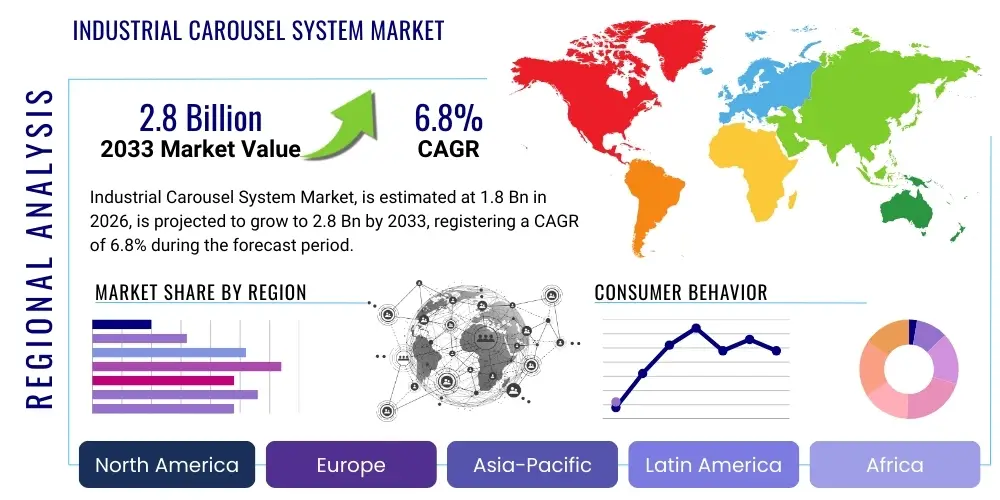

Industrial Carousel System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443374 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Carousel System Market Size

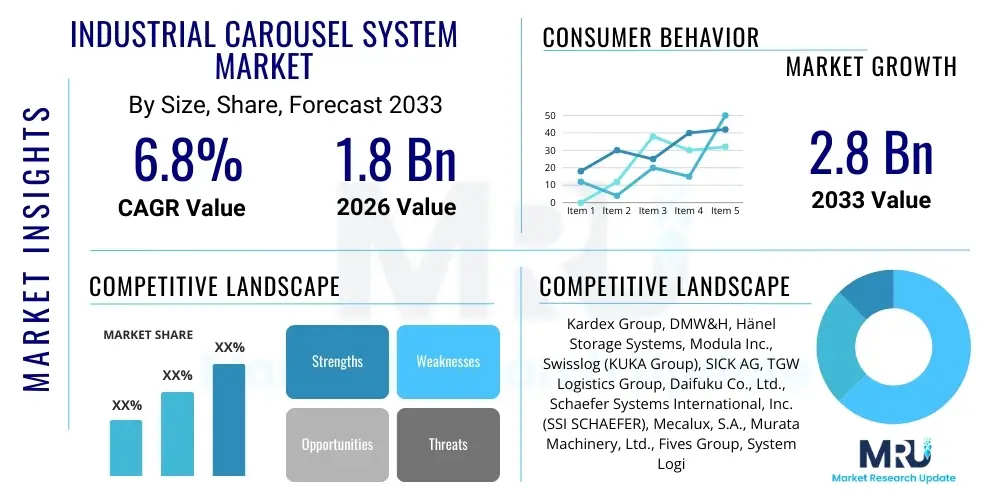

The Industrial Carousel System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

This substantial growth trajectory is underpinned by the accelerating global trend towards warehouse automation and optimization of intralogistics processes across diverse industries, particularly e-commerce, automotive, and pharmaceuticals. Industrial carousel systems, including horizontal and vertical configurations, are recognized as essential tools for maximizing storage density and improving retrieval speed, directly addressing the complexities introduced by high SKU counts and just-in-time inventory demands.

The increasing investment in automated material handling equipment, driven by rising labor costs and the need for enhanced workplace safety, further fuels market expansion. Emerging economies, especially in the Asia Pacific region, are witnessing rapid industrialization and modernization of logistics infrastructure, positioning them as key growth hubs for the adoption of efficient storage and retrieval systems like industrial carousels. Manufacturers are focusing on integrating advanced technologies, such as IoT sensors and sophisticated inventory management software, to enhance the performance and predictive maintenance capabilities of these systems, solidifying their role in modern supply chains.

Industrial Carousel System Market introduction

The Industrial Carousel System Market encompasses a range of automated storage and retrieval systems designed to efficiently handle, store, and retrieve items within industrial and commercial environments. These systems operate on the "goods-to-person" principle, drastically reducing manual travel time and enhancing picking accuracy and speed. Products within this market segment primarily include vertical carousels, which leverage vertical space to minimize floor footprint, and horizontal carousels, which function similarly to a rotating racetrack for bins or carriers. Major applications span inventory management, tool storage, order fulfillment, and buffer storage across sectors such as manufacturing, distribution, retail, and healthcare. The inherent benefits—including high-density storage, improved operational throughput, enhanced security for valuable items, and better ergonomic conditions for workers—are key drivers fueling the widespread adoption of these solutions globally. The market's growth is fundamentally driven by the continuous pressure on businesses to optimize supply chain efficiency and respond flexibly to fluctuating market demands.

Industrial carousel systems represent a critical component of modern intralogistics infrastructure, serving as a foundational element for achieving Industry 4.0 standards in material handling. These systems are specifically engineered to interface seamlessly with Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) platforms, facilitating real-time inventory tracking and dynamic slotting optimization. The sophisticated mechanics and control systems embedded within contemporary carousels allow for precise positioning and retrieval, minimizing errors associated with manual picking processes. Furthermore, their modular design permits scalability and customization to fit various facility layouts and capacity requirements, making them a versatile investment for companies ranging from small-to-medium enterprises (SMEs) to large multinational corporations.

The driving factors behind market dynamism include the explosive growth of e-commerce, which mandates faster and more accurate order fulfillment capabilities, and the necessity for manufacturing facilities to manage complex component inventories efficiently. Regulatory pressures regarding workplace safety and the increasing cost disparity between automated solutions and manual labor also accelerate adoption. As industries continue to focus on lean manufacturing and waste reduction, the ability of carousel systems to consolidate inventory and reduce search time provides compelling economic justification for capital expenditure. The evolution toward lighter, more energy-efficient models equipped with predictive diagnostics further strengthens their appeal in an increasingly sustainability-conscious business environment.

Industrial Carousel System Market Executive Summary

The Industrial Carousel System Market is experiencing robust expansion, characterized by a fundamental shift toward automated, data-driven storage solutions. Business trends indicate a strong prioritization of vertical storage configurations (vertical carousels) due to their superior space utilization capabilities, particularly in densely populated urban logistics centers where real estate costs are prohibitive. Technology integration, specifically the incorporation of IoT connectivity, advanced sensor arrays, and sophisticated control software, is defining the competitive landscape, pushing manufacturers to offer highly customized and integrated systems. The core business objective driving current procurement decisions is maximizing throughput rates while maintaining high inventory accuracy, directly correlating with investment in high-speed and tandem carousel operations.

Regionally, the market demonstrates significant variance in maturity and growth drivers. North America and Europe currently dominate the market share, primarily due to high levels of automation across automotive, aerospace, and pharmaceutical manufacturing sectors, coupled with established infrastructure for technology adoption. However, the Asia Pacific region is projected to register the highest CAGR, spurred by rapid development in logistics infrastructure, burgeoning e-commerce markets, and increasing adoption of automation technologies in countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa are emerging markets, showing gradual but steady growth, primarily driven by investments in modernizing port logistics and establishing robust cold chain facilities.

Segment trends highlight the dominance of the vertical carousel segment in terms of revenue, reflecting the universal need for space optimization. In terms of application, the order fulfillment and warehousing segment continues to hold the largest share, directly influenced by e-commerce demands for micro-fulfillment centers and decentralized inventory locations. The trend towards integrating these systems with specialized robotic components, such as automatic unloaders and sorters, signifies the ongoing evolution from simple storage solutions to fully integrated material flow systems. Furthermore, the rising demand for specialty carousels designed for cold storage or highly secure environments (e.g., narcotics or high-value electronics) is creating lucrative niche opportunities within the broader market.

AI Impact Analysis on Industrial Carousel System Market

User queries regarding AI's influence on the Industrial Carousel System Market predominantly focus on how intelligent automation can move beyond simple mechanical movement to cognitive inventory management. Key themes include the implementation of predictive maintenance (minimizing downtime), dynamic inventory slotting (optimizing picking paths in real-time based on demand forecasts), and the integration of machine learning algorithms to enhance picker productivity and accuracy. Users are concerned about the complexity and cost of retrofitting existing carousel infrastructure with AI capabilities, yet they expect significant operational gains, particularly in mitigating supply chain disruptions and improving labor efficiency through data-driven task allocation. The expectation is that AI will transform carousels from static storage units into proactive, self-optimizing intralogistics assets.

The integration of Artificial Intelligence (AI) algorithms into the control systems of industrial carousels promises a paradigm shift in operational efficiency. AI enables predictive analytics for components such as motors, bearings, and chains, forecasting potential failure points long before mechanical breakdown occurs. This capability allows maintenance teams to schedule interventions optimally, significantly reducing unplanned downtime and enhancing overall equipment effectiveness (OEE). Furthermore, AI-driven demand forecasting directly impacts the carousel's operational strategy by dynamically adjusting the internal organization of inventory. High-velocity items can be automatically repositioned to the most accessible locations, minimizing retrieval cycle times and maximizing throughput during peak operational hours.

Beyond maintenance and inventory placement, AI plays a crucial role in optimizing the human-machine interface. Machine learning models analyze picker behavior and carousel operational data to develop personalized training protocols and optimize the sequence of tasks presented to human operators. This minimizes cognitive load and reduces picking errors. The continuous feedback loop provided by AI ensures that the carousel system adapts constantly to changing inventory profiles, order volumes, and labor availability, ensuring maximum system utilization and adaptability in volatile market conditions. This cognitive layer transforms the industrial carousel from a piece of hardware into an intelligent, adaptive component of the overarching supply chain network.

- AI-driven predictive maintenance reducing unplanned downtime by up to 30%.

- Machine learning algorithms optimizing dynamic inventory slotting based on real-time order velocity.

- Enhanced picker efficiency and error reduction through AI-guided task allocation and sequencing.

- Integration of computer vision and AI for automated quality control and verification during retrieval processes.

- Optimization of energy consumption through intelligent cycle scheduling and demand-based speed adjustments.

DRO & Impact Forces Of Industrial Carousel System Market

The Industrial Carousel System Market is shaped by powerful Driving forces (D) focused on efficiency and cost reduction, balanced against significant Restraints (R) related to capital expenditure and complexity, while substantial Opportunities (O) exist in technological innovation and market expansion. The dominant impact force is the necessity for streamlined supply chains, driven by relentless consumer demands for rapid delivery, which fundamentally necessitates the high-speed, accurate retrieval capabilities offered by carousel systems. The impact forces collectively push the market towards greater automation density and software sophistication, prioritizing systems that offer demonstrable return on investment (ROI) within competitive operational timelines.

Key drivers include the global expansion of e-commerce necessitating robust, scalable fulfillment centers, and the growing complexity of SKU management across sectors, particularly in pharmaceuticals and automotive spare parts. Furthermore, labor shortages and the rising cost of manual labor in developed economies are compelling businesses to substitute human effort with automated material handling systems. Technological advancements, such as the miniaturization of components and the increased energy efficiency of modern systems, also contribute positively to adoption rates, making these solutions more financially viable for a broader range of organizations. These drivers establish a strong, non-negotiable requirement for fast, space-saving inventory solutions.

Conversely, significant restraints hinder market growth. The high initial capital investment required for implementing industrial carousel systems, especially when integrating them into legacy infrastructure, represents a major barrier for small and medium-sized enterprises (SMEs). Operational complexity, including the requirement for specialized technical staff for maintenance and programming, can also deter adoption. Furthermore, the inherent limitation of carousel systems regarding handling extremely large or irregularly shaped items restricts their universality. Opportunities abound in developing modular, plug-and-play systems that reduce installation complexity, offering flexible financing options (e.g., equipment-as-a-service), and targeting untapped geographic markets, particularly within emerging logistics hubs focused on modernizing cold chain and micro-fulfillment capabilities.

Segmentation Analysis

The Industrial Carousel System Market is comprehensively segmented based on Type, Operation, End-User Industry, and Geographic Region, providing a detailed view of market dynamics and targeted adoption patterns. The segmentation by Type, specifically differentiating between Vertical and Horizontal Carousels, highlights the core mechanical approaches to high-density storage, with Vertical systems typically favored where floor space is scarce. Operational segmentation (manual, semi-automated, fully automated) reflects the degree of integration with WMS and the reliance on human intervention, with the trend overwhelmingly favoring fully automated, integrated solutions for maximal efficiency.

Segmentation by End-User Industry reveals critical adoption hot spots, with sectors characterized by high inventory throughput and stringent compliance requirements leading the demand. The E-commerce & Retail sector utilizes carousels heavily for rapid order fulfillment, while the Automotive sector relies on them for precise management of spare parts and tools. The Pharmaceutical and Healthcare industries leverage these systems for secure, compliant storage and retrieval of medications and sensitive medical devices. This granular segmentation allows market players to tailor product features—such as temperature control, weight capacity, or cleanroom compatibility—to specific industry needs.

The continuous refinement of segmentation criteria, driven by technological evolution, emphasizes the shift towards specialized applications. For instance, the distinction between standard and customized systems is becoming crucial, as bespoke solutions are increasingly necessary for integrating carousels into complex, multi-modal automated facilities, often featuring integration with Automated Guided Vehicles (AGVs) or specialized sorting equipment. Understanding these nuances is vital for accurate market forecasting and strategic planning across the value chain.

- By Type:

- Vertical Carousel Modules (VCM)

- Horizontal Carousel Modules (HCM)

- Specialty Carousels (e.g., Tire Carousels, Refrigerated Carousels)

- By Operation:

- Semi-Automated Systems

- Fully Automated Systems

- By End-User Industry:

- Automotive & Transportation

- E-commerce & Retail

- Manufacturing (General and Heavy)

- Pharmaceutical & Healthcare

- Food & Beverage (including Cold Storage)

- Aerospace & Defense

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Industrial Carousel System Market

The value chain for the Industrial Carousel System Market begins with Upstream activities encompassing the sourcing and processing of raw materials, primarily steel, specialized plastics, motors, and sophisticated electronic components for control systems. Key upstream players include manufacturers of precision bearings, industrial automation software developers, and specialized motor providers. Quality and reliability at this stage are paramount, as the durability and operational lifespan of the carousel system are heavily dependent on the quality of its foundational mechanical and electrical components. Strong relationships with reliable component suppliers capable of meeting stringent industrial standards are crucial for maintaining manufacturing throughput and product quality.

Midstream activities involve the core manufacturing, assembly, and integration of the carousel systems. This phase includes precision engineering of the vertical or horizontal framework, assembly of the rotating carriers, installation of the drive mechanisms, and integration of the specialized control systems and software interfaces. Direct distribution channels often involve the system manufacturers selling directly to large corporate clients or integrators, while indirect distribution relies on a network of authorized dealers, logistics consultants, and certified third-party integrators who provide regional sales support, installation, and after-sales services. The selection of distribution channel often depends on the complexity of the project, with highly customized, large-scale installations typically requiring direct manufacturer involvement.

Downstream activities focus on installation, commissioning, software integration with existing customer WMS/ERP systems, and ongoing maintenance and support. This stage is critical for customer satisfaction and long-term revenue generation through service contracts. After-sales support, including spare parts supply, preventative maintenance scheduling, and software updates, constitutes a significant portion of the total value delivered. The seamless integration of the carousel system into the client's material flow architecture is the ultimate measure of success, making the role of specialized systems integrators who possess deep domain knowledge indispensable in the downstream segment.

Industrial Carousel System Market Potential Customers

Potential customers for Industrial Carousel Systems are diverse, primarily comprising end-user organizations that require high-density storage, rapid retrieval of inventory, and enhanced picking accuracy to support their operational model. The primary buyers (End-Users) are typically logistics managers, warehouse operators, supply chain executives, and production supervisors in industries characterized by high SKU volumes, fluctuating demand cycles, and significant reliance on efficient parts or product management. This includes large-scale distribution centers and e-commerce fulfillment hubs seeking to maximize throughput in limited spaces, as well as specialized manufacturing environments requiring precision tool crib management and secure component storage.

In the manufacturing sector, key customers include automotive Tier 1 suppliers, aerospace maintenance facilities, and electronics manufacturers, where rapid access to specific small parts, tools, or high-value components is essential for minimizing assembly line downtime. For the healthcare sector, potential buyers are hospitals, pharmaceutical distributors, and centralized laboratories, which require highly secure, temperature-controlled, and auditable storage systems for medications, surgical supplies, and biological samples. The core motivation for these customers is achieving compliance, optimizing labor utilization, and ensuring inventory accountability, often justifying the significant upfront investment through documented reductions in operational expenses and error rates.

Emerging buyers include organizations focusing on micro-fulfillment strategies in urban centers, such as grocery delivery services and dark stores, where space optimization is the paramount concern. Additionally, companies specializing in maintenance, repair, and overhaul (MRO) services are substantial customers, needing efficient systems to manage vast catalogs of low-velocity spare parts. The decision-making unit often involves a cross-functional team including IT specialists (for integration), finance executives (for ROI analysis), and operations leaders, emphasizing the need for vendors to present solutions that address both technical performance and financial viability comprehensively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kardex Group, DMW&H, Hänel Storage Systems, Modula Inc., Swisslog (KUKA Group), SICK AG, TGW Logistics Group, Daifuku Co., Ltd., Schaefer Systems International, Inc. (SSI SCHAEFER), Mecalux, S.A., Murata Machinery, Ltd., Fives Group, System Logistics SpA, Beumer Group, Integrated Systems Design (ISD), AS/RS Specialists, LLC, Viastore Systems GmbH, Dematic (KION Group), AutoCrib, Inc., Fastenal Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Carousel System Market Key Technology Landscape

The technological landscape of the Industrial Carousel System Market is rapidly evolving, driven by the principles of Industry 4.0 and the pursuit of fully interconnected, intelligent warehouses. Fundamental advancements focus on control software sophistication, enabling seamless integration with WMS, MES (Manufacturing Execution Systems), and ERP systems. Modern carousels utilize highly efficient servo motors and variable frequency drives (VFDs) to ensure smooth, rapid, and energy-efficient rotation and positioning. Precision laser or photoelectric sensors are now standard, ensuring the accurate identification and verification of inventory items and carrier positions, minimizing the risk of picking errors and mechanical misalignment.

A major technological frontier is the adoption of IoT (Internet of Things) connectivity, allowing carousel systems to transmit real-time operational data, status reports, and diagnostics remotely. This connectivity is essential for enabling predictive maintenance schedules, where sensors monitor temperature, vibration, and energy consumption patterns to anticipate component failure before it occurs. Furthermore, advanced Human-Machine Interface (HMI) systems featuring high-resolution touchscreens and intuitive graphical user interfaces enhance operator training and operational feedback, often integrating light-directed picking (pick-to-light) technology to ensure high accuracy and speed, a critical factor in e-commerce fulfillment.

The continuous improvement in mechanical design focuses on modularity and robustness, facilitating easier installation, expansion, and maintenance. Many manufacturers are also incorporating specialized technology for unique requirements, such as controlled atmosphere enclosures for moisture or temperature-sensitive goods (cold storage carousels), or high-security locking mechanisms for valuable items. Robotics integration is also gaining traction, particularly at the interface where robotic arms or conveyors automatically load or unload carriers, further automating the goods-to-person process and extending operational autonomy beyond the core carousel movement.

Regional Highlights

Regional dynamics play a crucial role in the Industrial Carousel System Market, reflecting varied levels of industrial automation maturity and logistical infrastructure development across the globe. North America remains a dominant force, characterized by high labor costs and the presence of massive e-commerce and retail distribution networks that require continuous investment in high-throughput automation solutions. The region's market is highly receptive to cutting-edge technologies, including AI integration and sophisticated WMS interfacing, driven by large capital expenditure from major logistics firms and manufacturing giants seeking competitive advantages in speed and accuracy. The focus in North America is generally on maximizing vertical space utilization and minimizing dependence on manual processes.

Europe demonstrates a strong and steady growth trajectory, particularly in Western European nations like Germany, the UK, and France. This growth is underpinned by stringent regulatory standards (e.g., in pharmaceuticals and automotive manufacturing) and a historical commitment to precision engineering and quality control. European demand is characterized by a strong preference for durable, energy-efficient, and highly customizable systems that integrate seamlessly with lean manufacturing principles. Eastern Europe is emerging as a significant growth area as companies establish new production and logistics hubs to serve the broader European market, driving initial investments in basic and semi-automated carousel systems.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive urbanization, rapidly expanding domestic e-commerce markets (especially in China and India), and governmental initiatives promoting smart manufacturing and logistics modernization. While cost sensitivity remains a factor, the sheer scale of manufacturing and distribution operations in countries like China mandates the adoption of high-density storage solutions. Investment in cold chain logistics for food and pharmaceuticals is also a powerful regional driver. Latin America and the Middle East & Africa (MEA) are developing markets, where growth is currently concentrated in port logistics, large-scale mining operations (for parts storage), and emerging pharmaceutical supply chains, though often constrained by infrastructure challenges and economic volatility.

- North America (U.S., Canada): Focus on AI integration, rapid e-commerce fulfillment, and advanced vertical storage solutions due to high real estate costs.

- Europe (Germany, UK, France): Emphasis on energy efficiency, lean manufacturing compatibility, and compliance-driven storage (e.g., pharmaceutical traceability).

- Asia Pacific (China, India, Japan): Highest growth potential driven by explosive e-commerce expansion, manufacturing base scale-up, and investment in modern logistics infrastructure.

- Latin America & MEA: Emerging markets with targeted growth in port logistics, resource management (mining), and initial modernization of local distribution centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Carousel System Market.- Kardex Group

- Hänel Storage Systems

- Modula Inc.

- Daifuku Co., Ltd.

- SSI SCHAEFER (Schaefer Systems International, Inc.)

- TGW Logistics Group

- Swisslog (KUKA Group)

- Mecalux, S.A.

- Murata Machinery, Ltd.

- Dematic (KION Group)

- System Logistics SpA

- Fives Group

- Beumer Group

- DMW&H

- Integrated Systems Design (ISD)

- Viastore Systems GmbH

- SICK AG (Sensor Technology Provider)

- Interlake Mecalux

- AutoCrib, Inc.

- Fastenal Company

Frequently Asked Questions

Analyze common user questions about the Industrial Carousel System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a vertical carousel and a vertical lift module (VLM)?

The primary difference lies in their mechanical operation. A vertical carousel rotates carriers in a vertical loop to bring the required item to the operator (rotary technology). A Vertical Lift Module (VLM) uses an inserter/extractor mechanism to retrieve and place trays into vertical storage shelves dynamically (shuttle technology). Carousels are typically faster for high-throughput, homogeneous inventory, while VLMs offer greater flexibility in storing items of varying heights.

How do industrial carousel systems improve return on investment (ROI)?

ROI is typically improved through three main factors: significantly increased storage density (up to 80% space savings), dramatically enhanced labor efficiency by implementing the goods-to-person principle (reducing manual travel time), and reduction in inventory errors and obsolescence through integrated software and accurate counting capabilities. The reduction in picking time per line item is a critical driver for justifying capital expenditure.

Are industrial carousels suitable for managing temperature-sensitive inventory like pharmaceuticals?

Yes, specialized industrial carousels, known as refrigerated or cold storage carousels, are specifically engineered with insulated enclosures and temperature control systems to maintain precise conditions. These systems are widely utilized in pharmaceutical, biotech, and food distribution sectors to store temperature-sensitive goods securely while maintaining high-speed retrieval capabilities compliant with regulatory requirements.

What are the key integration challenges when implementing a new carousel system?

The main challenges involve seamless integration of the carousel control software with the customer’s existing Warehouse Management System (WMS) and Enterprise Resource Planning (ERP) platform. Other challenges include ensuring adequate structural support for vertical systems, optimizing data mapping for accurate inventory synchronization, and providing sufficient training for operators and maintenance staff on the new automated equipment.

Which industries are driving the fastest adoption rates for vertical carousel systems?

The e-commerce and retail fulfillment sectors are currently driving the fastest adoption rates, necessitated by the need for micro-fulfillment centers and high-speed, accurate order picking in limited urban spaces. Additionally, the pharmaceutical and electronics manufacturing sectors are exhibiting strong growth due to requirements for high security, precise inventory tracking, and component protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager