensor Technology Ltd.

- Precision Acoustics Ltd.

- RESON (Teledyne Marine)

- High Tech Inc.

- GeoSpectrum Technologies Inc.

- Benthos (Teledyne Marine)

- Neptune Sonar

- SEA-BIRD Scientific

- L-3 Communications (now L3Harris)

- JASCO Applied Sciences

- HTI-Hydroacoustics Inc.

- RTS Systems

- Sonardyne International Ltd.

- Ultra Electronics

- Orca Offshore

- Bruel & Kjaer

- Colmar Systems

- Piezotech S.A.

- Aquarian Audio Products

Frequently Asked Questions

Analyze common user questions about the Hydrophone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between piezoelectric and fiber optic hydrophones?

Piezoelectric hydrophones rely on ceramic materials to generate an electrical charge when compressed by sound waves, offering robustness and cost-effectiveness. Fiber optic hydrophones (FOH) utilize light interference to detect pressure changes, offering superior immunity to electromagnetic interference (EMI) and suitability for ultra-long-distance, deep-sea applications without electronic components underwater.

Which application segment drives the highest demand in the Hydrophone Market?

The Defense & Homeland Security segment consistently drives the highest revenue due to large-scale procurement of sophisticated sonar systems, towed arrays, and surveillance equipment necessary for Anti-Submarine Warfare (ASW) and maritime border protection, demanding high-sensitivity, broadband acoustic sensors.

How does the deployment of Autonomous Underwater Vehicles (AUVs) impact hydrophone design?

AUV deployment mandates smaller, lighter, and more energy-efficient hydrophones, often favoring miniaturized MEMS or highly integrated piezoelectric designs. The need for autonomous data processing also pushes the integration of edge computing capabilities and AI algorithms directly into the sensor platform.

What are the main restraints hindering the Hydrophone Market growth?

Key restraints include the extremely high cost and technical complexity associated with deep-sea deployments, the challenges of biofouling and corrosion affecting long-term sensor reliability, and the need for highly specialized and expensive calibration facilities to ensure acoustic accuracy.

What is the projected growth trajectory for the Asia Pacific (APAC) Hydrophone Market?

APAC is projected to exhibit the fastest growth (highest CAGR) owing to significant naval modernization programs across major economies, increased territorial disputes driving defense spending, and expanding regional offshore oil and gas exploration activities requiring seismic surveys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager