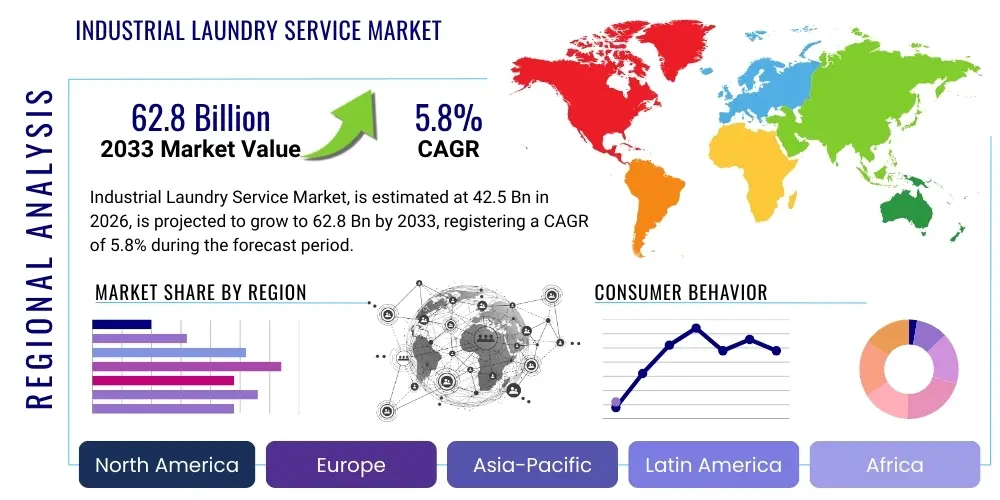

Industrial Laundry Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442172 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Industrial Laundry Service Market Size

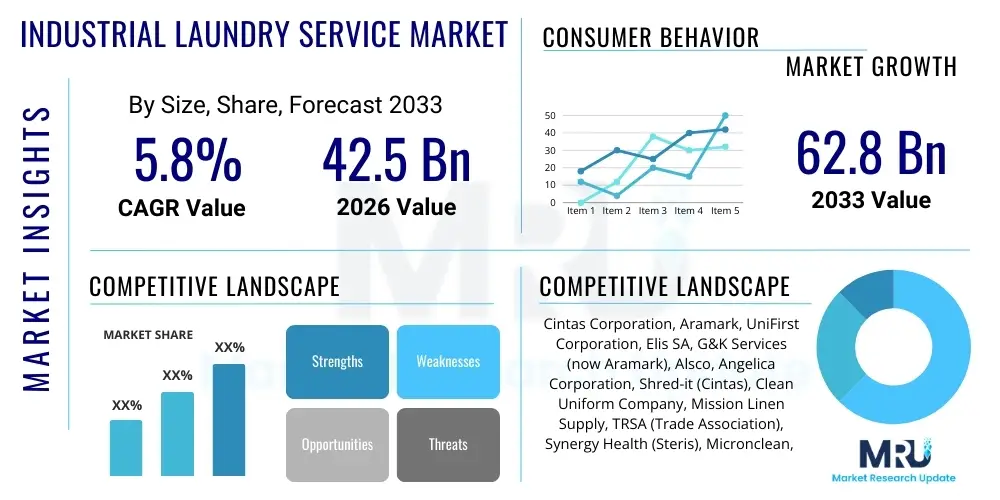

The Industrial Laundry Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $42.5 Billion in 2026 and is projected to reach $62.8 Billion by the end of the forecast period in 2033.

Industrial Laundry Service Market introduction

The Industrial Laundry Service Market encompasses professional cleaning, maintenance, and rental services for specialized textiles, uniforms, and protective apparel utilized across various industrial sectors. These services are crucial for maintaining hygiene, compliance with regulatory standards, and ensuring the longevity and safety of workwear and facility linens. Key product offerings include laundering of personal protective equipment (PPE), specialized uniforms for food processing and healthcare, mats, towels, and facility supplies. The demand for these outsourced services is driven primarily by stringent health and safety regulations, particularly in pharmaceutical, chemical, and food manufacturing sectors, which mandate specific cleaning protocols that in-house operations often cannot meet efficiently or cost-effectively. Furthermore, the rising focus on core competencies encourages organizations to offload non-core tasks like textile management, thereby stimulating market expansion.

Major applications for industrial laundry services span institutional facilities, manufacturing plants, automotive workshops, healthcare systems, and hospitality environments. For healthcare, services involve rigorous sanitization to prevent cross-contamination, while in manufacturing, they focus on removing heavy grease, chemicals, or particulate matter from specialized garments. The primary benefits derived from utilizing these professional services include guaranteed compliance with OSHA and FDA requirements, reduced capital expenditure related to laundry equipment, consistent quality control, and enhanced environmental sustainability through optimized water and energy usage in commercial-scale operations. These services transition textile management from a liability and operational burden into a streamlined, predictable cost center, allowing client companies to concentrate resources on their primary business activities.

Driving factors propelling this market forward include the accelerating growth of the healthcare industry globally, which necessitates continuous provision of hygienically clean linens and surgical gowns. Additionally, the proliferation of large-scale manufacturing operations in developing economies, coupled with increased regulatory oversight regarding employee safety and cleanliness standards, mandates the professional laundering and maintenance of uniforms and specialized garments. The shift from outright purchase of workwear to rental and full-service leasing models also significantly boosts the service segment, as it provides predictable costs and ensures textile maintenance and replacement are managed entirely by the service provider. Technological advancements in washing machinery, water recycling, and tracking systems further enhance the efficiency and appeal of outsourced industrial laundry solutions.

Industrial Laundry Service Market Executive Summary

The global Industrial Laundry Service Market is characterized by robust growth, propelled primarily by escalating hygiene compliance requirements and the sustained trend of outsourcing non-core operational functions. Current business trends indicate a strong move toward full-service rental programs where service providers manage the entire lifecycle of textiles, including inventory tracking, cleaning, repair, and replacement. This strategic shift allows businesses in end-user industries like pharmaceuticals and food processing to maintain strict quality control without internal infrastructure investment. Consolidation remains a defining feature of the competitive landscape, with major regional and global players leveraging acquisitions to expand geographic reach, enhance service portfolios, and achieve greater operational economies of scale, particularly in technologically advanced sorting and finishing processes. Sustainability has also emerged as a key business imperative, influencing procurement decisions toward providers utilizing water reclamation technologies and biodegradable detergents.

Regional trends highlight North America and Europe as mature markets driven by stringent regulatory frameworks and high labor costs, making outsourced services highly economical. These regions exhibit advanced adoption of RFID and IoT solutions for inventory management. Conversely, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid industrialization, expansion of manufacturing hubs (especially in textiles and automotive), and increasing awareness regarding industrial safety standards. Latin America and the Middle East & Africa (MEA) are also experiencing moderate growth, spurred by investments in hospitality and healthcare infrastructure, though market penetration remains lower than in established economies. Differentiation in these emerging markets often centers on local operational agility and competitive pricing strategies designed to convert traditional in-house laundry operations.

Segmentation trends reveal that the Rental Service segment dominates the market due to its inherent benefits of capital avoidance and comprehensive maintenance coverage, especially popular among small and medium-sized enterprises (SMEs). Among end-users, the Healthcare and Food & Beverage segments are the fastest-growing due to non-negotiable hygiene mandates and continuous operational expansion. Technology-wise, investment is heavily concentrated in sophisticated sorting machinery, energy-efficient washers, and advanced tracking systems like RFID chips embedded in garments, which optimize logistics, reduce loss, and ensure accurate billing. This technological integration is crucial for maintaining competitive advantage and meeting the high throughput demands of industrial clients, underscoring a move towards highly automated, centralized processing facilities capable of handling massive volumes of specialized laundry.

AI Impact Analysis on Industrial Laundry Service Market

User inquiries regarding AI's influence in the Industrial Laundry Service Market frequently center on automation potential, predictive maintenance capabilities, and the transformation of supply chain logistics. Common questions explore whether AI can fully replace manual sorting (leading to concerns about labor displacement), how machine learning enhances quality control, and what return on investment (ROI) sophisticated AI systems provide. Users are keen to understand how AI-driven predictive analytics can optimize washing cycles based on real-time textile contamination levels, minimizing water and chemical usage while maximizing fabric longevity. The consensus expectation is that AI will elevate efficiency and compliance standards but requires significant upfront capital investment and specialized technical expertise for integration, creating a potential barrier to entry for smaller service providers. Furthermore, there is interest in how AI can optimize route planning and fleet management for collection and delivery services, offering precise scheduling and reduced operational expenditures, which directly translates to improved customer experience and streamlined logistics management.

AI is transforming the back-end operations of industrial laundries through sophisticated pattern recognition and optimization algorithms. For instance, computer vision systems, powered by machine learning models, are being deployed for automated sorting and quality inspection, rapidly identifying types of garments, assessing levels of soiling, and detecting minor damages or wear before washing. This level of automated pre-processing significantly reduces human error, speeds up throughput, and ensures that specific textiles receive the appropriate tailored washing treatment, leading to better cleaning outcomes and prolonged asset life. Furthermore, AI tools are essential in optimizing energy consumption and resource management; algorithms analyze historical and real-time data on load size, water temperature, and chemical dosing to calculate the most resource-efficient washing protocol possible, aligning with the industry's increasing focus on sustainability and operational cost reduction.

Beyond the physical laundry process, AI’s greatest impact is visible in the realm of predictive logistics and demand forecasting. Machine learning models analyze historical usage data from large corporate clients—including seasonal fluctuations, shift patterns, and anticipated maintenance requirements—to predict future textile needs and inventory levels accurately. This predictive capability minimizes stockouts, optimizes replacement schedules, and ensures that specialized uniforms or linens are available precisely when needed, enhancing client satisfaction and minimizing inventory holding costs for the service provider. The integration of AI with RFID tracking systems further refines this process, creating a truly smart inventory management loop where data informs real-time adjustments to logistics and processing schedules, creating a highly resilient and responsive industrial laundry supply chain.

- AI-driven automated sorting and grading of soiled textiles significantly increases throughput efficiency.

- Predictive maintenance analytics for laundry machinery reduces downtime and unexpected equipment failure.

- Machine learning algorithms optimize washing cycle parameters (temperature, chemicals, water volume) for energy and resource conservation.

- Computer vision systems enable rapid, consistent quality control and damage detection post-wash.

- AI-enhanced routing and logistics planning for collection and delivery fleets minimize fuel consumption and transit times.

- Demand forecasting models predict client inventory needs accurately, improving stock management and replacement cycles.

- Integration of AI with RFID systems creates self-optimizing textile asset tracking and utilization reports.

DRO & Impact Forces Of Industrial Laundry Service Market

The Industrial Laundry Service Market is shaped by a confluence of powerful drivers, stringent restraints, and lucrative opportunities, creating a dynamic competitive landscape. The primary driver is the non-negotiable necessity for regulatory compliance, especially within heavily scrutinized sectors such as healthcare, food processing, and pharmaceuticals, where specific cleaning standards (e.g., OSHA, FDA, HACCP) must be met, often exceeding in-house capabilities. This regulatory push is further amplified by increasing urbanization and population density, which correlate with higher demand for professional hygiene services across institutions. However, the market faces significant restraints, chiefly high capital investment required for automated, high-throughput machinery and the continuous operational expense related to energy, water, and specialized chemical procurement. Furthermore, the industrial nature of the service creates inherent logistics challenges related to large-scale transportation and delivery schedules, particularly across disparate geographic regions, which requires substantial infrastructure investment to overcome efficiently. Finally, the growing market reliance on sustainable practices and advanced water treatment technologies creates both a driver (for differentiation) and a restraint (due to compliance costs).

Key opportunities within this sector revolve around technological innovation and geographic expansion into underserved markets. The implementation of advanced technologies such as robotic handling systems, intelligent tracking via IoT and RFID, and water recycling apparatus presents a significant opportunity for service providers to enhance operational margins and offer premium, specialized services (e.g., certified cleanroom laundry). Geographically, the rapidly developing manufacturing bases in Southeast Asia, Latin America, and select parts of Africa are emerging as high-growth potential areas, driven by multinational corporations establishing facilities that demand globally standardized industrial hygiene services. Additionally, strategic vertical integration or targeted acquisitions that allow larger players to absorb specialized niche providers (e.g., those focused solely on nuclear or aerospace cleanroom garments) are key avenues for market expansion and revenue diversification. The shift towards circular economy models also presents an opportunity for offering garment refurbishment and recycling services, aligning with corporate sustainability mandates.

The overall impact forces are overwhelmingly positive, favoring market expansion driven by mandatory compliance and economic efficiency. The increasing complexity of textiles and regulatory requirements makes outsourcing industrial laundry services an economic imperative rather than a discretionary choice for many businesses. While labor costs and initial technology investments act as friction points, the long-term cost savings, risk mitigation associated with non-compliance, and the ability to maintain core operational focus solidify the value proposition of professional industrial laundry providers. These factors ensure sustained demand throughout the forecast period, pushing industry players toward continuous process optimization and technological superiority to maintain competitive edge. The market is increasingly characterized by scale—only providers with significant operational leverage and advanced environmental technology can meet the complex, high-volume demands of modern industrial clients effectively.

Segmentation Analysis

The Industrial Laundry Service Market is meticulously segmented based on the type of service offered, the type of textile handled, and the diverse applications across various end-user industries. This granularity is essential for service providers to tailor their offerings, optimize pricing strategies, and target specific vertical markets with highly specialized compliance requirements. The primary segmentation dimensions include classifying services into rental versus direct cleaning, distinguishing between specialized protective garments and general facility linens, and focusing on sectors such as healthcare, hospitality, and heavy manufacturing. Understanding these distinct segments allows for accurate assessment of market penetration rates and identification of high-growth pockets, particularly where regulatory frameworks are tightening or industrial activity is accelerating. The market structure inherently favors service providers who can demonstrate expertise across multiple critical segments, offering integrated solutions that meet diverse operational needs.

The Service Type segmentation reveals a crucial operational distinction within the market. Rental services, which involve the provider owning the garments, laundering them, maintaining inventory, and replacing them as needed, dominate due to the convenience and capital expenditure savings they offer clients. This model ensures uniform quality and compliance without burdening the client’s balance sheet with fixed assets. Conversely, direct cleaning services involve the service provider cleaning garments owned by the client. While this offers greater flexibility for clients with unique or proprietary uniforms, it places the inventory and replacement risk back onto the end-user. The trend leans heavily toward rental services as industrial operations seek to minimize asset management complexity and stabilize operational expenditures, thereby reducing overall risk exposure related to textile management and ensuring consistent adherence to stringent sanitation protocols.

End-user segmentation is critical, demonstrating vastly different service requirements and volumes. Healthcare demands the highest levels of sterilization and sophisticated handling for surgical linens and patient gowns, making quality control paramount. The Food & Beverage sector requires stringent HACCP-compliant washing processes for uniforms and facility supplies to prevent contamination. Manufacturing and Automotive sectors focus more on removing heavy grease, chemicals, and handling durable, specialized protective clothing (PPE). The diversity of needs necessitates industrial laundry facilities to possess varied technological capabilities and compliance certifications, reinforcing the specialization within the market. Providers capable of navigating the high regulatory hurdles of the healthcare and food industries often command premium pricing and enjoy greater market stability due to the non-cyclical nature of demand in these sectors.

- By Service Type:

- Rental Services (Dominant segment due to CAPEX avoidance)

- Direct Cleaning Services

- By Textile Type:

- Uniforms and Workwear (Standard, specialized, and high-visibility garments)

- Linens and Facility Supplies (Towels, mats, mops, bed linens)

- Specialized Protective Apparel (Cleanroom garments, fire-resistant PPE, chemical-resistant textiles)

- By End-User Industry:

- Healthcare (Hospitals, clinics, surgical centers)

- Food & Beverage Manufacturing and Processing (Compliance-driven)

- Manufacturing (Automotive, Heavy Machinery, Electronics)

- Hospitality (Hotels, Resorts, Large Catering)

- Pharmaceutical and Biotechnology (Cleanroom and validated processes)

- Chemical and Petroleum

Value Chain Analysis For Industrial Laundry Service Market

The value chain of the Industrial Laundry Service Market is complex, beginning with the upstream supply of specialized textiles and advanced laundry chemicals, moving through sophisticated processing, and culminating in efficient downstream distribution. Upstream analysis involves sourcing raw materials such as industrial-grade textiles (often blended for durability, flame resistance, or fluid repellency) and high-performance cleaning agents and disinfectants designed to operate effectively in industrial-scale washing machines. Strong relationships with textile manufacturers are crucial, particularly for rental services, as consistency in quality and longevity directly impacts the service provider’s total cost of ownership (TCO) for their inventory. Chemical suppliers play a vital role, providing highly concentrated, specialized formulations that ensure compliance with specific industry hygiene standards, such as those required for medical or food-contact materials. Optimization at this stage focuses heavily on securing sustainable and cost-effective inputs.

The core of the value chain is the processing stage, which encompasses collection logistics, sorting, washing, drying, finishing, quality control, and packaging. This stage is where technological investments—such as automated sorting systems, high-efficiency washing tunnels, water recycling plants, and advanced drying technology—provide the competitive edge. Downstream analysis focuses on the efficient delivery and management of the cleaned textiles at the client’s facility. Distribution channels are predominantly direct, meaning the service provider maintains its own fleet and logistics network for routine collection and delivery, ensuring reliable, scheduled service which is essential for continuous industrial operations. The effectiveness of this direct distribution channel is heavily reliant on advanced route optimization software and real-time tracking systems, often integrated with the overall asset management solution.

The distribution methodology relies almost entirely on direct engagement to maintain tight control over inventory and quality assurances. Indirect channels, such as third-party logistics (3PL) providers, are sometimes used for transportation over long distances or in highly specialized, remote areas, but the direct relationship between the industrial laundry provider and the client remains paramount for service integrity. The integration of RFID tags into textiles facilitates accurate tracking throughout the entire cycle—from sorting through washing, delivery, and eventual return—significantly minimizing loss and ensuring accurate billing. This end-to-end control, facilitated by proprietary logistics and technology, defines the efficiency and reliability of a leading industrial laundry service provider, distinguishing them from traditional commercial laundry operations and cementing their role as a critical operational partner for industrial clients globally.

Industrial Laundry Service Market Potential Customers

The primary customers and end-users of Industrial Laundry Services are large institutions and corporations across sectors where strict hygiene, regulatory compliance, and employee protection are mandatory for sustained operation. These customers purchase the service not merely as a cleaning task but as a managed solution that mitigates risks associated with contamination, ensures adherence to safety standards, and preserves the operational integrity of specialized workwear. Key buying criteria for these customers include reliability, demonstrated compliance track record, scalability of service, and the ability to handle highly specific textile types, such as static-dissipative garments or flame-resistant apparel. Potential customers are typically facilities with high employee counts, continuous production cycles, or environments requiring controlled contamination levels.

The largest volume buyers are concentrated in the Healthcare and Food & Beverage industries, where the volume of textiles (linens, uniforms, scrubs, protective coverings) is immense and the hygiene standards are non-negotiable. Hospitals and surgical centers require validated sterilization processes, making outsourced services essential for compliance. Similarly, large-scale food processing plants, meat packers, and beverage manufacturers rely on industrial laundries to maintain HACCP protocols for all employee uniforms and facility supplies, preventing biological or chemical cross-contamination. These end-users prioritize providers offering guaranteed microbial reduction levels and comprehensive audit trails, viewing the service as a regulatory necessity rather than an optional expense.

Other significant potential customers reside in the heavy manufacturing, automotive, and pharmaceutical sectors. Automotive plants and industrial workshops require services capable of removing heavy oils, grease, and metallic particulates from durable workwear. Pharmaceutical companies and high-tech electronics manufacturers require specialized cleanroom laundry services, demanding validated processes that ensure garments meet ISO cleanliness standards (e.g., ISO Class 5 or 7). For these high-value customers, the focus shifts to process validation, environmental control within the laundry facility itself, and the use of specialized packaging to maintain cleanliness until the garment is deployed in the controlled environment, making service specialization and demonstrable technical expertise the primary purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $42.5 Billion |

| Market Forecast in 2033 | $62.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cintas Corporation, Aramark, UniFirst Corporation, Elis SA, G&K Services (now Aramark), Alsco, Angelica Corporation, Shred-it (Cintas), Clean Uniform Company, Mission Linen Supply, TRSA (Trade Association), Synergy Health (Steris), Micronclean, Auchen Industrial Laundry, P&G Professional. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Industrial Laundry Service Market Key Technology Landscape

The Industrial Laundry Service Market is undergoing a rapid technological transformation, moving towards fully digitized, automated, and sustainable operations. Central to this evolution is the deployment of sophisticated machinery, including continuous batch washers (tunnel washers) that offer superior water and energy efficiency compared to traditional stand-alone machines, crucial for handling high volumes economically. Furthermore, specialized finishing equipment, such as automated folding, bagging, and stacking systems, significantly reduces manual labor costs and enhances output consistency. The integration of advanced chemical dispensing systems ensures precise dosing tailored to the specific level of soiling and textile type, maximizing cleaning efficacy while minimizing environmental impact and chemical waste, thus meeting stringent environmental regulations and corporate sustainability targets mandated by large enterprise clients.

Tracking and inventory management systems represent another cornerstone of the modern industrial laundry technology landscape. Radio Frequency Identification (RFID) technology has become the industry standard, replacing older barcode systems. Small, durable RFID chips are embedded directly into every garment, allowing service providers to track the location, usage history, number of washes, and specific client assignment of millions of individual items in real-time. This level of granular tracking drastically reduces lost inventory, automates sorting processes through electronic scanners, streamlines billing accuracy, and provides valuable data on textile longevity and utilization rates. This shift from manual counting to automated scanning minimizes human error and significantly speeds up the logistical throughput required for large rental contracts, providing enhanced accountability and verifiable asset management across complex client portfolios.

The future of the technology landscape is heavily influenced by sustainability and smart systems. Advanced water reclamation and recycling technologies are essential investments, enabling laundry facilities to treat and reuse significant percentages of their process water, addressing both rising utility costs and regulatory pressures related to water scarcity and discharge limits. Simultaneously, the adoption of IoT sensors and cloud-based operational software allows for remote monitoring and predictive maintenance of machinery, reducing unexpected downtime. These smart systems optimize routing logistics, forecast energy demand, and apply machine learning algorithms (as detailed in the AI analysis) to continuously fine-tune operational parameters. Companies that strategically invest in these integrated digital platforms are positioned not only for cost leadership but also for delivering the verifiable compliance and sustainability metrics increasingly demanded by institutional and corporate customers in highly regulated industries.

Regional Highlights

The global Industrial Laundry Service Market exhibits diverse characteristics across major geographies, influenced heavily by industrial maturity, regulatory frameworks, and labor cost structures. North America, encompassing the United States and Canada, represents a highly mature and dominant market segment. Growth in this region is driven not by new industrial expansion but by the increased outsourcing of laundry services, mandated by stringent workplace safety and health regulations (OSHA, FDA). Key trends include consolidation among major players like Cintas and Aramark, extensive adoption of advanced RFID tracking systems for efficiency, and a high demand for specialized services, particularly in healthcare and protective garment rental due to high labor costs making in-house laundry economically prohibitive. The market is characterized by high operational efficiency and technological investment.

Europe mirrors North America in terms of maturity, regulatory pressure, and the adoption of advanced automation, but with an even stronger emphasis on environmental sustainability. Countries like Germany, France, and the UK have highly developed industrial laundry sectors where service providers adhere to strict EU directives regarding water usage, chemical discharge, and energy efficiency. European providers, such as Elis SA, focus heavily on green laundry solutions and circular economy models for textile management. The region's dense industrial landscape and robust healthcare systems ensure steady demand for full-service rental programs, especially customized PPE and certified cleanroom garments necessary for the region's strong pharmaceutical and automotive manufacturing bases.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is a direct result of accelerating industrialization, massive infrastructure development, and increasing foreign direct investment in manufacturing hubs across China, India, and Southeast Asian nations. As local industries adopt international standards for workplace hygiene and safety, the demand for professional outsourced laundry services surges. While capital investment and infrastructure development pose challenges, the sheer scale of manufacturing activity and the emerging healthcare sector create immense opportunity. Service providers in APAC are focusing on scaling up operations rapidly, often through establishing large, centralized facilities to cater to the burgeoning industrial complexes and export-oriented manufacturing zones.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets characterized by moderate but consistent growth. In LATAM, growth is tied to the expansion of hospitality, oil & gas, and manufacturing sectors in countries like Brazil and Mexico. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees demand spurred by massive government investments in healthcare facilities, luxury hotels, and large infrastructure projects, necessitating reliable, high-volume laundry services for both hospitality linens and industrial workwear used in construction and petroleum sectors. In these regions, market growth relies heavily on penetrating local institutions that traditionally performed laundry in-house and convincing them of the long-term cost benefits and compliance superiority of outsourcing.

- North America: Market maturity, stringent regulatory compliance (OSHA), high automation adoption, and consolidation among key players.

- Europe: High focus on sustainability (EU directives), well-established rental models, strong demand from pharmaceutical and high-tech manufacturing.

- Asia Pacific (APAC): Fastest growth driven by rapid industrialization, increasing foreign investment in manufacturing, and rising adoption of international safety standards.

- Latin America (LATAM): Growth linked to expanding manufacturing, hospitality, and resource extraction industries (Oil & Gas).

- Middle East & Africa (MEA): Demand acceleration due to significant investments in healthcare infrastructure, construction, and tourism sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Industrial Laundry Service Market.- Cintas Corporation

- Aramark

- UniFirst Corporation

- Elis SA

- Alsco

- Angelica Corporation

- Mission Linen Supply

- MicroClean

- Clean Uniform Company

- G&K Services (now part of Aramark)

- Shred-it (Cintas subsidiary, specialized services)

- Synergy Health (Steris)

- Auchen Industrial Laundry

- Linen King

- Unitex Healthcare Laundry Services

- Faultless Linen

- Morgan Services, Inc.

- P&G Professional (Chemical and technology provider influence)

- Textile Rental Services Association (TRSA - Trade body influence)

- F. Engel Group (Uniform supplier with service integration)

Frequently Asked Questions

Analyze common user questions about the Industrial Laundry Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between industrial and commercial laundry services?

Industrial laundry services focus on high-volume, specialized textiles like heavy-duty uniforms, protective apparel (PPE), and regulated linens (healthcare/food processing), prioritizing regulatory compliance, validated sanitation processes, and asset tracking (rental models). Commercial services typically cater to general hospitality needs and less stringent cleaning requirements.

How do stringent regulatory standards impact the growth of the Industrial Laundry Market?

Stringent standards, such as those mandated by the FDA or HACCP, act as a primary driver. These regulations often require specialized equipment, verified cleaning protocols, and detailed documentation that most companies cannot maintain in-house, compelling them to outsource to professional industrial laundry service providers who possess the necessary compliance expertise and certified technology.

What role does RFID technology play in optimizing industrial laundry operations?

RFID technology is crucial for asset management and logistics optimization. By embedding chips in garments, service providers can achieve 100% accurate, real-time tracking of inventory, automate sorting processes, minimize losses, ensure accurate billing per wash cycle, and provide detailed utilization reports to clients, thereby enhancing efficiency and reducing operational costs significantly.

Which end-user segment is driving the highest demand for specialized industrial laundry services?

The Healthcare sector (hospitals, surgical centers) is the largest and most demanding segment, driving high demand for specialized, validated sterilization processes for patient linens and surgical gowns. The Food & Beverage manufacturing sector is the second fastest-growing segment due to non-negotiable compliance with HACCP and food safety regulations.

What are the main sustainability initiatives adopted by industrial laundry providers?

Sustainability initiatives focus on resource conservation and waste reduction. Key actions include installing advanced water reclamation and recycling systems, utilizing high-efficiency continuous batch washers (tunnel washers), adopting biodegradable or environmentally friendly detergents, and implementing optimized logistics routes to reduce carbon emissions from transportation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager