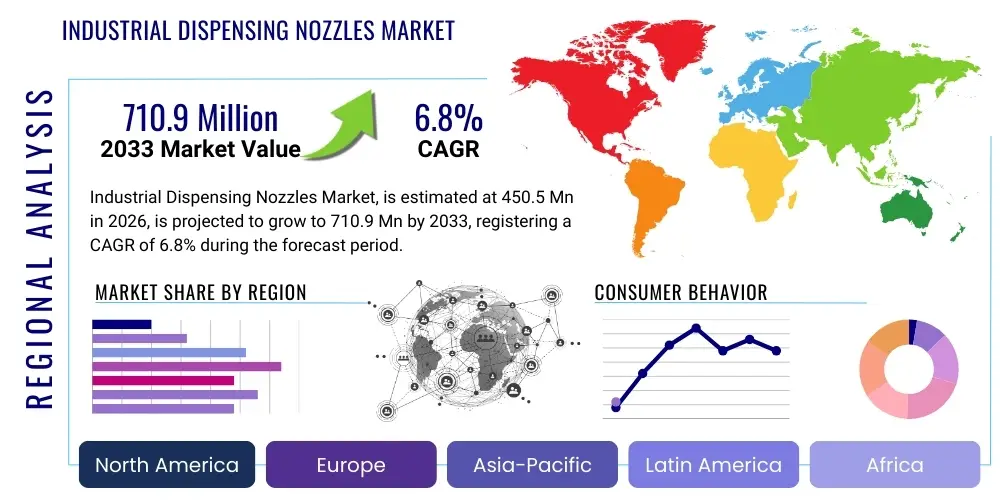

Industrial Dispensing Nozzles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442817 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Industrial Dispensing Nozzles Market Size

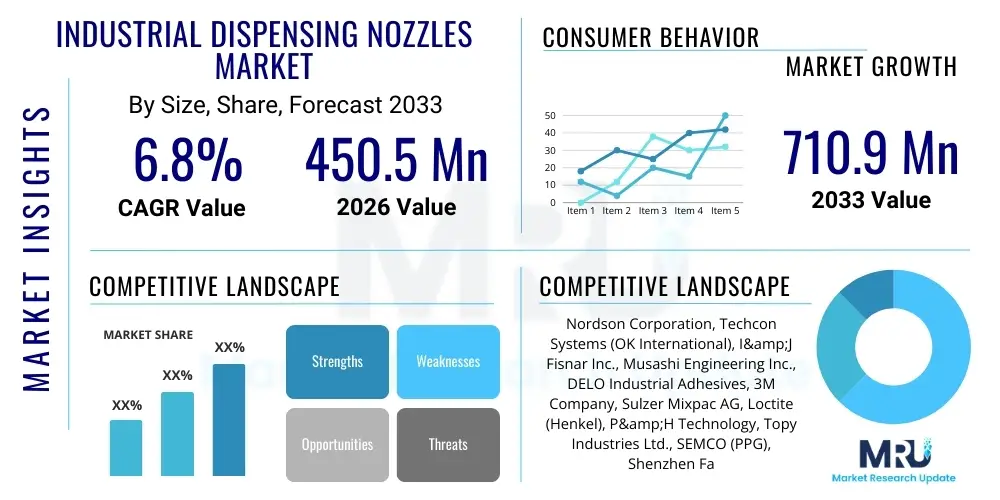

The Industrial Dispensing Nozzles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 710.9 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for automated precision fluid dispensing across critical manufacturing sectors, particularly electronics assembly, automotive component manufacturing, and the rapidly growing medical device fabrication industry. The continuous miniaturization of electronic components requires increasingly accurate and reliable dispensing equipment, positioning specialized nozzles as essential, high-value consumables within these advanced production environments.

Industrial Dispensing Nozzles Market introduction

The Industrial Dispensing Nozzles Market encompasses a diverse range of precision components engineered for the controlled application of various fluids, including adhesives, sealants, lubricants, flux, and thermal interface materials, within industrial manufacturing processes. These nozzles are integral to highly automated dispensing systems, serving as the critical interface between the dispensing apparatus and the substrate, thereby determining the accuracy, consistency, and repeatability of the fluid deposition. The product landscape includes standard conical nozzles, specialized micro-dispensing tips, flexible nozzles, jetting nozzles, and custom-designed tips fabricated from materials such as stainless steel, plastics, and ceramics, each optimized for specific fluid viscosities, pressures, and application geometries, ensuring optimal performance across highly complex and demanding industrial applications.

Major applications for industrial dispensing nozzles span across several high-growth industries. In the electronics sector, they are indispensable for processes such as solder paste deposition, underfill application for sensitive chips, and encapsulation of integrated circuits, where micro-level accuracy is paramount to component functionality and reliability. Within the automotive industry, these nozzles are crucial for structural bonding, sealing operations, and applying gasketing materials to ensure vehicle safety, durability, and compliance with increasingly stringent environmental standards. Furthermore, the medical device manufacturing segment relies heavily on these precision tools for assembling complex diagnostic kits, applying biocompatible adhesives, and manufacturing drug delivery systems, emphasizing the need for sterile, high-tolerance dispensing capabilities, which necessitates the utilization of specialized, non-contaminating nozzle materials.

The primary benefits derived from utilizing high-quality industrial dispensing nozzles include enhanced process control, minimization of material waste, and significant improvements in production throughput. Driving factors contributing to market expansion include the global shift towards Industry 4.0 principles, demanding greater automation and integration of intelligent dispensing systems. The consistent rise in demand for miniaturized electronics, such as smartphones, wearables, and advanced sensor technologies, directly fuels the need for extremely fine pitch and micro-dispensing capabilities, requiring nozzles with apertures often measuring less than 100 microns. Regulatory pressures concerning product quality, coupled with the necessity for highly repeatable manufacturing outcomes, further cement the indispensable role of advanced dispensing nozzle technology in modern manufacturing ecosystems, propelling sustained market growth globally.

Industrial Dispensing Nozzles Market Executive Summary

The Industrial Dispensing Nozzles Market is characterized by robust growth, primarily driven by the confluence of advanced manufacturing requirements across key global economies. Business trends indicate a strong industry focus on developing multi-functional dispensing nozzles capable of handling complex, high-viscosity fluids and specialized materials like thermal conductive compounds and electrically conductive adhesives. Key manufacturers are prioritizing the integration of smart materials and micro-machining techniques to achieve nozzle designs that offer zero-drip functionality and extremely long operational life, addressing the critical industry need for enhanced uptime and reduced maintenance expenditure in highly automated lines. Furthermore, strategic partnerships between dispensing equipment providers and material suppliers are becoming commonplace to offer integrated solutions that optimize fluid dynamics and dispensing precision, moving beyond simple component supply to comprehensive application engineering services, thereby reinforcing customer loyalty and expanding the total addressable market in high-value applications.

Regionally, the Asia Pacific (APAC) region currently dominates the market, largely attributable to its undisputed status as the global manufacturing hub for consumer electronics, automotive components, and solar energy equipment. Rapid urbanization, significant governmental investments in infrastructure development, and the increasing penetration of sophisticated factory automation systems, particularly in countries like China, South Korea, and Taiwan, are accelerating the adoption of high-precision dispensing nozzles. North America and Europe, while representing mature markets, exhibit strong demand for highly specialized, regulatory-compliant nozzles, especially those used in medical device assembly and aerospace manufacturing, driven by rigorous quality control standards and the high technological complexity of the products manufactured within these geographies, ensuring stable growth in the high-end segment of the market.

In terms of segmentation, the Micro-Dispensing segment, defined by nozzle tip diameters below 200 microns, is projected to register the fastest growth rate throughout the forecast period due to the unstoppable trend of miniaturization across consumer electronics and advanced semiconductor packaging. By material type, ceramic and specialized engineered polymer nozzles are gaining prominence over traditional stainless steel, primarily because of their superior chemical resistance, enhanced wear characteristics, and ability to handle abrasive materials without degrading precision. End-user trends show the Electronics and Semiconductor sector remaining the largest consumer base, followed closely by the Automotive sector, which is witnessing a surge in demand for dispensing solutions related to electric vehicle (EV) battery assembly and specialized thermal management applications, requiring novel nozzle designs optimized for thick, viscous thermal interface materials.

AI Impact Analysis on Industrial Dispensing Nozzles Market

Common user questions regarding AI's impact on the Industrial Dispensing Nozzles Market frequently revolve around how artificial intelligence can enhance dispensing accuracy, predict nozzle wear or failure, and optimize fluid flow parameters in real-time to minimize defects and material wastage. Users are keenly interested in the potential for AI-driven vision systems to autonomously detect and compensate for minor dimensional variations in substrates, which directly affects the required nozzle path and fluid volume. A major theme is the integration of predictive maintenance algorithms trained on vibration, pressure, and temperature data gathered near the nozzle tip to forecast tool life, thereby allowing manufacturers to implement proactive replacements and avoid costly production line shutdowns. Additionally, there is significant inquiry into how AI can optimize the selection of the correct nozzle type and dispensing parameters (speed, height, pressure) for novel or complex material formulations, significantly reducing the lengthy setup and calibration times traditionally associated with process engineering, making the dispensing process more adaptive and efficient, especially in high-mix, low-volume manufacturing environments which are increasingly common.

- AI enables predictive maintenance of dispensing systems, forecasting nozzle wear rates based on operational data (pressure spikes, material abrasion patterns), maximizing uptime.

- Integration of machine learning algorithms with high-speed vision systems allows for real-time adjustments to nozzle position and dispensing volume, compensating for substrate irregularities and thermal expansion.

- AI optimizes fluid dynamic parameters and dispensing profiles (e.g., jetting pulse frequency, valve opening time) for specific nozzle geometries and fluid viscosities, ensuring precise bead placement and uniformity.

- Intelligent process control reduces material waste and minimizes defect rates by learning optimal operating conditions and flagging anomalies related to clogged or damaged nozzles instantly.

- AI-driven simulation tools accelerate the design and testing phases of new, highly specialized nozzle types by modeling fluid interaction and shear stress effects before physical prototyping.

DRO & Impact Forces Of Industrial Dispensing Nozzles Market

The Industrial Dispensing Nozzles Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the relentless global trend toward miniaturization in electronics, demanding extreme precision that only advanced nozzles can deliver, and the escalating adoption of automation across all major manufacturing sectors seeking increased efficiency and standardized output. Restraints primarily involve the inherent complexity and high initial cost associated with specialized, high-tolerance nozzles, particularly those manufactured using advanced materials like ceramics, coupled with the critical challenge of material compatibility and the requirement for frequent replacement due due to wear or clogging, adding operational overhead. Opportunities are abundant, centered around the proliferation of Electric Vehicle (EV) manufacturing, which requires novel thermal management material dispensing solutions, and the surging demand from the burgeoning bio-medical and pharmaceutical sectors for highly sterile and precise fluidic control components, opening lucrative avenues for material innovation and specialized product development aimed at controlled environments.

Impact forces within this market structure are characterized by high buyer bargaining power, stemming from the commoditized nature of standard nozzles and the ability of large end-users (like major automotive OEMs or electronics contract manufacturers) to dictate pricing and quality specifications for mass-produced items. However, the bargaining power of suppliers remains moderate to high for highly specialized, custom-engineered nozzles, particularly those protected by proprietary manufacturing techniques or advanced material patents, where only a few companies possess the requisite expertise. Threat of substitution is relatively low, as physical nozzles remain an essential component for contact dispensing and jetting technologies, with alternatives like non-contact printing technologies only partially overlapping the application scope. Furthermore, the threat of new entrants is moderate, given the high capital requirement for precision tooling and the necessity of deep technical expertise in fluid dynamics and materials science required to compete effectively in the high-end segment of the market.

The intensity of competitive rivalry within the industrial dispensing nozzles sector is high, particularly in the standard nozzle segment, leading to pricing pressures and constant innovation cycles focused on enhancing product lifespan and consistency. However, niche segments, such as micro-dispensing for semiconductor applications or specialty nozzles for UV-curable adhesives, offer higher margins and reduced competition due to the specialized nature of the technology and the stringent regulatory hurdles involved. Addressing the restraint of cost and replacement frequency through advanced ceramic coatings or disposable, bio-compatible polymer nozzles that reduce cleaning time represents a major strategic opportunity for market participants, aligning product development with the industry-wide focus on sustainable manufacturing practices and operational expenditure reduction, thereby driving long-term market vitality and sustained growth prospects.

Segmentation Analysis

The Industrial Dispensing Nozzles Market is meticulously segmented based on key criteria including Nozzle Type, Material, Application Method, Fluid Type, and End-Use Industry, reflecting the diversity of dispensing requirements across the global manufacturing landscape. Segmentation allows for a focused analysis of demand drivers, technological advancements, and competitive dynamics within specific product niches, facilitating targeted strategic planning and product development efforts. The segmentation by Type, encompassing standard conical tips, bent tips, tapered tips, and advanced jetting nozzles, directly correlates with the required fluid volume, viscosity, and application accessibility. Meanwhile, the segmentation by Material, featuring stainless steel, PTFE, ceramics, and specialized plastics, dictates the nozzle’s chemical resistance, lifespan, and suitability for high-pressure or high-temperature dispensing operations. Understanding these distinct segments is crucial for manufacturers to tailor their offerings to the evolving, precise demands of end-user sectors such as semiconductor packaging, electric vehicle battery assembly, and high-volume consumer goods production.

The segmentation by Application Method distinguishes between time-pressure dispensing, volumetric dispensing, and high-speed jetting, with jetting technology rapidly gaining traction due to its ability to achieve non-contact dispensing at extremely high speeds and superior precision, often essential in modern electronics assembly lines. By End-Use Industry, the market analysis highlights the dominant roles of Electronics and Automotive, emphasizing the specialized requirements of each—electronics demanding micron-level accuracy and minimal material residue, while automotive prioritizing structural strength, durability, and resistance to environmental factors in their dispensed materials and corresponding nozzles. The growing environmental regulations globally are also leading to an increased demand for nozzles compatible with environmentally friendly adhesives and sealants, driving innovation in material chemistry and nozzle geometry specifically designed to optimize the performance of these less conventional fluid formulations, expanding the scope of the market.

Analyzing these segments reveals distinct growth trajectories; for instance, the rapid expansion of the Electric Vehicle market is bolstering the 'Automotive' segment's demand for large-bore, robust nozzles for battery thermal interface material application, while the continued miniaturization in IoT and semiconductor devices sustains the dominance of the 'Micro-Dispensing' sub-segment. Furthermore, regional analyses of these segments provide critical intelligence, indicating, for example, a higher uptake of advanced ceramic nozzles in Asian semiconductor hubs compared to a stable, yet high-volume demand for stainless steel tips in general industrial assembly in North America. This granular segmentation approach ensures that market players can effectively position their high-value products to capture growth opportunities inherent in these specialized application areas, moving away from reliance solely on highly competitive, lower-margin standard products.

- By Nozzle Type:

- Conical/Tapered Nozzles

- Straight Wall Nozzles

- Bent/Angled Nozzles

- Micro-Dispensing Tips

- Jetting Nozzles

- Specialty Custom Nozzles (e.g., Oval, Ribbon)

- By Material:

- Stainless Steel

- Polymer (e.g., PTFE, Polyethylene)

- Ceramic (e.g., Zirconia)

- Tungsten Carbide

- Fused Silica/Glass

- By Application Method:

- Time-Pressure Dispensing

- Volumetric/Positive Displacement Dispensing

- Jetting/Non-Contact Dispensing

- Spray Coating

- By End-Use Industry:

- Electronics and Semiconductors (Underfill, Encapsulation, Solder Paste)

- Automotive (Gasketing, Structural Bonding, Thermal Management)

- Medical Devices and Pharmaceuticals (Microfluidics, Component Assembly)

- Aerospace and Defense (Sealing, Potting)

- General Industrial Assembly

- Consumer Goods (Assembly, Bonding)

Value Chain Analysis For Industrial Dispensing Nozzles Market

The value chain for industrial dispensing nozzles begins with the upstream procurement and processing of highly specialized raw materials. This segment involves sourcing precision-grade materials such as high-purity stainless steel alloys, engineering thermoplastics like PTFE, and advanced ceramics (e.g., Zirconia, Alumina). Upstream analysis highlights that material suppliers must meet extremely strict purity, dimensional tolerance, and mechanical strength specifications, as the performance of the final nozzle is entirely dependent on the quality and consistency of the base material. Manufacturing processes at this stage often include advanced techniques like micro-machining, laser cutting, and precision injection molding to create the complex internal geometries and ultra-small apertures required for high-accuracy dispensing, demanding significant capital investment in specialized manufacturing equipment and quality control instrumentation to ensure consistent product output.

The central manufacturing stage involves the assembly, finishing, and rigorous quality inspection of the dispensing nozzles. This stage is dominated by specialized component manufacturers who might operate as Original Equipment Manufacturers (OEMs) or as independent aftermarket suppliers. Distribution channels are varied, including both direct and indirect routes. Direct distribution is common for high-volume, strategic, or custom-engineered nozzles sold directly to major OEMs in the electronics and automotive sectors, facilitated through dedicated technical sales teams that provide application engineering support. Indirect distribution relies heavily on global and regional distributors, industrial supply houses, and specialized fluid handling resellers who provide inventory management and logistics support to a broader base of small to medium-sized enterprises (SMEs) across diverse geographies, leveraging existing supply chains and local market knowledge for efficient product delivery and aftermarket support services.

Downstream analysis focuses on the end-users—the various manufacturing and assembly plants where the nozzles are integrated into automated dispensing robots or systems. The effectiveness of the nozzle is validated at this stage, depending on its ability to minimize defects and maximize line efficiency, driving the replacement cycle and market demand. Key success factors downstream include ease of integration, material compatibility, and the availability of technical support for troubleshooting complex dispensing applications. The shift towards proprietary dispensing systems that require specific, often branded, nozzle tips is tightening the coupling between the dispensing equipment supplier and the nozzle consumption, often creating a high barrier to entry for generic nozzle competitors, thereby influencing purchasing decisions based on system compatibility rather than solely on component price, reinforcing the importance of strategic OEM partnerships within the value chain.

Industrial Dispensing Nozzles Market Potential Customers

The primary potential customers and end-users of industrial dispensing nozzles span across sectors requiring high-precision fluidic control for assembly, bonding, sealing, or coating applications. The largest consumer base is the Electronics and Semiconductor industry, including integrated device manufacturers (IDMs), semiconductor packaging houses, and electronics manufacturing services (EMS) providers. These buyers require specialized micro-dispensing tips for handling materials like epoxy underfill, conductive adhesives, and flux during chip bonding, wafer-level packaging (WLP), and surface mount technology (SMT) processes. Their purchasing criteria are heavily weighted towards tip geometry consistency, material purity, and compatibility with highly sensitive electronic materials, often driving demand for high-cost ceramic or precision metallic nozzles that offer superior resistance to wear and chemical attack, ensuring long-term process stability and minimal defect rates in high-value component manufacturing.

Another major segment constitutes the Automotive industry, including Original Equipment Manufacturers (OEMs) and Tier 1 suppliers. With the pervasive shift towards electric vehicles (EVs), this sector requires robust, high-flow nozzles for large-volume applications such as applying structural adhesives for chassis bonding, dispensing high-viscosity thermal interface materials (TIMs) within battery packs, and applying automated gasketing materials (Formed-in-Place Gaskets). These customers value durability, flow rate capacity, and the ability of nozzles to handle abrasive or filled materials without clogging or premature wear, leading to a strong demand for specialized, large-bore stainless steel or tungsten carbide nozzles capable of continuous operation in harsh, high-throughput assembly line environments. The complexity of modern vehicle assembly, requiring multi-material joining, further increases the diversity of nozzle types needed across different production stages.

Furthermore, the Medical Device and Pharmaceutical sectors represent high-value potential customers, driven by stringent regulatory requirements (e.g., FDA, EMA) demanding absolute precision and traceability. These end-users, including manufacturers of diagnostic kits, surgical tools, and drug delivery systems, require nozzles constructed from bio-compatible, non-contaminating materials like specialized plastics or fused silica. The applications typically involve micro-volume dispensing of reagents, applying medical-grade adhesives for catheter or syringe assembly, and microfluidic device fabrication. The purchasing decision in this sector is heavily influenced by quality assurance documentation, sterilization compatibility, and the guaranteed absence of leachables or extractables from the nozzle material, prioritizing suppliers who can provide validated, sterile dispensing components over cost considerations, thereby creating a premium market niche focused entirely on quality and compliance assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Techcon Systems (OK International), I&J Fisnar Inc., Musashi Engineering Inc., DELO Industrial Adhesives, 3M Company, Sulzer Mixpac AG, Loctite (Henkel), P&H Technology, Topy Industries Ltd., SEMCO (PPG), Shenzhen Fancort Engineering Co., Ltd., Adhesives & Dispensing Systems (ADS), AXXAIR, and Kitov Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Dispensing Nozzles Market Key Technology Landscape

The technological landscape of the Industrial Dispensing Nozzles Market is rapidly evolving, driven by the demand for sub-micron precision and enhanced material longevity. A pivotal technology is advanced micro-machining, which uses processes like laser etching, electrochemical machining (ECM), and micro-grinding to fabricate nozzle tips with internal diameters less than 50 microns and extremely smooth bore surfaces, critical for ensuring laminar flow and preventing shear-thinning of sensitive fluids used in semiconductor packaging. Complementary to machining is the use of high-performance materials, particularly engineered ceramics (such as Zirconia and Silicon Nitride) and specialized polymers (like PEEK and UHMW PE), which offer exceptional resistance to abrasive fillers found in thermal interface materials and conductive inks, significantly extending the lifespan and reducing the replacement frequency of nozzles, thereby lowering operational expenditure for end-users operating high-volume production lines.

Another dominant technological trend involves the integration of high-speed non-contact dispensing systems, notably jetting technology. Jetting nozzles utilize piezoelectric or pneumatic actuation mechanisms to eject precise micro-dots of fluid without physically touching the substrate, reaching dispensing speeds far exceeding traditional contact methods, often upwards of 500 dots per second. The efficacy of jetting technology is highly dependent on proprietary nozzle design, material selection, and sophisticated real-time temperature control systems that manage fluid viscosity precisely before ejection, ensuring consistent droplet size and placement accuracy across complex three-dimensional surfaces. This technology addresses the growing need in consumer electronics manufacturing for high-speed, high-density component assembly, especially for flexible circuit boards and miniaturized sensors where conventional contact dispensing could cause damage or unnecessary material spread, thereby cementing its role as a disruptive force within the application method segment.

Furthermore, the technological ecosystem increasingly includes smart components and integrated vision systems. Many advanced dispensing systems now feature integrated high-resolution cameras that monitor the fluid bead shape and placement in real-time, feeding data back to the control unit for immediate corrective adjustments to nozzle height, pressure, or dispensing speed, achieving a closed-loop control mechanism. This integration transforms the nozzle from a passive fluid conduit into an active component within a highly automated, intelligent manufacturing cell. Future technology developments are concentrating on utilizing 3D printing (Additive Manufacturing) for rapid prototyping and production of complex, internal-channel customized nozzles optimized for specific highly viscous or multi-component fluid dispensing requirements, promising to dramatically shorten the design-to-deployment cycle and offering unparalleled geometric flexibility previously unobtainable through traditional subtractive manufacturing techniques.

Regional Highlights

- Asia Pacific (APAC): APAC stands as the undisputed leader in the Industrial Dispensing Nozzles Market, driven by its massive manufacturing footprint encompassing the global supply chains for consumer electronics, automotive components, and solar energy products. China, South Korea, Taiwan, and Japan are key contributors, hosting the largest semiconductor fabrication and assembly plants globally, demanding continuous volumes of high-precision micro-dispensing tips for wafer processing, die attachment, and advanced packaging techniques (e.g., Fan-Out Wafer Level Packaging, 3D stacking). Furthermore, the rapid expansion of EV manufacturing in China and Southeast Asia necessitates localized supply of high-capacity nozzles for battery cell and module assembly applications, ensuring sustained, aggressive growth in market volume and revenue within this region throughout the forecast period.

- North America: North America represents a mature, high-value market segment characterized by a focus on technological innovation, aerospace, medical device manufacturing, and high-end automotive R&D. Demand here is typically concentrated in specialized, proprietary, and highly regulated nozzle types, particularly ceramic and advanced polymer nozzles used in cleanroom environments for sterile assembly and defense applications requiring materials with extreme durability and traceability. The region shows strong early adoption of cutting-edge jetting technology and integrated AI-enabled dispensing systems, reflecting a preference for high automation and minimal human intervention, driving premium pricing and strong growth in the technologically sophisticated segments of the market.

- Europe: The European market is defined by stringent environmental and safety regulations, fostering high demand for nozzles compatible with low-VOC adhesives and sealants, particularly within the automotive, machinery, and pharmaceutical sectors, notably in Germany, France, and Italy. Europe is a strong hub for precision machinery and industrial automation suppliers, creating a symbiotic relationship between nozzle manufacturers and dispensing equipment integrators. The focus on quality, durability, and compliance ensures a stable and steady growth rate, with particular emphasis placed on sustainability and the development of reusable or easily recyclable nozzle components that meet the region's green manufacturing standards and minimize industrial waste generation.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but are exhibiting promising growth potential, fueled by increasing foreign direct investment in localized manufacturing, particularly in automotive assembly (Mexico, Brazil) and nascent electronics production. Market growth in MEA is largely concentrated around infrastructure projects and general industrial assembly, requiring standard, high-flow nozzles for sealing and bonding operations. As these regions expand their industrial bases and adopt higher levels of automation, the demand for both standard and moderately specialized industrial dispensing nozzles is expected to escalate, although market penetration remains lower compared to the established economies of APAC and North America, necessitating localized distribution and support infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Dispensing Nozzles Market.- Nordson Corporation

- Techcon Systems (OK International)

- I&J Fisnar Inc.

- Musashi Engineering Inc.

- DELO Industrial Adhesives

- 3M Company

- Sulzer Mixpac AG

- Loctite (Henkel)

- P&H Technology

- Topy Industries Ltd.

- SEMCO (PPG)

- Shenzhen Fancort Engineering Co., Ltd.

- Adhesives & Dispensing Systems (ADS)

- AXXAIR

- Kitov Systems

- Dymax Corporation

- GPD Global

- Fisnar Europe

- HumiSeal (Chase Corporation)

- Master Bond Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Dispensing Nozzles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for micro-dispensing nozzles in industrial applications?

The primary driver is the relentless miniaturization of components in consumer electronics, semiconductors, and medical devices. Manufacturers require nozzles with tip diameters often below 100 microns to accurately apply minute volumes of fluids (e.g., underfill, conductive inks) onto small, densely packed substrates, ensuring product performance and reliability. This technological shift mandates ultra-high precision dispensing capabilities.

How does nozzle material choice impact the dispensing process and product lifespan?

Nozzle material directly dictates chemical compatibility, resistance to wear, and dispensing precision. Materials like ceramic (Zirconia) and tungsten carbide are favored for handling abrasive, filled fluids (e.g., thermal interface materials) due to superior hardness and lifespan, while specialized polymers like PTFE are used for chemically aggressive or bio-compatible fluid applications where cross-contamination must be strictly avoided. Proper material selection prevents premature wear and ensures flow stability.

Which end-use industry holds the largest market share for industrial dispensing nozzles?

The Electronics and Semiconductor industry currently holds the largest market share. This dominance is due to the high volume, complexity, and precision required in manufacturing integrated circuits, smartphones, and advanced electronic assemblies, necessitating continuous consumption of specialized, high-accuracy nozzles for encapsulation, bonding, and sealing processes integral to device functionality.

What is the key technological advantage of non-contact jetting nozzles over traditional dispensing tips?

The key advantage of non-contact jetting nozzles is their ability to dispense fluid droplets at extremely high speeds (hundreds per second) and with superior precision, without physically touching the substrate. This eliminates the risk of substrate damage, reduces stringing or tailing, and allows for accurate deposition onto uneven or complex geometries, significantly boosting production throughput and quality control in high-speed assembly environments.

What role does the shift toward electric vehicles (EVs) play in the dispensing nozzle market?

The rise of EVs is a major opportunity, driving significant demand for high-capacity and durable nozzles used specifically in battery assembly. These nozzles are essential for precisely applying large volumes of highly viscous thermal interface materials (TIMs) and structural adhesives required for securing, cooling, and protecting battery cells and modules, necessitating robust nozzle designs optimized for thick, challenging fluid dynamics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager