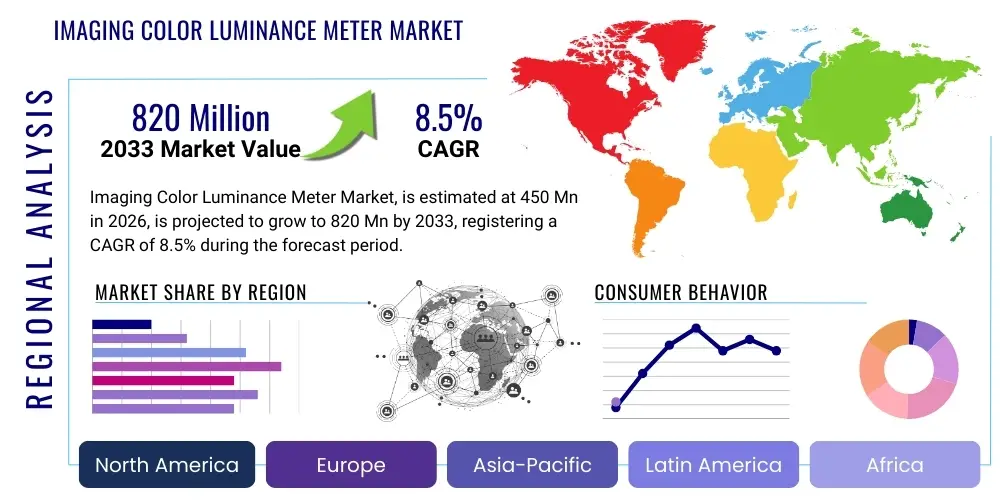

Imaging Color Luminance Meter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441447 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Imaging Color Luminance Meter Market Size

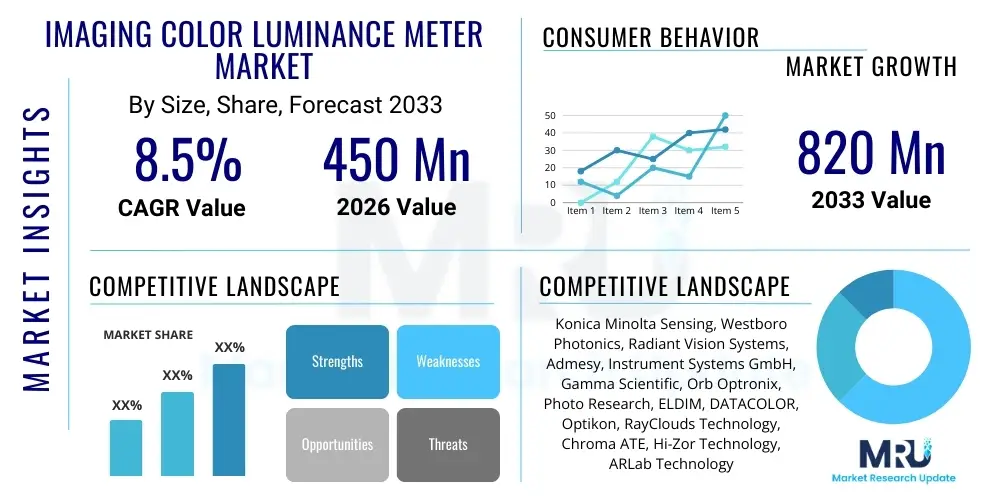

The Imaging Color Luminance Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 820 Million by the end of the forecast period in 2033.

Imaging Color Luminance Meter Market introduction

The Imaging Color Luminance Meter (ICLM) Market encompasses advanced optical instruments designed for non-contact measurement of luminance, color coordinates, and uniformity across displays, lighting sources, and surfaces. These sophisticated devices utilize CCD or CMOS sensors combined with precise optics and color filters to capture two-dimensional spatial data, providing comprehensive analysis far beyond traditional spot meters. The core product functionality is critical for quality control, research and development, and calibration across various industries where visual quality and photometric accuracy are paramount. They enable manufacturers to ensure compliance with international display standards and maintain consistency in complex visualization systems, leading to superior end-user experiences.

Major applications for ICLMs span consumer electronics, automotive manufacturing, aerospace and defense, and general lighting sectors. In consumer electronics, they are indispensable for testing OLED, LCD, and MicroLED displays for smartphones, televisions, and virtual reality (VR)/augmented reality (AR) headsets, ensuring pixel uniformity, color gamut accuracy, and freedom from mura defects. In the automotive industry, they are crucial for evaluating heads-up displays (HUDs), instrument cluster backlighting, and interior ambient lighting systems, focusing on safety compliance and aesthetic consistency under varying driving conditions. The high-resolution mapping capabilities of ICLMs provide benefits such as faster measurement times, comprehensive spatial analysis, and the ability to detect minor defects invisible to the human eye or standard spot measurements.

Key driving factors accelerating market adoption include the proliferation of high-resolution and complex display technologies (such as 8K, HDR, and curved screens), the stringent quality requirements mandated by the automotive sector for advanced lighting and display systems, and the increasing demand for precise color calibration in VR/AR devices. Furthermore, the growing emphasis on standardization and quality assurance in manufacturing processes worldwide necessitates the use of accurate and repeatable measurement tools like imaging color luminance meters. The shift towards autonomous vehicles, which rely heavily on complex visual systems, further bolsters the demand for robust photometric testing equipment.

Imaging Color Luminance Meter Market Executive Summary

The Imaging Color Luminance Meter (ICLM) market is characterized by robust growth, primarily fueled by rapid advancements in display technology and the global proliferation of high-end consumer electronics and advanced vehicular display systems. Business trends indicate a strong move towards automated measurement solutions, incorporating robotics and AI-driven analysis to improve throughput and consistency in mass production environments. Leading manufacturers are focusing on developing high-resolution sensors, enhanced software integration capabilities, and meters optimized for testing micro-displays and highly complex optical components, positioning the market for significant innovation. Strategic partnerships between hardware providers and calibration software developers are also becoming critical to delivering comprehensive turnkey solutions to major industry clients.

Regionally, the Asia Pacific (APAC) region dominates the market, largely due to the concentration of major display panel manufacturing hubs and large-scale consumer electronics production facilities located in China, South Korea, Taiwan, and Japan. North America and Europe demonstrate strong demand driven by R&D activities, the adoption of advanced automotive technologies, and the strict quality standards enforced by regulatory bodies in these regions. Emerging markets are beginning to show increased adoption as local manufacturing capabilities expand and global quality expectations become standardized, particularly within the nascent EV and local display production sectors.

Segment trends highlight the dominance of high-resolution CCD/CMOS sensor-based meters, which cater to the stringent requirements of contemporary display testing. In terms of application, the consumer electronics segment remains the largest revenue generator, although the automotive sector is exhibiting the highest growth trajectory, driven by the shift towards electric vehicles (EVs) and sophisticated in-cabin display interfaces. The integration of advanced features such as flicker testing, viewing angle analysis, and high dynamic range (HDR) measurement capabilities are key differentiators influencing segmentation uptake and pricing strategies across the competitive landscape.

AI Impact Analysis on Imaging Color Luminance Meter Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are enhancing the efficiency and capabilities of Imaging Color Luminance Meters. Common questions center on AI's role in automating defect detection, improving calibration speed, handling complex data analysis from high-resolution images, and integrating ICLMs into fully autonomous quality assurance pipelines. The central concern revolves around transitioning from human interpretation of photometric data to reliable, objective, and reproducible AI-driven decision-making. Users expect AI to minimize false positives, accelerate the identification of subtle non-uniformity issues (like mura), and optimize production line yields by providing predictive maintenance insights based on real-time measurement data. They are specifically interested in deep learning algorithms tailored for spatial analysis of color and luminance patterns.

AI's impact is transformative, shifting the primary function of ICLMs from pure data capture to intelligent diagnostic tools. Integrating ML models allows ICLM systems to learn from massive datasets of known good and defective displays, drastically improving the speed and accuracy of quality control assessments. For instance, sophisticated deep learning techniques can instantly analyze complex color patches and spatial luminance maps captured by the meter, classifying defects far quicker and more consistently than traditional image processing methods. This accelerated data processing is crucial in high-volume manufacturing settings where measurement cycle time is a critical operational parameter, ensuring that the meters are not a bottleneck in the production flow.

Furthermore, AI is enabling the development of predictive calibration algorithms. Instead of relying on manual adjustments or fixed measurement sequences, AI can analyze environmental factors, historical meter drift, and material characteristics to proactively recommend or execute calibration adjustments, thereby enhancing the long-term accuracy and reliability of the photometric measurements. This integration elevates ICLMs from simple measuring devices to key components within smart factory environments, facilitating truly automated quality assurance and reducing the total cost of ownership associated with calibration maintenance and specialized operator training.

- AI-driven automated defect classification enhances speed and objectivity in quality control.

- Machine Learning algorithms optimize ICLM measurement parameters for maximum efficiency.

- Predictive analytics enables real-time compensation for environmental or instrument drift.

- Deep learning accelerates spatial non-uniformity (mura) detection in high-resolution displays.

- Integration of AI facilitates autonomous calibration and reduced reliance on human inspectors.

- AI models are used for advanced color grading and optimizing display performance characteristics.

DRO & Impact Forces Of Imaging Color Luminance Meter Market

The Imaging Color Luminance Meter market dynamics are shaped by a complex interplay of technological demands (Drivers), high initial investment hurdles (Restraints), emerging application frontiers (Opportunities), and external standardization pressures (Impact Forces). The primary driving force is the relentless innovation cycle within the display industry, particularly the transition to next-generation technologies like MicroLEDs, advanced OLED structures, and high dynamic range (HDR) panels, which demand superior measurement accuracy and spatial resolution. Opportunities are expanding into new sectors such as biomedical imaging and complex architectural lighting, while restraints often center on the steep cost of high-end ICLM systems and the necessity for specialized operator expertise. These forces collectively dictate the adoption rate and strategic direction of the key market participants.

Key drivers include the global push for higher resolution displays (4K/8K) requiring detailed pixel-level inspection, the stringent safety and regulatory requirements in the automotive sector concerning light sources and in-cabin displays, and the rapid growth of immersive technologies like Virtual Reality (VR) and Augmented Reality (AR) headsets, which require extremely precise color and luminance uniformity calibration for user comfort and visual fidelity. These technological shifts ensure a consistent replacement and upgrade cycle for existing measurement equipment. Conversely, major restraints include the high capital expenditure required for purchasing advanced ICLM systems, particularly those with cooled high-resolution sensors suitable for low-light or HDR testing. Furthermore, the complexity of the accompanying software and the requirement for highly skilled technicians to interpret and manage the vast amounts of photometric data can impede adoption among smaller manufacturers or non-specialized users.

Opportunities are significant, particularly in leveraging the meter's capabilities beyond traditional flat panel displays. The burgeoning market for heads-up displays (HUDs) in both automotive and aerospace contexts requires advanced photometric testing that ICLMs are uniquely suited to provide. The push towards smart lighting and Human-Centric Lighting (HCL) also opens new avenues for precise spectroradiometric and photometric verification. Impact forces, such as global standardization efforts (e.g., CIE, ISO standards for display measurement) and competitive pressures to reduce product defects, mandate the adoption of best-in-class measurement tools, forcing manufacturers across the supply chain to invest in ICLM technology to maintain competitive edge and regulatory compliance. The shift towards automated inline inspection systems also acts as a powerful force reshaping how these instruments are integrated into manufacturing workflows.

Segmentation Analysis

The Imaging Color Luminance Meter market is segmented primarily based on the sensor type, measurement application, and end-use industry. This structure allows market participants to tailor offerings to specific technical requirements and budgetary constraints across diverse industrial sectors. Sensor technology segmentation, encompassing CCD and CMOS sensors, reflects a fundamental trade-off between sensitivity, cost, and measurement speed, with high-end applications often requiring cooled CCD sensors for superior low-light performance. Application-based segmentation defines the specific measurement task, such as uniformity testing, viewing angle measurement, or flicker analysis, which directly influences the necessary software capabilities and optical configuration of the device. End-use segmentation highlights the most lucrative and high-growth sectors driving market demand.

The dominance of high-resolution CMOS sensors is accelerating, as they offer faster readout speeds and a competitive cost profile suitable for inline production testing, though high-accuracy research and demanding HDR applications still often rely on specialized CCD technology. Analyzing the market by application reveals that uniformity and defect analysis remains the largest segment due to its criticality in display quality control, followed closely by color and gamma calibration. The increasing adoption of flexible and foldable displays also necessitates specialized ICLMs capable of assessing non-flat surfaces, driving innovation in lens and optical design.

Segmentation by end-use industry clearly points to the consumer electronics manufacturing sector as the primary revenue generator, given the sheer volume of smartphones, tablets, and large-screen TVs produced globally. However, the automotive sector is exhibiting substantial growth due to the regulatory push for advanced lighting safety and the integration of multiple digital screens into vehicle interiors. The market for general lighting (LEDs, smart fixtures) and aviation/aerospace display testing, while smaller, demands the highest levels of accuracy and certification, often utilizing the most sophisticated and expensive ICLM models available on the market, driving the high-value segment.

- By Sensor Type:

- CCD (Charge-Coupled Device) Sensors

- CMOS (Complementary Metal-Oxide-Semiconductor) Sensors

- By Application:

- Display Uniformity and Mura Inspection

- Color and Gamma Calibration

- Flicker and Response Time Measurement

- Viewing Angle Measurement

- Light Source Testing (LEDs, Headlights)

- By End-Use Industry:

- Consumer Electronics (Smartphones, TVs, Monitors, Wearables)

- Automotive and Transportation (HUDs, Instrument Clusters, Interior Lighting)

- Aerospace and Defense

- Research and Development/Academia

- General Lighting and Signage

- By Resolution/Pixel Count:

- Standard Resolution (Up to 1 MP)

- High Resolution (2 MP to 8 MP)

- Ultra-High Resolution (Above 8 MP)

Value Chain Analysis For Imaging Color Luminance Meter Market

The Value Chain for the Imaging Color Luminance Meter market is complex, beginning with highly specialized component suppliers and concluding with end-user deployment in industrial quality control and R&D labs. The upstream segment is dominated by manufacturers of critical components such as high-grade optical lenses, specialized CCD/CMOS image sensors (often cooled), and precision color filters designed to match the CIE photometric curve. These components require extremely tight tolerances and specialized manufacturing processes, leading to high barriers to entry for new suppliers. The core value addition occurs at the meter manufacturing stage, where these components are integrated with proprietary electronics, calibration mechanisms, and highly sophisticated software algorithms to create a complete measurement solution.

Midstream activities involve the crucial integration of hardware and software. Leading ICLM providers differentiate themselves not just on sensor quality, but heavily on the robustness and user-friendliness of their analysis software, which handles data acquisition, image processing, defect mapping, and reporting. Calibration and certification services are also significant value-adds at this stage, ensuring the instruments meet rigorous international standards (e.g., NIST traceability). Distribution channels are predominantly indirect, leveraging a network of specialized technical distributors and representatives who possess deep knowledge of optical measurement technology and can provide local installation, training, and ongoing support to end-users.

The downstream segment involves installation, ongoing maintenance, and critical technical support for the end-users. Direct sales are often reserved for key strategic accounts or large original equipment manufacturers (OEMs) requiring highly customized solutions. However, most market transactions flow through authorized distributors who service specific geographical or industrial niches. The complexity of the product means that the technical support provided post-sale, including periodic recalibration and software updates, constitutes a significant part of the value delivery, maintaining the accuracy and functional lifespan of the expensive capital equipment. The choice of distribution model is vital, as end-users require immediate access to expert consulting to maximize the utility of their advanced measurement systems.

Imaging Color Luminance Meter Market Potential Customers

Potential customers for Imaging Color Luminance Meters are defined by their critical need for accurate, non-contact, spatial photometric and colorimetric measurement, primarily concentrated in high-volume, high-value manufacturing and advanced research environments. The largest cohort of buyers resides within the consumer electronics manufacturing ecosystem, encompassing Tier 1 display panel makers (e.g., Samsung Display, LG Display, BOE), and device assemblers (e.g., Apple, Xiaomi, Sony). These customers use ICLMs extensively for end-of-line quality control to guarantee display uniformity, color accuracy, and detect subtle visual defects (like mura or dust) across millions of units annually.

The second major customer group is the automotive manufacturing sector, including major OEMs (e.g., BMW, Tesla, Toyota) and their supply chain partners (Tier 1 suppliers of instrument clusters, ambient lighting, and external lighting systems). This segment requires ICLMs to verify compliance with strict automotive quality standards regarding light emission, display contrast ratios under various conditions, and the precise color matching of internal components to maintain brand consistency and safety certifications. The increasing sophistication of heads-up displays (HUDs) and interior aesthetic lighting in electric vehicles (EVs) is rapidly expanding this customer base and their demands for advanced measurement capabilities.

Other significant potential customers include specialized laboratories and institutions engaged in optical research, government agencies focused on defense and aerospace visualization systems (e.g., cockpit displays), and manufacturers in the general lighting industry who require precise spectral and photometric measurements for high-efficiency LED and specialty light sources. These customers seek the highest resolution and most sensitive ICLMs for R&D purposes and specialized calibration tasks, prioritizing accuracy and customizability over pure speed or cost efficiency, establishing distinct purchasing criteria within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 820 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Konica Minolta Sensing, Westboro Photonics, Radiant Vision Systems, Admesy, Instrument Systems GmbH, Gamma Scientific, Orb Optronix, Photo Research, ELDIM, DATACOLOR, Optikon, RayClouds Technology, Chroma ATE, Hi-Zor Technology, ARLab Technology, JETI Technische Instrumente GmbH, TEC/WEST, Shenzhen Kingsun Instruments, Microvision, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Imaging Color Luminance Meter Market Key Technology Landscape

The technological landscape of the Imaging Color Luminance Meter market is defined by continuous advancements in sensor technology, optics, and computational algorithms necessary to meet the increasing complexity and demands of modern displays. A primary technological focus is the optimization of image sensors. While CCD sensors historically provided superior uniformity and sensitivity, especially for low-light measurements, CMOS sensors are rapidly closing the performance gap while offering higher frame rates and faster data throughput crucial for high-speed production line integration. Key developments include cooling mechanisms (Peltier cooling) applied to sensors to minimize thermal noise, ensuring accurate measurement of low-luminance displays (e.g., in VR/AR devices or micro-displays).

Another critical area involves advanced optical design, specifically the development of high-numerical aperture lenses capable of capturing wide fields of view without introducing significant distortion or vignetting. Specialized telescopic and wide-angle lenses are essential for accurately measuring large displays or complex optical systems like heads-up displays, which rely on projecting images onto curved surfaces. Furthermore, the integration of specialized tristimulus filters, which precisely match the human eye's color response functions (CIE 1931 color matching functions), is fundamental. Manufacturers invest heavily in proprietary filter technology and precise calibration routines to guarantee the accuracy and inter-instrument agreement of color measurements across their product lines.

Software and processing power constitute the third pillar of the technological landscape. Modern ICLMs rely on powerful embedded processors and sophisticated software platforms capable of rapidly processing massive image data files (often 12-bit or 16-bit depth). Key software technologies include proprietary algorithms for defect detection (such as mura, line defects, and spot variations), viewing angle compensation algorithms, and seamless integration capabilities with factory automation systems (e.g., SECS/GEM protocols). The future trajectory involves greater integration of AI/ML for autonomous calibration, predictive maintenance, and enhanced spatial data interpretation, pushing the technological boundary toward fully automated photometric analysis systems capable of handling the intricacies of MicroLED and quantum dot displays.

Regional Highlights

- Asia Pacific (APAC): APAC represents the cornerstone of the Imaging Color Luminance Meter market, driven by its undeniable dominance in global display panel manufacturing. Countries like China, South Korea, Taiwan, and Japan host the world's largest production facilities for LCD, OLED, and next-generation MicroLED displays. This high concentration of manufacturing necessitates continuous, high-volume investment in quality control and measurement equipment. Furthermore, the immense consumer electronics market in this region fuels demand, ensuring that ICLMs are critical tools for maintaining competitive quality standards in smartphones, tablets, and advanced televisions. The region exhibits the highest growth rate due to ongoing capacity expansion and technological upgrades, particularly in mainland China's display manufacturing ecosystem.

- North America: North America is a significant market primarily defined by strong research and development activities, high-value aerospace and defense programs, and rapid adoption of advanced automotive technologies. The demand here focuses less on high-volume production testing and more on specialized, high-accuracy ICLMs used for developing new display materials, calibrating high-fidelity simulation systems, and ensuring compliance with stringent safety and military display specifications. Key drivers include the booming AR/VR market and the headquarters of major technology firms requiring top-tier measurement solutions for product validation and certification.

- Europe: The European market is characterized by robust demand from the premium automotive sector, particularly Germany, which leads in automotive lighting design, heads-up display technology, and stringent interior aesthetics. European manufacturers prioritize quality assurance and adherence to strict EU regulations regarding display safety and lighting uniformity. R&D in materials science and specialized industrial display applications also contributes significantly. Adoption is driven by the need to integrate ICLMs into automated production lines to meet high quality standards for luxury vehicles and complex industrial visualization systems.

- Latin America (LATAM): The LATAM market remains relatively nascent but exhibits potential, driven by limited local assembly operations and the growing presence of global automotive and electronics manufacturers establishing localized supply chains. Demand is typically project-based, centered around localized calibration centers and assembly quality control rather than large-scale panel fabrication. Brazil and Mexico are the primary centers for adoption, reflecting their status as major hubs for vehicle assembly and consumer electronics distribution.

- Middle East and Africa (MEA): The MEA region is currently the smallest market segment, with demand generally concentrated in specific high-value sectors such as aviation (for maintenance and calibration of flight deck displays) and emerging smart city projects that require advanced LED lighting verification. Market penetration is highly dependent on large infrastructure investments and technology transfer from global players. Growth relies on industrial diversification efforts, particularly the establishment of regional manufacturing hubs and the development of local R&D capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Imaging Color Luminance Meter Market.- Konica Minolta Sensing

- Radiant Vision Systems (a Konica Minolta company)

- Instrument Systems GmbH

- Westboro Photonics

- Admesy

- Gamma Scientific

- Photo Research (a JADAK company)

- ELDIM

- Orb Optronix

- DATACOLOR

- Chroma ATE Inc.

- Hi-Zor Technology

- RayClouds Technology

- JETI Technische Instrumente GmbH

- TEC/WEST (Technology West)

- Optikon

- Microvision, Inc. (focusing on specialized scanning solutions)

- Shenzhen Kingsun Instruments

- ARLab Technology

Frequently Asked Questions

Analyze common user questions about the Imaging Color Luminance Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a spot luminance meter and an imaging color luminance meter?

A spot luminance meter measures light intensity and color at a single, specific point. Conversely, an imaging color luminance meter (ICLM) captures a high-resolution, two-dimensional image of the light source or display, providing thousands or millions of measurement points simultaneously. This allows for comprehensive spatial uniformity analysis, defect mapping (mura), and viewing angle characterization, which is impossible with spot meters.

Which end-use industry is expected to drive the highest growth for ICLMs during the forecast period?

The Automotive and Transportation industry is expected to drive the highest Compound Annual Growth Rate (CAGR). This acceleration is due to the rapid transition towards electric and autonomous vehicles, which feature multiple, complex digital displays (HUDs, instrument clusters) and sophisticated internal and external lighting systems requiring precise photometric and colorimetric quality assurance to meet safety and aesthetic standards.

How does the high capital cost of ICLMs impact market adoption?

The high capital expenditure (CapEx) associated with purchasing advanced, high-resolution ICLMs acts as a primary restraint, particularly for smaller enterprises and developing economies. This cost mandates that manufacturers justify the investment through increased production efficiency, reduced defect rates, and compliance with high-value product standards, often necessitating the adoption of advanced leasing or equipment-as-a-service models.

What role does AI play in modern imaging color luminance measurement?

AI, specifically deep learning and computer vision, enhances ICLM functionality by automating the analysis of captured images. AI accelerates defect detection and classification (e.g., mura detection), reduces measurement cycle times in inline production environments, and improves overall accuracy by minimizing human subjectivity in quality control decisions, turning raw data into actionable manufacturing insights.

What are the key technical challenges facing ICLMs concerning MicroLED displays?

MicroLED displays present several challenges, primarily low emission area, high brightness requirements, and extremely small pixel pitch. ICLMs must offer ultra-high spatial resolution (high pixel count sensors) and high sensitivity to accurately measure the individual micro-emitters and ensure uniformity and consistent color matching across the array, demanding technological advancements in optics and sensor cooling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager