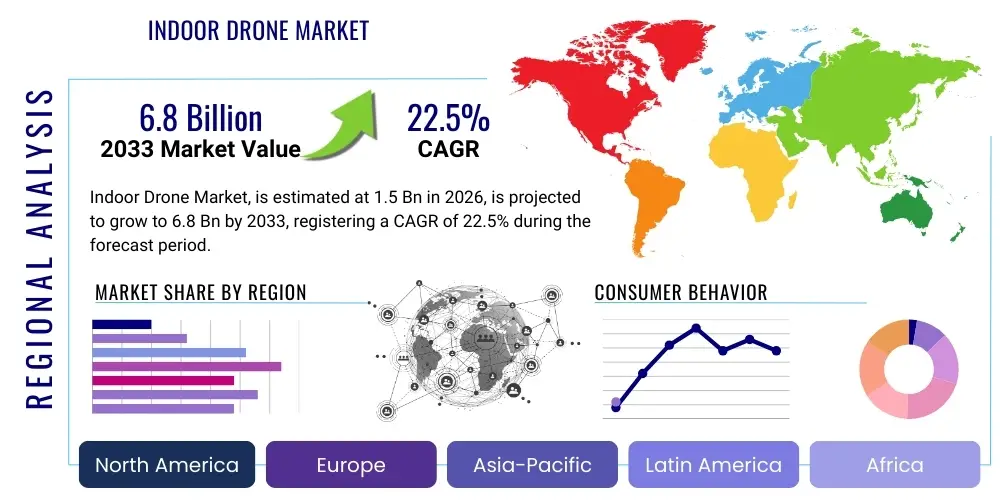

Indoor Drone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441185 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Indoor Drone Market Size

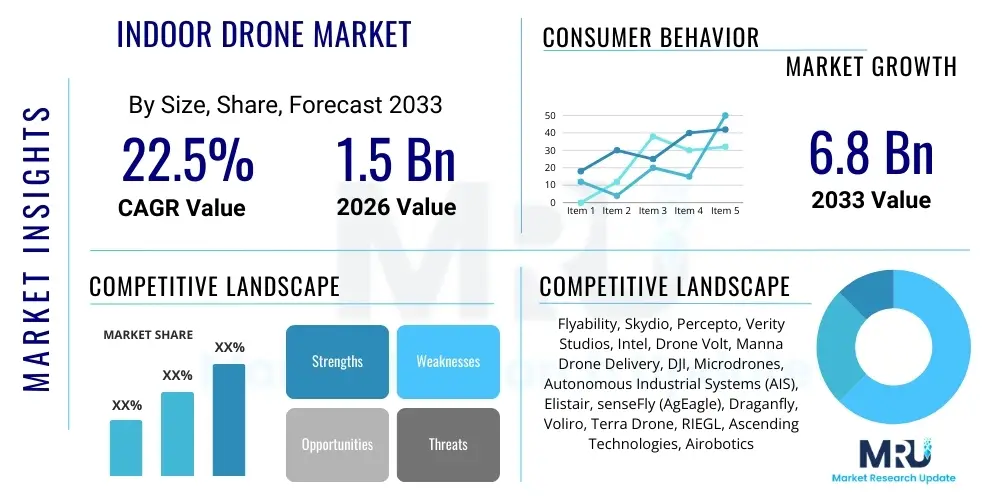

The Indoor Drone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033. This significant expansion is driven by the increasing demand for automated inspection and inventory management solutions across complex indoor environments, particularly in manufacturing, logistics, and large commercial spaces. The miniaturization of sensors and advancements in simultaneous localization and mapping (SLAM) technology are pivotal factors enabling the reliable operation of autonomous systems within GPS-denied areas.

Indoor Drone Market introduction

The Indoor Drone Market encompasses specialized Unmanned Aerial Vehicles (UAVs) designed for autonomous or semi-autonomous operation within contained, often GPS-restricted, environments such as warehouses, industrial facilities, mines, and large infrastructure projects. These drones are fundamentally characterized by their reliance on advanced non-GPS navigation systems, including LiDAR, ultrasonic sensors, computer vision, and sophisticated inertial measurement units (IMUs), enabling precise collision avoidance and high-accuracy data acquisition in confined spaces. The primary function of these systems is to automate tasks that are typically dangerous, difficult, or time-consuming for human personnel, significantly improving operational efficiency and reducing safety risks across various industrial sectors.

Major applications for indoor drones span critical operational areas, including infrastructure inspection (e.g., checking pipelines, structural integrity inside power plants), inventory tracking and asset management in sprawling logistics centers, public safety and surveillance, and entertainment (e.g., light shows and cinematic applications). Key benefits derived from the implementation of indoor drone solutions include enhanced data granularity, minimization of operational downtime required for manual inspections, improved worker safety by eliminating the need to access hazardous areas, and substantial cost savings associated with automated data capture. These benefits are driving rapid adoption, especially as regulatory frameworks governing indoor autonomous systems become clearer and technology matures.

Driving factors propelling market growth include the escalating global focus on Industry 4.0 and the digitalization of supply chains, necessitating real-time, high-fidelity data on asset location and status. Furthermore, the advancements in battery technology, leading to extended flight times, and the improved robustness of sensor payloads suitable for challenging industrial environments, contribute significantly to the commercial viability of indoor drone fleets. The decreasing cost of advanced sensor technology, coupled with the rising integration of artificial intelligence for autonomous navigation and data processing, positions indoor drones as essential tools for future industrial operations, fostering market expansion across diversified end-user segments.

Indoor Drone Market Executive Summary

The Indoor Drone Market is experiencing robust acceleration, fueled by pervasive digitalization trends and the imperative for enhanced workplace safety and operational efficiency across global manufacturing and logistics sectors. Business trends highlight a pronounced shift towards 'Drone-as-a-Service' (DaaS) models, minimizing upfront capital expenditure for end-users and accelerating deployment, thereby facilitating broader market penetration. Strategic partnerships between hardware manufacturers and AI software developers are defining the competitive landscape, focusing on specialized solutions for complex tasks such as volumetric scanning and confined space inspection. Investors are increasingly targeting companies specializing in SLAM (Simultaneous Localization and Mapping) and computer vision algorithms essential for reliable indoor autonomy.

Segment trends indicate that the Inspection and Monitoring application segment holds the largest market share, driven by stringent regulatory requirements and the critical need for preventive maintenance in energy, utilities, and infrastructure. Technologically, the rotary-wing drone segment dominates due to superior maneuverability in tight spaces, although emerging hybrid designs offering extended endurance are gaining traction. The software component, encompassing mission planning, data analytics, and fleet management platforms, is projected to exhibit the fastest growth, reflecting the shift in value from hardware procurement to data intelligence. Furthermore, the rising adoption of tethered systems in certain industrial contexts, prioritizing prolonged flight duration over extreme mobility, presents niche growth opportunities.

Regionally, North America maintains market leadership, largely due to high technological readiness, significant defense and commercial investments in automation, and the presence of numerous key technology innovators specializing in indoor navigation systems. Europe follows closely, driven by rigorous industrial safety standards and strong adoption within the automotive manufacturing and warehouse sectors. Asia Pacific (APAC) is anticipated to register the highest CAGR, primarily fueled by massive infrastructure development and the rapid expansion of e-commerce logistics operations in countries like China, Japan, and India, creating immense demand for scalable inventory management solutions utilizing indoor UAV technology.

AI Impact Analysis on Indoor Drone Market

User queries regarding AI's influence on the Indoor Drone Market frequently center on concerns about true autonomy, data processing efficiency, and the reliability of systems in dynamic, complex environments. Key themes revolve around 'How AI enables drones to navigate GPS-denied spaces without human intervention,' 'The role of machine learning in real-time collision avoidance and path optimization,' and 'The capability of AI to automatically detect anomalies from collected sensor data.' Users are keenly interested in the transition from remote-controlled systems to fully autonomous indoor fleets, seeking assurances regarding safety protocols and the integration of predictive maintenance functionalities based on AI-driven data analysis. The market expectation is that AI will democratize sophisticated indoor inspection, making it faster, more reliable, and accessible across varied industries.

The integration of Artificial Intelligence, particularly through Deep Learning (DL) and Reinforcement Learning (RL) models, is fundamentally transforming the capabilities and operational envelope of indoor drones. AI provides the necessary cognitive infrastructure for drones to interpret complex spatial data gathered by LiDAR and cameras, enabling sophisticated decision-making required for autonomous navigation in cluttered and variable indoor settings, where traditional programmed routes would fail. Furthermore, AI-powered analytics platforms are crucial downstream, converting raw visual and sensor data into actionable insights, such as identifying defective components, quantifying inventory levels, or flagging security breaches, moving the technology beyond simple data capture to automated intelligence generation. This evolution significantly increases the return on investment (ROI) for end-users by enhancing data throughput and accuracy.

- Autonomous Navigation and Path Planning: AI-driven SLAM algorithms enable real-time mapping, localization, and dynamic path re-planning, ensuring safe operation within highly congested indoor spaces without external human input.

- Real-Time Anomaly Detection: Machine vision models utilize AI for instantaneous recognition of defects, inventory misplacements, structural damages, or thermal anomalies, significantly speeding up the inspection process.

- Predictive Maintenance Integration: AI analyzes historical flight and sensor data to predict system component failures, enhancing fleet reliability and reducing unexpected operational downtime.

- Optimized Fleet Management: Machine learning algorithms allocate missions, manage charging cycles, and optimize drone deployment across multiple assets, maximizing utilization rates for large-scale operations.

- Enhanced Data Compression and Processing: AI streamlines the massive influx of sensor data (images, point clouds) onboard the drone, prioritizing critical information transmission and reducing bandwidth dependency.

DRO & Impact Forces Of Indoor Drone Market

The Indoor Drone Market is primarily driven by the imperative to increase worker safety by replacing manual inspections in hazardous or confined spaces, coupled with the overwhelming economic pressure for streamlined inventory management in burgeoning logistics and e-commerce sectors. Restraints include technological hurdles such as the limited scalability of battery life for extended industrial missions and the susceptibility of sensors to environmental interference (dust, moisture, high temperatures). Opportunities are significantly present in specialized applications, including subterranean inspections (mining, tunnels) and in integrating drone data with existing Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS). These forces collectively impact the market by dictating the pace of technological development, the speed of regulatory acceptance, and the vertical specificity of adopted drone solutions.

The principal drivers are rooted in operational efficiency, specifically the ability of drones to conduct rapid, repetitive, and accurate scans of large facilities, vastly outperforming traditional manual counting methods, which often suffer from low accuracy rates and require significant operational interruption. However, market adoption faces significant restraints due to high initial procurement costs for specialized, highly accurate indoor navigation payloads (e.g., high-resolution LiDAR and sophisticated IMUs) and the critical need for highly skilled technical personnel to operate, maintain, and analyze the data generated by these advanced systems. This complexity presents a barrier to entry for smaller enterprises. Moreover, concerns regarding data security and potential unauthorized surveillance within private industrial spaces remain persistent restraints that require robust legislative and technical solutions.

Opportunities are emerging through the convergence of drone technology with edge computing and 5G/private network connectivity, enabling robust low-latency control and real-time data streaming essential for critical infrastructure monitoring. Impact forces, such as global supply chain disruptions and the accelerating growth of automated dark warehouses, necessitate fully automated internal logistics, making indoor drone solutions non-optional for sustained competitive advantage. Conversely, the market is continually impacted by the lack of unified global standards for indoor flight protocols and data exchange formats, which hinders mass deployment and interoperability between competing drone platforms and software ecosystems.

Segmentation Analysis

The Indoor Drone Market is highly segmented based on configuration, payload, application, and end-user industry, reflecting the diverse and specific requirements of internal operational environments. Analyzing these segments is crucial for understanding where growth capital is being allocated and which technological innovations are achieving maximum commercial traction. The segmentation by component (hardware, software, services) highlights the transition from a hardware-centric market to one driven by software intelligence and recurring service models (DaaS), reflecting the industry's maturation toward delivering actionable outcomes rather than just aerial platforms.

Key segmentation reveals that multi-rotor designs dominate due to their superior hovering capabilities and maneuverability in confined spaces, essential for detailed inspection tasks, while fixed-wing or hybrid designs are often reserved for larger, open indoor areas like sports arenas or exhibition halls where speed and endurance are prioritized. Application-wise, inspection and monitoring consistently represent the most lucrative segment, particularly in sectors requiring high-frequency safety checks, such as Oil & Gas and chemical processing. The ongoing trend involves highly customized payloads, including gas detectors, thermal cameras, and specialized ultrasonic sensors, designed specifically to meet the stringent compliance and data quality requirements of specific industrial segments.

- By Component:

- Hardware (Drone platforms, Flight Controllers, Motors, Batteries)

- Software (Flight Control Software, Data Processing & Analytics, Fleet Management)

- Services (Drone-as-a-Service, Maintenance, Training, Consultation)

- By Drone Type:

- Rotary Wing (Quadcopters, Hexacopters)

- Fixed Wing

- Hybrid/Tethered Systems

- By Payload:

- Sensors (LiDAR, Ultrasonic, Thermal Imaging, Optical/RGB Cameras)

- Gas Detectors

- Manipulators/Sampling Tools

- By Application:

- Inspection and Monitoring (Structural Inspection, Confined Space Entry)

- Inventory Management and Logistics (Cycle Counting, Volume Measurement)

- Surveillance and Security

- Entertainment and Media

- Mapping and Surveying

- By End-User Industry:

- Manufacturing and Automotive

- Oil & Gas and Energy (Power Plants, Refineries)

- Logistics and E-commerce

- Mining and Construction

- Public Safety and Defense

- Retail and Commercial Spaces

Value Chain Analysis For Indoor Drone Market

The value chain for the Indoor Drone Market is highly complex, beginning with upstream raw material suppliers and component manufacturers (sensors, microprocessors, battery cells) who provide the foundational technology. The middle segment involves specialized drone platform designers, system integrators, and software developers who assemble the components, create proprietary flight control systems, and integrate sophisticated indoor navigation stacks (such as SLAM or visual odometry systems). This stage is critical for differentiating products based on autonomy and reliability in GPS-denied environments. Upstream analysis focuses on securing reliable, high-density power sources (batteries) and cutting-edge sensor technology (miniaturized LiDAR and high-speed processors) that are essential for extended, safe indoor operations.

Downstream analysis highlights the crucial role of data service providers and DaaS operators. Unlike outdoor drone operations where data acquisition is often the primary goal, indoor applications emphasize the integration of drone-collected data (inventory counts, thermal scans, 3D models) directly into the client’s existing operational IT infrastructure, such as WMS or ERP systems. This requires specialized middleware and analytics platforms that transform raw data into actionable business intelligence. The downstream segment is defined by strong relationships between drone manufacturers and systems integrators who offer end-to-end solutions, including deployment, training, and continuous maintenance of the drone fleet within often sensitive industrial environments.

Distribution channels are multifaceted, utilizing both direct and indirect sales models. Direct sales are common for high-value, bespoke industrial inspection solutions, where manufacturers work directly with large industrial clients (e.g., major utility companies or Tier 1 automotive manufacturers) to customize hardware and software for highly specific tasks. Indirect distribution relies heavily on regional value-added resellers (VARs) and specialized technology distributors, particularly for lower-cost surveillance or inventory management drones intended for the broader commercial sector. The emergence of DaaS models further solidifies the indirect channel, where service providers purchase and maintain the assets, offering operational capacity on a subscription basis, thereby shifting the financial burden and technical complexity away from the end-user.

Indoor Drone Market Potential Customers

Potential customers for indoor drone solutions are concentrated in sectors characterized by vast operational areas, high costs associated with manual inspection, and critical requirements for safety and inventory accuracy. Primary end-users include large logistics and e-commerce giants who require automated cycle counting and asset tracking across immense warehouse complexes, significantly enhancing inventory accuracy and throughput speed. Furthermore, infrastructure operators in the energy sector, specifically nuclear power plants, chemical refineries, and utility providers, constitute a high-value customer segment, relying on indoor drones to perform detailed structural and thermal inspections in inaccessible or radioactive confined spaces, minimizing human exposure to risk.

The manufacturing sector, particularly automotive and aerospace, represents a core customer base, utilizing drones for quality assurance checks, monitoring tooling status, and verifying large assembly progress within expansive factory floors, aligning perfectly with Industry 4.0 initiatives focused on digitization and automation. Other key buyers include large retail operations needing automated security surveillance and auditing of shelf layout, as well as construction companies deploying drones for internal site progress mapping and volumetric measurements in large buildings or tunnels prior to fit-out. The defining characteristic of these potential customers is the scale and complexity of their indoor operational environments, which makes manual data collection economically unfeasible or physically dangerous.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flyability, Skydio, Percepto, Verity Studios, Intel, Drone Volt, Manna Drone Delivery, DJI, Microdrones, Autonomous Industrial Systems (AIS), Elistair, senseFly (AgEagle), Draganfly, Voliro, Terra Drone, RIEGL, Ascending Technologies, Airobotics, CyPhy Works, Teal Drones |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indoor Drone Market Key Technology Landscape

The technological landscape of the Indoor Drone Market is defined by sophisticated advancements necessary to overcome the fundamental challenges of operating in GPS-denied, often cluttered, and low-light environments. The core enabling technology is Simultaneous Localization and Mapping (SLAM), which allows the drone to build a map of its surroundings while simultaneously tracking its own precise location within that map using inputs from sensors like LiDAR, stereoscopic cameras, and depth sensors. Advanced computer vision algorithms are crucial for interpreting this sensory input, providing real-time obstacle avoidance and facilitating highly accurate visual odometry. The shift towards proprietary indoor positioning systems (IPS) utilizing Ultra-Wideband (UWB) or magnetic tracking, particularly for extremely high-precision tasks, is also a critical technological development ensuring sub-centimeter accuracy for industrial metrology applications.

Furthermore, energy efficiency and safety mechanisms are paramount technological areas of focus. Battery technology, specifically advancements in high-density Li-Po and solid-state batteries, directly impacts operational endurance, a major constraint for extensive indoor missions. Safety advancements include robust, redundant flight controllers and specialized drone designs featuring protective cages or compliant structures (e.g., spherical cages) to absorb impacts and prevent rotor damage during close-proximity inspection within pipelines or silos. The development of onboard edge computing capabilities, often utilizing specialized GPUs or dedicated AI chips, is essential for processing sensor data locally and executing complex AI models for autonomy and inspection in real-time, reducing reliance on external communication links which may be intermittent indoors.

Connectivity solutions are rapidly evolving to support fleet operations and high-volume data transfer. This includes the implementation of robust private 5G networks, Wi-Fi 6, and specialized mesh networking protocols designed to penetrate dense industrial structures, ensuring reliable communication between the ground control station and the drone fleet. The integration of tethered drone technology is also becoming significant in applications requiring continuous power and secure, high-bandwidth data transmission over long periods, circumventing battery life limitations for stationary monitoring or detailed structural scanning tasks. These interconnected technologies collectively drive the reliability and effectiveness required for widespread commercial adoption.

Regional Highlights

The Indoor Drone Market exhibits distinct regional adoption patterns driven by varying industrial maturity, regulatory frameworks, and investment in automation technologies. North America, specifically the United States, leads the market due to robust early adoption in logistics, defense, and large-scale industrial infrastructure maintenance. The region benefits from a dense concentration of technology innovators specializing in autonomous navigation software and a high willingness among major corporations (e-commerce, energy utilities) to invest heavily in efficiency-boosting technologies. Government support through R&D funding and favorable regulations for private network deployment further solidify its leadership position.

Europe demonstrates significant momentum, particularly in Western European nations like Germany and the UK. Market penetration is strongly driven by stringent occupational health and safety regulations, pushing industries like automotive manufacturing and petrochemicals towards drone-based inspection to minimize human risk in confined spaces. European market growth is also characterized by a strong focus on sustainable and ethical automation, often prioritizing robust data security and privacy compliance in drone operations.

The Asia Pacific (APAC) region is forecasted to achieve the highest growth rate during the projection period. This explosive expansion is primarily attributed to the massive scale of manufacturing and the unprecedented expansion of logistics infrastructure in key economies like China, India, and Southeast Asia. The necessity for rapid and accurate inventory management to support burgeoning e-commerce platforms is a major growth catalyst. Furthermore, large-scale mining and infrastructure projects in this region are rapidly integrating indoor drone solutions for subterranean mapping and structural integrity checks, driving demand for specialized platforms.

- North America: Market leader; driven by high technological maturity, early adoption in logistics (Amazon, Walmart), and significant defense applications. Strong focus on autonomous navigation (Skydio, Percepto).

- Europe: Second largest market; emphasis on industrial safety, structural inspection in complex manufacturing (Automotive/Aerospace), and stringent regulatory compliance driving specialized drone service uptake.

- Asia Pacific (APAC): Fastest growing region; propelled by massive e-commerce growth (warehouse automation), rapid infrastructure development, and high adoption rates in mining and utility sectors in China and India.

- Latin America (LATAM): Emerging market; driven by adoption in large-scale resource extraction (mining) and agricultural supply chain monitoring, though regulatory hurdles and infrastructure limitations present challenges.

- Middle East and Africa (MEA): Niche growth area; concentrated demand from the Oil & Gas sector for internal tank and pipeline inspection, and substantial government investments in smart city surveillance and critical infrastructure protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indoor Drone Market.- Flyability

- Skydio

- Percepto

- Verity Studios

- Intel Corporation

- Drone Volt

- Manna Drone Delivery

- DJI (Dajiang Innovations)

- Microdrones

- Autonomous Industrial Systems (AIS)

- Elistair

- senseFly (AgEagle)

- Draganfly

- Voliro

- Terra Drone

- RIEGL Laser Measurement Systems

- Ascending Technologies

- Airobotics

- CyPhy Works

- Teal Drones

Frequently Asked Questions

Analyze common user questions about the Indoor Drone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological challenges for indoor drone operation?

The main challenges are navigating without GPS (relying on complex SLAM, LiDAR, and computer vision), ensuring sufficient battery life for large facilities, and maintaining reliable communication links in dense, metal-rich industrial environments.

How do indoor drones maintain positioning accuracy in GPS-denied environments?

They utilize Simultaneous Localization and Mapping (SLAM) algorithms combined with highly sensitive inertial measurement units (IMUs), visual odometry from cameras, and active sensor data (LiDAR/UWB) to achieve high-precision localization and mapping simultaneously.

Which end-user industries are driving the highest demand for indoor drones?

The highest demand originates from Logistics and E-commerce (for automated inventory and cycle counting), and the Oil & Gas/Energy sector (for structural and confined space inspection, ensuring safety and compliance).

What is the role of AI in enhancing indoor drone performance?

AI is crucial for enabling true autonomy, facilitating dynamic path planning, real-time collision avoidance, and automated processing of sensor data to detect anomalies or verify inventory status without human interpretation.

Is Drone-as-a-Service (DaaS) a common business model in this market?

Yes, DaaS is rapidly becoming the preferred operational model, especially for industrial clients. It allows companies to leverage advanced drone technology and analytical capabilities without significant upfront capital investment, maintenance costs, or the necessity for specialized in-house expertise.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager