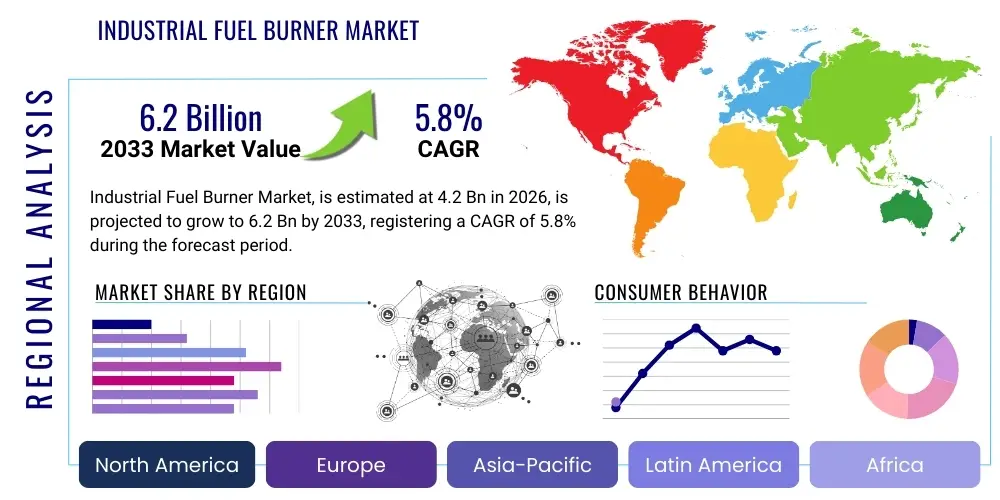

Industrial Fuel Burner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442382 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Industrial Fuel Burner Market Size

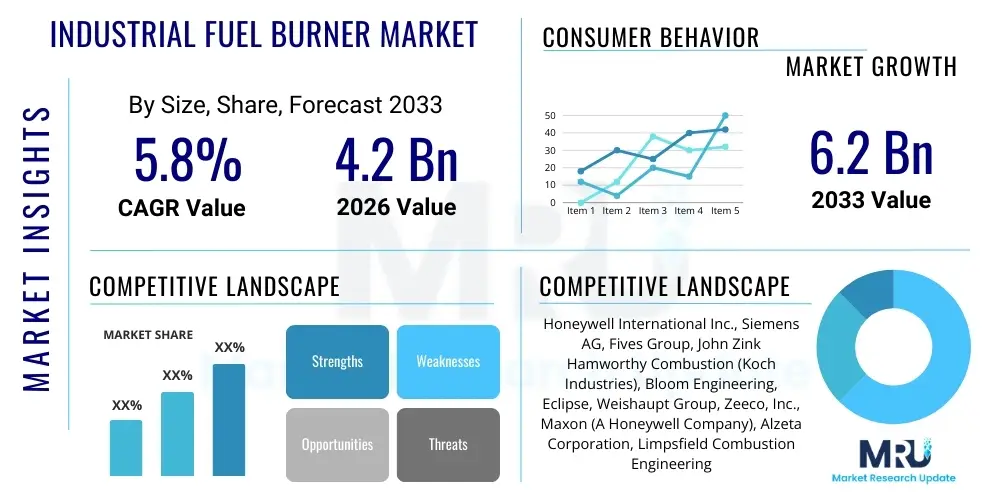

The Industrial Fuel Burner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Industrial Fuel Burner Market introduction

The Industrial Fuel Burner Market encompasses the design, manufacturing, and distribution of high-efficiency thermal equipment used to generate heat energy by combusting various fuels, including natural gas, oil, biomass, and alternative fuels, across a multitude of industrial processes. These critical components are integral to operations requiring controlled thermal input, such as power generation, steam production, process heating in chemicals, petrochemicals, metallurgy, and food processing. The core function of industrial burners is to achieve complete and stable combustion while minimizing emissions, thereby maximizing energy utilization and adhering to stringent environmental regulations globally. Modern industrial burners are complex engineering systems optimized for flexibility, precise flame control, and robust operation under demanding industrial environments. Their performance directly impacts the operational cost and environmental footprint of large-scale manufacturing facilities.

The product portfolio within this market includes diverse categories such as regenerative burners, ultra-low NOx burners, dual-fuel burners, and high-velocity burners, each tailored to specific temperature requirements and fuel types. Major applications are predominantly found in industrial boilers, furnaces, kilns, heaters, and thermal oxidizers, which are foundational equipment in sectors like cement manufacturing, glass production, refining, and steel fabrication. The increasing global focus on energy efficiency and decarbonization is fundamentally shifting product development toward modular, smart, and fuel-flexible systems capable of seamlessly transitioning between fossil fuels and cleaner alternatives like hydrogen or biogas. This transition is not merely driven by cost savings but increasingly by mandatory regulatory compliance, particularly concerning carbon dioxide and nitrogen oxide emissions.

Key driving factors accelerating market growth include rapid industrialization in developing economies, particularly in Asia Pacific, which necessitates expanded infrastructure for manufacturing and power generation. Furthermore, the global mandate for retrofitting existing facilities with high-efficiency, low-emission burners is providing a significant uplift to the aftermarket and replacement segment. The benefits derived from implementing advanced industrial burners are substantial, including reduced fuel consumption, enhanced process control accuracy, prolonged equipment life, and a measurable reduction in harmful environmental pollutants. As industries seek operational excellence and sustainability, the demand for technologically sophisticated industrial fuel burners designed for optimal thermal performance and regulatory adherence continues to intensify.

Industrial Fuel Burner Market Executive Summary

The Industrial Fuel Burner market is undergoing a transformative period defined by twin pressures: the need for heightened energy efficiency and the imperative for emissions reduction. Business trends indicate a strong move away from standard, fixed-fuel burners towards modular, intelligent combustion systems equipped with advanced sensors and diagnostic capabilities. Mergers and acquisitions are frequent among leading manufacturers aiming to consolidate technological expertise, particularly in ultra-low NOx technologies and digital integration. Service models focused on predictive maintenance and operational optimization are gaining prominence, shifting revenue streams beyond mere hardware sales. Supply chain resilience, especially concerning specialized materials and electronic components necessary for modern control systems, remains a critical focus area for sustained market competitiveness and maintaining operational uptime for end-users.

Regional trends reveal disparate market maturity levels and regulatory environments influencing growth trajectories. Asia Pacific represents the largest and fastest-growing region, fueled by massive infrastructure projects and expanding manufacturing capabilities, particularly in China and India, although compliance with new localized environmental standards is a growing challenge. Europe, characterized by mature industry and extremely strict emission regulations (driven by the European Green Deal), is dominated by retrofit and replacement activities focusing heavily on hydrogen-ready burners and decarbonization solutions. North America demonstrates robust growth, largely driven by the availability of inexpensive natural gas and increasing investments in refinery and petrochemical expansion, alongside governmental incentives for energy-saving industrial upgrades.

Segment trends underscore the dominance of natural gas burners due to the clean-burning properties and lower operational costs compared to heavy fuel oil. However, the fastest-growing segment is anticipated to be alternative fuel burners (biogas, hydrogen, syngas), reflecting the global energy transition. By application, industrial boilers and furnaces remain the largest consumers, but high-temperature applications in cement and steel are showing accelerated demand for advanced, regenerative thermal solutions that recover waste heat. Small to medium capacity burners are witnessing increased adoption due to the proliferation of decentralized manufacturing and smaller, highly efficient process units, while the heavy-duty segment focuses intensely on longevity and maximal thermal transfer efficiency.

AI Impact Analysis on Industrial Fuel Burner Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Industrial Fuel Burner Market typically revolve around operational safety, predictive maintenance capabilities, and real-time optimization of combustion efficiency and emissions control. Users are keen to understand how AI algorithms can interpret complex sensor data from flame detectors, gas analyzers, and temperature probes to autonomously adjust fuel-air ratios, thereby achieving optimal firing rates and minimizing pollutant output (like CO and NOx) under fluctuating load conditions. Concerns also frequently surface regarding the cybersecurity implications of integrating AI-driven control systems and the necessary skills gap required to manage and maintain these sophisticated analytical platforms. The overarching expectation is that AI will move burner systems beyond reactive control toward proactive, self-learning thermal management.

The implementation of AI and Machine Learning (ML) is fundamentally transforming industrial burner operation from a static, pre-set configuration to a dynamic, self-tuning system. ML models can analyze historical performance data, environmental conditions, and fuel quality variances to predict potential component failures, thereby enabling just-in-time maintenance scheduling and significantly reducing unplanned downtime, which is immensely costly in continuous processes like refining or chemical manufacturing. Furthermore, AI facilitates the creation of digital twins of combustion systems, allowing operators to simulate the effects of different operational parameters or fuel switching scenarios safely before implementing changes on the physical equipment, leading to unparalleled operational agility and safety.

AI's primary influence lies in optimizing the combustion process in real-time, especially when dealing with dual or multi-fuel burners where blended fuel compositions change frequently. Traditional PID controllers often struggle to react optimally to minor fluctuations, leading to efficiency losses or temporary emission spikes. AI algorithms, however, can instantaneously adjust damper positions, fan speeds, and valve openings based on dozens of input variables simultaneously, ensuring sustained high efficiency (often exceeding 98%) and consistent compliance with low emission limits, regardless of the operational load or external atmospheric conditions. This level of optimization drastically improves fuel economics and environmental stewardship, becoming a core competitive advantage for manufacturers who successfully integrate these technologies.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting component failure (e.g., refractory, flame scanner issues) through sensor data analysis.

- Real-time Combustion Optimization: Dynamically adjusts fuel-air ratios based on complex environmental and fuel quality variables to maintain peak thermal efficiency and minimal emissions.

- Autonomous Fault Diagnosis: Instantly identifies combustion instability or control system anomalies, initiating corrective measures automatically.

- Digital Twin Simulation: Allows for the safe testing of new fuel types or operational strategies before deployment, minimizing risk and commissioning time.

- Enhanced Cybersecurity Measures: Protecting integrated control systems from external cyber threats targeting critical infrastructure components.

DRO & Impact Forces Of Industrial Fuel Burner Market

The market trajectory for industrial fuel burners is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating adoption rates and technological focus. A primary driver is the accelerating stringency of global environmental regulations, particularly concerning NOx and particulate matter emissions, forcing industries to invest in ultra-low NOx burner technologies and mandatory retrofitting programs. Concurrently, the rising and volatile cost of traditional fossil fuels acts as a powerful incentive for industries to adopt high-efficiency burners (such as regenerative and recuperative types) that minimize energy waste and operational expenditure. These two drivers—regulatory pressure and economic incentives—create a compelling business case for immediate market investment and technological innovation.

However, the market faces significant restraints that slow potential growth. High initial capital investment required for advanced, automated burner systems and associated control infrastructure can be prohibitive, especially for Small and Medium Enterprises (SMEs) struggling with short-term return on investment considerations. Furthermore, the reliance on specialized technical expertise for the installation, commissioning, and maintenance of these complex combustion systems presents a restraint, particularly in emerging economies where skilled labor is scarce. Another notable challenge is the lengthy replacement and upgrade cycles common in heavy industry (e.g., 15–20 years for large industrial boilers), which naturally caps the annual replacement demand and necessitates market focus on new capacity expansion and strategic retrofitting.

Opportunities within the industrial fuel burner space are largely concentrated around the global energy transition and industrial decarbonization efforts. The burgeoning interest in hydrogen as an industrial fuel source presents a massive opportunity for manufacturers capable of producing hydrogen-ready or 100% hydrogen burners, future-proofing industrial assets. The development of integrated smart burner systems utilizing IoT and advanced analytics allows manufacturers to offer value-added services focused on efficiency monitoring and remote diagnostics, opening new recurring revenue streams. The rising adoption of alternative fuels (biomass, sustainable aviation fuels (SAF), biogas) in process heating also creates niche markets demanding highly adaptable and customized combustion solutions, enabling targeted technological differentiation among market players.

Segmentation Analysis

The Industrial Fuel Burner Market is highly segmented based on critical technical characteristics, application needs, fuel type used, and capacity requirements. Comprehensive segmentation allows manufacturers to target specific industrial niches with highly optimized products, ensuring maximum thermal efficiency and compliance. The primary segmentation axes—type of fuel, end-user industry, burner capacity, and design type—reflect the diverse operational demands ranging from low-temperature, highly precise processes like food drying to extremely high-temperature metallurgical applications. Understanding these segments is crucial for strategic planning, resource allocation, and forecasting market shifts driven by energy policy and industrial expansion patterns.

- By Fuel Type:

- Gas Fuel Burners (Natural Gas, LPG)

- Oil Fuel Burners (Light Oil, Heavy Oil, Kerosene)

- Dual Fuel Burners

- Alternative Fuel Burners (Biogas, Hydrogen, Syngas, Bio-Oil)

- By Burner Type/Technology:

- Regenerative Burners

- Recuperative Burners

- High Velocity Burners

- Low NOx/Ultra-Low NOx Burners

- Flat Flame Burners

- Radiant Wall Burners

- By Operating Capacity:

- Less than 10 MMBtu/hr (Small Capacity)

- 10 MMBtu/hr to 50 MMBtu/hr (Medium Capacity)

- Above 50 MMBtu/hr (Large Capacity/Heavy Duty)

- By End-User Industry:

- Oil & Gas (Refineries, Petrochemicals)

- Power Generation

- Chemicals and Pharmaceuticals

- Metals and Mining (Steel, Aluminum)

- Food and Beverages

- Cement and Construction Materials

- Glass and Ceramics

Value Chain Analysis For Industrial Fuel Burner Market

The value chain for industrial fuel burners is characterized by complexity, starting with the specialized sourcing of materials and concluding with rigorous installation and long-term service agreements. Upstream analysis reveals a dependence on suppliers of specialized alloys capable of withstanding extreme temperatures and corrosive environments, high-precision electronic controls, sensors, and robust insulation materials. The quality and reliability of these upstream components—particularly the high-temperature combustion heads and automated control systems—directly dictate the final burner performance, efficiency, and longevity. Manufacturers often maintain close relationships with key component suppliers to ensure quality control, manage raw material cost volatility (especially steel and ceramics), and incorporate the latest sensor technology required for smart combustion systems.

The midstream segment involves the design, manufacturing, assembly, and quality testing of the burner systems. This phase requires significant investment in advanced manufacturing techniques, including precision welding, complex fluid dynamic modeling (CFD) for optimal flame shaping, and rigorous testing facilities to validate emission levels and thermal output before shipment. Downstream analysis focuses heavily on distribution channels, installation, commissioning, and, crucially, aftermarket services. Due to the technical nature of the equipment, direct sales teams and highly specialized engineering distributors are often preferred over mass market channels. These distributors provide localized technical support and ensure compliance with regional safety codes and environmental standards, acting as a critical link between the manufacturer and the end-user.

The aftermarket service component is increasingly valuable, representing a significant portion of the total revenue stream. This includes the supply of spare parts (e.g., flame scanners, igniters, refractory), mandatory safety inspections, efficiency tuning, and often, complete retrofitting services to upgrade older equipment to modern emission standards. Direct distribution channels, particularly for large, customized industrial projects, allow manufacturers to offer comprehensive lifecycle management packages, guaranteeing long-term operational efficiency and minimizing risk for the end-user. Indirect channels, often through specialized integrators, dominate the supply of standard, smaller-capacity burners, streamlining logistics and installation for common applications like commercial boilers.

Industrial Fuel Burner Market Potential Customers

The primary customers for industrial fuel burners are heavy process industries and large-scale utility providers whose operations are fundamentally dependent on continuous, high-temperature thermal input. These end-users, such as oil refineries, petrochemical plants, steel mills, and cement manufacturers, require burners optimized for continuous duty cycles, high capacity, and the capacity to handle diverse or waste gas fuels. Their purchasing decisions are driven by strict regulatory compliance, the need to maximize production uptime, and a strong focus on minimizing fuel costs, making efficiency and reliability the core purchasing criteria. For this segment, custom engineering and proven operational track records are paramount considerations during vendor selection.

A secondary, but rapidly expanding, customer base includes power generation facilities, particularly those utilizing Combined Heat and Power (CHP) systems or smaller decentralized power plants, and specialized manufacturing sectors like glass, ceramics, and food processing. These customers prioritize burners that offer precise temperature control, minimal pollutant discharge (essential for food safety standards or highly controlled chemical reactions), and flexibility in switching between fuels to respond to market price volatility. The increasing number of industrial parks and decentralized manufacturing hubs globally contributes to the demand for medium-capacity, standardized, yet highly efficient burner systems that can integrate seamlessly into modular boiler units.

Furthermore, the retrofitting market segment targets existing industrial facilities globally that must upgrade outdated combustion systems to meet new energy efficiency mandates or updated environmental emission laws (e.g., stricter limits on sulfur dioxide or carbon monoxide). These potential buyers are driven less by new capacity expansion and more by capital expenditure allocated for maintenance and regulatory adherence. Consultants and energy management firms often serve as influencers and indirect buyers for this segment, recommending specific high-efficiency or ultra-low NOx burner technologies that promise rapid return on investment through fuel savings and avoided environmental penalties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Siemens AG, Fives Group, John Zink Hamworthy Combustion (Koch Industries), Bloom Engineering, Eclipse, Weishaupt Group, Zeeco, Inc., Maxon (A Honeywell Company), Alzeta Corporation, Limpsfield Combustion Engineering Ltd., Oilon Group Oy, Selas Heat Technology Company, Baltur S.p.A., Riello Group, Forbes Marshall, Webster Combustion Technology, Inc., ThyssenKrupp Industrial Solutions, Cannon Boiler Works, Inc., Andritz AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Fuel Burner Market Key Technology Landscape

The industrial fuel burner technology landscape is rapidly evolving, driven primarily by the need to achieve ultra-low emissions and maximize thermal efficiency while maintaining fuel flexibility. A core technological trend is the proliferation of Ultra-Low Nitrogen Oxide (NOx) burners, which utilize techniques such as flue gas recirculation (FGR), staged combustion, or highly controlled pre-mixing to ensure combustion temperatures are kept below the threshold where significant thermal NOx formation occurs. Furthermore, technologies like regenerative burners are gaining traction, especially in high-temperature applications (e.g., steel reheating), as they utilize heat exchangers to recover substantial heat from flue gases, preheating the combustion air, often resulting in 30% to 50% fuel savings compared to conventional systems. This technological pivot towards waste heat recovery is foundational to industrial decarbonization efforts.

A second major technological front involves digitalization and connectivity, fundamentally transforming how burners are operated and maintained. Modern burners are increasingly equipped with integrated IoT sensors, advanced communication protocols (e.g., Modbus, OPC UA), and sophisticated Burner Management Systems (BMS). These systems enable continuous, real-time monitoring of critical parameters—including flame stability, air damper positions, fuel flow rates, and pollutant concentrations—which can be remotely accessed and analyzed. This connectivity facilitates proactive adjustments, ensuring the burner operates within its most efficient envelope and allowing for quick diagnostics, significantly reducing the need for manual, time-consuming field troubleshooting. The move toward integrating Machine Learning models within the BMS for predictive failure analysis marks the frontier of operational technology.

Finally, the growing viability of alternative and sustainable fuels mandates the development of entirely new burner designs. The market is seeing a surge in "Hydrogen-Ready" burners, designed specifically to safely and efficiently combust high percentages of hydrogen (up to 100%) blended with natural gas, addressing the forthcoming shift in industrial energy sources. Combustion of hydrogen presents unique challenges, primarily due to its faster flame speed and wider flammability range, requiring specialized flame retention heads and material modifications to prevent flashback and ensure stable operation. Similarly, burners optimized for biomass, biogas, or synthetic gases must contend with variable energy content and moisture levels, demanding robust and adaptable burner controls capable of maintaining consistent performance despite fluctuating fuel quality, ensuring technological adaptability remains a key competitive factor.

Regional Highlights

The global Industrial Fuel Burner Market exhibits distinct regional dynamics influenced by local industrial growth, existing infrastructure, and regulatory frameworks concerning environmental standards.

- Asia Pacific (APAC): APAC currently dominates the market share and is projected to experience the highest growth rate during the forecast period. This explosive growth is primarily attributed to rapid urbanization, massive infrastructure development, and the expansion of heavy manufacturing sectors in economies like China, India, and Southeast Asian nations. The high demand for new process heating equipment in cement, textile, and chemical industries is driving new capacity installations. While efficiency remains important, the immediate demand is often driven by volume and initial capital cost considerations, although governmental pressure to adopt stricter environmental norms (especially in Tier 1 and 2 Chinese cities) is increasingly favoring low-NOx solutions.

- North America: The North American market is characterized by maturity, robust infrastructure, and readily available, competitively priced natural gas, which favors gas-fired burner solutions. Growth is strong, fueled by expansion in the petrochemical and refining industries, particularly along the U.S. Gulf Coast. Regulatory action, especially state-level mandates in California and federal emissions standards (like those from the EPA), drive demand for retrofits using ultra-low NOx and smart burners. The focus here is on maximizing operational flexibility and integrating digital controls for remote diagnostics and enhanced efficiency management.

- Europe: Europe is a technologically advanced, albeit slower-growing, market dominated by replacement and upgrade activities. This region leads globally in adopting the strictest environmental standards, driven by the EU’s decarbonization goals and the Green Deal. Consequently, the demand for highly efficient, customized solutions, including hydrogen-ready burners and those optimized for alternative and sustainable fuels (biogas, bio-oil), is extremely high. European end-users prioritize energy savings and compliance over initial costs, making it a key market for premium, integrated smart burner systems and services.

- Middle East and Africa (MEA): MEA demonstrates significant potential, driven by massive investments in the oil & gas and petrochemical sectors, particularly in Saudi Arabia, UAE, and Qatar. Burner demand is tied directly to new refinery and upstream processing capacity expansions. While energy costs are often subsidized, efficiency is critical for optimizing operational capacity. Furthermore, the push for localization and development of diversified manufacturing bases, especially in construction materials and metals, is spurring demand for heavy-duty, reliable burner systems capable of operating under harsh climatic conditions.

- Latin America (LATAM): The LATAM market growth is steady, driven by capacity expansion in key economies like Brazil and Mexico, particularly in the food & beverage, mining, and cement sectors. Political and economic volatility sometimes affects large capital expenditure decisions, but the underlying demand for reliable process heating remains strong. The market is primarily served by dual-fuel burners to hedge against price volatility in natural gas and fuel oil, focusing on robust construction and ease of maintenance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Fuel Burner Market.- Honeywell International Inc.

- Siemens AG

- Fives Group

- John Zink Hamworthy Combustion (Koch Industries)

- Bloom Engineering

- Eclipse (A Honeywell Company)

- Weishaupt Group

- Zeeco, Inc.

- Maxon (A Honeywell Company)

- Alzeta Corporation

- Limpsfield Combustion Engineering Ltd.

- Oilon Group Oy

- Selas Heat Technology Company

- Baltur S.p.A.

- Riello Group

- Forbes Marshall

- Webster Combustion Technology, Inc.

- ThyssenKrupp Industrial Solutions

- Cannon Boiler Works, Inc.

- Andritz AG

Frequently Asked Questions

Analyze common user questions about the Industrial Fuel Burner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the demand for Ultra-Low NOx Industrial Burners?

The demand for Ultra-Low NOx burners is primarily driven by increasingly stringent global environmental regulations, particularly the mandates set by agencies like the EPA and European bodies, requiring industries to drastically reduce nitrogen oxide emissions to curb air pollution and smog formation. Economic incentives tied to compliance and the pursuit of corporate sustainability goals also heavily influence adoption, especially during new installations and mandated retrofitting cycles across heavy industries.

How is the market adapting to the shift towards hydrogen and alternative industrial fuels?

The market is adapting by rapidly developing 'Hydrogen-Ready' burner technology, which includes modifications to materials and flame stabilization methods to safely and efficiently combust pure hydrogen or hydrogen blends. Manufacturers are also focusing on fuel-flexible and custom-engineered systems capable of handling variable energy content fuels like biogas, syngas, and bio-oils, ensuring industrial processes can remain operational throughout the energy transition.

Which end-user industry accounts for the largest share of the Industrial Fuel Burner Market?

The Oil & Gas (Refineries and Petrochemicals) and Metals and Mining industries typically account for the largest market share. These sectors require extremely large capacity, high-temperature, and continuous-duty burners for foundational processes like cracking, heating, and smelting. The demand is concentrated in both new facility construction in emerging economies and efficiency-driven retrofits in mature markets.

What role does digitalization (IoT and AI) play in modern industrial burner systems?

Digitalization allows for the integration of IoT sensors and AI-driven Burner Management Systems (BMS) that facilitate real-time performance monitoring, remote diagnostics, and predictive maintenance. This integration enables autonomous adjustment of combustion parameters (like air-fuel ratio) for sustained peak efficiency, substantial fuel savings, and proactive identification of component failures, significantly improving operational uptime and safety.

Is Asia Pacific or Europe exhibiting faster growth in the industrial burner sector?

Asia Pacific (APAC) is exhibiting the fastest growth due to extensive industrial expansion, new capacity installations, and high volume manufacturing demands, especially in China and India. While Europe is a critical market for technological innovation and high-value retrofits driven by regulatory compliance (like hydrogen readiness), APAC leads in overall market volume growth spurred by rapid industrialization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager