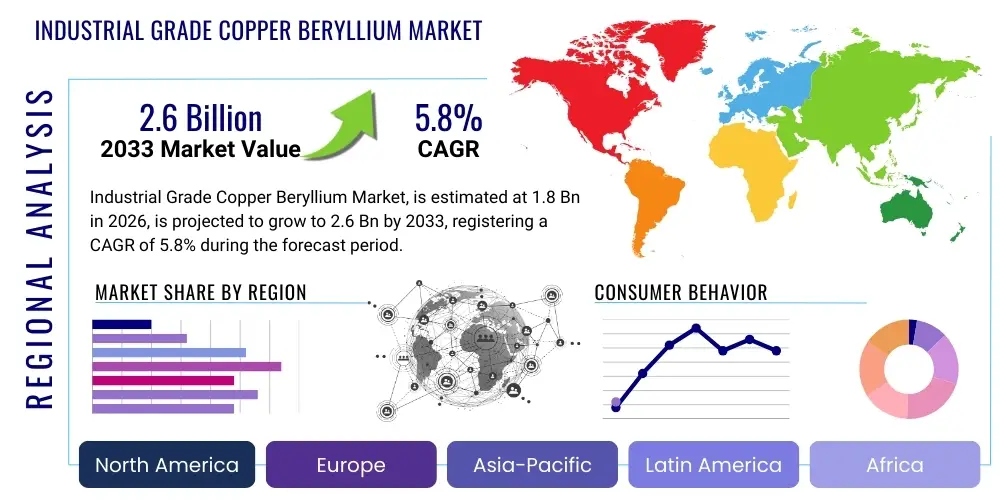

Industrial Grade Copper Beryllium Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441465 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Industrial Grade Copper Beryllium Market Size

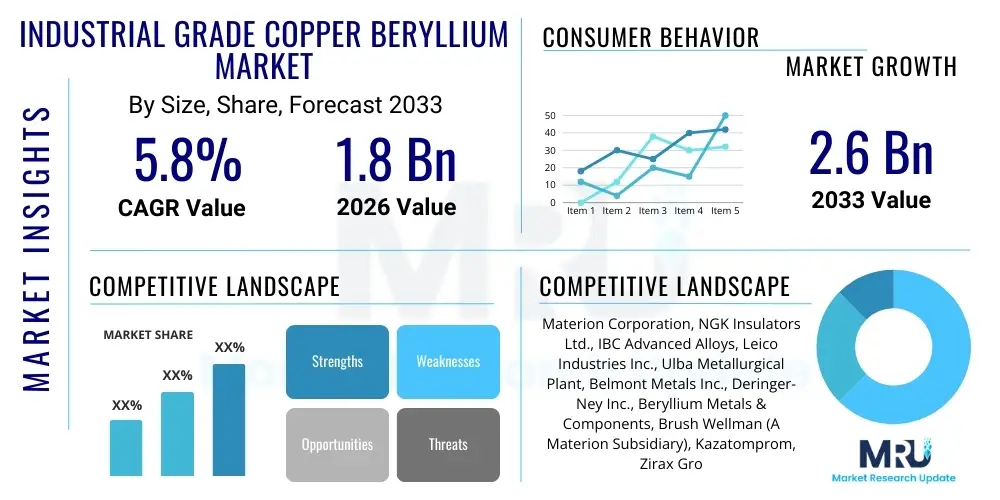

The Industrial Grade Copper Beryllium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.6 Billion by the end of the forecast period in 2033.

Industrial Grade Copper Beryllium Market introduction

Industrial Grade Copper Beryllium (CuBe) alloys represent a critical class of materials renowned for their exceptional combination of mechanical strength, high electrical conductivity, excellent corrosion resistance, and superb thermal conductivity. These unique properties make them indispensable across a wide range of demanding industrial applications where reliability under extreme conditions is paramount. The primary product description encompasses various alloy compositions, most notably C17200 and C17510, which are tailored to optimize either strength or conductivity, respectively. C17200, often referred to as Alloy 25, is primarily used for high-stress components requiring maximum tensile strength, while C17510 offers a better balance of conductivity and moderate strength, crucial for current-carrying parts and resistance welding components. The market introduction highlights the increasing reliance on these alloys in advanced manufacturing sectors that demand miniaturization and increased performance efficiency.

Major applications of Industrial Grade Copper Beryllium span the electrical and electronic sectors, particularly in the fabrication of high-reliability connectors, switches, relays, and springs utilized in telecommunications and data processing equipment. Furthermore, the material's non-sparking and non-magnetic characteristics are highly valued in specialized fields such as oil and gas exploration tools, aerospace instruments, and defense applications, ensuring operational safety and precision. The benefit profile of CuBe includes its superior resistance to stress relaxation at elevated temperatures, which significantly enhances the longevity and stability of critical electrical contacts compared to traditional copper alloys or bronzes. This durability reduces maintenance costs and system downtime, driving its adoption in high-performance machinery and infrastructure.

Key driving factors accelerating the market growth include the global push for higher energy efficiency in electronic devices, leading to increased demand for high-conductivity, low-loss materials. The expansion of 5G infrastructure and subsequent requirements for robust, high-frequency connectors further boost consumption. Additionally, the automotive industry's transition toward electric vehicles (EVs) and advanced driver-assistance systems (ADAS) requires specialized, high-reliability interconnects and battery management components, which are ideally served by the unique attributes of Industrial Grade Copper Beryllium alloys. The rigorous demands of modern manufacturing environments for materials that can withstand aggressive thermal cycling and mechanical fatigue solidify the material's market position.

Industrial Grade Copper Beryllium Market Executive Summary

The Industrial Grade Copper Beryllium market is characterized by robust growth driven primarily by technological advancements in telecommunications, automotive electrification, and high-performance electronics. Business trends indicate a focus on material innovation, particularly developing low-beryllium or beryllium-free alternatives to address health and safety concerns associated with beryllium handling, though pure CuBe alloys remain the performance benchmark for many critical applications. Strategic alliances among primary beryllium producers and downstream alloy fabricators are common, aimed at securing raw material supply chains and optimizing production efficiency. Furthermore, there is a distinct trend towards offering customized alloy compositions and specialized surface treatments to meet the increasingly stringent performance specifications of aerospace and defense contractors, emphasizing high-purity and tightly controlled mechanical tolerances.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing market, largely fueled by massive investments in electronics manufacturing hubs in China, South Korea, and Taiwan, along with the rapid expansion of electric vehicle production capacity across the region. North America and Europe maintain significant market shares, characterized by high demand from the aerospace, defense, and sophisticated medical device sectors, which prioritize quality and stringent certification standards. Regulatory environments, particularly regarding the safe handling and processing of beryllium, influence regional market dynamics, compelling manufacturers in mature economies to invest heavily in advanced ventilation and dust control technologies, increasing operational overheads but ensuring regulatory compliance.

Segmentation trends reveal that the High Strength Alloys segment (such as C17200) currently holds the largest market share due to its extensive use in structural components and high-stress contact applications in industrial machinery and defense systems. However, the High Conductivity Alloys segment (C17510 and variants) is projected to exhibit the highest CAGR, driven by the explosive growth in high-speed data transmission equipment, complex sensor systems, and EV battery connectors where thermal management and minimal electrical resistance are critical. By form, the strip and plate segments dominate the market volume, catering to high-volume stamping processes for connectors and springs, while specialized forms like wire and tube command premium pricing due to their niche applications in specialized probes and high-precision instruments.

AI Impact Analysis on Industrial Grade Copper Beryllium Market

User questions regarding the impact of Artificial Intelligence (AI) on the Industrial Grade Copper Beryllium market frequently center on how AI can optimize manufacturing processes, predict material performance failures, and accelerate the discovery of new, high-performance alloys. Key themes identified include expectations that AI-driven predictive maintenance will increase the lifespan of existing CuBe components, reducing replacement cycles but ensuring consistent demand for initial high-quality parts. Concerns also revolve around the potential for AI-guided materials informatics to rapidly identify viable substitutes, posing a long-term threat to the premium pricing of beryllium-containing alloys. Users are keenly interested in the application of machine learning for quality control, specifically detecting microstructural defects in manufactured parts and ensuring compliance with stringent aerospace and medical device standards. The summarized expectation is that while AI will enhance manufacturing efficiency and quality within the CuBe supply chain, its primary disruptive long-term effect will be accelerating R&D towards substitution materials driven by sustainability and safety concerns.

- AI-driven Predictive Maintenance: Enhances lifespan of CuBe components (e.g., connectors, springs) in critical systems, reducing sudden failures and minimizing system downtime.

- Optimized Manufacturing Processes: Utilizes machine learning algorithms to fine-tune casting, rolling, and heat treatment parameters, maximizing material properties and reducing scrap rates.

- Quality Control and Defect Detection: AI vision systems and predictive analytics improve non-destructive testing, ensuring microstructural integrity vital for aerospace and defense applications.

- Materials Informatics Acceleration: AI models accelerate the simulation and discovery of novel alloy compositions, potentially leading to faster development of safer, comparable beryllium-free alternatives.

- Supply Chain Resilience: AI algorithms analyze geopolitical risks and commodity price volatility, optimizing procurement strategies for key raw materials like copper and beryllium ore.

DRO & Impact Forces Of Industrial Grade Copper Beryllium Market

The dynamics of the Industrial Grade Copper Beryllium market are governed by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). The primary drivers stem from the inherent superior performance characteristics of CuBe alloys—namely, unmatched conductivity combined with high strength and thermal stability—which are essential for next-generation technology integration, especially in high-density electronic packaging and advanced telecommunications infrastructure. Restraints primarily involve the significant health hazards and environmental concerns associated with beryllium processing, necessitating strict regulatory compliance and high capital investment in safety infrastructure, which limits the number of manufacturers and increases end-product cost. Opportunities arise from emerging technologies like high-power computing, advanced electric vehicle charging systems, and miniature medical implants that require materials operating reliably at extreme performance limits, where CuBe currently holds a non-negotiable advantage.

Impact forces within the market are predominantly technological and regulatory. The accelerating pace of electronic miniaturization acts as a powerful driver, as smaller components require materials with higher reliability and thermal performance packed into confined spaces. Conversely, stringent occupational health and safety regulations (e.g., OSHA standards in the US, REACH in Europe) regarding beryllium exposure exert a strong restrictive force, influencing location decisions for manufacturing facilities and pushing research towards safer, yet equally effective, alternatives. The monopolistic control over beryllium raw material extraction by a few global entities also constitutes a significant structural force, impacting pricing and supply chain stability for downstream alloy producers and thus stabilizing or inflating final product costs irrespective of copper price fluctuations.

Specific market drivers include the rapid adoption of high-performance computing (HPC) and data centers, which require reliable heat dissipation and uninterrupted power delivery components made from high-conductivity CuBe. The defense sector's continuous demand for radar systems, precision guidance components, and ordnance parts that must withstand extreme mechanical shock and temperature variations also sustains demand. Conversely, the high processing cost associated with melting, casting, and heat-treating beryllium alloys, coupled with the difficulty of recycling components containing beryllium, acts as a financial constraint. However, the rise of additive manufacturing techniques, offering potential for localized production and reduced material waste, presents a future opportunity to mitigate some processing costs and improve material utilization efficiency across the value chain.

Segmentation Analysis

The Industrial Grade Copper Beryllium market is comprehensively segmented based on product type, form, and application, allowing for targeted strategic analysis across diverse end-user industries. Product type segmentation distinguishes between alloys optimized for mechanical properties (high strength) and those prioritized for electrical and thermal properties (high conductivity), reflecting varied customer needs ranging from resilient structural elements to efficient current carriers. The Form segment captures the intermediate product forms supplied to manufacturers, indicating the dominant processing methods employed by the end-users, such as stamping (strips) or specialized machining (rods and tubes). This multi-dimensional segmentation provides a nuanced view of where growth is most concentrated and identifies specific industrial needs driving material adoption.

Application segmentation is critical, demonstrating the breadth of industries relying on the unique attributes of CuBe. The Electrical & Electronic Components segment typically dominates due to the necessity of reliable connectors, springs, and switches in all modern devices, encompassing consumer electronics, industrial controls, and telecommunications. The growing influence of the Automotive segment, particularly related to safety-critical sensors and battery packs in electric vehicles, is projected to be the fastest-growing application area. Understanding these segment dynamics is crucial for producers aiming to align R&D efforts and capacity expansion with sectors exhibiting the highest technological growth and willingness to pay for premium material performance.

- By Product Type

- High Strength Alloys (e.g., C17200)

- High Conductivity Alloys (e.g., C17510)

- High Modulus Alloys

- By Form

- Strip

- Rod

- Wire

- Plate

- Tube

- By Application

- Electrical & Electronic Components (Connectors, Relays, Switches)

- Automotive (EV Battery Connectors, Sensors)

- Aerospace & Defense (Landing Gear Components, Instrumentation)

- Industrial Machinery (Molds, Bushings, Non-Sparking Tools)

- Telecommunications (5G Infrastructure Components)

- Oil & Gas (Downhole Tools, Measurement While Drilling - MWD Equipment)

Value Chain Analysis For Industrial Grade Copper Beryllium Market

The value chain for Industrial Grade Copper Beryllium begins with highly specialized upstream activities involving the mining and refining of Beryllium ore, a process characterized by high entry barriers due to complex technology, strict environmental regulations, and limited global resources. This critical raw material is then combined with high-purity copper, typically through vacuum melting and casting processes performed by primary alloy manufacturers like Materion or NGK. Upstream analysis reveals that the consolidation of beryllium sourcing significantly impacts the price stability and supply security for the entire market. Subsequent processes involve rigorous metallurgical treatments, including hot and cold working, heat treatment (age hardening), and finishing operations to achieve the desired mechanical and electrical properties tailored for specific industrial grades. Quality assurance and certification are vital at this stage, particularly for materials destined for regulated sectors like aerospace and medical devices.

Moving downstream, the distribution channel is multifaceted, relying heavily on both direct and indirect sales strategies. Direct distribution is common for large-volume customers, such as major automotive Tier 1 suppliers or aerospace primes, where customized alloys and technical support are paramount. Indirect channels, involving specialized metal distributors and regional wholesalers, serve smaller fabricators and machine shops that require inventory management and rapid supply of standard stock forms (strip, rod, plate). The complexity of processing CuBe, which requires specialized equipment and handling precautions, often restricts the number of downstream fabricators capable of machining or stamping these materials, thus maintaining pricing power within the specialized manufacturing segment of the chain. These downstream fabricators produce the final components, such as molded parts, stamped connectors, or machined non-sparking tools.

The final stage involves the integration of these components into end-user systems. End-users benefit from the performance enhancements provided by CuBe, but they also bear responsibility for managing the eventual disposal or recycling of beryllium-containing parts. The increasing complexity of electronic devices means that original equipment manufacturers (OEMs) often require close collaboration with alloy producers to optimize material selection for extreme operating environments. The efficiency of the distribution channel—whether direct or indirect—is measured by its ability to provide technical specifications, certification documentation, and reliable, time-sensitive delivery, especially given the high-cost nature of the material which makes inventory holding expensive for both distributors and end-users.

Industrial Grade Copper Beryllium Market Potential Customers

Potential customers for Industrial Grade Copper Beryllium alloys are primarily sophisticated manufacturers and technology integrators operating in sectors where component failure is economically costly, logistically disruptive, or life-threatening. The largest segment of end-users/buyers includes global Original Equipment Manufacturers (OEMs) specializing in advanced electronics, telecommunications infrastructure providers, and data center operators. These customers procure CuBe in strip and wire forms for high-volume stamping and wire drawing processes to produce millions of highly reliable, miniature electrical connectors, spring contacts, and high-frequency shielding mechanisms. Their key requirement is materials with superior stress relaxation resistance, ensuring consistent spring force and low electrical resistance over decades of operation in compact electronic assemblies.

Another significant customer base resides within the heavy industrial and machinery sectors, encompassing manufacturers of high-performance plastic injection molds, resistance welding electrodes, and specialized non-sparking safety tools. For these buyers, CuBe is selected not only for its conductivity but also its excellent hardness, wear resistance, and the crucial safety attribute of not generating sparks upon impact, which is mandatory in hazardous environments like petrochemical plants and munitions depots. These customers typically purchase the alloy in rod, plate, and tube forms for subsequent machining into complex, durable industrial components, often focusing on the high-strength grades (e.g., C17200) to withstand severe mechanical stress.

The aerospace and defense (A&D) industries represent high-value, high-specification customers. A&D contractors and military equipment producers purchase CuBe for critical applications in inertial guidance systems, instrumentation, aircraft landing gear bushings, and sophisticated electronic warfare systems. Their purchasing decisions are heavily influenced by military specifications (Mil-Specs), material traceability, and proven performance reliability under extreme thermal and vibrational conditions. Similarly, high-end medical device manufacturers utilize CuBe for complex surgical instruments, biopsy tools, and miniature, high-reliability connectors in implantable devices, where biocompatibility, fatigue resistance, and absolute precision are non-negotiable purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, NGK Insulators Ltd., IBC Advanced Alloys, Leico Industries Inc., Ulba Metallurgical Plant, Belmont Metals Inc., Deringer-Ney Inc., Beryllium Metals & Components, Brush Wellman (A Materion Subsidiary), Kazatomprom, Zirax Group, Bekaert, Little Falls Alloys Inc., Aviva Metals, Ampco Metal, Precision Engineered Products LLC, Wrought Copper Alloy Holdings, National Bronze Mfg. Co., Shanghai Metal Corporation, CNMC Ningxia Orient Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Grade Copper Beryllium Market Key Technology Landscape

The core technology landscape for Industrial Grade Copper Beryllium revolves around advanced metallurgical processing designed to achieve the precise balance of ductility, strength, and electrical properties necessary for high-performance applications. The most critical technological process is age hardening (precipitation hardening), which involves precise thermal treatment following solution annealing. This process precipitates tiny Beryllium atoms within the copper matrix, dramatically increasing mechanical strength while maintaining high conductivity. Technological differentiation among market leaders often centers on proprietary melt practice and casting techniques, such as vacuum melting, which minimizes impurities and controls microstructure to enhance fatigue life and material uniformity, essential for high-reliability components used in space and defense applications.

Furthermore, surface engineering and coating technologies represent an increasingly important part of the landscape. Manufacturers are employing specialized plating techniques, such as gold, silver, or palladium coatings, onto CuBe connectors and contacts. These coatings enhance surface conductivity, reduce insertion force, and provide additional resistance to oxidation and wear, extending the functional life of the component, particularly in harsh or corrosive operating environments like marine or downhole oil exploration. Advancements in thin-film deposition and controlled atmosphere processing ensure that the inherent beneficial properties of the CuBe substrate are maximized and protected against external factors, fulfilling strict performance requirements for miniature electronic packaging.

Emerging technologies, specifically in metal additive manufacturing (AM), are beginning to impact the traditional fabrication routes of CuBe. While full-scale additive manufacturing of complex CuBe parts is still nascent due to challenges related to beryllium toxicity handling and achieving dense, fully age-hardenable microstructure, research is focusing on using Selective Laser Melting (SLM) and Electron Beam Melting (EBM) for producing customized, high-precision tools or prototype components. Successful integration of AM would allow for the creation of geometries impossible with traditional casting and machining, offering opportunities for lightweighting and enhanced heat dissipation features in future designs. This technological exploration, while challenging, points towards future efficiency gains in material usage and design complexity.

Regional Highlights

Regional dynamics are dominated by the concentration of electronics manufacturing and technological innovation hubs globally. Asia Pacific (APAC) stands out as the primary engine of market growth, driven by China, South Korea, and Taiwan, which host massive production facilities for consumer electronics, semiconductors, and telecommunication hardware. The region benefits from lower manufacturing costs and substantial government support for high-tech industries, leading to high volume consumption of CuBe strip and wire for connectors and relays utilized in 5G devices and burgeoning EV production lines. India and Southeast Asian countries are also emerging as significant consumption centers due to their expanding industrial bases and increasing adoption of automation and advanced machinery.

North America maintains a crucial role in the market, primarily driven by high-specification, high-value applications in the aerospace, defense, and specialized medical device sectors. The presence of major defense contractors and stringent military requirements for components with zero failure tolerance ensure a stable, albeit slower, growth rate for high-purity CuBe alloys. Strict regulatory oversight regarding material sourcing and processing compels US manufacturers to invest heavily in advanced environmental controls, which influences global safety standards and operational costs. Innovation in materials science and high-speed data centers also drives steady demand for high-performance connectors and thermal management components.

Europe represents a mature but technologically demanding market, with significant consumption centered in Germany, France, and the UK. Demand is robust in the high-end automotive sector (specifically luxury EVs and high-performance racing) and complex industrial automation equipment. European environmental and worker safety regulations (e.g., REACH) are among the most stringent globally, actively encouraging research into sustainable processing and recycling methods for beryllium alloys. This regulatory pressure fosters niche market opportunities for specialized suppliers who can demonstrate full compliance and offer certified, highly traceable materials for critical applications.

- Asia Pacific (APAC): Dominates market share and growth rate; fueled by electronics manufacturing, 5G deployment, and large-scale EV production in China, South Korea, and Japan.

- North America: Strong demand from high-reliability sectors including Aerospace & Defense (A&D), medical devices, and sophisticated data center infrastructure; emphasis on Mil-Spec compliance and quality.

- Europe: Focus on high-end automotive, industrial automation, and stringent regulatory compliance (REACH); mature market characterized by high technical requirements and sustainability focus.

- Latin America (LATAM): Emerging market primarily driven by local infrastructure development and increasing industrial automation; smaller market volume but growing steadily.

- Middle East and Africa (MEA): Key growth areas linked to oil and gas exploration (demand for non-sparking and downhole tools) and expanding telecommunications projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Grade Copper Beryllium Market.- Materion Corporation

- NGK Insulators Ltd.

- IBC Advanced Alloys

- Leico Industries Inc.

- Ulba Metallurgical Plant

- Belmont Metals Inc.

- Deringer-Ney Inc.

- Beryllium Metals & Components

- Brush Wellman (A Materion Subsidiary)

- Kazatomprom

- Zirax Group

- Bekaert

- Little Falls Alloys Inc.

- Aviva Metals

- Ampco Metal

- Precision Engineered Products LLC

- Wrought Copper Alloy Holdings

- National Bronze Mfg. Co.

- Shanghai Metal Corporation

- CNMC Ningxia Orient Group

Frequently Asked Questions

Analyze common user questions about the Industrial Grade Copper Beryllium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Copper Beryllium over standard copper alloys?

Copper Beryllium (CuBe) offers a unique combination of extremely high mechanical strength (comparable to steel) and superior electrical/thermal conductivity. This synergy is crucial for components requiring both structural integrity under stress and efficient current or heat transfer, such as critical electrical spring contacts and high-performance connectors.

How do global regulations impact the manufacturing and price of Industrial Grade Copper Beryllium?

Regulations, particularly those concerning occupational safety (beryllium exposure), necessitate substantial capital investment in closed-loop manufacturing systems and specialized ventilation. This increases operational costs, contributes to the premium pricing of CuBe, and limits the number of qualified producers, thus impacting global supply elasticity.

Which application segment is driving the fastest growth rate for the CuBe market?

The Automotive segment, specifically the electrification trend (Electric Vehicles - EVs) and the integration of Advanced Driver-Assistance Systems (ADAS), is driving the fastest growth. CuBe is essential for high-reliability, high-current connectors in battery management systems and charging infrastructure where thermal stability is critical.

Are there viable substitutes for Industrial Grade Copper Beryllium in high-performance applications?

While alloys like Copper Nickel Silicon (CuNiSi) and high-performance phosphor bronzes are used as substitutes in certain less-demanding applications, a complete, performance-equivalent, non-beryllium alternative has not been widely adopted. For applications requiring the maximum combined strength, conductivity, and fatigue resistance, CuBe remains the material of choice.

What is the current trend regarding the sourcing and supply chain security of Beryllium raw material?

The supply chain remains highly concentrated, with a few key global entities controlling the mining and primary refining of Beryllium. This concentration creates geopolitical risk and supply volatility, leading downstream alloy producers to focus heavily on long-term supply contracts and inventory management to mitigate sudden price spikes or shortages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager