Industrial Area Scan Camera Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440796 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Area Scan Camera Market Size

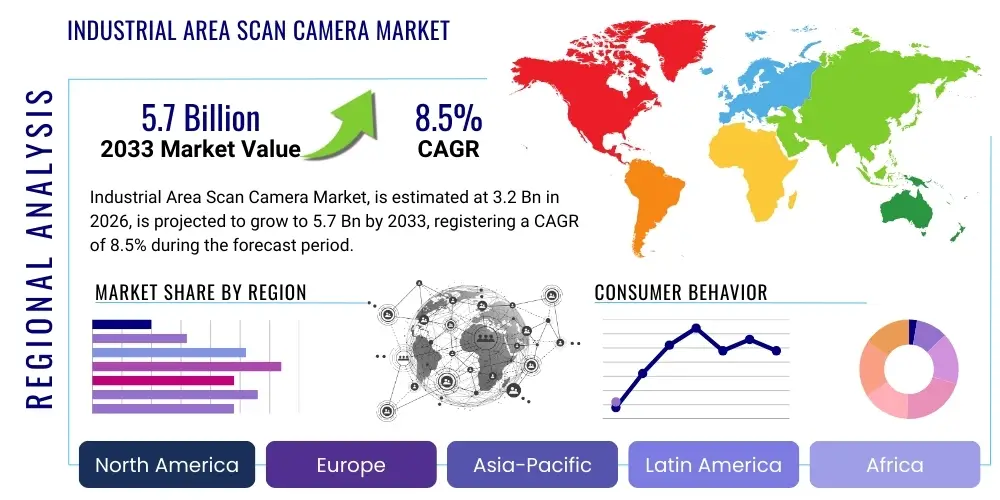

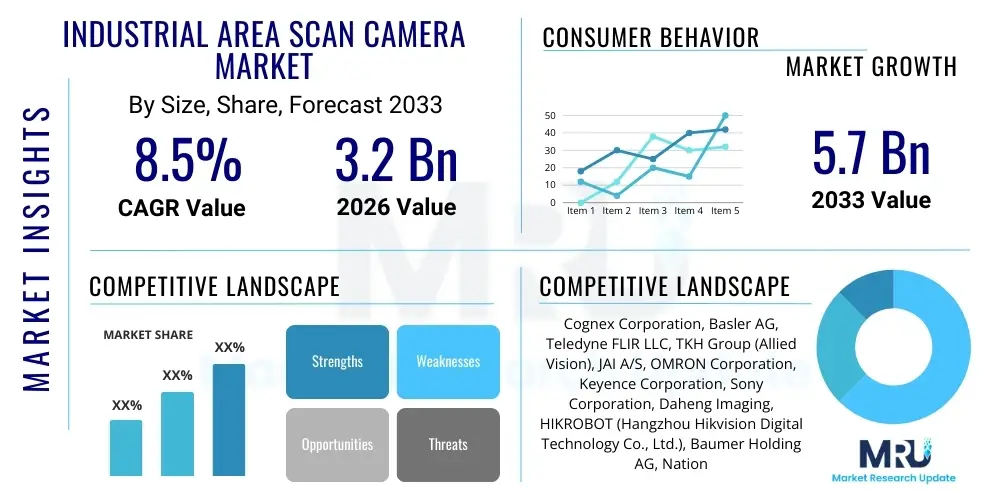

The Industrial Area Scan Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.2 billion in 2026 and is projected to reach USD 5.7 billion by the end of the forecast period in 2033. This robust growth is primarily driven by the increasing automation across manufacturing sectors, the rising demand for quality inspection, and the continuous technological advancements in machine vision systems, enabling greater precision and efficiency in diverse industrial applications.

Industrial Area Scan Camera Market introduction

The Industrial Area Scan Camera Market encompasses the design, manufacturing, and distribution of vision systems specifically engineered for high-speed, high-resolution image capture in industrial environments. These cameras are critical components in machine vision applications, providing comprehensive two-dimensional images for tasks such as quality control, robot guidance, automated inspection, and measurement. Unlike line scan cameras, area scan cameras capture an entire field of view simultaneously, making them ideal for inspecting stationary objects or for applications requiring a broad contextual view. Their robust construction and advanced imaging capabilities are tailored to withstand harsh industrial conditions while delivering consistent, reliable performance.

Major applications of industrial area scan cameras span across numerous sectors, including automotive manufacturing for assembly verification and paint inspection, electronics production for PCB inspection and component placement, food and beverage processing for quality sorting and packaging verification, and pharmaceuticals for label inspection and serialization. These cameras are instrumental in enhancing production efficiency, reducing manufacturing defects, and ensuring product quality and compliance with stringent industry standards. Their ability to integrate seamlessly with robotic systems and automation platforms further solidifies their position as indispensable tools in modern smart factories and Industry 4.0 initiatives. The continuous evolution of sensor technology, coupled with advancements in computational power, drives their broader adoption and increasingly sophisticated applications.

Industrial Area Scan Camera Market Executive Summary

The Industrial Area Scan Camera Market is experiencing significant momentum, propelled by global industrial automation trends and the accelerating adoption of advanced manufacturing techniques. Business trends highlight a strong focus on enhancing operational efficiency, minimizing human error, and achieving higher levels of product quality and consistency, all of which are directly addressed by the capabilities of area scan cameras. The market is witnessing increased investment in R&D to develop cameras with higher resolution, faster frame rates, and enhanced sensitivity, catering to more demanding inspection and guidance tasks. Strategic collaborations between camera manufacturers and machine vision software providers are also becoming prevalent, leading to integrated solutions that offer superior analytical capabilities and ease of deployment. Furthermore, the push towards smart factories and connected manufacturing ecosystems is creating new opportunities for market expansion, as these cameras serve as vital data acquisition points for real-time monitoring and predictive analytics.

Regionally, Asia Pacific continues to dominate the market, driven by its burgeoning manufacturing sector, particularly in countries like China, Japan, South Korea, and India, which are rapidly investing in factory automation and digital transformation. Europe and North America also represent mature markets with strong adoption rates, fueled by initiatives to reshore manufacturing, modernize existing facilities, and comply with stringent quality regulations. Emerging markets in Latin America and the Middle East & Africa are showing promising growth, albeit from a smaller base, as industrialization efforts gain traction and awareness of the benefits of machine vision systems increases. Each region exhibits unique demand patterns influenced by its specific industrial landscape and regulatory environment.

Segmentation trends indicate a strong preference for high-resolution and high-speed cameras, particularly in precision-intensive industries such as semiconductor manufacturing and medical device production. The demand for smart cameras, which integrate processing capabilities directly into the camera unit, is also on the rise, reducing system complexity and latency. Furthermore, color area scan cameras are gaining traction for applications requiring detailed color analysis, such as food inspection and textile quality control. The market is also seeing a diversification in interface technologies, with GigE Vision, USB3 Vision, and Camera Link remaining popular, while newer standards like CoaXPress are emerging for ultra-high-speed applications. The increasing sophistication of machine learning and artificial intelligence algorithms is also influencing camera design, with manufacturers integrating features that facilitate AI-driven image processing and analysis at the edge.

AI Impact Analysis on Industrial Area Scan Camera Market

Common user questions regarding the impact of AI on the Industrial Area Scan Camera Market frequently revolve around how artificial intelligence enhances camera capabilities, improves inspection accuracy, reduces false positives, and enables more complex decision-making processes. Users are keen to understand the extent to which AI can automate tasks previously requiring human intervention, particularly in nuanced quality control scenarios or highly variable production environments. Concerns often touch upon the ease of integration, the computational overhead, and the potential for AI to democratize advanced vision systems, making them accessible and cost-effective for a wider range of industrial applications. There is also significant interest in AI's role in predictive maintenance for vision systems and its capacity to unlock new applications through advanced pattern recognition beyond conventional rule-based algorithms. Expectations are high for AI to deliver greater adaptability, precision, and efficiency, ultimately driving higher throughput and superior product quality while minimizing operational costs.

- Enhanced Defect Detection: AI algorithms can identify subtle, complex, and previously undetectable defects by learning from vast datasets of images, surpassing traditional rule-based vision systems.

- Reduced False Positives: Machine learning models improve accuracy by distinguishing between acceptable variations and actual defects, significantly reducing costly false positives and unnecessary rejections.

- Adaptive Inspection: AI allows vision systems to adapt to variations in product batches, lighting conditions, and object orientation without extensive reprogramming, increasing flexibility in manufacturing lines.

- Predictive Maintenance Integration: AI-powered analytics can monitor the performance of area scan cameras and associated components, predicting potential failures and scheduling proactive maintenance to minimize downtime.

- Complex Pattern Recognition: AI enables cameras to recognize intricate patterns, textures, and anomalies that are difficult for human inspectors or conventional algorithms to process, crucial for intricate assemblies or aesthetic quality control.

- Automated Decision-Making: Smart cameras with integrated AI can make real-time decisions on the production line, such as sorting, guiding robots, or triggering alerts, without human intervention, streamlining processes.

- Data-Driven Optimization: AI processes camera data to provide deeper insights into production quality, identifying root causes of defects and facilitating continuous process improvement.

- New Application Development: AI unlocks possibilities for applications requiring subjective judgment or handling of unstructured data, expanding the scope of machine vision beyond purely quantitative measurements.

DRO & Impact Forces Of Industrial Area Scan Camera Market

The Industrial Area Scan Camera Market is significantly shaped by a confluence of driving factors, restrictive elements, and emerging opportunities, all contributing to its dynamic growth trajectory and overall impact forces. The primary drivers include the escalating global demand for industrial automation, particularly in manufacturing sectors seeking to enhance efficiency, reduce labor costs, and improve product quality. The proliferation of Industry 4.0 initiatives and the trend towards smart factories are further catalyzing the adoption of advanced machine vision systems, with area scan cameras at their core. Additionally, the continuous advancements in sensor technology, image processing algorithms, and connectivity standards are leading to more capable, cost-effective, and versatile camera solutions, broadening their applicability across diverse industrial segments. The increasing stringency of quality control standards and regulatory compliance across industries also compels manufacturers to implement highly accurate and reliable inspection systems.

Despite robust growth, several restraints challenge the market's full potential. The high initial investment cost associated with deploying sophisticated machine vision systems, including high-performance area scan cameras, remains a significant barrier for small and medium-sized enterprises (SMEs) with limited capital budgets. Technical complexities related to system integration, calibration, and maintenance also pose hurdles, requiring specialized expertise that may not always be readily available. Furthermore, the rapid pace of technological change necessitates frequent upgrades and investments in new equipment, potentially leading to faster obsolescence of existing systems. Economic downturns or geopolitical instabilities can also temper capital expenditures by industries, thus impacting the demand for industrial automation equipment. Finally, a lack of standardized interoperability between different camera models, software platforms, and automation systems can complicate deployments and limit market penetration.

Opportunities for growth are abundant, stemming from the expanding application scope of area scan cameras into new industries such as agriculture, logistics, and medical diagnostics, where automated visual inspection is becoming increasingly critical. The development of AI and deep learning capabilities integrated into camera systems presents a vast opportunity to address more complex and nuanced inspection challenges, offering greater precision and adaptability. The rising demand for customized and application-specific vision solutions tailored to unique industrial requirements also creates avenues for market differentiation and specialized product development. Furthermore, the growth of the aftermarket for vision components, including spare parts, upgrades, and maintenance services, represents a stable revenue stream. The trend towards edge computing and smart cameras, which can perform processing directly at the source, minimizes data transfer bottlenecks and latency, opening up possibilities for more autonomous and distributed vision systems. These opportunities, coupled with the inherent advantages of area scan technology, collectively exert strong impact forces, pushing the market towards sustained innovation and expansion.

Segmentation Analysis

The Industrial Area Scan Camera Market is comprehensively segmented to provide a granular understanding of its diverse landscape and to identify key growth drivers within specific product types, applications, end-user industries, and technology implementations. This segmentation allows market participants to tailor their strategies, product development, and sales approaches to address the unique demands of various sub-markets. The core of this analysis typically involves categorizing cameras based on their technical specifications such as resolution and interface, their functional purpose within industrial processes, and the industrial sectors that are the primary beneficiaries of this technology. Understanding these segments is crucial for predicting market shifts, identifying high-growth niches, and assessing competitive dynamics.

- By Type

- Monochrome Area Scan Cameras

- Color Area Scan Cameras

- Smart Area Scan Cameras

- 3D Area Scan Cameras

- High-Resolution Area Scan Cameras (e.g., 5MP and above)

- High-Speed Area Scan Cameras (e.g., 100 fps and above)

- By Interface

- GigE Vision

- USB3 Vision

- Camera Link

- CoaXPress

- HDMI/VGA

- Proprietary Interfaces

- By Application

- Quality Inspection and Metrology

- Robot Guidance and Control

- Identification (Barcode, QR Code, OCR/OCV)

- Sorting and Picking

- Assembly Verification

- Packaging and Labeling

- Security and Surveillance (Industrial)

- Process Monitoring

- By End-User Industry

- Automotive

- Electronics and Semiconductor

- Food and Beverage

- Pharmaceuticals and Medical Devices

- Packaging

- Textile

- Logistics and Postal

- Printing and Paper

- Aerospace and Defense

- Agriculture

- General Manufacturing

- By Technology

- CMOS Sensors

- CCD Sensors

- Global Shutter

- Rolling Shutter

- NIR Enhanced

Value Chain Analysis For Industrial Area Scan Camera Market

The value chain for the Industrial Area Scan Camera Market begins with an intricate upstream analysis, focusing on the suppliers of fundamental components that form the core of these sophisticated devices. This includes manufacturers of image sensors (CMOS and CCD being prevalent), optical lens suppliers, developers of specialized semiconductors and microprocessors for image processing, and providers of various electronic components such as memory chips, interface controllers, and power management units. Key upstream players also involve software developers creating embedded firmware and drivers crucial for camera functionality. The competitive landscape at this stage is characterized by a relatively concentrated number of highly specialized companies that possess advanced technological expertise and proprietary manufacturing processes. Relationships in this segment are often long-term and strategic, driven by the need for high-quality, reliable components that directly impact the performance and cost-effectiveness of the final camera product.

Moving downstream, the value chain encompasses the actual manufacturing, assembly, and integration of industrial area scan cameras, primarily undertaken by specialized machine vision companies. These companies integrate the components received from upstream suppliers, develop their proprietary camera designs, and perform rigorous testing to ensure industrial-grade performance and durability. This stage also involves extensive research and development to innovate new camera features, enhance imaging capabilities, and improve connectivity options. Once manufactured, these cameras move through various distribution channels to reach end-users. The distribution network is bifurcated into direct and indirect channels. Direct channels involve manufacturers selling directly to large industrial customers, system integrators, or through their own sales teams and online platforms, allowing for greater control over customer relationships and solution customization. This approach is often preferred for complex projects requiring significant technical consultation and support.

Indirect distribution channels play a crucial role in expanding market reach, especially for SMEs and in geographically dispersed regions. These channels typically involve a network of authorized distributors, value-added resellers (VARs), and specialized machine vision system integrators. Distributors often stock a range of cameras and accessories, providing regional availability and logistical support. VARs and system integrators are particularly vital as they combine cameras with other components such as lighting, lenses, software, and robotic systems to deliver complete, tailored machine vision solutions to end-users. They possess the technical expertise to design, install, and commission complex automation systems, thereby adding significant value to the camera product. Their role is critical in bridging the gap between component manufacturers and diverse industrial applications, often providing essential post-sales support and technical services. The choice between direct and indirect channels often depends on market size, geographical reach, product complexity, and the specific strategic objectives of the camera manufacturer.

Industrial Area Scan Camera Market Potential Customers

The potential customers for the Industrial Area Scan Camera Market are broadly defined as any industrial entity engaged in manufacturing, production, or logistics processes that require automated visual inspection, quality control, measurement, or guidance systems. These end-users span a vast array of sectors, ranging from heavy industries to precision manufacturing, all seeking to enhance operational efficiency, ensure product integrity, and comply with stringent quality standards. Key demographic segments include large multinational corporations that operate multiple production facilities and are deeply invested in advanced automation, as well as small and medium-sized enterprises (SMEs) that are increasingly recognizing the cost-benefit advantages of machine vision technologies. The primary motivation for these customers to invest in industrial area scan cameras is the critical need to minimize defects, reduce waste, increase throughput, and achieve consistent, repeatable results that human inspection alone cannot reliably deliver.

Specific end-user/buyers include automotive manufacturers using cameras for robot guidance in assembly, paint inspection, and component verification. Electronics and semiconductor companies employ them for PCB inspection, microchip alignment, and defect detection on intricate components. Food and beverage processors utilize them for sorting, quality grading, foreign object detection, and packaging integrity checks. Pharmaceutical and medical device manufacturers rely on them for sterile packaging inspection, label verification, serialization, and ensuring the absence of contaminants. Furthermore, packaging companies leverage these cameras for label positioning, print quality, and fill-level inspection, while logistics and postal services use them for automated package sorting and identification. General manufacturing industries, including plastics, metals, and textiles, also represent significant customer bases for diverse inspection and process control applications. The growing trend of Industry 4.0 and smart factories is expanding the customer base further, as more businesses seek to integrate real-time visual data into their connected manufacturing ecosystems for advanced analytics and predictive capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 billion |

| Market Forecast in 2033 | USD 5.7 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cognex Corporation, Basler AG, Teledyne FLIR LLC, TKH Group (Allied Vision), JAI A/S, OMRON Corporation, Keyence Corporation, Sony Corporation, Daheng Imaging, HIKROBOT (Hangzhou Hikvision Digital Technology Co., Ltd.), Baumer Holding AG, National Instruments (NI), ISRA VISION AG, SICK AG, Datalogic S.p.A., Vieworks Co., Ltd., Zvision, Hamamatsu Photonics K.K., Leutron Vision AG, Photonfocus AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Area Scan Camera Market Key Technology Landscape

The technology landscape for the Industrial Area Scan Camera Market is characterized by continuous innovation aimed at enhancing image quality, speed, versatility, and integration capabilities. At the core of these advancements are image sensor technologies, primarily Complementary Metal-Oxide-Semiconductor (CMOS) and Charge-Coupled Device (CCD) sensors. CMOS sensors have largely overtaken CCDs due to their higher speed, lower power consumption, and ability to integrate more functionalities directly onto the chip, offering global shutter capabilities that eliminate motion blur for fast-moving objects. The ongoing development in CMOS technology focuses on increasing pixel density, improving dynamic range, and enhancing sensitivity, particularly in low-light or specific spectral ranges like Near-Infrared (NIR), to cater to a wider array of demanding industrial applications.

Beyond sensors, the market is heavily influenced by advancements in camera interfaces and data transmission protocols. GigE Vision and USB3 Vision remain popular choices due to their balance of speed, cable length, and cost-effectiveness. However, for ultra-high-speed and high-resolution applications, Camera Link and CoaXPress are gaining prominence, offering significantly higher bandwidth for real-time data streaming. The integration of advanced image processing units directly into the camera, leading to the rise of "smart cameras," is another critical technological trend. These smart cameras embed powerful processors and often include proprietary or open-source image processing algorithms, sometimes even AI/deep learning capabilities, allowing them to perform analysis at the edge and reduce the load on central computing systems. This trend simplifies system architecture, reduces latency, and enables more autonomous machine vision solutions directly on the factory floor.

Furthermore, the development of specialized optics and lighting solutions is equally crucial. Lenses with superior optical performance, low distortion, and interchangeable mounts are essential for optimizing image capture in various industrial settings. Advanced lighting techniques, including structured light for 3D imaging, polarized light to reduce glare, and specific wavelength illumination, are often paired with area scan cameras to enhance contrast and highlight specific features for inspection. Software development is also a significant technological driver, with sophisticated machine vision libraries, SDKs, and user-friendly graphical programming interfaces making it easier to deploy and configure complex vision applications. The convergence of these technologies, coupled with the increasing adoption of artificial intelligence and machine learning for advanced pattern recognition and decision-making, continues to push the boundaries of what industrial area scan cameras can achieve, leading to more robust, intelligent, and adaptable vision systems for modern manufacturing.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to robust manufacturing growth, particularly in automotive, electronics, and semiconductor industries in China, Japan, South Korea, and India. Significant government investments in automation and smart factory initiatives fuel adoption. The region is also a key hub for camera component manufacturing and assembly, leading to competitive pricing and rapid technological deployment.

- North America: A mature market characterized by high adoption rates in diverse sectors like automotive, aerospace, pharmaceuticals, and food & beverage. Driven by initiatives to modernize manufacturing infrastructure, enhance quality control, and integrate advanced robotics. Strong presence of key technology developers and early adopters of AI-driven vision solutions.

- Europe: A leading market propelled by stringent quality standards, high labor costs, and significant investment in industrial automation, especially in Germany, France, and Italy. Emphasis on precision engineering, R&D in machine vision technologies, and strong industry regulations. Growing focus on sustainable and energy-efficient manufacturing processes, integrating vision for optimization.

- Latin America: An emerging market exhibiting steady growth, primarily in countries like Brazil and Mexico, driven by increasing industrialization, expansion of manufacturing bases, and foreign direct investment in automation technologies. Adoption is gradual but accelerating as industries seek to improve competitiveness and production efficiency.

- Middle East & Africa (MEA): Represents a nascent but growing market, with increasing investments in industrial diversification, infrastructure development, and smart city initiatives, particularly in Gulf Cooperation Council (GCC) countries. The adoption of industrial area scan cameras is rising in oil & gas, packaging, and food processing sectors as automation becomes more critical for operational efficiency and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Area Scan Camera Market.- Cognex Corporation

- Basler AG

- Teledyne FLIR LLC

- TKH Group (Allied Vision)

- JAI A/S

- OMRON Corporation

- Keyence Corporation

- Sony Corporation

- Daheng Imaging

- HIKROBOT (Hangzhou Hikvision Digital Technology Co., Ltd.)

- Baumer Holding AG

- National Instruments (NI)

- ISRA VISION AG

- SICK AG

- Datalogic S.p.A.

- Vieworks Co., Ltd.

- Zvision

- Hamamatsu Photonics K.K.

- Leutron Vision AG

- Photonfocus AG

Frequently Asked Questions

Analyze common user questions about the Industrial Area Scan Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Industrial Area Scan Camera and how does it differ from a Line Scan Camera?

An Industrial Area Scan Camera captures an entire two-dimensional image or field of view simultaneously, making it ideal for inspecting stationary objects or providing a broad contextual view in applications like robot guidance and quality control. In contrast, a Line Scan Camera captures images one line at a time as an object moves past it, building up a full image sequentially, which is best suited for continuous web inspection or high-speed conveyor belt applications.

What are the primary applications of Industrial Area Scan Cameras?

Primary applications include automated quality inspection and defect detection in manufacturing (e.g., automotive, electronics, food & beverage), robot guidance for precision assembly and picking, optical character recognition (OCR) for reading labels and codes, metrology for accurate measurements, and general process monitoring to ensure operational efficiency and compliance.

How is AI impacting the Industrial Area Scan Camera Market?

AI is profoundly impacting the market by enabling advanced capabilities such as enhanced defect detection (identifying subtle flaws beyond traditional algorithms), reduced false positives, adaptive inspection for varying conditions, and complex pattern recognition. It allows cameras to make smarter, real-time decisions, transforming them into more intelligent and autonomous vision systems.

What factors drive the growth of the Industrial Area Scan Camera Market?

Key growth drivers include the increasing adoption of industrial automation and robotics across diverse manufacturing sectors, the global push towards Industry 4.0 and smart factories, continuous technological advancements in sensor and image processing capabilities, and the rising demand for stringent quality control and inspection to meet regulatory standards.

What are the common interface technologies used for Industrial Area Scan Cameras?

Common interface technologies include GigE Vision, offering good balance of speed and cable length for many applications; USB3 Vision, known for high bandwidth and ease of use; Camera Link, preferred for ultra-high-speed data transfer; and CoaXPress, emerging for even higher bandwidth requirements over longer distances, crucial for high-resolution, high-frame-rate cameras.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager