Industrial Grade Ammonium Nitrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443594 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Industrial Grade Ammonium Nitrate Market Size

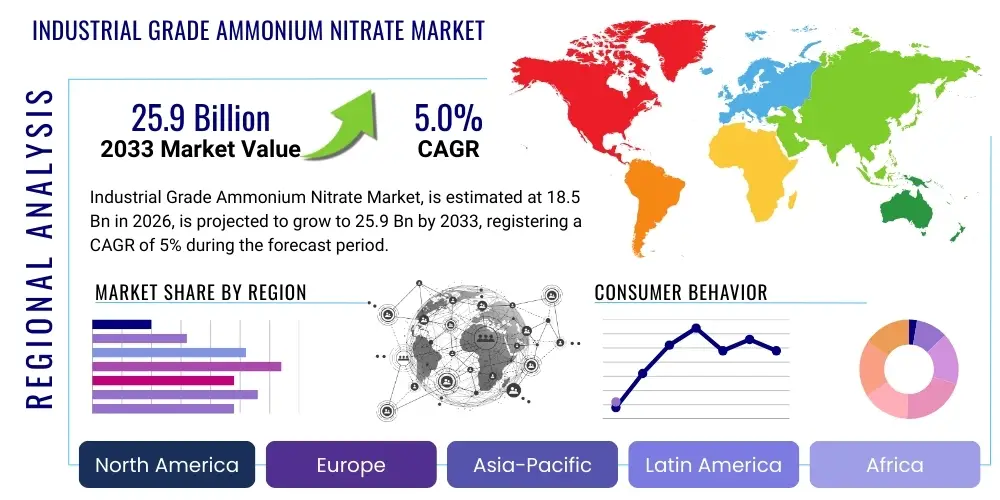

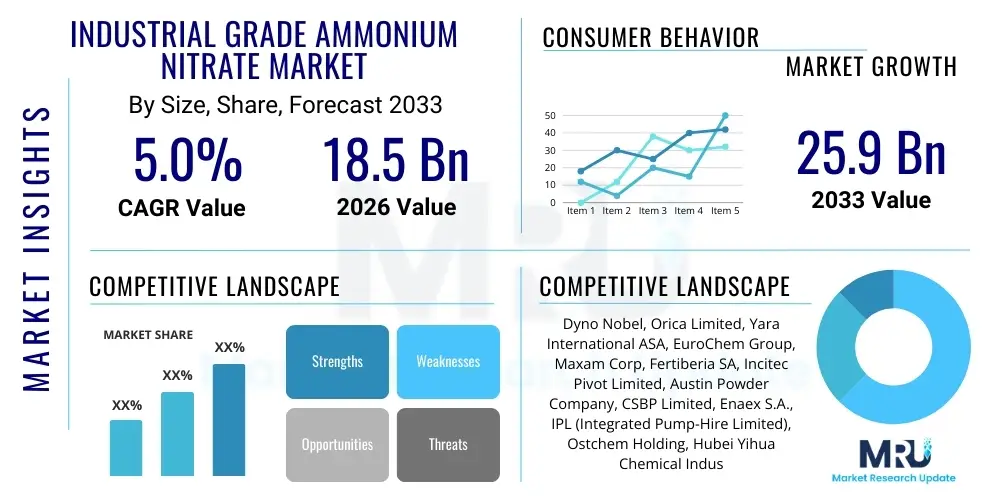

The Industrial Grade Ammonium Nitrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.0% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.9 Billion by the end of the forecast period in 2033.

Industrial Grade Ammonium Nitrate Market introduction

The Industrial Grade Ammonium Nitrate (IGAN) market encompasses the production, distribution, and consumption of high-purity ammonium nitrate primarily intended for non-agricultural applications. IGAN is a vital chemical compound characterized by its high nitrogen content and oxidizing properties, making it essential in the manufacturing of commercial explosives, notably Ammonium Nitrate Fuel Oil (ANFO). This grade differs significantly from fertilizer-grade ammonium nitrate due to stricter requirements regarding particle size, density, and porosity, optimized specifically for blast efficacy in demanding environments such as deep-pit mining and large-scale infrastructure projects. The market is deeply intertwined with global economic cycles, particularly the performance of the construction, quarrying, and mineral extraction industries, which rely heavily on efficient blasting techniques facilitated by IGAN products.

Major applications of Industrial Grade Ammonium Nitrate are overwhelmingly concentrated in the mining sector, covering coal, metal ores (iron, copper, gold), and non-metallic mineral extraction. Its widespread adoption stems from its cost-effectiveness, ease of use in preparing bulk explosives, and superior energy output when compared to alternative blasting agents. The inherent benefits of IGAN, including improved safety profiles when handled correctly and versatility in formulation, cement its position as the preferred oxidizer base. Furthermore, IGAN derivatives are increasingly utilized in civil engineering projects, including tunneling, dam construction, and roadway excavation, necessitating high-volume demolition capabilities. The market dynamics are profoundly influenced by stringent global regulations aimed at preventing diversion for unauthorized purposes, requiring manufacturers and distributors to adhere to rigorous security and tracking protocols.

The primary driving factors fueling the growth of the Industrial Grade Ammonium Nitrate market include the sustained global demand for key commodities such as iron ore and copper, necessitating expanded mining operations, particularly in emerging economies like those within the Asia Pacific and Latin America regions. Rapid urbanization and infrastructure development worldwide further stimulate demand for aggregates and construction materials, directly translating to increased consumption of blasting agents. Technological advancements in blasting techniques, such as electronic detonation systems and precision loading methods, enhance the efficiency of IGAN usage, making it even more economically attractive. However, market expansion is tempered by fluctuating raw material costs (primarily natural gas and nitric acid) and the pervasive regulatory burden associated with its storage, transport, and use.

Industrial Grade Ammonium Nitrate Market Executive Summary

The global Industrial Grade Ammonium Nitrate (IGAN) market trajectory is defined by robust growth in the Asia Pacific region, driven by extensive mining activities and massive government investments in infrastructure development, establishing it as the epicenter of demand over the forecast period. Business trends indicate a strong focus among leading manufacturers on backward integration into raw material production, particularly ammonia, to mitigate supply chain volatility and ensure cost competitiveness. Furthermore, strategic partnerships between IGAN producers and major mining companies are becoming prevalent, securing long-term supply contracts and promoting customized product development tailored to specific geological requirements. The shift towards higher density, porous prills for enhanced explosive performance represents a key product innovation trend, alongside increased investment in security systems to address regulatory compliance and safety mandates.

Regionally, while Asia Pacific leads in volume consumption, North America maintains significant market value owing to high-tech mining operations and substantial regulatory compliance costs, contributing to higher average selling prices. Europe demonstrates moderate growth, largely constrained by environmental policies and the maturation of its established mining infrastructure, leading to a concentrated emphasis on specialized, high-margin IGAN products for quarrying and civil works. Latin America, rich in mineral resources, presents compelling growth opportunities, particularly in Brazil and Chile, where new mega-mining projects are commencing. These regional trends underscore a bifurcated market where growth is led by volume demand in developing regions and sustained by technological sophistication and safety expenditure in developed economies.

In terms of segmentation, the porous prills segment dominates the market by product type, reflecting its superior performance and adaptability for large-scale ANFO manufacturing, especially when used in bulk systems. The end-use analysis clearly highlights the mining sector as the principal consumer, followed distantly by the construction and quarrying industries. Within mining, the consumption breakdown shows highest reliance from iron ore and coal extraction, which require frequent and large-scale blasting. Future segment trends suggest increasing penetration of low-density ANFO formulations designed for controlled blasting in sensitive urban or environmental zones, offering manufacturers avenues for diversification beyond traditional bulk explosives.

AI Impact Analysis on Industrial Grade Ammonium Nitrate Market

User inquiries regarding AI's impact on the Industrial Grade Ammonium Nitrate market predominantly center on improving safety protocols, optimizing blasting logistics, and enhancing regulatory oversight and supply chain security. Common questions explore how AI-driven predictive modeling can minimize accidental detonation risks, whether machine learning algorithms can optimize the blend ratio of ANFO based on real-time geological data for better efficiency, and how advanced tracking systems might utilize AI to prevent the diversion of IGAN materials. The key theme emerging is the expectation that AI and automation will primarily serve as tools for risk mitigation, efficiency enhancement in mining operations (thereby optimizing IGAN consumption), and ensuring rigorous, real-time compliance with global security regulations, shifting the focus from physical product innovation to intelligent application management.

- AI-powered predictive modeling for geological analysis optimizes blast patterns, minimizing IGAN waste and maximizing resource extraction yield.

- Machine learning algorithms enhance inventory management and logistics, ensuring just-in-time delivery of IGAN to remote mining sites, thereby reducing on-site storage risks.

- Advanced sensor networks and AI integration in manufacturing plants improve process control, leading to superior quality IGAN prills with enhanced porosity and density consistency.

- AI-driven surveillance and tracking systems (e.g., using drone technology and computer vision) strengthen regulatory compliance and prevent unauthorized access or diversion of explosive precursors.

- Optimization of blending parameters for ANFO mixtures using real-time environmental and rock mass classification data, improving explosive performance and reducing overall consumption volumes per ton of extracted material.

DRO & Impact Forces Of Industrial Grade Ammonium Nitrate Market

The Industrial Grade Ammonium Nitrate market is influenced by a powerful combination of infrastructural growth drivers, stringent governmental restraints related to safety and diversion risk, and emerging opportunities in specialized applications and process optimization. The fundamental drivers include relentless global demand for base metals and critical minerals, fueling expansion in the mining sector across continents, particularly in regions undergoing rapid industrialization. Simultaneously, the market faces significant headwinds from increasingly complex regulatory frameworks established by organizations like the UN and national security agencies aimed at preventing the use of IGAN in illicit activities, which escalate operational costs for manufacturers and end-users. Opportunities arise from technological advancements in electronic detonation and environmentally friendly blasting agents that may incorporate IGAN derivatives, offering safer and more precise methods for material extraction and earth moving.

Drivers: Significant global infrastructure spending, particularly in transportation networks, urbanization projects, and power generation facilities, sustains the demand for aggregates and necessitates extensive use of blasting agents. Furthermore, the robust global commodity supercycle, driven by the transition to renewable energy sources requiring vast amounts of battery metals (lithium, cobalt, nickel), mandates increased mining depth and volume, directly increasing IGAN consumption. The proven economic efficiency and reliability of ANFO compared to competitive explosives in large-scale operations ensure its continued dominance in bulk blasting applications, reinforcing the market’s underlying growth trajectory.

Restraints: The most critical restraint is the heightened risk of IGAN diversion, leading governments worldwide to impose severe restrictions on its sale, transport, and storage, substantially raising compliance and security expenditure. Volatility in the price of natural gas, a primary feedstock for ammonia production (a key intermediate), introduces significant uncertainty regarding production costs and final product pricing. Additionally, increasing environmental concerns and regulatory pressures, particularly in developed markets, promote the substitution of IGAN with less potent, non-explosive alternatives for specific civil engineering applications, potentially limiting market penetration in niche areas.

Opportunities & Impact Forces: Key opportunities lie in the development of next-generation blasting techniques, such as gassed ANFO matrices and specialized emulsion blends, which offer improved stability, water resistance, and optimized energy release profile, appealing to challenging mining environments. The ongoing digitalization and automation of mining processes, coupled with AI-driven blast design, offer the chance for IGAN manufacturers to position themselves as providers of integrated solutions, rather than mere chemical suppliers. The primary impact force remains the cyclical nature of the global mining industry; any sudden slowdown in commodity prices or reduction in infrastructure spending can rapidly depress IGAN demand, illustrating the market's high sensitivity to macroeconomic shifts.

Segmentation Analysis

The Industrial Grade Ammonium Nitrate market is comprehensively segmented based on its Product Type, primarily distinguishing between the physical form and characteristics optimized for specific explosive formulations, and its End-Use Application, defining the major consuming industries globally. Analyzing these segments provides critical insights into consumption patterns, pricing differentials, and regional demand dynamics. The segmentation by type typically focuses on density and porosity, which dictates the explosive potential and handling properties of the material. By application, the clear dominance of the mining industry dictates investment priorities and technological development for IGAN producers, ensuring products meet the stringent requirements of large-scale, high-impact rock fragmentation.

The product segmentation, encompassing high-density and low-density prills, porous prills, and specialized crystal forms, reflects the need to tailor the oxidizing agent to specific explosive blends, such as ANFO or heavy ANFO. Porous prills, designed with high oil absorption capacity, dominate due to their optimal performance in ANFO mixtures, which remain the cheapest and most effective bulk explosive solution for open-pit mining. The segmentation by end-user allows for a granular understanding of sector-specific growth rates. While mining drives volume, the construction sector, particularly in emerging markets, offers intermittent, project-based demand, emphasizing specialized packaging and distribution logistics tailored to smaller, localized sites.

Understanding these segments is essential for strategic planning, enabling manufacturers to optimize production capacity, target marketing efforts, and develop differentiated product lines that comply with varying regulatory standards across different industrial applications. For instance, the growing demand for high-strength explosives in deep underground mining requires IGAN manufacturers to develop products that ensure superior blast velocity and reliability under challenging, high-pressure subterranean conditions, leading to investment in proprietary manufacturing processes that enhance prill integrity and consistency, thereby justifying a premium price point within the specialized segment.

- By Product Type:

- Low Density Prills (LDP)

- High Density Prills (HDP)

- Porous Prills

- Solution/Liquid Form

- By Application:

- Mining (Metal, Coal, Non-Metallic Minerals)

- Construction (Roads, Tunnels, Buildings)

- Quarrying (Aggregates, Dimensional Stone)

- Civil Engineering (Dam Construction, Excavation)

Value Chain Analysis For Industrial Grade Ammonium Nitrate Market

The Industrial Grade Ammonium Nitrate value chain is characterized by energy-intensive upstream production and complex, highly regulated downstream distribution. The upstream segment involves the synthesis of key raw materials: ammonia and nitric acid. Ammonia production relies heavily on natural gas as a feedstock, making the upstream costs highly vulnerable to energy market volatility. Nitric acid is produced via the catalytic oxidation of ammonia. Companies that integrate backward into ammonia and nitric acid production gain significant cost advantages and control over supply consistency. This stage demands substantial capital investment in large chemical complexes, ensuring economies of scale are critical for competitiveness in IGAN manufacturing, which itself involves prilling or crystallization processes to achieve the required industrial specifications (density, porosity).

The midstream process involves the conversion of the raw materials into finished Industrial Grade Ammonium Nitrate prills or solutions, a stage dominated by rigorous quality control to meet industry safety and performance standards. Logistics and storage constitute a major cost center in the midstream, requiring specialized facilities compliant with strict hazard material regulations. Downstream, the distribution channel is complex and often dual-layered. Direct channels involve large producers supplying integrated mining companies or major explosive manufacturing firms via long-term contracts. Indirect distribution relies on specialized chemical distributors and regional explosive suppliers who manage the logistics, blending (e.g., mixing with fuel oil to form ANFO), and site delivery to smaller quarrying or construction operations. Due to security concerns, the downstream channel is intensely scrutinized by regulatory bodies, necessitating strict chain-of-custody documentation and enhanced security protocols.

The final consumption is concentrated predominantly among end-users involved in large-scale excavation. Mining companies are the primary buyers, often receiving IGAN in bulk or as a component in pre-mixed explosives delivered directly to the blast site. The effectiveness of the value chain is measured by the ability of suppliers to maintain product integrity and ensure timely, compliant delivery under hazardous conditions. Efficiency in the distribution network, minimizing transit time and optimizing inventory levels at secure storage depots, is paramount, as is the critical relationship between the IGAN manufacturer and the explosive services provider who manages the on-site application. This symbiotic relationship ensures that the end-product performance aligns precisely with the complex requirements of geological fragmentation and removal.

Industrial Grade Ammonium Nitrate Market Potential Customers

The primary customers for Industrial Grade Ammonium Nitrate are large industrial entities that rely on powerful, cost-effective blasting solutions for material extraction and earth movement. Leading the consumer base are global mining conglomerates focused on the extraction of bulk commodities such as iron ore, thermal coal, metallurgical coal, and base metals like copper and gold. These companies require vast quantities of IGAN, often procuring it under long-term supply agreements directly from manufacturers or integrated explosive service providers. Their procurement decisions are driven by blast efficiency, cost per ton of extracted material, consistency of product quality, and the supplier's capacity to meet strict safety and regulatory compliance standards.

Secondary significant customers include major civil engineering and infrastructure development firms. These companies utilize IGAN in construction projects that involve large-scale rock excavation, such as tunneling for metropolitan transit systems, creating foundation pits for massive structures, and grading mountainous terrain for highway construction. While their volume requirement is typically lower and more project-specific compared to continuous mining operations, their demand is highly sensitive to the successful execution timeline of public works projects. Additionally, independent quarrying operations, which supply aggregates and dimensional stone to the local construction industry, form a fragmented but substantial customer base, often relying on specialized local distributors for their smaller volume needs and technical support on blast design.

Beyond these core industrial segments, specialized applications create niche customer segments, including military contractors utilizing IGAN components for certain non-conventional explosive formulations and specific governmental agencies involved in land remediation or controlled demolition operations. Procurement from these specialized buyers is extremely complex, involving strict security clearances and often necessitating IGAN customized for exceptional stability or specific explosive characteristics. Overall, the potential customer base is dominated by B2B entities where procurement is highly centralized and governed by performance specifications and rigorous safety audit requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.9 Billion |

| Growth Rate | 5.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dyno Nobel, Orica Limited, Yara International ASA, EuroChem Group, Maxam Corp, Fertiberia SA, Incitec Pivot Limited, Austin Powder Company, CSBP Limited, Enaex S.A., IPL (Integrated Pump-Hire Limited), Ostchem Holding, Hubei Yihua Chemical Industry Co. Ltd., Shandong Haili Chemical Industry Co., Ltd., Vijayalakshmi Agro Chemicals, Zaklady Azotowe Pulawy S.A., Sasol Ltd., Uralkali PJSC, Sanjiang Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Grade Ammonium Nitrate Market Key Technology Landscape

The core technology for Industrial Grade Ammonium Nitrate (IGAN) production revolves around the Haber-Bosch process for ammonia synthesis, followed by the Oswald process for nitric acid production, and subsequent neutralization and concentration. The critical technology differentiator in the IGAN sector lies not in the basic chemistry, but in the final prilling or granulation stage. Manufacturers employ proprietary prilling tower designs and crystallization techniques to precisely control the physical properties of the prill, such as porosity, density, and uniformity, which directly impact the prill's ability to absorb fuel oil and its resultant explosive performance in ANFO mixtures. Advanced prilling technologies focus on maximizing the surface area and consistent internal pore structure, enabling higher absorption rates and improving detonation velocity under various geological conditions. These technological investments are essential for maintaining a competitive edge, particularly when serving high-performance mining applications.

Beyond manufacturing, the technology landscape includes significant advancements in handling and application systems. The shift towards bulk delivery and mechanized mixing systems at mine sites, rather than reliance on bagged explosives, necessitates IGAN that is resistant to breakage and dusting during pneumatic conveyance. Modern mining technology integrates electronic detonators and sophisticated blast design software that uses algorithms to model rock fragmentation and predict the optimal IGAN charge density required for effective breaking, thereby enhancing efficiency and safety. These software platforms, increasingly incorporating geological mapping data, allow for precision blasting, which reduces over-fragmentation and environmental impact, driving demand for premium, highly consistent IGAN products suitable for precise volumetric dosing.

Looking forward, the technology landscape is being shaped by environmental sustainability and security demands. Manufacturers are exploring advanced catalytic converters and process improvements to reduce nitrous oxide (N2O) emissions, a potent greenhouse gas, during nitric acid production. Furthermore, security technologies, including advanced telemetry systems for real-time tracking of IGAN shipments and smart warehouse management using IoT sensors, are becoming mandatory. These technological upgrades are necessary not only for regulatory compliance but also for operational integrity, ensuring that the supply chain is resilient against diversion risks and capable of rapid response to safety incidents, positioning technology as a critical enabler of secure market growth.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region in the IGAN market, fueled by robust industrialization, massive infrastructure investment (especially in China, India, and Southeast Asia), and extensive mining of coal, iron ore, and bauxite. The region benefits from large-scale domestic production capacity and comparatively lower labor costs, but faces challenges related to inconsistent regulatory enforcement and high localized pollution control costs. The demand from the Australian mining sector, driven by resource exports, significantly contributes to the high-value segment of the market.

- North America: This region is characterized by mature mining and quarrying operations, focusing on high-tech extraction methods, particularly in Canada and the United States. Growth is steady, underpinned by sustained demand for aggregates and renewed focus on domestic critical mineral supply chains. North America adheres to the strictest safety and security regulations globally (e.g., Homeland Security measures), driving innovation in secured logistics and advanced handling equipment, resulting in higher product pricing but consistent, premium-grade consumption.

- Europe: The European IGAN market is relatively constrained by strict environmental policies and a mature, shrinking heavy industry base. Demand is highly stable and focused mainly on quarrying for construction materials in Central and Southern Europe, along with specialized civil engineering projects (tunneling in the Alps). Manufacturers here focus heavily on optimization technologies, maximizing energy efficiency in production, and specializing in high-stability products that comply with stringent REACH regulations and domestic security standards.

- Latin America: This region represents a high-potential growth market due to its rich endowment of mineral resources, particularly in the Andean belt (Chile, Peru, Argentina) for copper and lithium. Market expansion is closely tied to new investment cycles in large-scale open-pit mines. While regulatory frameworks can be complex and variable, the fundamental need for bulk explosives in these mega-projects ensures consistent, high-volume demand for IGAN.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in specific regions, primarily driven by large construction and infrastructure projects in the Gulf Cooperation Council (GCC) countries and significant mineral extraction (gold, diamonds, coal, and phosphates) in South and West Africa. The market is fragmented, characterized by supply chain logistical challenges, but offers significant upside potential as governments diversify economies away from oil and gas and invest in domestic industrial capability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Grade Ammonium Nitrate Market.- Dyno Nobel (a subsidiary of Incitec Pivot Limited)

- Orica Limited

- Yara International ASA

- EuroChem Group

- Maxam Corp

- Fertiberia SA

- Austin Powder Company

- CSBP Limited

- Enaex S.A.

- IPL (Integrated Pump-Hire Limited)

- Ostchem Holding

- Hubei Yihua Chemical Industry Co. Ltd.

- Shandong Haili Chemical Industry Co., Ltd.

- Vijayalakshmi Agro Chemicals

- Zaklady Azotowe Pulawy S.A.

- Sasol Ltd.

- Uralkali PJSC

- Sanjiang Chemical Co., Ltd.

- Mitsubishi Chemical Holdings

- CF Industries Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Industrial Grade Ammonium Nitrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Industrial Grade and Fertilizer Grade Ammonium Nitrate?

Industrial Grade Ammonium Nitrate (IGAN) is manufactured with specific physical properties, notably high porosity and lower density, optimized for fuel oil absorption to create effective explosives (ANFO) for mining and construction. Fertilizer Grade Ammonium Nitrate (FGAN) is denser, designed for agricultural nutrient delivery, and is regulated differently. IGAN production focuses on consistency and purity for maximum blast performance, while FGAN focuses on nitrogen content and dissolution rate for soil application.

Which end-use industry is the largest consumer of Industrial Grade Ammonium Nitrate globally?

The mining sector is overwhelmingly the largest consumer of Industrial Grade Ammonium Nitrate. IGAN serves as the primary oxidizer component in Ammonium Nitrate Fuel Oil (ANFO), the most commonly used bulk explosive for extraction of minerals, coal, and metallic ores, which requires high-volume, cost-effective fragmentation of rock masses globally.

How do global regulations impact the Industrial Grade Ammonium Nitrate supply chain and market growth?

Strict global regulations, driven by security concerns over potential diversion for illicit activities, significantly impact the IGAN market. These regulations enforce stringent track-and-trace requirements, secure storage mandates, specialized transportation protocols, and higher operational costs for compliance, acting as a major restraint on market growth but simultaneously driving innovation in secured logistics and supply chain transparency.

What key raw materials are essential for Industrial Grade Ammonium Nitrate production?

The key raw materials required for IGAN production are ammonia and nitric acid. Ammonia synthesis, primarily reliant on natural gas as a hydrogen source (Haber-Bosch process), determines the cost structure of IGAN production. Volatility in natural gas prices is a major factor influencing the final pricing of Industrial Grade Ammonium Nitrate products worldwide.

What technological trends are currently shaping the future of IGAN application in mining?

Key technological trends include the increased adoption of electronic detonation systems for precision blasting, which maximizes the effectiveness of IGAN charges. Additionally, AI and machine learning are being used to analyze geological data and optimize ANFO blend ratios and blast design, leading to reduced IGAN consumption per ton of material extracted and improved safety profiles in complex mining environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager