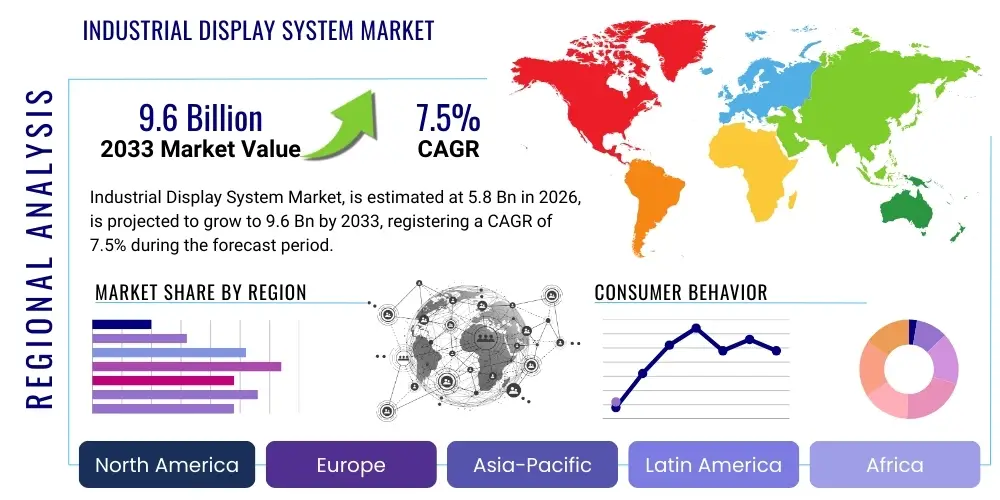

Industrial Display System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442272 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Industrial Display System Market Size

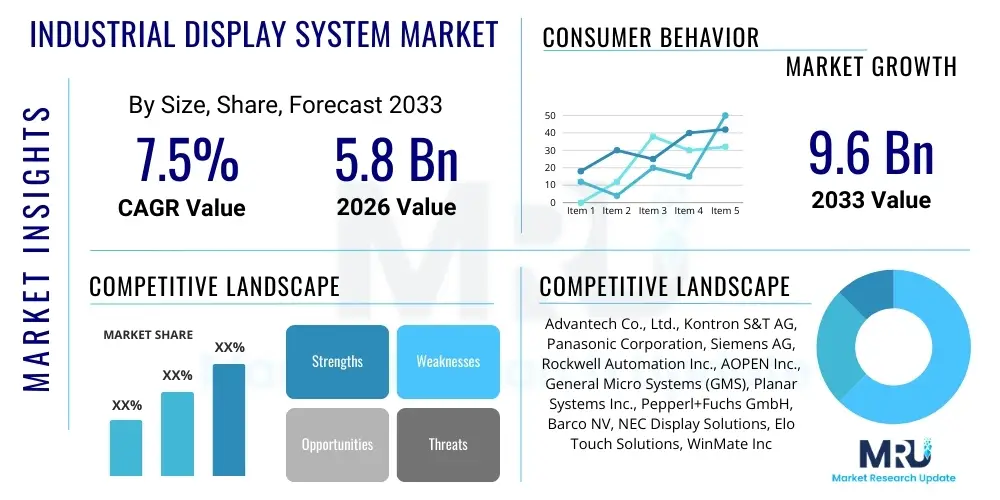

The Industrial Display System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating global trend toward smart manufacturing, the integration of Human-Machine Interface (HMI) systems across diverse industrial verticals, and the increasing necessity for robust, reliable visualization solutions in harsh operating environments. The market expansion reflects significant investment in digital transformation initiatives across sectors like automotive, oil & gas, and process manufacturing, driving demand for high-performance, ruggedized display technologies capable of supporting critical operational data and control functions.

Industrial Display System Market introduction

Industrial Display Systems are highly specialized visualization devices designed for continuous operation and resilience in demanding industrial settings, distinguishing them fundamentally from standard commercial displays. These systems encompass monitors, panel PCs, and HMI units utilized for real-time data monitoring, process control, and interactive communication between operators and machinery. Their inherent design emphasizes durability, featuring rugged enclosures, resistance to dust, moisture, vibration, and extreme temperature variations, often incorporating enhanced brightness and anti-glare coatings for optimal visibility in diverse lighting conditions. Key product offerings include open-frame, panel-mount, and chassis-mount configurations, catering to specific installation requirements within manufacturing floors, control rooms, and field operations.

The major applications of these systems span across sophisticated manufacturing execution systems (MES), supervisory control and data acquisition (SCADA) platforms, and quality assurance stations in industries such as energy and power, transportation, and chemical processing. The primary benefits derived from deploying industrial displays include improved operational efficiency through immediate access to crucial performance metrics, enhanced safety protocols via clear visualization of hazards, and significant reduction in downtime due to their exceptional reliability and longevity compared to consumer-grade alternatives. They serve as critical components for facilitating the seamless interaction required for modern automated processes and complex control loops.

The market is significantly driven by the rapid adoption of Industry 4.0 paradigms, which necessitate integrated, highly connected visualization endpoints to manage massive datasets generated by IoT devices and sensors. Furthermore, regulatory requirements mandating higher standards for operational safety and data recording in sensitive industries, coupled with continuous technological advancements in display panel quality (such as higher resolutions, wider viewing angles, and improved touch sensitivity), propel market momentum. The shift towards ergonomic and intuitive operator interfaces further cements the role of advanced industrial displays as central nervous systems for modern factories.

Industrial Display System Market Executive Summary

The Industrial Display System Market demonstrates robust growth, primarily fueled by the global shift towards fully automated and intelligent operational environments. Current business trends highlight a strong demand for modular display solutions that can be easily customized and integrated into existing legacy infrastructure, focusing on fanless designs and enhanced thermal management to maximize uptime. Furthermore, the convergence of display technology with advanced computing capabilities (Panel PCs) allows for localized data processing at the edge, reducing latency and improving decision-making speed on the factory floor. Strategic alliances between display manufacturers and industrial automation providers are defining the competitive landscape, pushing innovation in specialized display features such as sunlight readability and hazardous area certifications (e.g., ATEX, Class 1 Div 2).

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, driven by massive investments in manufacturing expansion, particularly in China, Japan, South Korea, and India, where governments are actively promoting smart factory initiatives and digitalization across heavy industries. North America and Europe, while mature, exhibit strong demand for replacement and upgrade cycles, focusing intensely on high-end, high-reliability displays optimized for highly regulated sectors like aerospace, defense, and pharmaceutical manufacturing. These regions prioritize features related to cybersecurity and long-term product availability, aligning with stringent operational lifecycles.

Segment trends reveal that the Panel Mount Display type holds the largest market share due to its ease of integration into control cabinets and industrial enclosures. However, the Open Frame segment is anticipated to witness the highest growth, driven by its versatility in embedded applications and customizable machine designs. By technology, LCD remains prevalent, but high-performance sectors are rapidly adopting advanced LED and OLED technologies for superior contrast and energy efficiency. The largest end-user segment, Manufacturing, continues to expand its deployment of large-format displays for production monitoring and Overall Equipment Effectiveness (OEE) visualization, while the Oil & Gas segment drives demand for specialized, explosion-proof units.

AI Impact Analysis on Industrial Display System Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Industrial Display System Market typically revolve around whether AI integration will necessitate entirely new hardware, how AI-driven predictive maintenance impacts display reliability requirements, and the necessity of incorporating enhanced computing capabilities directly into display units to handle localized AI processing. Users are highly interested in the role of AI in transforming Human-Machine Interface (HMI) interactions, expecting smarter, context-aware displays that can prioritize critical information dynamically and guide operators proactively through complex procedures. Key themes emerging from these concerns center on the convergence of visualization, processing power, and intelligent data interpretation at the point of action, moving industrial displays from passive monitors to active, cognitive interfaces essential for optimized industrial operations. The core expectation is for AI to improve the actionable nature of the data presented.

The integration of AI fundamentally transforms industrial displays from passive visualization tools into active components of intelligent control systems. AI algorithms, particularly those related to machine vision and predictive analytics, require the industrial display system to serve as an edge computing gateway, processing sensor data locally before displaying synthesized, actionable insights rather than raw data streams. This necessitates displays with greater computational power (embedded processors), faster refresh rates, and the capability to run sophisticated visualization software tailored for AI output, such as augmented reality overlays or predictive failure indicators. Manufacturers are responding by developing rugged panel PCs that incorporate specialized AI accelerators or powerful GPUs specifically designed to manage complex, parallel processing tasks related to real-time industrial diagnostics and control loop optimization.

Furthermore, AI improves the ergonomics and efficiency of the display interface itself. AI systems can dynamically adjust the layout, color scheme, and data density of the display based on the operator's current task, stress level, or the immediate priority of the machine being monitored, thereby minimizing cognitive load and reducing the potential for human error. This shift from static HMI dashboards to dynamic, AI-optimized user interfaces ensures that industrial display systems remain central to human oversight in highly automated environments, focusing human attention only on exceptions and critical deviations identified by the AI system, thus justifying the continued investment in high-quality, high-reliability display hardware.

- AI enables predictive maintenance visualization, prioritizing machine health alerts directly on the display.

- Integration of machine learning models for real-time anomaly detection and visual representation of deviations.

- Demand for higher computational power (edge AI) embedded within industrial Panel PCs for low-latency processing.

- Development of adaptive and context-aware HMI interfaces driven by AI algorithms to optimize operator workflow.

- Requirement for high-resolution displays to support complex, overlay visualizations generated by computer vision applications.

DRO & Impact Forces Of Industrial Display System Market

The trajectory of the Industrial Display System Market is shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), whose collective impact determines investment and innovation cycles. The principal driver is the imperative for digital transformation across global manufacturing, spearheaded by Industry 4.0 initiatives, which fundamentally relies on real-time data visualization and human interaction through robust HMI systems. Concurrently, the increasing regulatory focus on worker safety and environmental monitoring in high-risk sectors (e.g., chemical, nuclear) mandates the use of certified, explosion-proof, and durable display systems, thereby expanding the demand for premium products. However, the market faces significant restraints, including the high initial procurement and installation costs of ruggedized industrial-grade displays compared to standard commercial alternatives, coupled with the long industrial lifecycle requirements which sometimes hinder the rapid adoption of the latest consumer display technologies (like bendable OLEDs) due to concerns over long-term parts availability and support.

Opportunities for growth are predominantly found in the synergistic integration of Industrial IoT (IIoT) technologies with display systems, enabling remote diagnostics, cloud-based monitoring, and the development of specialized augmented reality (AR) interfaces for maintenance technicians, leveraging the display as a gateway for immersive data interaction. The market is also presented with the opportunity to penetrate emerging economies in Southeast Asia and Latin America, where rapid infrastructure development and subsequent automation of new manufacturing facilities create greenfield opportunities for advanced industrial display deployment. Furthermore, the development of ultra-low-power, sunlight-readable e-paper and transflective displays presents a niche opportunity for specialized mobile and outdoor applications, such as logistics tracking and field maintenance.

The impact forces influencing the market are high. The technological intensity is significant, with continuous pressure to improve durability (e.g., anti-shock, anti-scratch coatings), optical performance (brightness, clarity), and connectivity options (Ethernet/IP, PROFINET). Competitive rivalry is moderate-to-high, characterized by established automation giants competing with specialized display manufacturers, often leading to rapid product feature convergence. Customer bargaining power is moderate, particularly in large-volume contracts within the automotive and major discrete manufacturing sectors. The cumulative effect of these forces suggests a market that is mature yet continuously evolving, with innovation focused heavily on integration, reliability, and adapting to stringent industrial communication protocols.

Segmentation Analysis

The Industrial Display System Market is highly fragmented and analyzed based on key criteria including display type, screen size, technology, and primary end-use industry, providing a granular view of market dynamics and targeted deployment strategies. This segmentation is crucial for understanding specific regional demands—for instance, the heavy reliance on Panel PCs in North American discrete manufacturing versus the higher demand for basic monitors in APAC infrastructure projects. Detailed analysis reveals distinct growth patterns across segments, with touchscreen-enabled devices rapidly gaining prominence over traditional push-button interfaces due to improved operational efficiency and familiarity derived from consumer electronics.

- By Type:

- Panel Mount Displays

- Open Frame Displays

- Chassis Mount Displays

- Marine/Military Grade Displays

- Industrial Monitors (Non-PC)

- By Technology:

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

- Organic Light Emitting Diode (OLED)

- Electronic Paper (E-Paper)

- Plasma Display Panels (PDP)

- By Screen Size:

- Below 10 Inches

- 10 Inches to 17 Inches

- 17 Inches to 21 Inches

- Above 21 Inches

- By Touchscreen Technology:

- Resistive

- Capacitive (Projected and Surface)

- Surface Acoustic Wave (SAW)

- By Industry Vertical:

- Manufacturing (Discrete and Process)

- Oil & Gas

- Energy & Power

- Transportation (Automotive, Rail, Marine)

- Healthcare and Pharmaceutical

- Chemical and Petrochemical

- Mining and Metallurgy

Value Chain Analysis For Industrial Display System Market

The value chain of the Industrial Display System Market begins with upstream activities dominated by raw material suppliers (glass substrates, semiconductors, liquid crystals) and core component manufacturers (TFT-LCD/OLED panels, backlights, touch sensors). These suppliers exert significant influence over pricing and product availability, particularly regarding specialized industrial-grade panels that require long-term supply agreements and stringent quality control. Key upstream challenges involve maintaining a stable supply chain for customized components needed for ruggedization, such as specialized housing materials and high-luminance LEDs, ensuring industrial specifications are met beyond standard consumer tolerances.

Midstream activities involve the core manufacturing, assembly, and integration processes carried out by Original Equipment Manufacturers (OEMs) and specialized industrial display system providers. This stage is critical for adding value through ruggedization (IP ratings, shock resistance), system integration (embedding industrial processors and I/O ports), and compliance certification (ATEX, UL, CE). Manufacturers often focus on developing proprietary thermal management systems and modular designs that allow for flexible configuration of processors and connectivity, ensuring the final product meets the diverse environmental and functional requirements of various end-user industries.

The downstream flow involves distribution channels, which are typically bifurcated into direct and indirect routes. Direct sales are common for large-scale, highly customized projects, where manufacturers deal directly with major automation system integrators or Tier 1 end-users (e.g., large automotive manufacturers). Indirect channels involve specialized industrial distributors, value-added resellers (VARs), and regional system integrators who provide local support, installation, and software integration services. These indirect partners are crucial for penetrating Small and Medium-sized Enterprises (SMEs) and providing tailored solutions that incorporate the display system into a broader control architecture. The efficacy of the downstream segment relies heavily on the technical competence of these distributors to support complex industrial networking and software environments.

Industrial Display System Market Potential Customers

The primary customers for Industrial Display Systems are entities that require reliable, continuous operational visualization and control in non-standard, demanding environments. This encompasses a broad spectrum of heavy and process industries where environmental factors (temperature extremes, dust, moisture) and operational criticality necessitate specialized hardware. End-users fall broadly into two categories: Automation System Integrators and Direct Industrial Operators. System Integrators purchase displays in bulk to embed them within larger turnkey control systems, acting as the primary channel for newly built or upgraded manufacturing facilities.

Direct Industrial Operators represent the ultimate buyers across critical infrastructure sectors. In the Manufacturing sector, customers include automotive assembly plants, semiconductor fabrication facilities, and food & beverage processing plants that utilize these displays for MES/SCADA interface, machine diagnostics, and quality control checkpoints. The Oil & Gas industry utilizes certified hazardous location (HazLoc) displays for drilling platforms and refinery operations. Transportation (rail and marine) relies on rugged displays for navigation and control interfaces. Healthcare and Pharmaceutical customers deploy panel PCs in cleanroom environments and for diagnostic equipment where non-contaminating, sealed displays are mandatory. These diverse end-users prioritize product longevity, specific industrial certifications, and backward compatibility over price, driving the market toward high-specification solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Advantech Co., Ltd., Kontron S&T AG, Panasonic Corporation, Siemens AG, Rockwell Automation Inc., AOPEN Inc., General Micro Systems (GMS), Planar Systems Inc., Pepperl+Fuchs GmbH, Barco NV, NEC Display Solutions, Elo Touch Solutions, WinMate Inc., Industrial PC (IPC) Solutions, Beckhoff Automation, Dell Technologies (Industrial), ASUStek Computer Inc. (Industrial), Fujitsu Ltd. (Industrial), LG Display (Industrial Solutions), Samsung Display (Industrial) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Display System Market Key Technology Landscape

The industrial display market's technological landscape is defined by the ongoing pursuit of superior durability, optical performance, and seamless integration with complex industrial networks. While traditional thin-film transistor liquid crystal display (TFT-LCD) technology remains the dominant backbone due to its cost-effectiveness and proven industrial reliability, the market is actively integrating advanced backlighting techniques, specifically LED backlighting, which significantly enhances energy efficiency, improves brightness uniformity, and extends the operational lifespan compared to older cold cathode fluorescent lamp (CCFL) technology. A critical technological focus is on strengthening the display's mechanical resilience through optically bonded cover glass and specialized coatings that prevent reflection, resist chemicals, and allow operation even when the surface is wet or operators are wearing heavy gloves, a necessity in environments like oil rigs or chemical processing plants.

Touchscreen technology is a major area of innovation. Projected Capacitive (PCap) touch is rapidly displacing legacy Resistive technology due to its superior multi-touch capabilities, high clarity, and scratch resistance, making it suitable for intuitive HMI applications demanding complex gestures. Furthermore, the integration of high-performance System-on-Chip (SoC) architectures and advanced processor units directly into panel PCs is crucial. These embedded systems enable edge computing capabilities, allowing the display unit to handle localized data acquisition, filtering, and real-time operational analytics without relying solely on centralized servers, thereby improving the responsiveness of control systems and reducing network load, directly supporting modern IIoT architectures.

Another emerging area involves compliance and interoperability. Manufacturers are increasingly focusing on developing standardized communication interfaces and robust operating system support (e.g., industrial versions of Windows, Linux) that guarantee seamless connectivity with common industrial protocols such such as EtherCAT, Profibus, and Modbus TCP. The push towards modularity, where displays, computing units, and I/O modules can be separately upgraded or replaced, is a key technological trend ensuring long-term maintainability and total cost of ownership reduction for end-users operating in critical infrastructure. The increasing use of hazardous area certifications (e.g., IECEx, ATEX) necessitates specialized encapsulation and intrinsic safety designs, representing a high-barrier technological niche within the market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by extensive governmental push toward 'Made in China 2025' and similar smart factory initiatives across India, South Korea, and Southeast Asia. The region’s strength lies in its vast manufacturing base, requiring both mass deployment of standard industrial monitors and high-end panel PCs for newly constructed, digitally advanced facilities. The primary demand is generated by the automotive, consumer electronics manufacturing, and rapidly expanding infrastructure sectors, leading to massive scale adoption and competitive pricing pressures.

- North America: North America represents a mature market characterized by high expenditure on high-reliability, premium-grade display systems. The demand is heavily concentrated in the defense, aerospace, pharmaceutical, and oil & gas sectors, where stringent regulatory compliance and the need for certified, high-durability hardware (including military-grade specifications) are paramount. The region is also a pioneer in implementing advanced edge computing displays and sophisticated AR-enabled HMI systems, leveraging technological leadership.

- Europe: Europe maintains a strong market position, highly influenced by the "Industry 4.0" (Industrie 4.0) concept originated in Germany. The region focuses on integrating displays into highly automated, efficient production lines, prioritizing standardization, energy efficiency, and modularity. Key markets include Germany (heavy machinery, automotive), Scandinavia (marine, energy), and Western Europe (chemical processing). European demand often centers on displays meeting high safety standards (CE marking) and specialized ATEX certifications for explosive atmospheres.

- Latin America (LATAM): LATAM is an emerging region experiencing significant investment in industrial modernization, particularly in resource extraction (mining), agriculture, and burgeoning automotive manufacturing hubs in Mexico and Brazil. Market growth here is primarily driven by multinational companies standardizing equipment across global operations, leading to increasing demand for cost-effective yet reliable industrial display solutions for new installations and major facility upgrades.

- Middle East and Africa (MEA): MEA market growth is tied directly to large-scale infrastructure projects, especially in the Oil & Gas, utility, and construction sectors across the Gulf Cooperation Council (GCC) countries. The demand is characterized by the need for displays capable of operating reliably under extreme heat and desert conditions, necessitating high brightness and robust thermal management systems. Investment cycles tend to be volatile, dependent on global commodity prices, particularly crude oil.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Display System Market.- Advantech Co., Ltd.

- Kontron S&T AG

- Panasonic Corporation

- Siemens AG

- Rockwell Automation Inc.

- AOPEN Inc.

- General Micro Systems (GMS)

- Planar Systems Inc.

- Pepperl+Fuchs GmbH

- Barco NV

- NEC Display Solutions

- Elo Touch Solutions

- WinMate Inc.

- Industrial PC (IPC) Solutions

- Beckhoff Automation

- Dell Technologies (Industrial)

- ASUStek Computer Inc. (Industrial)

- Fujitsu Ltd. (Industrial)

- LG Display (Industrial Solutions)

- Samsung Display (Industrial)

Frequently Asked Questions

Analyze common user questions about the Industrial Display System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between industrial and commercial display systems?

Industrial display systems are engineered for superior ruggedness, featuring higher IP ratings, wider temperature tolerance, enhanced resistance to vibration and shock, and extended product lifecycle support (typically 5-10 years) to ensure reliability in harsh 24/7 operational environments, unlike standard commercial displays.

How is Industry 4.0 influencing the demand for industrial displays?

Industry 4.0 drives demand by necessitating advanced Human-Machine Interfaces (HMIs) and Panel PCs capable of processing, visualizing, and interacting with massive data streams from IoT sensors and integrated production systems, requiring displays that support real-time edge computing and network connectivity (e.g., Ethernet/IP).

Which technology type is currently dominating the industrial display market?

Liquid Crystal Display (LCD) technology remains dominant due to its proven reliability, cost efficiency, and wide availability of industrial-grade panels, although advanced LED backlighting and the integration of Projected Capacitive (PCap) touch are setting the modern standard for new installations.

What are the key certification requirements for industrial displays in hazardous locations?

Displays deployed in hazardous (HazLoc) environments, such as oil refineries or chemical plants, must comply with stringent certifications like ATEX (European Union) or IECEx (International), ensuring they are intrinsically safe or explosion-proof and designed not to ignite volatile substances in the surrounding atmosphere.

What is the expected CAGR of the Industrial Display System Market between 2026 and 2033?

The Industrial Display System Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.5% from 2026 to 2033, driven primarily by ongoing global industrial automation and infrastructure modernization projects across Asia Pacific and established Western markets.

How does open frame industrial display segmentation differ from panel mount units?

Open frame displays are supplied without an external bezel or enclosure, designed to be permanently embedded directly into proprietary machinery or specific kiosks, offering maximum flexibility and customization for OEMs. Panel mount units, conversely, are designed for flush mounting into the front of control cabinets or panels, providing a sealed front face.

What is the role of edge computing in modern industrial display systems?

Edge computing integrated into industrial display systems (Panel PCs) allows for localized data processing and analysis close to the source of data generation, significantly reducing network latency, improving real-time control loop execution, and enabling AI-driven diagnostics without continuous reliance on cloud or centralized servers.

Which industry vertical is the largest end-user for industrial displays?

The Manufacturing industry, encompassing both discrete manufacturing (e.g., automotive, aerospace) and process manufacturing (e.g., food & beverage, chemicals), represents the largest end-user segment due to the pervasive requirement for reliable Human-Machine Interfaces (HMIs) and operational monitoring across production lines.

What factor restrains the rapid adoption of new display technologies like flexible OLED in industrial settings?

The primary restraint is the industry's requirement for long-term product availability and stability (10+ years), which newer, rapidly evolving technologies like flexible OLED often cannot guarantee due to their shorter commercial lifecycle and the high cost associated with industrializing fragile components for rugged environments.

What geopolitical factors influence the global industrial display supply chain?

Geopolitical factors, particularly trade disputes and concentration of core component manufacturing (e.g., TFT panels) in certain APAC countries (China, Taiwan, Korea), create vulnerability in the supply chain, leading manufacturers to seek diversified sourcing strategies and regional assembly facilities to ensure supply resilience.

How are industrial display manufacturers addressing cybersecurity concerns?

Manufacturers are integrating enhanced security features, including trusted platform modules (TPM), secure boot processes, and specialized operating system hardening, into Panel PCs to prevent unauthorized access, secure industrial network communication, and protect sensitive operational data displayed and managed by the systems.

Why is optical bonding an important technological feature in industrial displays?

Optical bonding, which involves adhering the display panel and the cover glass together, eliminates the air gap. This dramatically reduces internal reflection, increases contrast, improves sunlight readability, and enhances the system's mechanical ruggedness by preventing moisture ingress and resisting vibration and shock more effectively.

What is the significance of the 21-inch and above screen size segment?

Displays sized 21 inches and above are gaining significance, predominantly used in centralized control room environments, high-level supervisory SCADA systems, and for group viewing of Overall Equipment Effectiveness (OEE) metrics, reflecting a trend toward consolidated, high-information-density visualization panels.

What is the primary competitive strategy employed by key players in the market?

Key players often employ a strategy focused on specialized product differentiation, emphasizing vertical integration (combining hardware and software), offering extreme ruggedization and niche certifications, and providing comprehensive long-term support and legacy component compatibility to secure repeat business from major industrial clients.

How does the transportation industry utilize industrial display systems?

The transportation sector, including rail, marine, and commercial vehicles, uses these systems for reliable human-machine interface (HMI) applications in cockpits and control rooms, requiring specialized, often military/marine-grade ruggedization to handle constant vibration, varying temperatures, and critical navigation or operational control tasks.

What impact does the need for fanless design have on industrial display manufacturing?

The demand for fanless designs, crucial for operating in dusty, high-vibration, or sterile (cleanroom) environments, forces manufacturers to utilize sophisticated passive cooling techniques like heat pipes and specialized thermal enclosures. This increases the complexity and cost of the chassis but significantly improves system reliability and reduces maintenance needs.

In the value chain, what are the critical roles of system integrators?

System integrators are crucial downstream participants, responsible for customizing, installing, and integrating the industrial display systems (Panel PCs and monitors) with the end-user’s specific automation software, legacy control systems, and network architecture, providing value-added services necessary for tailored industrial solutions.

Which regional market shows the greatest potential for new entrants?

The Asia Pacific region, particularly emerging economies like India and Southeast Asian nations, presents the greatest potential due to rapid industrialization, large-scale factory construction, and growing demand for cost-effective, medium-specification industrial display solutions necessary for foundational automation upgrades.

What is the primary function of a chassis mount industrial display?

Chassis mount industrial displays are semi-open modules with protective casing around the electronics, designed for maximum flexibility, often employed when the display needs to be fixed directly onto a machine body or installed into specialized custom enclosures that provide the final level of environmental protection.

How does the shift towards sustainable manufacturing affect the industrial display market?

Sustainable manufacturing promotes the use of energy-efficient components, favoring technologies like LED backlighting and low-power embedded processors. It also drives demand for displays that monitor and visualize resource consumption (energy, water) in real time, supporting overall plant efficiency and environmental compliance tracking.

What role do specialized coatings play in display performance?

Specialized coatings, such as anti-reflective, anti-glare, and anti-smudge (oleophobic) treatments, are essential for improving the usability of industrial displays by maintaining visibility under strong factory lighting or direct sunlight, while also protecting the screen surface from chemicals, grease, and excessive wear from frequent touch interaction.

What technological advancements are driving the adoption of larger screen sizes?

Advancements in display resolution (4K and beyond) and seamless integration technologies allow large displays to consolidate multiple monitoring functions onto a single, high-clarity panel, replacing banks of smaller, disparate monitors and improving the ergonomic control and situational awareness for operators in control rooms.

How do industrial displays aid in regulatory compliance?

In highly regulated industries like pharmaceutical or nuclear energy, industrial displays serve as the primary interface for logging operational parameters, displaying critical safety warnings, and interacting with validated control software, ensuring that all actions and data recording adhere strictly to legal and industry standards.

What is the significance of M&A activity among industrial display manufacturers?

Mergers and Acquisitions (M&A) are common strategies used by large automation firms to acquire niche display expertise, particularly in areas like advanced touch technology or certified hazardous area solutions, thereby expanding their product portfolios and enhancing their capability to offer complete, integrated automation ecosystems.

In the context of the supply chain, what are the challenges related to long-term component availability?

The biggest challenge is managing component obsolescence, especially for processors and display controllers, which have shorter commercial lifecycles. Industrial display manufacturers must implement rigorous change management processes and ensure high volume "last time buys" to support customer operational demands spanning 7-10 years.

How is the oil and gas industry driving specialization in industrial displays?

The oil and gas industry demands extremely specialized displays that are certified explosion-proof (Zone 1/Div 1), resistant to corrosive chemicals, and capable of operating reliably in extreme temperature fluctuations experienced on offshore platforms and remote pipelines, requiring significant material science and engineering customization.

What is the typical lifespan expectation for a robust industrial display system?

A high-quality, ruggedized industrial display system is typically expected to have an operational lifespan ranging from 50,000 to 70,000 hours of continuous use (backlight life), and manufacturers generally guarantee product supply and parts support for a minimum of five to seven years post-launch.

What is the primary advantage of capacitive touch technology over resistive touch in industrial settings?

Projected Capacitive (PCap) touch offers superior optical clarity, supports multi-touch gestures (pinching, zooming), and provides higher durability and scratch resistance compared to the pressure-sensitive nature of resistive technology, making it preferred for modern, highly interactive HMI applications.

How does the demand for remote monitoring affect display features?

Increased remote monitoring necessitates display systems with enhanced network security, robust remote access capabilities (e.g., VNC, RDP), and the ability to clearly visualize data transmitted over IIoT platforms, driving the integration of powerful communication modules and specialized software interfaces within the display unit.

In Latin America, what factors constrain market growth despite industrial expansion?

Constraints in LATAM primarily include high import tariffs, volatile currency fluctuations impacting procurement costs, and often inconsistent local technical support infrastructure, which make the total cost of ownership (TCO) for premium industrial displays higher than in mature markets.

What are the implications of OLED technology entering the industrial display sector?

OLED offers superior contrast ratio, perfect blacks, and fast response times, highly desirable for critical visual tasks. However, industrial adoption is slow due to high cost, concerns over burn-in during static HMI use, and limited proven longevity in extreme operating temperatures, restricting its current use mainly to specialized high-end, low-volume applications.

How is the defense sector's demand unique for industrial display systems?

The defense sector demands extremely high reliability, compliance with strict military specifications (MIL-STD-810G for shock/vibration, MIL-STD-461 for EMI), secure data transmission capabilities, and often requires specialized night vision compatibility and non-reflective coatings for tactical environments, placing them in the highest tier of ruggedization.

What is the market relevance of E-Paper technology in this domain?

E-Paper (Electronic Paper) technology is relevant for niche industrial applications requiring ultra-low power consumption and excellent sunlight readability, such as outdoor asset tracking labels, field maintenance tags, or certain remote sensor data displays where continuous battery operation over long periods is critical.

How do manufacturers ensure compatibility with diverse industrial communication protocols?

Manufacturers achieve compatibility by embedding specialized industrial communication interface cards (like PROFINET, EtherCAT slave interfaces) directly into the display or panel PC, ensuring seamless integration and high-speed data exchange with standard programmable logic controllers (PLCs) and distributed control systems (DCS).

What is the forecasted trend for screen size adoption in the coming years?

The forecasted trend indicates a steady shift towards larger screen sizes (17 inches and above) and multi-display configurations, driven by the increasing complexity of industrial processes and the need to display integrated visualization outputs generated by advanced AI and IIoT analytical platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager