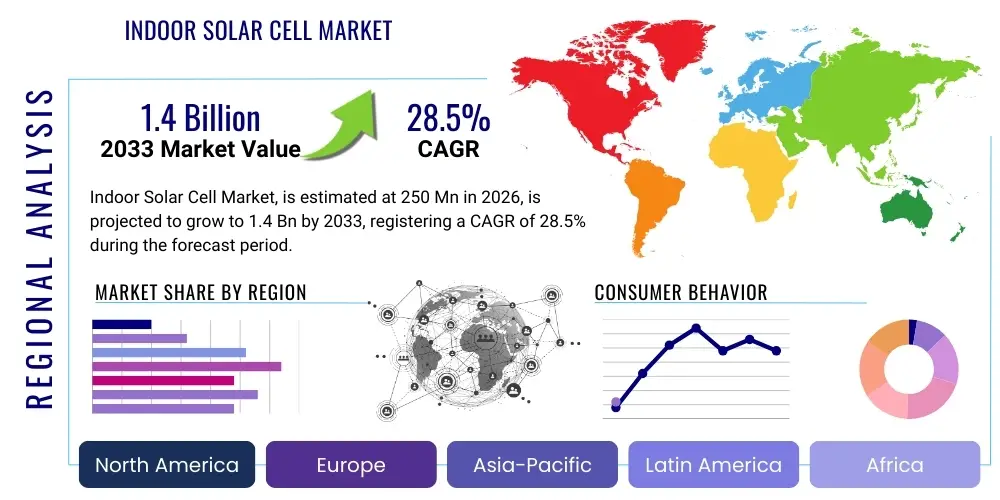

Indoor Solar Cell Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441065 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Indoor Solar Cell Market Size

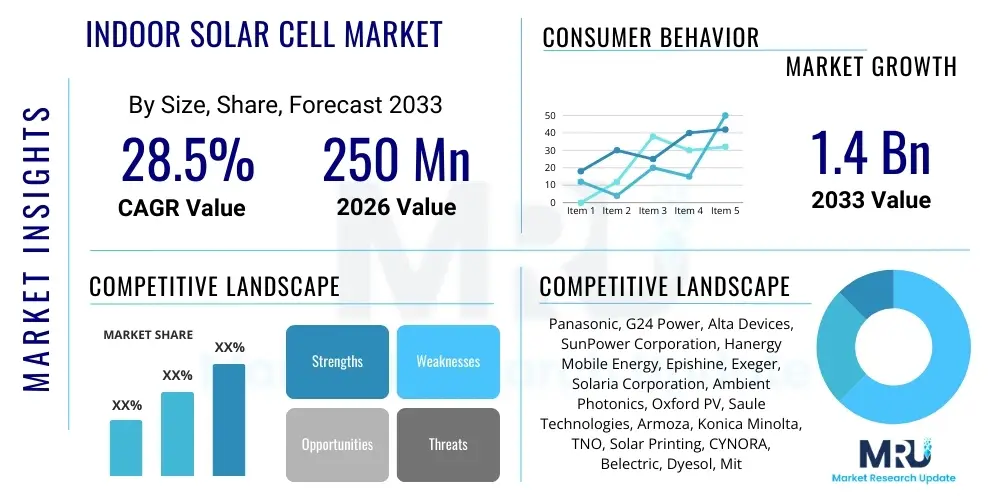

The Indoor Solar Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $1.4 Billion by the end of the forecast period in 2033. This substantial expansion is driven by the explosive growth in Internet of Things (IoT) deployment and the increasing demand for energy harvesting solutions that power wireless sensors and low-power electronics without relying on traditional batteries or external wiring. The efficiency improvements in emerging thin-film technologies, coupled with significant reductions in manufacturing costs, are creating a lucrative environment for market players focused on sustainable indoor power solutions across commercial and residential sectors globally. The convergence of miniaturization and energy efficiency is fundamentally reshaping how electronic devices are powered within built environments.

Indoor Solar Cell Market introduction

The Indoor Solar Cell Market encompasses photovoltaic technologies specifically engineered to efficiently capture and convert ambient, low-intensity light (such as LED or fluorescent illumination) into electrical energy. These specialized solar cells, often utilizing materials like Organic Photovoltaics (OPV), Perovskites (PSC), or Dye-Sensitized Solar Cells (DSSC), differ significantly from traditional silicon-based outdoor solar panels, which are optimized for intense sunlight. The core product description involves highly sensitive, thin, flexible, and often transparent cells that maintain high power conversion efficiency even under illuminance levels typically below 1,000 lux. The technology enables the seamless integration of energy sources directly into consumer electronics, smart home devices, and industrial monitoring tools, dramatically enhancing device autonomy and reducing maintenance burdens associated with battery replacement. This innovation is crucial for sustaining the predicted exponential growth of battery-less IoT networks in urban and commercial landscapes, positioning indoor solar cells as a critical enabler of next-generation smart infrastructure and pervasive computing environments.

Major applications for indoor solar cells span a wide range of low-power consuming devices. These include wearables (smartwatches, fitness trackers), environmental sensors (temperature, humidity, air quality), asset trackers, electronic shelf labels (ESLs) in retail, and remote controls. The primary benefit derived from these cells is energy autonomy and sustainability, eliminating the need for frequent battery disposal and replacement, thereby lowering operational expenditures (OpEx) for large-scale sensor deployments. Furthermore, the small form factor and flexibility of indoor photovoltaic materials allow for aesthetically pleasing and non-intrusive integration into product designs and building materials, supporting advanced architectural requirements.

The driving factors for market growth are multifaceted, centering primarily on the rapid proliferation of the IoT ecosystem and the persistent industry push towards sustainable and maintenance-free operational models. Regulatory pressures encouraging green building standards and the increasing consumer preference for environmentally responsible technologies further propel adoption. Moreover, significant technological breakthroughs, particularly in enhancing the spectral response of cells to indoor lighting spectra (which often peak differently than natural sunlight), are continuously improving the performance metrics, making indoor solar cells a viable and superior alternative to conventional power sources for many low-power applications. This foundational shift towards perpetual power harvesting is cementing the technology’s essential role in future connected device architectures.

Indoor Solar Cell Market Executive Summary

The Indoor Solar Cell Market is experiencing robust expansion driven by unprecedented growth in IoT applications, demanding perpetual power solutions. Business trends indicate a strong focus on strategic partnerships between materials manufacturers (specializing in OPV and Perovskites) and major electronics and device integrators to scale production and standardize component sizing for mass deployment in consumer and industrial sectors. Companies are heavily investing in flexible substrates and printable electronics to achieve lower cost manufacturing techniques, making the technology economically feasible for disposable and high-volume electronic shelf labels and sensors. Furthermore, mergers and acquisitions activity is increasing, particularly targeting specialized startups that possess proprietary intellectual property in high-efficiency, low-light conversion materials, solidifying market positions for established players aiming for a diversified product portfolio and speed-to-market advantages in niche applications like medical monitoring and high-end wearables. The primary challenge remains the long-term stability and lifetime performance validation of emerging technologies, such as Perovskite cells, under varied indoor environmental conditions, although ongoing research is rapidly mitigating these concerns.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by its status as a global manufacturing hub for consumer electronics and IoT hardware, coupled with supportive government policies encouraging smart city infrastructure development and widespread 5G adoption. North America and Europe, while representing significant current market shares, focus more intensely on high-value industrial IoT (IIoT) applications and smart building retrofitting, emphasizing energy efficiency and integration with existing HVAC and lighting management systems. European regulations regarding e-waste reduction and sustainable design practices provide a particularly strong impetus for indoor solar adoption, promoting the concept of zero-maintenance devices. This regional divergence in application focus drives differentiated R&D efforts, with APAC focusing on high volume and cost-effectiveness, while Western markets prioritize performance, durability, and integration complexity.

Segmentation trends show that the Organic Photovoltaics (OPV) segment currently dominates due to its superior performance under diffuse light and adaptability to flexible substrates, crucial for small, curved devices. However, Perovskite Solar Cells (PSC) are poised for the most rapid growth, attributed to their dramatically higher efficiency potential under indoor LED lighting and reducing cost profile, pending further improvements in operational longevity. Application-wise, Consumer Electronics, specifically wearables and wireless peripherals, maintain the largest market share, serving as the earliest adopters of perpetual power technology. Looking forward, the Smart Home and Building segment, encompassing sophisticated sensor grids for energy management and security, is anticipated to accelerate substantially, fueled by increased residential and commercial investment in interconnected, energy-autonomous infrastructure that minimizes manual intervention and power delivery complexities.

AI Impact Analysis on Indoor Solar Cell Market

User inquiries concerning AI's role in the Indoor Solar Cell Market predominantly center on optimization, predictive maintenance, and system integration complexity. Common questions explore how AI algorithms can maximize energy harvesting efficiency given dynamic and unpredictable indoor light conditions, whether AI can predict the degradation rate of novel materials like Perovskites, and how intelligent systems manage power output for varied IoT load requirements. Users express high expectations regarding AI's ability to create ‘smarter’ power management units (PMUs) that adapt instantaneously to ambient changes (e.g., changes in LED color temperature or light intensity fluctuations), ensuring constant power availability. There is also significant interest in using AI-driven simulation tools during the R&D phase to accelerate the discovery and testing of new high-efficiency light-harvesting materials, thereby speeding up the commercialization pipeline and addressing current limitations in material stability and conversion rates.

The key themes emerging from this analysis revolve around optimization for variability and sustainability assurance. Users want confirmation that the intermittent and low-intensity nature of indoor light can be reliably mitigated by AI-driven algorithms embedded within the Power Management Integrated Circuits (PMICs) of devices, maximizing the useful energy stored or consumed. Furthermore, the inherent novelty of materials like OPV and PSC raises concerns about lifespan and reliability, making AI-powered predictive modeling essential for quality assurance and enabling warranties necessary for widespread industrial adoption. The expectation is that AI will transform indoor solar cells from static components into dynamic energy systems capable of self-regulation and preemptive fault reporting, significantly reducing the total cost of ownership (TCO) for large-scale IoT deployments across commercial properties and smart cities.

The market anticipates that the integration of machine learning will move beyond mere optimization and into the realm of system-level strategic energy allocation. For example, in smart buildings, AI could analyze historical sensor usage data, predict future energy spikes (e.g., during peak usage hours), and dynamically adjust the charging profiles of indoor solar cells and micro-storage units to meet future demands, ensuring continuity of service without reliance on external grids or large batteries. This systemic approach, guided by sophisticated data analytics and predictive capabilities, is expected to accelerate the transition to truly battery-less, maintenance-free IoT architectures, effectively realizing the promise of perpetual computing within the built environment and further solidifying the indoor solar cell's role as a foundational technology for next-generation smart infrastructure globally.

- AI-driven optimization of Power Management Units (PMUs) to maximize energy harvesting under dynamic indoor light conditions.

- Predictive maintenance analytics utilizing sensor data to forecast material degradation (e.g., Perovskites and OPV) and extend device lifespan.

- Machine Learning (ML) acceleration in R&D for rapid screening and development of new, high-efficiency photovoltaic materials optimized for specific indoor spectra.

- Intelligent load balancing and energy storage management within complex IoT sensor networks using real-time data analysis.

- Automated quality control and manufacturing process refinement through computer vision and deep learning models to ensure consistency in thin-film deposition.

- Enhanced system integration by allowing seamless power conversion management across different lighting sources (fluorescent, LED, natural daylight leakage).

DRO & Impact Forces Of Indoor Solar Cell Market

The market dynamics of indoor solar cells are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that influence investment decisions and technology adoption. The primary drivers include the escalating demand from the rapidly expanding IoT device market, which mandates self-sustaining power sources to reduce wiring complexity and battery waste, coupled with the relentless technological advancements improving cell efficiency under low-light conditions. These drivers create a compelling economic argument for mass deployment, minimizing operational labor and material costs associated with manual battery changes in hundreds or thousands of distributed sensors. Conversely, significant restraints include the relatively high initial cost associated with specialized materials (such as certain organic and perovskite precursors), concerns about the long-term stability and moisture sensitivity of emerging thin-film technologies, and the necessity for highly efficient, yet costly, specialized Power Management Integrated Circuits (PMICs) designed for micro-power harvesting. Overcoming these cost and stability barriers is crucial for achieving pervasive adoption across diverse industrial sectors.

Opportunities in this market are vast, predominantly centered on penetration into high-growth vertical markets such as smart logistics (asset tracking), advanced medical monitoring devices, and the complete displacement of primary batteries in remote controls and electronic shelf labels (ESLs) across retail. Furthermore, the development of tandem cells, combining optimized outdoor and indoor harvesting capabilities into a single unit, presents a lucrative market niche for devices that experience varied light exposure. The ongoing standardization of power requirements for low-power wide-area networks (LPWAN) protocols, such as LoRaWAN and NB-IoT, aligns perfectly with the output capabilities of indoor solar cells, streamlining integration processes and accelerating time-to-market for manufacturers. Strategic governmental initiatives promoting green technology and circular economy principles in manufacturing and consumption also act as strong external facilitators, incentivizing businesses to adopt sustainable energy solutions.

Impact forces currently shaping the competitive landscape are technological disruption and supply chain reliability. The rapid emergence of Perovskite technology, promising significantly higher indoor efficiency than established OPV or Amorphous Silicon, exerts pressure on incumbents to innovate or risk obsolescence. Simultaneously, geopolitical shifts and raw material sourcing constraints for certain specialty chemicals required in thin-film deposition represent significant external risks, demanding robust supply chain diversification and vertical integration strategies from key market players. Moreover, regulatory mandates, particularly in Europe, focusing on battery lifecycle management and hazardous substance restriction, create a favorable regulatory environment for battery-free power solutions, enhancing the inherent value proposition of indoor solar cells over traditional chemical energy storage, influencing purchasing decisions across institutional and commercial buyers worldwide. This delicate balance of disruptive technology and regulatory push defines the high-stakes competitive environment.

Segmentation Analysis

The Indoor Solar Cell Market is comprehensively segmented based on the type of photovoltaic material used, the specific application areas where these cells are deployed, and the end-user demographics driving demand. This segmentation is crucial for market participants to tailor their material research, manufacturing processes, and strategic marketing efforts to address the distinct performance criteria and cost sensitivities inherent in different segments. Technological segmentation differentiates between established, stable technologies like Amorphous Silicon and highly dynamic, high-potential options such as Organic Photovoltaics (OPV) and Perovskite Solar Cells (PSC), each offering a unique trade-off between efficiency, longevity, and manufacturing flexibility. Application segmentation, on the other hand, delineates the practical use cases, ranging from highly sensitive, low-power medical sensors to high-volume, cost-constrained electronic shelf labels, dictating requirements for form factor and power output stability under varied indoor spectra. Understanding these segments provides a clear roadmap for investment and product development focus, enabling companies to capture maximum value from targeted growth areas within the pervasive computing ecosystem.

The dominance of certain material types is transient, with continuous R&D investment fueling shifts in competitive advantage. For instance, while Dye-Sensitized Solar Cells (DSSC) offer aesthetic advantages and good performance under low light, the commercial viability is often challenged by solvent stability issues, pushing the industry towards more stable, although potentially more expensive, OPV formulations or the rapidly improving PSC technology. The segmentation by end-user, including Commercial, Residential, and Industrial sectors, reflects differing procurement scales and reliability demands; commercial applications often prioritize lifetime cost and minimal maintenance, while residential applications may favor aesthetic integration and ease of installation. This detailed segmentation analysis reveals that future market growth will be disproportionately driven by the confluence of high-efficiency materials suitable for miniaturization and deployment within the booming Industrial IoT (IIoT) sector, where reliability and operational longevity significantly outweigh initial component costs, presenting premium opportunities for high-performance solar cell manufacturers.

- By Type:

- Organic Photovoltaics (OPV)

- Perovskite Solar Cells (PSC)

- Amorphous Silicon (a-Si)

- Dye-Sensitized Solar Cells (DSSC)

- Hybrid and Tandem Cells

- By Application:

- Consumer Electronics (Wearables, Remote Controls, Keyboards)

- Smart Homes and Buildings (Environmental Sensors, Security Devices)

- Industrial Sensors and Asset Tracking (Logistics Tags, IIoT Devices)

- Medical Devices (Continuous Glucose Monitors, Remote Patient Monitoring)

- Electronic Shelf Labels (ESLs)

- By End-User:

- Commercial

- Residential

- Industrial

- Institutional/Government

Value Chain Analysis For Indoor Solar Cell Market

The Indoor Solar Cell Market value chain initiates with the upstream analysis, focusing heavily on the specialized sourcing and synthesis of raw materials. This phase involves the procurement of high-purity polymers, organic semiconductors, specialized dyes, and metal halide precursors (in the case of Perovskites), which are critical for achieving high light absorption and conversion efficiency under indoor conditions. Key players in this stage are specialized chemical and material science companies that produce proprietary inks and solutions necessary for deposition techniques like slot-die coating or inkjet printing. The complexity and proprietary nature of these materials mean that material R&D is highly concentrated and protected by extensive intellectual property, often forming the core competitive advantage for cell manufacturers. Supply chain integrity and stable pricing for these specialty chemicals are significant risks that define the upstream market dynamics, requiring manufacturers to forge long-term strategic relationships with reliable material suppliers to ensure continuity of production and material quality.

The central manufacturing segment involves the intricate process of cell fabrication, where the specialized inks and solutions are deposited onto flexible or rigid substrates (glass, plastic films, or textiles). This process typically employs high-throughput, roll-to-roll (R2R) manufacturing techniques for OPV and DSSC to achieve cost efficiency at scale, contrasting with more controlled, small-batch processes for high-performance PSCs or highly specialized applications. This manufacturing expertise dictates cost structures and scalability. Downstream analysis focuses on product integration and distribution. This involves assembling the fabricated solar cell with the necessary Power Management Integrated Circuits (PMICs) and micro-energy storage components (supercapacitors or thin-film batteries) into a complete energy harvesting module, often customized for specific client requirements such as form factor, voltage output, and longevity. The integrators must possess strong electronics design capabilities to optimize the module's performance under various load conditions, which is crucial for the final device’s reliable operation.

Distribution channels for indoor solar cells are bifurcated into direct and indirect routes. Direct distribution often involves B2B sales where solar cell manufacturers directly supply large original equipment manufacturers (OEMs) in the consumer electronics or smart building sectors (e.g., supplying sensors to a major smart thermostat company). These relationships are characterized by long contract cycles and customized product specifications. Indirect channels utilize specialized electronics distributors and value-added resellers (VARs) who bundle the solar cells with PMICs and integration services, targeting smaller IoT startups or specialized industrial automation clients. The effectiveness of the distribution network hinges on timely delivery and technical support capabilities, especially regarding integration challenges faced by device manufacturers transitioning from traditional battery power to perpetual energy harvesting. Successful market penetration relies heavily on establishing a robust network that can address both high-volume OEM demands and specialized, niche industrial requirements globally.

Indoor Solar Cell Market Potential Customers

Potential customers and end-users of indoor solar cell technology span the entire spectrum of industries deploying low-power, wireless electronics, driven by the fundamental need for maintenance reduction and enhanced device autonomy. The largest segment of immediate potential customers resides within the Consumer Electronics sector, particularly manufacturers of wearables, smart peripherals (mice, keyboards), and remote controls, where continuous power and a slim profile are paramount design considerations. These buyers are seeking alternatives to coin cell batteries, which often require inconvenient and repetitive replacement. A second major customer base is the rapidly expanding Retail and Logistics sector, purchasing Electronic Shelf Labels (ESLs) and asset tracking tags. For these large enterprises, replacing thousands of batteries across multiple locations constitutes a prohibitive operational expense, making the switch to perpetually powered indoor solar cells a clear decision based on Total Cost of Ownership (TCO) reduction.

Furthermore, significant traction is being observed among Smart Building Management System (BMS) providers and commercial real estate owners. These institutional buyers require pervasive networks of environmental sensors (temperature, light, CO2) integrated into ceilings and walls to optimize energy consumption and monitor occupancy. Eliminating the need to run wires or periodically access high-mounted sensors for battery service is a substantial logistical and financial advantage for these customers. Finally, the specialized Industrial IoT (IIoT) sector and medical device manufacturers represent high-value potential customers. Industrial clients, such as large manufacturing plants or utility providers, require sensors for condition monitoring in hard-to-reach or hazardous locations where battery changes are impractical or dangerous. Medical device manufacturers, particularly those creating continuous patient monitoring wearables, prioritize reliability and long operational life, making the stable power output from optimized indoor solar cells an essential component for critical patient care applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $1.4 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic, G24 Power, Alta Devices, SunPower Corporation, Hanergy Mobile Energy, Epishine, Exeger, Solaria Corporation, Ambient Photonics, Oxford PV, Saule Technologies, Armoza, Konica Minolta, TNO, Solar Printing, CYNORA, Belectric, Dyesol, Mitsubishi Chemical, Ricoh, Fraunhofer ISE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Indoor Solar Cell Market Key Technology Landscape

The technology landscape for indoor solar cells is dominated by specialized thin-film photovoltaic technologies that are optimized for the lower light intensities and different spectral compositions (often weighted toward the blue/green spectrum from LEDs) found in indoor environments, contrasting sharply with traditional polycrystalline silicon optimized for the solar spectrum. Organic Photovoltaics (OPV) are central to the current market, utilizing carbon-based semiconductor materials that offer excellent flexibility, low manufacturing temperature requirements, and strong performance under diffuse light, making them ideal for integration into textiles or curved surfaces. The manufacturing processes frequently involve roll-to-roll printing techniques, which promise substantial cost reductions as production scales up, making OPV a viable choice for high-volume, low-cost applications such as smart packaging and basic sensors. Advances in donor-acceptor materials are continuously improving OPV efficiency, although stability remains a persistent R&D focus area to achieve long operational lifetimes required by industrial clients.

Perovskite Solar Cells (PSC) represent the most disruptive technology in the indoor segment, offering dramatically higher power conversion efficiencies—often exceeding 30% under specific indoor illumination—compared to OPV or a-Si. This superior performance is driving significant research investment globally. While PSCs are still grappling with large-scale manufacturing challenges related to environmental stability (sensitivity to moisture and oxygen) and lead content, innovative encapsulation techniques and the substitution of lead with less toxic alternatives are rapidly addressing these barriers. The potential for high efficiency at ultra-low thicknesses means PSCs are perfectly positioned for integration into the most energy-demanding IoT devices, such as sophisticated wearables and communication gateways. The ability to tune the bandgap of Perovskites also allows for customization to specific indoor lighting sources, maximizing energy capture regardless of the light source utilized within a building.

Complementary technologies are equally critical, particularly the development of highly optimized Power Management Integrated Circuits (PMICs). These chips are essential for efficiently harvesting the extremely small, variable amounts of power generated by indoor cells and boosting the voltage to levels usable by microprocessors and communication radios. Sophisticated PMICs incorporate maximum power point tracking (MPPT) algorithms specifically tuned for low-light, low-voltage input, ensuring that every available photon is converted into usable electricity and stored effectively in micro-storage units like supercapacitors or solid-state batteries. Further technological advancements include hybrid cell structures, where two different types of indoor cells (e.g., OPV and PSC) are stacked to capture a broader spectrum of indoor light, maximizing total efficiency. This holistic technological ecosystem—combining advanced materials, cost-effective manufacturing via printing, and intelligent power electronics—is converging to unlock the true potential of perpetual power within the Internet of Things.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the Indoor Solar Cell Market’s manufacturing and adoption surge, driven by its massive consumer electronics production base and aggressive governmental investments in smart city infrastructure, particularly in China, South Korea, and Japan. The region benefits from lower manufacturing costs associated with high-volume R2R printing and a highly competitive environment fostering rapid innovation in cost-effective material scaling. APAC is expected to exhibit the highest CAGR due to the sheer volume of IoT devices being manufactured and deployed across logistics, retail (Electronic Shelf Labels), and industrial monitoring applications within the region, positioning it as both the largest producer and consumer of these specialized photovoltaic solutions.

- North America: This region holds a significant market share, driven primarily by strong adoption in high-value industrial IoT (IIoT), sophisticated healthcare monitoring systems, and advanced smart building projects. North American enterprises prioritize performance and integration ease, focusing on solutions that offer demonstrable Total Cost of Ownership (TCO) reductions through minimized maintenance in commercial spaces. Key drivers include robust venture capital funding for clean energy startups and early adoption of novel technologies like high-efficiency Perovskites, particularly in controlled environments and specialized medical applications where reliability commands a price premium.

- Europe: The European market is heavily influenced by stringent environmental regulations, such as the Waste Electrical and Electronic Equipment (WEEE) Directive and broader sustainability mandates, creating a strong regulatory push for battery-free and low-maintenance electronic devices. This drives demand across commercial real estate for green building certifications and low-carbon footprint technologies. Germany, the Nordic countries, and the UK are key markets, focusing on integrating indoor solar cells into smart energy metering, intelligent lighting controls, and pervasive sensor networks within refurbished and newly constructed highly energy-efficient buildings, favoring providers who can guarantee material sustainability and long operational life.

- Latin America (LATAM) and Middle East & Africa (MEA): While currently holding smaller market shares, these regions present high growth potential, particularly in institutional and commercial sectors. LATAM’s growth is fueled by increasing urbanization and the adoption of retail automation (ESLs) and basic smart infrastructure. MEA, particularly the GCC countries, is investing heavily in large-scale smart city initiatives and commercial property development (e.g., NEOM), where the integration of advanced, energy-autonomous sensor technology is a core requirement for establishing state-of-the-art, future-proof urban environments, paving the way for targeted industrial and commercial deployments in the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Indoor Solar Cell Market.- Panasonic Corporation

- G24 Power Ltd.

- Alta Devices, Inc. (acquired by Hanergy Mobile Energy)

- SunPower Corporation

- Hanergy Mobile Energy Holding Group Limited

- Epishine AB

- Exeger Operations AB

- Solaria Corporation

- Ambient Photonics

- Oxford PV Ltd.

- Saule Technologies S.A.

- Armoza Co., Ltd.

- Konica Minolta, Inc.

- TNO (Netherlands Organisation for Applied Scientific Research)

- Solar Printing (Flexterra Inc.)

- CYNORA GmbH

- Belectric GmbH

- Dyesol Limited (Greatcell Solar)

- Mitsubishi Chemical Corporation

- Ricoh Company, Ltd.

Frequently Asked Questions

Analyze common user questions about the Indoor Solar Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in high-efficiency indoor solar cells?

The most promising and rapidly advancing material is Perovskite, known for its ability to achieve significantly higher power conversion efficiencies than traditional Amorphous Silicon or established Organic Photovoltaics (OPV) under low-intensity, indoor LED illumination. OPV remains dominant due to superior flexibility and stability under current commercial production, but Perovskites are expected to lead in efficiency metrics.

How do indoor solar cells perform compared to traditional outdoor panels?

Indoor solar cells are fundamentally different; they are optimized for low-light conditions (below 1,000 lux) and the specific spectra of artificial light (LEDs/fluorescents), whereas outdoor panels are optimized for high-intensity sunlight. While generating far less total power, indoor cells achieve high relative efficiency under their intended operating conditions, making them ideal for ultra-low-power devices like IoT sensors.

Which applications are driving the highest commercial adoption rates?

The highest commercial adoption rates are currently driven by Electronic Shelf Labels (ESLs) in the retail sector, followed closely by wireless sensors utilized in commercial smart building management systems (BMS). These applications yield the fastest Return on Investment (ROI) by eliminating the substantial operational costs and labor associated with manual battery replacement across large sensor networks.

What are the main stability challenges facing emerging indoor photovoltaic technologies?

The main challenges are the long-term stability and lifetime performance of newer materials, especially Perovskites and OPV, under continuous exposure to moisture, oxygen, and varied temperature cycles common in built environments. Manufacturers are addressing this through advanced hermetic encapsulation techniques and developing more robust, intrinsic material formulations to meet industrial reliability standards.

Will indoor solar technology completely replace batteries in IoT devices?

While indoor solar cells significantly reduce reliance on batteries, they typically work in tandem with micro-storage components (e.g., supercapacitors or thin-film batteries). The solar cell provides perpetual power harvesting, charging the micro-storage unit, which then handles peak power demands and ensures continuous operation during periods of complete darkness. They enable battery-less operation in many cases but often rely on micro-storage for sustained performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager