Ice Hockey Skate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443180 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Ice Hockey Skate Market Size

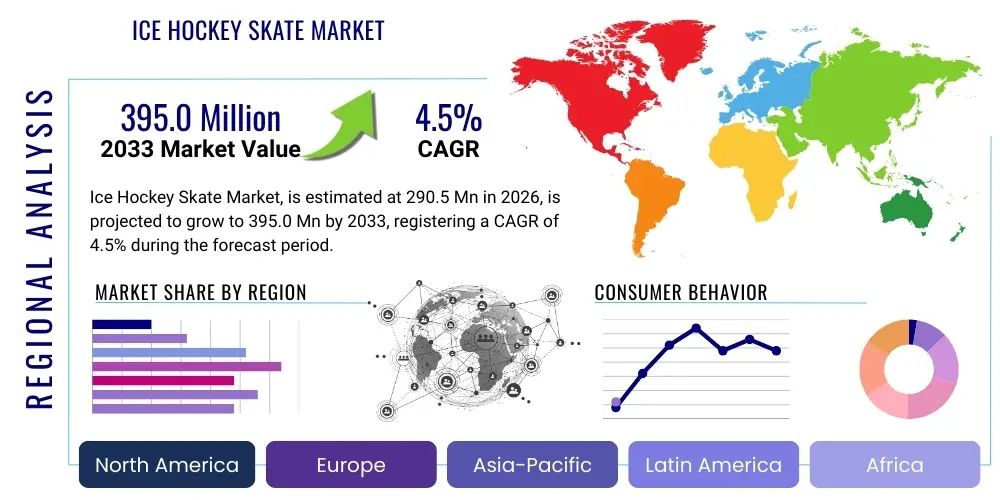

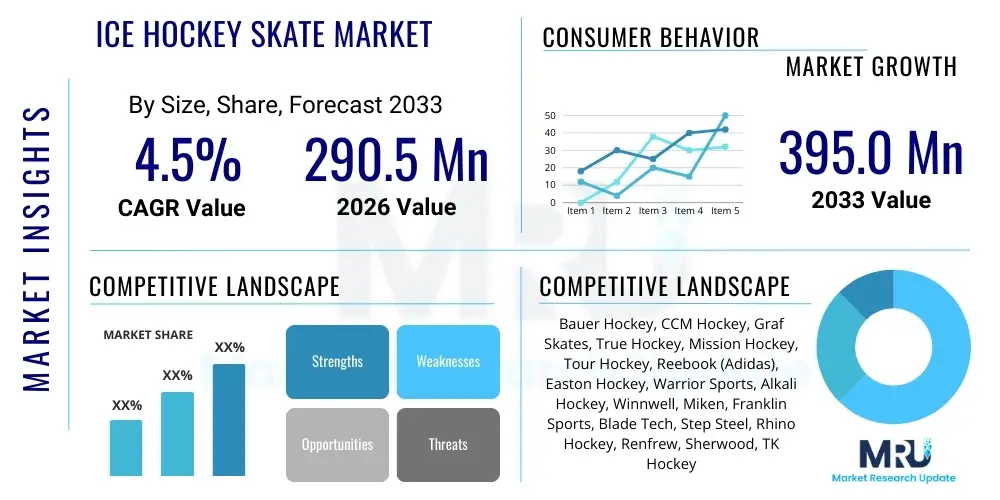

The Ice Hockey Skate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. This consistent, moderate growth trajectory is indicative of both the maturity of core markets in North America and Europe, and the increasing penetration into non-traditional hockey regions driven by infrastructural investment and heightened participation in competitive winter sports. The stability of demand is further reinforced by the regular replacement cycles mandated by high wear-and-tear in competitive usage, coupled with continuous technological innovation in material science aimed at enhancing player speed and reducing injury risks.

The market is estimated at $290.5 Million in 2026 and is projected to reach $395.0 Million by the end of the forecast period in 2033. This valuation encompasses sales across all major skate categories, including high-performance professional models, intermediate recreational skates, and youth hockey equipment. Crucially, the growth forecast is supported by premiumization trends, where consumers are willing to invest higher capital in customized and technologically advanced skates featuring composite materials, precision blade holders, and advanced thermoforming capabilities. These advancements justify higher average selling prices, significantly contributing to the overall market valuation growth over the projection period.

Geographically, North America continues to dominate the market size owing to the long-standing prevalence of ice hockey as a major sport, supported by extensive youth programs and professional leagues such as the NHL. However, the anticipated growth rate is subtly influenced by rising participation rates in Eastern European countries and parts of Asia, particularly China and South Korea, which are increasingly investing in winter sports infrastructure. The shift towards lightweight, durable materials, such as carbon composite boots, is a primary driver sustaining the market's monetary expansion and influencing manufacturing efficiency across the value chain, ensuring the market remains robust despite economic fluctuations.

Ice Hockey Skate Market introduction

The Ice Hockey Skate Market comprises the manufacturing, distribution, and sale of specialized footwear designed for gliding on ice surfaces during the game of ice hockey. The product is fundamentally composed of four main components: the boot (providing support and protection), the holder (securing the blade), the blade (or runner, made of steel for traction and glide), and the footbed. Modern ice hockey skates are engineered products, increasingly utilizing advanced materials like thermoformable composite materials, carbon fiber, and aerospace-grade steel to maximize energy transfer, minimize weight, and offer unparalleled anatomical fit and protection against high-velocity impacts inherent to the sport.

Major applications of ice hockey skates span professional leagues, high-level amateur and collegiate competition, youth hockey development programs, and general recreational skating activities. The primary benefit derived from high-quality skates is enhanced performance, including quicker acceleration, tighter turns, improved stability during stops, and superior control, which are critical performance determinants in the fast-paced nature of ice hockey. Furthermore, advanced boot construction, particularly stiff ankle support and reinforced toe caps, offers essential protection, mitigating the risk of common lower limb injuries caused by pucks or sticks.

The market’s substantial growth is principally driven by increasing global participation in winter sports, governmental initiatives promoting physical activity, and relentless technological innovation focused on customization and fit. Manufacturers are heavily investing in 3D scanning and computer-aided design (CAD) to produce skates tailored to individual foot profiles, significantly improving comfort and performance. Additionally, the visibility and popularity of professional leagues like the NHL continue to act as powerful marketing catalysts, encouraging young athletes to adopt the sport and purchase high-quality equipment.

Ice Hockey Skate Market Executive Summary

The Ice Hockey Skate Market is characterized by intense competition among a few dominant global players, coupled with a discernible trend toward consolidation and specialization. Key business trends include the strong emphasis on direct-to-consumer (DTC) sales models, facilitated by sophisticated e-commerce platforms, allowing brands greater control over pricing and customer experience, particularly regarding custom fitting services. Furthermore, sustainability is emerging as a critical factor, pushing manufacturers to explore recyclable materials and energy-efficient manufacturing processes, aligning with evolving consumer ethical preferences and regulatory pressures across developed economies.

Regional dynamics underscore the North American and European dominance, where established consumer bases drive consistent demand for replacement and upgrade cycles. North America, specifically the US and Canada, remains the largest revenue generator due to the deep cultural integration of ice hockey. However, the Asia Pacific region, particularly China and Japan, is forecasted to exhibit the highest growth rate, albeit from a smaller base, spurred by governmental support for winter sports post-Beijing 2022 and rising disposable incomes fueling participation in aspirational leisure activities. This regional diversification is crucial for mitigating risks associated with saturation in mature Western markets and capitalizing on new infrastructural development.

Segmentation trends highlight the increasing importance of the high-performance segment, driven by professional and elite amateur players who prioritize technology and material superiority over cost. Composite material skates are rapidly replacing traditional leather models, reflecting a preference for lightness and rigidity. Concurrently, the distribution segment is witnessing a shift, with specialized sports stores and online retailers gaining prominence over general departmental stores, as consumers require expert advice, especially concerning specialized services like heat molding and blade profiling, which are vital for optimizing skate performance and fit.

AI Impact Analysis on Ice Hockey Skate Market

User inquiries regarding AI's influence in the Ice Hockey Skate Market center primarily around predictive personalization, manufacturing optimization, and performance tracking. Common questions investigate how AI algorithms can utilize 3D foot scanning data to generate perfectly fitting boot molds, moving beyond traditional manual sizing methods. Users are also concerned about the integration of AI-powered sensors within skates to provide real-time performance analytics—such as stride efficiency, edge pressure, and fatigue monitoring—thereby revolutionizing coaching and training regimes. Furthermore, there is significant interest in how AI can optimize the complex supply chain, predicting demand fluctuations and optimizing inventory management for specialized components like high-grade steel runners, reducing lead times and waste across global distribution networks, ultimately making customization more accessible and cost-effective.

- AI-driven 3D Scanning and Custom Boot Design: Utilizing machine learning algorithms to process high-resolution foot geometry data, enabling the automated design of anatomically precise, customized skate shells, reducing fitting errors and maximizing energy transfer efficiency.

- Predictive Maintenance and Material Durability Analysis: Employing AI models to analyze wear patterns based on usage data (collected via embedded sensors) to predict component failure (e.g., blade fatigue, holder stress) and advise users or teams on timely replacements, thereby enhancing safety and equipment longevity.

- Optimized Manufacturing Processes: Implementing AI in smart factories to enhance the precision and consistency of composite material layup and thermoforming, ensuring uniform quality control and minimizing material scrap in the highly detailed boot construction phase.

- Real-Time Performance Analytics: Using AI to interpret sensor data related to skating dynamics (acceleration, cornering radius, maximum speed, and balance distribution), providing coaches and players with actionable insights to refine technique and optimize training efficacy.

- Intelligent Inventory and Supply Chain Management: Leveraging machine learning for demand forecasting of specific skate models and component parts across different geographic regions, optimizing stocking levels, and improving the responsiveness of the highly complex global supply chain for specialized materials.

DRO & Impact Forces Of Ice Hockey Skate Market

The market dynamics are defined by a confluence of growth drivers, inherent constraints, and significant opportunities, which collectively shape the competitive landscape and strategic direction for stakeholders. Primary drivers include the global expansion of ice hockey infrastructure, particularly in non-traditional regions, alongside relentless advancements in material science that allow for the production of lighter, stronger, and more comfortable skates. These technological leaps continually drive product replacement cycles as professional and high-level amateur players seek marginal performance gains. Conversely, the market faces significant restraints, notably the high initial investment cost associated with high-performance skates, which can be prohibitive for casual or low-income players, and the inherent seasonality of ice sports, which causes fluctuating demand throughout the year and complicates inventory management.

Opportunities within the market largely revolve around personalization and digital integration. The burgeoning demand for fully customized, 3D-printed or scanned skates offers manufacturers lucrative, high-margin revenue streams. Furthermore, integrating smart technology (sensors, connectivity) into skates presents a unique avenue for value-added services, turning the skate into a performance tracking device that appeals strongly to data-driven athletes and coaches. The market impact forces emphasize competitive pricing strategies among the top-tier brands and the critical importance of intellectual property surrounding boot structure and blade metallurgy, establishing high barriers to entry for new competitors who lack the necessary technological expertise and specialized manufacturing capabilities.

The ultimate impact of these forces is the polarization of the market: a high-end segment focused intensely on performance and customization, utilizing advanced composites and sensor technology, and a volume-driven recreational segment where durability and affordability are the paramount purchasing criteria. Manufacturers must strategically navigate these demands, balancing the capital expenditure required for continuous R&D in materials science against the need for efficient mass production of entry-level and intermediate products to sustain market share across all consumer brackets. This strategic balancing act determines long-term profitability and global market positioning in this highly specialized equipment sector.

Segmentation Analysis

The Ice Hockey Skate Market is extensively segmented based on criteria such as product type, material composition, end-user category, and distribution channel, reflecting the varied needs and purchasing power of different consumer groups. Understanding these segments is crucial for manufacturers to tailor their product development, marketing campaigns, and distribution strategies effectively. The core differentiation often lies in the balance between performance features (lightness, stiffness) required by professional users and economic accessibility and durability sought by recreational and youth players. The material segment, especially the shift from traditional leather to thermoformable synthetic and composite materials, is the most dynamic area of segmentation, influencing both pricing and market competitive advantage.

Within the End-User segmentation, professional and elite amateur players represent the most lucrative, though volume-limited, segment, demanding the highest technological specifications and bespoke fitting services, often driving initial market adoption of new innovations. Conversely, the recreational and youth segments constitute the bulk of unit sales, requiring models that balance safety, comfort, and affordability, often leading to a focus on durable plastics and simpler construction methods. Analyzing the distribution channel reveals a growing preference for specialty stores that offer essential fitting expertise, especially in developed markets, though online retail is rapidly expanding its footprint by offering competitive pricing and extensive product customization configurators.

Geographical segmentation remains vital, with North America and Europe defining the demand curve, while Asia Pacific offers significant future growth potential. Manufacturers must localize their marketing efforts to reflect regional differences in playing styles and economic conditions. For instance, the demand for specific blade profiles and boot stiffness can vary significantly between European and North American hockey cultures. Therefore, comprehensive segmentation allows for precise market targeting, inventory optimization, and ensures that product portfolios meet the diverse, specific functional requirements of the global ice hockey community.

- By Type:

- Ice Hockey Skates

- Goalie Skates

- By Material:

- Synthetic Leather

- Genuine Leather

- Composite Materials (Carbon Fiber, Fiberglass)

- By End-User:

- Professional Players

- Amateur Players (Competitive Leagues)

- Recreational Users (Casual Skating)

- Youth Players

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Sports Stores (Physical Retailers offering Fitting Services)

- Departmental Stores and Mass Merchandisers

Value Chain Analysis For Ice Hockey Skate Market

The value chain of the Ice Hockey Skate Market begins with highly specialized upstream activities centered around raw material sourcing and primary component manufacturing. This stage is dominated by specialized suppliers providing aerospace-grade stainless steel (for blades/runners), high-performance carbon fiber or specialized polymers (for boot construction), and complex foam padding materials. Due to the stringent performance and safety requirements of the sport, the procurement of these raw materials demands rigorous quality control and long-term contracts with certified suppliers. The subsequent manufacturing phase involves complex, often proprietary processes such as multi-layer composite molding, heat pressing, and precision grinding of the runners, creating significant value through technological expertise and specialized equipment.

Mid-stream activities are characterized by assembly, quality testing, and branding, primarily conducted by the major skate manufacturers. Downstream analysis focuses critically on distribution and retail. The unique nature of ice hockey skates—where precise fit is paramount to performance and safety—means that specialty sports retailers occupy a crucial position in the downstream segment. These direct channels provide necessary expert services like heat molding, blade sharpening, and custom profiling, generating considerable post-manufacturing value and influencing consumer brand loyalty. Direct-to-consumer (DTC) sales via online platforms are growing, especially for replacement blades and standardized accessories, bypassing traditional intermediaries but still requiring fulfillment of specialized sizing and fitting information.

Distribution channels are a mixture of direct sales, through brand-owned e-commerce sites targeting replacement parts and accessories, and indirect channels via specialty stores and established sporting goods distributors. Specialty stores are irreplaceable for high-value transactions involving customized and high-performance skates because they offer the critical physical interaction required for professional fitting, thereby reducing returns and ensuring customer satisfaction. The efficiency of the logistics network, particularly managing the seasonal inventory peaks associated with the hockey season start, is vital for maintaining profitability across the entire value chain, from raw material procurement to final consumer delivery.

Ice Hockey Skate Market Potential Customers

Potential customers for the Ice Hockey Skate Market encompass a broad spectrum of athletes and recreational users, segmented primarily by skill level, frequency of use, and age. The most critical segment comprises professional and high-level amateur players (including collegiate and junior leagues) who represent the primary buyers of premium, high-tech skates. These end-users demand skates engineered for maximum performance, minimum weight, and custom precision fitting, resulting in frequent replacement cycles (often annually or semi-annually) driven by training intensity and competitive requirements. Their purchasing decisions are heavily influenced by professional endorsements, brand reputation for innovation, and the availability of advanced customization services.

The second substantial customer base involves organized youth hockey programs and mid-level amateur leagues. These buyers prioritize durability, consistent sizing, and a balance of performance and cost. For youth hockey, rapid growth necessitates frequent replacement of skates, often every season, driving consistent volume demand for entry-level and mid-range products. Parents purchasing for youth athletes are highly sensitive to the skate’s ability to support developing technique while maintaining a reasonable price point. This segment is often accessed through local sports club partnerships and team equipment distributors, offering bulk purchase options and streamlined sizing programs.

Finally, the recreational user segment includes individuals who engage in casual public skating or non-competitive league play. These consumers focus on comfort, ease of use, and durability, typically opting for less aggressive blade profiles and more forgiving boot constructions. Their purchasing frequency is significantly lower, but the sheer volume of this segment contributes consistently to the overall market. Distribution channels for recreational buyers are typically broader, including mass market retailers and online platforms, where convenience and price sensitivity are the key decision drivers for the end-user.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $290.5 Million |

| Market Forecast in 2033 | $395.0 Million |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bauer Hockey, CCM Hockey, Graf Skates, True Hockey, Mission Hockey, Tour Hockey, Reebook (Adidas), Easton Hockey, Warrior Sports, Alkali Hockey, Winnwell, Miken, Franklin Sports, Blade Tech, Step Steel, Rhino Hockey, Renfrew, Sherwood, TK Hockey, STX |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ice Hockey Skate Market Key Technology Landscape

The technological landscape of the Ice Hockey Skate Market is rapidly evolving, driven primarily by the pursuit of anatomical perfection, weight reduction, and enhanced energy transfer. Key technologies center on the application of advanced material science, notably the widespread adoption of thermoformable composite materials, such as carbon fiber and fiberglass, in boot construction. These composites offer superior stiffness and durability compared to traditional leather or plastics while significantly reducing the overall weight of the skate, enabling players to achieve higher speeds and quicker maneuverability. Thermoforming technology allows the boot shell to be heated and molded precisely to the player’s foot shape, providing a custom fit that minimizes energy loss and maximizes comfort, representing a major technological leap from standardized sizing methods.

Furthermore, innovations in blade and holder technology are critical competitive differentiators. Manufacturers are utilizing proprietary methods to treat high-grade stainless steel blades, often incorporating specialized coatings or cryogenic processes to enhance edge retention and glide properties. The quick-release holder system is another major technological advancement, allowing players or equipment managers to swap out dull or damaged blades within seconds, minimizing downtime. This focus on modularity and serviceability is a key trend in high-performance equipment, acknowledging the intense physical demands placed on the skate components during competitive play and the need for immediate adjustments.

The integration of digital technology is the newest frontier. This includes advanced 3D scanning technology used by retailers to capture precise foot measurements, feeding data directly into customized boot fabrication processes. Additionally, the nascent field of "smart skates" involves embedding miniaturized sensors (e.g., accelerometers, gyroscopes) within the skate structure to monitor and record player performance metrics such as stride count, force distribution, and balance. This data connectivity is transforming the skate from a static piece of protective equipment into a dynamic analytical tool, offering valuable feedback for coaching and athlete development, and pushing the technological boundaries of athletic hardware.

Regional Highlights

The global Ice Hockey Skate Market exhibits distinct regional consumption patterns and growth dynamics, heavily influenced by local sporting traditions, economic infrastructure, and climate suitability.

- North America (United States and Canada): This region is the undisputed leader in terms of market share and revenue generation, driven by the entrenched culture of ice hockey, the presence of major professional leagues (NHL), extensive youth participation programs, and high disposable income levels that support frequent purchase of premium equipment. Canada, in particular, demonstrates the highest per capita consumption. The region is also the primary hub for technological innovation and R&D for leading global manufacturers.

- Europe (Nordic Countries, Russia, Czech Republic, Germany): Europe represents the second-largest market, characterized by strong competitive league structures and a tradition of winter sports excellence. Countries like Sweden, Finland, and Russia maintain high levels of participation. The demand here is robust for both professional-grade equipment and durable, mid-range skates suitable for extensive amateur league play. Market growth is steady, bolstered by investments in indoor rink infrastructure.

- Asia Pacific (China, South Korea, Japan): While currently holding a smaller market share, APAC is projected to be the fastest-growing region. This explosive growth is stimulated by major international sporting events hosted in the region (e.g., Winter Olympics), significant government funding allocated to develop winter sports infrastructure, and a rising middle class adopting ice sports. Manufacturers are focusing on establishing new distribution networks and educational programs in China to capitalize on future demand.

- Latin America, Middle East, and Africa (MEA): These regions constitute emerging or niche markets. Demand is sporadic and often focused on recreational or indoor ice facilities located in major metropolitan areas. Growth potential is entirely dependent on future infrastructure development, such as the construction of climate-controlled rinks. Sales volume remains low, primarily focused on standard, durable recreational models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ice Hockey Skate Market. These companies drive innovation, control major intellectual property related to skate technology, and dominate global distribution networks.- Bauer Hockey

- CCM Hockey

- Graf Skates

- True Hockey

- Mission Hockey

- Tour Hockey

- Reebook (Adidas)

- Easton Hockey

- Warrior Sports

- Alkali Hockey

- Winnwell

- Miken

- Franklin Sports

- Blade Tech

- Step Steel

- Rhino Hockey

- Renfrew

- Sherwood

- TK Hockey

- STX

Frequently Asked Questions

Analyze common user questions about the Ice Hockey Skate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the high-performance ice hockey skate market?

The primary factor driving the high-performance segment is the continuous technological advancement in composite materials, specifically carbon fiber and advanced polymers. These materials allow manufacturers to produce ultra-lightweight, high-stiffness boots that significantly improve energy transfer and maneuverability, catering directly to the needs of professional and elite amateur players seeking a competitive edge. The emphasis on custom anatomical fit through technologies like thermoforming further solidifies demand.

How has 3D scanning technology impacted the customization and fit process of ice hockey skates?

3D scanning technology has revolutionized the customization and fit process by providing precise, non-contact measurement of a player’s foot geometry. This data is fed into CAD systems to create personalized boot molds, drastically reducing human error in sizing and ensuring a truly bespoke fit. This process minimizes break-in time, improves comfort, and optimizes the performance characteristics of the skate, which is particularly critical for high-end professional equipment.

Which geographic region currently holds the largest market share for ice hockey skates, and why?

North America (comprising the United States and Canada) currently holds the largest market share. This dominance is attributed to the deep cultural integration of ice hockey, the high volume of participants across all age groups, the presence of the NHL which influences consumer purchasing, and substantial disposable income levels allowing consumers to invest in high-quality, replacement-cycle equipment.

What are the main restraints affecting the market growth, particularly in emerging regions?

The main restraints are the high initial investment cost required for premium, performance-grade ice hockey skates and the necessity of specialized infrastructure (ice rinks) and coaching. In emerging regions, the lack of widespread, accessible indoor rinks and the prohibitive expense of high-end gear often restrict mass participation, thereby limiting overall market volume growth despite high interest.

What is the significance of the Distribution Channel segmentation, and why are specialty stores critical?

Specialty sports stores are critical within the distribution channel because they offer essential value-added services such as professional sizing, heat molding, and blade profiling, which are crucial for optimizing skate performance and safety. While online channels offer convenience, the specialized, personalized nature of ice hockey skate fitting ensures that physical specialty retailers maintain a significant and indispensable role in the value chain, particularly for premium and competitive-level sales.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager