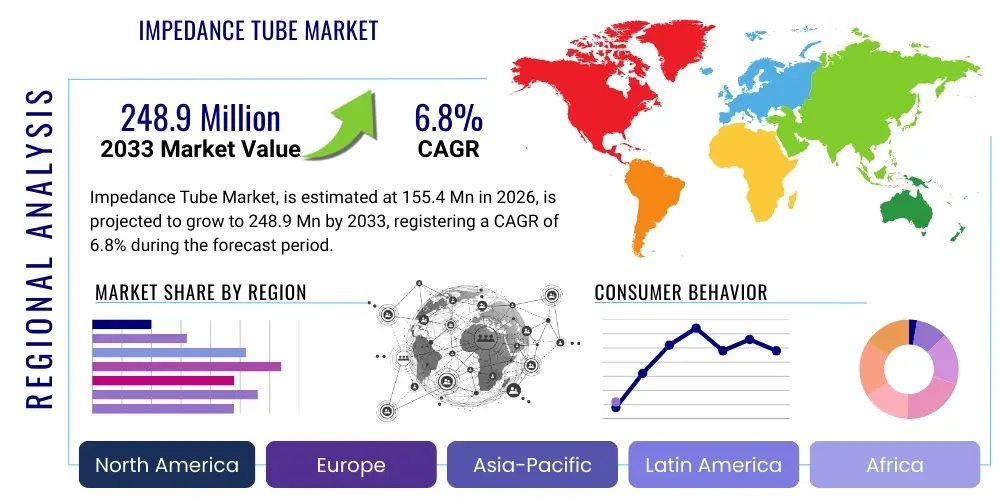

Impedance Tube Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441024 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Impedance Tube Market Size

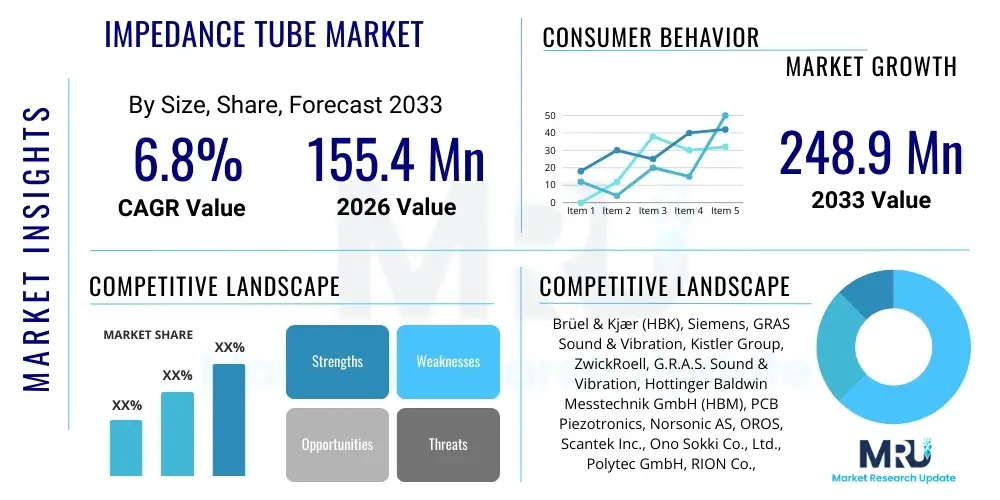

The Impedance Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 155.4 Million in 2026 and is projected to reach USD 248.9 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by increasingly stringent noise and vibration harshness (NVH) regulations across major industries, coupled with the rapid expansion of acoustic material research aimed at developing quieter, more efficient products. Demand is particularly strong in the automotive and aerospace sectors, where reducing internal and external noise pollution is a critical design priority, necessitating highly accurate methods for measuring sound absorption and impedance properties of various materials, tasks for which the impedance tube remains the gold standard.

Impedance Tube Market introduction

The Impedance Tube Market encompasses the sale, distribution, and utilization of acoustic testing devices designed to measure the sound absorption coefficient and acoustic impedance of materials, typically following standardized methodologies such as ISO 10534-2. The impedance tube, often referred to as a standing wave tube or Kundt's tube, works by generating a plane wave in a tube, allowing for precise measurement of sound pressure at multiple points to determine material properties under normal incidence conditions. The core product is essential for research and development activities involving noise control materials, including foams, fabrics, composites, and porous absorbents used extensively in built environments, transportation systems, and industrial machinery. Key benefits driving market adoption include its high accuracy, repeatability, ability to test small samples, and its foundational role in validating computational models. Major applications span quality control in manufacturing, academic research in acoustics, and advanced product development in sectors prioritizing noise mitigation, such as electric vehicles (EVs) and advanced air mobility (AAM) platforms, where unique low-frequency noise issues require tailored acoustic solutions.

Driving factors for this market include the global push towards quieter urban environments and stricter occupational safety standards regarding noise exposure. Furthermore, the rapid growth in material science necessitates faster and more reliable testing protocols for newly engineered acoustic materials, particularly those designed to be lighter or more resilient in harsh conditions. Impedance tubes offer a non-destructive testing method that provides critical baseline data for engineers and researchers, accelerating the development cycle for effective noise reduction solutions. The integration of advanced digital signal processing (DSP) and automated data acquisition systems into modern impedance tubes enhances efficiency and minimizes measurement errors, further bolstering their appeal across diverse industrial and academic testing environments, contributing significantly to market expansion.

Impedance Tube Market Executive Summary

The Impedance Tube Market is characterized by robust growth, propelled by sustained business trends emphasizing noise reduction strategies in mobility and construction, and regional trends reflecting stringent regulatory frameworks, particularly in Western Europe and North America. Segment trends highlight a shift towards sophisticated multi-microphone systems (four-microphone method) due to their superior phase analysis capabilities and the ability to handle a broader range of frequencies, necessary for modern acoustic material characterization. Business trends show a strategic focus among manufacturers on developing integrated testing platforms that combine impedance tube measurements with other acoustic analysis tools, allowing end-users to conduct comprehensive NVH testing efficiently. There is also a notable movement toward cloud-based data storage and analysis solutions, facilitating collaboration and standardization across global research teams, positioning the market favorably for continued technological advancement and wider industrial penetration, especially as industries like aerospace seek complex material validations for supersonic travel and drone technology.

Regionally, the Asia Pacific (APAC) stands out as a high-growth area, driven by burgeoning manufacturing hubs in China and India, where increasing industrialization necessitates greater quality control and adherence to international acoustic standards. These regions are rapidly investing in sophisticated testing equipment to support domestic automotive, consumer electronics, and construction industries. Conversely, mature markets like Europe exhibit high demand for premium, highly precise instruments, often linked to specialized academic research centers and established automotive R&D facilities that focus heavily on material innovation and compliance with strict EU noise directives. Segmentally, the demand is particularly pronounced within the research and development category, underscoring the market's reliance on continuous innovation in material science and acoustic engineering, contrasting slightly with steady, baseline demand from quality control labs ensuring product consistency.

AI Impact Analysis on Impedance Tube Market

User queries regarding the impact of Artificial Intelligence (AI) on the Impedance Tube Market center primarily on enhancing data processing efficiency, automating complex calibration routines, and enabling predictive modeling for material performance. Users frequently ask if AI can replace physical testing entirely, or how AI can be integrated into existing setups to improve accuracy and speed. Key concerns revolve around the necessary investment in upgraded hardware and software, and the skills required to implement and manage AI-driven acoustic analysis. Expectations are high regarding AI's ability to correlate physical impedance measurements with material structure (e.g., porosity, density) and predict acoustic properties for untested material variations, thereby significantly reducing the time and cost associated with experimental iteration. The overall sentiment is that AI will act as a powerful augmentation tool rather than a replacement, accelerating the material discovery pipeline.

The integration of AI algorithms, specifically machine learning (ML) models, into impedance tube software suites allows for sophisticated analysis of raw acoustic data, minimizing the influence of ambient noise and instrument drift, leading to higher confidence in measurement results. Furthermore, predictive ML models can be trained on vast datasets of measured impedance values and corresponding material characteristics, enabling engineers to input material parameters and instantly estimate absorption coefficients across a frequency range without the need for immediate physical testing. This capability drastically improves the efficiency of early-stage material screening. The use of neural networks for recognizing subtle patterns in acoustic response that traditional linear signal processing might overlook is a major anticipated benefit, leading to the development of novel, high-performing acoustic materials tailored for specific NVH applications.

- AI integration enhances the automation of calibration processes, reducing human error and setup time.

- Machine Learning (ML) algorithms accelerate material screening by predicting acoustic properties based on structural inputs.

- AI optimizes data filtering and noise reduction in acquired signals, improving measurement accuracy and reliability.

- Predictive modeling capabilities minimize the need for extensive physical prototyping, lowering R&D costs.

- Deep Learning models facilitate the correlation between physical material parameters (e.g., pore size) and acoustic impedance characteristics.

DRO & Impact Forces Of Impedance Tube Market

The market for impedance tubes is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively determining its growth trajectory and resilience. Primary drivers include the global expansion of regulatory mandates enforcing lower noise emissions in vehicles, industrial settings, and construction, particularly the move towards Silent by Design principles in modern engineering. Restraints often center around the initial capital investment required for high-precision measurement systems and the technical expertise necessary to operate and interpret complex acoustic data, which can limit adoption in smaller research facilities or developing economies. Opportunities emerge from the accelerating innovation in advanced materials (e.g., metamaterials, bio-based absorbents) which require specialized testing methods, and the growing synergy between physical testing and virtual simulation environments, where impedance tube data is crucial for validating finite element analysis (FEA) models. These forces collectively push market participants towards developing more user-friendly, cost-effective, and technologically advanced testing solutions.

Impact forces currently shaping the market are largely technological and economic. The impact of digitalization and the integration of sophisticated sensors are forcing market players to rapidly upgrade their product portfolios, emphasizing features like faster data acquisition rates and wider frequency measurement capabilities. Economic impact forces include fluctuating raw material costs (especially for high-tolerance metals used in tube construction) and global supply chain vulnerabilities, which can affect manufacturing costs and product lead times. Moreover, the increasing demand for high-frequency testing, often requiring smaller tubes and specialized instrumentation, exerts a pressure on manufacturers to miniaturize and refine their products without compromising on measurement accuracy, thereby influencing product development cycles and market pricing strategies across all geographical regions.

Segmentation Analysis

The Impedance Tube Market segmentation provides a critical view of where demand originates and how different product types cater to specific application needs. Segmentation is typically performed based on the number of microphones used (Two-Microphone vs. Four-Microphone method), the application type (Research & Development vs. Quality Control), and the end-use industry (Automotive, Aerospace, Construction, Academia, etc.). This granular analysis helps manufacturers tailor their product offerings, focusing on high-accuracy, wide-frequency-range systems for R&D centers, and robust, easy-to-use systems for quality control in manufacturing lines. The rising complexity of acoustic challenges, particularly in low-frequency noise management, dictates the increasing demand for advanced four-microphone systems, which offer better phase tracking and separation of incident and reflected waves, improving the precision of low-frequency sound absorption measurements.

Further analysis reveals that the End-Use segmentation is highly sensitive to regional industrial trends. For instance, high demand from the Automotive sector is dominant in markets with significant EV production, as these vehicles face unique noise profiles requiring dedicated material tuning. Conversely, the Construction sector demonstrates consistent demand for evaluating soundproofing materials used in commercial and residential buildings to meet increasingly strict acoustic comfort standards. The R&D segment, covering both academic institutions and corporate research centers, remains the largest revenue generator due to its continuous need for cutting-edge instrumentation capable of handling experimental and novel material forms, driving innovation in tube design, such as variable diameter tubes to cover extremely broad frequency ranges efficiently.

- By Method

- Two-Microphone Method (ISO 10534-2)

- Four-Microphone Method (ASTM E2611, enhanced capabilities)

- By Application

- Research and Development (R&D)

- Quality Control (QC) and Material Certification

- Consultancy Services and Field Testing

- By End-Use Industry

- Automotive and Transportation (NVH testing, EV materials)

- Aerospace and Defense (Lightweight acoustic treatments)

- Construction and Architecture (Soundproofing, reverberation control)

- Consumer Electronics (Speaker damping, product noise reduction)

- Academic and Research Institutions

- Industrial Machinery and Equipment

- By Tube Diameter/Frequency Range

- Small Diameter Tubes (High Frequency Testing, typically >1600 Hz)

- Large Diameter Tubes (Low Frequency Testing, typically <500 Hz)

- Multi-Diameter Systems and Modular Tubes

Value Chain Analysis For Impedance Tube Market

The Value Chain for the Impedance Tube Market begins with upstream activities focused on the sourcing and precision machining of high-grade materials, typically aluminum, stainless steel, or specialized composites, which ensure the tube’s dimensional accuracy and acoustic integrity. This stage also includes the procurement of highly sensitive, calibrated microphones (often electret or prepolarized condenser types) and advanced data acquisition (DAQ) hardware. Midstream activities involve the design, assembly, and rigorous calibration of the final tube systems, requiring specialized acoustic engineering expertise and controlled environment manufacturing processes to meet strict international standards (e.g., ISO and ASTM). Key value addition here is the development of proprietary software algorithms for signal processing and data interpretation, offering competitive advantages in measurement speed and accuracy.

The downstream segment focuses on market distribution and end-user support. Distribution channels are typically specialized, utilizing direct sales teams for major industrial accounts and academic institutions, supplemented by a network of technical distributors or regional representatives who possess deep knowledge of acoustic measurement principles. Given the technical complexity, extensive post-sale support, training, and maintenance services are crucial value propositions. Direct channels allow manufacturers to maintain control over pricing and customer relationship management, vital for high-value, sophisticated instrumentation. Indirect channels, through specialized resellers, often provide better regional penetration and faster service response times in geographically dispersed markets, especially in APAC where localized support is highly valued.

Impedance Tube Market Potential Customers

Potential customers for impedance tube systems are diverse, spanning multiple industrial sectors and research domains unified by the need for precise acoustic material characterization. The primary end-users or buyers are R&D departments within large manufacturing organizations, particularly those involved in developing Noise, Vibration, and Harshness (NVH) solutions for transportation sectors like automotive, rail, and aviation. Acoustic material producers, such as manufacturers of specialized foams, fiber-based insulators, or multilayer damping sheets, rely on these tubes for quality control and product certification before market release. Furthermore, independent acoustic testing laboratories and engineering consultancy firms purchase these instruments to provide specialized services to smaller companies that lack in-house testing capabilities.

A significant customer base resides within academic and governmental research institutions, where impedance tubes are essential tools for fundamental research into wave propagation, novel acoustic structures (like meta-materials), and standardized material testing for public infrastructure projects. The shift toward sustainable engineering also creates a segment of customers focusing on bio-based or recycled acoustic materials, requiring specialized low-frequency measurement capabilities to validate their performance. Ultimately, any organization whose product performance or regulatory compliance is influenced by sound absorption and transmission characteristics represents a viable customer for impedance tube technology, driving demand across industrialized economies where environmental noise pollution is a growing concern for consumers and regulators alike.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.4 Million |

| Market Forecast in 2033 | USD 248.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brüel & Kjær (HBK), Siemens, GRAS Sound & Vibration, Kistler Group, ZwickRoell, G.R.A.S. Sound & Vibration, Hottinger Baldwin Messtechnik GmbH (HBM), PCB Piezotronics, Norsonic AS, OROS, Scantek Inc., Ono Sokki Co., Ltd., Polytec GmbH, RION Co., Ltd., National Instruments, ATS Engineering, SMT (Sound Measurement Tools), Acoustar, Klippel GmbH, Listen Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Impedance Tube Market Key Technology Landscape

The Impedance Tube Market is highly dependent on precision technology, driven by advancements in sensor technology and digital signal processing (DSP). Key technological pillars include the utilization of high-precision matched microphone pairs, essential for minimizing phase mismatch errors, particularly crucial in the four-microphone transfer function method which offers improved standing wave ratio calculation and noise resistance. Modern systems integrate high-resolution Analog-to-Digital Converters (ADCs) and sophisticated data acquisition systems capable of high sampling rates, ensuring the accurate capture of sound pressure waves across a broad spectrum, especially critical for high-frequency measurements that require very small tubes and high precision alignment. The software component, often incorporating Fast Fourier Transform (FFT) analysis, is equally vital, managing complex calibration routines, performing averaging over multiple tests, and presenting data clearly against international standards like ISO 10534-2 and ASTM E1050.

Another significant technological trend is the development of modular and portable impedance tubes. Traditional systems were large, laboratory-bound instruments, but contemporary demands for in-field testing and faster quality control have necessitated smaller, robust designs that maintain acoustic accuracy. Furthermore, manufacturers are increasingly focusing on integrating non-acoustic sensors, such as temperature and humidity sensors, directly into the tube setup. These environmental parameters are critical, as sound speed is temperature-dependent, and precise environmental correction factors must be applied to measurement results to ensure absolute accuracy and repeatability, particularly important for aerospace material testing conducted under varying simulated environmental conditions. The ongoing shift toward network-enabled and IoT-ready instruments allows for remote diagnostics and data management, improving operational efficiency for multi-site organizations.

The technological landscape is also being shaped by the increasing need for high-frequency testing, which poses challenges related to tube fabrication tolerances and air viscosity effects. This has led to the exploration of alternative techniques, though the impedance tube remains dominant for standardized material characterization. Researchers are also investigating methods to automate the process of sample preparation and mounting, which is often a source of error in traditional testing, by utilizing robotic placement and standardized sample holders to ensure perfect sealing and alignment, thereby enhancing the overall reliability and throughput of acoustic material laboratories across various industries seeking rapid and consistent results for innovative noise control applications.

Regional Highlights

- North America: This region holds a significant share, characterized by high investment in aerospace and defense acoustics, particularly driven by requirements for lighter, high-performance acoustic dampening materials. Strong regulatory adherence and a large presence of advanced acoustic R&D labs and automotive innovation centers (especially in the US and Canada) ensure sustained demand for high-end, multi-channel impedance tube systems. The rapid development of urban air mobility (UAM) technologies is also a unique regional driver necessitating new standards for noise characterization.

- Europe: Europe is a key market, heavily influenced by the European Union's stringent environmental noise directives (e.g., relating to vehicles and construction noise). The region boasts a strong presence of global automotive OEMs and world-class academic research institutions focused on material science and sustainable acoustics. Germany, France, and the UK are primary consumers, focusing on quality control and certification, often preferring equipment that strictly complies with local and international ISO standards.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest growth rate. This acceleration is fueled by massive infrastructure development, rapid industrialization, and the booming manufacturing sector in countries like China, Japan, South Korea, and India. Increased consumer awareness regarding quiet products, coupled with the rapid expansion of EV manufacturing bases in China, drives demand for cost-effective, yet reliable, testing solutions. The region is increasingly shifting from basic testing to advanced R&D capabilities.

- Latin America (LATAM): This market is smaller but growing steadily, driven primarily by construction projects and expansion in the automotive manufacturing sector, especially in Brazil and Mexico. Demand is generally centered on standard two-microphone systems for quality control in local material production, with gradual adoption of more advanced systems mirroring foreign investment trends in manufacturing and infrastructure development.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to large-scale urban development projects (smart cities, high-speed rail) and investment in the energy sector, where industrial noise control is critical for safety and compliance. Adoption tends to be concentrated in technology hubs and large government-funded research institutions, relying heavily on imports from European and North American suppliers for sophisticated acoustic instrumentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Impedance Tube Market.- Brüel & Kjær (HBK)

- Siemens

- GRAS Sound & Vibration

- Kistler Group

- ZwickRoell

- Hottinger Baldwin Messtechnik GmbH (HBM)

- PCB Piezotronics

- Norsonic AS

- OROS

- Scantek Inc.

- Ono Sokki Co., Ltd.

- Polytec GmbH

- RION Co., Ltd.

- National Instruments

- ATS Engineering

- SMT (Sound Measurement Tools)

- Acoustar

- Klippel GmbH

- Listen Inc.

- Eckel Industries

Frequently Asked Questions

Analyze common user questions about the Impedance Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an impedance tube?

The primary function is to accurately measure the sound absorption coefficient and acoustic impedance of materials under normal incidence conditions, critical data for noise control applications in various industries.

What is the difference between the two-microphone and four-microphone methods?

The two-microphone method (ISO 10534-2) measures the standing wave ratio for absorption calculations. The four-microphone method (ASTM E2611) uses advanced transfer functions to separate incident and reflected waves, offering greater accuracy, especially for transmission loss and complex material characteristics.

Which industries are the largest consumers of impedance tubes?

The Automotive (NVH testing, particularly EVs), Aerospace (lightweight material characterization), and Construction (acoustic insulation certification) industries are the largest end-users due to stringent regulatory requirements and continuous product development needs.

How does the impedance tube frequency range relate to its size?

The measurable frequency range is inversely proportional to the tube's diameter. Larger diameter tubes are necessary for accurate low-frequency measurements, while smaller tubes are used exclusively for high-frequency testing, typically requiring multiple tubes to cover a broad spectrum.

Can AI integration improve impedance tube measurement accuracy?

Yes, AI algorithms, particularly machine learning, can filter out measurement noise, automate complex calibration tasks, and enable highly accurate predictive modeling of acoustic material performance, significantly enhancing the reliability and efficiency of testing.

The rigorous requirements for noise mitigation across global manufacturing and urban development sectors guarantee the continued relevance and necessary evolution of impedance tube technology. Future market expansion will heavily rely on the successful integration of digital twins, AI-driven predictive analytics, and increasingly automated testing protocols, enabling faster material certification and adoption of cutting-edge acoustic solutions. Furthermore, specialized materials like sound-absorbing meta-surfaces and highly porous composites are constantly pushing the limits of current measurement capabilities, requiring ongoing technological advancements in sensor precision and software sophistication from market leaders.

Regulatory harmonization efforts across various continents, seeking to standardize NVH testing procedures, will further drive the demand for certified, high-standard impedance tube systems compliant with ISO and ASTM frameworks. Manufacturers are expected to prioritize user experience, offering modular systems that simplify sample preparation and enhance data visualization. The combination of regulatory pressure, continuous innovation in material science, and technological advancements in sensor and signal processing ensures a healthy competitive landscape focused on delivering high-precision acoustic measurement solutions essential for a quieter world.

Key strategic challenges for market participants include managing the high development cost associated with maintaining extreme precision in tube manufacturing and developing software that seamlessly integrates complex acoustic models with end-user workflows. Success in the competitive environment will depend not only on the accuracy of the hardware but also on the completeness of the software packages, including integrated reporting, database management, and cloud connectivity features, addressing the modern demands of global R&D teams and quality assurance laboratories striving for repeatable and verifiable acoustic data, regardless of geographical location or operator skill level, thus ensuring long-term market leadership and sustained growth across high-value segments.

The increasing complexity of acoustic materials, particularly anisotropic and nonlinear materials, demands that next-generation impedance tubes move beyond simple absorption coefficient measurement to provide detailed characterization of internal material parameters, such as tortuosity and characteristic impedance. This trend is necessitating advancements in signal processing techniques and potentially the adoption of more advanced internal sensors or scanning technologies to fully map the acoustic response within the material sample itself. The ongoing market shift towards electric vehicles, which necessitates extensive high-frequency noise control solutions to mask motor whine and other residual sounds previously obscured by internal combustion engines, further validates the crucial role of precise, standard-compliant impedance testing equipment as a fundamental tool in the acoustic engineer’s toolkit for effective product design and verification.

Another major factor driving market dynamics is the strategic mergers and acquisitions among large instrumentation groups, aiming to consolidate expertise in acoustic measurement, data acquisition, and material testing. This consolidation allows for integrated solutions that offer end-users a complete NVH testing ecosystem, rather than fragmented tools. Companies that can provide comprehensive solutions—from hardware manufacture and calibration to specialized analysis software and consultancy services—are positioned to capture larger market share, especially within large multinational corporations that require standardized acoustic protocols across their global operations. The demand for turnkey acoustic testing laboratories, where the impedance tube is a core component, presents a substantial opportunity for vendors capable of delivering comprehensive, validated setups tailored to specific industrial requirements, such as those related to high-temperature or high-pressure material evaluation scenarios common in industrial process control and specialized energy sectors.

The long-term outlook for the Impedance Tube Market remains strongly positive, anchored by the immutable laws of physics governing sound propagation and material interaction, ensuring that physical measurement remains essential, even amidst advancements in virtual testing. The market's resilience is further cemented by its role in regulatory compliance; standards bodies require physical test data generated by verified instruments, maintaining the impedance tube's status as a critical tool for material certification and validation. Investment in R&D within academic sectors continues to feed the demand for cutting-edge instruments, pushing manufacturers to innovate on sensor technology, thermal stability, and automated operation to meet the rigorous demands of fundamental research exploring the next generation of acoustic materials designed to optimize energy efficiency and environmental impact across global infrastructure projects and consumer products alike.

The specialization within the market is also evident in the increasing offering of small-diameter tubes optimized for extremely high frequencies, catering to niche markets like ultrasonic transducer development or small-scale acoustic component testing within consumer electronics. These small-scale applications demand tolerances and precision far exceeding standard industrial requirements, pushing the boundaries of acoustic manufacturing technology. Conversely, the continuing need to measure heavy, dense materials used in construction sound barriers drives demand for robust, large-diameter setups capable of handling substantial sample weights and ensuring perfect acoustic seals necessary for reliable low-frequency performance metrics. This duality in demand—for both micro-scale precision and macro-scale robustness—highlights the versatile nature of the impedance tube market and its ability to adapt to diverse technological and industrial needs globally.

Furthermore, the competitive landscape is increasingly defined by intellectual property related to proprietary signal processing algorithms that minimize measurement uncertainties and enhance the separation of incident and reflected acoustic waves. Leading manufacturers continuously invest in research to reduce the influence of factors like microphone position uncertainty, temperature gradients, and signal non-linearity, all of which are critical for maximizing measurement confidence, especially when characterizing complex acoustic treatments. The development of advanced graphical user interfaces (GUIs) that streamline the testing process, integrate seamlessly with data analysis platforms (like MATLAB or custom laboratory information management systems, LIMS), and provide automated reporting functions are essential differentiators in winning large commercial contracts and maintaining loyalty within specialized research communities that value efficiency alongside absolute acoustic measurement integrity.

The market also sees consistent growth in demand for calibration services and certification, as the accuracy of impedance tube systems must be regularly verified against traceable standards to ensure continuous compliance with industry regulations. This after-market service component provides a stable, recurring revenue stream for key players and contributes significantly to the overall perceived value of the instrumentation. The requirement for highly trained technicians to perform these calibration tasks further underscores the specialized nature of this market, acting as a barrier to entry for generalized testing equipment providers and reinforcing the dominance of established acoustic measurement specialists who possess the necessary accredited facilities and technical expertise to handle precision acoustic instrumentation and maintain stringent quality control standards.

The adoption rate of new technologies, particularly in emerging economies, is often constrained by budget limitations, driving demand for lower-cost, two-microphone systems for fundamental QC checks. However, this is balanced by the premium market in established regions like Europe and North America, where the adoption of the four-microphone method for high-fidelity R&D is standard practice, allowing manufacturers to maintain high margins on specialized, advanced instrumentation. Successfully navigating this global market requires a tiered product strategy, offering basic, reliable systems alongside advanced, customizable research platforms, effectively capturing market share across the diverse spectrum of customer needs, from industrial quality control engineers to fundamental acoustic physicists seeking to innovate material design.

The future convergence of physical testing with virtual reality and augmented reality tools also promises to impact the user experience, allowing engineers to visualize complex acoustic wave phenomena and material performance characteristics derived from impedance tube data in immersive environments. While still nascent, this development indicates a long-term trajectory toward integrating fundamental acoustic measurements with advanced visualization and predictive simulation tools, further solidifying the impedance tube's position not just as a measurement device, but as a critical data source for holistic NVH engineering and product validation across sophisticated manufacturing environments globally. This integration strategy is a key focus for market leaders seeking to provide comprehensive digital transformation solutions to their industrial client base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager