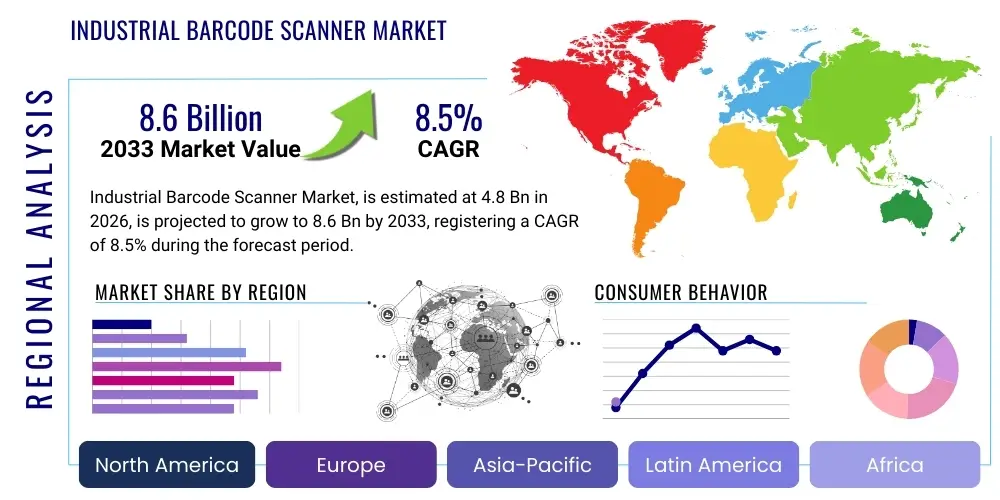

Industrial Barcode Scanner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443284 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Industrial Barcode Scanner Market Size

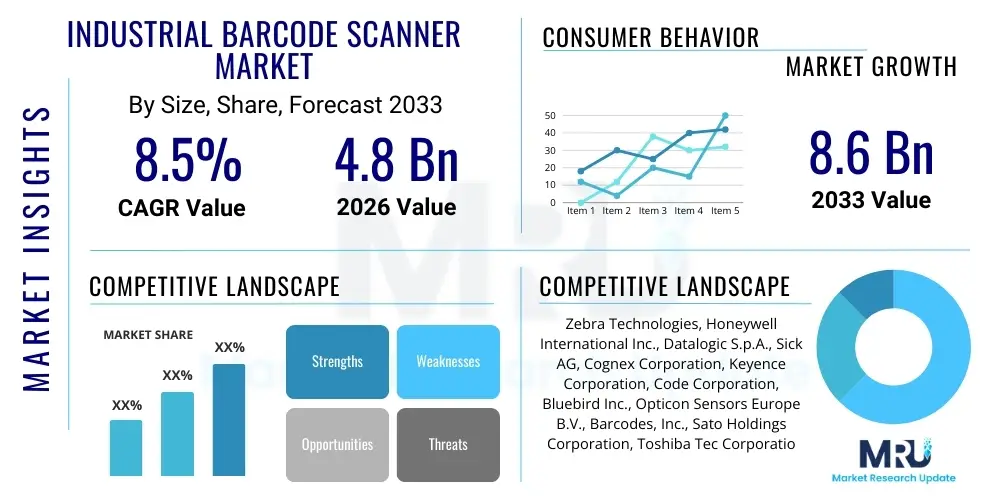

The Industrial Barcode Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Industrial Barcode Scanner Market introduction

The Industrial Barcode Scanner Market encompasses devices specifically designed for high-volume, high-durability data capture operations within challenging industrial environments, such as manufacturing floors, large-scale warehouses, and distribution centers. Unlike standard retail scanners, industrial units are built to withstand extreme temperatures, dust, moisture, and frequent drops, ensuring reliability in continuous operation cycles. These devices are integral to modern supply chain management, facilitating crucial tasks such as inventory tracking, asset management, quality control, and order fulfillment. The primary functionality involves decoding linear (1D) and two-dimensional (2D) barcodes, and increasingly, specialized codes like Direct Part Mark (DPM), to instantly transmit critical information into Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS).

Industrial barcode scanners vary significantly in form factor, including rugged handheld devices, fixed-mount scanners for automated assembly lines, and mobile computer-integrated units. The key product characteristic is their robust construction, often rated with high Ingress Protection (IP) standards, guaranteeing operational longevity in demanding settings. They employ various reading technologies, predominantly 2D imaging technology (which captures both 1D and 2D codes rapidly), replacing older, slower laser-based systems in many applications. Major applications span across logistics (inbound and outbound goods processing), manufacturing (tracking components and work-in-progress), and healthcare (surgical tool and patient tracking). The immediate data accuracy provided by these scanners minimizes human error and significantly accelerates processing speeds across the industrial value chain.

The market growth is fundamentally driven by the global imperative toward digitalization and the implementation of Industry 4.0 principles, where seamless connectivity and real-time data flow are paramount. Benefits derived from utilizing advanced industrial scanners include enhanced operational efficiency, reduced inventory shrinkage, improved traceability mandated by regulatory bodies, and optimization of labor resources. The accelerating expansion of e-commerce and the consequent explosion in parcel volume necessitate automated and rapid data capture solutions, positioning advanced industrial barcode scanners as indispensable tools for large-scale distribution operations aiming for precision and speed in hyper-competitive global logistics networks. Furthermore, the integration of these scanners with wider Internet of Things (IoT) ecosystems enables predictive maintenance and advanced analytics.

Industrial Barcode Scanner Market Executive Summary

The Industrial Barcode Scanner Market is experiencing robust growth fueled primarily by global shifts toward automated warehousing, the exponential expansion of e-commerce, and the stringent regulatory requirements for product traceability across sectors like pharmaceuticals and food & beverage. Business trends indicate a strong move away from traditional laser scanners towards advanced 2D imaging technology, which offers superior reading capability, especially for damaged or poorly printed codes, and the ability to capture complex data matrices. Key industry players are focusing heavily on developing ruggedized mobile computers integrated with high-performance scanning engines, emphasizing wireless connectivity (Wi-Fi 6, 5G readiness), and ergonomic designs to improve worker productivity and reduce operational fatigue. Strategic partnerships between hardware manufacturers and software providers specializing in WMS solutions are becoming common to deliver integrated, turnkey automation solutions to end-users.

Regional trends reveal that the Asia Pacific (APAC) region is poised for the highest growth rate due to rapid industrialization, massive investments in manufacturing automation in China and India, and the development of extensive logistics infrastructure to support surging regional e-commerce consumption. North America and Europe, while representing mature markets, maintain dominance in overall market value, driven by high adoption rates of advanced fixed-mount systems in highly automated production lines and the consistent upgrading of legacy equipment to IoT-enabled smart scanners. Investments in smart factory initiatives and resilient supply chain technologies following global disruptions are major market accelerators in these developed regions, pushing demand for sophisticated, high-speed data capture solutions compatible with robotic systems and Autonomous Mobile Robots (AMRs).

Segmentation trends highlight that the Logistics and Warehouse segment continues to hold the largest market share by application, benefiting directly from the need for high-speed sorting and tracking of millions of items daily. Within the Technology segment, 2D Imager scanners are projected to exhibit the fastest growth, steadily replacing 1D laser scanners due to their versatility in reading various symbologies and codes displayed on screens (m-commerce). By product type, Fixed-Mount Scanners are experiencing accelerating adoption, particularly in highly automated environments such as automated conveyor systems and robotic picking cells, reflecting the industry's commitment to minimizing human intervention and maximizing continuous operational throughput. This segment's expansion is intrinsically linked to capital expenditures in large-scale material handling automation projects.

AI Impact Analysis on Industrial Barcode Scanner Market

User questions concerning the impact of Artificial Intelligence on the Industrial Barcode Scanner Market primarily revolve around how AI enhances the efficiency of data interpretation, reduces operational bottlenecks, and enables predictive maintenance for the scanning hardware itself. Common inquiries focus on whether AI can improve the decoding rate of severely damaged or highly distorted codes (a critical issue in industrial settings), if AI-powered vision systems will eventually replace traditional barcode readers entirely, and how machine learning optimizes data flow within the WMS based on real-time scanning activity. Users are deeply concerned with the seamless integration of AI-driven data processing capabilities directly into the scanning device firmware, looking for solutions that offer immediate, intelligent feedback rather than simply capturing raw data. Expectations are high regarding AI's role in improving system resilience, ensuring scanners remain operational by anticipating hardware failures and streamlining complex, multi-stage sorting processes using algorithmic optimization.

- AI enables advanced image processing algorithms, dramatically improving the read rate accuracy of damaged, obscured, or poorly printed 1D and 2D barcodes, reducing manual data entry exceptions.

- Integration of machine learning (ML) allows scanners to recognize and adapt to new or non-standard symbologies quickly, enhancing future-proofing and operational flexibility.

- AI-powered predictive maintenance analyzes scanner performance metrics (e.g., laser degradation, imager lens clarity, connection stability) to anticipate hardware failure, minimizing unexpected downtime on assembly lines.

- AI enhances optical character recognition (OCR) capabilities within imaging scanners, allowing devices to read human-readable labels and supplement barcode data capture, providing redundancy.

- Adoption of AI-driven deep learning cameras allows for combined identification (barcode reading) and quality inspection (defect detection) using a single, integrated vision system, optimizing complex manufacturing tasks.

- AI supports sophisticated fixed-mount systems in high-speed applications (e.g., parcel sorting), optimizing camera settings and lighting conditions autonomously for maximum throughput efficiency.

DRO & Impact Forces Of Industrial Barcode Scanner Market

The Industrial Barcode Scanner Market is significantly driven by the accelerating global transition towards smart manufacturing and Industry 4.0 initiatives, necessitating real-time inventory visibility and integrated automation solutions across the production floor. The pervasive expansion of global e-commerce has put immense pressure on logistics providers and warehouses to process exponentially increasing volumes of parcels at faster speeds, demanding robust, high-throughput fixed-mount and mobile scanners capable of 24/7 operation. Furthermore, stringent regulatory mandates, particularly in the pharmaceutical and food and beverage sectors, requiring end-to-end product traceability (e.g., UDI and serialization), fundamentally underpin the sustained demand for advanced barcode scanning systems to maintain compliance and supply chain integrity. These drivers collectively create a compelling business case for replacing legacy scanning equipment with modern, connected, and highly reliable industrial-grade devices.

Restraints impeding market growth include the substantial initial capital investment required for implementing sophisticated, automated scanning infrastructure, particularly the high cost associated with fully integrated fixed-mount systems and associated vision software in large distribution centers. The complexity of integrating next-generation barcode scanners seamlessly with disparate legacy WMS and ERP systems presents a significant technical hurdle for many enterprises, requiring specialized IT expertise and substantial downtime during transition periods. Furthermore, while the general trend is positive, economic uncertainties and geopolitical instability can temporarily delay large-scale automation projects, as capital expenditure budgets for material handling equipment are often among the first to be reviewed during financial tightening, impacting the immediate adoption rate, especially among small and medium-sized enterprises (SMEs).

Opportunities for market expansion are vast, primarily centered on the increasing adoption of 3D vision systems and dimensioning solutions that incorporate advanced 2D/3D barcode scanning, enabling simultaneous data capture, volume calculation, and quality inspection. The growing demand for ruggedized mobile computers equipped with integrated scanners for field services, maintenance, repair, and operations (MRO), and last-mile delivery applications presents a lucrative untapped segment. Moreover, the development of affordable, high-performance, compact scanners tailored for integration into Autonomous Mobile Robots (AMRs) and automated guided vehicles (AGVs) within smart warehouses opens up new avenues for automation beyond traditional conveyor systems. Impact forces such as technological advancement in imaging and wireless connectivity and the macroeconomic shift towards resilient, digitized supply chains ensure that the demand trajectory remains robust and focused on high-performance solutions.

Segmentation Analysis

The Industrial Barcode Scanner Market is meticulously segmented based on technology, product type, application, and geography, reflecting the diverse operational requirements across various industrial sectors. This segmentation is crucial for vendors to tailor their offerings, addressing specific needs ranging from high-speed automated sorting in logistics hubs to rugged data capture on manufacturing assembly lines. The primary segmentation drivers are the operational environment (e.g., need for ruggedness), the complexity of the data required (1D vs. 2D/3D), and the degree of automation implemented (handheld vs. fixed-mount systems). Analyzing these segments provides a clear pathway for understanding where high-value growth is concentrated, notably in advanced imaging technologies and the massive logistics application segment.

The segmentation by Product Type offers a fundamental distinction between mobility and deployment, where Handheld Scanners provide flexibility for manual tasks like cycle counting and picking, while Fixed-Mount Scanners are indispensable for rapid, continuous scanning on conveyors and automated machinery. Technology segmentation highlights the competitive landscape between traditional Laser Scanners (cost-effective for basic 1D reading) and the dominant 2D Imagers (versatile for complex codes and DPM). Application analysis confirms that the growth engine remains rooted in the Logistics and Manufacturing industries, which continually invest in high-performance scanning infrastructure to maintain competitive supply chain efficiency. This detailed breakdown ensures accurate forecasting and strategic market positioning for manufacturers.

- By Product Type:

- Handheld Scanners (Corded, Cordless/Wireless)

- Fixed-Mount Scanners (High-Speed, Compact)

- Mobile Computers/PDAs (Integrated Scanning)

- By Technology:

- Laser Scanners (1D only)

- 2D Imagers (Area Imaging)

- CMOS/CCD Imagers (Specialized applications)

- 3D Barcode Scanners/Vision Systems

- By Application/End-User:

- Logistics and Warehousing (Sorting, Inventory, Shipping/Receiving)

- Manufacturing (Work-in-Progress Tracking, Asset Management)

- Retail and Commercial (Backroom Operations, Inventory Management)

- Healthcare (Patient Identification, Pharmacy Management)

- Automotive

- Food and Beverage

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Barcode Scanner Market

The value chain for the Industrial Barcode Scanner Market commences with the Upstream Analysis, dominated by suppliers of critical raw materials and components, specifically optical lenses, advanced CMOS/CCD sensors, high-performance microprocessors, rugged casing materials (e.g., specialized plastics and composites), and connectivity modules (Bluetooth, Wi-Fi, RFID). Key upstream activities involve the specialized manufacturing of imaging modules, firmware development, and the sourcing of power management circuitry essential for battery-powered mobile units. Strategic procurement is critical here, as the quality and performance of the sensor technology directly determine the scanner’s reading speed, depth of field, and reliability in harsh lighting conditions. Maintaining a stable supply of advanced semiconductor components is paramount for uninterrupted manufacturing schedules among major scanner producers.

The midstream section involves the core manufacturing, assembly, and integration processes carried out by major Original Equipment Manufacturers (OEMs) like Zebra, Honeywell, and Datalogic. This stage includes sophisticated industrial design focused on ergonomics and ruggedness (IP rating), complex software integration (decoding algorithms, operating systems), and rigorous quality testing to meet industrial standards. Distribution Channel analysis reveals a multi-faceted approach: Direct sales are often preferred for large-scale, customized automation projects involving fixed-mount systems where specialized integration and consulting services are required. Indirect sales, relying heavily on a network of Value-Added Resellers (VARs), system integrators, and specialized distributors, dominate the sales of standard handheld and mobile computer solutions, providing local support and application expertise to end-users.

Downstream analysis focuses on the final delivery, installation, and post-sales support provided to end-users in manufacturing, logistics, and retail. System integrators play a vital role here, especially for complex installations involving WMS/ERP integration and the setup of automated conveyor systems that utilize fixed-mount scanners. The ultimate success relies on the effective deployment and service quality, including firmware updates, maintenance contracts, and technical support, which often become long-term revenue streams for manufacturers. Effective management of the distribution channel is crucial for maximizing market reach and ensuring rapid deployment cycles, particularly in fast-growing regions like APAC where the need for industrial-grade solutions is escalating rapidly due to new infrastructure development.

Industrial Barcode Scanner Market Potential Customers

Potential customers for Industrial Barcode Scanners are predominantly large-scale organizations operating high-throughput environments where data capture accuracy and speed are non-negotiable prerequisites for operational viability. The primary end-users fall into the Logistics and Warehousing segment, including third-party logistics (3PL) providers, major e-commerce fulfillment centers, and global express shipping carriers. These entities rely on high-speed fixed-mount scanners for automated sorting processes and rugged mobile computers for inbound receiving, putaway, and outbound shipping verification, processing millions of transactions daily across vast physical spaces. The critical nature of rapid order fulfillment necessitates continuous investment in the latest 2D and 3D imaging technology to handle increased package density and variable code quality.

The Manufacturing sector represents another crucial customer base, encompassing automotive assembly plants, aerospace component fabrication, and complex electronics manufacturing. In these environments, scanners are utilized for work-in-progress (WIP) tracking, component serialization, tool crib management, and quality control checkpoints. Customers in this sector demand highly reliable, rugged scanners, often capable of reading Direct Part Mark (DPM) codes etched directly onto metal or plastic components, ensuring permanent traceability throughout the product lifecycle. The investment decisions here are driven by regulatory compliance (e.g., safety standards) and the pursuit of lean manufacturing principles, where minimizing waste and maximizing real-time data flow are core objectives.

Furthermore, the Healthcare and Pharmaceutical industries are rapidly increasing their adoption, driven by mandates for unique device identification (UDI) and pharmaceutical serialization (e.g., Drug Supply Chain Security Act). Hospitals, pharmacies, and drug manufacturers use these scanners for patient safety (bedside verification), asset tracking (equipment and surgical tools), and managing complex drug inventories. Customers here prioritize scanning accuracy for small, high-density barcodes and often require specialized disinfection-ready housings. The continued digitalization of supply chains across all industrial segments ensures a widening customer base focused on optimizing internal operations and maintaining resilience against global supply disruptions, consistently driving demand for sophisticated industrial data capture solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International Inc., Datalogic S.p.A., Sick AG, Cognex Corporation, Keyence Corporation, Code Corporation, Bluebird Inc., Opticon Sensors Europe B.V., Barcodes, Inc., Sato Holdings Corporation, Toshiba Tec Corporation, NCR Corporation, Epson America, Inc., Casio Computer Co., Ltd., Denso Wave Inc., Newland Auto-ID Tech, Microscan Systems (Omron), ProGlove. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Barcode Scanner Market Key Technology Landscape

The technology landscape of the Industrial Barcode Scanner Market is characterized by a rapid migration from linear laser scanning to sophisticated 2D area imaging, complemented by advancements in wireless communication and ruggedized design. The shift to 2D imagers is driven by their versatility, allowing them to read not only traditional 1D barcodes but also complex 2D matrix codes (QR, Data Matrix, Aztec) and Direct Part Marks (DPM), crucial for component traceability in manufacturing. These imagers utilize advanced CMOS sensors and high-speed processors to capture and decode images almost instantaneously, often supporting omnidirectional reading, significantly improving workflow speed compared to laser devices that require precise alignment. Furthermore, technological innovation focuses on enhancing the reading capability in challenging conditions, such as through shrink wrap, reflective surfaces, or poor lighting, by incorporating intelligent illumination and auto-focus mechanisms.

A major development involves the integration of high-performance scanning engines into ruggedized mobile computers and wearable devices. This allows workers increased mobility and real-time data access through robust operating systems (primarily Android-based) and enterprise applications, moving beyond simple data capture toward mobile workflow management. Connectivity advancements, including the adoption of Wi-Fi 6 and anticipating 5G capabilities, ensure low latency and high data throughput, essential for transferring large volumes of data captured by multiple scanners in large, automated facilities. Furthermore, the development of sophisticated decoding algorithms, often utilizing AI/ML, allows scanners to maintain high read rates even when codes are partially obscured, severely damaged, or printed on low-contrast materials, ensuring minimal interruption to continuous operations.

Another emerging area is the deployment of 3D vision systems that combine barcode scanning with dimensioning and volumetric data capture, especially critical for parcel and pallet processing in high-speed logistics. These systems use advanced sensing technologies (e.g., LiDAR or structured light) alongside 2D imaging to simultaneously identify the item, read its code, and calculate its precise dimensions. For fixed-mount applications, Power over Ethernet (PoE) integration simplifies deployment and maintenance by combining power supply and data transmission into a single cable. Overall, the industry is moving towards smart, connected scanning solutions that not only capture data efficiently but also communicate seamlessly with the broader IoT industrial ecosystem, providing analytics for operational optimization and process control.

Regional Highlights

- North America: North America holds a significant share of the global industrial barcode scanner market value, characterized by early adoption of automation technologies and large-scale investment in e-commerce fulfillment infrastructure. The region, particularly the United States, is home to major logistics and retail giants that continuously upgrade to fixed-mount and high-speed 2D imaging systems to cope with increasing parcel volumes and same-day delivery pressures. Strict FDA regulations and traceability requirements in the pharmaceutical and food & beverage sectors drive consistent demand for high-accuracy, validated scanning solutions capable of handling complex serialization data. Technological maturity means the market is driven primarily by replacement cycles and the integration of advanced features such as AI-enhanced vision systems and AMRs incorporating scanning capabilities. Companies in this region focus heavily on providing integrated software solutions alongside hardware to address complex WMS requirements, establishing a high benchmark for operational excellence and efficiency, especially in automated sorting hubs.

- Europe: The European market is mature and technologically advanced, with robust demand driven by strong manufacturing bases, particularly in Germany (Industry 4.0), and efficient cross-border logistics operations. European regulations emphasize workplace safety and operational efficiency, prompting companies to invest in ergonomic handheld scanners and advanced fixed-mount systems for highly specialized production lines. The focus is increasingly on sustainability and energy efficiency in automated processes, influencing purchasing decisions towards compact, energy-efficient scanning hardware and PoE-enabled systems. Western Europe exhibits high penetration rates, while Eastern European nations, driven by foreign direct investment in manufacturing and logistics infrastructure, are emerging as rapid growth areas. The complexity of managing diverse national logistics standards and customs procedures necessitates flexible and highly configurable scanning hardware and software interfaces.

- Asia Pacific (APAC): The Asia Pacific region is forecast to exhibit the highest CAGR during the forecast period, primarily due to rapid industrialization, massive government spending on infrastructure, and the exponential growth of local e-commerce markets in countries like China, India, and Southeast Asia. The sheer volume of manufacturing output in countries like China drives immense demand for fixed-mount scanners for assembly line automation and quality control. Investments in building new smart warehouses and distribution centers to support urbanization and growing consumer bases are primary accelerators. While cost sensitivity remains a factor, the imperative to compete globally and improve supply chain resilience is pushing adoption of advanced 2D imaging and mobile computing solutions. The region is characterized by a mix of high-end automation projects (Japan, South Korea) and large-scale basic automation deployments (India, Indonesia), resulting in diverse demand across all product segments.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, heavily influenced by investments in commodity production (mining, agriculture) and expanding retail sectors. Market penetration is generally lower than in North America or Europe, but increasing foreign investment and the modernization of port and logistics facilities are stimulating demand for rugged handheld scanners and entry-level fixed systems. Economic volatility in key countries like Brazil and Mexico can impact large capital expenditure projects, yet the underlying need for improved inventory management and operational control continues to drive baseline adoption, particularly in segments related to pharmaceutical tracking and retail backroom operations.

- Middle East & Africa (MEA): Growth in the MEA region is concentrated in the GCC states (Saudi Arabia, UAE) due to massive infrastructural projects, diversification efforts away from oil economies, and the establishment of global logistics hubs. Significant investment in cold chain management and pharmaceutical supply chains is boosting the requirement for specialized industrial scanners. Africa, while offering lower overall market value currently, represents a future opportunity driven by improving telecommunications infrastructure and increasing foreign investment in manufacturing and retail distribution networks, leading to a gradually expanding need for durable, cost-effective data capture solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Barcode Scanner Market.- Zebra Technologies Corporation

- Honeywell International Inc.

- Datalogic S.p.A.

- Cognex Corporation

- Sick AG

- Keyence Corporation

- Code Corporation

- Bluebird Inc.

- Opticon Sensors Europe B.V.

- Sato Holdings Corporation

- Toshiba Tec Corporation

- NCR Corporation

- Epson America, Inc.

- Denso Wave Inc.

- Newland Auto-ID Technology Co., Ltd.

- Omron Corporation (Microscan Systems)

- ProGlove

- Casio Computer Co., Ltd.

- Bixolon Co., Ltd.

- ID TECH

Frequently Asked Questions

Analyze common user questions about the Industrial Barcode Scanner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between industrial and retail barcode scanners?

Industrial barcode scanners are engineered for extreme durability and reliability, featuring ruggedized housings (high IP ratings) to resist dust, moisture, and drops. They are designed for continuous, high-volume operation in harsh environments like warehouses and manufacturing floors, often utilizing advanced 2D imaging for complex codes, whereas retail scanners focus on cost-efficiency and aesthetic design in controlled indoor settings.

Which technology segment is growing fastest in the industrial barcode scanner market?

The 2D Imager technology segment is experiencing the fastest growth. 2D imagers are replacing traditional laser scanners due to their ability to read a wider variety of codes (1D, 2D, DPM) omnidirectionally, their superior performance on damaged or poor-quality labels, and their essential role in modern logistics and manufacturing traceability systems.

How is Industry 4.0 influencing the demand for industrial scanners?

Industry 4.0 mandates real-time data connectivity and automation. This drives demand for fixed-mount scanners integrated directly into automated machinery (AMRs, conveyors) and IoT-enabled mobile scanners that transmit data seamlessly to cloud-based WMS/ERP systems, enabling smart factory management and predictive maintenance capabilities.

Which geographical region offers the most significant growth opportunities?

The Asia Pacific (APAC) region offers the most significant growth opportunities, driven by exponential e-commerce growth, massive investments in logistics infrastructure modernization, and rapid expansion of the manufacturing base across countries like China, India, and Southeast Asia, requiring substantial new deployments of automated scanning solutions.

Are fixed-mount scanners becoming more prevalent than handheld models?

While handheld scanners remain critical for manual tasks, the adoption of Fixed-Mount Scanners is accelerating rapidly, primarily driven by the increasing automation of high-speed sorting and assembly lines. Fixed-mount systems are indispensable for maximizing throughput and minimizing labor costs in fully automated fulfillment and manufacturing operations, marking them as the highest growth segment by product type in automated facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager