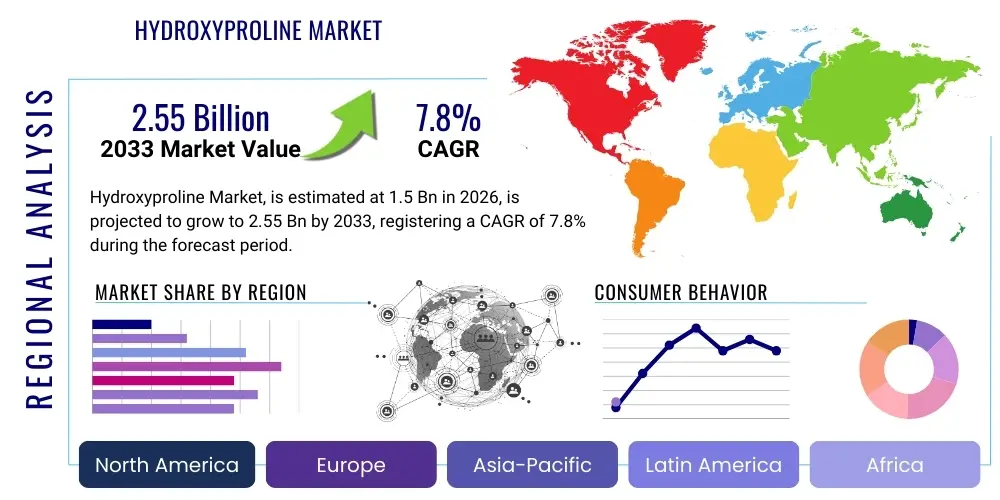

Hydroxyproline Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442573 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Hydroxyproline Market Size

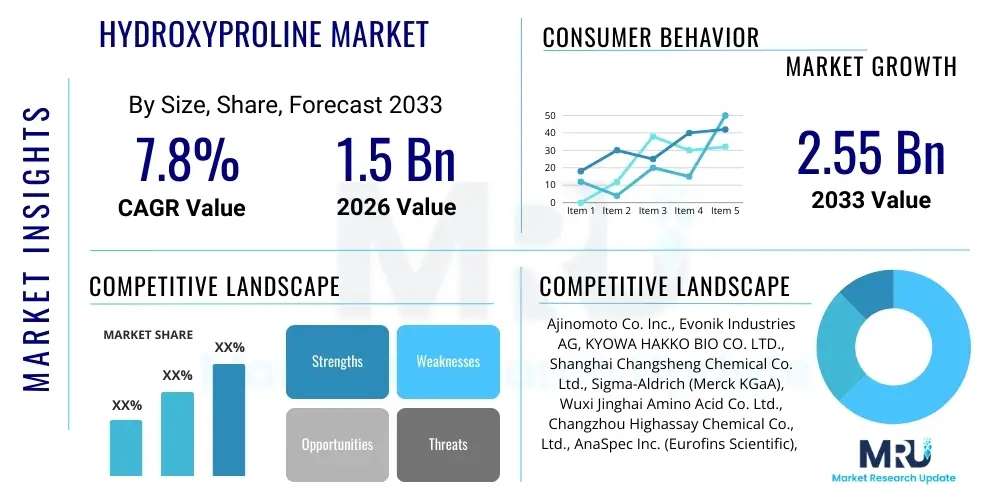

The Hydroxyproline Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for advanced anti-aging ingredients, particularly within the rapidly evolving nutraceutical and cosmeceutical sectors. Hydroxyproline, a critical component of collagen, is increasingly utilized for its proven efficacy in promoting skin elasticity, wound healing, and joint health, positioning it as a foundational ingredient in high-value functional products.

Hydroxyproline Market introduction

The Hydroxyproline Market encompasses the global production, distribution, and utilization of the non-essential amino acid, L-hydroxyproline. This specialized amino acid is predominantly derived from the hydrolysis of collagen or gelatin, serving as a primary structural element responsible for the triple helix stability of collagen molecules found in skin, bone, and connective tissues. The product is valued for its unique biological properties, making it indispensable in diverse high-growth sectors. Major applications span pharmaceuticals, where it is crucial for tissue regeneration and drug delivery systems; nutraceuticals, used extensively in dietary supplements aimed at joint health, bone density improvement, and sports recovery; and the booming cosmetics industry, where it is incorporated into anti-aging creams and serums for enhanced dermal structure and hydration. The market is primarily driven by heightened consumer awareness regarding proactive health and wellness, coupled with technological advancements in fermentation and enzymatic synthesis, which offer more sustainable and scalable production methods compared to traditional animal sourcing.

The core product description revolves around its function as a marker for collagen turnover and its utility as a foundational building block for synthesized collagen derivatives. The increasing prevalence of musculoskeletal disorders, particularly in aging populations across developed and emerging economies, fuels the demand for supplements containing collagen precursors like hydroxyproline. Furthermore, stringent quality requirements in the biomedical sector necessitate high-purity hydroxyproline, prompting manufacturers to invest heavily in advanced purification and extraction technologies. The benefits associated with topical and systemic administration of hydroxyproline—such as improved skin texture, reduced fine lines, and increased collagen density—solidify its market position across consumer segments. Key driving factors include the massive expansion of the beauty-from-within trend, regulatory support for health supplements demonstrating clinical benefits, and globalization of supply chains enabling wider accessibility to raw materials.

Hydroxyproline Market Executive Summary

The Hydroxyproline Market demonstrates robust growth propelled by converging trends in health, beauty, and sustainable ingredient sourcing. Business trends highlight a significant shift toward plant-based and synthetic hydroxyproline production methods to address ethical concerns and supply chain volatility associated with animal-derived sources, leading to intensified research and development (R&D) in microbial fermentation technologies. Regional trends indicate Asia Pacific (APAC) as the fastest-growing market, driven by its massive consumer base, increasing discretionary income allocated to personal health products, and the presence of major pharmaceutical and nutraceutical manufacturing hubs in countries like China, Japan, and South Korea. Meanwhile, North America and Europe maintain dominance in terms of market value, characterized by mature regulatory frameworks, high expenditure on premium cosmeceuticals, and strong demand for sports nutrition supplements. Segmentation trends reveal that the nutraceutical application segment is the largest revenue contributor, owing to the widespread adoption of collagen supplements. Concurrently, the powder form segment commands market share due to its ease of incorporation into various matrices, including capsules, tablets, and functional beverages, ensuring its continued prominence throughout the forecast period.

AI Impact Analysis on Hydroxyproline Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Hydroxyproline market generally center on its role in optimizing ingredient discovery, personalizing supplement formulation, and streamlining complex manufacturing processes. Users frequently ask about AI's capacity to predict the efficacy of novel collagen peptides, enhance fermentation yields, and accelerate clinical trial phases for hydroxyproline-based therapeutics. The consensus expectation is that AI will dramatically reduce R&D cycles and improve quality control. Specific concerns often relate to the integration cost of machine learning systems in traditional manufacturing settings and the ethical implications of using deep learning models to predict personalized nutritional needs based on genetic data. The key theme is the transformation from traditional biochemical synthesis to data-driven, predictive biotechnology, positioning AI as a critical enabler for innovation in high-purity, specialized amino acid production.

- AI-driven optimization of microbial strains used in hydroxyproline fermentation, leading to enhanced yields and reduced production costs.

- Machine learning algorithms utilized for predictive quality control, ensuring high purity levels required for pharmaceutical and injectable cosmetic applications.

- Personalized nutrition platforms using AI to recommend optimal dosages of collagen supplements, directly influencing consumer demand for specific hydroxyproline concentrations.

- Accelerated discovery of novel peptide sequences incorporating hydroxyproline, enhancing therapeutic applications in wound care and tissue engineering.

- Supply chain optimization through predictive analytics, mitigating risks related to raw material sourcing (e.g., gelatin, microbial inputs) and logistics.

DRO & Impact Forces Of Hydroxyproline Market

The Hydroxyproline market dynamics are shaped by a strong interplay of escalating demand from aging populations (Driver), stringent raw material sourcing regulations (Restraint), and the emergence of synthetic, high-purity substitutes (Opportunity). Impact forces, primarily driven by consumer behavior shifts toward preventative health and the integration of biotechnology, dictate the pace and direction of market growth. The increasing acceptance of functional foods fortified with amino acids globally serves as a significant accelerant. However, dependence on bovine and porcine sources for traditional extraction poses ethical and supply chain constraints, necessitating rapid diversification into bio-fermentation alternatives. The successful commercialization of these technologically advanced production methods presents a lucrative opportunity for market expansion and competitive differentiation.

Drivers: The fundamental driver is the pervasive demographic shift toward older age groups worldwide, particularly in developed nations, which translates directly into higher spending on anti-aging products and joint health supplements. Furthermore, the rising awareness of collagen's crucial role in sports recovery and muscle protein synthesis has significantly expanded the market’s scope beyond traditional beauty applications into the high-growth sports nutrition segment. Regulatory approvals for novel health claims related to skin elasticity and bone health further validate the use of hydroxyproline. The increasing focus on natural and biologically active ingredients in cosmetic formulations also provides a sustained tailwind for market penetration.

Restraints: Significant restraints include the volatility of raw material prices, primarily gelatin and collagen, which are commodity-based and susceptible to livestock market fluctuations. Ethical and religious concerns surrounding animal-derived products (bovine, porcine) create consumer resistance in specific geographic markets, compelling manufacturers to seek costlier, non-animal alternatives. Moreover, the complex regulatory landscape surrounding dietary supplements and novel food ingredients, especially concerning purity standards and labeling requirements across different countries, often creates entry barriers for smaller players and prolongs product commercialization timelines.

Opportunity: Key opportunities lie in the development and commercialization of microbial and plant-based (vegan) hydroxyproline, which satisfy ethical consumer demands and mitigate supply chain risks associated with animal sourcing. Technological advancements in fermentation technology allow for high-purity, sustainable production at scale, opening new avenues for premium applications in injectable cosmetics and high-end pharmaceuticals. Furthermore, the untapped potential in developing hydroxyproline derivatives and complexes specifically tailored for targeted drug delivery systems in oncology and regenerative medicine offers long-term, high-value growth prospects. Expanding outreach in emerging economies with growing middle classes also presents a substantial opportunity for increasing consumption of nutraceuticals.

Impact Forces: The intensity of competition among manufacturers focusing on cost-efficient and high-purity synthesis methods is a dominant impact force. Buyer power is moderate to high, as end-product manufacturers (cosmetics and nutraceutical firms) are increasingly demanding stringent quality standards and competitive pricing due to intense finished product market competition. Supplier power remains significant, particularly for specialized raw material inputs or proprietary fermentation strains. The threat of substitutes, largely synthetic collagen peptides or other cosmetic actives, is moderate but constantly evolving based on scientific breakthroughs. Overall industry profitability is sustained by the high perceived value and clinical validation of hydroxyproline in premium product categories.

Segmentation Analysis

The Hydroxyproline Market is segmented based on Source, Application, and Form, reflecting the diverse origins and end-use requirements of the specialized amino acid. This structured approach allows for precise targeting of consumer segments and optimized supply chain management. The Source segmentation highlights the industry's shift from traditional animal-derived collagen to modern, bio-based alternatives, impacting ethical consumer choices and production sustainability. Application segmentation demonstrates the widespread use across high-value sectors, with Nutraceuticals dominating due to global health and wellness trends. Form segmentation addresses the logistics and final product formulation requirements, with powder being the preferred choice for bulk manufacturing and easy integration into various matrices.

- By Source:

- Animal-Derived (Bovine, Porcine, Marine)

- Synthetic

- Microbial/Fermentation-Based (Plant-Based/Vegan)

- By Application:

- Nutraceuticals (Dietary Supplements, Functional Foods, Sports Nutrition)

- Cosmetics & Personal Care (Anti-Aging Creams, Serums, Hair Care)

- Pharmaceuticals (Wound Healing, Tissue Regeneration, Drug Delivery)

- Others (Chemical Research, Specialty Laboratories)

- By Form:

- Powder

- Liquid

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Hydroxyproline Market Analysis by Source

The source segment is critical as it dictates the cost structure, ethical perception, and purity level of the final hydroxyproline product. Traditionally, the market has relied heavily on animal-derived sources, primarily bovine and porcine hides and bones, which offer cost-effectiveness and high availability. However, these sources face challenges related to disease transmission risks, varying regulatory scrutiny (e.g., BSE concerns), and cultural/religious dietary restrictions. The dominance of animal sources is gradually being eroded by advances in biotechnology that enable the scalable production of synthetic or fermentation-based hydroxyproline, offering higher purity and guaranteed absence of animal contaminants.

The shift toward microbial and synthetic production represents the most significant technological evolution in this segment. Fermentation-based methods utilize genetically engineered microorganisms (like certain bacteria or yeast) to synthesize hydroxyproline, which is inherently cleaner, highly scalable, and completely vegan. This caters directly to the growing segment of consumers prioritizing sustainability and ethical sourcing, particularly in Western markets. While currently holding a smaller market share, synthetic and microbial sources are projected to exhibit the highest CAGR due to increased R&D investment aimed at reducing production costs and achieving economies of scale comparable to animal sources.

Marine-derived hydroxyproline, extracted from fish scales and skin, is another important sub-segment, valued for its superior bioavailability and suitability for consumers who avoid terrestrial animal products. However, the environmental sustainability of wild-caught fish and the variability in supply chains present hurdles. Manufacturers are strategically diversifying their sourcing portfolios to mitigate risks, utilizing animal sources for bulk, cost-sensitive applications (like lower-grade industrial uses) while reserving synthetic or microbial sources for premium, high-value cosmetic and pharmaceutical products demanding absolute purity and ethical compliance.

Hydroxyproline Market Analysis by Application

The application landscape is fragmented, yet the Nutraceuticals segment remains the primary revenue driver. This segment includes a vast array of dietary supplements, functional foods, and beverages focused on promoting joint mobility, skin health (beauty-from-within), and sports recovery. The effectiveness of hydroxyproline as a key structural component of ingested collagen peptides, which are broken down and utilized by the body to synthesize new collagen, drives this massive market. Increasing health consciousness globally, coupled with a proactive approach to managing age-related health issues, ensures continuous expansion in this area.

The Cosmetics & Personal Care segment represents the second largest application area, characterized by its high average selling price (ASP) and focus on anti-aging efficacy. Hydroxyproline and its derivatives are utilized in topical formulations for their ability to signal collagen synthesis, improve skin hydration, and reduce the appearance of wrinkles. This segment is highly responsive to consumer trends and marketing claims, often featuring proprietary blends that leverage the amino acid's proven benefits. The premiumization of skincare routines, especially in Asia Pacific, substantially bolsters the demand for high-quality, pure hydroxyproline ingredients suitable for direct dermal application.

The Pharmaceutical segment, though smaller in volume, demands the highest purity levels and is characterized by long-term growth potential. Hydroxyproline is vital in specialized medicinal uses, including accelerated wound healing, bone graft substitutes, and biomaterials for tissue engineering and regenerative medicine. Its role in stabilizing synthetic biological scaffolds makes it indispensable for applications requiring biocompatibility and structural integrity. R&D expenditure in biopharma focusing on complex drug delivery systems further solidifies the steady, high-value demand originating from this critical sector.

Hydroxyproline Market Analysis by Form

The market by form is distinctly dominated by the Powder segment. Hydroxyproline powder offers significant advantages in terms of shelf life, ease of transportation, reduced logistical costs, and flexibility in final product formulation. It is the preferred form for manufacturers of dietary supplements (capsules, tablets, protein mixes), functional beverage premixes, and bulk pharmaceutical compounding. The stability of the amino acid in its powdered state ensures minimal degradation over time, which is crucial for maintaining product efficacy throughout the supply chain and consumer use period. Furthermore, the powder form facilitates precise dosing necessary for specific clinical or nutritional requirements.

The Liquid segment primarily serves specialized applications where rapid absorption or ease of direct consumption is necessary, such as ready-to-drink functional beverages, liquid supplements, and certain high-end cosmetic serums. While liquid formulations offer consumer convenience and sometimes superior bioavailability, they typically require additional stabilization agents, packaging complexity, and face shorter shelf life constraints compared to powders. Despite these challenges, the demand for liquid formats is steadily increasing, particularly in the premium functional beverage market where consumers seek immediate, convenient nutritional intake.

The choice of form often directly correlates with the end application. Bulk ingredient suppliers focus heavily on powdered forms to serve the nutraceutical and bulk chemical industries. In contrast, highly concentrated, purified liquid solutions are often utilized in laboratory settings or for specific pharmaceutical injectables where precision and sterility are paramount. Ongoing efforts in microencapsulation and advanced drying techniques are continually blurring the lines, aiming to combine the stability of powders with the enhanced bioavailability sometimes associated with liquids.

Value Chain Analysis For Hydroxyproline Market

The value chain for the Hydroxyproline Market begins with the upstream sourcing and extraction of raw materials, primarily animal collagen or inputs for fermentation processes. Upstream activities involve high R&D intensity for microbial strain development or efficient sourcing of high-quality gelatin/collagen. Manufacturers then engage in complex hydrolysis, purification, and crystallization processes to produce the final high-purity hydroxyproline. The efficiency of the purification stage is critical, determining whether the product meets pharmaceutical, cosmetic, or general nutraceutical grade standards. Distribution channels are bifurcated, utilizing direct sales for key pharmaceutical and large nutraceutical customers and indirect channels through specialized chemical distributors for smaller cosmetic labs and regional supplement manufacturers, ensuring broad market reach and technical support.

Downstream activities involve the formulation and incorporation of hydroxyproline into finished consumer products. Key integrators include cosmetic formulators developing anti-aging serums, supplement companies producing collagen peptide blends, and specialized biomedical firms creating tissue scaffolds. The high brand equity and clinical validation associated with the finished products allow for significant margin capture at this stage. Direct sales channels are typically used when supplying proprietary ingredients to major multinational corporations (MNCs) that require strict adherence to confidentiality and customized batch production. Indirect channels, primarily specialized chemical and nutraceutical ingredient distributors, manage inventory and regulatory compliance for numerous smaller, localized end-users who require less volume but consistent, readily available supply.

Hydroxyproline Market Potential Customers

Potential customers for hydroxyproline are highly concentrated within three major industrial sectors: nutraceuticals, personal care, and pharmaceuticals, each utilizing the ingredient for its structural or signaling capabilities related to collagen synthesis. Large-scale dietary supplement manufacturers constitute the largest buyer group, focusing on bulk purchasing of powder forms for encapsulation and blending into sports nutrition and joint health formulations. Cosmetics firms, particularly those specializing in anti-aging and premium dermatological products, demand high-purity, often synthetically derived, hydroxyproline for topical applications, valuing clinical efficacy and ethical sourcing credentials above cost.

The pharmaceutical sector, comprising both finished dosage producers and biomedical material developers, represents the highest-value customer segment, requiring stringent quality control and regulatory compliance (e.g., GMP standards). These buyers leverage hydroxyproline for advanced applications in wound care management, biomaterial matrices, and regenerative medicine research. Beyond these primary industries, research institutions and specialty chemical laboratories also serve as consistent, albeit smaller, purchasers, utilizing the amino acid as a reagent or a standard in biochemical analysis. Strategic marketing efforts often involve targeting specific R&D departments within these organizations, emphasizing technical specifications and validated clinical data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Evonik Industries AG, KYOWA HAKKO BIO CO. LTD., Shanghai Changsheng Chemical Co. Ltd., Sigma-Aldrich (Merck KGaA), Wuxi Jinghai Amino Acid Co. Ltd., Changzhou Highassay Chemical Co., Ltd., AnaSpec Inc. (Eurofins Scientific), Tokyo Chemical Industry Co., Ltd. (TCI), Manus Bio, Inc., Hebei Meishen Technology Co., Ltd., NutraQ, Shaanxi Pioneer Biotech Co., Ltd., Seawind Chemicals Corp., Lonza Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hydroxyproline Market Key Technology Landscape

The technology landscape for the Hydroxyproline Market is characterized by a strong move away from classical hydrolysis towards advanced, highly controlled bioprocesses. The traditional method involves the acid or enzymatic hydrolysis of collagenous raw materials (like gelatin), followed by intensive chromatographic separation and purification steps. While mature and cost-effective for bulk production, this method often struggles to meet the ultra-high purity specifications required by the pharmaceutical industry, and it is inherently reliant on volatile animal sourcing. Consequently, technological innovation is primarily focused on overcoming these limitations through sustainable, precise manufacturing.

The most significant emerging technology is Microbial Fermentation. This process uses engineered bacterial or yeast strains to synthesize L-hydroxyproline, offering a vegan, highly scalable, and contaminant-free alternative. Advances in synthetic biology and metabolic engineering are continually optimizing these microbial pathways, increasing fermentation yields, and reducing processing time and environmental footprint. This technological shift is crucial for mitigating risks associated with animal sourcing and catering to the premium cosmeceutical and pharmaceutical sectors demanding traceable, high-purity ingredients. Furthermore, the ability to control chirality and isomer production is greatly enhanced through precision fermentation, which is difficult to achieve with conventional extraction.

Another area of focus is Advanced Purification Techniques, including continuous chromatography (like simulated moving bed, or SMB) and ultrafiltration. These methods are essential for achieving the pharmaceutical-grade purity required for injectable or implantable products. Integrating these high-efficiency purification systems directly into the production line not only enhances the quality but also improves the overall yield and reduces operational costs by minimizing solvent consumption and waste generation. Investment in these cutting-edge separation technologies is a defining characteristic of market leaders aiming for differentiation in high-end applications.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by explosive growth in the nutraceutical and personal care industries, especially in China, India, and South Korea. Rapid urbanization, increasing disposable incomes, and cultural emphasis on preventative health and anti-aging remedies fuel the massive consumption of functional foods and supplements containing hydroxyproline. The region is also a major global manufacturing hub, necessitating large-scale local production and importing of raw materials. Favorable government policies supporting domestic biotechnology and pharmaceutical manufacturing further accelerate market maturity.

- North America: North America holds a commanding share of the market value, underpinned by a high per capita expenditure on sports nutrition and premium supplements. The region's robust regulatory environment and established consumer trust in clinically validated ingredients drive demand for high-quality, often patented, hydroxyproline formulations. The strong presence of major pharmaceutical companies and cutting-edge biotechnology firms focused on regenerative medicine ensures sustained, high-value demand, particularly for synthetic and high-purity grades.

- Europe: Europe is characterized by stringent regulatory standards (e.g., REACH compliance) and high consumer preference for sustainably and ethically sourced ingredients. This drives strong demand for fermentation-based and vegan hydroxyproline alternatives. Countries like Germany and France exhibit mature markets for medical aesthetics and premium cosmeceuticals. European manufacturers are leaders in enzymatic synthesis and advanced purification techniques, focusing heavily on vertical integration to ensure supply chain transparency and product quality.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by increasing health awareness, particularly concerning cardiovascular and joint health. Market penetration is expanding as international cosmetic and supplement brands increase their presence in countries like Brazil and Mexico. Economic volatility remains a challenge, yet the expanding middle class is gradually adopting products that were previously considered luxury goods.

- Middle East & Africa (MEA): The MEA market is still nascent but shows promising growth, particularly in the Gulf Cooperation Council (GCC) countries, supported by high healthcare spending and a growing expatriate population driving demand for international health and beauty standards. Religious considerations strongly influence sourcing decisions, driving higher demand for halal-certified or non-animal derived hydroxyproline, presenting a niche opportunity for specialized suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hydroxyproline Market.- Ajinomoto Co. Inc.

- Evonik Industries AG

- KYOWA HAKKO BIO CO. LTD.

- Shanghai Changsheng Chemical Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Wuxi Jinghai Amino Acid Co. Ltd.

- Changzhou Highassay Chemical Co., Ltd.

- AnaSpec Inc. (Eurofins Scientific)

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Manus Bio, Inc.

- Hebei Meishen Technology Co., Ltd.

- NutraQ

- Shaanxi Pioneer Biotech Co., Ltd.

- Seawind Chemicals Corp.

- Lonza Group Ltd.

- Geno Biotechnology Co., Ltd.

- Zhejiang Sanhe Bio-Tech Co., Ltd.

- Amino Up Chemical Co., Ltd.

- BOC Sciences

- VWR International (Avantor)

Frequently Asked Questions

Analyze common user questions about the Hydroxyproline market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Hydroxyproline and what is its primary function in the human body?

Hydroxyproline is a non-essential amino acid, crucial for stabilizing the collagen triple helix structure, which provides strength and flexibility to connective tissues, skin, bone, and cartilage. It serves as a key indicator of collagen turnover and is essential for maintaining tissue integrity.

Which application segment drives the highest demand for Hydroxyproline?

The nutraceutical application segment, encompassing dietary supplements for joint health, sports nutrition, and 'beauty-from-within' products, currently drives the highest volume and revenue growth for the Hydroxyproline market globally, capitalizing on proactive health trends.

Are there vegan or plant-based sources of Hydroxyproline available?

Yes, technological advancements, particularly in microbial fermentation, have led to the commercial production of synthetic and fermentation-based hydroxyproline. These sources are considered plant-based or vegan, directly addressing ethical and dietary restrictions associated with traditional animal-derived collagen.

What key regulations affect the global trade of Hydroxyproline ingredients?

The trade of hydroxyproline is primarily affected by regulations governing dietary ingredients and pharmaceutical excipients, including FDA guidelines in North America, EFSA approvals in Europe, and national purity standards (e.g., GMP, ISO) for certifying absence of contaminants and ensuring ingredient traceability.

How is AI influencing the future production of Hydroxyproline?

AI is accelerating production by optimizing microbial strains in fermentation processes to increase yields, enhancing predictive quality control for high-purity grades, and streamlining R&D for novel peptide derivatives incorporating hydroxyproline, ultimately reducing time-to-market for innovative products.

Why is the Asia Pacific region experiencing the fastest market growth?

The APAC region’s rapid growth is due to expanding middle-class disposable income, increasing consumer focus on aesthetic anti-aging solutions, and the region's dominant role as a manufacturing and export hub for high-volume finished nutraceutical and cosmetic products.

What are the main purity standards for Hydroxyproline in the pharmaceutical industry?

Pharmaceutical-grade Hydroxyproline requires adherence to strict Good Manufacturing Practices (GMP), confirmation of enantiomeric purity (L-isomer), extremely low levels of heavy metals and microbial contaminants, and compliance with pharmacopeial standards such as USP or EP specifications.

What is the significance of the shift from Animal-Derived to Microbial Hydroxyproline?

The shift mitigates supply chain risks associated with volatile livestock markets, addresses strong consumer demands for ethical and sustainable sourcing (vegan options), and guarantees a higher, more consistent purity level crucial for premium medical and cosmetic applications.

How do Hydroxyproline manufacturers achieve competitive advantage?

Manufacturers gain advantage primarily through technological superiority (e.g., proprietary fermentation strains for lower cost and higher yield), vertical integration to ensure control over raw materials, and obtaining premium certifications (Halal, Kosher, Vegan) for market differentiation.

What technological advancements are crucial for high-purity Hydroxyproline production?

Key technological advancements include advanced separation techniques like Simulated Moving Bed (SMB) chromatography for highly efficient purification, metabolic engineering for strain optimization, and advanced drying methods like spray drying for stable powder forms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager