Inactivated Vaccine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442491 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Inactivated Vaccine Market Size

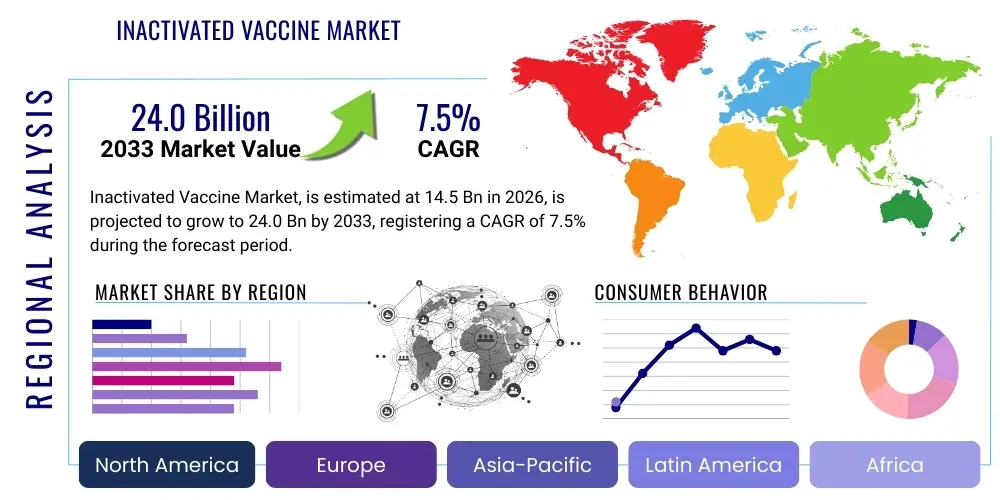

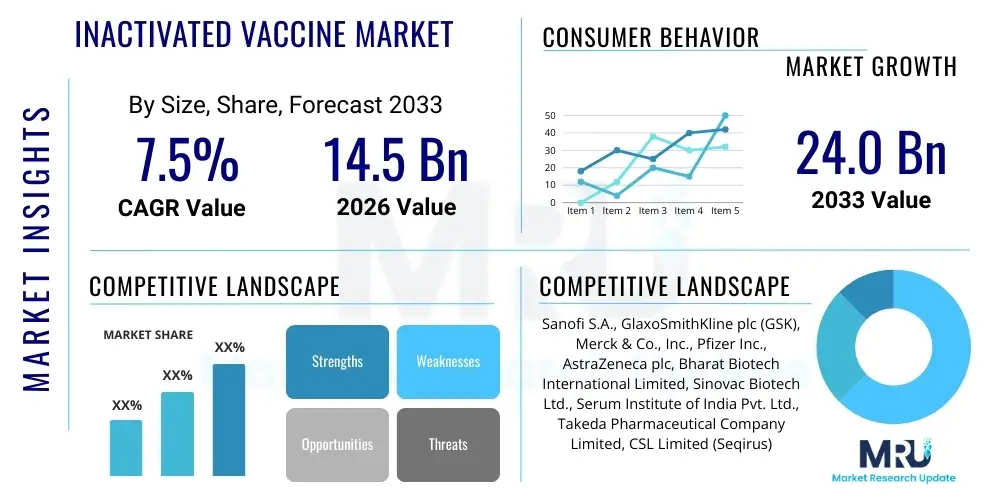

The Inactivated Vaccine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $24.0 Billion by the end of the forecast period in 2033.

This robust expansion is fundamentally driven by the escalating global incidence of infectious diseases, coupled with increasing government investments in immunization programs, particularly in developing nations. Inactivated vaccines, characterized by their established safety profile and relative ease of transport compared to live attenuated counterparts, remain cornerstones of public health strategies worldwide. The consistent need for annual updates in formulations, such as those targeting seasonal influenza, ensures continuous demand and sustained revenue streams for manufacturers operating within this specialized segment of the pharmaceutical industry.

Furthermore, technological advancements in purification techniques and antigen stabilization are enhancing the efficacy and shelf-life of inactivated vaccine products, making them increasingly viable for mass immunization campaigns in challenging logistical environments. The regulatory pathways for these traditional vaccine types are well-defined, facilitating quicker market entry for new formulations addressing emerging viral threats. This predictability, combined with the substantial production capacity established by leading biopharmaceutical entities, solidifies the market's trajectory towards the projected valuation by 2033, underscoring its pivotal role in preventive medicine.

Inactivated Vaccine Market introduction

The Inactivated Vaccine Market encompasses pharmaceutical products developed by utilizing microorganisms (viruses or bacteria) that have been rendered non-infectious, typically through heat, radiation, or chemical agents, while still retaining their ability to elicit a protective immune response. These vaccines are essential tools in global infectious disease control, offering a crucial balance between immunogenicity and safety. Major applications span critical public health concerns, including the prevention of polio, hepatitis A, influenza, and rabies, among others. The primary benefit of inactivated vaccines lies in their inability to cause disease, making them safe for immunocompromised individuals, pregnant women, and the elderly, thereby broadening the eligible patient pool for critical preventative care interventions.

Market growth is significantly driven by demographic shifts, specifically the aging global population which requires consistent immunization against endemic diseases, and the expanding immunization schedules mandated by international health organizations like the World Health Organization (WHO). High-volume procurement by governmental agencies and non-governmental organizations (NGOs) for large-scale eradication and control initiatives acts as a powerful demand accelerator. Additionally, the continuous development of multivalent inactivated vaccines that protect against multiple strains simultaneously improves patient compliance and vaccination efficiency, further bolstering market performance. Regulatory stability and proven efficacy across decades of clinical use contribute to high public confidence in these established vaccine platforms.

The introduction of novel adjuvants and delivery systems is simultaneously rejuvenating the inactivated vaccine sector. These innovations aim to potentiate the immune response generated by the non-replicating antigens, allowing for lower dose requirements and potentially reducing production costs. While traditional production methods involving egg-based or cell culture systems are standard, the market is gradually witnessing the integration of recombinant technologies to standardize antigen preparation. The robust intellectual property landscape surrounding efficient inactivation methods and stabilization protocols ensures that innovation remains a competitive advantage for market leaders, sustaining the overall momentum of the sector.

- Market Intro: Utilization of chemically or physically deactivated pathogens to stimulate protective immunity without causing infection.

- Product Description: Vaccines based on whole virus/bacteria or split-antigen components that are non-replicative and immunologically potent.

- Major Applications: Prevention of Influenza, Poliovirus, Hepatitis A, Rabies, Pertussis, and certain types of Japanese Encephalitis.

- Benefits: High safety profile, suitability for immunocompromised patients, logistical stability, and established regulatory approval pathways.

- Driving factors: Government support for immunization, increasing disease prevalence, technological improvements in adjuvant use, and expanding adult immunization programs.

Inactivated Vaccine Market Executive Summary

The Inactivated Vaccine Market is characterized by stable growth, primarily anchored by mandatory childhood immunization schedules and the sustained requirement for seasonal influenza vaccines. Business trends indicate a strategic focus on expanding manufacturing capacities in emerging economies to meet high regional demand and reduce supply chain vulnerabilities. Leading pharmaceutical companies are investing heavily in process optimization, transitioning from traditional egg-based production to scalable cell-culture systems, enhancing throughput, and mitigating reliance on avian supply volatility. Furthermore, strategic partnerships between large biopharmaceutical firms and specialized adjuvant developers are crucial for maximizing the immunogenicity of inactivated products, positioning those players with robust pipeline candidates for sustained competitive advantage over the forecast period.

Regionally, the market exhibits bifurcation. North America and Europe dominate in terms of revenue contribution due to high healthcare expenditure and advanced regulatory frameworks facilitating premium pricing for novel formulations. Conversely, the Asia Pacific (APAC) region and Latin America are poised for the highest growth rates, driven by massive population density, rising disposable incomes, and increasing state funding for universal health coverage (UHC) programs that prioritize preventative measures. Governments in APAC, particularly India and China, are rapidly scaling up domestic vaccine production capabilities to achieve self-sufficiency, influencing global supply dynamics and pricing stability for core inactivated products like polio and rabies vaccines.

Segment trends reveal that the Influenza vaccine segment maintains the largest market share, necessitated by annual reformulation and widespread uptake. However, segments focused on neglected tropical diseases and pediatric vaccines are demonstrating accelerated growth as global health initiatives push for eradication. Within the end-user segmentation, governmental and public health sectors represent the dominant purchasing channel due to centralized procurement for large-scale immunization campaigns. The future market trajectory is highly dependent on regulatory updates regarding vaccine storage requirements and the success of clinical trials aimed at expanding the application scope of existing inactivated platforms to tackle new infectious threats, such as emerging zoonotic viruses.

AI Impact Analysis on Inactivated Vaccine Market

Common user questions regarding AI's impact on the Inactivated Vaccine Market center around its capability to expedite antigen discovery, optimize manufacturing efficiency, and predict viral evolution for timely strain selection. Users are keen to understand if AI can reduce the time-consuming and labor-intensive aspects inherent in traditional inactivation and purification processes. Key themes include the utility of machine learning in refining adjuvant selection to maximize immune response, the potential for AI-driven clinical trial simulation to streamline development, and addressing concerns related to data security and the high computational cost associated with implementing these advanced algorithms in established, conservative pharmaceutical settings.

The core influence of Artificial Intelligence (AI) and Machine Learning (ML) within the inactivated vaccine sector is transforming the preclinical and manufacturing stages. AI algorithms are proving instrumental in analyzing vast genomic and proteomic datasets of target pathogens, identifying optimal viral or bacterial antigens that maintain structural integrity post-inactivation while eliciting a strong neutralizing antibody response. This targeted approach significantly reduces the often-randomized screening processes, cutting down development timelines and reducing the use of valuable laboratory resources. Furthermore, sophisticated ML models are being deployed to predict antigenic drift in pathogens like influenza, enabling vaccine developers to select circulating strains months ahead of traditional surveillance methods, thereby improving the predictive accuracy and efficacy of seasonal formulations.

In manufacturing, AI optimizes bioprocessing protocols, enhancing yield and consistency. By utilizing predictive maintenance models and real-time monitoring of bioreactor conditions (such as pH, oxygen levels, and cell viability), ML systems can autonomously adjust parameters to maintain optimal growth and inactivation efficiency, minimizing batch variability and reducing waste. This level of optimization is crucial for high-volume, low-margin products like influenza vaccines. While the regulatory conservatism surrounding vaccine production necessitates rigorous validation, the efficiency gains realized through AI-enhanced quality control and supply chain management are undeniable, promising significant long-term operational cost reductions for major market players.

- AI impacts on Inactivated Vaccine Market:

- Accelerated Antigen Identification: ML analyzes pathogen genomes to pinpoint highly immunogenic target proteins suitable for inactivation.

- Optimized Strain Selection: Predictive modeling forecasts viral evolution (e.g., influenza drift) for enhanced vaccine matching.

- Bioprocess Optimization: AI improves bioreactor monitoring, yield prediction, and real-time adjustment of manufacturing parameters.

- Clinical Trial Acceleration: AI tools analyze patient data and simulate trial outcomes, speeding up Phase I and II studies.

- Quality Control Enhancement: Machine vision and learning algorithms improve batch consistency and reduce human error in large-scale purification.

- Supply Chain Resilience: Predictive analytics anticipates demand fluctuations and optimizes cold chain logistics for global distribution.

DRO & Impact Forces Of Inactivated Vaccine Market

The Inactivated Vaccine Market is shaped by a powerful interplay of Drivers, Restraints, and Opportunities, with government immunization mandates and the proven track record of safety acting as primary market drivers. These factors are tempered by significant restraints, chiefly high manufacturing complexity and the competitive pressure from advanced vaccine technologies, such as mRNA and viral vector platforms. Opportunities arise from expanding vaccination mandates into developing regions and the development of next-generation adjuvants that can improve the efficacy of older, established vaccines. These forces collectively dictate the strategic decisions of market participants, influencing investment in research and development, capacity expansion, and pricing strategies across diverse geographical landscapes.

Key drivers include the global commitment to eliminating infectious diseases like polio, which relies heavily on inactivated vaccine formulations, and the continuous necessity for seasonal influenza immunization across all demographics. Furthermore, the inherent stability of inactivated vaccines, which often require less stringent cold chain management than live vaccines, makes them ideal for deployment in low-resource settings, broadening their applicability. Regulatory authorities worldwide favor these established platforms due to their extensive history of safe usage and predictable immune responses. Increased public awareness campaigns regarding preventive health measures further amplify demand, creating a stable foundation for market growth and sustainable demand aggregation.

However, significant restraints impede faster growth. The traditional manufacturing process for inactivated vaccines, particularly those requiring extensive cell culture or egg inoculation, is time-consuming, resource-intensive, and prone to scaling challenges, particularly during pandemic events. The high cost of clinical development and stringent regulatory scrutiny over batch consistency also pose financial hurdles. An emerging restraint is the growing competition from novel vaccine technologies, which, while sometimes requiring complex logistics, often offer rapid development timelines and potentially higher immunogenicity for novel threats. Opportunities, nevertheless, persist, centered on utilizing recombinant DNA technology to produce cleaner, highly specific antigens, and exploring therapeutic applications for inactivated vaccines beyond purely preventive uses.

Impact forces stemming from technological breakthroughs, such as high-throughput screening and automated bioprocessing, are rapidly transforming the cost structure and scalability of production. Regulatory harmonization across major markets (like the US, EU, and WHO) facilitates faster global distribution and reduces redundancy in clinical submissions. Economic conditions, particularly government procurement budgets in major purchasing nations, directly impact market volume. The most critical sociological impact force is the level of vaccine hesitancy globally; addressing misinformation and maintaining public trust remains paramount for sustaining high vaccination rates and ensuring market stability.

Segmentation Analysis

The Inactivated Vaccine Market segmentation provides a critical view into the diverse mechanisms, applications, and end-user uptake patterns defining the market landscape. Segmentation by type differentiates based on the method of preparation, such as whole-cell/whole-virus versus split-virus or subunit presentations, which directly impacts the breadth of the immune response and the safety profile. The application segmentation, which includes influenza, polio, hepatitis A, and rabies, highlights the therapeutic areas driving the highest revenue contribution, with infectious disease burden in specific geographies playing a key determinant role in demand concentration.

Segmentation by manufacturing technology—traditional versus modern cell culture or recombinant methods—reflects the technological maturity within the industry. While traditional methods still account for a substantial volume, the shift toward cell-culture-based production is accelerating, driven by the need for enhanced scalability and reduced susceptibility to external biological variables. Furthermore, the End-User segmentation clearly identifies governmental agencies and hospitals as the primary bulk purchasers, emphasizing the critical role of public health infrastructure in vaccine distribution and utilization, contrasting with the smaller, yet growing, segments of private clinics and research institutes focusing on specialized prophylactic treatments.

Analyzing these segments reveals strategic opportunities; for instance, investing in technologies that facilitate thermostable formulations is crucial for penetrating rural areas within the APAC and MEA regions, aligning with the end-user requirements of public health campaigns. Furthermore, the rising demand for travel vaccines, such as those targeting rabies and Japanese encephalitis, underscores a growing, niche revenue stream driven by increased global travel patterns. Manufacturers must strategically align their product portfolio with regional disease prevalence and existing immunization program requirements to capture optimal market share across these differentiated segments.

- Key Segments:

- By Type:

- Whole-Cell/Whole-Virus Inactivated Vaccines

- Split-Virus/Subunit Inactivated Vaccines

- By Application:

- Influenza (Seasonal and Pandemic Preparedness)

- Poliovirus (Inactivated Polio Vaccine - IPV)

- Hepatitis A

- Rabies

- Japanese Encephalitis

- Pertussis (Acellular components, often combined)

- Others (e.g., Tick-borne Encephalitis)

- By Manufacturing Technology:

- Egg-based Production

- Cell Culture-based Production

- Recombinant Protein-based Production

- By End-User:

- Hospitals and Clinics

- Government/Public Health Programs

- Research Institutes and Academic Centers

- Pharmaceutical and Biotech Companies

Value Chain Analysis For Inactivated Vaccine Market

The Value Chain for the Inactivated Vaccine Market is complex, beginning with upstream activities focused on antigen discovery and raw material sourcing, progressing through highly regulated and capital-intensive manufacturing stages, and concluding with downstream distribution and administration. Upstream analysis involves the procurement of high-grade raw materials, including specific pathogen strains, culture media, cell lines, adjuvants, and stabilizers. Critical reliance on high-quality, certified biosafety level facilities and specialized vendors for critical components (e.g., validated cell lines for polio vaccine production) characterizes this phase. Ensuring the consistent availability and purity of these inputs directly impacts the efficiency and regulatory compliance of the final product.

The core manufacturing process, involving pathogen culture, inactivation, purification, formulation, and aseptic filling, represents the highest value-addition step due to the specialized infrastructure (bioreactors, cleanrooms), intensive quality control (QC/QA), and intellectual property related to achieving effective inactivation without antigen degradation. Direct distribution channels, primarily involving large tenders and contracts with governmental health ministries (e.g., CDC, WHO, UNICEF), dominate the market, leveraging streamlined logistics for mass immunization campaigns. Indirect distribution involves established pharmaceutical distributors supplying private hospitals, clinics, and pharmacies, ensuring last-mile delivery, though often adhering to stricter cold chain requirements and smaller batch sizes.

Downstream analysis highlights the crucial role of supply chain management, particularly maintaining the strict temperature-controlled environment required for vaccine stability—the cold chain. Effective logistics networks are paramount, especially in reaching remote populations, necessitating specialized transportation and storage infrastructure. The final stage involves the health system (hospitals, public clinics) administering the vaccine, which generates clinical data essential for post-marketing surveillance and future formulation improvements. Efficiency in this value chain is critical, as any disruption in sourcing, production, or cold chain logistics can severely compromise public health initiatives, emphasizing the need for robust risk mitigation strategies throughout the entire process.

Inactivated Vaccine Market Potential Customers

The primary customers and end-users of inactivated vaccines are predominantly centralized public health organizations and governmental bodies, driven by mass purchasing power and the mandate to protect national populations against endemic and epidemic threats. These entities, including national Ministries of Health, Public Health Agencies, and international organizations like the WHO and UNICEF, require massive volumes, predictable supply chains, and competitive pricing, often procured through high-value, long-term tender agreements. Their purchasing decisions are primarily influenced by disease prevalence, regulatory approval, and demonstrable product efficacy within large populations.

Secondary, yet rapidly growing, customer segments include hospitals, private clinics, and specialized medical centers in developed economies. These customers cater to private patient populations, focusing on adult immunization (e.g., annual influenza shots), travel medicine, and non-mandatory vaccines. Demand in this segment is less price-sensitive than the public sector and often prioritizes convenience, next-generation formulations, and integrated healthcare services. The proliferation of private wellness programs and corporate immunization initiatives further contributes to the steady growth of this end-user category, seeking personalized prophylactic solutions.

Finally, research institutions, academic centers, and other biopharmaceutical companies constitute a niche but crucial customer base. These entities purchase inactivated vaccines, or their components, for research purposes—such as developing combination vaccines, studying immune responses, or using them as controls in clinical trials for novel vaccines or therapies. Their demand is highly specialized, requiring small quantities of highly purified and certified materials, focusing less on volume and more on technical specifications and documentation required for rigorous scientific investigation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $24.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sanofi S.A., GlaxoSmithKline plc (GSK), Merck & Co., Inc., Pfizer Inc., AstraZeneca plc, Bharat Biotech International Limited, Sinovac Biotech Ltd., Serum Institute of India Pvt. Ltd., Takeda Pharmaceutical Company Limited, CSL Limited (Seqirus), Johnson & Johnson (Janssen), Mitsubishi Tanabe Pharma Corporation, Biological E. Limited, Emergent BioSolutions Inc., Bavarian Nordic, Novavax, Dynavax Technologies Corporation, Valneva SE, Panacea Biotec Ltd., Hualan Biological Engineering Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Inactivated Vaccine Market Key Technology Landscape

The technological landscape of the Inactivated Vaccine Market is characterized by continuous optimization of antigen production and enhancement of immunogenicity through sophisticated adjuvant systems. Traditionally, the market relied heavily on egg-based production, particularly for influenza vaccines, a method that is well-established but suffers from slow scalability and vulnerability to egg supply fluctuations. The primary technological shift involves transitioning high-volume production towards modern cell culture systems (e.g., using Vero, MDCK, or other proprietary cell lines). This technology allows for greater consistency, faster response times to pandemic threats, and reduced reliance on animal sources, significantly stabilizing the upstream supply chain.

Another crucial technological advancement is the integration of high-purity, synthetic adjuvants. Since inactivated vaccines often present weaker immunogenicity compared to live attenuated ones, the incorporation of compounds like aluminum salts, oil-in-water emulsions (e.g., MF59 or AS03), or specialized toll-like receptor (TLR) agonists is essential to potentiate the immune response. Researchers are focusing on developing novel adjuvant platforms that selectively steer the immune system toward the most effective T-cell or B-cell response, ensuring long-lasting protection with fewer side effects. This focus on molecular adjuvants is key to maintaining the competitive edge of inactivated vaccines against newer technologies.

Furthermore, the technology for inactivation itself is being refined. While traditional methods involve formalin or beta-propiolactone, new chemical inactivation processes that minimize structural alteration of the target antigen are being explored to maximize native conformation preservation, thereby improving the quality and breadth of the antibody response. Parallel advances in purification and stabilization techniques, including chromatography and lyophilization, allow for the development of highly purified final products with improved thermostability, directly addressing cold chain logistical challenges, particularly critical for distribution across vast distances in underserved regions.

Regional Highlights

- North America: North America, led by the US and Canada, commands a significant market share due to high annual influenza vaccination rates, advanced healthcare infrastructure, and robust private insurance coverage that facilitates broad access. The region is a leader in adopting cell-culture-based production technologies and premium-priced multivalent vaccines. Government stockpiling and rapid response strategies for biosecurity threats also drive substantial procurement volume. Strict regulatory standards ensure high product quality, though they contribute to higher development costs. The presence of major pharmaceutical innovators and a culture of proactive preventive medicine ensure stable, high-value demand.

- Europe: The European market is characterized by mandatory childhood immunization programs and strong public health systems in key economies like Germany, France, and the UK. Demand is stable, driven by centralized procurement systems and the European Medicines Agency (EMA) standards. The regional focus is increasingly on addressing neglected tropical diseases prevalent among travelers and maintaining high coverage for routine vaccinations like polio and hepatitis A. Europe is also a major hub for R&D in adjuvant technology, aimed at improving the efficacy of existing inactivated vaccines for the elderly population.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by vast population bases (China, India), increasing government expenditure on public health, and rising incidence of diseases like Japanese Encephalitis and Rabies. The market is highly competitive, dominated by large domestic manufacturers (e.g., Serum Institute of India, Sinovac) focused on high-volume, cost-effective production, often serving domestic and international low-income markets. The expansion of compulsory immunization programs and efforts to eradicate diseases like polio drive immense market volume, though average selling prices are typically lower than in Western regions.

- Latin America: The Latin American market exhibits moderate growth, underpinned by governmental investment in robust national immunization programs. Key markets, including Brazil and Mexico, are focusing on local manufacturing capacity expansion to ensure vaccine independence, often through technology transfer agreements with global leaders. Demand is primarily driven by pediatric vaccines and regional health initiatives tackling dengue and related threats, often utilizing the stability and established protocols associated with inactivated platforms, overcoming complex regional logistics.

- Middle East and Africa (MEA): The MEA region is poised for significant future growth, albeit from a lower base, driven by high birth rates, increasing urbanization, and ongoing global health initiatives targeting infectious disease control. The market is heavily reliant on international funding bodies (Gavi, WHO) for procurement, emphasizing the need for highly stable, affordable formulations. Investment in local fill-and-finish capacity is a strategic priority for several Middle Eastern countries seeking self-sufficiency and becoming regional vaccine distribution hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Inactivated Vaccine Market.- Sanofi S.A.

- GlaxoSmithKline plc (GSK)

- Merck & Co., Inc.

- Pfizer Inc.

- AstraZeneca plc

- Bharat Biotech International Limited

- Sinovac Biotech Ltd.

- Serum Institute of India Pvt. Ltd.

- Takeda Pharmaceutical Company Limited

- CSL Limited (Seqirus)

- Johnson & Johnson (Janssen)

- Mitsubishi Tanabe Pharma Corporation

- Biological E. Limited

- Emergent BioSolutions Inc.

- Bavarian Nordic

- Novavax

- Dynavax Technologies Corporation

- Valneva SE

- Panacea Biotec Ltd.

- Hualan Biological Engineering Inc.

Frequently Asked Questions

Analyze common user questions about the Inactivated Vaccine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between inactivated and live attenuated vaccines?

Inactivated vaccines contain killed pathogens that cannot replicate or cause disease but still trigger an immune response, offering a high safety profile, especially for immunocompromised individuals. Live attenuated vaccines use weakened, replication-competent pathogens, often eliciting a stronger, longer-lasting immune response, but they carry a slight risk of reverting to virulence.

How are advancements in adjuvant technology influencing the efficacy of inactivated vaccines?

Adjuvant technology is critical for enhancing the immunogenicity of inactivated vaccines. Novel adjuvants, such as oil-in-water emulsions and TLR agonists, are being used to potentiate the immune response, reducing the required antigen dose, improving manufacturing efficiency, and ensuring robust protection, particularly in vulnerable populations like the elderly.

Which application segment drives the highest volume and revenue in the Inactivated Vaccine Market?

The Influenza vaccine segment consistently drives the highest volume and revenue in the market. The necessity for annual reformulation and mass immunization campaigns globally ensures continuous, high-volume procurement by governments and healthcare providers across developed and emerging economies.

What are the primary logistical challenges facing the global distribution of inactivated vaccines?

While generally more stable than live vaccines, the primary logistical challenge remains maintaining the cold chain (strict temperature control) during transport to remote or resource-limited regions. Achieving high coverage necessitates investments in robust, verifiable cold chain infrastructure and minimizing spoilage.

How is the shift from egg-based to cell-culture technology impacting inactivated vaccine manufacturing?

The transition to cell-culture manufacturing addresses scalability limitations and dependency on egg supplies, offering faster production ramp-up, enhanced product consistency, and the ability to adapt quickly to changing viral strains. This technological shift is crucial for improving pandemic preparedness and production efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager