Image Guided Surgical Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441279 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Image Guided Surgical Equipment Market Size

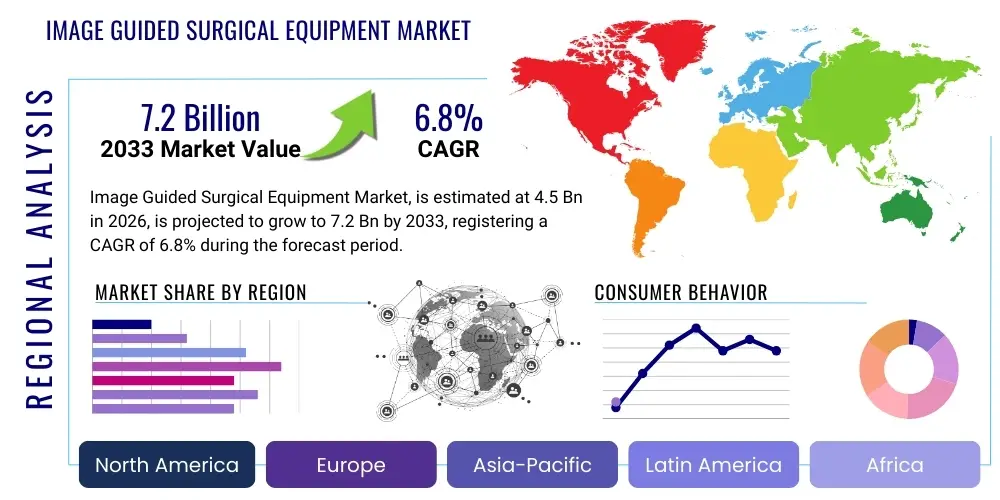

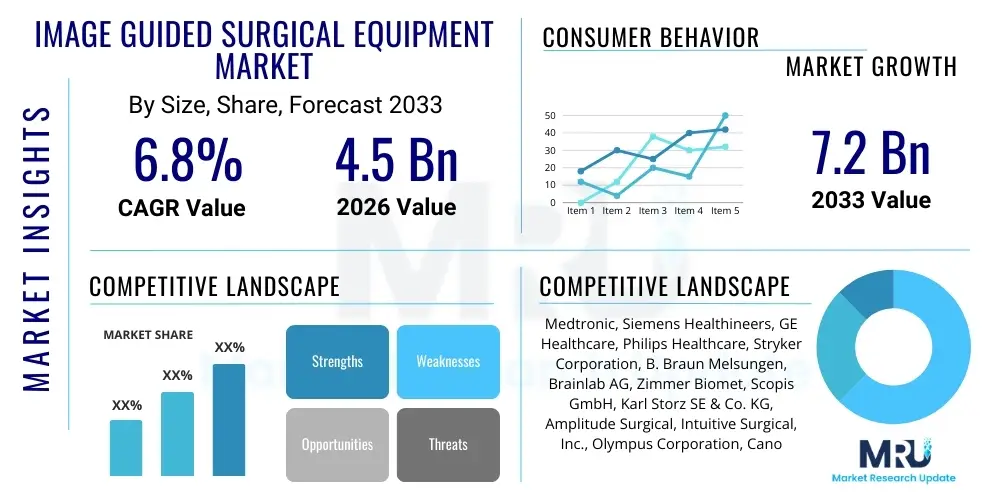

The Image Guided Surgical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Image Guided Surgical Equipment Market introduction

The Image Guided Surgical (IGS) Equipment Market encompasses advanced medical technologies designed to enhance surgical precision and minimize invasiveness by providing real-time, high-resolution visualization during operative procedures. This equipment integrates various imaging modalities—such as CT, MRI, Ultrasound, and Fluoroscopy—with sophisticated surgical navigation systems and robotic platforms. These integrated systems allow surgeons to accurately locate targets, track surgical tools relative to patient anatomy, and confirm procedure completion immediately, leading to improved patient outcomes, reduced recovery times, and decreased procedural complications. The primary product offerings in this sector include surgical navigation systems, intraoperative imaging devices (like specialized C-arms and mobile CT scanners), and advanced software solutions that merge preoperative scans with intraoperative data, creating a detailed 3D map for surgical planning and execution across complex specialties like neurosurgery, orthopedics, and oncology.

Major applications of IGS equipment span critical surgical domains. In neurosurgery, IGS systems are indispensable for tumor resection and deep brain stimulation, ensuring delicate structures are avoided while maximizing removal efficacy. Orthopedic applications heavily utilize these systems for complex joint replacements (hip and knee), spinal fusion procedures, and trauma surgery, enabling precise implant placement and alignment that significantly impacts long-term mobility and function. Furthermore, the technology is increasingly vital in ENT procedures for sinus surgery and skull base operations, where anatomical precision is paramount. The increasing complexity of modern surgical interventions and the growing global demand for minimally invasive treatments are driving the adoption of IGS solutions, particularly in high-volume surgical centers aiming for clinical excellence and operational efficiency.

The key benefits derived from the utilization of IGS equipment include enhanced safety through reduced reliance on manual estimation, improved visualization in anatomically challenging areas, and the capacity for smaller incisions, which inherently translates to less patient trauma. These technological capabilities contribute directly to faster patient mobilization and discharge, reducing the overall healthcare burden and costs associated with extended hospital stays. The principal driving factor accelerating market expansion is the technological evolution of imaging systems, particularly the integration of high-definition, multi-modal imaging and the fusion of these data streams with robotics, creating hybrid operating room environments. The rising incidence of chronic diseases requiring surgical intervention, coupled with an aging global population seeking less traumatic surgical options, further solidifies the foundational demand for advanced Image Guided Surgical Equipment.

Image Guided Surgical Equipment Market Executive Summary

The Image Guided Surgical Equipment market is witnessing rapid commercialization fueled by the pervasive business trend toward optimizing operating room efficiency and patient throughput while simultaneously enhancing surgical accuracy. Key business trends include aggressive mergers and acquisitions among technology firms specializing in software algorithms and navigation platforms, aimed at creating comprehensive, integrated surgical ecosystems. The shift from siloed imaging equipment to seamless, interconnected hybrid operating rooms represents a pivotal commercial transformation, positioning vendors that offer full-suite integration solutions at a competitive advantage. Furthermore, the development of subscription models for advanced visualization software and navigational updates is emerging as a critical revenue stream, stabilizing long-term growth and ensuring continuous technological adoption by healthcare providers.

Regionally, North America maintains market dominance due to early adoption of cutting-edge surgical technologies, robust healthcare expenditure, and the strong presence of major market leaders involved in both hardware manufacturing and sophisticated surgical software development. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is attributed to improving healthcare infrastructure investments in emerging economies like China and India, increasing governmental focus on upgrading medical facilities, and the rising prevalence of chronic conditions requiring complex surgeries, which necessitates precision IGS tools. Europe remains a significant market, driven by stringent quality standards and government initiatives promoting technological innovation in surgical oncology and orthopedics.

Segment trends highlight the burgeoning importance of surgical navigation systems, which form the core intellectual property and value proposition of many IGS solutions, offering real-time tracking and planning capabilities. Among application segments, neurosurgery continues to hold a substantial market share owing to the high complexity and criticality of brain and spinal procedures, demanding maximal precision that only IGS can reliably provide. Product innovation is heavily skewed toward integrating Augmented Reality (AR) and Virtual Reality (VR) overlays into surgical views, which are set to revolutionize surgeon training and intraoperative visualization, enhancing decision-making processes and further cementing the necessity of these advanced visualization tools in the modern operative setting.

AI Impact Analysis on Image Guided Surgical Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Image Guided Surgical Equipment Market frequently center on themes of enhanced diagnostic precision, the potential for autonomous or semi-autonomous surgical assistance, improved procedural workflow optimization, and the utility of predictive analytics for risk assessment. Users are particularly interested in how AI can move IGS from merely providing visualization to actively assisting in surgical planning and execution. The key concerns often revolve around data security, regulatory hurdles for autonomous systems, and the need for standardized training protocols to ensure safe integration of AI-driven decision support tools into high-stakes surgical environments. Essentially, users expect AI to automate routine tasks, minimize human error, and personalize surgical approaches based on vast datasets, thereby ushering in a new era of cognitive surgery.

- AI algorithms enable enhanced image segmentation and registration, dramatically improving the accuracy and speed of merging pre-operative scans (CT/MRI) with intra-operative imaging.

- Predictive analytics powered by AI assists surgeons in real-time risk assessment during procedures, forecasting potential complications based on physiological data and procedural progress.

- Machine learning models optimize surgical navigation pathways and trajectory planning, providing the most efficient and least invasive routes to the target anatomy.

- AI integration supports the development of sophisticated surgical robots that offer increased autonomy, managing instrument positioning and tremor compensation under the surgeon's supervision.

- Deep learning systems contribute to automated quality assurance checks during and after surgery, verifying implant placement or tumor margin delineation with high reliability.

DRO & Impact Forces Of Image Guided Surgical Equipment Market

The Image Guided Surgical Equipment market growth is principally driven by the global imperative to transition toward minimally invasive surgical techniques, which are facilitated and made safe by real-time visualization systems. Restraints predominantly involve the extremely high initial capital investment required for these complex systems and the associated training costs, which can limit adoption, particularly in budget-constrained healthcare settings and developing nations. Opportunities lie in the rapidly expanding application scope of IGS beyond traditional areas like neurosurgery into fields such as cardiac, laparoscopic, and bariatric surgery. The major impact forces shaping the market include strict regulatory oversight (ensuring device efficacy and safety), swift technological obsolescence necessitating continuous R&D investment, and favorable reimbursement policies established by government and private payers that incentivize the use of high-precision tools for complex procedures.

Key drivers include the substantial increase in the aging population globally, which translates directly to a higher incidence of age-related conditions requiring surgical intervention, notably joint replacements, cardiac valve repairs, and neurodegenerative disorder treatments. Furthermore, the continuous advancements in medical imaging technology, such as the introduction of high-field intraoperative MRI systems and portable robotic C-arms, are expanding the functional capabilities of IGS equipment, making complex procedures safer and more accessible. Strong support from key opinion leaders and surgical societies, advocating for standardization and integration of IGS for procedural accuracy, further reinforces the market momentum.

Conversely, significant restraints hinder unimpeded market growth. Beyond the high acquisition cost, the sophisticated nature of these devices requires specialized technical staff for maintenance and operation, presenting a logistical and financial barrier. Additionally, integration challenges, especially in older hospital infrastructure, where achieving seamless interoperability between various vendor systems (imaging, navigation, robotics) proves complex, remain a hurdle. However, substantial opportunities exist in the development of modular and portable IGS systems designed for Ambulatory Surgical Centers (ASCs), which prefer cost-effective and flexible solutions. Moreover, leveraging telepresence and remote guidance capabilities, particularly in rural or underserved areas, presents a significant avenue for market expansion and novel service delivery models.

The impact forces are fundamentally altering the competitive landscape. Regulatory pressures, especially those imposed by bodies such as the FDA and EMA, force manufacturers to invest heavily in clinical validation and post-market surveillance, raising the barrier to entry for smaller players. Meanwhile, economic impact forces, such as global supply chain volatility affecting specialized components and semiconductors, can influence manufacturing costs and time-to-market. Ultimately, the interplay of patient demand for faster recovery, physician need for precision, and regulatory requirements for proven safety defines the trajectory and technological emphasis of the entire Image Guided Surgical Equipment ecosystem.

Segmentation Analysis

The Image Guided Surgical Equipment Market is intricately segmented based on product type, application, and end-user, reflecting the diverse technological offerings and specific clinical needs addressed by this specialized equipment. The product segmentation differentiates between core hardware components, such as surgical navigation systems (optical and electromagnetic), intraoperative imaging devices, and advanced software platforms for fusion and planning. Application segmentation is critical as it highlights the primary surgical specialties utilizing IGS, with neurosurgery and orthopedics traditionally being the largest consumers. End-user categorization distinguishes between major purchasers, primarily hospitals and specialized clinics, based on their capacity to acquire and utilize high-cost, high-throughput surgical technology. This structure allows for precise market analysis across specific technological capabilities and clinical usage patterns.

- By Product:

- Surgical Navigation Systems (Electromagnetic, Optical, Hybrid)

- Intraoperative Imaging Devices (Intraoperative CT, Intraoperative MRI, C-Arms, Ultrasound Systems)

- Robotic Assistance Systems

- IGS Software and Services

- By Application:

- Neurosurgery

- Orthopedics

- Cardiology

- Oncology

- Urology

- ENT (Ear, Nose, and Throat) Surgery

- Other Applications

- By End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Clinics and Research Institutes

Value Chain Analysis For Image Guided Surgical Equipment Market

The value chain for Image Guided Surgical Equipment is complex and highly specialized, commencing with upstream activities focused on the procurement of highly sensitive components, particularly high-performance sensors, specialized medical-grade optics, sophisticated semiconductor chips for computational processing, and complex software development for algorithms and user interfaces. Upstream suppliers are typically technology firms specializing in precision engineering and high-reliability electronics. The manufacturing stage involves intricate assembly, rigorous calibration, and exhaustive testing to meet stringent medical device standards (e.g., ISO 13485). Given the reliance on advanced imaging modalities, partnerships with leading imaging companies are crucial for seamless integration, defining the early stages of value creation.

Midstream activities are characterized by market customization and distribution. Manufacturers utilize a mix of direct sales forces, particularly for major hospital systems requiring complex contractual and technical support, and indirect distribution channels involving specialized medical distributors who possess deep relationships with regional healthcare providers. The complexity of installation and the need for continuous post-sale support, training, and software updates necessitate strong technical expertise within the distribution network, adding significant value. Direct channels ensure maximum control over the sales process and post-installation service quality, which is vital for maintaining device performance and surgeon satisfaction, especially for newly launched robotic and AI-integrated platforms.

Downstream activities involve the ultimate consumption and maintenance of the equipment within end-user settings, primarily high-volume academic hospitals and specialized surgical centers. The downstream value is realized through the clinical outcomes achieved, the efficiency gains in the operating room (OR), and the reduction in surgical complications. Training and ongoing clinical education provided by the manufacturer or distributor are essential downstream services that ensure the optimal utilization of the IGS systems. Indirect distribution through third-party service providers handles routine maintenance and repairs, while direct involvement often manages critical software patches and hardware upgrades, ensuring continuous operational readiness and maximizing the return on investment for the healthcare provider.

Image Guided Surgical Equipment Market Potential Customers

The primary potential customers and end-users of Image Guided Surgical Equipment are institutions that prioritize high-precision, minimally invasive surgeries and possess the necessary capital infrastructure to support advanced medical technologies. This predominantly includes large, tertiary-care hospitals and academic medical centers, particularly those designated as Centers of Excellence in neurosurgery, orthopedics, and surgical oncology. These institutions serve as referral centers for complex cases, meaning they require the most advanced IGS systems, including intraoperative CT/MRI suites and advanced robotic navigation platforms, to handle challenging anatomical scenarios and high patient volumes effectively. Their purchasing decisions are driven by clinical reputation, research capabilities, and the need to offer state-of-the-art patient care.

Ambulatory Surgical Centers (ASCs) represent a rapidly growing segment of potential customers. As surgical procedures migrate out of inpatient hospital settings due to cost pressures and technological advancements, ASCs increasingly require modular, cost-effective, and easy-to-use IGS solutions, particularly for common orthopedic and ENT procedures. While ASCs may not invest in multi-million dollar fixed intraoperative imaging suites, they are highly receptive to portable C-arms, advanced navigation software subscriptions, and flexible robotic assistance systems that enhance efficiency without demanding excessive operational footprint or capital expenditure. Their purchasing drivers are centered on minimizing turnaround time and ensuring optimal procedural accuracy in an outpatient setting.

Specialized clinics focusing on specific surgical domains, such as spine clinics or dedicated cardiac catheterization labs, also constitute significant potential customers. These facilities often require highly specialized IGS equipment tailored to their niche needs, such as fluoroscopy-based navigation for pain management or electrophysiology mapping systems integrated with imaging guidance. Furthermore, military hospitals and governmental healthcare systems, which often operate under distinct procurement cycles and focus on trauma and highly specialized field surgery, represent another strategic customer base. The decision-making process for these customers is influenced by a balance between budgetary constraints, long-term maintenance contracts, and the necessity for rugged, reliable technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Siemens Healthineers, GE Healthcare, Philips Healthcare, Stryker Corporation, B. Braun Melsungen, Brainlab AG, Zimmer Biomet, Scopis GmbH, Karl Storz SE & Co. KG, Amplitude Surgical, Intuitive Surgical, Inc., Olympus Corporation, Canon Medical Systems, Fujifilm Holdings Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Image Guided Surgical Equipment Market Key Technology Landscape

The technology landscape of the Image Guided Surgical Equipment market is dynamic, characterized by relentless innovation aimed at maximizing precision and integrating diverse data streams. A core component of this landscape is the advancement in surgical navigation systems, which now predominantly rely on high-fidelity optical and electromagnetic tracking technologies. Optical systems, using infrared cameras to track passive or active markers on instruments and patient anatomy, offer high accuracy but require line-of-sight. Electromagnetic systems, conversely, provide greater flexibility by eliminating line-of-sight constraints, making them increasingly popular for procedures deep within the body, such as catheter-based interventions. The current technological focus is on enhancing the robustness and user-friendliness of these tracking systems while minimizing system drift and calibration time, thereby reducing OR setup delays.

Intraoperative imaging constitutes another critical pillar of the IGS technological ecosystem. The shift from standard C-arms to advanced mobile robotic C-arms and dedicated intraoperative CT (iCT) and MRI (iMRI) scanners has revolutionized complex surgical fields. These high-definition intraoperative modalities allow surgeons to verify the success of the procedure, assess residual tumor margins, or check implant alignment before the patient leaves the OR, minimizing the need for subsequent corrective surgeries. The integration challenge involves ensuring that these large imaging devices can smoothly interface with existing OR infrastructure and navigation platforms, often necessitating the specialized design of hybrid operating suites that facilitate multi-modal imaging without compromising sterility or workflow efficiency. Furthermore, dose reduction technologies in X-ray based imaging devices are crucial to ensuring safety for both patients and the surgical team.

The most transformative recent technology is the integration of Augmented Reality (AR) and Virtual Reality (VR), often combined with artificial intelligence, for enhanced visualization. AR overlays project critical pre-operative data, such as tumor boundaries or critical vascular structures, directly onto the surgeon’s view of the patient’s anatomy, offering a "see-through" capability without diverting attention to external monitors. VR technology is primarily utilized for complex surgical planning and immersive professional training, allowing surgeons to rehearse challenging procedures in a simulated environment derived from patient-specific data. This fusion of real-time imaging, high-precision tracking, and cognitive assistance provided by AI-driven algorithms represents the frontier of Image Guided Surgery, promising unprecedented levels of procedural accuracy and personalization in treatment.

Regional Highlights

- North America: Dominates the global market share, driven by extensive healthcare expenditure, early and aggressive adoption of cutting-edge IGS technologies (especially robotic surgery integration), and favorable reimbursement policies for complex procedures. The US market, in particular, benefits from the strong presence of major market players and a high volume of complex orthopedic and neurosurgical procedures.

- Europe: Represents a mature market characterized by robust government funding for healthcare technology modernization and stringent regulatory standards (e.g., MDR). Western European countries (Germany, UK, France) are key adopters, focusing heavily on integrating sophisticated navigation systems into oncology and trauma centers.

- Asia Pacific (APAC): Projected to be the fastest-growing region, fueled by massive investments in public and private healthcare infrastructure, increasing prevalence of chronic diseases requiring surgical intervention, and a growing medical tourism sector in countries like Singapore and South Korea. China and India are critical growth engines, driven by large patient populations and increasing access to advanced medical facilities.

- Latin America (LATAM): Exhibits steady growth, primarily in economically stable nations like Brazil and Mexico. Market expansion is currently constrained by budget limitations and reliance on imported high-cost equipment, but increasing investment in private healthcare facilities is boosting IGS adoption for minimally invasive procedures.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to high per capita income and state-funded healthcare initiatives focused on establishing world-class medical cities. South Africa also serves as a key regional hub for advanced surgical technology adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Image Guided Surgical Equipment Market.- Medtronic plc

- Siemens Healthineers AG

- GE Healthcare (a part of General Electric Company)

- Koninklijke Philips N.V.

- Stryker Corporation

- B. Braun Melsungen AG

- Brainlab AG

- Zimmer Biomet Holdings, Inc.

- Scopis GmbH

- Karl Storz SE & Co. KG

- Amplitude Surgical SA

- Intuitive Surgical, Inc.

- Canon Medical Systems Corporation

- Hitachi, Ltd.

- Fujifilm Holdings Corporation

- Accuray Incorporated

- Microsurgery Instruments, Inc.

- Boston Scientific Corporation

- Smith & Nephew plc

- Curetis N.V.

Frequently Asked Questions

Analyze common user questions about the Image Guided Surgical Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Image Guided Surgical Equipment market?

The primary driver is the accelerating shift towards minimally invasive surgery (MIS) across various medical disciplines, requiring real-time, high-precision visualization and navigational assistance to enhance patient safety and reduce recovery times.

How is Artificial Intelligence (AI) being integrated into Image Guided Surgery systems?

AI is integrated to enhance image processing, automate complex image registration and segmentation, optimize surgical planning trajectories, and provide real-time predictive analytics and risk assessment during the operation.

Which surgical application currently holds the largest share in the IGS equipment market?

Neurosurgery holds the largest market share. The critical nature and high anatomical complexity of brain and spine procedures necessitate the maximal precision and real-time guidance offered by advanced IGS navigation and intraoperative imaging systems.

What are the main financial barriers to adopting Image Guided Surgical Equipment?

The main barriers include the extremely high initial capital investment required for purchasing sophisticated IGS systems (such as iMRI/iCT suites), coupled with significant ongoing costs for maintenance, software licensing, and specialized staff training.

Which geographical region is expected to demonstrate the fastest growth rate for IGS equipment?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth due to rising healthcare infrastructure spending, a growing patient pool for complex surgeries, and increasing governmental focus on modernizing medical facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager