Hydroxyprogesterone Caproate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441902 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Hydroxyprogesterone Caproate Market Size

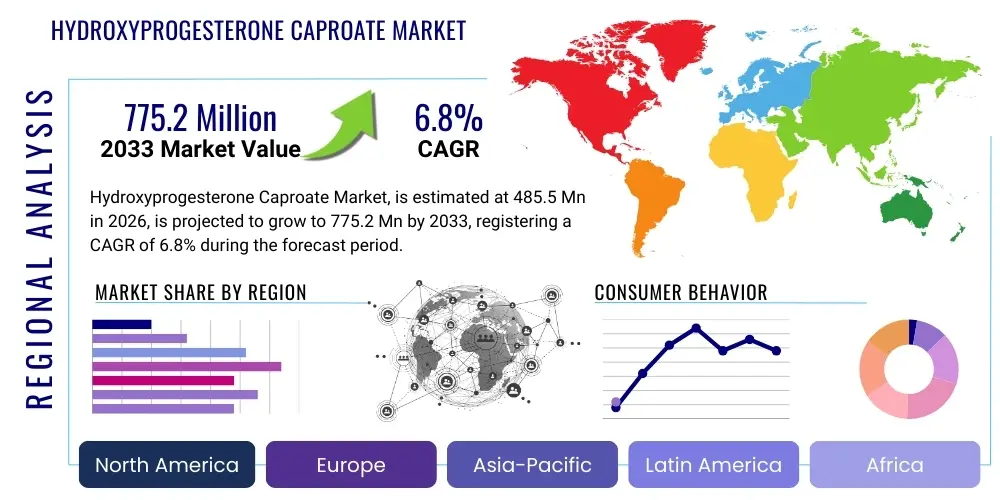

The Hydroxyprogesterone Caproate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 775.2 Million by the end of the forecast period in 2033.

Hydroxyprogesterone Caproate Market introduction

The Hydroxyprogesterone Caproate (HPC) market encompasses pharmaceuticals utilized primarily for the prevention of recurrent preterm birth in women with a singleton pregnancy who have a history of spontaneous preterm delivery. HPC is a synthetic progestin that acts by maintaining uterine quiescence, thus extending gestation. Historically, this compound has been critical in maternal-fetal medicine, providing a preventative measure against one of the leading causes of neonatal mortality and morbidity globally. The market growth is intricately linked to rising awareness of high-risk pregnancies, advancements in diagnostic techniques allowing for earlier identification of candidates for therapy, and ongoing clinical research exploring optimal dosing and administration methods.

Major applications of HPC are concentrated within obstetrics and gynecology, specifically targeting high-risk pregnant women. While the regulatory landscape surrounding HPC, particularly in major markets like the U.S., has recently undergone significant scrutiny regarding efficacy claims, the need for effective preterm birth prevention strategies continues to drive market activities in regions where the drug remains a standard of care. Furthermore, research into novel drug delivery systems, such as subcutaneous formulations or long-acting injectables, aims to improve patient compliance and therapeutic outcomes, bolstering the market's trajectory.

The primary benefit of widespread HPC adoption is the reduction in spontaneous preterm births, leading to decreased healthcare expenditure associated with neonatal intensive care, long-term developmental challenges, and associated socio-economic burdens. Key driving factors for the market include the high global incidence of preterm birth, government initiatives promoting maternal health, increased healthcare accessibility in emerging economies, and persistent research efforts validating the drug's role in specific high-risk populations. However, ongoing discussions about efficacy and reimbursement policies present complex challenges that stakeholders must navigate to ensure sustainable market expansion.

Hydroxyprogesterone Caproate Market Executive Summary

The Hydroxyprogesterone Caproate market exhibits robust growth driven by persistent demand for effective interventions against recurrent preterm birth, despite recent regulatory uncertainties in certain developed economies. Business trends indicate a strategic focus shift toward geographical diversification, particularly capitalizing on the growing demand for advanced maternal care solutions in the Asia Pacific and Latin American regions where birth rates are high and clinical guidelines support HPC use. Furthermore, key players are investing heavily in lifecycle management strategies, including the development of new formulations and combination therapies, to solidify market share against generic competition and regulatory pressures. Mergers and acquisitions remain a moderate trend, primarily focused on securing specialized manufacturing capabilities or expanding distribution networks in underserved markets.

Regional trends highlight North America as a highly saturated but technologically advanced market, facing challenges due to the controversial withdrawal recommendations by regulatory bodies, leading to a need for more definitive, large-scale clinical trials. Conversely, the European market maintains stability, often guided by national guidelines that incorporate HPC based on specific risk assessments. The most dynamic growth is anticipated in the Asia Pacific (APAC) region, fueled by expanding healthcare infrastructure, increasing disposable incomes, and the high volume of pregnancies requiring preventative interventions. Middle East and Africa (MEA) also represent significant opportunities due to high unmet needs in maternal health and increasing adoption of Western clinical protocols.

Segment trends underscore the dominance of the injectable segment, which constitutes the traditional and widely accepted administration route. However, there is a burgeoning interest in novel delivery systems designed to enhance convenience and patient adherence. In terms of end-users, specialty obstetric clinics and hospitals represent the largest consumption channels, driven by the specialized nature of high-risk pregnancy management. The competitive landscape is characterized by established pharmaceutical companies alongside a growing presence of generic manufacturers, pressuring pricing structures and necessitating continued innovation in product differentiation and supply chain efficiency across all segments.

AI Impact Analysis on Hydroxyprogesterone Caproate Market

Common user inquiries concerning AI’s impact on the Hydroxyprogesterone Caproate market frequently revolve around its potential to refine risk stratification for preterm birth, optimize clinical trial design for efficacy confirmation, and improve patient adherence through personalized monitoring. Users are particularly interested in whether AI-driven predictive models can accurately identify the most suitable candidates for HPC therapy, mitigating the risk of administering the drug to individuals who may not benefit, a key concern raised during recent regulatory debates. Key themes include the expectation that AI will automate the analysis of vast datasets comprising patient histories, genomic information, and real-world outcomes (RWE) to provide deeper insights into HPC effectiveness mechanisms and patient selection criteria. Concerns often center on data privacy, the validation of AI algorithms in diverse global populations, and the potential displacement of traditional clinical decision-making processes, yet the overwhelming expectation is that AI will introduce unprecedented precision medicine capabilities to the field of recurrent preterm birth prevention.

- AI algorithms enhance precision in identifying high-risk pregnant women through analysis of electronic health records (EHRs) and genomic markers, thereby optimizing the target population for HPC use.

- Machine learning accelerates drug discovery and repurposing efforts by predicting effective formulations and potential synergistic therapies for preterm birth prevention, complementing existing HPC protocols.

- AI tools improve the efficiency and cost-effectiveness of phase IV clinical trials by analyzing real-world efficacy data from diverse cohorts, providing robust evidence needed for regulatory validation and market acceptance.

- Personalized dosage and treatment adherence monitoring facilitated by AI-driven mobile health platforms and wearables can optimize the therapeutic regimen, improving patient outcomes associated with HPC administration.

- AI-powered supply chain management systems enhance forecasting accuracy for HPC demand, reducing inventory waste and ensuring timely distribution to clinics and hospitals globally.

DRO & Impact Forces Of Hydroxyprogesterone Caproate Market

The Hydroxyprogesterone Caproate market is propelled by the rising global incidence of preterm birth and the subsequent high necessity for preventative pharmacological interventions, coupled with increasing governmental and NGO support for maternal and child health programs, particularly in emerging economies. However, market expansion is significantly constrained by ongoing regulatory uncertainties, especially concerning definitive evidence of efficacy for all patient subpopulations, leading to reimbursement challenges and market access hurdles in major Western economies. Opportunities abound in developing novel drug delivery technologies, such as long-acting implants or transdermal patches, which address patient compliance issues, alongside expanding geographic reach into high-growth, underserved APAC and LATAM markets where clinical acceptance remains strong. These dynamics create powerful impact forces centered around regulatory scrutiny, price sensitivity driven by generic penetration, and the constant clinical imperative to reduce neonatal morbidity, compelling continuous innovation in formulation science and robust data generation.

Drivers: The high prevalence of spontaneous preterm birth globally mandates the continuous availability of preventative options like HPC. Increased access to specialized maternal healthcare facilities and the implementation of standardized protocols in obstetrics, particularly in developed and rapidly developing nations, drive prescription volumes. Furthermore, successful advocacy and educational campaigns regarding the risks associated with preterm birth encourage proactive pharmacological intervention. The development of biosimilars and generics, while potentially restraining premium pricing, simultaneously increases the accessibility and affordability of the therapy, broadening its application base, especially in resource-constrained settings.

Restraints: The most prominent restraint is the controversy surrounding the definitive efficacy data for HPC in heterogeneous patient populations, which has led to stringent regulatory reviews and, in some cases, the market withdrawal or significant limitation of indications. High manufacturing costs associated with maintaining pharmaceutical grade injectable standards, along with the increasing penetration of generic versions which compress profit margins for branded products, also restrict market growth. Patient factors, such as discomfort associated with weekly injections and the need for rigorous adherence to the treatment schedule throughout pregnancy, also pose compliance challenges that indirectly restrict overall market potential.

Opportunities: Significant market opportunities lie in geographical expansion, targeting Asia Pacific and Latin America, where maternal health funding is increasing and the clinical necessity is profound. Innovation in drug delivery, focusing on formulations that minimize injection frequency or offer non-invasive administration routes, promises enhanced market appeal and improved patient quality of life. Furthermore, leveraging pharmacogenomic research to precisely identify patient subgroups that respond optimally to HPC offers a route to overcoming efficacy concerns and securing more focused regulatory approvals, thereby rejuvenating confidence in the compound's therapeutic role.

Segmentation Analysis

The Hydroxyprogesterone Caproate market is segmented based primarily on the formulation type, indicating the method of administration, and the end-user setting, defining the consumption channels. The segmentation analysis provides granular insights into market dynamics, revealing preferences for specific delivery methods and concentration of demand within specialized healthcare facilities. The injectable formulation segment dominates the market due to its established clinical history and widespread acceptance, though newer delivery methods are expected to gain traction as they address chronic adherence challenges associated with weekly intramuscular administration. End-user segmentation reveals that hospitals and specialty obstetric clinics are the primary procurement points, reflecting the specialized medical oversight required for administering HPC to high-risk patients.

Analysis by Formulation Type (Injectable and Others) highlights that injectable HPC, including intramuscular (IM) formulations, constitutes the foundational structure of the market. This dominance is due to decades of clinical practice and established regulatory pathways. However, the 'Others' category, encompassing novel delivery systems like sustained-release formulations, subcutaneous injections, or transdermal patches, represents a high-growth potential segment as manufacturers seek to enhance patient comfort and compliance. These novel systems aim to differentiate products in a landscape increasingly populated by generics.

The end-user segment is crucial for understanding distribution dynamics. Hospitals, especially those with large obstetrics and gynecology departments and tertiary care services, account for the largest share of consumption due to their role in managing high-risk pregnancies and providing inpatient administration services. Specialty obstetric clinics, often focused on outpatient care for recurrent preterm birth prevention, represent the second largest segment, emphasizing decentralized but specialized treatment delivery. Analyzing these segments helps stakeholders tailor marketing strategies, optimize distribution logistics, and anticipate shifts in procurement patterns.

- By Formulation Type:

- Injectable (Intramuscular, Subcutaneous)

- Others (e.g., Oral, Transdermal, Long-acting Implants - currently niche/experimental)

- By End-User:

- Hospitals

- Specialty Obstetric Clinics

- Ambulatory Surgical Centers (for minor procedures related to high-risk pregnancy)

- Research and Academic Institutions

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Sales (Government/NGO contracts)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Hydroxyprogesterone Caproate Market

The Hydroxyprogesterone Caproate market value chain begins with the upstream procurement and synthesis of raw materials, primarily specialized progestin precursors, followed by stringent active pharmaceutical ingredient (API) manufacturing. This phase requires significant quality control and compliance with Good Manufacturing Practices (GMP). Midstream activities involve the formulation into final dosage forms, predominantly sterile injectables, packaging, and regulatory filing. Downstream analysis focuses on logistics, distribution channels (hospital pharmacies, retail outlets), and ultimately, prescription by obstetric specialists and administration to the high-risk patient population. Efficiency at the upstream manufacturing level directly impacts the competitiveness of the final drug product, especially in a market facing generic competition and high regulatory demands.

Upstream analysis emphasizes the specialized nature of steroid chemistry required for HPC synthesis. Key challenges include securing reliable, high-purity sources of precursors and managing the complex chemical processes involved in caproate esterification. Manufacturers must navigate intellectual property rights and maintain robust quality management systems, as slight variations in API purity can have significant consequences in clinical settings. The increasing trend of outsourcing API production to specialized Contract Development and Manufacturing Organizations (CDMOs), particularly in APAC, is observed to achieve cost efficiencies while adhering to international regulatory standards, thereby optimizing the initial stages of the value chain.

The distribution channel is predominantly direct or indirect through specialized pharmaceutical wholesalers. Direct channels are often utilized for large hospital systems or government procurement tenders, ensuring bulk supply and potentially lower per-unit costs. Indirect channels rely on a complex network of regional distributors who manage cold chain logistics crucial for injectable pharmaceuticals, delivering the product to hospital and retail pharmacies. The end-user, comprising obstetricians and maternal health centers, plays a critical role in the final stage, where the drug is administered under strict medical supervision. Regulatory changes or shifts in clinical guidelines (e.g., recommendations regarding specific patient inclusion criteria) significantly influence prescribing behavior, representing a key dynamic force within the downstream segment of the value chain.

Hydroxyprogesterone Caproate Market Potential Customers

The primary potential customers and end-users of Hydroxyprogesterone Caproate are medical institutions and healthcare providers specializing in maternal-fetal medicine and high-risk obstetrics. Specifically, the target audience includes women who have a documented history of spontaneous preterm birth and are currently carrying a singleton pregnancy, as this demographic aligns precisely with the drug's approved indication in most jurisdictions. Therefore, the immediate purchasers are typically large hospitals, specialized maternity centers, and outpatient obstetric clinics that manage complex pregnancies. Academic medical centers also constitute a vital customer segment, both for clinical usage and for conducting pivotal research and training new generations of obstetric specialists.

Beyond the direct institutional purchasers, governmental health agencies and non-governmental organizations (NGOs) focused on public health initiatives represent significant, albeit often tender-driven, customer segments, particularly in regions with high maternal mortality rates. These organizations procure HPC in large volumes for nationwide or regional programs aimed at reducing preterm birth rates as a critical public health metric. Furthermore, third-party payers, including insurance providers and national health systems, are key stakeholders as they ultimately determine the reimbursement landscape and patient access to the drug, fundamentally impacting market volume and pricing strategies.

The segmentation of potential customers based on income level and regional accessibility is also critical. In developed markets, customers prioritize convenience and specialized care (often leading to interest in novel, less frequent dosing schedules), whereas in emerging economies, the overriding factor is affordability and inclusion in essential drug lists. Therefore, pharmaceutical companies must tailor their commercial strategies—including pricing, packaging, and distribution methods—to meet the distinct procurement requirements and clinical priorities of hospitals in high-resource settings versus public health clinics in low-resource environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 775.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AMAG Pharmaceuticals (now part of Covis Pharma), Watson Pharmaceuticals (now Allergan), Luitpold Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Mylan N.V., Dr. Reddy's Laboratories, Sun Pharmaceutical Industries Ltd., Viatris Inc., Pfizer Inc., Bristol-Myers Squibb, Gland Pharma Limited, Aurobindo Pharma, Zydus Lifesciences Limited, Hikma Pharmaceuticals PLC, Ciron Drugs & Pharmaceuticals Pvt. Ltd., Biological E. Limited, Baxter International Inc., Fresenius Kabi AG, Intas Pharmaceuticals Ltd., Cipla Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxyprogesterone Caproate Market Key Technology Landscape

The technology landscape for the Hydroxyprogesterone Caproate market is primarily centered on formulation technology aimed at improving drug solubility, stability, and patient convenience, moving beyond the traditional oil-based intramuscular injection. The primary technology utilized historically is standard sterile injectable manufacturing, demanding high precision in ensuring API dispersion in the carrier oil (often castor oil) and rigorous aseptic processing to prevent contamination. Current technological advancements focus on microencapsulation and nanotechnology to create sustained-release systems, which could potentially extend the dosing interval from weekly to bi-weekly or monthly, drastically improving adherence and reducing healthcare resource utilization associated with frequent clinic visits.

Novel delivery systems represent the frontier of technological innovation in this market. Researchers are exploring transdermal patch technology to allow non-invasive, continuous delivery of HPC, potentially minimizing systemic peaks and troughs and reducing injection site reactions. Additionally, the integration of smart manufacturing principles, including continuous manufacturing processes and advanced analytical technologies (PAT), is being adopted by leading API manufacturers to enhance batch consistency, reduce production cycle times, and lower overall manufacturing costs, which is crucial for competing effectively in the genericized segment of the market. These technological shifts are pivotal to differentiating products and addressing the current clinical shortcomings of the therapy.

Furthermore, technology is playing a major role in the clinical support system surrounding HPC administration. This includes digital health technologies and telemedicine platforms that facilitate remote monitoring of high-risk patients, track adherence to the weekly injection schedule, and flag potential complications early. The use of advanced imaging technologies (e.g., high-resolution ultrasound) combined with AI-driven predictive analytics helps clinicians accurately assess cervical length and other risk factors, ensuring that HPC therapy is initiated only in the most appropriate patients, thereby maximizing the therapeutic benefit and providing technological reinforcement for clinical decision-making processes.

Regional Highlights

Regional dynamics within the Hydroxyprogesterone Caproate market are highly diverse, reflecting variations in regulatory environments, healthcare spending, and clinical practice guidelines regarding preterm birth prevention. North America, historically the dominant market, faces substantial regulatory headwinds due to recent FDA actions questioning the drug’s overall efficacy, which has led to significant market uncertainty and operational challenges for key stakeholders. Despite this, the region benefits from advanced healthcare infrastructure, high awareness, and established reimbursement mechanisms for obstetrical interventions, necessitating ongoing investment in large-scale clinical trials to reaffirm the drug's utility in specific, well-defined patient cohorts.

Europe presents a more stable, albeit fragmented, landscape, with individual countries maintaining distinct national guidelines. HPC usage remains integrated into high-risk pregnancy management in many key European economies (such as Germany and France), driven by local clinical society recommendations and robust health technology assessment (HTA) evaluations. Market penetration is supported by comprehensive public health systems and favorable reimbursement for specialized prenatal care. The focus across European countries is largely on managing procurement costs and ensuring standardized administration protocols across diverse clinical settings.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, primarily due to the large population base, high birth rates, increasing prevalence of high-risk pregnancies due to lifestyle changes, and rapidly improving healthcare access and spending in countries like China and India. The clinical adoption of HPC in APAC is often less burdened by the historical controversies seen in the US market, and the emphasis is placed on immediate public health benefit. Latin America (LATAM) and the Middle East and Africa (MEA) also offer strong growth potential, characterized by significant unmet maternal health needs and increasing adoption of specialized Western pharmaceuticals, though market access is often contingent upon navigating complex public procurement tenders and addressing supply chain complexities.

- North America (NA): Characterized by high market saturation, advanced clinical practice, and significant recent regulatory uncertainty (specifically concerning Makena/HPC efficacy), driving a focus on R&D for definitive proof and lifecycle management.

- Europe: Stable market with robust national clinical guidelines supporting localized usage; growth is incremental, focused on cost-efficiency and adherence to country-specific HTA requirements.

- Asia Pacific (APAC): Highest growth potential driven by population size, rising healthcare expenditure, expanding accessibility, and strong acceptance of preventative measures in key emerging economies like India and China.

- Latin America (LATAM): Growing market fueled by increasing government investment in maternal health programs and urbanization, leading to greater demand for specialized obstetric drugs; procurement often involves governmental tenders.

- Middle East and Africa (MEA): Emerging market with high unmet needs; growth supported by infrastructure development in affluent Middle Eastern nations and increasing international aid for reproductive health in Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxyprogesterone Caproate Market.- AMAG Pharmaceuticals (now part of Covis Pharma)

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now Viatris Inc.)

- Luitpold Pharmaceuticals

- Dr. Reddy's Laboratories

- Sun Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Zydus Lifesciences Limited

- Hikma Pharmaceuticals PLC

- Gland Pharma Limited

- Cipla Limited

- Intas Pharmaceuticals Ltd.

- Fresenius Kabi AG

- Baxter International Inc.

- Bristol-Myers Squibb

- Pfizer Inc.

- Ciron Drugs & Pharmaceuticals Pvt. Ltd.

- Biological E. Limited

- Allergan (now part of AbbVie)

- Covis Pharma

Frequently Asked Questions

Analyze common user questions about the Hydroxyprogesterone Caproate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary therapeutic use of Hydroxyprogesterone Caproate (HPC)?

The primary therapeutic use of HPC is the prevention of recurrent spontaneous preterm birth in women carrying a single fetus who have a history of a previous spontaneous preterm delivery. It is administered via injection, typically starting around 16 to 20 weeks of gestation, to help maintain uterine quiescence.

Why is the market for HPC facing regulatory challenges and uncertainties?

The market faces regulatory challenges due to mixed clinical trial results, specifically regarding definitive proof of efficacy across diverse, heterogeneous patient populations. In certain major markets, post-market studies have failed to conclusively confirm the benefit previously established, leading to recommendations for withdrawal or significant limitations on usage, affecting commercial viability and patient access.

Which geographical region is expected to demonstrate the highest growth rate for the HPC market?

The Asia Pacific (APAC) region is projected to demonstrate the highest compound annual growth rate (CAGR) for the HPC market. This growth is driven by expanding healthcare infrastructure, high population density, rising public health awareness, and increasing investment in advanced maternal care in economies like India and China.

What technological innovations are impacting the future of HPC delivery?

Key technological innovations impacting HPC delivery focus on improving patient adherence and comfort, including the development of sustained-release formulations, such as subcutaneous injections, long-acting implants, and transdermal patches. These technologies aim to reduce the frequency of administration required throughout the pregnancy.

How does the entry of generic versions affect the competitive landscape?

The entry of generic versions significantly increases price competition, driving down average selling prices and reducing profit margins for branded HPC products. This forces innovators to invest in differentiated formulations (lifecycle management) and focus on expanding market share in price-sensitive regions where generics improve overall accessibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager