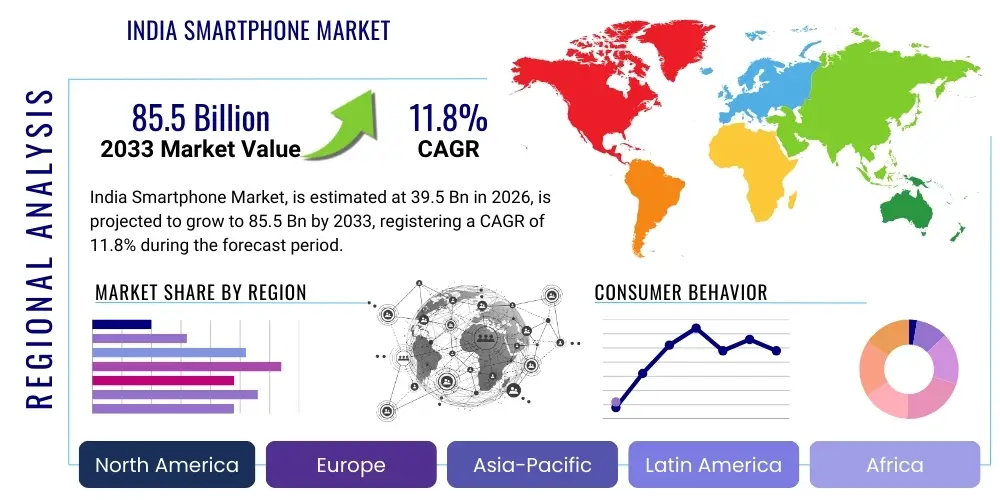

India Smartphone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442754 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

India Smartphone Market Size

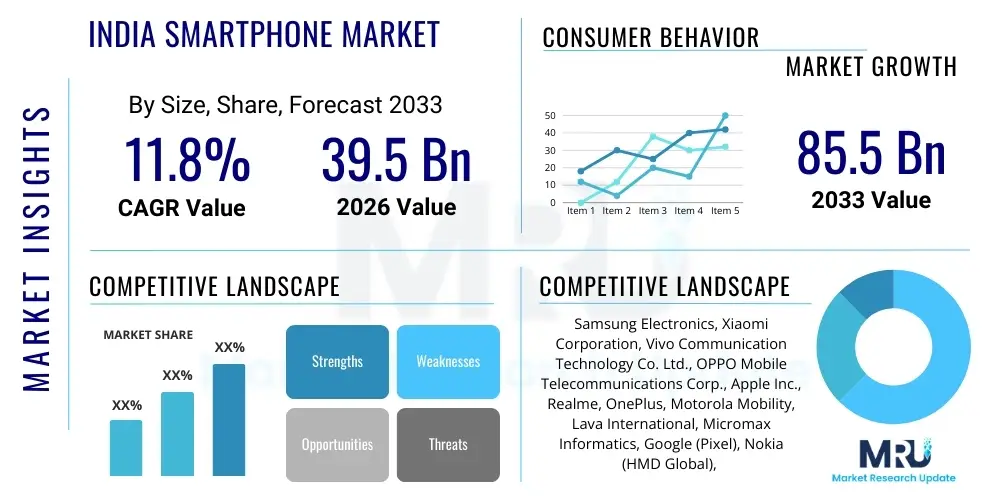

The India Smartphone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.8% between 2026 and 2033. The market is estimated at USD 39.5 Billion in 2026 and is projected to reach USD 85.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by accelerated digital transformation initiatives, increasing penetration into Tier 2 and Tier 3 cities, and the continuous migration of feature phone users to entry-level and mid-range smartphone segments. Government policies supporting local manufacturing, such as the Production Linked Incentive (PLI) scheme, further solidify India’s position as both a crucial consumer market and a global manufacturing hub.

The transition to 5G technology is a pivotal factor driving premiumization within the Indian market. Consumers are increasingly willing to invest in high-specification devices that support faster connectivity, enhanced gaming capabilities, and sophisticated camera features. This shift is not only restricted to metropolitan areas but is also gaining traction in semi-urban centers where robust network infrastructure is being deployed. Competitive pricing strategies, flexible financing options, and aggressive marketing campaigns by both domestic and international brands are crucial determinants of consumer adoption rates and overall market value trajectory.

India Smartphone Market introduction

The India Smartphone Market encompasses the sale and distribution of mobile devices offering advanced computing capabilities, connectivity, and operating systems. These devices function as primary platforms for digital consumption, communication, financial transactions, and entertainment across the country. The market is characterized by intense competition, rapid technological iteration, and high volume sales driven by favorable demographic dividends. Key applications range from basic communication and social media access to complex enterprise resource planning (ERP) functions and sophisticated mobile banking services, reflecting the smartphone's integral role in India's socio-economic landscape.

The primary benefits derived from widespread smartphone adoption include enhanced digital inclusion, improved access to educational resources (EdTech), expanded healthcare services (Telemedicine), and facilitation of the burgeoning e-commerce sector. Smartphones are the foundational technology enabling the UPI (Unified Payments Interface) ecosystem, dramatically transforming financial transactions and driving economic activity, particularly in underserved regions. Driving factors underpinning this growth include decreasing average selling prices (ASPs) for entry-level devices, increasing disposable incomes among the middle-class segment, and extensive rollout of affordable mobile data plans, making internet access ubiquitous and necessary.

Furthermore, government initiatives promoting digitalization, such as 'Digital India' and 'Aadhaar' integration, necessitate the use of smartphones for accessing public services, thereby creating a captive consumer base. The market benefits significantly from high replacement cycles, typically occurring every 18 to 24 months, especially in the premium and mid-range categories, driven by consumer demand for incremental technological improvements like better cameras, longer battery life, and faster processors. This continuous upgrade cycle ensures sustained volume growth and market vitality throughout the forecast period.

India Smartphone Market Executive Summary

The India Smartphone Market exhibits dynamic business trends dominated by strategic partnerships between manufacturers and telecom operators, coupled with a strong emphasis on localized content and vernacular language support. A key trend involves manufacturers diversifying their supply chains and ramping up localized assembly, reducing import dependence and leveraging government incentives. The competitive landscape is bifurcated, with Chinese brands holding significant volume share in the budget segment, while premium segments see fierce rivalry between global giants like Samsung and Apple. The rise of direct-to-consumer (D2C) channels and aggressive online flash sales models have also fundamentally altered traditional retail dynamics, focusing on operational efficiency and speed to market.

Regionally, the market shows pronounced variation. While Tier 1 metropolitan areas like Mumbai, Delhi, and Bangalore drive demand for high-end flagship devices, leading to higher ASPs, the bulk of volume growth originates from Tier 2, Tier 3, and rural markets, where the demand centers around reliable, affordable 4G and 5G entry-level devices. The Southern and Western regions historically show higher digital adoption rates and faster uptake of new technologies compared to the Northern and Eastern parts of India, although these disparities are rapidly shrinking due to extensive infrastructure development and affordability improvements. Targeted marketing strategies tailored to regional festivals and cultural nuances are essential for successful market penetration across India’s diverse geographical regions.

Segment trends highlight a noticeable 'premiumization' wave, driven by the expanding affluent consumer base and easier access to high-value financing options. The Rs 30,000 and above price band is witnessing the fastest growth rate, shifting the market structure away from being purely volume-driven to one that increasingly values feature richness and brand prestige. Concurrently, the proliferation of specialized segments, such as rugged smartphones for industrial use and devices optimized for mobile gaming (equipped with enhanced cooling systems and high refresh rate displays), demonstrates the increasing maturity and complexity of the consumer demand landscape in India.

AI Impact Analysis on India Smartphone Market

User queries regarding AI's impact on the Indian smartphone sector frequently revolve around enhanced computational photography, device security, personalized user experiences, and the integration of advanced localized voice assistants. Key themes emerging from this analysis include concerns about data privacy concerning AI-driven personalization, expectations for efficiency gains (e.g., battery management and app optimization), and the potential for AI to bridge language barriers for non-English speaking users through real-time translation and localized command recognition. Users are particularly interested in how on-device AI—leveraged by dedicated Neural Processing Units (NPUs)—will differentiate devices in the crowded mid-range segment, moving beyond mere marketing buzzwords to deliver tangible functional improvements.

The deployment of AI in Indian smartphones is already transforming user interaction, notably through sophisticated camera algorithms that adapt to diverse lighting conditions and Indian skin tones, addressing a crucial local requirement. Furthermore, AI is central to optimizing 5G network performance, managing thermal output during intense mobile gaming sessions, and improving predictive text and language inputs tailored to the complex linguistic diversity of the Indian consumer base. This integration is increasingly making AI capabilities a standard feature rather than a high-end luxury, democratizing advanced functionality across various price tiers.

Looking ahead, the next phase of AI integration is expected to focus heavily on edge computing for improved security features like facial recognition and behavioral biometrics, reducing reliance on cloud processing and enhancing data sovereignty—a critical factor for Indian consumers. AI-powered resource allocation also ensures that devices maintain peak performance over extended usage periods, directly tackling common user concerns related to device aging and slowdown. Manufacturers are actively investing in local AI research and development to tailor these technological advancements specifically to the unique operational challenges and cultural preferences inherent in the Indian market environment.

- Enhanced Computational Photography: AI optimizes image processing, scene recognition, and low-light performance specific to local environments.

- Personalized User Experience: AI-driven adaptive interfaces, predictive application loading, and tailored battery management based on user habits.

- Improved Voice Assistants: Integration of multilingual and vernacular voice commands for broader accessibility and digital inclusion.

- Advanced Device Security: AI-powered threat detection, behavioral biometrics, and enhanced facial recognition accuracy.

- Optimized Chipset Performance: Use of dedicated NPUs for efficient on-device processing, reducing latency for tasks like real-time translation.

- 5G Network Optimization: AI dynamically manages antennae switching and connectivity quality, crucial for reliable mobile data in congested urban areas.

DRO & Impact Forces Of India Smartphone Market

The India Smartphone Market is propelled by powerful macro-economic drivers, structural constraints, and significant technological opportunities, which collectively define the impact forces shaping its future. Drivers include the massive, digitally native youth population, falling data costs (making mobile internet highly accessible), and aggressive 5G infrastructure deployment enabling new use cases. However, growth is tempered by restraints such as intense price sensitivity among low-income segments, persistent supply chain risks (despite localization efforts), and regulatory volatility concerning data security and manufacturing standards. Opportunities lie predominantly in capitalizing on the premiumization trend, expanding into the vast rural market, and integrating advanced functionalities like IoT connectivity and sophisticated financial services.

The primary impact force remains the 'Affordability vs. Feature Set' paradox. While consumers demand cutting-edge technology (e.g., 5G, high-resolution cameras), the overwhelming majority remain highly sensitive to price increases, forcing manufacturers to operate with extremely thin margins in the budget and mid-range segments. Another significant impact force is the geopolitical and trade dynamic, which influences component sourcing and manufacturing location decisions, directly affecting the profitability and stability of major market players. The Government of India’s push for 'Make in India' acts as a strong gravitational force, driving capital investment towards domestic assembly and R&D capabilities.

The market also faces an increasing structural force from sustainability and durability concerns. Consumers are gradually shifting towards demanding longer software support cycles and more environmentally friendly materials, moving beyond purely hardware specifications. The rapid evolution of mobile payment technologies and integration with government identity systems (Aadhaar, UPI) acts as a powerful enabling force, making the smartphone an indispensable tool for daily life and ensuring sustained, compulsory demand across all demographics. Strategic management of these complex interacting forces is vital for securing market share and ensuring long-term success in this highly competitive environment.

Segmentation Analysis

Segmentation is critical for understanding the highly diverse Indian market, enabling manufacturers to tailor product specifications, pricing, and distribution strategies effectively. The market is primarily segmented based on Price Band (defining affordability and premiumization), Operating System (OS), Distribution Channel (online vs. offline sales), and Technology (e.g., 5G vs. 4G penetration). Price bands often dictate hardware specifications and target demographics, with the sub-Rs 15,000 segment driving volume, while the Rs 30,000+ segment drives revenue growth and technological innovation. The clear dominance of Android OS due to its open nature and affordability contrasts sharply with the smaller, yet highly profitable, iOS segment.

- By Price Band:

- Low-End (Below Rs 10,000)

- Mid-Range (Rs 10,001 - Rs 30,000)

- Premium (Rs 30,001 - Rs 50,000)

- Ultra-Premium (Above Rs 50,000)

- By Operating System (OS):

- Android (Dominant share)

- iOS

- Others (Minimal share)

- By Distribution Channel:

- Online Retail (E-commerce platforms and brand websites)

- Offline Retail (Exclusive stores, Multi-brand outlets, Large format retail)

- By Technology:

- 4G Smartphones

- 5G Smartphones (Fastest growing segment)

Value Chain Analysis For India Smartphone Market

The value chain for the Indian smartphone market begins with Upstream Analysis, dominated by global component suppliers providing critical inputs such as chipsets (SoC), displays, memory, and camera modules, largely sourced from East Asia. Key players in this stage include semiconductor giants and display manufacturers. While India’s domestic manufacturing capability has increased significantly through assembly operations, reliance on imported high-value components remains a structural challenge. The efficiency and cost-effectiveness of this upstream logistics chain directly influence the final device pricing and technological competitiveness in the Indian consumer market.

The Midstream phase involves original equipment manufacturing (OEM), assembly, and final testing. In India, this stage is increasingly localized, driven by government incentives (PLI schemes) encouraging major global players and domestic contract manufacturers (like Foxconn, Wistron, and Dixon) to scale up operations. This localization not only shortens lead times but also provides cost advantages, making products more competitive. The complexity of managing quality control across various outsourced assembly partners is a significant operational challenge at this stage.

Downstream Analysis focuses on distribution and sales, which is bifurcated into Direct and Indirect channels. Direct channels involve manufacturers selling via their own brand stores or dedicated e-commerce portals. Indirect channels, which account for the majority of volume, utilize vast networks of large format retail, local multi-brand outlets, and major e-commerce platforms (Amazon, Flipkart). E-commerce platforms specialize in rapid inventory movement and financing schemes, whereas physical retail remains crucial for consumers seeking tactile experience, immediate purchase, and personalized after-sales support, particularly in rural and semi-urban areas.

India Smartphone Market Potential Customers

The primary End-User/Buyers of smartphones in the Indian market can be segmented into several distinct groups based on their purchasing power and usage patterns. The largest group consists of first-time smartphone buyers and feature phone migrators, typically residing in Tier 2/Tier 3 cities and rural areas, prioritizing affordability, long battery life, and basic internet connectivity (the sub-Rs 10,000 segment). This group is crucial for volume expansion and relies heavily on local retail channels and word-of-mouth recommendations for purchasing decisions.

The second major segment comprises the value-driven upgraders, mostly middle-class urban and semi-urban consumers who replace their devices every 18-30 months. These buyers focus on optimizing the price-to-performance ratio, demanding features like advanced cameras, strong processors for gaming, and 5G connectivity (the Rs 15,000 to Rs 30,000 segment). This cohort is highly informed, utilizing online reviews and comparisons extensively, and drives the sales volume of key players through aggressive online sales events.

The third, rapidly expanding segment is the premium and ultra-premium user base, predominantly high-net-worth individuals and professionals in Tier 1 cities. These customers prioritize brand status, seamless ecosystem integration, cutting-edge flagship technology (e.g., foldable screens, high-end cameras), and security (Rs 50,000+ segment). This segment exhibits lower price sensitivity but high brand loyalty, primarily purchasing through brand-exclusive stores and premium financing options. Corporate and enterprise buyers also form a growing subset, focusing on ruggedness, security certifications, and device management capabilities for large-scale deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 39.5 Billion |

| Market Forecast in 2033 | USD 85.5 Billion |

| Growth Rate | 11.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, Xiaomi Corporation, Vivo Communication Technology Co. Ltd., OPPO Mobile Telecommunications Corp., Apple Inc., Realme, OnePlus, Motorola Mobility, Lava International, Micromax Informatics, Google (Pixel), Nokia (HMD Global), POCO, Tecno Mobile, Infinix Mobile, iQOO, Jio (JioPhone Next), Celkon, Spice Mobility, Karbonn Mobiles. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

India Smartphone Market Key Technology Landscape

The technological landscape of the India Smartphone Market is currently defined by the rapid shift towards 5G connectivity, the increasing sophistication of mobile System-on-Chips (SoCs), and the integration of advanced camera systems. 5G capability is no longer a niche feature but a critical requirement, even in the mid-range segment, driving demand for devices with optimized modem technologies and superior thermal management to handle higher data throughput. This technological migration necessitates substantial investment in localized 5G research and development to ensure seamless compatibility with India's evolving telecom standards and spectral allocations.

Furthermore, innovations in mobile display technology are crucial, with high refresh rate (90Hz, 120Hz, or higher) AMOLED and OLED screens becoming standard, significantly enhancing the consumer experience for gaming and multimedia consumption. Coupled with this is the continuous evolution of computational photography, where multi-lens arrays (wide, ultra-wide, telephoto, macro) are supported by powerful AI algorithms for superior image processing, a feature highly valued by the social media-driven Indian youth demography. Security features are also advancing, moving beyond simple fingerprint scanners to include more sophisticated ultrasonic sensors and AI-powered facial recognition systems for enhanced data protection.

The increasing focus on sustainability and longevity is pushing manufacturers to enhance battery technologies, utilizing faster charging standards (e.g., 65W, 100W+) while maintaining battery health over time through advanced charging algorithms. Operating System customization is another key area, with Android modifications (e.g., MIUI, ColorOS, OxygenOS) specifically tailored to offer localized features, security enhancements, and optimized user interfaces that resonate with regional preferences. The successful integration of these technologies determines a brand’s competitive edge, moving the market away from specification wars toward overall user ecosystem quality and reliability.

Regional Highlights

While the overall report covers global regions for comparative context (North America, Europe, APAC, Latin America, MEA), the India Smartphone Market analysis inherently focuses on the domestic dynamics within the Asia Pacific (APAC) region. India represents one of the most vital national markets globally, characterized by distinct regional consumer behaviors.

The metropolitan clusters—specifically Delhi-NCR, Mumbai, Bangalore, Chennai, Hyderabad, and Kolkata—act as primary centers for technological adoption and premium segment sales. These areas drive high ASPs and are the first to embrace flagship devices and 5G services due to superior network density and higher disposable incomes. The urban population here frequently participates in online purchasing, relying on major e-commerce platforms for competitive pricing and quick delivery.

The vast majority of volume growth, however, stems from the semi-urban and rural markets (Tier 2 and Tier 3 cities and surrounding areas). States like Uttar Pradesh, Maharashtra (excluding Mumbai), Bihar, and Madhya Pradesh are key growth engines for the affordable and entry-level mid-range segments. Market penetration in these regions requires robust offline distribution networks, deep dealer relationships, and marketing content tailored to regional languages and consumer sensibilities. Government initiatives focused on digital literacy and affordable data access are disproportionately boosting demand in these non-metro areas.

- Asia Pacific (APAC) - India Focus: Dominant market share contributor, characterized by volume growth, fierce price competition, and rapid premiumization trends driven by 5G and PLI manufacturing schemes.

- Tier 1 Cities (Metro Areas): High adoption of premium and ultra-premium devices, early adopters of cutting-edge technology, and primary focus for Apple and high-end Samsung models.

- Tier 2 & Tier 3 Cities (Semi-Urban): Fastest volume growth, driven by mid-range and affordable 5G devices, relies heavily on strong offline distribution and localized marketing strategies.

- North America & Europe: Relevant primarily as sources of core technology R&D and influencing global brand strategies which filter down to the Indian market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the India Smartphone Market.- Samsung Electronics

- Xiaomi Corporation

- Vivo Communication Technology Co. Ltd.

- OPPO Mobile Telecommunications Corp.

- Apple Inc.

- Realme

- OnePlus

- Motorola Mobility (Lenovo)

- Lava International

- Micromax Informatics

- Google (Pixel)

- HMD Global (Nokia)

- POCO

- Tecno Mobile

- Infinix Mobile

- iQOO

- Jio Platforms

- Foxconn Technology Group (Contract Manufacturer)

- Dixon Technologies (India) Ltd. (Contract Manufacturer)

- MediaTek Inc. (Key Component Supplier)

Frequently Asked Questions

Analyze common user questions about the India Smartphone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the accelerated growth in the premium smartphone segment in India?

The accelerated growth in the premium segment (above Rs 30,000) is primarily driven by rising disposable incomes, aggressive financing and EMI options, increased consumer desire for high-end features like superior camera performance and 5G connectivity, and strong brand loyalty towards Apple and high-end Samsung devices among the affluent urban population.

How is the Production Linked Incentive (PLI) scheme impacting smartphone manufacturing in India?

The PLI scheme provides financial incentives to manufacturers for incremental production, significantly boosting local assembly and export capabilities. It has attracted global players, reduced reliance on imported components for basic assembly, and positioned India as a strategic global manufacturing hub, shifting the focus from purely consumption to production.

What are the current dominant smartphone technologies in the Indian market?

The market is currently dominated by 5G-enabled devices across all price tiers. Key technologies include advanced computational photography (AI-enhanced cameras), high refresh rate AMOLED displays, and faster charging standards (Quick Charge technologies), coupled with highly localized Android operating system optimizations.

Which distribution channel holds the most influence in the India Smartphone Market?

While online channels (e-commerce giants) dominate the sale of specific mid-range and volume models through heavy discounting, the combined strength of the traditional offline retail network (multi-brand stores and exclusive brand outlets) remains crucial, especially for the premium segment and for penetrating Tier 2 and rural markets where consumers prefer touch-and-feel experiences before purchase.

What role does pricing play in consumer purchasing decisions outside of major metro areas?

Outside major metro areas, price sensitivity remains extremely high. Consumers in Tier 2/Tier 3 cities prioritize value for money, reliable battery life, and durability. The Rs 10,000 to Rs 20,000 price band is the sweet spot in these regions, forcing manufacturers to optimize component selection rigorously to meet cost targets without compromising on essential features like 4G/5G connectivity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager