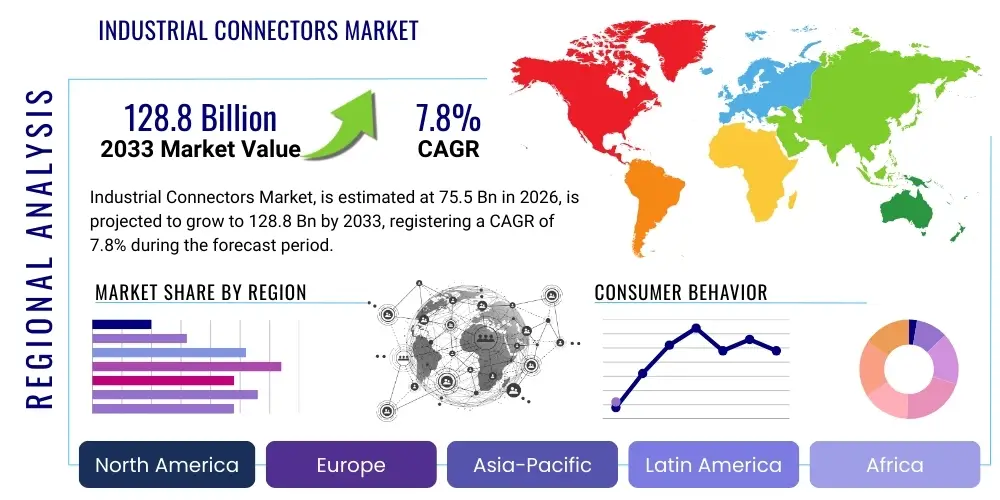

Industrial Connectors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441688 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Connectors Market Size

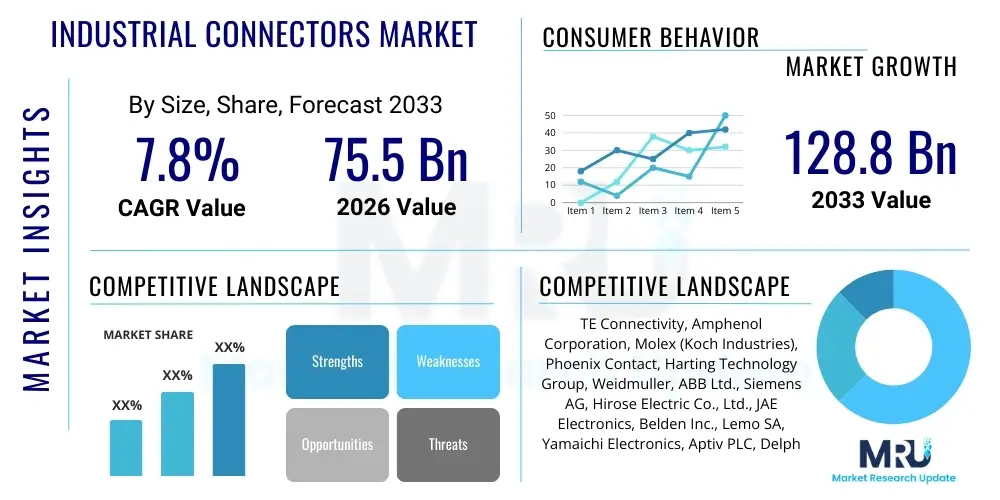

The Industrial Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $75.5 Billion USD in 2026 and is projected to reach $128.8 Billion USD by the end of the forecast period in 2033.

Industrial Connectors Market introduction

The Industrial Connectors Market encompasses a broad spectrum of devices designed to provide reliable, robust, and secure electrical, electronic, and fiber optic connections in harsh industrial environments. These components are essential for maintaining the operational integrity of complex machinery, automation systems, and data infrastructure within manufacturing plants, energy facilities, transportation systems, and telecommunications networks. Unlike standard commercial connectors, industrial counterparts are engineered to withstand extreme conditions, including high vibration, moisture, dust, temperature fluctuations, and exposure to corrosive chemicals, ensuring continuous and safe power and data transmission critical for modern industrial processes.

Product descriptions typically categorize industrial connectors by form factor—such as circular, rectangular, heavy-duty, or application-specific types like PCB connectors or terminal blocks—and by function, including power, signal, and data transmission. Major applications span across factory automation, where high reliability is paramount for robotics and sensing equipment; renewable energy systems, which require weather-resistant and high-current solutions; and transportation infrastructure, necessitating robust connection points for railway and heavy-duty vehicles. The fundamental benefit provided by these connectors is enhanced system reliability and minimized downtime, directly translating into higher productivity and reduced maintenance costs for end-users operating high-value industrial assets.

Driving factors propelling market expansion include the rapid proliferation of Industry 4.0 initiatives globally, demanding seamless connectivity between diverse devices and centralized control systems. This trend necessitates vast deployment of sensors and networked machinery, all reliant on durable connector solutions. Furthermore, increasing investments in renewable energy infrastructure, such as solar farms and wind turbines, coupled with modernization projects in aging industrial facilities, contribute significantly to the demand for advanced, high-performance industrial connectors capable of handling increasing data rates and power requirements securely and efficiently across varied operational terrains.

Industrial Connectors Market Executive Summary

The global Industrial Connectors Market is poised for significant expansion, primarily driven by the overarching trend of digital transformation and the widespread adoption of industrial automation and robotics across manufacturing sectors worldwide. Business trends highlight a strong shift toward modular and miniaturized connector solutions that support higher density packaging and increased data transfer speeds, crucial for edge computing and real-time control applications within smart factories. Strategic mergers and acquisitions among major players focus on expanding product portfolios, particularly in highly specialized segments such as high-speed data connectors and hybrid connectors that combine power and fiber optics, enhancing competitive positioning and technological readiness for future industrial standards.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth potential, fueled by aggressive governmental support for manufacturing expansion and infrastructure development in countries like China, India, and South Korea, which are rapidly transitioning toward advanced automation methodologies. North America and Europe maintain leading positions in terms of technological adoption and market value, characterized by mature industrial bases prioritizing the replacement of legacy systems with robust, IoT-enabled connectivity solutions to improve operational efficiency and comply with stringent safety regulations. Latin America and MEA are emerging markets, showing accelerated demand driven by investments in oil and gas infrastructure, mining, and expanding telecommunications networks.

Segmentation trends indicate that circular connectors remain dominant due to their robust mechanical integrity and ease of mating, especially in heavy-duty machinery and outdoor applications. However, high-density rectangular connectors are gaining traction, favored in machine control cabinets and modular systems where space optimization is critical. The strongest growth is observed within the market segment dedicated to data and communication connectors, reflecting the exponential increase in industrial Ethernet, PROFINET, and other fieldbus protocol usage, compelling manufacturers to innovate with products offering higher shielding effectiveness and superior immunity to electromagnetic interference (EMI) in harsh environments.

AI Impact Analysis on Industrial Connectors Market

Common user questions regarding AI's impact on the Industrial Connectors Market frequently revolve around how artificial intelligence influences connector design requirements, the need for 'smart' connectors, and how predictive maintenance driven by AI affects connector lifecycles and selection criteria. Users are keen to understand if AI-optimized systems necessitate higher data throughput capability in connectors, whether AI can streamline the manufacturing processes of connectors themselves, and how AI-powered quality inspection tools ensure the reliability needed for critical industrial applications. The key themes summarized from this analysis indicate a strong expectation that AI integration will primarily drive demand for connectors supporting ultra-high bandwidth, demanding enhanced reliability metrics, and facilitating the development of self-monitoring or 'intelligent' connectivity solutions that communicate their status in real-time to AI diagnostics platforms.

- AI mandates the development of ultra-high-speed industrial data connectors (e.g., 10 Gbps and above) to support real-time sensor data aggregation and processing necessary for machine learning models.

- Predictive maintenance systems, powered by AI, increase the requirement for ruggedized, highly reliable connectors, as connection failure points are critical inputs for determining asset downtime.

- Integration of miniature sensors and basic processing capabilities into connectors (Smart Connectors) allows for real-time monitoring of temperature, vibration, and signal integrity, feeding crucial health data to AI analytical tools.

- AI optimization of factory floors drives the adoption of advanced robotics, necessitating flexible, dynamic-movement connectors (robotics connectors) designed for millions of flex cycles.

- AI deployment in quality control enhances the precision of connector manufacturing and assembly inspection, leading to higher quality standards and reduced defect rates in mass production.

- The development of AI algorithms for network configuration and self-healing systems places a premium on connectors with enhanced plug-and-play functionalities and integrated shielding against electromagnetic interference (EMI).

DRO & Impact Forces Of Industrial Connectors Market

The Industrial Connectors Market is primarily driven by the accelerating pace of industrial automation, including the mass deployment of robotics and the convergence of IT and Operational Technology (OT) under the Industry 4.0 framework, necessitating robust and high-speed connectivity solutions. Key restraints often involve the high initial cost associated with specialized, ruggedized connectors compared to standard commercial variants, alongside the complexity of standardizing protocols and form factors across diverse manufacturing ecosystems. Significant opportunities emerge from the massive global investment in electric vehicle (EV) charging infrastructure and renewable energy systems, both requiring specialized high-power and high-voltage connectivity solutions that are resistant to harsh environmental exposure. These internal forces—Drivers, Restraints, and Opportunities—are further amplified by external Impact Forces such as global supply chain instability, which drives demand for localized manufacturing capabilities, and evolving regulatory mandates favoring safer, more environmentally compliant connection materials.

Specifically, the primary driver is the necessity for reliable communication in complex industrial IoT (IIoT) networks. As factories become smarter, every component, from sensors to actuators, requires continuous, uninterrupted data and power flow. Industrial connectors provide this necessary backbone, driving strong demand for connectors compliant with industrial Ethernet standards (e.g., M12, M8). Conversely, a significant restraint is the lengthy design and qualification cycles required for specialized connectors in highly regulated industries like aerospace and medical devices, slowing the adoption of newer technologies. Moreover, the lack of backward compatibility in some next-generation high-speed connectors poses adoption barriers for facilities attempting incremental upgrades rather than full system overhauls, thereby capping immediate market potential in legacy sectors.

The opportunity landscape is significantly broadened by the increasing complexity and scale of data centers and hyper-scale computing infrastructure, requiring rugged connectors for power distribution units and server racks that must operate reliably under high thermal loads. Furthermore, the push towards decentralization of power generation through smart grids and microgrids creates a niche market for heavy-duty, field-installable connectors capable of handling extreme current levels and minimizing insertion loss over extended periods. External forces, particularly trade policies and tariffs, dictate sourcing strategies, often compelling multinational corporations to diversify their supplier base, which indirectly increases market competition and encourages rapid innovation in connector durability and standardization to meet geographically diverse compliance requirements.

Segmentation Analysis

The Industrial Connectors Market is structurally segmented based on crucial factors including type, function, end-use industry, and application environment, reflecting the high degree of specialization required by industrial systems. Analyzing these segments provides a clear roadmap of where technological innovation and market demand are concentrated. Connectors are primarily categorized by their physical form factor, such as circular, rectangular, and application-specific PCB connectors, each serving unique mechanical and spatial requirements within machinery. Functionally, they are divided into power connectors, signal connectors, and data connectors, with hybrid models gaining prominence, allowing for multi-functional transmission through a single interface. The core of segmentation often lies in the end-use industries, ranging from resource-intensive sectors like oil & gas and mining to high-tech manufacturing, automotive, and crucial infrastructure segments like transportation and energy, dictating the required ruggedness and performance specifications.

The segmentation by Type sees circular connectors dominating due to their robust locking mechanisms and superior environmental sealing capabilities, making them the standard choice for harsh environments. However, the rise of modular automation systems is propelling the growth of rectangular and heavy-duty connectors, which offer high pin counts and flexible configuration options suitable for complex machine interfaces and control panels. Within the function segmentation, data connectors, particularly those supporting Industrial Ethernet (M12 X-coded), are experiencing the fastest growth rate, directly correlated with the deployment of high-resolution sensing technologies and IIoT devices demanding reliable, high-bandwidth connectivity for large-scale data aggregation and real-time operational analysis.

Geographically, the segmentation highlights APAC as the volume leader due to vast manufacturing operations, while North America leads in adopting high-reliability, specialized connectors, particularly in the aerospace and defense sectors, where failure tolerance is near zero. End-use segmentation confirms that the Factory Automation & Control segment remains the largest consumer, driven by ongoing investments in robotics and integrated control systems globally. The Energy & Utility segment represents a crucial growth vector, especially with the transition toward renewable energy sources, demanding connectors capable of withstanding extreme temperature cycles and high UV exposure over multi-decade operational lifecycles, pushing material science innovation within the market.

- By Type:

- Circular Connectors

- Rectangular Connectors

- Heavy-Duty Connectors (HDCs)

- PCB Connectors (Terminal Blocks, Headers)

- Fiber Optic Connectors

- By Function:

- Power Connectors

- Signal Connectors

- Data Connectors (Industrial Ethernet)

- Hybrid Connectors

- By End-Use Industry:

- Factory Automation & Control

- Energy & Power (Renewable, Traditional)

- Transportation (Rail, Automotive, Aerospace)

- Heavy Equipment & Machinery

- Telecommunications & Data Centers

- Oil & Gas/Mining

- By Data Rate:

- Low-Speed (Fieldbus)

- High-Speed (Industrial Ethernet, PROFINET, IO-Link)

Value Chain Analysis For Industrial Connectors Market

The Value Chain for the Industrial Connectors Market commences with the upstream activities centered on raw material procurement, including specialized plastics, high-conductivity copper alloys, aluminum, and advanced insulating ceramics, which determine the fundamental mechanical and electrical properties of the final product. Key upstream challenges involve securing stable supplies of specialized materials required for ruggedness, such as specific plating materials for corrosion resistance (e.g., gold, nickel, palladium). Manufacturers must invest heavily in precision engineering and tooling to shape these materials into complex contact geometries and housing designs, forming the crucial manufacturing segment of the chain. This stage is highly capital-intensive, requiring strict quality control to meet industrial tolerances and safety standards, particularly concerning current carrying capacity and insulation performance.

Midstream activities involve core manufacturing, including stamping, molding, plating, and complex assembly processes, often requiring high levels of automation to achieve necessary precision and volume. Connector manufacturers (OEMs and Tier 1 suppliers) utilize sophisticated design software to ensure products comply with international industrial standards (e.g., IP ratings for ingress protection, UL, CSA, IEC standards). The distribution channel forms a critical link, often relying on both direct and indirect routes. Direct distribution involves large-volume sales to major industrial OEMs (like Siemens or ABB) who integrate connectors into their machinery and control systems. Indirect channels, typically managed by global or regional distributors (e.g., Digi-Key, Mouser, specialized industrial distributors), cater to smaller system integrators, maintenance, repair, and overhaul (MRO) operations, providing localized stock and technical support.

The downstream analysis focuses on the end-user deployment and application support. System integrators play a vital role, selecting and configuring connectors for specific machine layouts and operational environments, ensuring compatibility across various protocols (e.g., EtherCAT, Profibus). End-users, such as factory operators or energy companies, dictate product lifespan requirements and maintenance strategies. The growth of e-commerce platforms has begun to influence the indirect distribution channel, offering greater accessibility for MRO purchasers, though specialized industrial connectors often still necessitate technical consultancy provided by the distributor or the manufacturer's field application engineers due to the complexity of installation and safety considerations in demanding industrial settings.

Industrial Connectors Market Potential Customers

The primary customers for the Industrial Connectors Market are large-scale Original Equipment Manufacturers (OEMs) specializing in industrial machinery, factory automation equipment, and heavy transportation systems. These buyers include global robotics firms (e.g., Fanuc, KUKA), control panel manufacturers, and providers of CNC machinery who integrate thousands of connectors into their final products, prioritizing reliability, lifetime cost, and seamless integration with existing protocols. Another critical segment comprises Engineering, Procurement, and Construction (EPC) firms, particularly those involved in developing large infrastructure projects, such as power plants (both conventional and renewable), large chemical processing facilities, and mass transit systems, requiring custom-designed, high-current, and environmentally sealed connectors that meet rigorous project specifications and certification requirements.

The second major group consists of Maintenance, Repair, and Overhaul (MRO) departments across all end-use industries, including automotive assembly plants, food and beverage processing facilities, and utility companies. These buyers purchase connectors for replacement purposes or incremental system upgrades, often prioritizing quick availability, compatibility with legacy systems, and durability in harsh operating environments. Furthermore, specialized end-users in emerging high-growth sectors, notably high-density data centers and 5G network infrastructure providers, represent rapidly growing customer groups. These customers demand advanced fiber optic and copper connectors capable of handling extreme data density and supporting high-power distribution necessary for advanced computing and cooling requirements, often pushing the boundaries of existing connector technology standards to ensure maximum uptime and data integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $75.5 Billion USD |

| Market Forecast in 2033 | $128.8 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol Corporation, Molex (Koch Industries), Phoenix Contact, Harting Technology Group, Weidmuller, ABB Ltd., Siemens AG, Hirose Electric Co., Ltd., JAE Electronics, Belden Inc., Lemo SA, Yamaichi Electronics, Aptiv PLC, Delphi Technologies, Intercontec (TE subsidiary), Binder Group, ODU GmbH, ITT Cannon, Esterline Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Connectors Market Key Technology Landscape

The technological landscape of the Industrial Connectors Market is currently dominated by innovations focused on achieving higher data throughput, enhanced environmental protection, and greater modularity to meet the demands of Industry 4.0 and decentralized architecture. A crucial technological shift involves the transition from traditional fieldbus systems to Industrial Ethernet protocols, driving the widespread adoption of M12 and M8 connectors utilizing X-coding and D-coding standards to support Gigabit speeds (10 Gbps and 1 Gbps, respectively) over copper wiring in challenging operational settings. This requires advanced shielding technologies within the connector body and cable assembly to mitigate electromagnetic interference (EMI), which is pervasive in factory environments due to motors and power electronics. Furthermore, the increasing need for power efficiency in automation necessitates the continuous improvement of contact technologies, such as advanced plating techniques and lower resistance contact designs, to minimize power loss and heat generation under high current loads, ensuring longevity and reliability.

Another significant area of technological advancement is the development of hybrid connector solutions that consolidate power, high-speed data (copper or fiber optic), and pneumatic lines into a single housing. This integration is vital for simplifying the interface of complex machinery, particularly multi-axis robotics and modular production cells, reducing cabling clutter, and speeding up installation and maintenance procedures. Fiber optic industrial connectors are gaining traction, especially in applications requiring extreme distance data transmission or absolute immunity to electrical noise, utilizing ruggedized termini and secure locking mechanisms adapted from mil-spec standards to protect delicate glass fibers from industrial vibration and shock. The use of robust polymer materials and specialized sealing compounds (e.g., two-shot molding) ensures connectors maintain high Ingress Protection (IP) ratings, often up to IP67 or IP68, critical for wash-down and outdoor applications.

The manufacturing process itself is undergoing technological optimization through the implementation of advanced materials science and automation. Self-cleaning contacts and vibration-proof locking mechanisms, such as push-pull or bayonet coupling systems, are becoming standard features to ensure foolproof mating and sustained connection integrity over millions of operational cycles. Furthermore, the inclusion of integrated diagnostic capabilities, such as LED indicators or embedded monitoring chips, allows connectors to become 'smart components' capable of signaling their operational health or impending failure, facilitating preventive maintenance strategies. This move towards intelligent connectivity aligns directly with the overall shift towards highly optimized, condition-based monitoring systems in modern industrial facilities, representing a major technological paradigm shift in how connectors contribute to overall system intelligence and resilience.

Regional Highlights

Regional dynamics within the Industrial Connectors Market are highly stratified, reflecting global industrialization patterns, technological readiness, and regional investment priorities. Asia Pacific (APAC) currently stands as the fastest-growing region, driven primarily by the massive scale of manufacturing operations in China, the burgeoning automation sector in South Korea and Japan, and the rapid industrial modernization efforts across Southeast Asia. Government initiatives, such as China’s "Made in China 2025," heavily subsidize advanced manufacturing, leading to widespread adoption of automation technologies that inherently require millions of industrial connector installations. The region’s growth is concentrated not only in consumer electronics manufacturing but increasingly in automotive production (especially EVs) and critical infrastructure build-outs, requiring robust connectivity solutions for high-volume, cost-sensitive applications.

North America maintains a dominant position in terms of market value and the adoption of cutting-edge, high-reliability connector technology. This is spurred by robust investments in aerospace, defense, advanced medical devices, and the expansive oil and gas sector, all demanding connectors that adhere to stringent performance standards and certification protocols. The United States market is characterized by a strong focus on digital transformation, with rapid uptake of IIoT devices and edge computing infrastructure within existing factory floors, driving demand for high-speed, miniaturized data connectors. Regulatory compliance, particularly concerning cybersecurity and physical integrity in critical infrastructure (CISA guidelines), further dictates the premium pricing and performance requirements for connectors used across the energy and telecommunications sectors in this region.

Europe represents a mature but technologically advanced market, spearheaded by Germany, a global leader in automation technology and machinery export (Industry 4.0). Demand here is concentrated on high-quality, standardized heavy-duty connectors, particularly in the automotive, rail, and renewable energy sectors. European manufacturers place a strong emphasis on compliance with environmental standards (e.g., REACH, RoHS), driving innovation toward sustainable and halogen-free connector materials. While growth rates may be lower than APAC, the market stability and consistent demand for complex, customized, and durable connection solutions ensure its continued significance. Latin America and the Middle East & Africa (MEA) are characterized by significant infrastructure projects, particularly in energy exploration, mining, and telecommunications expansion, leading to accelerated demand for rugged, environmentally resistant connectors suitable for extreme climatic conditions and remote operational sites, albeit from a smaller market base.

- Asia Pacific (APAC): Highest volume and fastest growth, driven by massive manufacturing scale, EV production, and infrastructure spending in China, India, and South Korea, focusing on cost-effective, high-volume automation components.

- North America: Leading market value, characterized by demand for ultra-high reliability and performance connectors in aerospace, defense, oil & gas, and advanced data center infrastructure, driven by high-tech specialization.

- Europe: Mature market focusing on high quality, standardization (Industry 4.0), and environmental compliance, with strong demand from automotive, machine building, and railway applications, particularly in Germany and Italy.

- Latin America: Emerging market driven by commodity sectors (mining, agriculture) and infrastructure modernization, requiring durable, corrosion-resistant connectors for outdoor and heavy-duty use.

- Middle East and Africa (MEA): Growth centered around oil & gas capital projects, expanding telecommunications networks (5G), and large-scale renewable energy ventures, demanding connectors suited for extreme temperatures and harsh desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Connectors Market.- TE Connectivity

- Amphenol Corporation

- Molex (Koch Industries)

- Phoenix Contact

- Harting Technology Group

- Weidmuller Interface GmbH & Co. KG

- ABB Ltd.

- Siemens AG

- Hirose Electric Co., Ltd.

- JAE Electronics (Japan Aviation Electronics Industry, Ltd.)

- Belden Inc.

- Lemo SA

- Yamaichi Electronics Co., Ltd.

- Aptiv PLC

- Delphi Technologies (BorgWarner)

- Binder Group

- ODU GmbH & Co. KG

- ITT Cannon

- Esterline Technologies

- Samtec Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between industrial connectors and commercial connectors?

Industrial connectors are specifically engineered for robust performance in harsh environments, featuring enhanced resistance to vibration, shock, dust (IP ratings), moisture, and extreme temperatures. Commercial connectors, typically used in office or consumer settings, lack these specialized ruggedization features, focusing instead on cost and size for benign operational conditions. Industrial variants prioritize reliability and long operational life under stress.

How is Industry 4.0 influencing the demand for industrial connectors?

Industry 4.0 drives demand by necessitating high-speed, high-density, and highly reliable connectivity for IIoT devices, sensors, and centralized control systems. This transformation increases the need for Industrial Ethernet compliant connectors (M12, M8) capable of supporting real-time data exchange, diagnostics, and power over Ethernet (PoE), pushing technological limits toward miniaturization and higher data rates (10 Gbps and above).

Which connector type is experiencing the highest growth rate in the market?

Data and Hybrid connectors are experiencing the highest growth. Data connectors, especially M12 X-coded types, are essential for implementing high-speed Industrial Ethernet in factory automation. Hybrid connectors, which combine power, signal, and data into one housing, are also seeing rapid adoption due to their ability to simplify complex wiring harnesses for modular machinery and robotics.

What role does the Ingress Protection (IP) rating play in selecting industrial connectors?

The IP rating (e.g., IP67, IP68) is critical as it defines the connector's ability to resist the ingress of solids (dust) and liquids (water/moisture). In industrial settings like food processing, wash-down areas, or outdoor energy facilities, a high IP rating is mandatory to prevent system failures, corrosion, and safety hazards, ensuring operational continuity in environmentally challenging locations.

What are the main regional drivers for the industrial connectors market?

The main regional driver is manufacturing expansion and automation in Asia Pacific (APAC), particularly in China and India, fueled by government industrial policies. In North America and Europe, the drivers are modernization and technological upgrades in critical infrastructure (energy, transport) and stringent requirements for high-reliability components in aerospace and defense sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager