Industrial Computed Tomography Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442651 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Computed Tomography Equipment Market Size

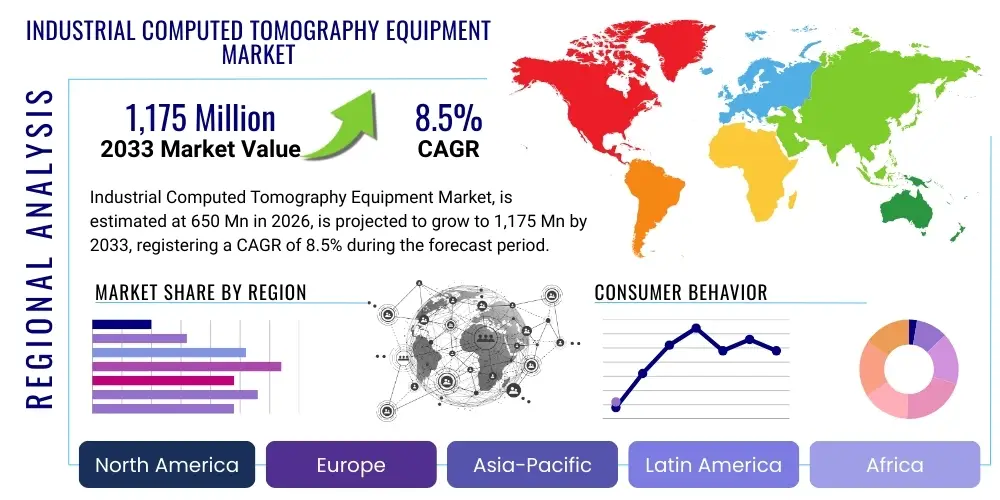

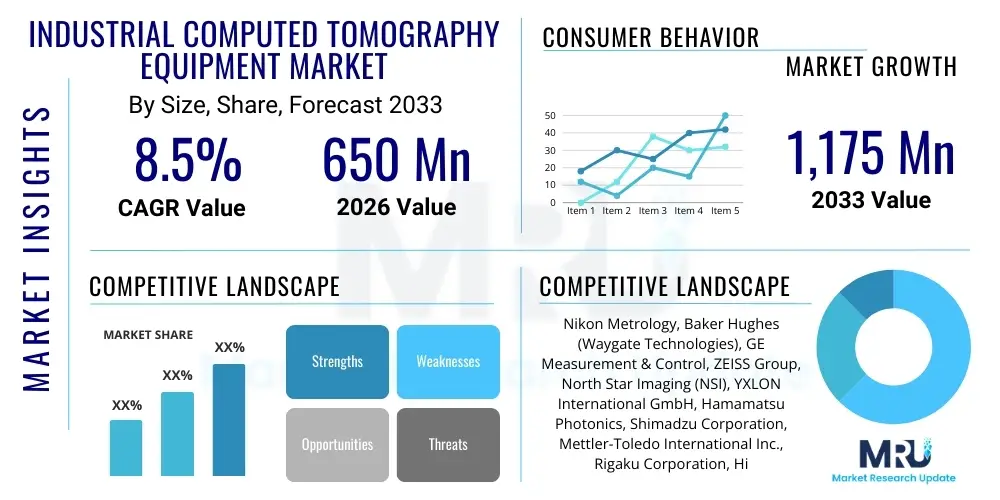

The Industrial Computed Tomography Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033.

Industrial Computed Tomography Equipment Market introduction

The Industrial Computed Tomography (CT) Equipment Market encompasses highly advanced non-destructive testing (NDT) systems utilized across various manufacturing sectors to provide detailed internal structural analysis of components without causing physical damage. These systems operate by capturing thousands of 2D X-ray images from different angles around an object, which specialized reconstruction software then uses to generate a precise 3D volumetric representation. This technology is critical for quality control, defect detection, dimensional metrology, and material science research, offering unparalleled insights into complex internal geometries, porosity, and assembly verification that traditional methods often fail to capture.

The primary applications of industrial CT equipment span high-reliability industries such as aerospace, automotive, electronics, and medical devices. In aerospace, CT is indispensable for inspecting critical components like turbine blades, complex cast parts, and additive manufactured structures for internal flaws and precise dimensioning. Automotive applications focus on quality assurance for engine components, lightweight materials, and battery packs (especially relevant to electric vehicles). The essential benefits driving market adoption include enhanced product safety, reduced recall rates, optimization of production processes, and the capability to verify the integrity of highly complex or enclosed components, thereby significantly accelerating the research and development lifecycle.

Driving factors stimulating the market growth include the global push toward Industry 4.0 standards, which emphasize stringent quality assurance and data-driven manufacturing processes. Furthermore, the rapid growth of additive manufacturing (3D printing) necessitates robust internal inspection capabilities, as CT is the only reliable method for validating the structural integrity and identifying residual stresses or internal pores in AM parts. Increasing regulatory requirements across sectors, particularly in medical and aviation fields, mandating higher levels of non-destructive inspection, further solidify the demand for high-resolution industrial CT systems, propelling investment in faster, more versatile, and automated inspection platforms.

Industrial Computed Tomography Equipment Market Executive Summary

The Industrial Computed Tomography Equipment Market is characterized by robust growth, driven primarily by technological advancements in X-ray source efficiency, detector resolution, and reconstruction algorithms, enabling faster inspection times and higher precision. Business trends indicate a strong move towards automated CT systems integrated directly into production lines, particularly in the mass production automotive and electronics sectors, shifting CT from a purely lab-based tool to an essential in-line quality assurance mechanism. Key market stakeholders are focusing on developing hybrid systems that combine CT with other NDT methods, such as ultrasound or phase-contrast imaging, to enhance inspection versatility and address the challenges associated with inspecting varying material densities and geometries.

Regionally, North America and Europe maintain leading positions, leveraging established aerospace, automotive, and medical device manufacturing ecosystems, which necessitate the highest standards of inspection. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive investments in manufacturing infrastructure, rapid adoption of advanced manufacturing technologies (including additive manufacturing), and the burgeoning electric vehicle market in countries like China, Japan, and South Korea, which requires extensive quality checks on battery assemblies and lightweight chassis components. This regional shift is compelling global CT providers to expand their service networks and localize their technology offerings to meet diverse industrial demands.

Segment trends reveal that the volume CT systems segment, offering high throughput and medium resolution, remains crucial for production-line inspection, while the micro-CT and nano-CT segments are experiencing significant R&D investment due to their essential role in analyzing miniaturized electronic components and advanced materials at microscopic levels. By application, the quality control and inspection segment dominates the market share, reflecting the foundational need for flaw detection and dimensional metrology. The increasing complexity of materials, such as carbon fiber composites and specialized alloys, continues to drive demand for higher energy (high kV) CT systems capable of penetrating denser objects while maintaining image quality and resolution.

AI Impact Analysis on Industrial Computed Tomography Equipment Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Industrial Computed Tomography Equipment Market revolve primarily around automation efficiency, data interpretation complexity, and the reliability of defect identification. Users frequently question how AI can expedite the notoriously time-consuming process of image reconstruction and analysis, particularly when dealing with massive datasets generated by high-resolution scans. Key concerns include the training requirements for deep learning models on specialized defect libraries, the integration challenges with existing NDT workflows, and whether AI algorithms can reliably detect novel or previously unseen failure modes. There is high expectation that AI will transition CT from requiring expert manual interpretation to a fully autonomous, prescriptive quality control tool, thereby reducing operational bottlenecks and ensuring consistency across global manufacturing sites.

- AI-Powered Automated Defect Recognition (ADR): Utilizing deep learning models to rapidly identify and classify internal defects (e.g., porosity, cracks, inclusions) with significantly reduced human intervention.

- Optimized Scan Parameter Selection: AI algorithms automatically determine the optimal X-ray energy, exposure time, and filter settings based on component material and geometry, improving image quality and reducing setup time.

- Accelerated Image Reconstruction: Implementing AI-driven iterative reconstruction techniques that drastically reduce the computational time required to convert 2D projections into high-resolution 3D volumetric models.

- Enhanced Dimensional Metrology: Applying machine learning to precisely segment and measure complex internal features directly from CT data, surpassing the limitations of traditional fixed thresholding methods.

- Predictive Maintenance for Equipment: AI monitors system health, X-ray source degradation, and detector performance to forecast maintenance needs, maximizing uptime and reducing unexpected failures.

- Improved Data Handling and Visualization: AI assists in managing and interpreting petabytes of CT data, providing intelligent visualization tools and comprehensive reporting summaries.

DRO & Impact Forces Of Industrial Computed Tomography Equipment Market

The Industrial CT market dynamic is powerfully shaped by the synergistic relationship between technological innovation and demanding quality standards across critical manufacturing sectors. Drivers include the proliferation of highly complex components produced by additive manufacturing and advanced casting techniques, which mandate 100% internal inspection. Simultaneously, regulatory pressures in aerospace and medical device production enforce stringent non-destructive testing protocols. Restraints largely center on the substantial initial capital investment required for high-energy CT systems, the specialized expertise needed for operation and data interpretation, and the physical limitations related to scanning extremely large or very dense components. Opportunities arise from expanding applications in battery inspection for EVs, materials science research, and leveraging AI to automate interpretation, thereby lowering the operational skill barrier and increasing accessibility.

Impact forces in the market are primarily driven by rapid technological evolution and economic cycles. The push towards micro- and nano-CT systems exemplifies the constant force of technological advancement catering to miniaturization trends in electronics and medical devices. The high cost of adoption acts as a dampening force, particularly for small and medium enterprises (SMEs), limiting broader market penetration. However, the increasing availability of CT scanning services (as opposed to outright purchase) mitigates this cost restraint. Furthermore, global supply chain scrutiny and the increasing need for verifiable quality documentation post-pandemic have amplified the impact of quality mandates, making Industrial CT an indispensable tool rather than a discretionary expense, fundamentally altering procurement strategies across multiple vertical industries.

The equilibrium between penetration and cost remains a critical challenge; while the benefits of comprehensive internal inspection are clear, the return on investment for high-end CT systems must be meticulously justified. The development of portable or mobile CT solutions represents an opportunity to disrupt traditional static lab setups, providing flexibility and potentially serving remote sites or large assembly plants more efficiently. The constant improvement in software capabilities, enabling faster processing and greater interoperability with CAD systems and metrology software, acts as a continuous driving force, enhancing the value proposition of CT data beyond mere defect detection to include full dimensional analysis and comparison against nominal geometry models.

Segmentation Analysis

The Industrial Computed Tomography Equipment Market is comprehensively segmented based on technology, component, application, and end-use industry, reflecting the diverse requirements of the manufacturing and research landscape. Technological segmentation primarily distinguishes between film-based and digital radiography systems, though the market heavily favors high-resolution digital flat panel detectors for superior image quality and real-time processing capabilities. Component segmentation highlights the critical roles of X-ray sources (mini-focus, micro-focus, nano-focus), detectors, manipulation systems (rotary stages), and the sophisticated reconstruction and analysis software, with software becoming increasingly pivotal for leveraging the hardware's capabilities. Application segmentation separates flaw detection, dimensional metrology, failure analysis, and assembly inspection, each requiring tailored system specifications.

Segmentation by end-use industry is particularly indicative of market dynamics and growth potential. The automotive sector, driven by EV battery inspection needs and lightweight material analysis, constitutes a major revenue stream. Aerospace remains critical due to its non-negotiable safety standards for complex turbine parts and specialized coatings. Electronics and semiconductor inspection demand drives the ultra-high resolution (micro/nano CT) segment, necessary for examining circuit boards, soldered joints, and integrated circuit packaging. The heterogeneity of requirements across these industries ensures that manufacturers must maintain a broad product portfolio, offering everything from high-energy systems for dense castings to high-magnification systems for material science and small component inspection.

Further granularity exists within the segmentation by system configuration, distinguishing between cabinet-style systems suitable for lab environments and larger, customized walk-in systems designed for inspecting sizeable components like aircraft engine blocks or large pipelines. The continuous evolution of additive manufacturing necessitates dedicated CT solutions optimized for powder bed fusion and material jetting process verification, leading to a specialized sub-segment focusing on porosity quantification, build analysis, and residual stress mapping. This detailed segmentation allows stakeholders to accurately target investment and product development efforts towards the highest growth potential areas, such as the intersection of metrology and AI-driven automated defect recognition.

- By Component: X-ray Sources (Microfocus, Nanofocus, High Energy), Detectors (Flat Panel, Linear Array), Software, Manipulation Systems (Rotary Tables, Stages)

- By Technology: X-ray (2D), Computed Tomography (3D/Volume CT, Micro CT, Nano CT), Laminography

- By Application: Quality Control & Inspection, Failure Analysis, Dimensional Metrology, Reverse Engineering, Material Research

- By End-Use Industry: Automotive, Aerospace & Defense, Electronics & Semiconductors, Medical Devices, Oil & Gas, Research & Academia

Value Chain Analysis For Industrial Computed Tomography Equipment Market

The value chain for industrial CT equipment begins with upstream component suppliers, encompassing highly specialized manufacturers of X-ray sources, detectors, and precision mechanics. X-ray source technology, particularly micro-focus and nano-focus tubes, forms the critical intellectual property core, dictating system resolution and penetration power. Detector manufacturing, involving high-sensitivity flat panel detectors or advanced linear arrays, is another upstream bottleneck. System integrators, who are the major CT equipment vendors, procure these components and integrate them with sophisticated proprietary software for reconstruction, visualization, and metrology, adding substantial value through engineering and software development.

The distribution channel involves a combination of direct sales and localized indirect distributors or representatives, particularly crucial for international markets where technical support and regional regulatory compliance are mandatory. High-end, customized CT systems are typically sold directly, ensuring specialized installation and extensive operator training. Standardized, lower-cost benchtop systems may utilize indirect channels. Post-sale, the value chain emphasizes service, maintenance, and software updates. Given the complexity and high investment cost of these machines, ongoing technical support, calibration services, and the provision of certified application specialists form a significant and recurring revenue stream.

The downstream analysis focuses on the end-users—the various manufacturing, R&D, and quality assurance departments. These users demand systems that integrate seamlessly into their production workflows, often requiring custom fixturing and compatibility with enterprise quality management systems (QMS). The increasing trend is towards service providers and contract inspection labs, offering CT scanning services on a contractual basis, especially to SMEs that cannot justify the capital expenditure of purchasing equipment. This downstream segment highlights the shift from product sales to solution provision, including data interpretation and certified metrology reporting, effectively democratizing access to this high-cost technology.

Industrial Computed Tomography Equipment Market Potential Customers

Potential customers for Industrial Computed Tomography Equipment are concentrated in sectors where component failure risk is high, product quality is non-negotiable, and internal structural complexity requires non-invasive verification. The primary buyer segments include quality assurance departments within major automotive Original Equipment Manufacturers (OEMs), particularly those involved in electric vehicle (EV) battery module and complex lightweight component manufacturing. Aerospace and defense contractors represent the highest-value customers, requiring high-energy CT systems for inspecting critical turbine blades, structural castings, and rocket components to meet strict FAA or military specifications regarding internal flaw limits.

Beyond traditional manufacturing, advanced R&D institutions, universities, and dedicated material science labs constitute another core customer base, utilizing micro-CT and nano-CT systems for investigating material microstructure, failure mechanisms, and developing new composite materials. The medical device manufacturing sector, which requires meticulous inspection of implants, surgical tools, and complex plastic assemblies, is a growing segment. Furthermore, third-party NDT service providers and contract metrology labs are significant purchasers, acting as outsourced inspection centers for various industries, thereby offering essential services to manufacturers worldwide seeking certified quality verification without large internal investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nikon Metrology, Baker Hughes (Waygate Technologies), GE Measurement & Control, ZEISS Group, North Star Imaging (NSI), YXLON International GmbH, Hamamatsu Photonics, Shimadzu Corporation, Mettler-Toledo International Inc., Rigaku Corporation, Hitachi High-Tech Corporation, VJ Technologies, Bosello High Technology S.R.L., Creaform (Ametek), RayScan Technologies GmbH, Exact Metrology, RX Solutions, ProCon X-Ray GmbH, 3D Systems, Comet Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Computed Tomography Equipment Market Key Technology Landscape

The industrial CT technology landscape is undergoing continuous evolution, primarily focused on enhancing speed, resolution, and automation capabilities. A major technological focus is the development of next-generation X-ray sources, moving beyond conventional micro-focus tubes to high-power micro-focus and specialized nano-focus sources. Nano-focus technology is paramount for achieving resolutions below the micrometer scale, essential for inspecting minute electronic components and advanced material structures. Simultaneously, manufacturers are integrating rotating targets and advanced cooling systems into high-energy X-ray sources (up to 450 kV or higher) to maintain beam stability and extend the operational life required for penetrating dense metallic parts, such as those found in gas turbines or large automotive castings, without sacrificing inspection speed.

Detector technology represents another critical area of advancement, with high-resolution digital flat panel detectors (FPDs) becoming standard. The trend here is toward larger active areas and higher frame rates, enabling quicker data acquisition and larger sample envelopes. Crucially, the integration of advanced scintillator materials is improving the conversion efficiency of X-ray photons into visible light, thereby enhancing the signal-to-noise ratio and image contrast, which is vital for detecting subtle defects within homogeneous materials. Furthermore, the push towards integrating specialized detectors, such as linear diode arrays (LDAs), for high-throughput scanning of long parts, continues to optimize system performance for specific industrial applications requiring extreme precision in linear movements.

The third, and arguably most disruptive, technological innovation is in the realm of software and computational power. Advanced iterative reconstruction algorithms are replacing traditional filtered back-projection methods. These iterative techniques offer superior image quality, especially in challenging scenarios like metal artifacts, and significantly reduce the required X-ray dose, yet they are computationally intensive. This reliance has spurred the adoption of high-performance computing (HPC) and GPU-accelerated processing, enabling near real-time reconstruction for complex scans. This software sophistication, coupled with the rising adoption of AI for Automated Defect Recognition (ADR) and automated metrology routines, is transforming the industrial CT system from a diagnostic tool into a fully automated, prescriptive quality management system capable of processing vast volumes of 3D data efficiently.

Regional Highlights

- North America: The market is characterized by high technological maturity and significant demand from the aerospace and defense sectors, particularly in the U.S. and Canada. The region is an early adopter of advanced systems like micro-CT for materials research and advanced manufacturing quality control, driven by stringent regulatory environments and substantial R&D budgets allocated to next-generation technologies such as spacecraft components and high-performance automotive parts.

- Europe: Europe holds a dominant position, primarily due to the strong presence of major automotive manufacturers (especially in Germany and France) focused on EV technology and complex casting inspection. The region benefits from established industrial automation standards and strong academic-industrial collaboration, pushing the limits of CT application in complex composite materials and high-value medical device manufacturing, maintaining steady demand for high-end metrology solutions.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid industrialization, massive investments in electronics and semiconductor manufacturing, and the explosive growth of the EV supply chain, especially in China, South Korea, and Japan. The demand here is dual-natured: high-volume, automated CT systems for mass production quality checks, and ultra-high-resolution nano-CT for complex semiconductor packaging and electronic failure analysis.

- Latin America (LATAM): Growth in LATAM is driven primarily by the automotive assembly and localized oil & gas sectors, requiring robust systems for quality control of metal parts and pipeline components. While adoption is slower than in mature markets, the growing focus on local manufacturing quality improvement and infrastructure projects provides a stable, though emerging, market for CT service providers and entry-level systems.

- Middle East and Africa (MEA): This region's CT demand is heavily concentrated in the upstream and downstream oil and gas sector for pipeline integrity inspection, material corrosion analysis, and complex component verification. Defense spending also contributes to market uptake. However, due to lower industrial diversification, the market remains specialized, focusing on high-energy systems capable of penetrating heavy metal structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Computed Tomography Equipment Market.- Nikon Metrology

- Baker Hughes (Waygate Technologies)

- ZEISS Group

- YXLON International GmbH

- North Star Imaging (NSI)

- GE Measurement & Control

- Hamamatsu Photonics

- Shimadzu Corporation

- Mettler-Toledo International Inc.

- Rigaku Corporation

- Hitachi High-Tech Corporation

- VJ Technologies

- Bosello High Technology S.R.L.

- Creaform (Ametek)

- RayScan Technologies GmbH

- Exact Metrology

- RX Solutions

- ProCon X-Ray GmbH

- 3D Systems (CT services/systems)

- Comet Group (Through YXLON)

Frequently Asked Questions

Analyze common user questions about the Industrial Computed Tomography Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Industrial CT over traditional 2D X-ray inspection?

Industrial CT provides a full 3D volumetric reconstruction of an object's internal structure, allowing for precise quantitative dimensional metrology, internal porosity analysis, and flaw detection without requiring component disassembly. Traditional 2D X-ray only provides an overlay projection, limiting depth perception and detailed internal measurement capabilities.

How is the growth of Additive Manufacturing (AM) impacting the demand for Industrial CT equipment?

AM relies heavily on industrial CT for quality validation. CT is the standard technique for verifying the integrity of 3D-printed parts, specifically for quantifying internal defects such as lack of fusion, residual powder presence, and porosity, ensuring manufactured components meet stringent mechanical performance standards required by aerospace and medical industries.

What is the key difference between Micro-CT and Nano-CT systems?

Micro-CT systems typically achieve spatial resolutions down to a few micrometers, suitable for inspecting complex materials and small electronic assemblies. Nano-CT systems achieve sub-micrometer (nanometer) resolution, crucial for examining extremely small features in semiconductors, battery electrode structures, and highly specialized material science samples.

What are the main restraints affecting the wider adoption of Industrial CT technology?

The primary restraints include the high initial capital investment required for purchasing high-resolution, high-energy systems, the high maintenance costs associated with X-ray sources and detectors, and the necessity for specialized technical expertise and highly trained personnel to operate the complex equipment and accurately interpret the resulting volumetric data.

In which industrial application is Artificial Intelligence (AI) having the greatest impact on CT workflows?

AI is having the greatest impact in Automated Defect Recognition (ADR). Deep learning models are trained to rapidly process 3D CT data to automatically detect, classify, and localize internal flaws, significantly accelerating the inspection process and ensuring objective, repeatable quality control decisions compared to manual interpretation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager