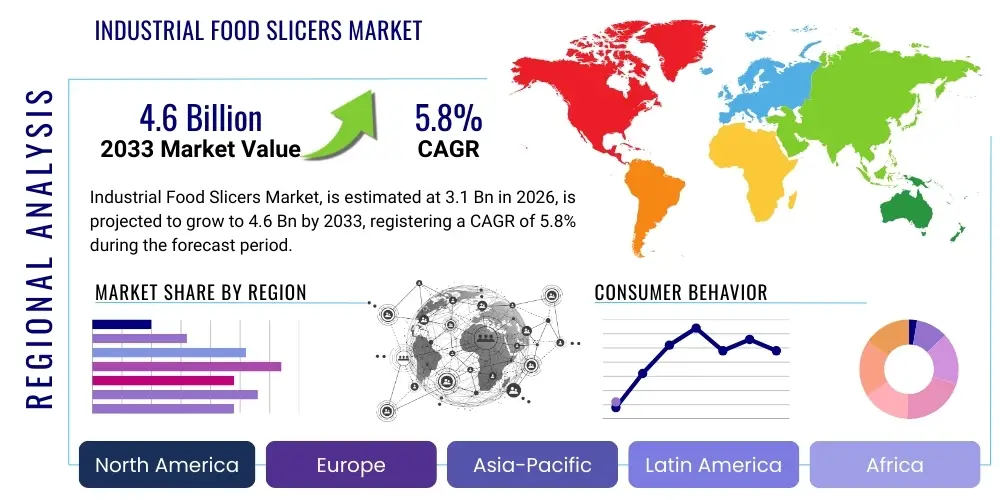

Industrial Food Slicers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440818 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Food Slicers Market Size

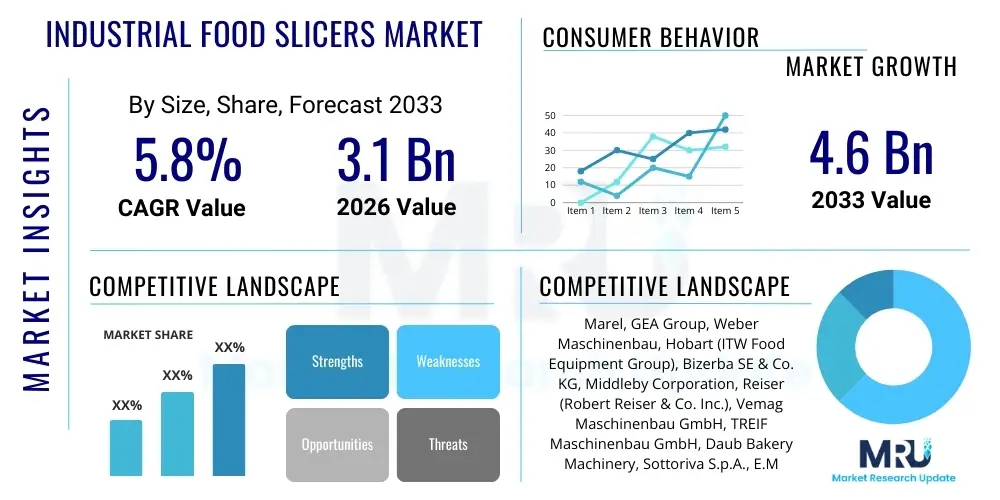

The Industrial Food Slicers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 billion in 2026 and is projected to reach USD 4.6 billion by the end of the forecast period in 2033. This growth is underpinned by the increasing demand for processed food products, the rising adoption of automation in the food processing industry, and stringent hygiene standards necessitating advanced slicing equipment. The market's expansion reflects a global shift towards efficient, high-volume food production with an emphasis on consistency and safety.

Industrial Food Slicers Market introduction

Industrial food slicers represent a critical category of machinery within the food processing and preparation industry, designed for high-volume, precision slicing of various food items. These sophisticated machines range from automatic to semi-automatic systems, utilizing advanced blade technologies and control mechanisms to ensure consistent product thickness and quality. Their primary function is to enhance operational efficiency, reduce labor costs, and maintain stringent hygiene standards across large-scale food production environments, contributing significantly to modern food supply chains.

The product scope encompasses a wide array of specialized slicers, including deli meat slicers, cheese slicers, bread slicers, vegetable slicers, and more, each engineered to handle specific product characteristics with optimal results. Key features often include adjustable slice thickness, high-speed operation, durable stainless-steel construction for sanitation, and integrated safety mechanisms. Major applications span commercial food processing plants, large-scale bakeries, meat packaging facilities, dairy operations, and industrial catering services, where consistent portion control and rapid throughput are paramount. These machines play a pivotal role in preparing consumer-ready products as well as ingredients for further processing.

The benefits derived from adopting industrial food slicers are multifaceted, extending beyond mere speed. They deliver unparalleled consistency in slice thickness and weight, which is crucial for product uniformity and cost control. Furthermore, these machines significantly improve food safety by minimizing human contact with food, complying with stringent global hygiene regulations. Driving factors for market growth include the burgeoning global demand for convenience foods, the ongoing trend towards automation in manufacturing to combat labor shortages, and increasing regulatory pressure for enhanced food safety and traceability. The technological advancements, such as integration with smart systems and improved sanitation features, further propel their adoption.

Industrial Food Slicers Market Executive Summary

The Industrial Food Slicers Market is experiencing robust growth driven by significant business trends, evolving regional dynamics, and specialized segment demands. A prominent business trend is the escalating adoption of automation and digitalization within the food processing sector, aiming to enhance productivity, mitigate labor dependencies, and ensure product uniformity. Manufacturers are increasingly integrating advanced control systems, IoT capabilities, and predictive maintenance features into slicers, transforming them into smart assets capable of optimizing operational workflows and reducing downtime. Furthermore, there is a growing emphasis on modular designs, customization options, and machines capable of processing a wider variety of food products, catering to diverse client needs and production scales. Sustainability concerns are also shaping design, with focus on energy efficiency and waste reduction features.

From a regional perspective, the market displays varied growth trajectories. Asia Pacific is anticipated to emerge as a powerhouse, propelled by rapid urbanization, increasing disposable incomes, and the consequent expansion of the processed food industry in countries like China, India, and Southeast Asian nations. North America and Europe, while mature markets, continue to demonstrate steady demand, primarily driven by replacement cycles, technological upgrades, and stringent food safety regulations that necessitate investments in modern, compliant equipment. Latin America, the Middle East, and Africa are showing nascent but accelerating growth, fueled by rising foreign investments in food infrastructure and the expansion of local food processing capabilities, creating new opportunities for market penetration.

Segment-wise, the market is witnessing distinct trends across various applications and machine types. The demand for automatic and high-capacity slicers is particularly strong in large-scale meat and cheese processing facilities, where high throughput and precision are non-negotiable. Semi-automatic slicers continue to hold relevance for medium-sized operations and specialty product manufacturers requiring more operator intervention for delicate or irregular items. The bread and bakery segment is also experiencing growth, driven by the increasing popularity of artisanal breads and baked goods that require precise slicing. Additionally, the focus on hygiene has spurred demand for slicers with easy-to-clean designs, quick-change parts, and advanced sanitation features, influencing purchasing decisions across all segments.

AI Impact Analysis on Industrial Food Slicers Market

The integration of Artificial Intelligence (AI) into industrial food slicers is poised to revolutionize operational efficiency, product consistency, and safety within the food processing industry. Users frequently inquire about how AI can enhance automation, particularly in optimizing slicing parameters for different food types and conditions, ensuring minimal waste and maximum yield. There is significant interest in AI's role in predictive maintenance, foreseeing equipment failures before they occur, thus reducing costly downtime and extending machine lifespan. Furthermore, users are keen on understanding AI's potential for real-time quality control, defect detection, and ensuring adherence to specific portion sizes and aesthetic standards, which are critical for brand reputation and consumer satisfaction. Concerns often revolve around the initial investment, data privacy, and the need for skilled personnel to manage and interpret AI-driven insights.

- AI-driven optimization of slicing parameters for various food types, adjusting blade speed, pressure, and temperature dynamically to maximize yield and minimize waste.

- Predictive maintenance algorithms leveraging sensor data to anticipate mechanical failures, scheduling proactive maintenance and reducing unscheduled downtime.

- Real-time quality control and defect detection through computer vision systems, identifying inconsistencies, foreign objects, or improper slices with high accuracy.

- Enhanced automation in product loading, positioning, and unloading using AI-powered robotics, improving throughput and reducing manual labor dependency.

- Integration with broader production planning systems for optimized scheduling, inventory management, and resource allocation based on demand forecasts.

- Improved food safety and hygiene monitoring by detecting cross-contamination risks or non-compliance with sanitation protocols through intelligent sensor networks.

- Personalized product offerings through AI's ability to learn and adapt to specific customer requirements for slice thickness, pattern, or product presentation.

- Energy consumption optimization through intelligent control of motor speeds and operational cycles, contributing to sustainable manufacturing practices.

- Automated recipe and product development support by analyzing slicing outcomes and suggesting improvements for ingredient formulation or processing techniques.

- Reduced operator error and enhanced training through AI-assisted interfaces that provide real-time feedback and guidance.

DRO & Impact Forces Of Industrial Food Slicers Market

The industrial food slicers market is shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces that continuously influence its trajectory. Key drivers include the ever-increasing global demand for convenience and processed foods, which necessitates high-volume, efficient slicing capabilities in food production facilities. The growing trend towards automation across industries, particularly in food processing, acts as a significant catalyst, aiming to reduce manual labor dependency, improve operational efficiency, and mitigate rising labor costs. Moreover, stringent food safety regulations and hygiene standards globally compel food manufacturers to invest in modern, easily sanitizable slicing equipment to prevent contamination and ensure product integrity. The need for precise portion control and consistent product quality also fuels the adoption of advanced slicers, directly impacting consumer satisfaction and brand consistency.

Despite the strong growth drivers, several restraints pose challenges to market expansion. The high initial capital investment required for industrial-grade slicing equipment can be a significant barrier for small and medium-sized enterprises (SMEs), particularly in developing regions. Additionally, the complexity of maintaining these sophisticated machines, coupled with the need for skilled technical personnel for operation and troubleshooting, adds to the operational costs. Market saturation in highly developed economies, where many food processing facilities have already adopted advanced slicing solutions, might lead to slower growth rates, with demand primarily driven by replacement and technological upgrades rather than new installations. The volatility in raw material prices, such as stainless steel and specialized alloys used in blade manufacturing, can also impact production costs and, consequently, the final product pricing.

However, numerous opportunities exist to propel the market forward. The rapid expansion of the food processing industry in emerging economies, fueled by urbanization and changing dietary habits, presents significant untapped potential for new market entrants and existing players. The ongoing development of smart slicers, integrated with IoT, AI, and robotics, opens avenues for enhanced efficiency, predictive maintenance, and real-time process optimization, creating premium market segments. Furthermore, customization and modular designs allowing for greater flexibility in handling diverse food products and scaling operations offer competitive advantages. The increasing consumer awareness regarding food safety and quality, coupled with the demand for specific types of processed foods (e.g., plant-based meats, artisanal cheeses), creates niche opportunities for specialized slicing equipment. The impact forces acting upon this market include rapid technological advancements, evolving regulatory landscapes regarding food safety and industrial automation, fluctuating global economic conditions affecting investment capabilities, and shifting consumer preferences towards healthier or more specialized food products, all of which necessitate continuous adaptation and innovation from market participants.

Segmentation Analysis

The Industrial Food Slicers Market is extensively segmented to reflect the diverse applications, operational needs, and technological preferences within the food processing industry. Understanding these segments is crucial for market participants to tailor their product offerings, marketing strategies, and regional focus. The segmentation typically encompasses factors such as machine type, application area, end-user industry, and geographical regions, each revealing distinct growth patterns and competitive landscapes. This granular analysis provides insights into specific demands, technological adoptions, and regulatory influences shaping different sub-markets.

- By Type

- Automatic Industrial Food Slicers

- Semi-Automatic Industrial Food Slicers

- Manual Industrial Food Slicers

- By Operating Speed

- High-Speed Slicers

- Medium-Speed Slicers

- Low-Speed Slicers

- By Application

- Meat Slicers (Deli Meats, Bacon, Poultry, Red Meat)

- Cheese Slicers

- Bread & Bakery Slicers

- Vegetable & Fruit Slicers

- Other Food Products (Confectionery, Fish, Plant-based Alternatives)

- By End-User

- Food Processing Plants (Meat, Dairy, Bakery, Confectionery)

- Food Service (Hotels, Restaurants, Catering)

- Retail & Supermarkets (Deli Counters, In-Store Processing)

- Industrial Kitchens

- By Technology

- Blade Slicers (Circular Blades, Band Blades, Straight Blades)

- Waterjet Slicers

- Ultrasonic Slicers

- By Material of Construction

- Stainless Steel Slicers

- Aluminum Alloy Slicers

- Composite Material Slicers

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Industrial Food Slicers Market

The value chain for the Industrial Food Slicers Market is a complex network involving multiple stakeholders, from raw material suppliers to the ultimate end-users, each contributing to the product's final value. The upstream segment primarily involves the procurement of essential raw materials and components. This includes high-grade stainless steel for blades and machine bodies, specialized alloys for critical moving parts, advanced electronics for control systems (PLCs, HMI), motors, sensors, and safety components. Key suppliers in this stage are metallurgical companies, electronic component manufacturers, and specialized engineering firms that produce precision parts. The quality and reliability of these upstream inputs directly impact the performance, durability, and safety of the final industrial food slicer, emphasizing the importance of strong supplier relationships and quality control at this foundational level.

Moving through the value chain, the manufacturing stage involves the design, assembly, testing, and quality assurance of the industrial food slicers. This stage is dominated by specialized machinery manufacturers who leverage advanced manufacturing techniques, including CNC machining, robotic welding, and precision assembly. Research and development activities are crucial here, focusing on innovation in blade technology, automation features, sanitation design, and energy efficiency. After manufacturing, the products enter the distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to large food processing plants or industrial clients, often accompanied by installation, training, and maintenance services. This approach allows for closer client relationships and customized solutions. Indirect channels involve a network of distributors, wholesalers, and specialized equipment retailers who cater to a broader range of end-users, including smaller food service providers and retail delis. These intermediaries often provide local support, inventory management, and after-sales service, broadening market reach.

The downstream analysis focuses on the end-users and their interaction with the product. End-users span a wide spectrum, including large-scale meat and poultry processors, dairy plants, commercial bakeries, institutional kitchens, hotels, restaurants, and supermarkets with in-store delis. Post-sales services, such as maintenance contracts, spare parts supply, technical support, and operational training, are critical components of the downstream value proposition. The effectiveness of these services significantly impacts customer satisfaction, machine uptime, and the overall lifecycle cost for the end-user. Additionally, feedback from end-users plays a vital role in informing future product development and design improvements, closing the loop in the value chain and ensuring that products continue to meet evolving industry demands and operational challenges. The efficiency and optimization of each stage within this value chain are paramount for competitive advantage and sustainable market growth.

Industrial Food Slicers Market Potential Customers

The potential customer base for industrial food slicers is broad and diverse, encompassing various sectors within the food industry that require high-volume, precise, and hygienic food preparation. At the forefront are large-scale food processing plants specializing in meat, poultry, and fish, which utilize these machines for slicing deli meats, bacon, sausages, and other processed meat products. Dairy processing units represent another significant segment, requiring slicers for cheese blocks, shredded cheese, and other dairy derivatives. Bakeries and confectionery manufacturers also constitute a vital customer group, needing precision slicers for bread, cakes, pastries, and various dough-based products to ensure consistent portioning and presentation. These industrial end-users prioritize high throughput, robust construction, and integration with automated production lines, often demanding custom solutions to fit their specific operational scales and product ranges.

Beyond large manufacturing facilities, the food service sector forms a substantial segment of potential customers. This includes institutional kitchens, such as those found in hospitals, schools, and corporate cafeterias, alongside hotels, restaurants, and catering companies. For these customers, industrial food slicers provide efficiency in preparing ingredients for large numbers of meals, ensuring consistent quality and reducing manual labor. The ability to quickly and uniformly slice a variety of ingredients, from vegetables and fruits to cooked meats, is critical for operational fluidity and cost management in these fast-paced environments. Small to medium-sized delis, butcher shops, and specialty food stores also represent a niche but important customer segment, often opting for semi-automatic or smaller automatic models that offer flexibility and precision for customized customer orders, focusing on presentation and freshness.

Furthermore, the retail sector, particularly supermarkets and hypermarkets with in-store deli counters or prepared food sections, constitutes a growing market for industrial food slicers. These retailers leverage slicers to prepare fresh, pre-packaged meats, cheeses, and other items, meeting consumer demand for convenience and quality. The increasing popularity of plant-based meat alternatives and vegan products is also creating new customer segments, as these products require specialized slicing equipment that can handle different textures and compositions while maintaining hygiene standards. Ultimately, any entity involved in the large-scale preparation, processing, or serving of food that requires consistent, high-volume slicing, portion control, and adherence to strict hygiene protocols represents a potential customer for industrial food slicers, driving continuous innovation and expansion in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, GEA Group, Weber Maschinenbau, Hobart (ITW Food Equipment Group), Bizerba SE & Co. KG, Middleby Corporation, Reiser (Robert Reiser & Co. Inc.), Vemag Maschinenbau GmbH, TREIF Maschinenbau GmbH, Daub Bakery Machinery, Sottoriva S.p.A., E.M.M.E. S.r.l., Grote Company, MAJA-Maschinenfabrik Hermann Schill GmbH, Grasselli S.p.A., Foodmate B.V., Rühle GmbH, Provisur Technologies, D&F Equipment Sales, Inc., Koneteollisuus Oy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Food Slicers Market Key Technology Landscape

The technology landscape for industrial food slicers is continuously evolving, driven by the demand for increased efficiency, precision, hygiene, and connectivity in food processing. One of the foundational technologies involves advanced blade design and material science, where innovations in high-carbon stainless steel, ceramic coatings, and specialized sharpening techniques lead to longer-lasting, sharper blades that produce cleaner cuts and reduce product waste. Simultaneously, sophisticated motor technologies, including servo motors, enable precise control over blade speed and movement, allowing for variable slice thicknesses and high-speed operation while minimizing energy consumption. These advancements are critical for handling diverse food textures, from delicate pastries to tough meats, ensuring consistent quality and minimizing tearing or crushing.

The adoption of advanced control systems, such as Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs), is paramount in modern industrial slicers. These systems provide operators with intuitive controls, enabling easy adjustment of slicing parameters, recipe management, and real-time monitoring of machine performance. Furthermore, sensor technology plays a crucial role, with integrated sensors monitoring product positioning, slice thickness, blade wear, and even environmental conditions to ensure optimal operation and safety. For instance, vision systems utilizing cameras and image processing software can detect imperfections in products before slicing or verify slice quality post-processing, significantly enhancing quality control and reducing manual inspection requirements. These intelligent systems contribute to minimizing human intervention, thereby reducing the risk of contamination and improving overall food safety compliance.

The most significant technological shift is towards the integration of Industrial Internet of Things (IIoT) and Artificial Intelligence (AI). IIoT connectivity allows industrial food slicers to communicate with other machinery on the production line and central control systems, facilitating seamless data exchange for operational analytics, predictive maintenance, and overall line optimization. AI algorithms are increasingly being used for predictive maintenance, analyzing sensor data to anticipate equipment failures before they occur, thereby minimizing downtime and maintenance costs. Moreover, AI can optimize slicing patterns and parameters in real-time based on product characteristics, ambient conditions, and desired output, leading to greater efficiency and yield. Robotics are also being increasingly deployed for automated loading and unloading of products, further enhancing automation, reducing manual handling, and accelerating throughput. These technologies collectively contribute to a future where industrial food slicers are not just cutting tools but intelligent, interconnected systems that significantly elevate the efficiency, safety, and productivity of food processing operations.

Regional Highlights

- North America: A mature market characterized by high automation adoption, stringent food safety regulations, and a strong demand for convenience and processed food products. The U.S. and Canada are leaders in adopting advanced slicing technologies, with emphasis on high-capacity, precise equipment for meat, poultry, and dairy processing. Replacement cycles and technological upgrades drive consistent demand.

- Europe: This region exhibits robust demand, particularly driven by countries like Germany, Italy, and the UK, which have well-established food processing industries. Strict EU food safety and hygiene standards necessitate investment in modern, easy-to-clean equipment. There's a growing focus on specialty food production, leading to demand for versatile and customizable slicers.

- Asia Pacific (APAC): Expected to be the fastest-growing market, propelled by rapid urbanization, increasing disposable incomes, and the expansion of the processed food industry in populous nations such as China, India, and Southeast Asian countries. Government initiatives to modernize food infrastructure and rising consumption of packaged foods are key growth drivers.

- Latin America: An emerging market showing steady growth, fueled by increasing investments in food processing capabilities and a rising middle-class population adopting processed food diets. Brazil, Mexico, and Argentina are key contributors to market expansion, with a focus on improving efficiency and hygiene standards in their local food industries.

- Middle East & Africa (MEA): This region presents nascent but accelerating growth opportunities. The expanding tourism sector, increasing foreign investments in food processing plants, and government efforts to enhance food security are stimulating demand for industrial food slicers. Countries like UAE, Saudi Arabia, and South Africa are leading this regional development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Food Slicers Market.- Marel

- GEA Group

- Weber Maschinenbau

- Hobart (ITW Food Equipment Group)

- Bizerba SE & Co. KG

- Middleby Corporation

- Reiser (Robert Reiser & Co. Inc.)

- Vemag Maschinenbau GmbH

- TREIF Maschinenbau GmbH

- Daub Bakery Machinery

- Sottoriva S.p.A.

- E.M.M.E. S.r.l.

- Grote Company

- MAJA-Maschinenfabrik Hermann Schill GmbH

- Grasselli S.p.A.

- Foodmate B.V.

- Rühle GmbH

- Provisur Technologies

- D&F Equipment Sales, Inc.

- Koneteollisuus Oy

Frequently Asked Questions

What are the primary factors driving the growth of the Industrial Food Slicers Market?

The market's growth is primarily driven by the increasing global demand for processed and convenience foods, the growing adoption of automation in the food processing industry to improve efficiency and reduce labor costs, and the stringent food safety and hygiene regulations requiring advanced and easily sanitizable equipment. Additionally, the need for precise portion control and consistent product quality across large production volumes significantly contributes to market expansion.

How is Artificial Intelligence impacting industrial food slicers?

AI is revolutionizing industrial food slicers by enabling predictive maintenance to minimize downtime, optimizing slicing parameters in real-time for various products to reduce waste and maximize yield, and enhancing quality control through computer vision systems for defect detection. AI integration also facilitates greater automation in product handling and improves overall operational efficiency, transforming slicers into smarter, more autonomous units.

What are the key technological advancements expected in industrial food slicers?

Key technological advancements include further integration of IoT for seamless connectivity and data analytics, enhanced AI for real-time process optimization and intelligent fault detection, sophisticated blade materials and designs for improved cutting precision and durability, and advanced sensor technologies for precise product positioning and quality monitoring. There is also a growing focus on modular designs and robotic integration for greater flexibility and automation.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to lead the market growth. This is attributed to rapid urbanization, rising disposable incomes, and the consequent robust expansion of the processed food industry in countries like China, India, and Southeast Asian nations. Increased investment in food infrastructure and a growing demand for packaged food products are significant accelerators in this region.

What are the main challenges faced by the Industrial Food Slicers Market?

The primary challenges include the high initial capital investment required for acquiring advanced industrial slicers, which can be a barrier for smaller enterprises. Other restraints involve the complexities associated with maintaining sophisticated machinery, the need for skilled labor for operation and technical support, and potential market saturation in highly developed economies where demand is primarily driven by replacement rather than new installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager