Impregnating Autoclaves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442035 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Impregnating Autoclaves Market Size

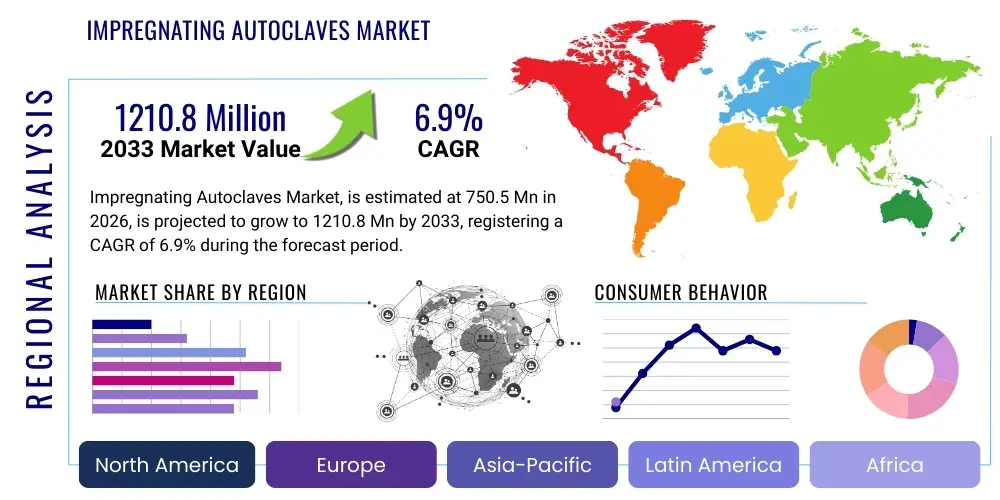

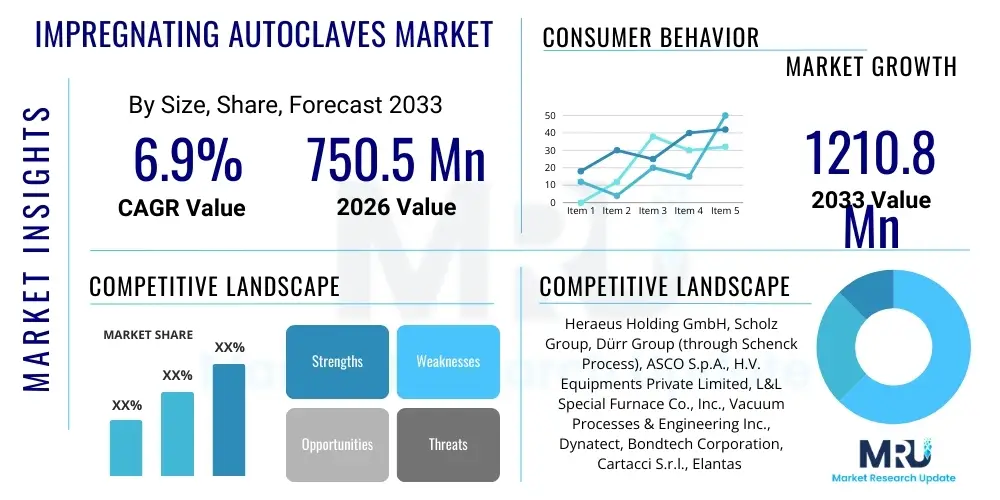

The Impregnating Autoclaves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 750.5 Million in 2026 and is projected to reach USD 1210.8 Million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by increasing demand for high-reliability electrical components and lightweight structural materials across key industrial sectors such as automotive, aerospace, and power generation. The need for enhanced insulation, improved thermal management, and effective porosity sealing in precision parts mandates the sophisticated vacuum pressure impregnation (VPI) processes facilitated by modern autoclaves.

Impregnating Autoclaves Market introduction

The Impregnating Autoclaves Market encompasses highly specialized industrial equipment designed to execute the Vacuum Pressure Impregnation (VPI) process. This critical process involves the removal of air and moisture from porous materials, components, or electrical windings, followed by the deep penetration and curing of liquid resins, sealants, or varnishes under controlled pressure and vacuum conditions. The primary product, the impregnating autoclave system, integrates multiple sub-systems including vacuum pumps, pressure vessels, material handling equipment, and precise temperature and process control units, ensuring the complete saturation of the workpiece for optimal performance.

Major applications of impregnating autoclaves span various high-stakes industries, centralizing around enhancing product integrity and longevity. In the electrical sector, VPI is essential for improving the dielectric strength and reliability of motor windings, transformers, and generators, protecting them against vibration, moisture, and extreme thermal cycling—a requirement that is accelerating with the global push toward high-efficiency electric vehicles (EVs) and renewable energy infrastructure. Furthermore, in non-electrical applications such as aerospace and defense, autoclaves are used for sealing lightweight metal castings to mitigate micro-porosity, thereby preventing leaks and ensuring structural robustness under stringent operating conditions. The inherent benefits derived from utilizing these systems—including superior mechanical strength, enhanced heat dissipation, and reduced failure rates—establish impregnating autoclaves as indispensable tools in advanced manufacturing workflows.

Key driving factors fueling the market growth include stringent quality and safety standards imposed on critical components, particularly in the automotive and aerospace industries. The rapid shift toward higher-voltage systems in EVs necessitates faultless insulation, boosting demand for VPI-treated electric motors and batteries. Technological advancements in resin formulations, coupled with the integration of automated monitoring and control systems (Industry 4.0 standards), are enabling faster cycle times and improved process repeatability. This combination of heightened performance requirements and technological maturity ensures sustained investment in sophisticated impregnating autoclave systems globally, solidifying their market relevance for the foreseeable future.

Impregnating Autoclaves Market Executive Summary

The Impregnating Autoclaves Market is characterized by robust investment driven by electrification trends and the need for precision manufacturing across global supply chains. Business trends indicate a movement toward higher capacity, fully automated VPI systems capable of handling large-scale production requirements typical of the EV manufacturing boom and large-scale power infrastructure projects. Key manufacturers are focusing on modular designs, offering customizable solutions that integrate advanced features such as real-time condition monitoring, automated resin mixing, and energy-efficient vacuum generation, differentiating their offerings in a competitive industrial landscape. Furthermore, strategic alliances and acquisitions aimed at consolidating specialized material science expertise (resins and varnishes) with equipment manufacturing capabilities are becoming common, signaling a focus on providing integrated VPI solutions rather than standalone machinery. This consolidation enhances market competitiveness and supports global expansion strategies, particularly into fast-growing industrial regions.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing market, largely due to immense industrialization, expansive manufacturing capacities in China, India, and South Korea, and the burgeoning regional adoption of electric vehicles and renewable energy systems. North America and Europe maintain strong market positions, primarily driven by strict regulatory requirements, continuous upgrades to aging power grids, and high-value manufacturing in aerospace and defense sectors, necessitating advanced, high-reliability VPI processes. These established markets prioritize technology adoption, focusing on systems that offer superior environmental compliance and energy efficiency. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are showing steady growth, spurred by local investments in infrastructure development, often acquiring basic to mid-range VPI systems, signaling future expansion potential as local industries mature and require higher quality component protection.

Segmentation trends reveal strong performance in the High-Capacity segment (above 5,000 liters), correlating directly with mass production needs, especially for large transformers and industrial motors. The demand for thermosetting resins (epoxies and polyesters) remains dominant in terms of volume due to their superior dielectric and thermal properties, although sustainable, low-VOC (Volatile Organic Compound) resin types are gaining traction under environmental pressure. End-user analysis underscores the Electrical & Electronics and Automotive sectors as the primary revenue generators, while the Maintenance, Repair, and Overhaul (MRO) segment shows consistent, moderate growth due to the long operational life of power equipment requiring periodic VPI retreatment. Manufacturers are increasingly tailoring equipment size and VPI parameters to meet the specific needs of these varied end-user groups, optimizing vessel material selection and control software for application-specific performance demands, leading to a more specialized market structure overall.

AI Impact Analysis on Impregnating Autoclaves Market

Common user questions regarding AI’s influence on the Impregnating Autoclaves Market frequently revolve around how artificial intelligence can enhance the traditionally complex VPI process, specifically focusing on achieving perfect batch consistency, minimizing resource waste (resins and energy), and predicting equipment failure before downtime occurs. Users seek clarity on the practical application of machine learning algorithms to optimize vacuum ramps, pressure hold times, and curing temperatures based on real-time sensor data and material property variations. Concerns are often raised about the complexity and cost of retrofitting existing analog autoclaves with AI-driven control systems and the cybersecurity risks associated with integrating networked, intelligent systems into critical industrial infrastructure. Expectations center on AI delivering predictive process modeling capabilities, enabling manufacturers to rapidly adjust VPI cycles for new materials or component geometries, thereby accelerating R&D timelines and ensuring zero-defect production runs, which is paramount for high-reliability components used in aerospace and medical devices.

The impact of AI is fundamentally transformative, shifting VPI operation from empirical, operator-dependent control toward data-driven, autonomous optimization. AI algorithms analyze vast datasets collected during VPI cycles, correlating parameters like vacuum integrity, resin viscosity, and temperature gradients with final product quality metrics such as dielectric strength and porosity levels. This predictive analytics capability allows the system to make minute adjustments in real-time, compensating for minor variations in raw materials or ambient conditions that would otherwise lead to batch rejection. Consequently, AI integration not only minimizes human error and reduces rework but also significantly improves material utilization, driving down operational costs associated with expensive specialty resins. Furthermore, advanced diagnostic AI models are being deployed to monitor the mechanical components of the autoclave itself—such as pumps, valves, and seals—anticipating maintenance needs through vibration analysis and temperature pattern recognition, thus maximizing equipment uptime and extending the lifecycle of the VPI system.

Beyond process control, AI is instrumental in quality assurance by automating the analysis of post-impregnation test data, allowing for faster certification of treated components. Integrating AI into the design phase (Digital Twin technology) allows manufacturers to simulate complex VPI processes virtually, testing various pressure and temperature profiles without consuming physical resources, dramatically reducing the time-to-market for new or customized products. While the initial investment for AI integration remains high, the long-term returns through enhanced process efficiency, superior product reliability, and reduced material wastage are positioning AI-driven VPI systems as the future standard for high-volume and high-precision impregnation applications, cementing its role as a competitive differentiator in the specialized equipment market.

- AI-driven Predictive Process Optimization: Real-time adjustment of VPI parameters (vacuum, pressure, temperature) based on material feedback.

- Enhanced Quality Control: Automated anomaly detection in curing cycles to ensure consistent dielectric strength and seal integrity.

- Predictive Maintenance (PdM): Use of machine learning to anticipate failures in critical components (pumps, heaters) of the autoclave system.

- Digital Twin Simulation: Virtual modeling of VPI processes to optimize cycle design and material compatibility before physical trials.

- Resource Efficiency: Minimizing resin and energy consumption through optimized, data-informed cycle runtimes.

DRO & Impact Forces Of Impregnating Autoclaves Market

The Impregnating Autoclaves Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate investment patterns and technological advancement. A primary Driver is the accelerating global transition towards electric mobility and renewable energy sources, both of which require high-performance, long-lasting electrical components whose windings and insulation must be protected via VPI to ensure functional reliability under harsh conditions. Concurrently, the increasing complexity and miniaturization of electronic devices necessitate precise porosity sealing in casings and substrates. Restraints largely center on the significant initial capital investment required for high-capacity, specialized autoclave systems, coupled with the high operational complexity necessitating specialized technical expertise for maintenance and operation. Furthermore, the handling and disposal of certain traditional impregnating resins pose environmental and regulatory compliance challenges, limiting adoption in environmentally sensitive regions. Opportunities exist primarily in the expansion into emerging APAC and Latin American industrial hubs, offering manufacturers new sales territories, along with the technological opportunity to develop and market advanced, sustainable, low-VOC resin systems and fully automated, Industry 4.0 compliant VPI machinery, leveraging digital integration for remote diagnostics and performance optimization.

Impact forces exerted on this market are substantial, originating from both regulatory and technological spheres. Regulatory bodies, particularly in North America and Europe, are imposing stricter environmental, health, and safety (EHS) standards concerning volatile organic compound (VOC) emissions from traditional solvent-based varnishes and resins, pressuring the industry to adopt solvent-free and UV-curing alternatives, influencing equipment design towards systems compatible with these materials. Global supply chain volatility, particularly affecting key material inputs like specialized steels for pressure vessels and advanced sensor components, continues to impact manufacturing lead times and final pricing. Geopolitical tensions and trade barriers can influence regional market access and technology transfer, particularly in high-technology equipment like sophisticated VPI systems. These external pressures mandate manufacturers to invest heavily in supply chain resilience, implement robust risk management strategies, and ensure their product portfolio remains adaptable to evolving international standards and consumer expectations for sustainable manufacturing practices, pushing continuous innovation in both hardware and consumable materials.

The overall market trajectory is moderately positive, driven by indispensable application requirements in critical infrastructure and high-reliability products, counterbalanced by the niche, high-cost nature of the equipment. The imperative for component reliability in sectors like aerospace and power distribution ensures persistent, foundational demand, making the VPI process non-negotiable for superior quality. However, the relatively slow adoption cycle typical of heavy industrial equipment, combined with the extensive customization required for specific applications (e.g., small precision components vs. multi-ton transformers), creates significant barriers to entry for new players and extends the sales cycle. Success in this specialized market demands a strong commitment to post-sales service, highly reliable engineering, and a proven track record of meeting stringent industry-specific compliance requirements, positioning the market evolution as steady, technology-focused, and highly regulated.

Segmentation Analysis

The Impregnating Autoclaves Market is segmented based on several critical parameters including the type of product, mode of operation, capacity, the primary application area, and the specific end-user industry. This segmentation structure allows for a granular understanding of varying customer needs, market dynamics, and technological preferences across different industrial environments. The largest segmentation is generally based on application, with the Electrical & Electronics sector demanding the highest volume and technical sophistication, requiring precise control over vacuum levels and curing cycles to maintain high dielectric integrity. Segmentation by capacity reflects the scale of operations, distinguishing between compact lab-scale units used in R&D and massive, customized systems necessary for large-scale manufacturing of high-voltage transmission components. Operational mode segmentation highlights the transition from traditional manual batch processing toward automated, continuously monitored systems, which is increasingly favored in high-throughput manufacturing settings driven by efficiency and consistency demands.

- By Product Type:

- Vacuum Pressure Impregnation (VPI) Systems

- Dry Impregnation Systems (Drying Autoclaves)

- Curing Autoclaves

- Pre-heating/Post-curing Equipment

- By Capacity:

- Small Capacity (Up to 1,000 Liters)

- Medium Capacity (1,001 – 5,000 Liters)

- High Capacity (Above 5,000 Liters)

- By Operating Mode:

- Manual/Semi-Automated Systems

- Fully Automated & PLC-Controlled Systems

- By Application (Impregnating Medium):

- Varnish Impregnation (For Motors/Generators)

- Resin Impregnation (Epoxy, Polyester, Urethane)

- Sealing Impregnation (For Castings/Porosity Mitigation)

- Oil Impregnation

- By End-User Industry:

- Electrical & Electronics Manufacturing (Motors, Transformers, Coils)

- Automotive (EV/Hybrid Components, Powertrain)

- Aerospace & Defense

- Power Generation and Transmission (Utilities)

- Industrial Manufacturing and Machinery

- Maintenance, Repair, and Overhaul (MRO) Services

Value Chain Analysis For Impregnating Autoclaves Market

The value chain for the Impregnating Autoclaves Market begins with Upstream Analysis, which involves the sourcing of critical raw materials and specialized components. Key upstream inputs include high-grade structural steel and alloys for manufacturing the pressure vessels (autoclave body), high-precision vacuum pumps and compressors, advanced control electronics (PLCs, sensors, monitoring systems), and heat exchange components. The cost and quality of these inputs significantly influence the final product’s performance and price. Suppliers of specialty resins, varnishes, and sealants also occupy a crucial upstream position, as compatibility between the impregnating medium and the autoclave system design is paramount. Disruptions in the supply of high-purity steel or advanced electronics can directly affect the manufacturing lead times and profitability of autoclave producers.

The midstream of the value chain is dominated by specialized Impregnating Autoclave Manufacturers who focus on engineering, design, fabrication, assembly, and rigorous testing of the complex VPI systems. These manufacturers often engage in extensive customization to meet specific end-user requirements regarding component size, required vacuum levels, and compliance standards (e.g., ASME certification for pressure vessels). This stage requires significant technical expertise in pressure vessel engineering, thermodynamics, and industrial automation. Distribution Channel analysis is multifaceted, involving both Direct and Indirect methods. Due to the high-cost, customized, and technically complex nature of the equipment, large manufacturers often rely on direct sales models, utilizing dedicated engineering sales teams to engage with prospective clients, offering comprehensive consulting, installation, and post-sale maintenance contracts. This direct engagement ensures accurate specification matching and strong customer relationships crucial for long-term service revenue.

Indirect distribution involves collaboration with specialized industrial equipment distributors, regional sales agents, and integrated solutions providers, particularly for standardized or smaller-capacity systems targeting local markets or specialized MRO shops. Downstream Analysis focuses on the end-users who deploy the autoclaves, primarily large industrial OEMs in the Electrical, Automotive, and Aerospace sectors. The downstream relationship often extends into long-term service agreements for maintenance, calibration, and provision of spare parts and specialized consumables (resins). The effectiveness of the VPI process—dictated by the autoclave’s performance—directly impacts the quality and reliability of the final end product (e.g., electric motors or sealed castings), making the autoclave a critical asset in the customer’s production line, thus reinforcing the importance of reliable upstream component supply and expert midstream manufacturing and service capabilities.

Impregnating Autoclaves Market Potential Customers

Potential customers for Impregnating Autoclaves are predominantly organizations involved in the manufacturing, repair, or refurbishment of high-reliability components where material porosity or inadequate electrical insulation poses a risk to functional performance or longevity. The primary segment comprises large Original Equipment Manufacturers (OEMs) within the Electric Motor and Transformer manufacturing industries. These companies require VPI processes to enhance the mechanical integrity, moisture resistance, and dielectric properties of stators, rotors, and coil windings used in industrial machinery, domestic appliances, and high-voltage transmission equipment. As the global energy grid modernizes and mandates higher efficiency and extended operational lifespan for transformers, investment by power utility suppliers and transformer manufacturers in state-of-the-art VPI systems remains a significant demand driver, necessitating systems capable of handling extremely large volumes and sophisticated resin chemistries.

The second major group of customers includes the Automotive and Aerospace & Defense sectors. Within Automotive, the rapid expansion of Electric Vehicles (EVs) creates a massive demand for VPI systems specifically engineered for high-volume impregnation of EV traction motors and associated power electronics, aiming for components that withstand severe thermal stress and vibration over extended vehicle lifecycles. Aerospace and defense companies utilize VPI primarily for two key applications: sealing lightweight aluminum or magnesium castings to ensure leak-free operation of hydraulic and fuel systems under extreme pressure changes, and for treating specialized composite materials. These end-users demand the highest levels of process control, stringent documentation, and often require autoclaves compliant with rigorous industry standards (e.g., Nadcap accreditation), emphasizing customization and quality assurance over simple cost metrics.

Furthermore, a consistent stream of demand originates from the Maintenance, Repair, and Overhaul (MRO) service providers and specialized job shops. These customers typically operate smaller to medium-capacity autoclaves and serve various industries by repairing or rewinding damaged electric motors, generators, and industrial pumps. Their requirement is centered around versatile, reliable equipment that can accommodate a wide range of component sizes and impregnation material types (varnishes, epoxies) efficiently. These MRO operations rely on VPI to restore components to original manufacturer specifications or better, extending the useful life of expensive industrial assets. As industrial aging accelerates globally, the MRO segment provides steady, predictable market demand for both new and refurbished VPI equipment, rounding out the customer landscape beyond large-scale new production OEMs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.5 Million |

| Market Forecast in 2033 | USD 1210.8 Million |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding GmbH, Scholz Group, Dürr Group (through Schenck Process), ASCO S.p.A., H.V. Equipments Private Limited, L&L Special Furnace Co., Inc., Vacuum Processes & Engineering Inc., Dynatect, Bondtech Corporation, Cartacci S.r.l., Elantas PDG, Inc., HK Technologies, PTC Group, Testo Industrial Services GmbH, Cee-Bee Aviation, North American Autoclave, Hi-Temp Insulation Inc., Pioneer Industrial Systems, J. Helmer Co., Vactec Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Impregnating Autoclaves Market Key Technology Landscape

The technological landscape of the Impregnating Autoclaves Market is rapidly evolving, driven primarily by the need for superior process control, automation, and enhanced material compatibility. A cornerstone technology involves sophisticated Vacuum Management Systems, which are moving beyond simple rough vacuum generation to complex, multi-stage pumping configurations utilizing turbomolecular or cryopumps in specialized applications to achieve ultra-high vacuum levels (e.g., 10-5 Torr range). This ultra-high vacuum capability is crucial for removing trace moisture and gases from highly porous or tightly wound components before impregnation, ensuring deeper and more uniform penetration of high-viscosity resins. Alongside vacuum systems, highly precise Temperature Control Systems, integrating zone heating, rapid cooling capabilities, and advanced thermal mapping via multiple embedded thermocouples, are essential for managing the exothermic curing process of reactive resins like epoxies, preventing thermal runaway and internal stress formation in large components, thereby guaranteeing material integrity and optimal curing kinetics.

Automation and Industry 4.0 integration represent another critical technological frontier. Modern impregnating autoclaves are increasingly equipped with advanced Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) that allow for the creation, storage, and execution of complex, multi-step VPI recipes with minimal operator input. This automation extends to automated material handling, integrated resin preparation systems (mixing and degasification), and automated cleaning cycles, maximizing throughput and repeatability. A key emerging technology within this domain is the integration of Supervisory Control and Data Acquisition (SCADA) systems and cloud-based monitoring platforms. These systems enable remote monitoring and diagnostics, allowing manufacturers to track key performance indicators (KPIs) such such as cycle time, energy consumption, and resin volume usage across multiple units globally. This centralized data acquisition is foundational for implementing AI-driven predictive maintenance and process optimization routines.

Furthermore, technology pertaining to materials compatibility and environmental sustainability is driving innovation. The shift towards solvent-free, high-solids, and UV-curable resins necessitates specific technological adaptations in the autoclave hardware, including specialized dispensing nozzles, UV light curing systems integrated within the vessel, and enhanced circulation systems designed to handle highly viscous, non-VOC materials. Non-destructive testing (NDT) technologies, such such as advanced ultrasonic and X-ray inspection systems, are often integrated downstream of the VPI process but are closely linked to the autoclave technology, providing immediate feedback on the efficacy of the impregnation process (checking for voids or incomplete penetration), further closing the quality control loop and ensuring that the autoclave process itself is consistently optimized to meet zero-defect standards required by the aerospace and high-reliability electronics industries, underscoring the convergence of process equipment and quality assurance instrumentation.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally for impregnating autoclaves. This explosive growth is underpinned by substantial government investments in infrastructure, particularly in power generation (including smart grids and renewable energy installations), coupled with the region's dominance in global manufacturing, especially in China, South Korea, and India. The rapid adoption of Electric Vehicle (EV) technology in countries like China is creating unprecedented demand for VPI systems to treat millions of EV motors and components. Key regional drivers include lower manufacturing labor costs (though this is less relevant for automated systems, it influences overall cost structures) and aggressive capacity expansion by both local and multinational electrical equipment manufacturers, prioritizing mid-to-high capacity automated systems.

- North America: The North American market is characterized by high demand for quality and compliance, driven by stringent regulatory frameworks in the aerospace and defense sectors, where VPI is critical for structural component sealing (porosity mitigation) and specialized winding insulation. Investment is steady, focusing primarily on replacing aging infrastructure (power transformers, generators) and adopting advanced, data-enabled VPI systems that comply with strict EPA and OSHA regulations regarding emissions and worker safety. The region emphasizes technological leadership, favoring customized, highly controlled systems that integrate predictive analytics and high levels of process documentation for traceability.

- Europe: Europe is a mature but highly innovative market. Growth is primarily fueled by the strong regional focus on sustainability and energy efficiency, leading to high demand for VPI in manufacturing high-efficiency industrial motors (IE4/IE5 standards) and components for offshore wind farms and complex industrial machinery. The European market leads in the adoption of solvent-free and environmentally benign resin systems, pushing autoclave manufacturers toward highly specialized, compatible equipment designs. Germany, Italy, and France are major hubs, driven by robust automotive, machinery, and electrical engineering sectors.

- Latin America (LATAM): LATAM is an emerging market for impregnating autoclaves, exhibiting growth primarily linked to infrastructure modernization, particularly in Brazil and Mexico. Demand is concentrated in the energy and general industrial sectors, focusing on establishing local capacity for motor repair and manufacturing. The market generally seeks reliable, cost-effective VPI solutions, though growing international investment is slowly introducing demand for more sophisticated, automated systems compliant with global standards.

- Middle East and Africa (MEA): Growth in MEA is sporadic but substantial, driven primarily by major oil and gas infrastructure projects (requiring robust, sealed equipment) and massive regional investments in power generation capacity and renewable energy initiatives, such as large solar and wind projects. The demand is heavily concentrated in the power utilities sector and requires autoclaves capable of handling large components designed for operation in harsh, high-temperature environments. Investment is often tied to large government or state-owned enterprise projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Impregnating Autoclaves Market.- Heraeus Holding GmbH

- Scholz Group (Scholz Autoclaves)

- Dürr Group (through Schenck Process)

- ASCO S.p.A.

- H.V. Equipments Private Limited

- L&L Special Furnace Co., Inc.

- Vacuum Processes & Engineering Inc.

- Bondtech Corporation

- Cartacci S.r.l.

- Elantas PDG, Inc. (Focus on Materials/Resins but also system compatibility)

- HK Technologies

- PTC Group (PTC Industries)

- Testo Industrial Services GmbH (Focus on calibration and services)

- Cee-Bee Aviation

- North American Autoclave

- Hi-Temp Insulation Inc.

- Pioneer Industrial Systems

- J. Helmer Co.

- Vactec Engineering

- WESVAC Industries

- Thermal Equipment Corporation (TEC)

Frequently Asked Questions

Analyze common user questions about the Impregnating Autoclaves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Impregnating Autoclave and how does it benefit industrial components?

The primary function of an impregnating autoclave is to perform Vacuum Pressure Impregnation (VPI), which involves thoroughly removing air and moisture from porous materials or electrical windings and forcing an insulating resin or sealant deep into the component structure under controlled pressure. This process enhances the component's dielectric strength, thermal dissipation capabilities, mechanical robustness, and resistance to moisture and chemical ingress, drastically extending its operational life, particularly critical for electric motors and castings.

Which key industries are driving the current demand for high-capacity Impregnating Autoclaves?

The current demand for high-capacity impregnating autoclaves is primarily driven by the Electrical & Electronics sector, specifically manufacturers of high-voltage transformers and industrial motors, and the Automotive sector, particularly the mass production of high-performance electric vehicle (EV) traction motors. These industries require large, automated VPI systems to ensure batch consistency and high throughput necessary for scaling up electrification infrastructure and vehicle production while meeting strict reliability standards.

What distinguishes Vacuum Pressure Impregnation (VPI) from traditional dipping methods?

VPI distinguishes itself from traditional dipping by utilizing deep vacuum to evacuate air and trapped gases from the component's internal structure before introducing the impregnating medium, and subsequently applying high pressure (typically 60-100 psi) to force the material into all voids. This ensures 100% saturation and eliminates air voids that could lead to electrical discharge (corona) or structural weakness, outcomes not reliably achievable through simple atmospheric dipping or baking processes.

How is environmental sustainability influencing the design and technology of modern Impregnating Autoclaves?

Environmental sustainability is significantly influencing the market by pushing manufacturers toward VPI systems compatible with low-VOC (Volatile Organic Compound) or solvent-free resins and varnishes, such as 100% reactive epoxy systems. This requires advanced technological adaptations, including highly efficient resin preparation systems, specialized filtration, and often integrated UV curing capabilities, allowing companies to meet stricter global air quality and safety regulations while minimizing hazardous waste generation.

What role does automation and Industry 4.0 integration play in new Impregnating Autoclave systems?

Automation and Industry 4.0 integration are critical for improving efficiency and traceability. New systems feature sophisticated PLC/SCADA controls, enabling autonomous operation based on predefined recipes, real-time data logging, and cloud connectivity for remote diagnostics and performance monitoring. This integration supports predictive maintenance and allows for AI-driven process optimization, reducing cycle times, minimizing human error, and ensuring compliance with stringent quality requirements by providing comprehensive digital records of every impregnation batch.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager