Industrial Fractional Horsepower Motors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442609 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Fractional Horsepower Motors Market Size

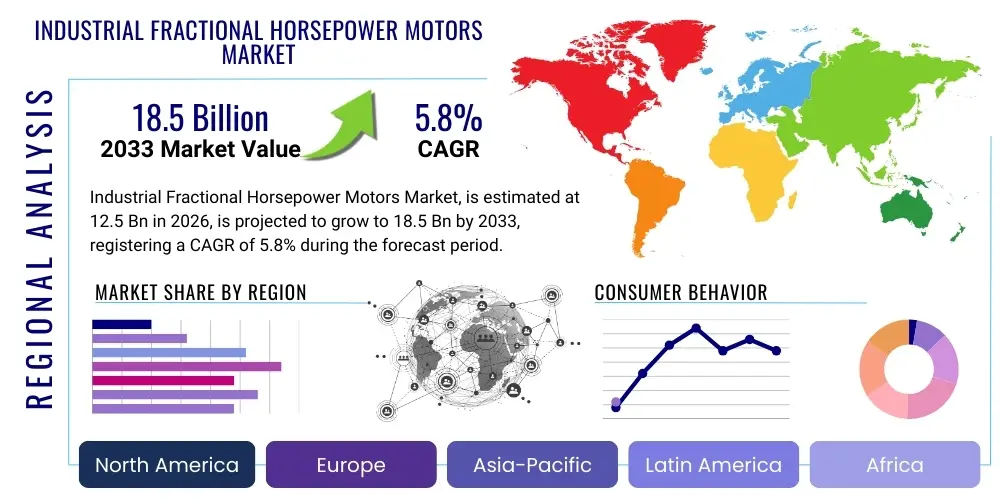

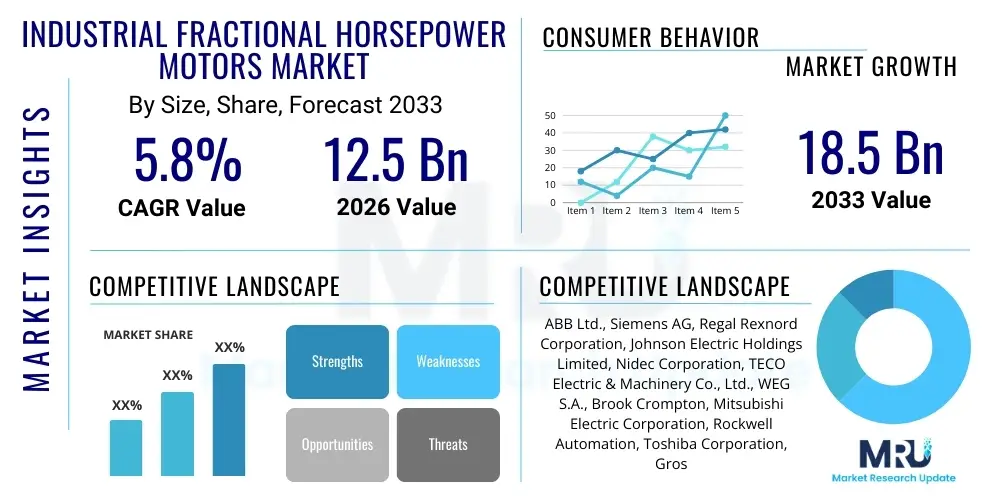

The Industrial Fractional Horsepower Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

Industrial Fractional Horsepower Motors Market introduction

The Industrial Fractional Horsepower (FHP) Motors Market encompasses electric motors rated below one horsepower (746 watts), primarily utilized for converting electrical energy into mechanical energy across various light-duty industrial and commercial applications. These motors are foundational components in automation, HVAC systems, small pumps, fans, blowers, and domestic appliances, characterized by their compact size, high efficiency, and reliability in intermittent or continuous operation. The primary product types driving innovation include permanent magnet synchronous motors (PMSM), brushless DC (BLDC) motors, and high-efficiency induction motors, all designed to meet stringent energy efficiency standards mandated globally.

Major applications of FHP motors span diverse industrial sectors, including material handling systems requiring precise motion control, medical equipment demanding high reliability, and food and beverage processing where compact, washdown-capable motors are essential. The intrinsic benefits of modern FHP motors, particularly the move toward electronically commutated (EC) and BLDC designs, include significantly reduced energy consumption, extended operational lifespan, and reduced maintenance requirements compared to legacy shaded pole or standard AC induction motors. This shift is crucial for industries seeking to lower their total cost of ownership (TCO) and comply with global decarbonization objectives.

The driving factors propelling market expansion are fundamentally linked to global industrial automation trends, the proliferation of smart manufacturing (Industry 4.0), and the increasing demand for energy-efficient appliances and HVAC systems worldwide. Furthermore, rapid urbanization and infrastructure development in emerging economies are generating substantial demand for essential equipment that relies heavily on reliable FHP motor technology. The continuous miniaturization of industrial components without compromising power output also ensures FHP motors remain indispensable for compact system designs.

Industrial Fractional Horsepower Motors Market Executive Summary

The Industrial Fractional Horsepower Motors Market is undergoing a rapid transition driven by digitalization and sustainability mandates. Key business trends include the strong focus on developing high-efficiency motor technologies, specifically BLDC and EC motors, which offer superior performance and energy savings compared to traditional brushed or AC induction counterparts. Manufacturers are heavily investing in integrating sensor technology and IoT capabilities into FHP motors, enabling predictive maintenance, real-time diagnostics, and seamless integration into larger industrial control systems (PLCs and SCADA). This technological shift necessitates specialized component sourcing and advanced manufacturing techniques, leading to consolidation among technology leaders.

Regionally, Asia Pacific (APAC) dominates the market, primarily fueled by massive manufacturing bases in China, India, and Southeast Asia, coupled with rapid infrastructure build-out and expanding domestic consumer markets demanding HVAC and white goods. North America and Europe, while mature, exhibit high growth in the premium segment, prioritizing motors that comply with IE3/IE4 efficiency standards and possess enhanced connectivity features essential for sophisticated industrial applications like robotics and precision machinery. The strategic focus in these regions is on replacing older, less efficient installed bases (retrofit market) and complying with stringent environmental regulations.

Segment trends indicate strong growth in the Permanent Magnet Synchronous Motor (PMSM) segment due to its efficiency profile and high power density, making it ideal for variable speed applications. Application-wise, the HVAC and fluid handling segments (pumps and compressors) remain the largest consumers, benefiting significantly from variable frequency drive (VFD) integration facilitated by advanced FHP motor designs. The market is increasingly polarizing between low-cost, high-volume manufacturing for mass consumer applications and high-specification, specialized manufacturing for critical industrial processes.

AI Impact Analysis on Industrial Fractional Horsepower Motors Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration fundamentally change the operational lifespan, maintenance schedules, and efficiency optimization of Industrial FHP Motors. Common questions revolve around the feasibility of autonomous self-correction, predicting catastrophic failures far in advance, and the role of AI in optimizing complex motion profiles and energy usage across fleets of motors. Users are seeking quantifiable data regarding the reduction in unplanned downtime achievable through AI-driven anomaly detection and condition monitoring systems. Key themes summarize to the expectation that AI will transform FHP motors from passive components into intelligent assets capable of active self-management and contributing actionable data to enterprise resource planning (ERP) systems, ultimately driving down operational expenditure and maximizing asset utilization rates.

The primary concern surrounding AI implementation is the necessary upfront investment in sensor technology, edge computing capabilities, and cloud infrastructure required to process the massive datasets generated by smart motors. Furthermore, the integration challenge—ensuring interoperability between proprietary motor control systems and generalized industrial AI platforms—remains a significant hurdle. However, the expectation is that as AI algorithms become more refined and hardware costs decrease, AI-powered predictive maintenance (PdM) will become a standard feature, drastically reducing traditional time-based maintenance practices for critical FHP motor installations, such as those in pharmaceutical clean rooms or essential fluid transport systems.

AI's influence is also extending into the design and manufacturing phases of FHP motors. Generative design tools powered by ML are enabling engineers to optimize motor geometry for maximum thermal performance and electromagnetic efficiency based on specific application requirements, leading to lighter and more powerful motor units. This shift towards AI-assisted R&D significantly shortens the design cycle and ensures motors are optimized for specialized tasks, moving beyond generic designs. The integration of AI-driven quality control in the manufacturing line further guarantees defect reduction, enhancing the overall reliability of the final product.

- AI enables predictive maintenance (PdM) through real-time vibration and temperature anomaly detection, minimizing unplanned downtime.

- Machine learning algorithms optimize motor control strategies, maximizing energy efficiency under variable load conditions.

- AI facilitates generative design processes, leading to lighter, thermally superior, and electromagnetically optimized motor structures.

- Enhanced remote diagnostics and troubleshooting are possible via AI processing of operational data transmitted via IoT gateways.

- AI systems are being deployed for automated quality inspection during manufacturing, ensuring higher consistency and reliability standards.

- Smart FHP motors contribute to fleet management optimization, allowing for centralized asset health monitoring and resource allocation planning.

DRO & Impact Forces Of Industrial Fractional Horsepower Motors Market

The Industrial FHP Motors Market is driven by stringent global energy efficiency regulations, such as the IE standards (IE3, IE4) and regional equivalents, which necessitate the adoption of premium, higher-priced technologies like BLDC and synchronous reluctance motors. Coupled with this is the unstoppable wave of industrial automation (Industry 4.0), which requires highly precise, compact, and network-connected motor components for robotics, automated guided vehicles (AGVs), and smart machinery. The rapid expansion of the HVAC sector, particularly in commercial buildings focusing on efficient air handling, further accelerates demand for energy-saving EC motors. These factors collectively push manufacturers toward high-efficiency design and digital integration.

However, the market faces significant restraints, primarily the intense cost pressure, particularly in high-volume, standard applications where cheaper, less-efficient AC induction motors still hold market sway, especially in emerging economies lacking strict enforcement mechanisms. Furthermore, the reliance on specialized raw materials, such as rare-earth magnets (used in PMSM and BLDC motors), introduces supply chain volatility and geopolitical risks, impacting manufacturing costs and lead times. The complexity of integrating variable speed drives (VFDs) and specialized control electronics also presents a technological barrier for smaller end-users who may lack the expertise for advanced system deployment and maintenance.

Significant opportunities lie in the vast retrofit market, where replacing millions of legacy standard-efficiency motors with modern FHP units offers immediate, measurable energy savings for industries globally. The burgeoning electric vehicle (EV) charging infrastructure and ancillary industrial support systems also present a new high-growth avenue for specialized, high-reliability FHP motors. Furthermore, the development of magnet-free high-efficiency solutions, such as synchronous reluctance motors, mitigates rare-earth dependence, offering a sustainable competitive advantage. Impact forces are predominantly shaped by regulatory mandates and technological innovation, favoring companies that can achieve cost-effective manufacturing of high-efficiency, smart, connected motor solutions while navigating supply chain complexities.

Segmentation Analysis

The Industrial Fractional Horsepower Motors Market is meticulously segmented based on motor type, technology, voltage range, application, and end-use industry, reflecting the diverse functional requirements across the industrial landscape. Segmentation analysis is crucial as different end-use sectors demand distinct performance characteristics, such as high starting torque (for pumps), high speed and precision (for robotics), or washdown capabilities (for food processing). The move toward digitalization means segmentation based on 'smart' versus 'standard' motor capabilities is becoming increasingly relevant, differentiating motors with integrated sensors and communication protocols (e.g., EtherCAT, PROFINET) from simpler components.

Technology-wise, the market is characterized by a fundamental shift from traditional Alternating Current (AC) motors towards Direct Current (DC) and advanced Electronic Commutation (EC) technologies, including Brushless DC (BLDC) motors and Permanent Magnet Synchronous Motors (PMSMs). This shift is driven entirely by the need for superior energy density, finer speed control, and reduced maintenance. Analyzing these segments provides strategic insights into investment priorities, indicating a strong move away from standardized, bulk production toward customized, high-performance motor solutions tailored for specific industrial machinery or mission-critical applications where failure tolerance is near zero.

Application segmentation reveals the dominance of HVAC, fluid power (pumps, compressors), and material handling, reflecting their large installed bases and the critical role FHP motors play in their operation. Geographically, segmentation highlights how differing regional energy standards and levels of industrial maturity directly influence the adoption rate of advanced FHP motor types. For instance, high-cost, ultra-efficient motors find rapid adoption in Western Europe, driven by favorable regulations, whereas high-volume, low-cost AC motors continue to satisfy large segments of the Asian manufacturing machinery market.

- By Motor Type:

- AC Fractional Horsepower Motors (Induction, Synchronous)

- DC Fractional Horsepower Motors (Brushed, Brushless DC - BLDC)

- Specialty Motors (Universal Motors, Stepper Motors, Servo Motors)

- By Technology:

- Permanent Magnet Synchronous Motors (PMSM)

- Electronically Commutated (EC) Motors

- Synchronous Reluctance Motors (SynRM)

- By Voltage Range:

- Below 40 V

- 41 V to 200 V

- 201 V and Above (Industrial Standard)

- By Application:

- HVAC (Fans, Blowers, Chillers)

- Fluid Handling (Pumps, Compressors)

- Material Handling (Conveyors, Actuators)

- Industrial Machinery (Machine Tools, Automation Equipment)

- Medical and Lab Equipment

- By End-Use Industry:

- Manufacturing (Automotive, Electronics, Consumer Goods)

- Oil and Gas

- Chemical and Petrochemical

- Food and Beverage

- Pulp and Paper

Value Chain Analysis For Industrial Fractional Horsepower Motors Market

The value chain for the Industrial FHP Motors Market begins with upstream activities, involving the sourcing of essential raw materials and specialized components. Key upstream inputs include copper wire, electrical steel laminations (silicon steel), specialized bearings, and increasingly critical rare-earth materials (neodymium, dysprosium) for high-performance permanent magnets used in BLDC and PMSM designs. The viability of the manufacturing process is highly dependent on reliable sourcing of semiconductors and power electronic components (IGBTs, MOSFETs) required for integrated motor drives and speed controllers. Price fluctuations and geopolitical stability related to rare-earth metals present significant risk factors at this stage, pushing manufacturers to explore alternative magnet-free designs.

Midstream activities involve core motor manufacturing, assembly, and quality control. This stage is dominated by large, integrated motor manufacturers that possess sophisticated automated winding and assembly technologies. The trend towards vertical integration is notable, where companies control the production of critical components like motor drives and control software to ensure seamless performance and competitive pricing. Customization and adherence to regional safety and efficiency certifications (e.g., UL, CE, IE standards) are key differentiators at this stage. Effective cost management here is essential, as FHP motors are often considered commodity items despite their underlying complexity.

Downstream distribution channels are segmented into direct sales (for large OEMs and specialized industrial projects) and indirect channels utilizing distributors, wholesalers, and specialized system integrators. Indirect distribution is vital for the replacement and maintenance market, offering local stocking and technical support. Direct channels provide closer collaboration with major equipment manufacturers (OEMs) for custom motor design and bulk procurement. The rise of e-commerce platforms is beginning to influence the aftermarket segment, offering quicker access to standard FHP motor replacements, though technical complexity often mandates specialized sales engineers for high-end industrial applications.

Industrial Fractional Horsepower Motors Market Potential Customers

Potential customers and end-users of Industrial Fractional Horsepower Motors span a vast range of industrial, commercial, and institutional entities that rely on automated processes, precise motion control, and efficient fluid dynamics. The largest customer base resides within Original Equipment Manufacturers (OEMs) who integrate FHP motors into their final products, such as HVAC system manufacturers (building ventilation and climate control units), pump manufacturers (domestic, industrial, chemical transfer), and specialized machinery builders (e.g., CNC machines, packaging lines, and textile machinery). These OEMs prioritize motor reliability, compact form factor, and compliance with specific performance envelopes.

Another critical customer segment includes Maintenance, Repair, and Overhaul (MRO) departments across large industrial facilities (e.g., refineries, power plants, manufacturing plants). These buyers primarily seek readily available replacement motors that match existing specifications, but are increasingly transitioning towards higher-efficiency replacements during scheduled maintenance shutdowns to lower long-term operational costs. Service providers and system integrators also constitute a significant customer group, purchasing FHP motors to upgrade or customize existing industrial infrastructure, particularly in retrofit projects aimed at improving energy performance or implementing smarter automation controls.

Furthermore, sectors requiring specialized environmental control or precision operation, such as the pharmaceutical industry (cleanroom ventilation, laboratory mixers), data centers (cooling fans and blowers), and the food and beverage industry (conveyors, mixing equipment requiring washdown ratings), represent premium customer segments. These buyers demand motors with specific certifications, corrosion resistance, and extremely high Mean Time Between Failures (MTBF) rates, leading to higher average selling prices (ASPs) in these niche applications compared to general industrial usage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Regal Rexnord Corporation, Johnson Electric Holdings Limited, Nidec Corporation, TECO Electric & Machinery Co., Ltd., WEG S.A., Brook Crompton, Mitsubishi Electric Corporation, Rockwell Automation, Toshiba Corporation, Groschopp Inc., Baldor Electric Company (ABB), Allied Motion Technologies, AMETEK Inc., Maxon Motor AG, Danaher Corporation, Bonfiglioli S.p.A., Franklin Electric Co., Inc., Delta Electronics, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Fractional Horsepower Motors Market Key Technology Landscape

The technological landscape of the Industrial FHP Motors Market is defined by a rigorous push toward enhanced energy efficiency and integrated intelligence. The dominant technology trend is the proliferation of Brushless DC (BLDC) motors and Permanent Magnet Synchronous Motors (PMSMs). These technologies leverage powerful permanent magnets, eliminating rotor losses and maximizing efficiency, particularly under variable speed conditions which are common in HVAC and fluid handling applications. The shift necessitates sophisticated electronic control via Variable Frequency Drives (VFDs) and specialized motor controllers, integrating advanced algorithms for field-oriented control (FOC) to achieve precise torque and speed regulation. Modern FHP motors are fundamentally integrated systems rather than standalone components.

Another crucial technological development involves the continuous integration of communication standards and sensing capabilities. Modern FHP motors are increasingly equipped with embedded sensors for monitoring parameters such as temperature, vibration, current draw, and rotational speed. These sensors are vital for enabling IoT connectivity, allowing motors to communicate their operational status directly to cloud-based or edge computing platforms using industrial communication protocols like EtherCAT, IO-Link, and PROFINET. This integration forms the backbone of predictive maintenance strategies, enabling operators to move from reactive or time-based servicing to condition-based servicing, significantly reducing the probability of catastrophic failure.

Furthermore, materials science plays a key role, focusing on improved magnetic materials and advanced lamination techniques to minimize core losses. The exploration of magnet-free alternatives, such as Synchronous Reluctance Motors (SynRM) specifically scaled down for FHP applications, is gaining traction. SynRM technology offers comparable high efficiency to PMSMs without the dependence on rare-earth magnets, addressing critical supply chain vulnerabilities. Overall, the technological focus is on miniaturization, maximizing power density (power output relative to size and weight), extending service intervals, and ensuring seamless digital connectivity within the broader smart factory ecosystem (Industry 4.0).

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, driven by its position as the global manufacturing hub and the massive scale of infrastructure development, particularly in China and India. The demand for FHP motors is explosive across consumer electronics manufacturing, textile machinery, and massive governmental investments in smart city infrastructure, including efficient public HVAC systems. While cost remains a primary factor, increasing regulatory pressure in countries like Japan and South Korea for higher energy efficiency standards is rapidly increasing the adoption of premium BLDC and PMSM technologies in industrial sectors. However, the region also retains a high consumption rate of low-cost, standard AC induction motors for general-purpose, non-critical applications.

- North America: North America is characterized by high market maturity and a strong preference for high-efficiency, digitally integrated motor solutions. Strict energy regulations (e.g., U.S. Department of Energy standards) compel widespread adoption of EC and BLDC motors in residential and commercial HVAC and refrigeration units. The market growth here is significantly driven by the massive installed base replacement (retrofit market) and the high penetration rate of sophisticated industrial automation, robotics, and logistics systems, particularly in the automotive and aerospace manufacturing sectors. Suppliers focus heavily on providing smart motor solutions with robust cybersecurity features and seamless integration into Rockwell and Siemens-based control architectures.

- Europe: Europe is a leader in adopting ultra-high efficiency standards (IE4 and forthcoming IE5 mandates), making it a premium market for advanced FHP motor technologies, including SynRM and high-specification PMSMs. The focus on sustainability, coupled with high electricity costs, provides a powerful economic incentive for industrial end-users to upgrade their motor assets. Germany, Italy, and France are pivotal markets due to their advanced manufacturing bases (machinery and equipment), demanding motors with exceptional precision and reliability. The market is also heavily influenced by the machinery directives and the strong presence of major European automation suppliers who prefer standardized, interoperable motor platforms.

- Latin America (LATAM): The LATAM market is in an emerging phase, exhibiting moderate growth primarily tied to infrastructure projects, mining, and expanding food and beverage processing sectors in Brazil and Mexico. Price sensitivity remains high, often leading to the selection of lower-cost AC induction motors. However, increasing industrial competitiveness and energy grid stability issues are gradually pushing large industrial consumers toward adopting more efficient FHP motor types. The lack of unified regional energy efficiency mandates presents both a challenge (slow adoption of premium products) and an opportunity (future regulatory compliance creating sudden market demand).

- Middle East and Africa (MEA): Growth in MEA is highly localized, concentrated primarily in the GCC countries (UAE, Saudi Arabia) due to massive construction and infrastructure spending, particularly on large-scale air conditioning projects. The extreme climate conditions necessitate specialized, heavy-duty FHP motors for HVAC and water management (pumping) applications. The African market is nascent, with demand driven by localized manufacturing growth and resource extraction industries (oil, gas, mining). Reliability in challenging operational environments (heat, dust) is often prioritized over initial cost, leading to demand for robust, specialized motor designs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Fractional Horsepower Motors Market.- ABB Ltd.

- Siemens AG

- Regal Rexnord Corporation

- Johnson Electric Holdings Limited

- Nidec Corporation

- TECO Electric & Machinery Co., Ltd.

- WEG S.A.

- Brook Crompton

- Mitsubishi Electric Corporation

- Rockwell Automation

- Toshiba Corporation

- Groschopp Inc.

- Baldor Electric Company (ABB)

- Allied Motion Technologies

- AMETEK Inc.

- Maxon Motor AG

- Danaher Corporation

- Bonfiglioli S.p.A.

- Franklin Electric Co., Inc.

- Delta Electronics, Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Fractional Horsepower Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the technological shift in FHP motors?

The primary technological driver is global compliance with stringent energy efficiency regulations (e.g., IE3, IE4, and forthcoming standards). This regulatory push mandates the adoption of advanced designs like Brushless DC (BLDC) and Permanent Magnet Synchronous Motors (PMSMs) to minimize energy waste and operational expenditure in industrial systems, accelerating the phase-out of legacy AC induction motors.

How are Industry 4.0 concepts being applied to industrial FHP motors?

Industry 4.0 integration involves equipping FHP motors with integrated sensors and communication capabilities (IoT connectivity) to enable real-time condition monitoring, predictive maintenance (PdM), and remote diagnostics. This allows the motor to become an intelligent asset contributing data for overall equipment effectiveness (OEE) and optimizing manufacturing throughput.

What are the main advantages of BLDC motors over traditional AC induction FHP motors?

BLDC motors offer significantly higher energy efficiency (often exceeding 90%), better speed and torque control across a wider range, lower heat generation, and a longer operational lifespan due to the absence of mechanical brushes or commutators. These features reduce maintenance needs and lower the Total Cost of Ownership (TCO), especially in critical, variable-speed applications such as HVAC and precise fluid pumps.

Which geographical region holds the highest growth potential for FHP motor manufacturers?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, holds the highest growth potential. This growth is fueled by massive expansion in manufacturing capacity, rapid urbanization, large-scale infrastructure projects, and increasing consumer adoption of energy-efficient appliances, resulting in sustained, high-volume demand across multiple end-use sectors.

What is the supply chain challenge associated with high-efficiency FHP motors?

A key supply chain challenge is the dependence on rare-earth magnets (e.g., Neodymium) essential for high-performance PMSM and BLDC motors. Geopolitical instability and limited sourcing options for these materials introduce significant cost volatility and supply risk, pushing the industry to invest in magnet-free alternatives like synchronous reluctance motors (SynRM).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager