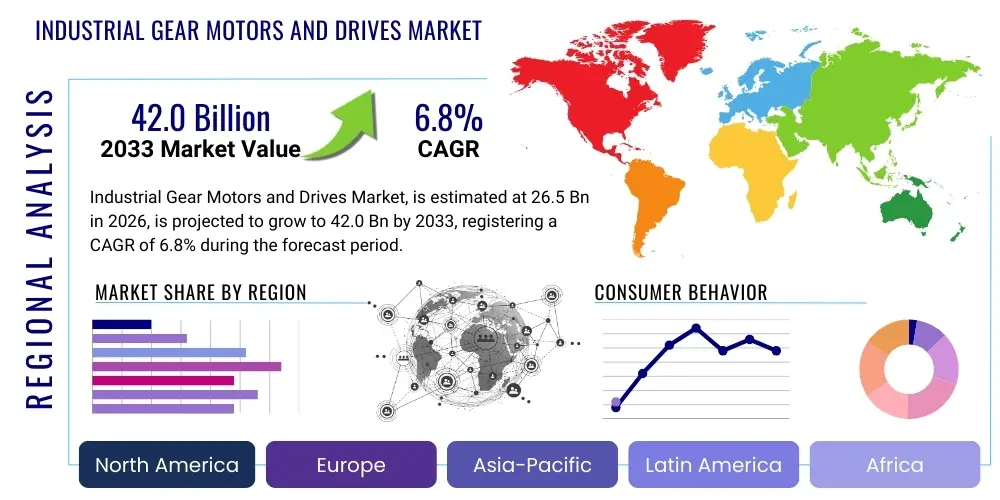

Industrial Gear Motors and Drives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441211 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Industrial Gear Motors and Drives Market Size

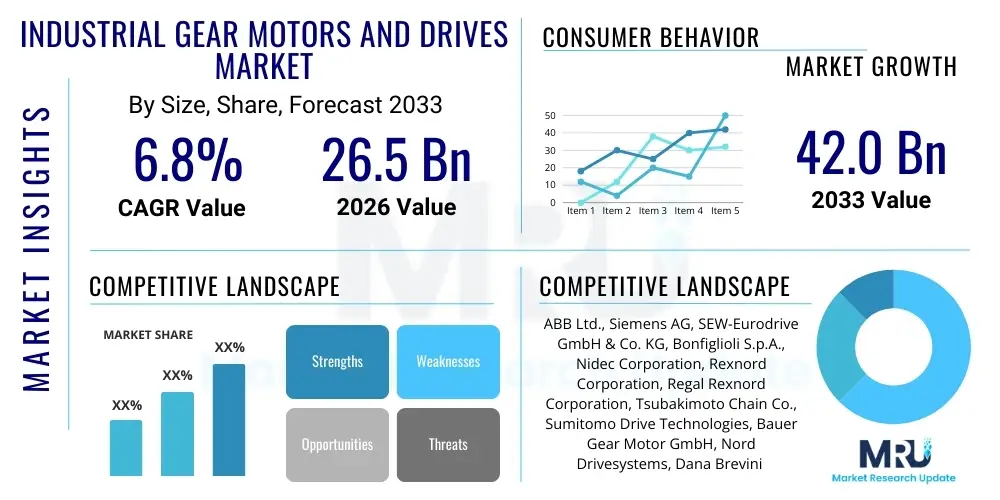

The Industrial Gear Motors and Drives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 26.5 Billion in 2026 and is projected to reach USD 42.0 Billion by the end of the forecast period in 2033.

Industrial Gear Motors and Drives Market introduction

The Industrial Gear Motors and Drives Market encompasses specialized electromechanical systems essential for converting electrical energy into mechanical energy, primarily utilized for controlled movement and precise speed reduction in industrial machinery. These systems consist of an electric motor integrated with a gearbox (gear reducer) or a standalone drive (VFD/VSD) coupled with a motor and gearbox. The core function is to deliver high torque at reduced speeds, ensuring reliability and efficiency across a myriad of complex industrial processes, thereby forming the backbone of modern automation.

The product portfolio spans various motor technologies, including AC and DC motors, and sophisticated gear configurations such as helical, bevel, planetary, and worm gears, each selected based on the specific load, speed reduction ratio, and space constraints of the application. Major applications are concentrated in power transmission for conveyor systems, packaging machinery, material handling equipment, and heavy-duty mixers in process industries. The primary benefit derived from these integrated solutions is enhanced energy efficiency, reduced maintenance downtime, and superior process control crucial for achieving stringent quality standards in manufacturing environments.

Market expansion is fundamentally driven by the escalating global shift towards automated manufacturing processes, often referred to as Industry 4.0 initiatives, particularly in emerging economies like China and India. Furthermore, the increasing adoption of Variable Frequency Drives (VFDs) and high-efficiency motor standards (IE4 and IE5) mandated by international energy regulations compel industries to upgrade legacy systems, thereby stimulating demand for new, optimized gear motor and drive solutions. The continuous technological advancements focused on compactness, higher power density, and seamless integration with Industrial Internet of Things (IIoT) platforms further solidify the market's robust growth trajectory.

Industrial Gear Motors and Drives Market Executive Summary

The Industrial Gear Motors and Drives Market is characterized by a strong emphasis on smart manufacturing capabilities and sustainability, with significant business trends revolving around the integration of advanced digital technologies. Manufacturers are increasingly offering modular, highly configurable gear motor systems that simplify installation and maintenance while facilitating seamless data exchange for predictive analytics. A notable trend is the convergence of high-efficiency permanent magnet motors with decentralized drive intelligence, optimizing overall equipment effectiveness (OEE) and reducing operational expenses across diverse industrial sectors globally.

Regionally, the Asia Pacific (APAC) continues its dominance, fueled by massive capital investment in manufacturing capacity expansion, particularly in automotive, electronics, and food and beverage sectors in Southeast Asia and China. Europe maintains a strong position driven by stringent energy efficiency directives and a high demand for premium, customized high-precision gearboxes, especially within robotics and specialized machine tools. North America is witnessing significant growth propelled by modernization efforts in the oil and gas infrastructure, material handling, and the burgeoning e-commerce warehouse automation sector which heavily relies on synchronized gear motor systems for complex logistical operations.

Segment trends reveal that the Helical Gear Motor segment maintains the largest market share due to its versatility, efficiency, and robustness, making it suitable for general industrial use. However, the Planetary Gear Motor segment is projected to exhibit the fastest growth, primarily owing to its compact design, high torque density, and superior load-carrying capacity, making it indispensable for high-precision applications like robotics and heavy construction equipment. Furthermore, the demand for sophisticated servo drives and motors is rapidly accelerating across all regions, reflecting the industry's sustained commitment to achieving unparalleled precision and dynamic control in automation tasks.

AI Impact Analysis on Industrial Gear Motors and Drives Market

User queries regarding the impact of Artificial Intelligence (AI) on the Industrial Gear Motors and Drives Market predominantly focus on how AI can enhance operational lifecycles, transition from scheduled to predictive maintenance, and optimize energy consumption profiles. Key themes revolve around the integration of machine learning algorithms for real-time fault detection, the development of 'digital twins' for simulation and performance modeling, and the potential for self-optimizing gear motor systems that dynamically adjust parameters based on live operational feedback. Users are keenly interested in understanding the practical implementation challenges, data privacy concerns associated with extensive sensor deployment, and the return on investment (ROI) derived from utilizing AI-driven diagnostics to minimize catastrophic component failure and maximize uptime.

- AI enables highly accurate predictive maintenance models by analyzing vibration, temperature, and current signatures, drastically reducing unexpected failures.

- Machine learning algorithms optimize the operational efficiency of variable speed drives (VFDs) by dynamically adjusting motor torque and speed requirements based on load changes.

- Digital twins of gear motor systems facilitate virtual testing, performance optimization, and simulation of wear and tear, leading to improved product design and deployment.

- AI-powered condition monitoring systems minimize downtime by identifying subtle anomalies invisible to traditional monitoring techniques, extending equipment lifespan.

- Enhanced control loops using AI optimize energy usage, allowing motors and drives to adhere strictly to energy efficiency standards and reduce operational carbon footprint.

DRO & Impact Forces Of Industrial Gear Motors and Drives Market

The Industrial Gear Motors and Drives Market is driven by the global imperative for automation and process efficiency, fueled significantly by the rapid expansion of e-commerce logistics and the accompanying requirement for high-speed material handling systems. The continuous deployment of sophisticated robotics in manufacturing lines necessitates precise, compact, and high-torque gear systems, propelling segment growth. Furthermore, government regulations promoting energy efficiency, specifically the widespread adoption of IE4 and IE5 efficiency class motors, mandate continuous upgrades across various industrial applications, serving as a powerful market driver.

Restraints in this market include the high initial capital expenditure associated with high-efficiency gear motor systems and advanced drives, particularly impacting small and medium-sized enterprises (SMEs). Moreover, the inherent cyclical nature of heavy industries, such as mining and primary metals, introduces demand volatility. Global supply chain disruptions, particularly related to critical raw materials and semiconductor components required for modern electronic drives, pose persistent challenges regarding production lead times and cost management, limiting smoother market growth.

Significant opportunities lie in the proliferation of IIoT-enabled smart gear motors capable of generating actionable data for remote monitoring and diagnostics, creating substantial aftermarket revenue streams. The demand for customized gear motor solutions optimized for niche applications, such as specialized pharmaceutical processing or tidal energy generation, offers high-margin potential. The growing need for decentralized drive technology, which eliminates centralized control cabinets, provides installation flexibility and opens new avenues for specialized manufacturers focusing on compact, integrated solutions. These factors collectively illustrate the dynamic interplay of market forces, pushing the industry toward greater technological sophistication and application specialization.

The impact forces within the market are predominantly technological and competitive. Rapid innovation in power electronics (SiC/GaN) is fundamentally changing VFD efficiency and size, while the intensifying competition among global manufacturers, especially those leveraging low-cost production centers, drives down component prices but simultaneously pushes for higher quality standards. Macroeconomic factors, such as global GDP growth and industrial output stabilization post-pandemic, exert a strong positive impact, whereas geopolitical tensions influencing global trade policies can introduce significant frictional forces.

Segmentation Analysis

The Industrial Gear Motors and Drives Market segmentation provides a critical view of product differentiation and application specialization, enabling manufacturers to strategically target high-growth areas. The market is broadly categorized by Motor Type, Gear Type, Power Range, and Application, each revealing unique demand patterns and technological requirements. Understanding these segments is paramount as industrial users seek highly specialized solutions tailored to operational constraints, such as high shock loading in mining or sanitary requirements in food processing, driving the development of specialized stainless steel gearboxes and highly sealed units.

Analysis of the Motor Type segment, covering AC, DC, and Servo Motors, shows a continued dominance of AC induction motors due to their robust and cost-effective nature, especially in general-purpose applications. However, the shift towards higher precision and energy efficiency strongly favors Permanent Magnet Synchronous Motors (PMSMs) and servo motors, particularly in high-dynamic applications like factory automation and robotics where fast acceleration and accurate positioning are non-negotiable. Furthermore, segmentation by power range highlights the concentration of demand in the low-to-medium power segments (up to 7.5 kW), corresponding to the vast installment base in material handling and light industrial machinery.

The application-based segmentation reveals that material handling equipment, driven by the expansion of automated warehouses and distribution centers, represents the single largest consumer category for gear motors and drives globally. Following closely are the food and beverage industry, demanding wash-down capabilities and specialized coatings, and the automotive sector, requiring precise control systems for assembly lines and paint shops. This granular segmentation not only aids in forecasting specific product demand but also guides R&D investment towards developing specialized features, such as explosion-proof casings for chemical plants or corrosion-resistant materials for marine applications.

- By Motor Type:

- AC Motors

- DC Motors

- Servo Motors

- Synchronous Motors (PMSM)

- By Gear Type:

- Helical Gear Motors

- Planetary Gear Motors

- Bevel Gear Motors

- Worm Gear Motors

- Other Types (Cycloidal, Hypoid)

- By Power Range:

- 0.1 kW to 7.5 kW (Low Power)

- 7.5 kW to 75 kW (Medium Power)

- Above 75 kW (High Power)

- By Application/End-Use Industry:

- Material Handling & Logistics

- Food & Beverage Processing

- Automotive & Transportation

- Mining & Cement

- Power Generation (Wind Turbines)

- Packaging Machinery

- Chemicals, Oil & Gas

- Water & Wastewater Treatment

- Metals & Machinery

Value Chain Analysis For Industrial Gear Motors and Drives Market

The value chain for Industrial Gear Motors and Drives begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized steel alloys for gears and casings, copper for motor windings, and rare earth magnets for high-efficiency motors. Suppliers of specialized components, such as high-precision bearings, seals, and advanced power semiconductor modules (IGBTs, MOSFETs) for variable frequency drives, hold significant influence. The efficiency and reliability of the final product are highly dependent on the quality and metallurgy of these sourced components, making supplier relationship management and quality control critical leverage points upstream.

The midstream stage constitutes the core manufacturing process, involving motor winding, gear cutting and hardening, precision assembly, and rigorous testing of the integrated unit. Key players are investing heavily in highly automated manufacturing facilities to achieve tighter tolerances, especially for planetary and high-precision helical gearboxes, which directly correlates with reduced noise and vibration. For the drive component, R&D focused on software algorithms, thermal management, and robust connectivity features (IIoT protocols) adds substantial intellectual value during this phase.

The downstream distribution channel involves a complex mix of direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through extensive networks of authorized distributors, system integrators, and value-added resellers (VARs). Direct distribution is preferred for highly customized, large-scale projects, ensuring technical support continuity. The indirect channel, however, is crucial for serving Maintenance, Repair, and Overhaul (MRO) markets and SMEs, offering localized inventory and quick technical service. Aftermarket services, including repairs, retrofits, and predictive maintenance contracts, represent a significant revenue stream and a vital link in maintaining customer relationships post-sale.

Industrial Gear Motors and Drives Market Potential Customers

Potential customers for Industrial Gear Motors and Drives are highly diverse and span nearly every sector of the global economy where mechanized motion and controlled power transmission are required. The primary customer groups are categorized into Original Equipment Manufacturers (OEMs), who integrate these systems into their final machinery (e.g., crane manufacturers, packaging machine builders), and end-users (Process Industries, Discrete Manufacturing), who purchase components for plant expansion, retrofitting, or replacement.

In the discrete manufacturing segment, the automotive industry represents a substantial buyer, utilizing complex drive systems for precision welding, stamping presses, and robotic arms, demanding high reliability and dynamic performance. The burgeoning e-commerce and logistics sector, necessitating high-throughput sorting, conveying, and automated storage and retrieval systems (AS/RS), is a rapidly growing customer segment, focusing on low-maintenance, decentralized drive solutions.

Process industries, including food and beverage, chemicals, pharmaceuticals, and cement, prioritize robustness against harsh environments, demanding specialized features such as stainless steel enclosures, high ingress protection (IP) ratings, and corrosion resistance. The buyers in these industries often look for integrated drive solutions offering energy efficiency certifications and global service networks to minimize operational risk and maximize regulatory compliance, positioning them as high-value, long-term procurement targets for gear motor manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 Billion |

| Market Forecast in 2033 | USD 42.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, SEW-Eurodrive GmbH & Co. KG, Bonfiglioli S.p.A., Nidec Corporation, Rexnord Corporation, Regal Rexnord Corporation, Tsubakimoto Chain Co., Sumitomo Drive Technologies, Bauer Gear Motor GmbH, Nord Drivesystems, Dana Brevini Group, Elecon Engineering Company Ltd., Winergy AG, Hitachi, Ltd., Lenze SE, WEG S.A., Getriebebau Nord GmbH & Co. KG, Emerson Electric Co., Johnson Electric Holdings Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Gear Motors and Drives Market Key Technology Landscape

The Industrial Gear Motors and Drives market is undergoing a profound technological transformation driven by the principles of connectivity, energy efficiency, and modularity. A core technology shaping the market is the development and commercialization of Permanent Magnet Synchronous Motors (PMSMs), which offer superior efficiency (often meeting IE5 standards) and higher power density compared to traditional AC induction motors, allowing for smaller, lighter, and more efficient drive packages. This shift is critical for applications where space and weight are premium, such as mobile robotics and high-precision machine tools. Furthermore, advanced gear manufacturing techniques, including precision grinding and surface treatments, are enhancing the load-carrying capacity and longevity of the gearboxes while significantly reducing operational noise levels.

In the drives segment, the technological landscape is dominated by sophisticated Variable Frequency Drives (VFDs) that utilize Silicon Carbide (SiC) and Gallium Nitride (GaN) power semiconductors. These wide-bandgap materials enable VFDs to operate at much higher switching frequencies with lower power losses and better thermal performance. This results in smaller drive footprints, increased motor performance control, and higher overall system efficiency. The integration of functional safety features (e.g., Safe Torque Off - STO) directly into the VFD firmware is becoming standard, ensuring compliance with strict international machine safety regulations and reducing the complexity of external safety circuits.

Perhaps the most disruptive technological trend is the seamless integration of Information Technology (IT) and Operational Technology (OT) via the Industrial Internet of Things (IIoT). Modern gear motors are now often equipped with embedded sensors for vibration, temperature, and current monitoring, coupled with onboard edge computing capabilities. This facilitates real-time condition monitoring and allows for data aggregation using industrial protocols like OPC UA and MQTT. The adoption of decentralized drive architecture, where the drive unit is mounted directly on the motor or near the application, reduces cabling and installation costs while simplifying maintenance, cementing the market's focus on smart, distributed intelligence.

Regional Highlights

The global Industrial Gear Motors and Drives market exhibits heterogeneous growth patterns influenced by regional industrial maturity, regulatory frameworks, and infrastructural investment cycles. Asia Pacific (APAC) currently holds the dominant market share and is expected to maintain the highest growth rate throughout the forecast period. This acceleration is attributed to massive government support for manufacturing expansion in countries like China, India, South Korea, and Japan, especially within the rapidly growing electric vehicle (EV) manufacturing, semiconductor production, and logistics industries. The need to implement reliable automation solutions to manage large-scale production facilities drives the core demand, particularly for helical and planetary gear systems.

Europe represents a highly mature market characterized by stringent environmental and energy efficiency regulations, making it a key adopter of premium, high-efficiency gear motor solutions (IE4/IE5) and advanced servo drives essential for precision engineering and robotics. Countries such as Germany, Italy, and Sweden, with robust machinery manufacturing sectors, focus heavily on technological innovation, demanding customized and highly modular systems that integrate seamlessly with advanced control platforms. The regional growth, while slower than APAC's, is driven by continuous retrofitting and modernization of existing industrial infrastructure to meet sustainability targets.

North America is a significant market propelled by the rapid digitalization of its industrial base and substantial investment in infrastructural upgrades, particularly in oil and gas, mining, and material handling sectors. The rise of e-commerce necessitates rapid deployment of large, automated warehousing facilities across the U.S. and Canada, creating a strong sustained demand for integrated gear motors and drives for complex conveyor and sorting systems. Furthermore, the region is a rapid adopter of cutting-edge technology, including AI-driven predictive maintenance solutions, enhancing the demand for sensor-equipped smart drives.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing promising growth driven by diversification away from resource extraction towards manufacturing and processing. In MEA, major investments in utilities, petrochemicals, and construction projects are stimulating demand for heavy-duty, robust gear motors built to withstand challenging environmental conditions. LATAM's market growth is tied to the recovery and expansion of sectors like agriculture, food processing, and automotive assembly in key economies such as Brazil and Mexico, focusing on balancing cost-effectiveness with improved operational reliability.

- Asia Pacific (APAC): Dominates the market; driven by high capital investments in electronics manufacturing, automotive, and logistics; high growth rate forecast due to rapid industrialization and governmental policy support.

- Europe: Characterized by high technological maturity; demand focused on IE4/IE5 efficiency compliance, precision drives for robotics, and industrial modernization projects across key manufacturing nations (Germany, Italy).

- North America: Strong market growth attributed to warehouse automation (e-commerce boom), modernization of oil & gas infrastructure, and rapid adoption of advanced digital/IIoT features in drive systems.

- Middle East & Africa (MEA): Emerging demand fueled by large infrastructure projects, investments in petrochemicals, and the need for robust, high-durability systems in extreme temperature environments.

- Latin America (LATAM): Growth linked to recovery in the agricultural, mining, and automotive sectors; increasing need for cost-effective, reliable gear motors for core industrial processes in Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Gear Motors and Drives Market.- ABB Ltd.

- Siemens AG

- SEW-Eurodrive GmbH & Co. KG

- Bonfiglioli S.p.A.

- Nidec Corporation

- Rexnord Corporation

- Regal Rexnord Corporation

- Tsubakimoto Chain Co.

- Sumitomo Drive Technologies

- Bauer Gear Motor GmbH

- Nord Drivesystems

- Dana Brevini Group

- Elecon Engineering Company Ltd.

- Winergy AG

- Hitachi, Ltd.

- Lenze SE

- WEG S.A.

- Getriebebau Nord GmbH & Co. KG

- Emerson Electric Co.

- Johnson Electric Holdings Ltd.

Frequently Asked Questions

Analyze common user questions about the Industrial Gear Motors and Drives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Industrial Gear Motors and Drives Market?

The primary factor driving market growth is the global acceleration of industrial automation and the widespread adoption of Industry 4.0 principles, necessitating precise, efficient, and robust power transmission solutions, particularly in the material handling and automotive sectors.

Which gear type segment is expected to show the highest growth rate during the forecast period?

The Planetary Gear Motors segment is expected to exhibit the highest growth rate. This is due to their superior torque density, compactness, and high-precision capabilities, making them ideal for modern robotic applications and machinery requiring high power in limited space.

How are government regulations influencing the demand for new industrial gear motors?

Government regulations, particularly those promoting energy efficiency like the mandatory adoption of IE4 (Super Premium Efficiency) and upcoming IE5 motors in regions such as Europe and North America, directly compel end-users to replace older, less efficient systems, thereby stimulating demand for advanced drives and motors.

What role does Artificial Intelligence (AI) play in modern gear motor systems?

AI is crucial for enabling predictive maintenance through real-time analysis of sensor data (vibration, temperature). This allows users to anticipate mechanical failures, optimize performance dynamically, and significantly reduce unplanned downtime, moving operations toward condition-based monitoring.

Which geographical region represents the largest consumer market for these products?

The Asia Pacific (APAC) region currently represents the largest and fastest-growing consumer market, driven by extensive manufacturing expansion, rapid industrialization, and significant investments in infrastructure and factory automation, especially in China and emerging Southeast Asian economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager