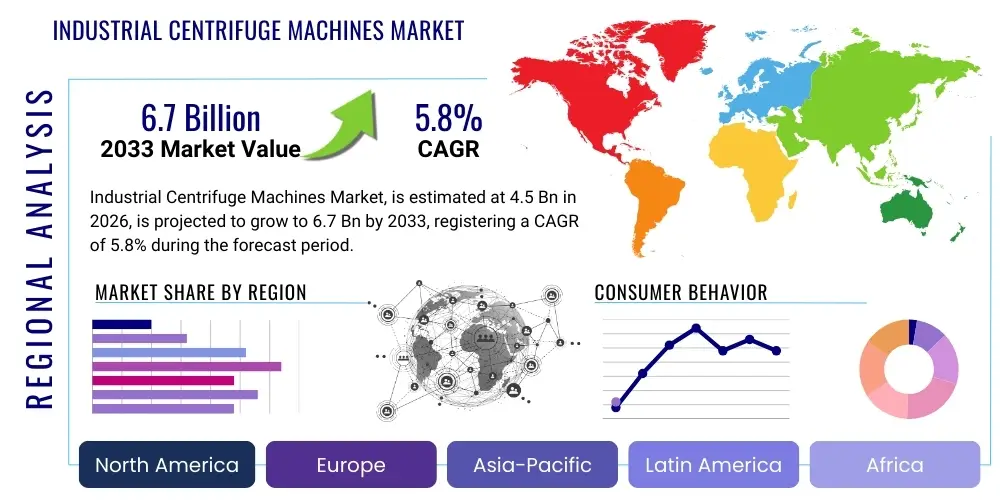

Industrial Centrifuge Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441555 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Centrifuge Machines Market Size

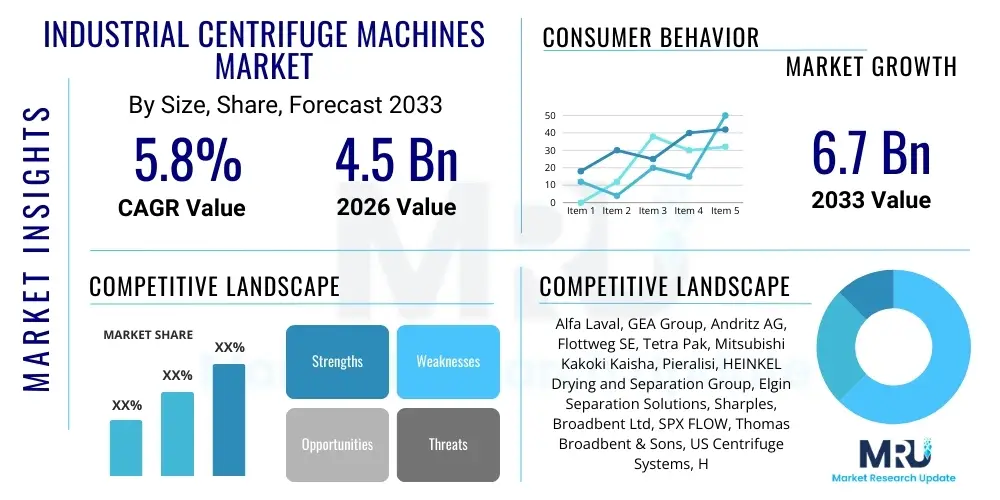

The Industrial Centrifuge Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by escalating global demands for effective liquid-solid separation in high-growth industries such as pharmaceuticals, biotechnology, and water treatment, coupled with increasingly stringent environmental regulations mandating higher purity standards in industrial effluents.

Industrial Centrifuge Machines Market introduction

Industrial Centrifuge Machines are critical mechanical separation devices utilized across a vast array of manufacturing and processing sectors to separate components of varying densities from liquid mixtures, primarily through the application of centrifugal force. These machines are engineered for continuous, high-throughput operations, providing superior efficiency compared to traditional gravity settling methods. The fundamental product description encompasses various types, including decanter centrifuges used extensively for dewatering sludges, separator centrifuges vital for clarifying liquids, and filter centrifuges utilized for extracting solids from slurries in a filtration process.

Major applications of industrial centrifuges span critical infrastructural and manufacturing processes, including municipal and industrial wastewater treatment, where they are indispensable for sludge thickening and dewatering. In the chemical processing industry, centrifuges facilitate catalyst recovery and solvent extraction. Furthermore, the burgeoning pharmaceutical and biotechnology sectors rely heavily on high-speed centrifuges for cell harvesting, protein fractionation, and vaccine production, necessitating machines that meet stringent hygienic and sterile design standards. The benefits of deploying these machines include significantly reduced processing times, enhanced product purity, lower operational costs through continuous processing capabilities, and minimized environmental footprint due to efficient waste handling.

Driving factors fueling market expansion include rapid global industrialization, especially in the Asia-Pacific region, leading to increased demand for separation technology in new manufacturing facilities. The necessity for resource efficiency, such as oil recovery from drilling muds or valuable product extraction from fermentation broths, further accelerates adoption. Moreover, regulatory frameworks concerning pollution control (e.g., limits on Total Suspended Solids - TSS in discharged water) compel industries to invest in high-performance separation technologies like modern industrial centrifuges, ensuring sustained market impetus throughout the forecast period.

Industrial Centrifuge Machines Market Executive Summary

The Industrial Centrifuge Machines Market trajectory is characterized by a strong emphasis on automation, energy efficiency, and customization tailored for specific process requirements. Business trends indicate a shift toward sophisticated sensor technology integration (Industry 4.0 compatibility) to enable predictive maintenance and real-time process optimization, reducing downtime and improving overall yield. The competitive landscape is intensely focused on technological differentiation, particularly in developing hybrid separation technologies combining centrifugation with membrane filtration or advanced flocculation techniques to handle complex or fine-particle mixtures more effectively, thereby securing long-term contracts in specialized, high-value segments like pharmaceuticals and food safety.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure investment, rapid urbanization, and corresponding growth in water treatment projects and chemical manufacturing capacity, particularly in China and India. North America and Europe, while mature, remain dominant markets due to stringent regulatory environments requiring continuous upgrades to advanced separation equipment, strong penetration of the biotechnology sector, and high adoption rates of automated and energy-efficient centrifuge models. These regions focus heavily on lifecycle cost reduction and compliance with exacting hygiene standards, driving demand for premium, highly durable stainless steel centrifuges.

Segment trends underscore the dominance of decanter centrifuges by value, owing to their versatility in handling high solid loads across diverse industries including wastewater and mining. However, the separator centrifuge segment, specifically disc stack centrifuges, is experiencing rapid growth driven by precision separation requirements in biotech and dairy processing, where high clarity and separation efficiency are paramount. Application-wise, the pharmaceutical and biotechnology segment is projected to exhibit the highest CAGR, propelled by expanding biosimilars production and increased R&D spending focused on bioprocessing technologies, demanding sterile and scalable separation solutions capable of handling sensitive biological materials without denaturation.

AI Impact Analysis on Industrial Centrifuge Machines Market

Common user questions regarding AI’s impact on industrial centrifuges center around predictive maintenance capabilities, optimization of operational parameters (e.g., bowl speed, differential speed, feed rate), and the automation of complex solid-liquid separation recipes. Users frequently inquire about how AI can minimize energy consumption, detect incipient mechanical failures before catastrophic events occur, and automatically adjust separation settings based on real-time inlet slurry variations (consistency, temperature, pH). The central concern is leveraging AI and machine learning (ML) to transform reactive maintenance into predictive servicing and to ensure sustained peak performance, thereby enhancing throughput and reducing human intervention, especially in hazardous or remote operational environments. Expectations include AI-driven algorithms capable of modeling complex separation dynamics to achieve optimal product quality consistently.

- AI enables predictive maintenance, drastically reducing unexpected downtime by analyzing vibration, temperature, and current consumption patterns.

- Machine learning algorithms optimize centrifuge operation parameters (speed, torque, feed rate) in real-time, maximizing separation efficiency and energy usage based on feed characteristics.

- Automated fault diagnosis through AI systems shortens repair cycles and improves technician efficiency by pinpointing exact component failure locations.

- AI facilitates process modeling and simulation, allowing operators to predict separation outcomes under various operational scenarios (Digital Twins).

- Enhances product quality consistency by using computer vision and ML to monitor and adjust output clarity and dryness automatically.

- Optimized inventory management for critical spare parts based on AI-predicted component lifespan and usage profiles.

DRO & Impact Forces Of Industrial Centrifuge Machines Market

The market is significantly driven by robust industrialization in emerging economies and the imperative for sustainable resource management, which necessitates advanced separation technologies for water recycling, waste minimization, and valuable product recovery. Restraints include the high initial capital investment required for procurement and installation of industrial-grade centrifuges, particularly specialized models compliant with FDA or ATEX standards, alongside the complexity of maintenance and operation which demands highly skilled technical personnel. Opportunities are largely centered on integrating Industry 4.0 technologies, expanding applications in the rapidly growing biopharmaceuticals sector, and developing highly modular, portable, and energy-efficient machines that cater to decentralized processing needs, addressing the stringent cost and space constraints prevalent in specific market niches.

Impact forces currently shaping the competitive environment include the intense pressure from regulatory bodies globally to achieve near-zero liquid discharge (ZLD) and higher sludge dryness, compelling industries to adopt superior dewatering centrifuges. Technological innovation acts as a major force, pushing manufacturers toward lighter, more durable materials, enhanced automation systems, and remote monitoring capabilities to reduce operational expenditure (OPEX). Furthermore, macroeconomic factors, such as fluctuating raw material costs (especially stainless steel), directly impact manufacturing costs and pricing strategies, thereby influencing market accessibility and supplier viability within the global industrial machinery ecosystem.

The cumulative effect of these forces suggests a market leaning towards high-efficiency, application-specific solutions. While capital expenditure remains a hurdle, the long-term operational savings associated with continuous, automated processing and superior separation performance often justify the investment, especially in high-value production environments like biotech or specialty chemicals. The market structure is shifting from generic separation solutions to precision engineering, where the selection of the correct centrifuge type, bowl geometry, and control system is paramount to achieving desired process outcomes, thereby increasing the technical sales complexity and reinforcing the role of established, technically proficient market leaders.

Segmentation Analysis

The Industrial Centrifuge Machines Market is segmented based on critical technical and application parameters, providing a detailed view of demand drivers across various industrial verticals. Key segmentation criteria include Centrifuge Type (Decanter, Separator, Filter), Operation Mode (Batch, Continuous), Design (Horizontal, Vertical), and Application (Wastewater, Chemical, Pharma/Biotech, F&B, Oil & Gas, Mining). This structure allows for a comprehensive analysis of where technological innovation is focused and which end-user sectors exhibit the highest current and projected demand. The continuous operation segment dominates due to the efficiency required by large-scale production facilities, while the growth rate is highest in segments serving highly regulated industries requiring ultra-clean separation, like pharmaceutical disc stack centrifuges.

- By Centrifuge Type:

- Decanter Centrifuges (Two-Phase, Three-Phase)

- Separator Centrifuges (Disc Stack, Tubular Bowl)

- Filter Centrifuges (Peeler, Push-Type, Basket)

- Solid-Bowl Centrifuges

- By Operation Mode:

- Continuous

- Batch

- By Design:

- Horizontal

- Vertical

- By Application:

- Water and Wastewater Treatment

- Chemical Processing

- Pharmaceutical and Biotechnology

- Food and Beverage (Dairy, Brewing, Oils)

- Oil and Gas (Drilling Mud, Oil Sludge)

- Mining and Metallurgy

- Other Industrial Applications

Value Chain Analysis For Industrial Centrifuge Machines Market

The value chain for industrial centrifuge machines begins with upstream analysis involving critical raw material procurement, dominated by high-grade stainless steel, specialized alloys for high-stress components (bowls and shafts), and advanced polymer composites. Key upstream activities also include the highly specialized manufacturing of high-speed bearings, robust motors, and sophisticated control systems (PLCs). The competitive advantage at this stage often lies in securing reliable supply chains for certified materials that meet international standards for corrosion resistance and structural integrity, especially crucial for machines handling aggressive chemicals or operating under high G-forces and temperature variations, thereby dictating base manufacturing costs and machine lifespan.

The midstream phase encompasses the core manufacturing process, involving precision machining, balancing (critical for high-speed rotors), assembly, and rigorous quality control testing (e.g., dynamic balancing, pressure testing, and hydrostatic testing). Major Original Equipment Manufacturers (OEMs) primarily focus on proprietary separation technologies, bowl geometry optimization, and developing advanced process control software that differentiates their product lines. This phase involves significant R&D investment aimed at enhancing energy efficiency, noise reduction, and developing self-cleaning mechanisms, which are essential factors driving end-user purchasing decisions and mitigating lifecycle costs associated with complex mechanical systems.

Downstream analysis covers the distribution channels, which are segmented into direct sales, utilized for large, custom-engineered projects (especially in oil & gas or large municipal wastewater plants), and indirect sales via authorized distributors or specialized system integrators for standardized or smaller units. Aftermarket services—including installation, commissioning, maintenance contracts, spare parts supply, and retrofitting—constitute a vital revenue stream and customer retention strategy for OEMs. The efficiency of the distribution network and the responsiveness of the service organization are critical differentiators, ensuring prompt support and minimizing production interruptions for end-users relying on continuous operation.

Industrial Centrifuge Machines Market Potential Customers

The primary potential customers and end-users of industrial centrifuge machines are diverse, spanning major industrial sectors requiring critical solid-liquid or liquid-liquid separation processes at scale. These buyers fall into categories ranging from large multinational corporations operating chemical plants and refineries to municipal authorities managing urban wastewater facilities, and highly specialized entities within the biopharmaceutical and nutraceutical industries. Purchasing decisions are typically driven by process efficiency demands, regulatory compliance needs, throughput requirements, and the necessity for minimal product loss or maximum dewatering capability.

Specific high-value customer segments include pharmaceutical companies and Contract Manufacturing Organizations (CMOs) engaged in fermentation and cell culture harvesting, who require centrifuges with high-G force capabilities and sterile, clean-in-place (CIP)/sterilize-in-place (SIP) designs. Furthermore, large food and beverage manufacturers, particularly in dairy, brewing, and vegetable oil processing, represent continuous consumers, seeking hygienic disc stack centrifuges for clarification and standardization processes. Municipal water treatment utilities represent stable, large-volume buyers, consistently requiring heavy-duty decanter centrifuges for sludge dewatering to reduce disposal volumes and costs associated with transporting wet solids.

The buying process often involves complex technical specifications, long lead times, and multiple stakeholder approval (engineering, procurement, and operations departments). Customers evaluate OEMs based on established reliability, global service footprint, energy efficiency ratings, and the total cost of ownership (TCO). Emerging markets in Southeast Asia and Latin America increasingly prioritize cost-effective, robust, and easily maintainable machines, while developed markets focus on advanced automation and integration capabilities consistent with Industry 4.0 standards, ensuring potential customers are segmented not just by industry but also by their level of technological adoption maturity and regulatory scrutiny.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfa Laval, GEA Group, Andritz AG, Flottweg SE, Tetra Pak, Mitsubishi Kakoki Kaisha, Pieralisi, HEINKEL Drying and Separation Group, Elgin Separation Solutions, Sharples, Broadbent Ltd, SPX FLOW, Thomas Broadbent & Sons, US Centrifuge Systems, Hiller GmbH, TEMA Systems, Centrimax, Wesfalia Separator, US Filter, Rousselet Robatel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Centrifuge Machines Market Key Technology Landscape

The industrial centrifuge technology landscape is continuously evolving, focusing on optimizing separation physics and integrating digital controls to enhance operational metrics. A significant technological advancement involves the design of high-G force rotors and bowls, utilizing advanced metallurgical processes and stress analysis to operate safely at higher speeds, which is critical for separating fine or colloidal particles efficiently, particularly in nanotechnology and biological research applications. Furthermore, the development of specialized abrasion-resistant materials, such as ceramic inserts and tungsten carbide tiles, is crucial for extending the lifespan of decanter centrifuges used in highly abrasive applications like mining slurries and abrasive chemical processing environments, directly reducing maintenance frequency and overall TCO.

Automation and control systems represent another pivotal area of technological focus. Modern industrial centrifuges incorporate advanced Programmable Logic Controllers (PLCs) and Variable Frequency Drives (VFDs) that allow operators precise control over key separation parameters, including bowl speed, differential speed, and torque monitoring. This enables the machine to dynamically adjust to changing feed conditions, optimizing solid dryness and liquid clarity automatically. Emerging technologies include the implementation of self-cleaning systems (Clean-In-Place, CIP) in disc stack and filter centrifuges, which minimize manual intervention, drastically reduce turnaround time between batches, and meet stringent hygiene standards required by the food, beverage, and pharmaceutical industries.

Digitalization, epitomized by the Industrial Internet of Things (IIoT) and cloud connectivity, is transforming how centrifuges are monitored and maintained. New machines often come equipped with embedded sensors that transmit real-time data regarding vibration levels, bearing temperatures, motor load, and process variables to remote diagnostic centers. This enables predictive maintenance scheduling, remote troubleshooting, and performance benchmarking across multiple installed units globally, ensuring operational continuity and maximizing asset utilization. Manufacturers are also increasingly focusing on modular design concepts, allowing for easier scalability, faster installation, and greater flexibility for end-users to adapt their separation processes without replacing the entire unit.

Regional Highlights

The geographical analysis reveals significant disparities in market maturity and growth dynamics, primarily segmented across North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). North America and Europe possess highly mature markets characterized by sophisticated infrastructure, stringent environmental legislation, and high penetration of high-specification equipment, particularly in the biotechnology and high-value chemical sectors. The demand in these regions is driven by replacement cycles, upgrades to energy-efficient models, and the expanding need for separation technologies compliant with updated regulatory mandates concerning wastewater quality and product traceability.

The Asia Pacific region stands out as the primary growth engine for the Industrial Centrifuge Machines Market. Rapid industrialization, substantial investments in water treatment infrastructure to support growing populations, and the aggressive expansion of the chemical and pharmaceutical manufacturing base in countries like China, India, and South Korea, are collectively fueling unprecedented demand. APAC manufacturers frequently prioritize cost-effectiveness and robustness, though there is a fast-growing segment willing to invest in advanced, automated centrifuges to meet increasingly complex export standards and domestic environmental targets.

Latin America and MEA represent emerging markets with considerable untapped potential. In Latin America, growth is spurred by the modernization of mining operations and increased activity in the food and beverage industry. The Middle East and Africa market is heavily influenced by the oil and gas sector, particularly the requirement for dewatering drilling muds and managing refinery sludge. However, infrastructure constraints and dependence on fluctuating commodity prices can sometimes restrain growth in capital expenditure for large machinery, necessitating a focus on reliable and geographically supported maintenance services by international OEMs.

- North America: Market maturity, strong regulatory compliance, high adoption of automation, dominant in bioprocessing and specialty chemicals.

- Europe: Leading region for environmental technology adoption (wastewater), emphasis on energy efficiency, strong presence of key OEMs and advanced R&D hubs.

- Asia Pacific (APAC): Fastest-growing region driven by industrial expansion, urbanization, large-scale infrastructure projects, and increasing adoption in water treatment and general manufacturing.

- Latin America: Growth tied to mining, oil & gas expansion, and localized food processing, favoring robust and maintainable equipment.

- Middle East and Africa (MEA): Demand primarily influenced by oil and gas operations (drilling and refining) and large-scale desalination projects, requiring specialized corrosion-resistant units.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Centrifuge Machines Market.- Alfa Laval

- GEA Group

- Andritz AG

- Flottweg SE

- Tetra Pak

- Mitsubishi Kakoki Kaisha

- Pieralisi

- HEINKEL Drying and Separation Group

- Elgin Separation Solutions

- Sharples

- Broadbent Ltd

- SPX FLOW

- Thomas Broadbent & Sons

- US Centrifuge Systems

- Hiller GmbH

- TEMA Systems

- Centrimax

- Wesfalia Separator

- US Filter

- Rousselet Robatel

Frequently Asked Questions

Analyze common user questions about the Industrial Centrifuge Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Industrial Centrifuge Machines Market?

The Industrial Centrifuge Machines Market is projected to grow at a robust CAGR of 5.8% between 2026 and 2033, driven by increasing industrial waste management needs and expansion of the biopharmaceutical sector globally.

Which centrifuge type dominates the market in terms of revenue?

Decanter Centrifuges currently dominate the market revenue share due to their high throughput capabilities and versatility in handling high solid loads, making them essential in wastewater treatment, chemical processing, and mining industries.

How is AI impacting the operational efficiency of industrial centrifuges?

AI integration facilitates advanced predictive maintenance and real-time operational optimization by analyzing vibration and performance data, significantly reducing machine downtime and maximizing separation efficiency across varying feed conditions.

Which geographical region exhibits the fastest growth potential for industrial centrifuges?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid industrialization, large-scale investments in municipal infrastructure, and escalating demand for efficient separation technologies in China and India.

What are the primary factors restraining market growth?

The key restraints include the high initial capital investment required for purchasing and installing sophisticated industrial centrifuges, coupled with the need for specialized, costly maintenance and high energy consumption rates associated with certain older models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager