Ice Cream Mooncake Preparations Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441522 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Ice Cream Mooncake Preparations Market Size

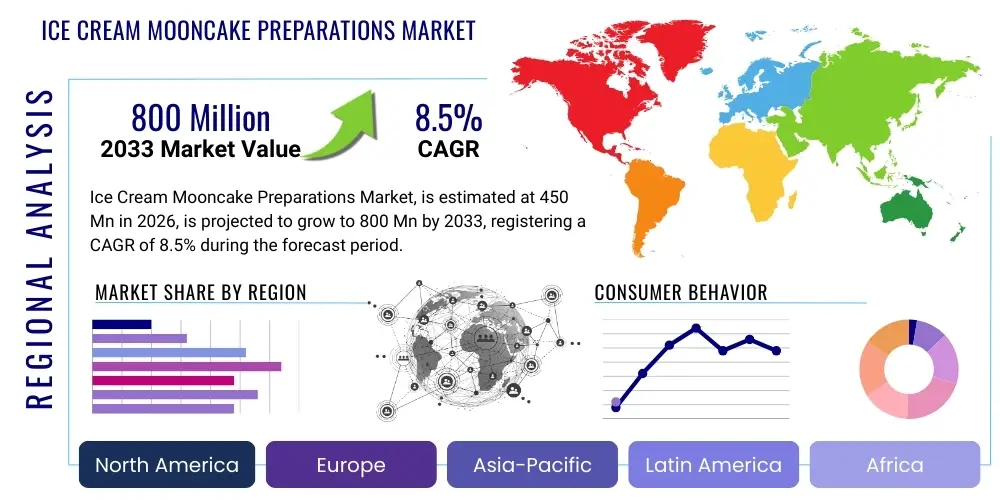

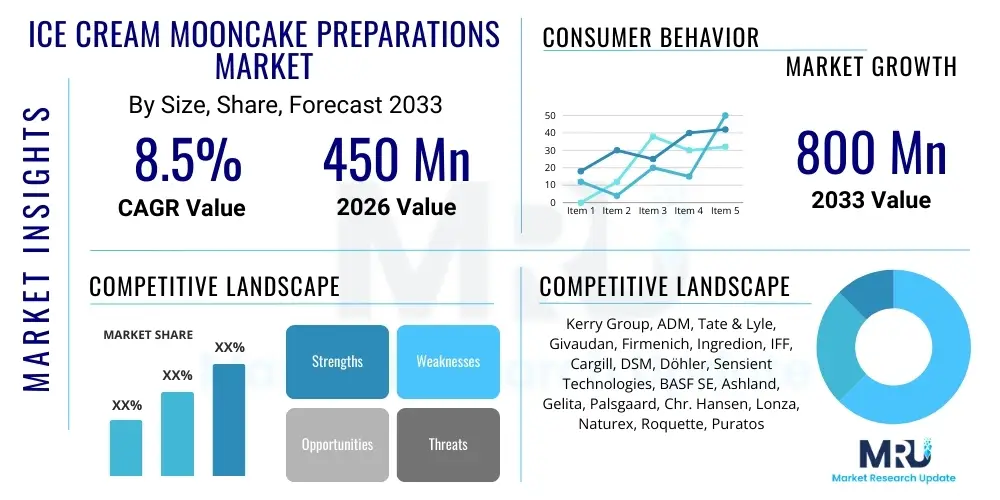

The Ice Cream Mooncake Preparations Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 800 million by the end of the forecast period in 2033.

The valuation reflects the increasing globalization of the Mid-Autumn Festival and the continuous demand for innovative, premium dessert options that merge traditional aesthetics with modern flavor profiles. Market sizing encompasses the sales of specialized ingredients, including stabilizers, emulsifiers, flavor encapsulation agents, coloring agents, and texture modifiers specifically formulated to maintain the structural integrity and sensory profile of ice cream when encased in a mooncake shell, often requiring cryogenic or advanced freezing processes.

Growth acceleration is driven primarily by the rising disposable incomes in Asia Pacific economies and the strong focus of leading confectionary manufacturers on product differentiation. The transition from traditional baked goods to frozen, novel confectionery demands high-performance preparation mixtures that prevent ice crystallization, mitigate thermal shock during storage and transportation, and ensure the filling remains smooth and creamy until consumption. The complexity of these functional ingredients justifies the high valuation and growth projection of this specialized preparations market.

Ice Cream Mooncake Preparations Market introduction

The Ice Cream Mooncake Preparations Market centers on the supply of specialized functional ingredients and pre-mixes necessary for the industrial and artisanal production of ice cream mooncakes. These unique seasonal desserts require sophisticated formulations to ensure the ice cream filling maintains stability, texture, and flavor despite being subjected to molding processes and prolonged frozen storage. Key preparations include highly optimized stabilizer systems (e.g., hydrocolloids, vegetable gums), specialized emulsifiers, and natural or encapsulated flavoring compounds that can withstand sub-zero temperatures without degradation.

Major applications of these preparations span commercial bakeries, large-scale food manufacturers specializing in frozen desserts, and dedicated mooncake producers aiming to diversify their seasonal offerings. The core benefit derived from utilizing these tailored preparations is enhanced product quality, specifically resistance to melting, improved scoopability (upon slight thawing), reduced ice crystal formation (freezer burn prevention), and extended shelf life, which are critical for meeting stringent international distribution standards for frozen confectionery.

Driving factors for market expansion include the premiumization trend in the dessert industry, the strategic efforts of food ingredient companies to offer customized solutions for niche cultural foods, and the increasing consumer preference for lighter, less traditional mooncake variations. Furthermore, efficient cold chain logistics in emerging markets, coupled with continuous innovation in ingredient technology—such as clean label stabilizers and natural colorants that remain vibrant in frozen conditions—are fueling the adoption of advanced preparation kits across the global production landscape.

Ice Cream Mooncake Preparations Market Executive Summary

The Ice Cream Mooncake Preparations Market is defined by robust growth driven by rapid innovation in food hydrocolloids and fat stabilization technologies, focusing heavily on enabling industrial scalability while preserving product integrity. Current business trends indicate a strong shift towards sourcing natural and plant-based preparation components, responding to consumer demand for clean label products, particularly in high-value Asian markets. Ingredient suppliers are increasingly forming technical partnerships with major dessert manufacturers to co-develop bespoke preparation blends tailored to specific local flavor profiles and regulatory requirements, streamlining the supply chain from raw material sourcing to final product formulation.

Regionally, Asia Pacific (APAC), particularly Greater China, dominates consumption and production, serving as the core innovation hub due to the cultural significance of the mooncake. However, North America and Europe show accelerated growth as Asian diaspora populations increase and luxury food retailers adopt seasonal novelty items, requiring specialized preparation imports. These Western markets prioritize shelf stability and ease of application, fostering demand for highly concentrated, multi-functional preparation systems that simplify complex manufacturing steps for non-specialized producers.

Segment-wise, the market sees dominant growth in the Stabilizers and Emulsifiers category, essential for texture management in frozen desserts. Furthermore, the specialized flavoring agents segment, including microencapsulated essences designed to release flavor only upon consumption, is rapidly expanding. Trends within segments highlight the move away from artificial ingredients, pushing producers toward high-performance substitutes like functional fibers and specialized dairy proteins, ensuring the aesthetic and structural requirements of the mooncake shell and filling are met simultaneously.

AI Impact Analysis on Ice Cream Mooncake Preparations Market

User inquiries regarding AI's influence in the Ice Cream Mooncake Preparations Market primarily revolve around optimizing ingredient sourcing, predicting seasonal demand peaks, and formulating novel stabilizer combinations for texture innovation. Key concerns center on whether AI-driven formulation tools can reduce the time-to-market for complex, highly technical preparation blends and if machine learning can predict the precise impact of climate variability or storage conditions on the stability of final products. Users also seek information on AI's ability to analyze consumer sensory data (taste, texture preference) across different regions to guide the development of locally relevant, high-performing ingredient preparations.

- AI-driven predictive modeling optimizes raw material procurement by forecasting volatile commodity prices for key ingredients like milk fats, specialized sugars, and hydrocolloids.

- Machine learning algorithms accelerate R&D by simulating thousands of stabilizer and emulsifier combinations, drastically reducing physical testing time for texture and freeze-thaw stability.

- AI assists in cold chain logistics optimization by predicting high-risk thermal events during distribution, ensuring the integrity of temperature-sensitive preparation blends and final products.

- Generative AI tools analyze global consumer sentiment and social media data to identify emerging flavor trends and functional ingredient preferences, informing preparation customization.

- Automation of quality control processes using computer vision detects inconsistencies in preparation batch quality, ensuring uniformity in texture modifiers and color agents prior to shipment to manufacturers.

DRO & Impact Forces Of Ice Cream Mooncake Preparations Market

The Ice Cream Mooncake Preparations Market is strongly influenced by demographic shifts and technological advancements in food science. Market drivers include the increasing global appeal of unique fusion desserts, the necessity for ingredients that offer superior freeze-thaw stability in complex frozen structures, and the high spending capacity of target consumer groups during festive seasons. Restraints primarily involve the seasonal and culturally specific nature of demand, leading to pronounced sales volatility, coupled with stringent regulatory hurdles regarding food additives and stabilizers in key production regions. Opportunities lie in developing clean label, plant-based, and vegan preparation alternatives, alongside expanding specialized distribution channels in emerging economies where cold chain infrastructure is rapidly improving.

Impact forces governing market evolution include high competition among global ingredient manufacturers to secure patents on superior emulsification systems, pressure from consumers for transparency regarding preparation origins, and the ongoing challenge of maintaining high sensory quality in mass-produced frozen goods. The shift towards natural coloring and flavoring agents significantly impacts production costs and formulation complexity, requiring substantial investment in research and development to achieve performance parity with synthetic alternatives. The overall market trajectory is defined by the convergence of culinary tradition and advanced food technology, forcing preparation suppliers to be highly specialized and responsive to ingredient purity demands.

Segmentation Analysis

The Ice Cream Mooncake Preparations Market is broadly segmented based on the type of preparation ingredient, the intended function, and the application sector. Segmentation by type captures the specialized nature of the components required to manage the distinct challenges of frozen mooncake production, which differs significantly from standard ice cream or baked goods production. The complexity of creating a shell that adheres well to a frozen core, coupled with the need for extended freezer life without developing large ice crystals, necessitates tailored ingredients categorized into functional groups. Application segmentation focuses on distinguishing the high-volume industrial user base from the smaller, artisanal producers or the rapidly growing segment of retail-focused DIY meal kits, each requiring different bulk sizes and formulation concentrations.

- By Ingredient Type:

- Stabilizers and Emulsifiers (Hydrocolloids, Mono- and Diglycerides, Carrageenan, Guar Gum, Locust Bean Gum)

- Flavoring Agents (Natural Extracts, Artificial Flavors, Microencapsulated Flavors)

- Texture Modifiers (Maltodextrins, Specialized Dairy Proteins, Functional Fibers)

- Coloring and Preservatives (Natural Colorants, Antioxidants, Shelf-life extenders)

- By Application/End-User:

- Commercial Bakeries and Confectionery Producers

- Specialized Mooncake Manufacturers (Seasonal Production)

- Food Service and Hospitality Industry

- Retail DIY Preparation Kits

- By Formulation Type:

- Ready-to-Use Preparation Blends

- Individual Functional Ingredients (Single-purpose additives)

Value Chain Analysis For Ice Cream Mooncake Preparations Market

The value chain for the Ice Cream Mooncake Preparations Market begins with the highly specialized upstream analysis, focusing on the sourcing and refinement of functional raw materials, such as specific strains of algae for hydrocolloids or specialized oilseeds for emulsifiers. Upstream activities are dominated by large chemical and ingredient manufacturers who focus on extracting, purifying, and blending these components into technical-grade preparations. Quality control at this stage is crucial, as the performance of the final preparation blend directly dictates the stability and sensory attributes of the finished ice cream mooncake, requiring advanced testing for moisture content, viscosity, and thermal tolerance.

The midstream involves the processing and distribution of these preparation blends. Leading ingredient suppliers formulate proprietary combinations (e.g., stabilizer-emulsifier complexes) and package them for industrial use. Distribution channels are highly dependent on the target end-user; bulk ingredients are typically sold directly (Direct Channel) to large commercial bakeries or specialized frozen dessert manufacturers through long-term supply agreements. These direct transactions often include technical support and custom formulation services, optimizing the preparation blend for the client’s specific equipment and production scale.

The downstream sector involves the use of the preparation blends by mooncake manufacturers, followed by distribution of the finished goods to consumers via indirect channels such as modern retail chains, e-commerce platforms, and specialized festive pop-up stores. Indirect channels, facilitated by third-party cold chain logistics providers, are essential for reaching the global consumer base. The specialized nature of the ingredients and the high value added by the manufacturers necessitates a secure, temperature-controlled supply chain from the ingredient production facility to the final point of sale, emphasizing the critical role of specialized distribution and cold warehousing.

Ice Cream Mooncake Preparations Market Potential Customers

Potential customers for Ice Cream Mooncake Preparations are fundamentally defined by their involvement in large-scale, frozen confectionery production, particularly those targeting the high-demand festive seasons associated with the Mid-Autumn Festival globally. The primary end-users are large multinational food and beverage corporations (F&B) that utilize global distribution networks to capitalize on seasonal demand across diverse geographies. These entities require bulk, high-performance, and regulatory-compliant preparation mixes to ensure product consistency across various manufacturing sites and extended supply chains.

Secondary, yet rapidly growing, customer segments include regional and artisanal bakeries that are transitioning from traditional baked mooncakes to higher-margin, premium ice cream variants. These smaller businesses often rely on ready-to-use preparation blends that simplify complex ingredient handling and formulation, minimizing batch variation and reducing R&D costs. Furthermore, the retail sector, specifically companies producing specialized frozen dessert kits or high-end supermarket private labels, constitutes a potential buyer base for both finished preparation blends and co-branded retail DIY ingredient kits aimed at home bakers and consumers seeking novelty culinary experiences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kerry Group, ADM, Tate & Lyle, Givaudan, Firmenich, Ingredion, IFF, Cargill, DSM, Döhler, Sensient Technologies, BASF SE, Ashland, Gelita, Palsgaard, Chr. Hansen, Lonza, Naturex, Roquette, Puratos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ice Cream Mooncake Preparations Market Key Technology Landscape

The Ice Cream Mooncake Preparations Market relies heavily on advanced ingredient science to overcome inherent technological challenges associated with merging frozen confectionery and molded pastry structures. A core technology is the utilization of synergistic hydrocolloid systems—precise blends of gums (e.g., carrageenan, xanthan, guar) formulated to minimize ice crystal growth during prolonged freezer storage, a phenomenon known as recrystallization. This stabilization technology ensures the ice cream maintains a desirable smooth, creamy texture throughout its shelf life, which is critical given the seasonal production cycle often requires long periods of frozen holding before distribution. These systems must be robust enough to withstand the stresses of high-speed industrial mixing and the subsequent rapid cooling and molding process unique to mooncake production, ensuring consistent viscosity and structural integrity.

Another crucial technological area is microencapsulation for flavoring and coloring agents. Since ice cream mooncakes are stored at extremely low temperatures, traditional volatile flavor compounds can be muted or altered. Microencapsulation protects these delicate flavors and ensures a controlled, delayed release upon consumption, providing a more intense and true-to-form sensory experience. Furthermore, the technology landscape includes the development of specialized fat systems (emulsifiers and fractionated oils) that integrate seamlessly with both the frozen filling and the mooncake shell interface, preventing lipid migration and textural breakdown. These emulsification systems are essential for achieving the required smooth, stable emulsion necessary for high-quality frozen desserts.

The industry is also investing significantly in High-Pressure Processing (HPP) compatible preparations and clean label formulation technologies. HPP-compatible ingredients enhance microbial safety without relying heavily on traditional chemical preservatives, aligning with modern consumer preferences. Clean label innovation focuses on functional replacements for synthetic stabilizers and colorants, leveraging natural sources like functional starches, dietary fibers, and fruit and vegetable extracts. The application of sophisticated rheology modifiers, which allow for precise control over the flow and molding characteristics of the ice cream mix, represents the frontier of preparation technology, enabling complex, multi-layered frozen structures within the mooncake.

Regional Highlights

The regional market landscape for Ice Cream Mooncake Preparations is heavily skewed towards Asia Pacific (APAC), reflecting the origin and core cultural significance of the product. The region, particularly Greater China, Southeast Asia (Singapore, Malaysia), and emerging markets like Vietnam, drives the highest volume and value demand for specialized preparations. The intense competition among local and international confectionery brands in these areas necessitates continuous innovation in ingredients that offer superior texture, stability, and adherence to local flavor nuances, driving large-scale procurement of advanced stabilizer and flavoring systems.

North America and Europe represent rapidly growing markets, characterized by high growth rates but lower base volume compared to APAC. This expansion is primarily fueled by the increasing size and cultural influence of the Asian diaspora, coupled with the rising interest among mainstream consumers in global, fusion dessert trends. Manufacturers in these regions prioritize preparations that offer easy integration into existing frozen dessert production lines, focusing on clean label certification and sophisticated flavor profiles tailored to Western palates, driving demand for premium, multi-functional ingredient blends.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but present substantial untapped growth potential, primarily driven by expanding urbanization and increasing disposable incomes that support the adoption of premium, imported festive products. Growth in these regions is fundamentally tied to the development of reliable cold chain logistics. Preparation suppliers targeting MEA and LATAM often focus on robust, heat-tolerant formulations, sometimes incorporating ingredients that offer enhanced stability under intermittent power supply challenges, a key logistical consideration in certain emerging economies.

- Asia Pacific (APAC): Dominates the market; epicenter of production and consumption. Key drivers are cultural tradition, high consumer premiumization, and intensive R&D in stabilizer technology for tropical climate stability.

- North America: High growth rate fueled by diaspora population and novelty food trends. Focus on clean label, natural ingredients, and sophisticated flavor pairings (e.g., matcha, salted caramel).

- Europe: Growth supported by specialty retailers and increasing international food exposure. Emphasis on stringent EU regulatory compliance for food additives and sustainable ingredient sourcing.

- Middle East & Africa (MEA): Emerging market characterized by rising luxury consumption and improving cold chain infrastructure. Demand focused on robust, shelf-stable preparations.

- Latin America (LATAM): Developing potential, with growth linked to increasing consumer experimentation with global food holidays and targeted marketing by major multinational corporations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ice Cream Mooncake Preparations Market.- Kerry Group

- ADM (Archer Daniels Midland Company)

- Tate & Lyle PLC

- Givaudan

- Firmenich International SA

- Ingredion Incorporated

- International Flavors & Fragrances (IFF)

- Cargill, Incorporated

- Koninklijke DSM N.V. (DSM)

- Döhler GmbH

- Sensient Technologies Corporation

- BASF SE

- Ashland Global Holdings Inc.

- Gelita AG

- Palsgaard A/S

- Chr. Hansen Holding A/S

- Lonza Group AG

- Naturex (Givaudan)

- Roquette Frères S.A.

- Puratos Group

Frequently Asked Questions

Analyze common user questions about the Ice Cream Mooncake Preparations market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional ingredients used in Ice Cream Mooncake preparations?

The primary functional ingredients include specialized stabilizer systems (like hydrocolloids such as carrageenan, guar, and locust bean gum) and advanced emulsifiers (mono- and diglycerides). These are essential for preventing ice recrystallization, ensuring freeze-thaw stability, and maintaining the desirable smooth texture of the ice cream filling under long-term frozen storage and thermal shock.

How does preparation technology address the seasonality challenge of this market?

Preparation technology addresses seasonality by enabling manufacturers to produce and store high volumes of stable mooncakes months in advance of the Mid-Autumn Festival. Specialized preparation blends extend the frozen shelf life significantly, maintaining sensory quality and structural integrity throughout the extended pre-sale holding period, thus mitigating the risks associated with volatile, time-sensitive production schedules.

Which geographical region dominates the consumption and innovation in the preparation market?

Asia Pacific (APAC), particularly Greater China, dominates both consumption and ingredient innovation. The region drives demand for highly specialized, premium preparation ingredients tailored to specific cultural flavor requirements and optimized for high-volume manufacturing within diverse climatic conditions, necessitating superior stabilization performance.

What is the impact of the clean label trend on Ice Cream Mooncake Preparation suppliers?

The clean label trend is forcing suppliers to replace synthetic stabilizers, colorants, and flavor enhancers with natural alternatives, such as functional fibers, vegetable proteins, and natural extracts. This shift increases R&D complexity and costs but aligns products with growing consumer preference for transparent labeling and natural ingredients, particularly in premium dessert segments.

What are the key distribution channels for preparation ingredients in this niche market?

The primary distribution channels are direct sales to large-scale Commercial Bakeries and Specialized Mooncake Producers, often involving custom formulation and technical support. Indirect channels include specialized distributors supplying smaller artisanal producers, and the increasing use of e-commerce platforms for distributing retail DIY preparation kits globally.

The Ice Cream Mooncake Preparations Market exhibits a high degree of technical sophistication, characterized by the necessity for synergistic ingredient systems that can bridge the inherent incompatibility between frozen dairy products and molded pastry structures. The successful preparation formulation must consider not only the taste and texture of the filling but also the interaction between the filling and the shell, often made of glutinous rice or specialized shortcrust pastry, ensuring zero moisture migration and textural compromise across varying freezer temperatures. This delicate balance elevates the preparation market from a simple ingredient supply chain to a highly specialized field of functional food chemistry.

Market growth is further underpinned by the increasing investment in advanced sensory analysis technologies by ingredient providers. These technologies utilize complex statistical modeling to correlate specific ingredient combinations with consumer-preferred attributes, such as melt rate, mouthfeel, and sustained flavor release. Suppliers leverage these insights to create next-generation preparation blends that offer superior performance metrics compared to generalized frozen dessert additives, thus securing premium pricing and long-term contracts with major multinational confectionery giants who prioritize consistency and exceptional consumer experience across their global seasonal product lines. The intellectual property surrounding these specialized blends—specifically relating to proprietary ratios of hydrocolloids and specialized proteins—is a significant competitive differentiator in this highly concentrated market segment.

Moreover, regulatory compliance plays an essential, albeit restraining, role in the market dynamics. As the primary end-user markets are scattered across regions with highly diverse food additive regulations (e.g., EU, FDA, CFDA), preparation suppliers must offer globally compliant or regionally customized formulations. This regulatory complexity necessitates significant investment in certification and traceability systems, often pushing smaller players out and reinforcing the dominance of multinational ingredient corporations capable of handling these comprehensive legal requirements. The ability of a preparation blend to perform reliably while adhering to 'clean label' requirements across multiple regulatory environments is now a non-negotiable factor influencing vendor selection among top-tier mooncake producers.

The innovation trajectory is also deeply tied to sustainability goals, pushing preparation manufacturers towards plant-based and resource-efficient ingredient sourcing. For instance, the demand for specialized vegan ice cream mooncakes, often utilizing coconut, oat, or almond bases, requires entirely new preparation matrices designed to replicate the mouthfeel and stability traditionally provided by dairy fats and proteins. This shift necessitates the development of novel functional fibers and protein isolates that deliver superior emulsification and water-binding capacity under cryogenic conditions, driving significant capital expenditure into fermentation and bio-processing technologies to create sustainable and high-performing ingredients.

The competitive landscape is defined by the strategic acquisition of smaller, specialized technology firms by global ingredient behemoths, aiming to integrate proprietary encapsulation and stabilization techniques directly into their product portfolios. This consolidation increases the market’s technological barriers to entry, making it challenging for new entrants without substantial R&D backing or highly niche, patented intellectual property. Success in this market is fundamentally reliant on a supplier’s ability to offer bespoke technical support, rapid formulation adjustments, and impeccable quality consistency across large-scale seasonal orders, reinforcing the importance of robust supply chain management and logistical excellence in delivering temperature-sensitive preparation materials.

Furthermore, the segmentation by Formulation Type, particularly the 'Ready-to-Use Preparation Blends' segment, is experiencing heightened adoption. These complex pre-mixes simplify the manufacturing process for clients, reducing the requirement for specialized on-site ingredient handling and weighing, thereby minimizing human error and enhancing batch consistency. This is especially critical during the intense, time-constrained seasonal production runs typical of mooncakes. The increasing adoption of these proprietary blends shifts the R&D burden almost entirely onto the preparation supplier, making the technical service component a core element of the total value proposition offered to the food manufacturer. This trend underscores the specialization inherent in the Ice Cream Mooncake Preparations market.

Within the Texture Modifiers segment, technological progress focuses on ingredients that minimize the glass transition temperature shift of the ice cream, ensuring that the filling remains structurally sound even when slightly tempered during packaging or consumer handling. Advanced polysaccharide blends and specialized proteins are engineered to control the water activity within the frozen matrix, effectively locking moisture away and preventing crystallization, which is paramount for maintaining the premium texture expected in high-end frozen mooncakes. The efficacy of these texture modifiers is often the defining factor in product differentiation in crowded festive markets, making their supply a strategic focus for manufacturers globally.

The Coloring and Preservatives segment is undergoing a massive transformation driven by the consumer-led demand for natural sources. The challenge is ensuring natural colorants, such as those derived from spirulina, beetroot, or turmeric, maintain vibrant hues and stability when subjected to freezing and potential light exposure during retail display. Preparation suppliers are utilizing complex co-pigmentation techniques and natural encapsulation methods to protect these sensitive compounds, delivering highly concentrated, color-stable preparations that satisfy both aesthetic demands and clean label requirements. This technical challenge adds significant complexity and cost compared to relying on synthetic food dyes, reflecting the premiumization of the final dessert product.

In terms of upstream analysis in the Value Chain, the procurement of specific raw materials, such as highly refined cocoa solids for chocolate flavors or specialized fruit purees for exotic fillings, must meet strict purity and compositional standards. Suppliers must guarantee that the ingredients are free from contaminants and possess consistent functionality batch after batch, as even minor variations in the quality of a hydrocolloid can compromise the stability of millions of dollars worth of finished frozen product. The initial cost of raw materials, particularly those ethically or sustainably sourced, significantly influences the final price point of the specialized preparation blend, reinforcing the high-value nature of this entire market chain.

The downstream implications of direct versus indirect distribution are evident in pricing strategies. Direct sales, typically involving large volumes and customized technical specifications, allow for more stable pricing structures and deeper technical collaboration between the ingredient supplier and the manufacturer. Conversely, indirect distribution, involving smaller volumes or off-the-shelf blends sold through third-party distributors to regional bakeries, often carries a higher mark-up to account for warehousing, cold-chain handling, and inventory risk managed by the distributor. The efficiency of the cold chain, which is mandatory for many advanced liquid or paste preparation blends, determines the viability of serving markets in regions with nascent infrastructure.

The analysis of Potential Customers extends to regulatory bodies and food safety organizations that indirectly influence the market by setting the standards for ingredient acceptance. While not direct purchasers, their requirements dictate the formulation parameters and necessary certification levels (e.g., Halal, Kosher, ISO 22000) that preparation suppliers must achieve, thereby restricting the customer base to those suppliers who maintain the highest standards of production hygiene and quality documentation. This necessitates substantial investment by ingredient producers into compliance infrastructure, a cost ultimately passed down the value chain to the end-user manufacturers.

The final paragraphs reiterate the significance of regional customization. In APAC, the demand frequently necessitates preparation blends optimized for specific Asian dairy standards or non-dairy substitutes common in local desserts (e.g., taro, red bean, durian). European and North American markets, while smaller, drive demand for experimental flavors and highly specialized texturizers, seeking preparations that yield unique, luxurious textures that differentiate the product in a competitive premium food market. This divergence in regional requirements ensures that the global Ice Cream Mooncake Preparations Market remains fragmented yet technically demanding, requiring suppliers to maintain broad R&D capabilities to cater effectively to these diverse global consumer bases.

The robust market growth predicted for the Ice Cream Mooncake Preparations Market is a direct consequence of the continuous efforts by the food science industry to elevate seasonal confectionery from simple, traditional offerings to complex, high-value, and technologically superior frozen desserts. The focus on functional ingredients that ensure textural perfection under challenging storage conditions—from the initial deep-freeze molding to the final consumer consumption—will continue to define the success and expansion of preparation suppliers in the coming forecast period, solidifying the market’s position as a crucial niche within the broader frozen dessert ingredients sector.

Further technological advancements expected include the commercialization of specialized cryoprotectant ingredients derived from natural sources, which offer superior protection against mechanical damage and thermal shock during transportation, especially critical for intercontinental frozen food shipments. The synergistic use of these cryoprotectants with advanced stabilizer matrices represents the next evolutionary step in ice cream mooncake preparation, promising even longer shelf lives and further reduction in potential product returns due to freezer burn or structural failure. This push for ultimate stability directly supports the ambitious expansion plans of major mooncake manufacturers into non-traditional geographic markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager